This guide covers all the details on Indonesian payroll and payroll related taxes, contributions, PPH21, deductions, work permits and more. If you have employees in Indonesia, or want to learn about running or managing payroll in Indonesia, then you are in the right place.

Indonesia is the fourth most popular country globally, behind only India, China, and the United States. With a large population, Indonesia represents a huge opportunity for international businesses to expand in Asia.

To set up a company in the Asia- Pacific region, Indonesia is becoming a popular destination for businesses. Businesses that are not familiar with the relevant laws and regulations, navigating payroll and tax in a foreign country, can face significant challenges. In Indonesia, payroll management involves various steps and tax deadline submissions to ensure that calculations match government regulations.

The Indonesia payroll consists of various elements for processing the payroll. This article will cover all the aspects, including work permits, PPH21, personal relief and deduction, contributions, taxes, reports, and how to file them on time.

Deskera People is an online-based Indonesia payroll application that makes the payroll process work easier! Try It Free Now!

Work Permits in Indonesia

Many people from all over the world come to Indonesia for business purposes. Foreigners who plan to establish a business of some sort and live in Indonesia to operate the company can choose various types of work and stay permits. The permit which is to be used will depend upon the type of job, qualifications, and preference of the foreigner. The Ministry of Manpower issues the work permit, while immigration authorities issue the stay permit (ITAS/ITAP).

Types of Work Permits

The following are the work permit types that can be obtained in Indonesia:

Business Visa Indonesia

A business visa enables the holder to visit Indonesia to conduct business, such as attending conferences or meetings. This visa is valid for one year. In Indonesia, when visiting the country on a business visa, the holder must not undertake paid work. All business visas are usually sponsored by a local entity (local, foreign, regional, or representative offices).

To process the application, it takes approx 6-10 working days for the Indonesian immigration to issue an invitation and telex.

For the Indonesian immigration authorities to issue an invitation and telex, the application process takes approximately 6 to 10 working days. The applicant must convert the telex to a business visa at their nearest Indonesian embassy abroad to enter the country.

Indonesia Work Visa

For foreign workers who plan to work in Indonesia, there are two types of employment permits available.

- ITAS (Izin Tinggal Terbatas) – Through a local immigration office, a limited-stay permit issued by the Indonesia Immigration Directorate General;

- KITAP (Kartu Izin Tinggal Tetap) – A permanent-stay permit available for those who have held ITAS for a minimum of three consecutive years.

While the ITAS is a limited-stay permit allowing the foreign worker to remain in the country for a limited duration, the VITAS (Visa Izin Tinggal Terbatas) is a limited-stay visa, a prerequisite to the application of the ITAS permit.

The ITAS is valid for between 6 to 12 months, depending on the length of the contract. Extensions are possible. Indonesia's work permit visa extension process shall start at least three months before the end date.

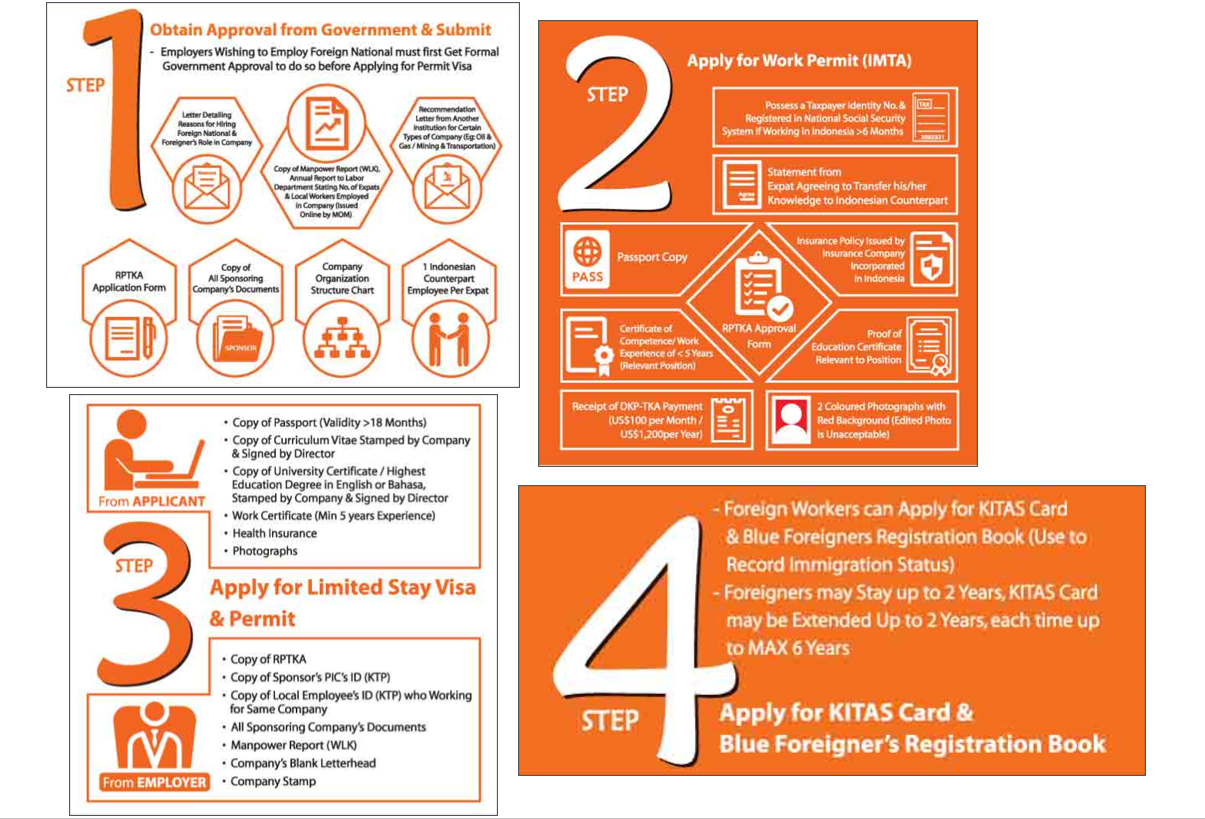

The Process of Getting a Work Permit in Indonesia

Understanding Payroll in Indonesia

A series of monthly procedures must be followed by the employers in Indonesia when administration payroll for locals and foreign employees. This is to ensure complete compliance with the Indonesian tax authorities. It includes making tax payments and social security contributions (Jamsostek), which employers must withhold each pay cycle.

Employees Basic Rights

The first thing that you need to know is exactly the rights of your employees. Listed below are some of the rights that your employee must get,

- Typical working hours are 40 hrs per week for full-time employees - approx 8 hrs a day over five days.

- All employees must be paid a minimum wage, which varies according to the district, province, and industry.

- Employees are eligible for social security and health insurance schemes.

- Based on the employment contract, employees must receive statutory payments instead of annual leaves, sick leave, maternity leave, and personal leave.

- On their employment contract, employees are entitled to THR allowances.

- According to the employer and industry type, employees are entitled to overtime rates.

Mandatory Payroll Administration System Components of Salary, Allowances, and Contributions in Indonesia

Based on the Circular of the Minister of Manpower of the Republic of Indonesia No. SE / 07 / MEN / 1990 of 1990 concerning the Classification of Wage Components and Non-Wage Income, there are five components of the salary needed to form income for employees.

Salary

The basic wage is the basic compensation paid to employees according to the level or type of work determined based on an agreement. In Article 94 of Law Number 13 Year 2003, it is further explained that the amount of the basic wage component is at least 75% of the total basic wage and fixed allowances..

Fixed allowances

A fixed allowance is a payment made regularly and given to workers and their families.

Fixed allowances are paid together with the basic wage and are not related to attendance or performance in the company. Fixed allowance can be in the form of wife allowance, child allowance, housing allowance, etc.

Food allowances and transportation allowances can be included in this component if not related to attendance and are received regularly by workers on a daily or monthly basis.

Variable Benefits

Variable benefits are payments given directly to an employee and his or her family and not related to the employee.

As the name implies, this allowance is paid on an irregular basis and does not coincide with the basic wage. Generally, this variable allowance is related to employee attendance or performance.

For example, a meal allowance will be given according to the number of days the employee has entered the office. Thus, this meal allowance is included in the component of the variable allowance.

Piece

In the salary component, there is a deduction that reduces the amount of income.

These deductions usually consist of income tax or PPh 21 and BPJS ( Health and Employment ) contributions. For withholding PPh21, there are separate calculation components to obtain the exact amount of tax that needs to be paid and reported.

Then, other deductions are not permanent and related to employees, for example, deductions from fines for delay, debt repayments to companies, or penalties for violating regulations.

All of these deductions are subject to company policy. So, not all companies apply the same payroll deduction.

Overtime Pay

Overtime pay is an additional wage that is given as employee benefits outside of official working hours.

Some companies that implement an overtime work system must include an overtime wage component in calculating employee payroll. The amount of overtime pay and payment time is adjusted to the agreement between the company and the employee.

There is one other component of the salary that you can take into account, namely bonuses. Items included in this bonus category are in the form of holiday allowances, performance or performance bonuses, annual bonuses, and profit-sharing.

The amount of this bonus is determined by the company based on their respective conditions and policies.

Read more,

The provision of overtime pay is stated in Article 78, paragraph 1 of the Manpower Act.

