So you have hired a new employee and are now surrounded by boatloads of paperwork and don't know where to start? One of the many forms you'll need to take care of is Form W-4. You also know this form as the "Employee's Withholding Certificate".

How you complete this form affects how much tax you need to withhold from their paycheck. You must submit to the IRS the amount you withheld from your employee's paycheck, together with their personal and tax-related information for reference.

The IRS deducts the withholding from the yearly income tax bill, which employees must compute when filing their tax returns in April. This article will answer all your W-4 questions to make the process seamless.

Here are the W-4 questions that we will cover in this article:

- What is the W-4?

- When do my employees have to fill out the W-4?

- Do all employees have to fill out a Form W-4?

- Are employees required to update their W-4?

- How long should we hold on to an employee's W-4 information?

- How to fill out a W-4 form?

Let's Start!

What is the W-4?

We should start answering the W-4 questions with the main one: What exactly is the W-4 form?

Form W-4 is a tax form used by the Internal Revenue Service to record your employees' "withholding allowances" to compute their federal income taxes. This is a clever way of stating it will decide how much federal income taxes the IRS will deduct from their paychecks.

The IRS often calculates withholding allowances depending on an employee's tax status, as well as the number of occupations and dependents they have. Allowances function in the following way:

- More allowances equate to a higher salary (with less tax withheld).

- Conversely, fewer allowances equate to a lower salary (more tax withheld).

Check out this article to understand How to Download the W-4 form for employees in Deskera People.

When do my employees have to fill out the W-4?

Every time someone starts alternative employment, they must submit a new W-4. The W-4, including the I-9, is among the first sets of documentation that your new workers will be required to complete.

Do all employees have to fill out a Form W-4?

Yes. The W-4 form and the other required documentation should be the first things you have a new employee fill out. If an employee cannot submit the W-4 for whatever reason, you must withhold taxes as if the person were single, with no allowances. You should keep this amount, the highest tax withholding, until the employee submits an updated form.

Are employees required to update their W-4?

This is one of the most frequently asked W-4 questions that confuses a lot of employers.

Employees can amend their W-4 forms at any time of year and for any reason if an employee submits an amended W-4 form.

While many people opt to review their financial status when they marry, have a child, or purchase a home, they do not need a qualified incident to revise their W-4. There is no government law requiring an annual update or an update based on specified life events.

However, we believe it is essential to have a thorough grasp of your W-4 and update it appropriately and frequently. Besides, it's a piece of cake with the W-4.

How long should we hold on to an employee's W-4 information?

An employer must record and store a W-4 for at least four years from the day an employee's taxes were due or paid, whichever one is later. You can save these forms either physically or digitally, as long as you can submit a copy of the document to the IRS whenever required. When the timer runs out, you can burn paper forms or remove electronic ones.

How to fill out a W-4 form?

There is a five-step process for filling out the W-4 form:

1. Fill up personal information

All workers must fulfill this phase. If an employee cannot complete the form, you must compute their withholding as "Single" to collect their taxes at the greater "Single" level.

2. Having multiple jobs or having a working spouse

For step 2, employees only need to complete options (a), (b), or (c). That's because options (a) and (b) will take employees away from the form itself, while you can fill option (c) right on the form.

The IRS has stated that option (a) will give employees the most accuracy and privacy of the three since the new withholding estimator will compute all the relevant entries for the form. Option (b) also provides accuracy but requires manual work, and (c) is the least accurate since it assumes the jobs have similar pay, but it's the easiest to complete.

3. Claim Dependent

The child tax credit is available to single taxpayers with a combined income of $200,000 or less. The Child Tax Credit is available to taxpayers for each eligible dependent child.

The Child Tax Credit reduces taxpayers' tax burden. The American Rescue Plan set the total yearly credit from $2,000 per kid (under the age of 17) in 2020 to $3,000 per child (under the age of 18) or $3,600 (children under the age of 6) in 2021, making the 2021 credit fully refundable.

Beginning in July 2021, the IRS will send the Child Tax Credit to qualified taxpayers in monthly advance installments. Parents do not have to pay taxes to get it since it is entirely refundable.