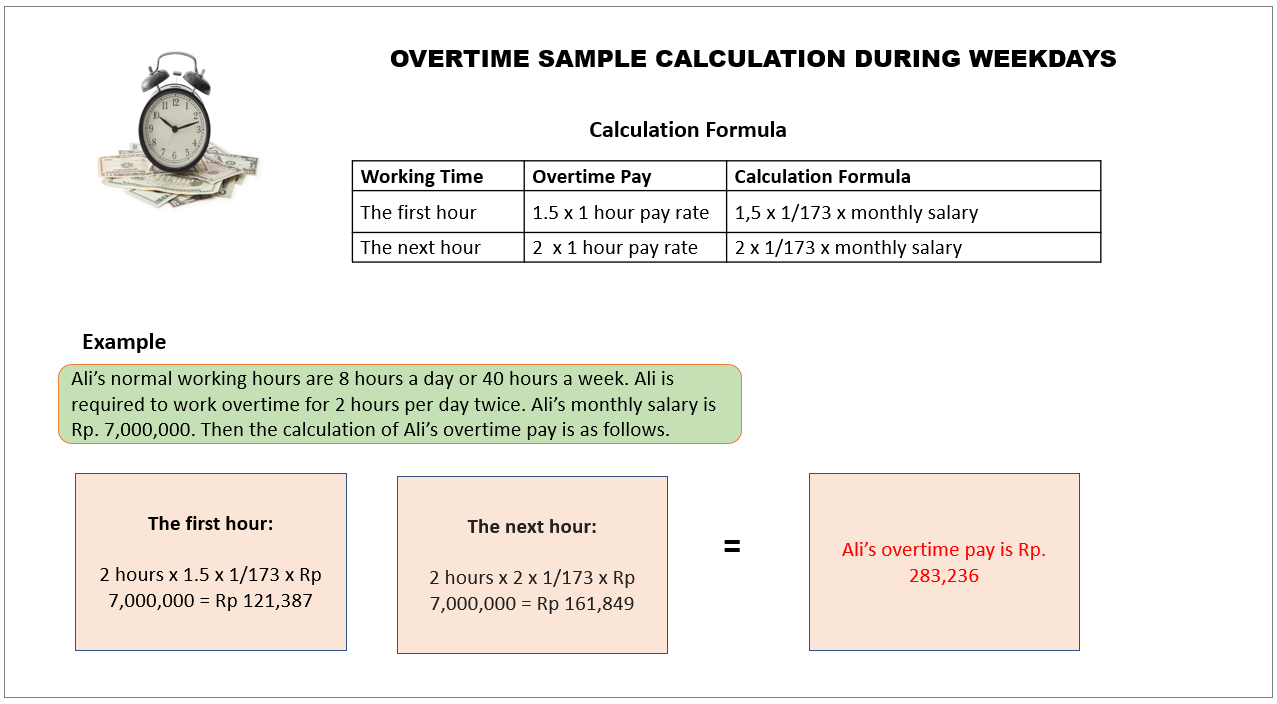

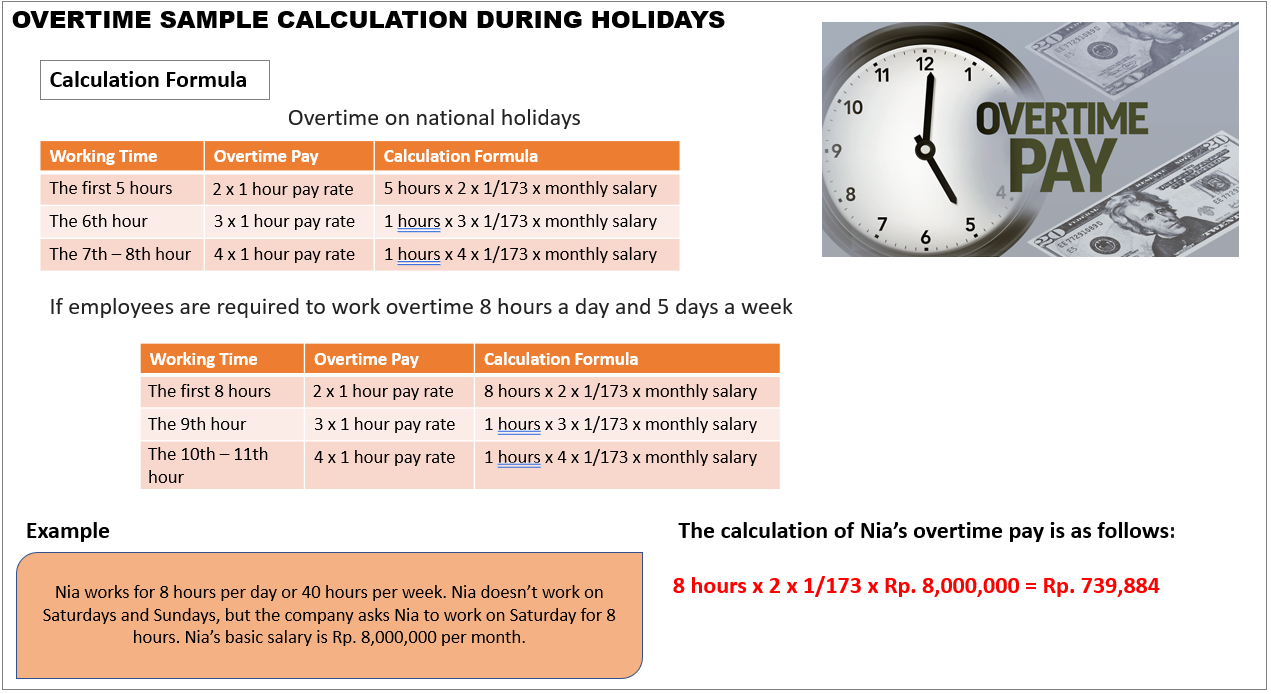

How to Calculate Overtime Pay in Indonesia?

In Indonesia, the overtime pay calculation is determined by Regulation of the Ministry of Manpower and Transmigration Decree No. 102/MEN/VI/2004.

- Based on the monthly salary of employees (including fixed allowances), overtime pay is calculated.

- Employees, one hour of overtime, is equal to 1/173 monthly salary.

Under the Ministry of Manpower and Transmigration regulations, overtime pay during weekdays and holidays is calculated differently. Below is how to calculate it.

Example of Overtime calculations during Weekdays and Holidays,

Note : The companies that apply for an overtime system must carry out the provision of an overtime pay policy. Also, overtime pay is not similar to incentives, so companies cannot replace overtime pay with incentives like THR, Bonuses, etc.

Minimum Wage

In Indonesia, The term minimum wage is undoubtedly familiar to employees and employers. According to a law or agreement, it is the lowest wage that an employer can pay an employee.

Usually, this minimum wage has increased every year.

The formula for calculating the minimum wage is regulated in PP 78/2015 article 44 paragraph 2, namely inflation plus economic growth.

Here is the calculation formula:

MWn = MWt + {MWt x (Inflation +% ∆ GDPt)}

Explanation:

- UMn: The minimum wage to be set.

- UMt: Minimum wage for the current year.

- Inflation: Inflation calculated from the period of September of the previous year to September of the current year.

- ∆ GDP: Gross Domestic Product growth calculated from the growth of Gross Domestic Product, covering the periods 3 and 4 of the previous year and the period 1 and 2 of the current year.

The following is an example of the calculation:

Usually, this minimum wage has increased every year. However, since late October 2020, Indonesia's Ministry of Manpower has noticed that due to the economic impact of the pandemic, the minimum wage rates will remain the same as in 2020.

Out of Indonesia's 34 provinces, only five provinces have decided to increase their minimum wage for 2021.

Following are the five provinces that have increased their minimum wage rate for 2021:

- Special Capital Region of Jakarta;

- South Sulawesi;

- Central Java;

- Special Region of Yogyakarta; and

- East Java.

For 2021, the minimum wage for each province is as follows,

With Deskera People, the Minimum Wage will automatically appear according to the selected State / Province. The minimum wage is updated according to government regulations.

The Regional minimum wage or UMR is a standard minimum salary that each region must pay in Indonesia. This UMR is the standard used by industry players and entrepreneurs to determine the wages paid to the employees.

Income Tax And Statutory Contributions in Indonesia

With its rich cultural landscape and global population, Indonesia has become a prominent location for expats looking to pursue new opportunities.

If you are relocating to Indonesia or are an expat, and are new to the tax regulations here, this is for you!

From the types of taxable income to non-taxable income to the different tax brackets that exist, let's navigate our way around the Indonesian Tax System.

Tax Residency Criteria

In December 2011, the Indonesian (DGT), Directorate General of Taxes, established an updated set of criteria to determine the tax residency in Indonesia.

Based on this, tax obligation is imposed on two separate groups:

- Individual Taxpayers

- Companies

Let's look in detail,

Individual Taxpayers

- If you have stayed in Indonesia for more than 183 days, the individual tax resident within a period of 12 months.

- Or within a fiscal year, it has been present in Indonesia for less than 183 days and has the intention to continue staying here.

- If the individual gets a working visa, work and stay permit, or an employment contract that extends beyond 183 days.

Non-Resident Taxpayers

For a non-resident, a single rate of 20% is imposed on gross income, except for income from the sale of shares and certain assets from incorporated companies, which is subject to final 5% tax on the sales proceeds.

Companies

- A company is considered registered in Indonesia if the establishment is based as per Indonesian law or if the setup is in Indonesia.

- A company is considered domiciled in Indonesia if its head office is based in Indonesia or has an administrative or financial headquarter in Indonesia or if its management is domiciled or domiciled in Indonesia.

Taxation Rates in the Indonesian Tax System

Personal Income tax in Indonesia is calculated through what is known as a self-assessment system. It means that all resident taxpayers are required to file their taxes on their tax returns.

Many registered local tax advisors in Indonesia can help find their way around in the taxation system.

All tax residents in Indonesia are subject to a Withholding Progressive Tax. It is a form of income tax that is contributed to the Government by the employee.

The higher your income, the bigger the tax imposed tax is known as the progressive tax system. Depending on the individual's income bracket, tax rates range from 5 percent to 30 percent,

Following are the individual Tax rates in Indonesia,

Most individuals income earned is subject to income tax at the following standard tax rates:

Taxable Income in Indonesia

In Indonesia, all forms of income generated by tax residents are considered as taxable; these includes,

- Income from employment

- Income from the exercise of a business or independent profession

- Passive Income ( royalties, interest, insurance gains, dividends, etc.)

- Capital gains (from the transfer or sale of the property)

- Any other income received from the property use (Rent collection)

The Taxpayer Registration Process

How to Register for an NPWP Number Online in Indonesia?

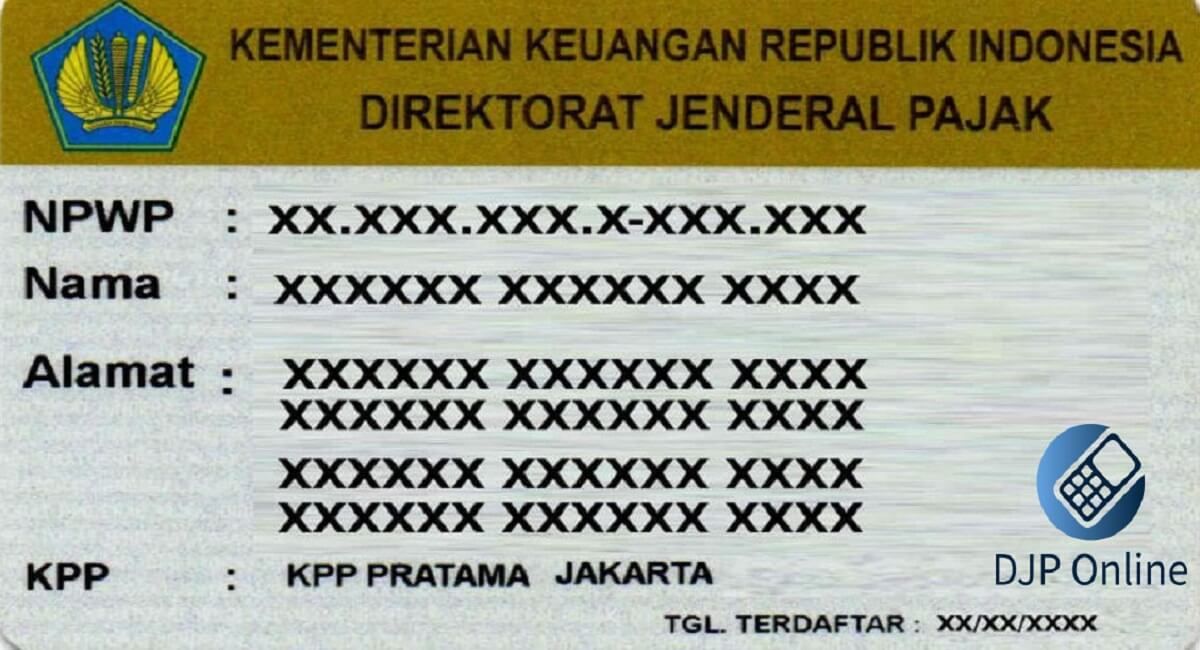

Taxpayer Identification Number (NPWP) is a series of serial numbers given by DGT to taxpayers as identity in carrying out tax obligations such as tax deposits and reporting.

You can register an NPWP Online through the DG Tax website. What are the procedures for registering an NPWP Online and the requirements? Check out our further discussion to find out the terms and how to make an online NPWP.

Requirements For Registering NPWP Online

When you want to create a Taxpayer Identification Number online, you need to prepare several documents below to make it.

A. Individual Taxpayers who do not carry out business or independent work

- Identity card (KTP) for Indonesian citizens.

- Passport and KITAS / KITAP for foreigners.

B. Individual Taxpayers Running Business or Independent Work or Certain Entrepreneurs

- Identity card (KTP) for Indonesian citizens.

- Passport and KITAS / KITAP for foreigners.

- Business activity permit documents issued by the competent authority or certificate of places of business activity or free employment from regional government officials at least from the Head of the Village or the Village Head.

C. Individual Taxpayers with the Status of Married Women who are subject to separate tax from their husbands

- Identity card (KTP) for Indonesian citizens.

- Passport and KITAS / KITAP for foreigners.

- Photocopy of husband's NPWP card.

- Photocopy of the family card.

- Photocopy of the agreement letter for the separation of income and assets or a statement letter intending to implement taxation rights and obligations separately from the taxation rights and obligations of the husband.

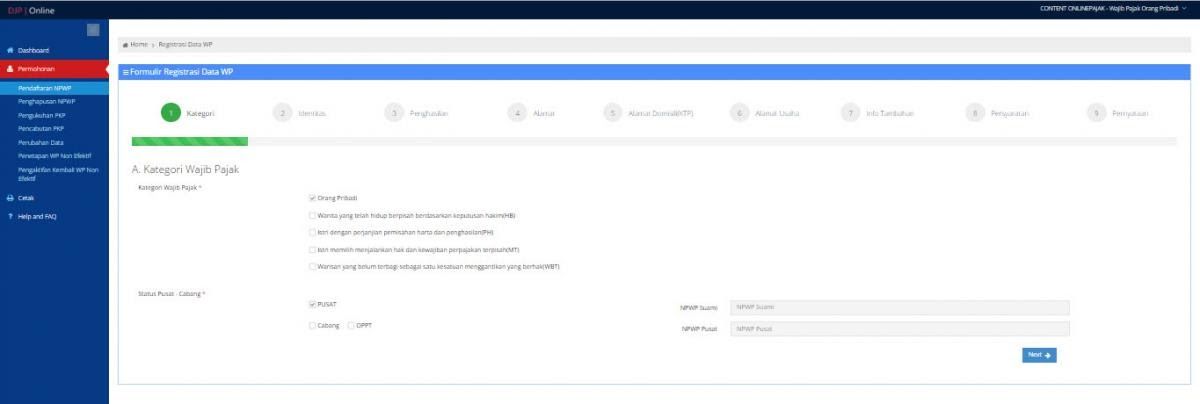

How to Register NPWP Online

Whatever the method ( online or offline ), the Taxpayer requirements must complete getting this Tax Card are no different.

However, this article will focus more on explaining how to register an online NPWP. The advantages of this method are that it is simpler, easier, and faster.

The following are the steps to register NPWP.

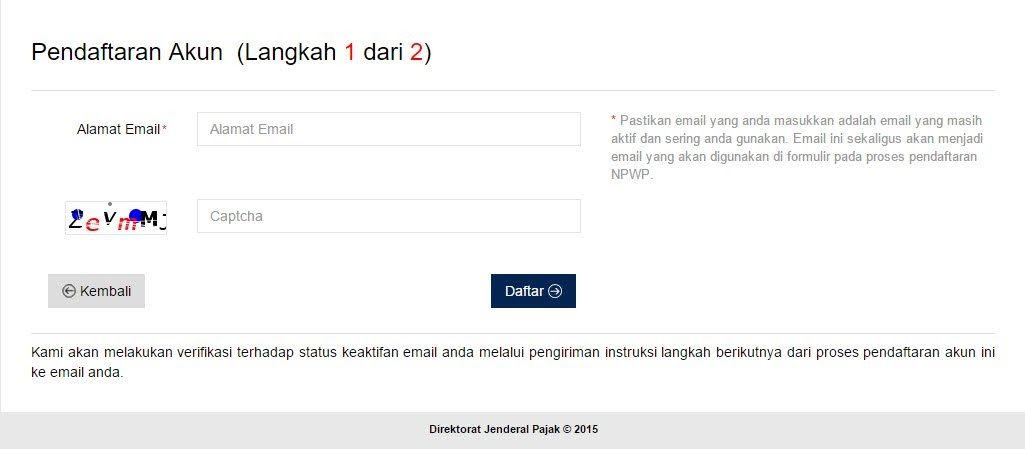

Step 1 - Create an Account at Ereg Tax

If you don't have an account, please create one by accessing the tax Ereg website ( https://ereg.pajak.go.id ).

You already know about Tax Ereg. For those of you who don't know, ereg.pajak.go.id is a website created by the Directorate General of Taxes to serve the making of NPWP online.

To get a new account, please fill in the fields as shown above according to the instructions.

Don't forget to check your email and click on the activation link sent. After that, follow the steps below.

Select the status "Center", if you are a single male or female. Meanwhile, if you are a married woman and want to branch your NPWP from your husband, choose a branch (often referred to as a Branch NPWP).

Do you often hear the term NPWP Pusat? The Central NPWP means the NPWP for individual taxpayers who are single or corporate taxpayers who only have one business unit.

Step 2. Complete Important Documents As Requirements

As a taxpayer, you must prepare several required documents as stated in the previous explanation. Don't also forget to adjust it to your Taxpayer status classification whether you are running a business or not.

Step 3. Send Electronic Files

After completing the form, click the "Token" button (secret code) on the dashboard. Then check your email. If, after 1 minute, the token has not been sent, please click the "Token" button again.

Then copy-paste the token in the email and go back to the dashboard menu. Then, click "Submit" and paste the token code in the "Token" column. After that, click "Submit Request."

Once approved, your NPWP card will be sent to your registered residential address. If you don't get it either after that period, chances are some documents have not been completed or are considered invalid.

Please re-register online by following the procedure mentioned above or call the KPP where you are registered for more information.

Besides online registration, you can also get it by coming directly to the Tax Office or sending a completed NPWP form and the required documents to the KPP near where you live.

Delivery can be made by post, courier service, or free expedition. Don't forget to save proof of delivery.

The following is a link to the registration form for an Individual Taxpayer Identification Number and a document submission letter: Online NPWP Form.

With Deskera People, you can auto-calculate PPH21 by entering the NPWP number in the system.

How to Calculate PPH21 Without NPWP Number in Deskera People?

Deskera People will auto calculate PPH21 as per the employee holding / not holding NPWP Number.

To understand more details, please refer to the below article,

Social Security Programs in Indonesia

In Indonesia, all companies must register their employees in health and employment and employment social security programs. The Indonesian Government has developed these programs to expand the social security benefits to more of the population.

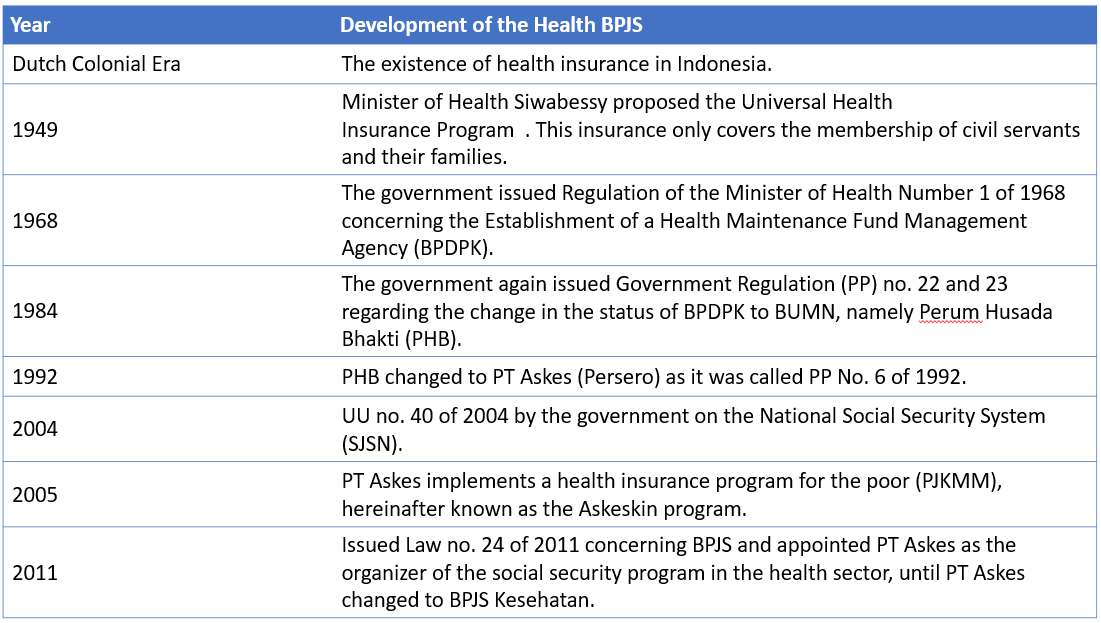

What Is BPJS?

BPJS stands for Badan Penyelenggara Jaminan Sosial (Social Insurance Administration Organization).

Indonesia's Social Security Programs(BPJS) is run by two organizations –

1. Social Security Administrator for Health (BPJS Kesehatan) for healthcare and,

2. the Workers Social Security (BPJS Ketenagakerjaan) for pensions.

Who Is Eligible?

The Indonesian Government has made it mandatory for all Indonesian citizens and foreigners to participate in social security programs. Expat employees must also enroll their families in the programs.

Let us see below in detail BPJS Kesehatan and BPJS Ketenagakerjaan that you need to know.

What Is BPJS Kesehatan?

Almost all Indonesian citizens must have heard of it, but do you know what BPJS Kesehatan is?

BPJS Kesehatan is certainly considered a breath of fresh air to create a prosperous society, especially in terms of health. If you experience an accident such as being sick and want to take medication, then the costs can be borne by BPJS Kesehatan through the fees that have been paid so far.

The Social Security Administration or BPJS Kesehatan is undergoing a long transformation. Following is the transformation journey for BPJS Kesehatan.

What Are the Documents Required to Register BPJS Health?

The various documents that you need to prepare are:

- A valid identity card like KTP, SIM, or passport.

- Family card.

- Marriage certificate for those of you who are married.

- Photocopy of passbook.

- Two pieces of 3 × four-color photography.

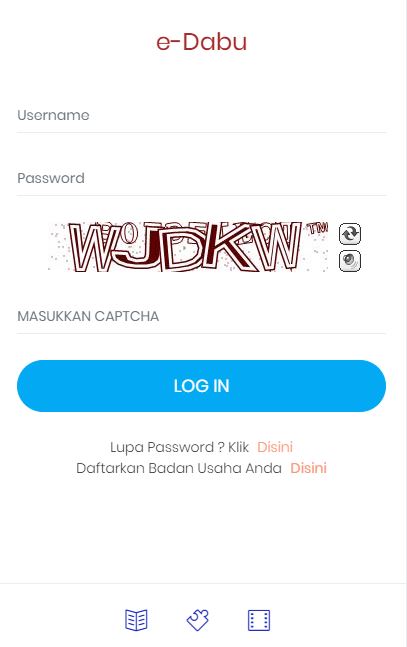

10 Easy Steps to Register for BPJS Health Online

If you are an employee of a company, the person who will register you is the local HRD office via the e-Dabu application. Follow the steps below,

Step 1- Ensure your company/business entity has been registered in the National Health Insurance Program - Healthy Indonesian Card (JKN - KIS). If your business entity has not been registered, you must read the terms and conditions before registering.

Step 2 - At the beginning of filling in the BPJS Kesehatan Business Entity registration portal, you will be asked to choose a location according to the applicable business license according to the work area of the BPJS Kesehatan branch office. You must complete all registration forms for business entities / other legal entities and include the email address used as the delivery address for the activation link.

Step 3 - As an applicant, you will receive an activation notification via email and then activate via a link to get:

- Print attachments for business entity registration forms.

- Business entity code.

- The JKN-KIS premium payment account number is in the form of a virtual account.

- Access rights ( username & password ) for applications used to register employees.

Step 4 - If your company/business entity has been registered, you can directly go to the BPJS Ketenagakerjaan website at https://edabu.bpjs-kkes.go.id to add your employees to the BPJS Healthcare Business Entity system.

Step 5 - Sign in using the username and password that you already have.

Step 6 - After loading a new page, click on "Participant Data" and select "Add Participant."

Step 7 - Then complete the required employee personal data. Make sure the employee's NIK is correct and in accordance with what is stated in the Dukcapil.

Step 8 - Click "health facility, then complete the data according to the city and province, as well as the participant clinic (according to the participant's domicile).

Step 9 - Select "Work Unit", then complete the data. Click Save.

Step 10 - After the data is saved, click "Approval. "In the "Approval" menu, select "New Participant Approval." Select the new entry "Mutation Type." Click "View Data." Make sure the date listed on the page is the date the data was saved. Check the little box and click "Check & Approval."

How to Calculate BPJS Healthcare Contribution for Employees?

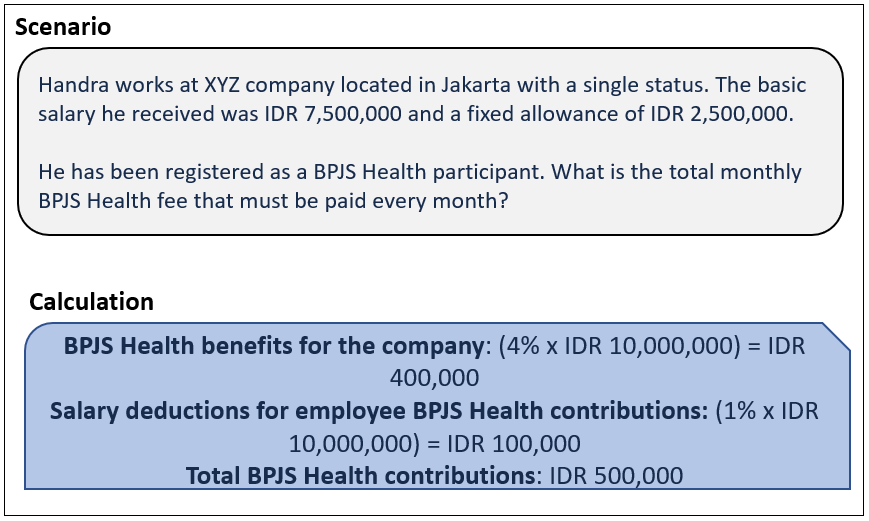

The following are the main points of calculating the Employee Health BPJS:

- BPJS Health contributions are 5% of wages or salaries.

- The company bears 4%, and employees pay 1% of wages/salaries.

- The highest limit of wages as a basis for calculation is Rp. 12 million.

- The lowest limit of wages as a basis for calculation is the UMK / UMP.

- Contribution includes benefits for five people (employees, husband/wife, three children).

- Additional family members are subject to an additional 1% fee per person.

Example of calculating BPJS

BPJS Health Care Premiums

Under Presidential Regulation Number 10 of 2016, your monthly amount of BPJS premium is determined. As per the class selected by members, the amount of the premium depends.