4. Other Modifications

This optional part is for various items that an employee may consider when calculating withholding. These are some examples:

- Other sources of income: Extra income that is not subject to withholding, such as pension savings or dividends.

- Deductions: This column is for deductions not included in the standard deduction. It covers all itemized deductions, less the standard deduction, such as loan interest and charitable donations. Remember that the standard deduction decreases a taxpayer's total income to get a taxable income.

The higher the standard deduction or itemized deductions will be the amount of tax owed. The standard deduction for married taxpayers filing jointly in 2022 is $25,900; for singles and married taxpayers filing separately is $12,950, and $19,400 for those filing as head of household.

- Extra withholding: Any additional withholdings that the employee wishes to make each pay period.

5. Cross check employees’ signature

Double-check that your employee has signed the document. If your employee does not complete this last step, the form will be invalid.

And these are all the biggest W-4 questions that you need to know when you hire a new employee. You can use automated online services to make your task easier. With that, let’s see how Deskera can help you.

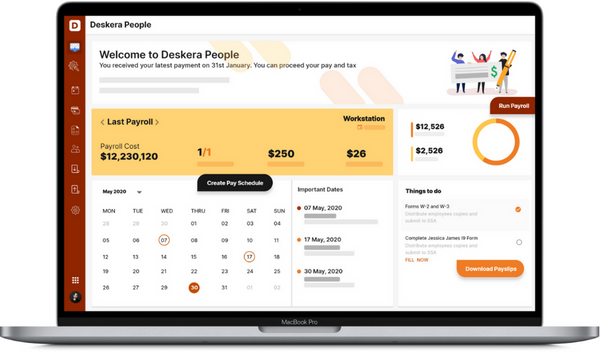

How Can Deskera Assist You?

Deskera People is an online employee management software that makes managing employees’ papers as easy as eating a pie. A one-stop solution, it provides all the information about an employee with just one click. To ensure clarity, it divides the information into three categories: personal details, components, and compliance.

That’s not it, Deskera People simplify leave, attendance, payroll, and other costs. Payslip generation for your employees is now simple since the platform also digitizes and automates HR activities.

The platform is ideal for both small and large firms. With this handy program, government compliance is always in check and the paperwork is always on point, so you are always in good standing with the authorities.

Now, let's look at some of the most frequently asked questions about W-4 questions.

Frequently Asked Questions

1: How do we address W-4 questions from employees?

This is extremely frequent when training new personnel. You hand employees the W-4 as part of their new hiring papers, and they ask you questions a few minutes later. You can explain the form's purpose, but you can't control or prescribe how many allowances an employee enters on Line 5. So instead, please send them to the Personal Allowances Worksheet included with the form or the IRS website's Withholding Calculator.

2: How much time do we have to complete the W-4 form for the employee?

You must complete the W-4 form within 30 days of receiving it. The W-4 remains in force until an employee fills out a new one, usually for personal or financial reasons, such as marriage, divorce, childbirth, or having less or more taxes deducted.

3: What's the Distinction Between a W-2 and a W-4?

The W-4 form instructs the employer on withholding from the employee's pay. The W-2 informs the IRS of the employee's earnings for the preceding year. Both small and big organizations must submit form no. W-2. Every employee is required to complete a W-4 form.

With that, we have reached the end of the article. Let's take a quick recap of the biggest W-4 questions.

Key Takeaway

- You must provide them with a new W-4 form whenever a new employee joins.

- Form W-4 is a tax form used by the IRS to record your employees' withholding allowances to compute their federal income taxes.

- One of the first things you should have a new employee fill out, along with the other needed papers, is the W-4 form.

- If an employee cannot submit a W-4 for whatever reason, you must withhold taxes as if the employee were single, with no allowances.

- Employees can change their withholding status at any time by filing a new W-4 form and submitting it to the employer.

- An employer must record and store a W-4 for at least four years from the day an employee's taxes were due or paid, whichever one is later.

- You can store W-4s either physically or electronically.

- If your employees fill out the form improperly, they may owe taxes when filing their returns.

- Employees' information on Form W-4 determines how much tax they deduct from their paycheck.

- The more precisely employees complete it, the less they will owe when submitting annual income taxes.

- The new Form W-4 allows employees to change their withholding depending on personal circumstances like working a second job

Related Articles