Class 1 - 150,000 rupiah per person, per month.

Class 2 - 100,000 rupiah per person, per month; and

Class 3 - 35,000 rupiah (US$1.74) per person, per month (Government can also top up an additional 7,000 rupiah, the total amount, per month, per person)

How to Pay for BPJS Kesehatan(Healthcare)?

When you become a member of BPJS Kesehatan, don't forget to pay monthly dues. So, after that, how do you pay BPJS Health dues? No need to worry; many channels can be selected and adjusted for your convenience, including:

- Come pay directly to the nearest BPJS Kesehatan Health office.

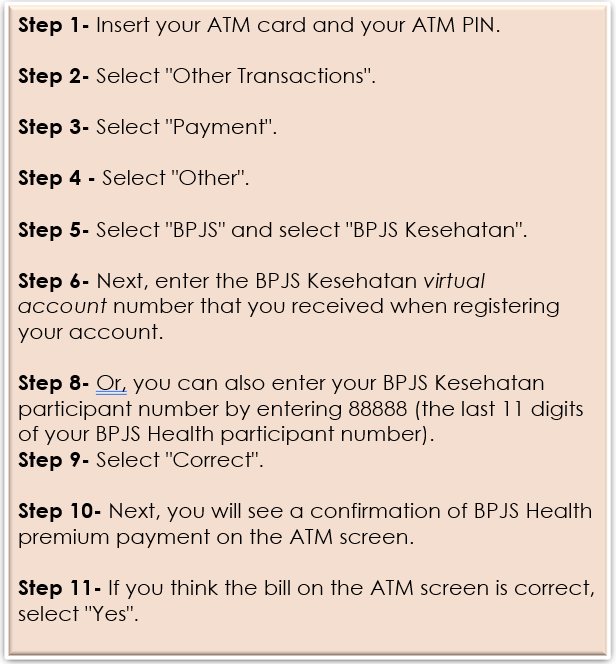

- Pay via ATMs that have collaborated with BPJS Kesehatan, such as ATM BCA, BNI, BRI, BTN, and Bank Mandiri.

- Come to the post office labeled PT Pos Indonesia.

- Pay via minimarkets such as Alfamart and Indomaret.

- Pay via e-commerce such as Tokopedia or Bukalapak.

Deskera People provides you with an automatic and accurate solution in calculating BPJS Kesehatan contributions as one of the components in PPh 21.

Penalty for Not Paying BPJS Healthcare Premiums

For over one month, if the BPJS healthcare premiums are overdue, then the coverage becomes inactive on the 10th of the following month.

Therefore, you need to pay any premiums that are outstanding to reactivate, capped at 24 months.

A penalty will incur within 45 days of reactivating coverage of any in-patient treatment. The penalty of 2.5% * treatment cost * a number of the month. It is up to the max 24 months/Rp 30 million, whichever is lower.

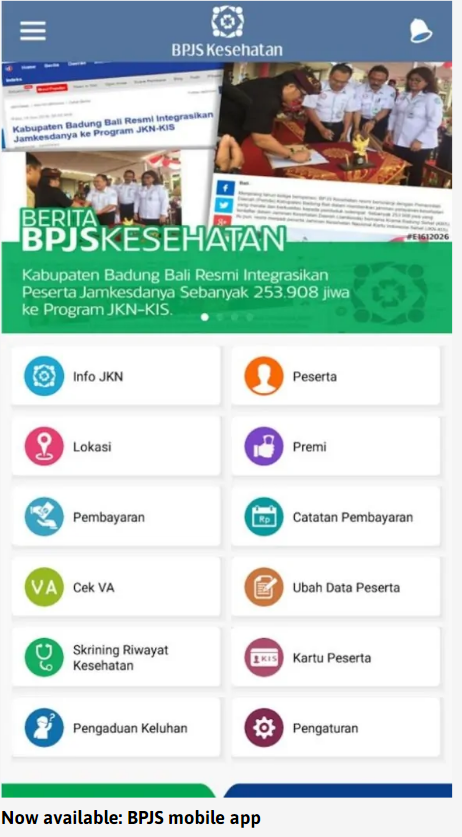

BPJS Android App

BPJS has also released an Android App, in July 2017. You can download this app for free via, Google Play store.

The app can also act as a virtual BPJS card. It can also check the status of your payments and lists the location of your care facility.

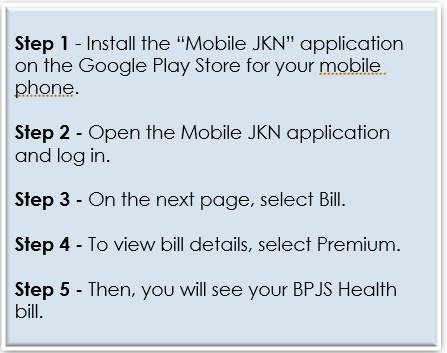

How to Check Your BPJS Health Bills?

After knowing everything from A to Z about BPJS Kesehatan, it's incomplete if you don't know how to check BPJS Health bills.

Well, here are five methods to check your BPJS Health bill:

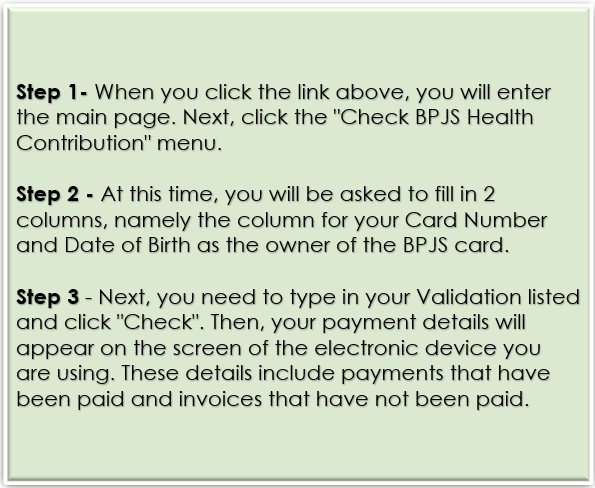

- BPJS Health Official Website

One of the easiest ways to check your BPJS Health bill is to use the BPJS official website, namely https://bpjs-kkes.go.id. Here are the steps you need to go through to check your BPJS Health bill through the website.

2. ATM

This one method is no less easy. You only need to come to an ATM of a bank that collaborates with BPJS, such as Bank Mandiri, Bank BNI, and Bank BRI. Well, here are the procedures for checking your BPJS Health bill:

3. Applications

You probably already know that BPJS Kesehatan has an official application that you can use to monitor your status, bills, and other needs regarding BPJS Kesehatan. For those of you who are Android users, you can upload it for free on the Google Play Store. Well, here's how to check BPJS Health bills through the official BPJS application:

4. SMS

The Government has also provided other convenient options for BPJS Kesehatan participants who want to check BPJS Health bills using the SMS method.

This service is also called SMS Gateway. You can directly call the cellular network at 087775500400. There is a variety of information about BPJS Health services that you can access via the number above

5. Other Channels

Some people wonder, are there other channels that can be used to check BPJS Health bills? Of course, there is. You can directly ask for your BPJS Health bill through the Care Center at 1500 400 or Mobile Customer Service (MCS).

How is BPJS Kesehatan (JPK) Applicable in Deskera People?

With Deskera People, you have an option to select the “JPK Applicable To” and add additional BPJS Kesehatan Family members, and it will auto calculate the amount in the system.

To understand more details, please refer to the below article,

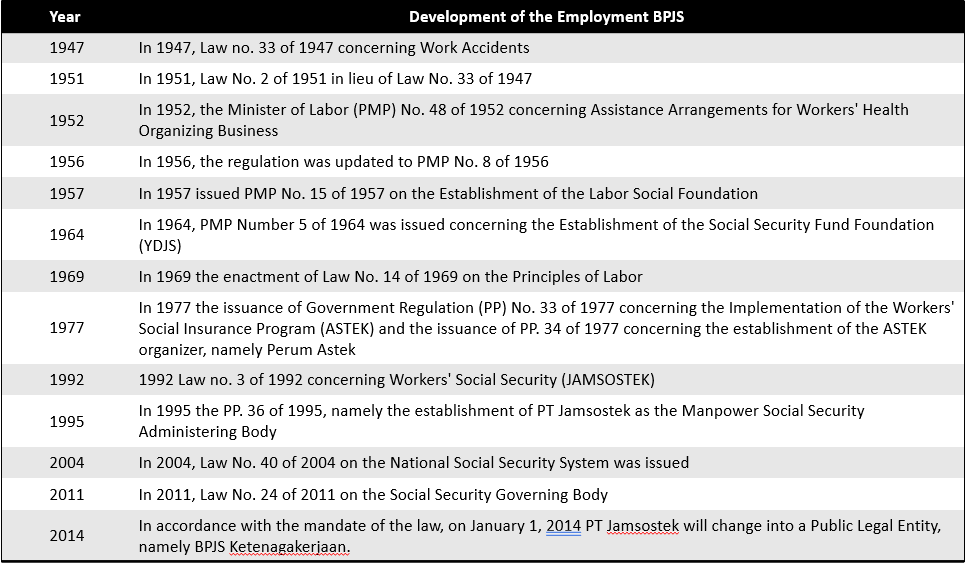

What Is BPJS Ketenagakerjaan?

BPJS Ketenagakerjaan (BPJSTK) is a legal entity provided to the public to protect all workers in Indonesia from certain socio-economic risks. The implementation of this BPJSTK uses a social insurance mechanism.

Previously, this service was called Jamsostek (Social Security for Workers), managed by PT Jamsostek (Persero). However, PT Jamsostek was later changed to BPJS Ketenagakerjaan under Law no. 24 of 2011 concerning BPJS since January 1, 2014.

BPJSTK has been operating actively since July 1, 2015, where the focus of the Government's social program is the workers or employees, both civil and private.

Therefore, BPJS Ketenagakerjaan is a mandatory program that the Government has launched. Every company is encouraged to register its workers in this BPJSTK program to get the social security they need.

Development Table of BPJS Ketenagakerjaan

Types of BPJS Ketenagakerjaan Programs

There are various types of programs available at BPJSTK. Well, here are the types of programs that Indonesian employees or workers can enjoy:

- Work Accident Security Program (JKK): The JKK program aims to protect various accident risks for workers in an employment relationship. For example, an accident that occurs on the way to the workplace/employee has a disease caused by the work environment.

- Old-Age Security Program (JHT): This program provides benefits in the form of cash under the accumulated contributions plus the proceeds from the development that can be used for life insurance in old age.

- Pension Security Program (JP): This type of BPJS Ketenagakerjaan is social security that aims to maintain a decent standard of life for the recipient/participant/heir by providing income after the participant enters retirement age, has a total permanent disability, or dies. Later, the benefits received by the participants are the money that will be paid out every month.

- Death Security Program (JKM): This program has benefits in the form of cash, which will be given to the heirs of participants who have passed away when membership is declared still active and not caused by work accidents.

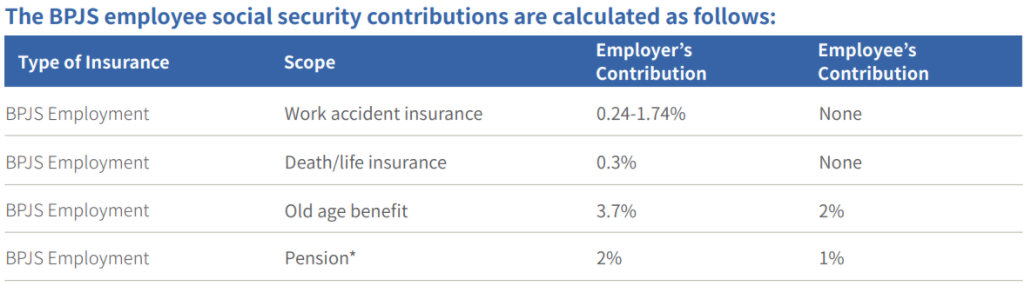

BPJS Ketenagakerjaan Contribution Rates

Talking about paying BPJS Ketenagakerjaan dues, after the company has registered its employees as participants in this social service, the participants must pay their monthly dues.

In this social program from the Government, several types of contributions must be paid, including:

- Work Accident Insurance (JKK), the amount is determined by the risk of work accidents, namely 0.24% for the risk of very low accidents, 0.54% for the low-risk level, 0.89% for the medium risk level, 1.27% for the risk level. High and 1.74 for the very high-risk level.

- Old Age Security (JHT) of 2%.

- Death Insurance (JK) of 0.3%.

- Pension security of 1% of basic salary.

Documents Required For BPJS Ketenagakerjaan

To register for BPJS Ketenagakerjaan will run smoothly if you have prepared the necessary conditions. You need to fulfill the following requirements before registering yourself or your company in the BPJS Ketenagakerjaan program.

BPJS Employment Registration Requirements for CompaniesFor workers participating in an employment relationship, registration is carried out by the employing agency or company by registering their employees in the BPJS Ketenagakerjaan program. Following documents are required for employers and workers to enroll in this program:

1. Original documents or photocopies of Trading Business Permits (SIUP).

2. Original documents or photocopies of the Company's NPWP.

3. Original documents or photocopies of Identity Cards.

4. Original/photocopy of the family card.

5. Original/photocopy of the family card.

6. Color photograph of the employee with the size of 2 x 3 (1 sheet).

BPJS Employment Registration Requirements for Independent Workers

You must fulfill the requirements as an independent worker/freelancer/entrepreneur without a business entity to register for BPJS Ketenagakerjaan, a forum or organization, is needed. You can form a forum or an organization consisting of at least ten people and then register BPJS Ketenagakerjaan. The following are some of the documentation requirements that must be met by independent workers when they want to register in the BPJS Ketenagakerjaan program:

1. Business license from the local village.

2. Photocopy of KTP of each worker.

3. Photocopy of the Family Card of each worker.

4. 1 sheet of color photographs for each worker with a size of 2 × 3.

After following the steps above, you will automatically be registered as a BPJS Ketenagakerjaan participant.

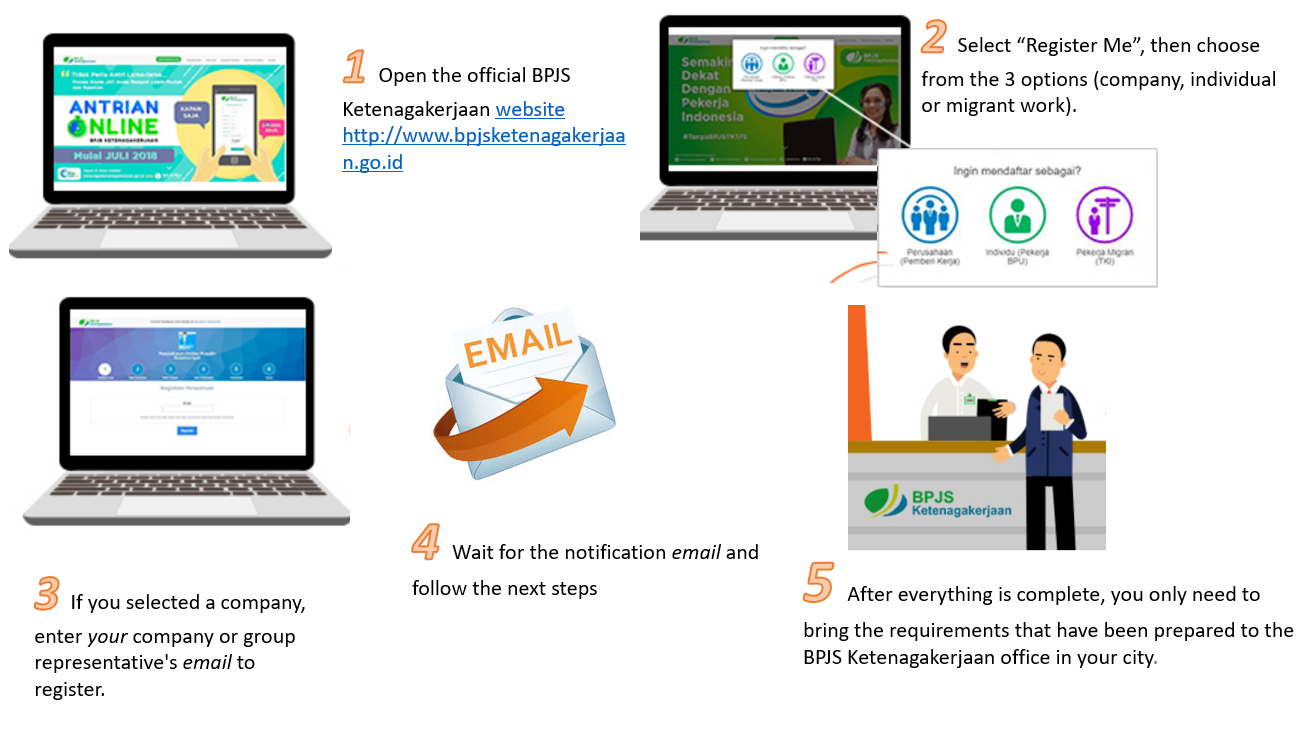

How to Register for BPJS Ketenagakerjaan Online & Offline?

If you are a company HRD or a business owner, employee happiness is essential. The reason is, happy employees will be much more productive and creative than those who are not.

Therefore, registering employees as BPJS Ketenagakerjaan participants is a must. Moreover, the Government requires companies to enroll their employees in this program.

So, if you are looking for a way to register employees as BPJS participants, here are easy ways you can follow, namely online and offline.

Steps to Register for BPJS Ketenagakerjaan Online

Step 1- Open the official BPJS Ketenagakerjaan website http://www.bpjsketenagakerjaan.go.id

Step 2 - Select "Register Me," then choose from the three options (company, individual or migrant work).

Step 3 - If you selected a company, enter your company or group representative's email to register.

Step 4- Wait for the notification email and follow the following steps.

Step 5 - After everything is complete, you only need to bring the requirements prepared to the BPJS Ketenagakerjaan office in your city.

How to Register for BPJS Ketenagakerjaan Offline

Unlike the way you register for BPJS Ketenagakerjaan online, if you register offline, you have to follow below such as:

1. Visit the nearest BPJS office.

2. For company registration (F1), fill out the form.

3. For worker registration (F1a), fill out the form.

4. Pay the first contribution by the amount calculated and determined by the BPJS Ketenagakerjaan.

How to Claim BPJS Ketenagakerjaan?

After knowing how to register for BPJS Ketenagakerjaan and what is required as a condition for registering for BPJS Ketenagakerjaan, it appears in your mind, how do you claim BPJS Ketenagakerjaan?

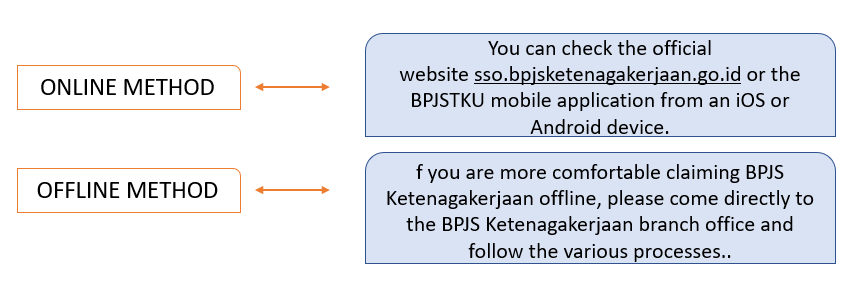

There are two options that you can use to claim BPJS Ketenagakerjaan, online and offline.

Participants who are still actively working or preparing for retirement can claim a JHT balance of 10% / 30%. Meanwhile, participants who are not working can submit a 100% balance search.

How to Pay BPJS Ketenagakerjaan Easily

There are various ways to pay for BPJS Ketenagakerjaan, from offline to online. If you are an employee at a company, usually your BPJS Ketenagakerjaan contributions will be taken care of by the company.

However, if you register individually, then you have to pay for it yourself. Paying BPJS Ketenagakerjaan contributions needs to be done once every month.

Following are some ways you can pay for BPJS Ketenagakerjaan:

- Through the BPJS Employment Office.

- Through the nearest BPJS Ketenagakerjaan (Jamsostek) Branch Office.

- Through the BPJS Ketenagakerjaan e-Payment System (EPS) from ATMs that have collaborated with BPJS Ketenagakerjaan EPS, such as Bank Mandiri, BRI, BNI.

Now, for BPJS Ketenagakerjaan payment, can be done online. It means that you no longer need to go to the BPJS Ketenagakerjaan office to make payments.

Easier, isn't it?

You can feel this convenience if you do it through the BPJS Ketenagakerjaan's Electronic Payment System (EPS) service. However, to use this service, you must register with the EPS BPJS Ketenagakerjaan service and create a dues code.

How to Check Your BPJS Ketenagakerjaan Bills?

Checking BPJS bills can be done independently. What media can be used to check BPJS bills? Checking bills and paying BPJS can be done in various ways.

To find out what steps can be used to check BPJS Employment bills, you can see below:

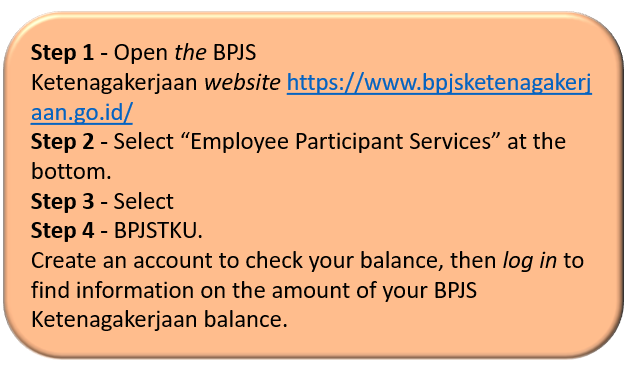

Check BPJS Employment Bills via the Website

Checking BPJS Employment bills can be done easily through the official BPJS Ketenagakerjaan website.

Here are the steps to check BPJS Ketenagakerjaan payments via the website :

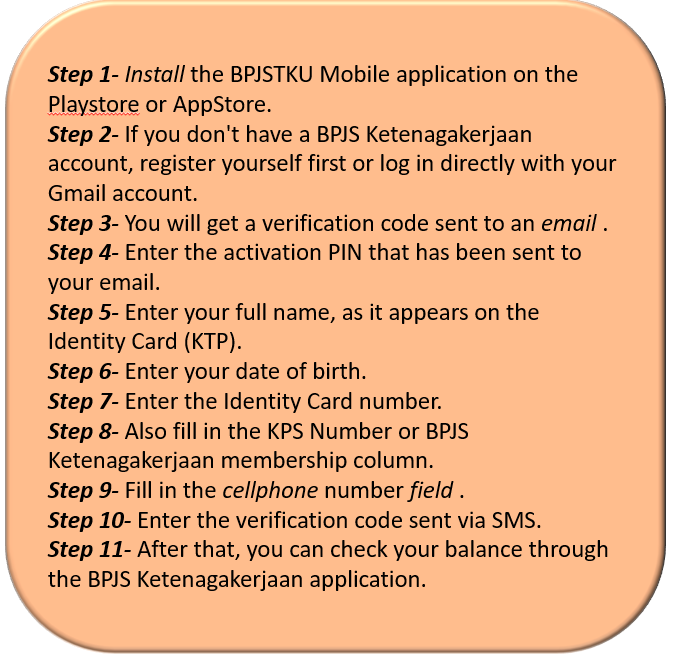

Check BPJS Employment Bills via the BPJSTKU Mobile Application

Apart from the official website, you can also check BPJS payments through the BPJSTKU Mobile application. How to do it?

Check BPJS Ketenagakerjaan Bills at the BPJS Ketenagakerjaan Office

Although conventional, the BPJS Ketenagakerjaan payment checks directly at the BPJS office is still a favorite of some participants. You just have to go to the BPJS Ketenagakerjaan office and bring your BPJS Ketenagakerjaan membership card. After showing the BPJS card. The clerk will help you to check the balance.

To read more in detail, click here.

With Deskera People, you can automatically calculate your BPJS Ketenagakerjaan amount without using Excel for FREE!

How Is BPJS Ketenagakerjaan Applicable in Deskera People?

With Deskera People, you have an option to select the JHT, JP, JKK, and JKM applicable To, which will auto calculate your BPJS employment amount in the system.

To understand more details, please refer to below articles,

Personal Reliefs And Deductions

The following personal reliefs and deductions are available for individual resident taxpayers in calculating their taxable income, depending on the taxpayer's circumstances.

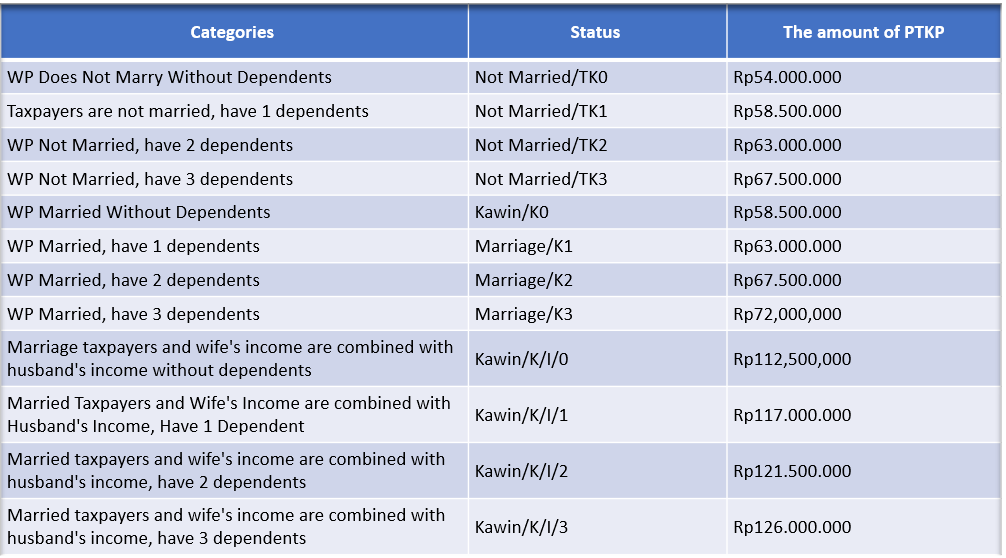

What Is PTKP (Non-Taxable Income)?

Non-taxable income (PTKP) is one of the important components in calculating income tax (PPh21).

When calculating taxes, PTKP is used as a subtraction component of the gross income earned by taxpayers. From the result of this deduction, you will get the amount of taxable income. Thus, taxpayers or employees whose income is equal to or below the PTKP limit do not need to pay income tax.

PTKP Rates and Categories

The amount of PTKP is not fixed. The PTKP may increase depending on the cost of living index and the minimum wage. The increase in inflation is also a consideration for the Director-General of Taxes to make the latest PTKP rate adjustments.

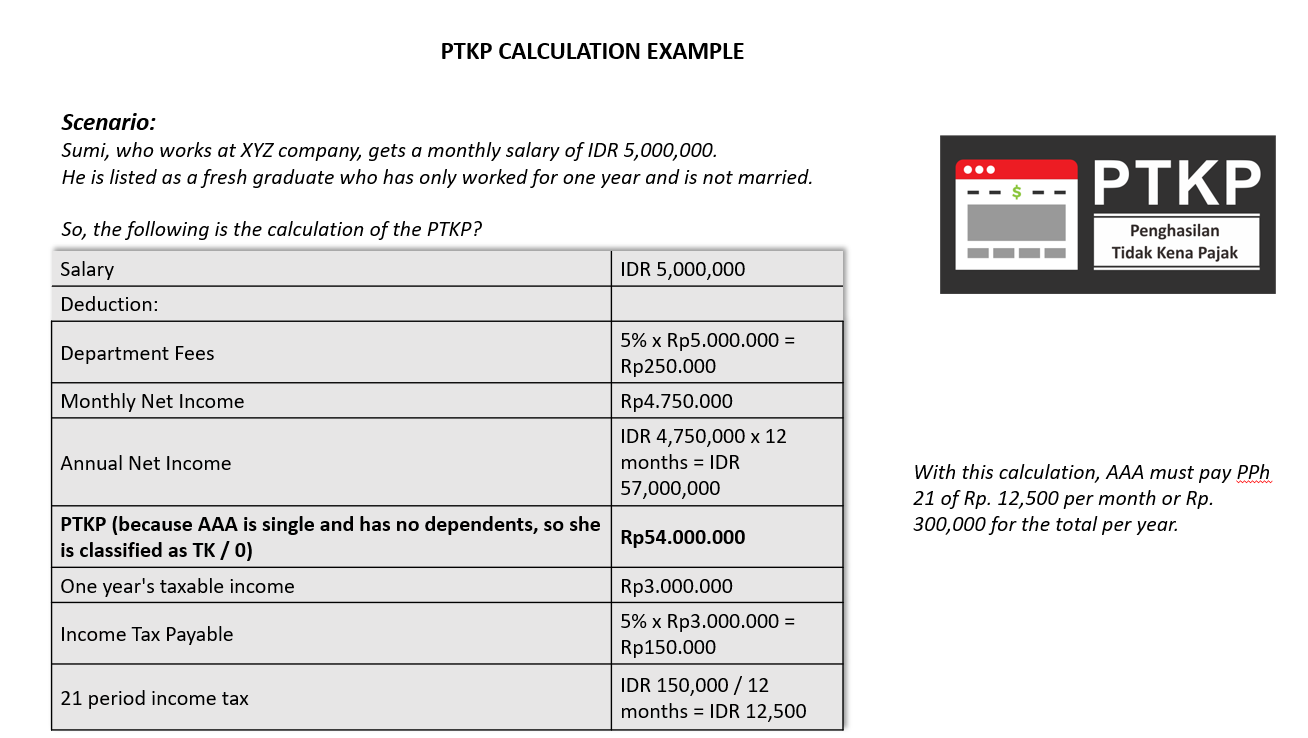

Example

Office/Occupational and Pension Cost

Occupational Cost:

Have you ever seen an employee's salary slip that has been deducted from PPh 21? Why is the gross income you receive always deducted by 5% for the cost of office?

Yes, it turns out that the office fee has been regulated in Law concerning Income Tax. The details are contained in Article 21 paragraph (3) of the Income Tax Law, which regulates the income of permanent employees or retirees who are deducted by PPh 21 every month gross income less office fees or pension costs, pension contributions, and non-taxable income (PTKP).

Imposition of a 5% office fee is stipulated. It is explained that the cost of the position is set at 5% of gross income. A maximum of IDR 6,000,000 a year or IDR 500,000 a month.

It is generally explained that the cost of a position in PPh 21 is the cost of obtaining, billing, and maintaining income that can be deducted from the income of permanent employees. Department costs can still be reduced (deductible), regardless of whether the officer has a department or not.

Example of calculating office fee

Sumi is a permanent employee with a single status at ABC Company with a salary of IDR 6,000,000 per month. To earn a net or net income, Anwar's salary must be deducted from the office fee by 5%, which is IDR 300,000 (5% x IDR 6,000,000)

Pension Cost

Deduction on pension annuity for a retiree: 5 percent of gross income up to a cap of IDR2,400,000 per year.

How Is PTKP Applicable in Deskera People?

With Deskera People, you have an option to select the PTKP status with the below simple steps, which will help auto exempt from PPH21 calculation while payroll processing.

To understand more details, please refer to the below articles,

What Is THR (Holiday Allowance)?

THR is a yearly holiday allowance given to the employees at least one week before the religious holiday observed by employees based on their religion. THR allowance is equivalent to one month's salary based on the period of employment. For THR payment, below are the recognized religious holidays,

- For muslims Eid-il-Fitri ;

- For Catholics and Protestants, Christmas;

- For Hindus Nyepi;

- For Buddhists Vesak; and

- For Confucianism Chinese New Year.

THR Calculation Provisions

THR must be paid to employees no later than seven days before the holidays. Therefore, it is only natural that as HR, you are busy calculating the THR when entering the month of Ramadan. The calculation of THR itself is regulated in the Minister of Manpower Regulation Number 6 of 2016 concerning Religious Holiday Allowances for Workers / Laborers in Companies. To get THR, an employee must work for at least one month with the company as per policy.

Articles 2 and 3 of Permenaker 6/2016 state that the employee THR calculation depends on the employee's tenure as follows:

1. Employees who have had a working time of 12 months continuously or more are given THR of 1 month's wages.

2. Employees who have a working period of one month continuously but less than 12 months are given THR proportionally according to the working period with the following calculation:

If any of your employees have worked for 12 months, they are entitled to receive THR, which is described as:

1. Wages without allowances (net wages).

2. Basic wage, including fixed allowance.

Example of THR Calculation

Abdul's monthly salary of Rp12,000,000 and a working period of 16 months, so he is entitled to THR of Rp12,000,000 as per the THR rules.

Meanwhile, Sasa is an employee with a monthly salary of Rp5,000,000 and a working period of 6 months, so the THR calculation for Sasa is:

(6 months x IDR 5,000,000)

_________________________ = IDR 2,500,000

12 months

What is Income Tax - PPH21, and How to Calculate It?

Every citizen who works or does business and has an income above the Non-Taxable Income (PTKP) is required to pay taxes in accordance with the applicable regulations. They are called individual taxpayers. Every year, taxpayers must report an Annual Income Tax Return (SPT ) 21 Personal or Income Tax Article 21.

"The definition of PPh 21 is a tax on income in the form of salary, wages, honorarium, allowances and other payments in whatever name and in any form in connection with work or position, services and activities carried out by individuals who are domestic tax subjects or referred to as taxpayers".

Who Is Required to Pay PPh21?

The regulation written in article 3, which states that there are six categories of taxpayers for Income Tax 21, namely:

- Employees

- Recipients of severance pay, pensions, or cash pension benefits, annuity, or pension, including the heir also the taxpayers of income tax 21

- Not employees or those who receive or earn income in connection with the provision of services, namely: Experts who do independent work, consisting of lawyers, accountants, architects, doctors, consultants, notaries, appraisers and actuaries, musician, presenter, singer, comedian, film star, soap opera star, commercials star, director, film crew, photo model, model/mannequin, playwright, dancer, sculptor, painter and other artists, sportsman, advisor, instructor, coach lecturers, extension agents and moderators, authors, researchers and translators, service providers in all fields including engineering, computers and their application systems, telecommunications, electronics, photography,etc.

- Members of the board of commissioners or the supervisory board do not serve concurrently as permanent employees at the same company,

- Former officer,

- Taxpayers with PPh 21 categories of activity participants who receive or earn income in connection with their participation in an activity, including competition participants in all fields, including sports, art, agility, science, technology and other competitions, meeting participants, conferences, etc

Methods to Calculate Employee's PPH21

In general, there are three methods to calculate the PPh 21 calculation, namely the Nett, Gross, and Gross-Up income tax calculation methods.

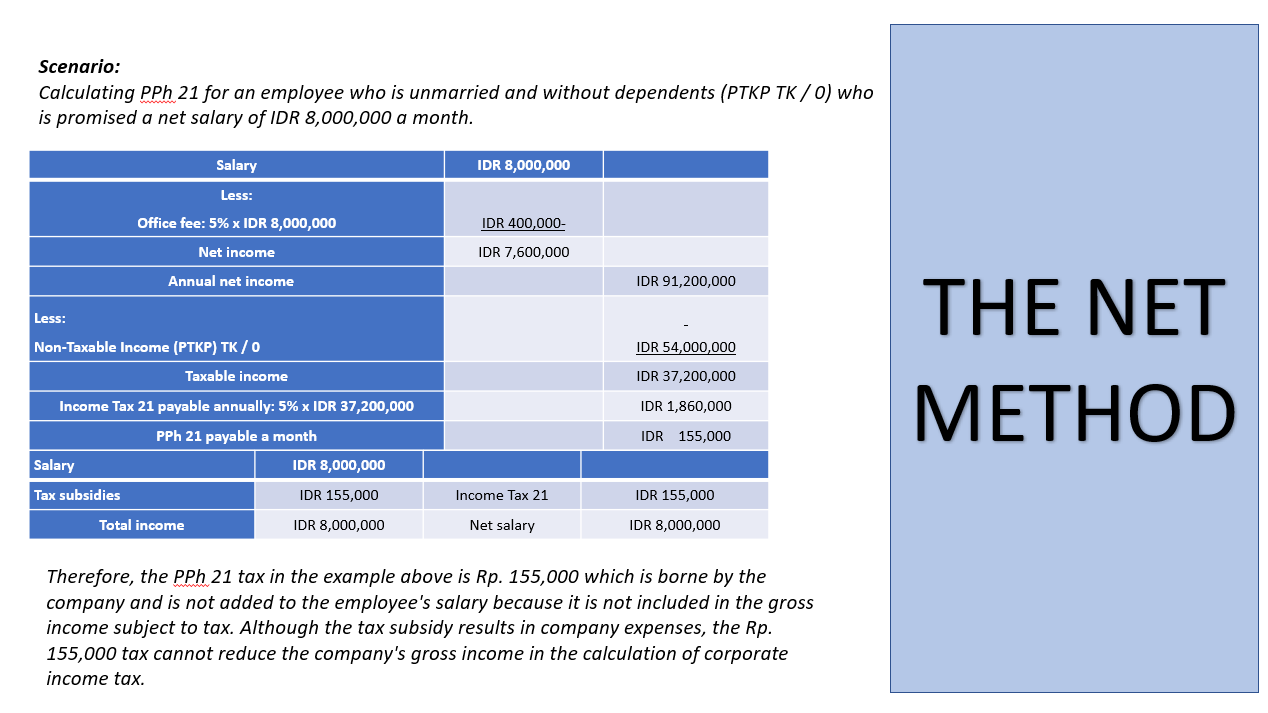

The Net Method

The net method is applied to employees or income recipients who get a net salary with taxes borne by the company.

Example of calculating PPh 21 with Net Method

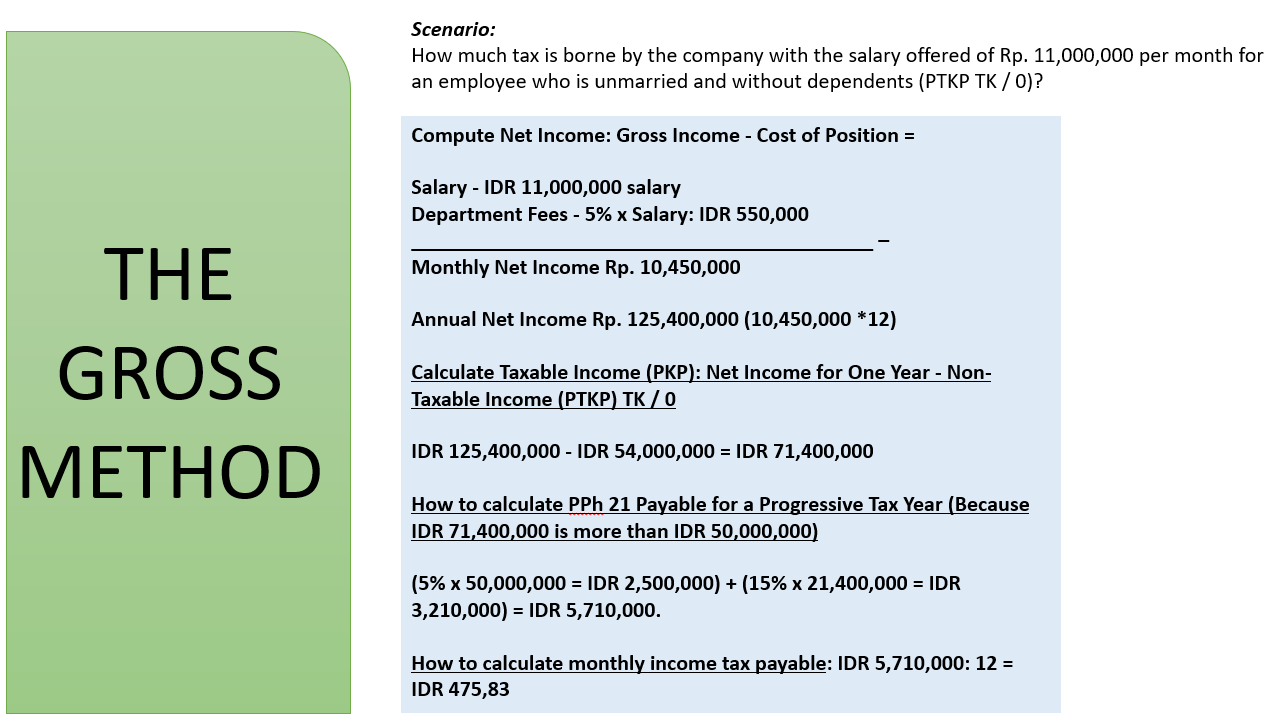

The Gross Method

The gross method is applied to employees or income recipients who bear their own payable PPh 21. It means that the employee's salary has not been deducted by PPh 21.

Example of calculating PPh 21 with Gross Method

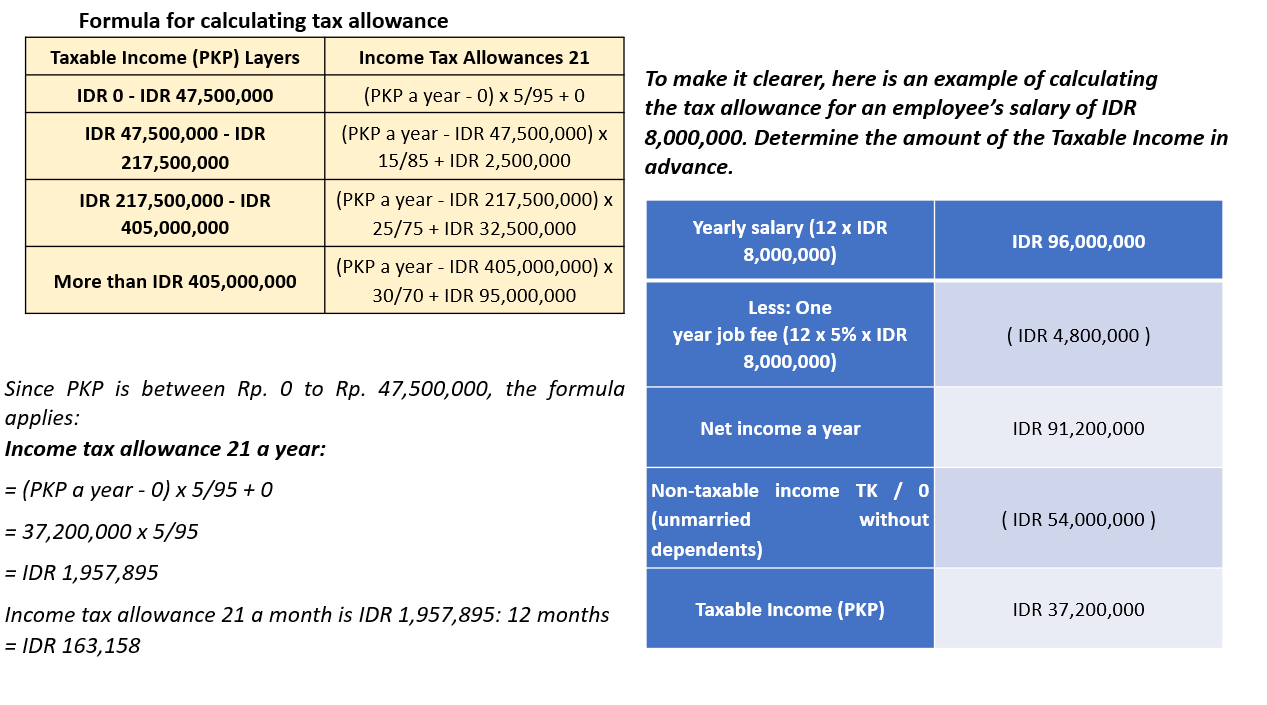

The Gross up Method

The gross-up method is applied to employees or income recipients given tax allowances (their salaries are increased first) in the amount of withholding tax.

So, in simple terms, the company's taxes and fees are borne by including tax allowances on the income provided.

There are two steps in calculating PPh 21 gross-up, namely:

1. Calculating Tax Allowances

The Gross-Up method is a tax deduction where the company provides tax allowances equal to the amount of tax withheld from employees. The Gross-Up Method is more complicated.

Example,

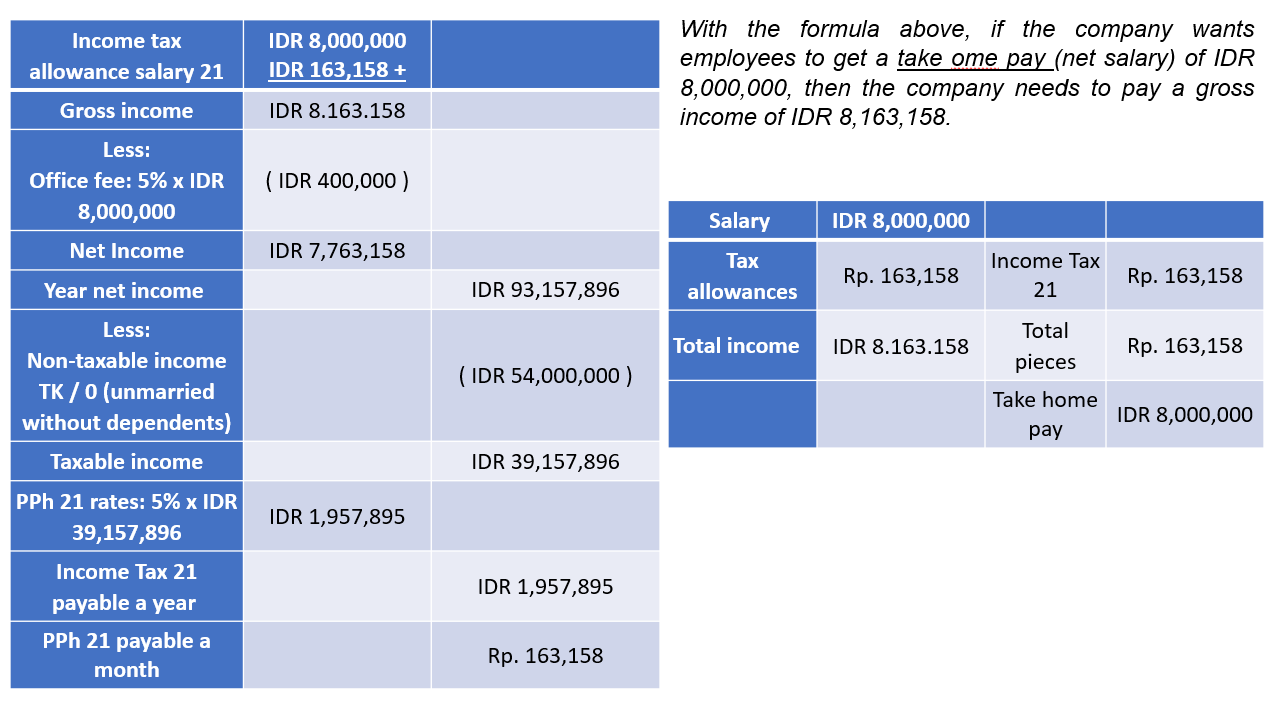

2. Calculating Gross-Up Income Tax 21

After getting the tax allowance amount, the next step is to calculate employees' PPH21 by entering this amount into the employee's gross income. The correct calculation will result in withholding PPh 21, which is the same amount as the tax allowance, as shown in bold below:

Example,

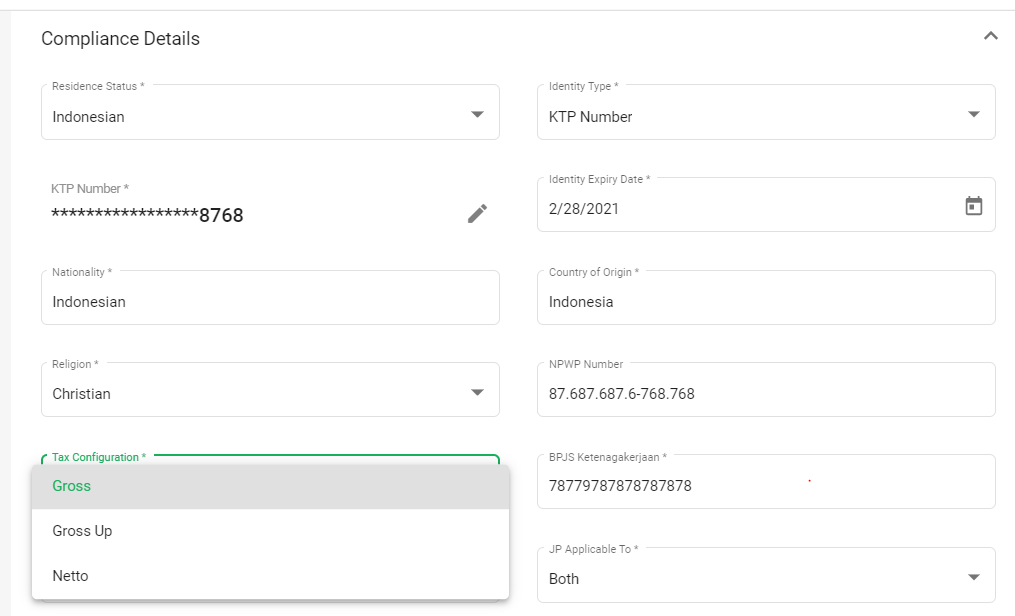

How Are These Methods Applicable in Deskera People?

With Deskera People, you have an option to select the type of tax calculation to Gross, Gross-up and netto methods, according to company regulations.

What Are The Components Required To Calculate PPH21?

To understand the details of calculating PPh Article 21, you can learn the basic components and concepts of how to calculate PPh 21 below.

Department Fees

Position costs are expenses (costs) for a year related to work. The position fee is set at 5% of gross annual income and a maximum of Rp. 500,000 a month or Rp. 6,000,000 a year.

Retirement Costs

The stipulated pension fee amount is 5% of gross income and a maximum of IDR 200,000 per month or IDR 2,400,000 per year.

BPJS Health and Employment

Currently better known as the Health Social Security Administration (BPJS), a public legal entity that has direct responsibility to the president, has the main task of providing national health insurance for all Indonesian citizens.

Operating officially since 2014, the Indonesian Government operates BPJS with a product called BPJS Kesehatan. This program requires all Indonesian citizens to have health insurance. Of the workers' wages, the costs taken for the BPJS Kesehatan allocation amount to 1 percent.

Meanwhile, another BPJS program, namely BPJS Ketenagakerjaan, has been operating since July 1, 2015. BPJS Ketenagakerjaan is a facility that replaces Jamsostek (Labor Social Security).

BPJS Ketenagakerjaan has the function of protecting all workers through 4 employment social security programs which include Work Accident Security (JKK), Death Security (JK), Old Age Security (JHT), and Pension Security (JP).

The monthly contribution for each guarantee is 2 percent for JHT, 1% for JP, 0.24% for JKK and, 0.3% for JK.

Taxable and Non-Taxable Income

Taxable Income (PKP) is the amount of wages of workers who will be subject to PPh 21 after being calculated with benefits, BPJS Employment and Health, and others.

Meanwhile, Non-Taxable Income (PTKP) is an important component which is a deduction from the total gross income value for taxpayers who are not subject to tax.

How Is PPH21 calculated in Deskera People?

With Deskera People, you can auto calculate the PPH21 quickly and accurately with the components mentioned above with lesser errors.

To learn more, please refer to the below article,

Annual Individual Income Tax Reports in Indonesia

As good citizens, employees of taxpayers are required to report their annual tax returns (SPT). The company has deposited the obligation to pay Income Tax (PPh) 21 to the state deducted from each employee's salary every month.

Therefore, as an individual, an employee is required to report the Annual Tax Return no later than March 31 of each year. It is proof that they, as taxpayers, have fulfilled their obligation to pay Income Tax 21.

This Annual Tax Return contains the total gross income and taxes that have been paid to the state through the DGT Online system.

Before reporting the Annual Tax Return, have an EFIN (Electronic Filing Identification Number) first obtained by DGT. Then prepare a proof of deduction form, which is used to fill out the SPT.

So, how do you report a complete Individual Annual Tax Return? Let's get into that further.

Types of Individual Annual Tax Return Forms

Personal taxpayers have three types of Annual SPT forms: SPT Form 1770, SPT Form 1770 S, and SPT Form 1770 SS.

The three forms are classified based on the amount and source of income obtained by an Individual Taxpayer (OP) in one tax year.

Annual SPT Form 1770

First, there is the Annual SPT form 1770. Form 1770 is a form used by WP OPs(Individual Taxpayers) who have status as business owners and workers with certain skills or can be called freelancers.

For example,

catering business owners, doctors, lawyers, and so on.

In addition, this form is used by OP WPs who have more than one type of work, either full-time or part-time.

Form 1770 is also intended for someone who works for more than one company or agency with final income tax and has income from within or outside the country.

Taxpayers who no longer earn income can also report the Annual Tax Return through this form, provided that they include a statement letter on the stamp and fill in the amount "0" in the income column.

Annual SPT Form 1770 S

Second, the Annual SPT form 1770 S. Form 1770 S is a form used by OP WPs with an annual income of more than Rp.60,000,000.

Not only that, workers who have sources of income from more than one workplace (at least two) can also report taxes with form 1770.

There are two attachments accompanying Form 1770. The attachment must be filled with information by taxpayers, such as proof of withholding tax, total income, number of family members, and other related matters.

Annual SPT Form 1770 SS

Finally, the Annual SPT form 1770 SS. Form 1770 SS is a form used by taxpayers with an income of less than or the equivalent of Rp.60,000,000 each year.

On this form, permanent employees must fill in the several fields provided, such as personal identity, income tax, list of assets and liabilities, statements, and additional attachments such as proof of withholding tax.

It is because it only transfers data from form or deduction evidence 1712 A1, intended for private workers, and form 1712 A2, which is intended for civilian workers.

Click here to download the forms.

Withholding Tax For Employees

As a taxpayer, you need to have proof of withholding tax. The obligation of every citizen in paying taxes should be accompanied by the production of evidence for the withholding tax.

Parties authorized by the state to withhold or withhold taxes are required to provide proof of withholding tax.

Withholding Tax Slip

Proof of withholding tax is an important document that all income recipients or taxpayers must own. Therefore, every taxpayer is advised to keep proof of withholding taxes properly. This evidence of tax cuts should be attached to the SPT Annual Income report.

Types of Withholding Tax Forms for Employees

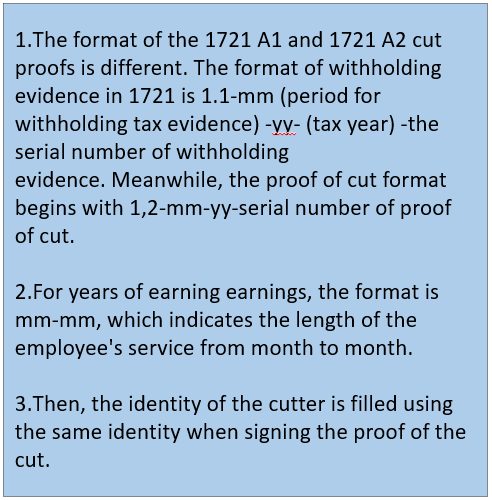

There are two types of withholding tax forms for employees: form 1721 A1 and 1721 A2. What is the difference?

- Form 1721 A1 is intended for private employees,

- And Form 1721 A2 is generally reserved for Civil Servants, Members of the Indonesian National Army, Members of the Police of the Republic of Indonesia, and retirees from these jobs.

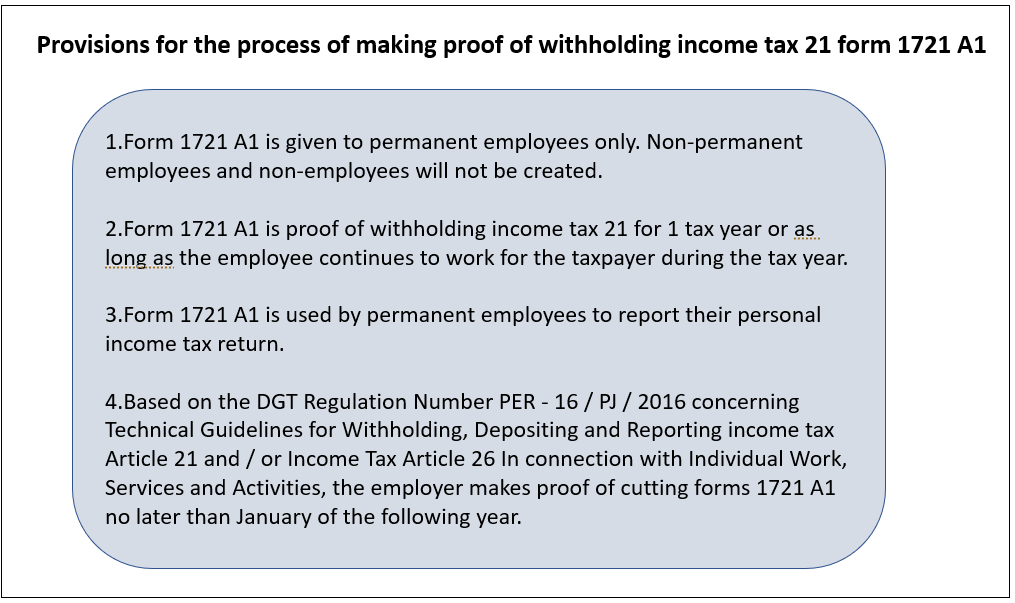

The process of making Form 1721 A1 cannot be done carelessly. Several conditions must be met before creating Form 1721 A1.

What Are The Provisions for Making Form 1721 A1?

Before making proof of deduction 1721 A1 or A2, there are several things that the employer must know,

When Is Form 1721 A1 Used?

Form 1721 A1 must be made by the employer, then given to the employee/employee before the tax reporting period.

For example, the period for receiving income is January-December, so proof of withholding income tax article 21, form 1721 A1 is given on the last week of December or at the latest in January of the following year.

And if the period of receipt of income is less than one year.

For example, in the period for receiving income from January to June, the proof of withholding income tax article 21 form 1721 A1 is given at the end of June or in July.

What Is DGT Online? Steps to Register for DGT Online

DJP Online is a website owned by the Directorate General of Taxes (DGT), which contains various tax applications. Through this government-owned tax application, taxpayers can report SPT online (e-filing) and pay taxes online.

Online DGT Taxation Features

On the government tax application site, there are two tax applications that taxpayers can use for free. These applications are e-Filing and e-Billing. However, we will specifically discuss the application for e-Filling government-owned tax returns.

e-Filing

e-Filing is a tax application that allows taxpayers to report SPT online and in real-time. This application, which was launched in 2014, can be used to report a number of tax returns such as SPT PPh Article 21/26, Personal Income Tax Return, Article 4 paragraph 2 PPh SPT, PPN SPT, and Article 22 PPh SPT.

In addition, this feature allows taxpayers to fill out SPT offline but can be uploaded and reported through DJP Online. This feature is used to report the 1770 S Annual SPT, 1770 Annual SPT, and 1771 Corporate Annual Tax Return.

The presence of the DJP Online application has made it easier for taxpayers to fulfill their tax reporting obligations since it was launched several years ago. In Indonesia, people categorized as taxpayers must regularly report their Annual Tax Returns (SPT).

Steps to Register DJP Online e-Filing

To use this online tax reporting service, you must first register an account. If this is your first time registering for e-Filing on the DJP Online website, here are the steps and preparations you need to pay attention to.

It must be noted that the EFIN application must be made by the person concerned or by yourself, especially for individual taxpayers.

You may not ask other people or authorize other parties to do so. Meanwhile, for corporate taxpayers, EFIN activation applications can be made by the management appointed to represent the agency in exercising tax rights and obligations.

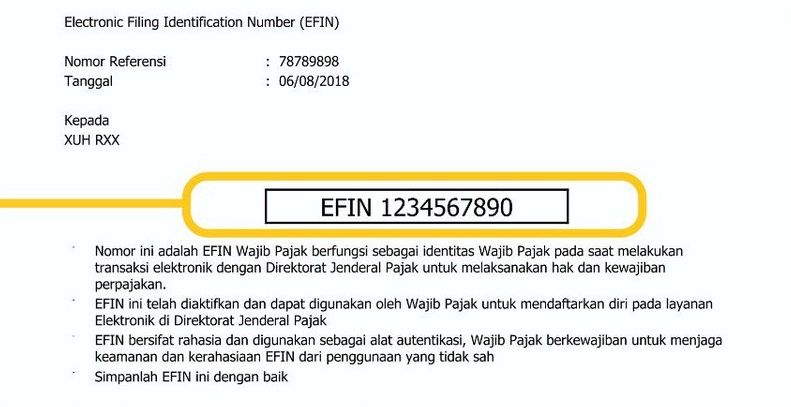

Step 1 -Apply for an EFIN

For taxpayers who are using tax e-filing for the first time, the first step you must take to register an account is to apply for EFIN ( Electronic Filing Identification Number ) activation.

EFIN is an identification number that the DGT only issues to taxpayers who wish to conduct tax transactions electronically. Activation has to be done no later than thirty days after you get your EFIN.

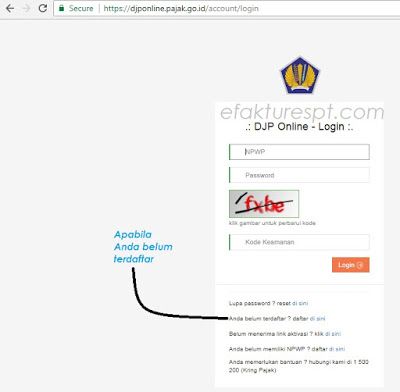

Step 2 - Click the Registration Link on the DGT Online website

If you have received an EFIN from the KPP or KP2KP, now you can register by creating an account at the online tax service. You can visit the DJP Online e-Filing website at djponline.pajak.go.id/account/login or the efiling application service provider (ASP).

In creating an e-Filing account, two things need to be prepared, namely EFIN and Taxpayer Identification Number (NPWP). After that, enter the DJP Online site and click the registration link.

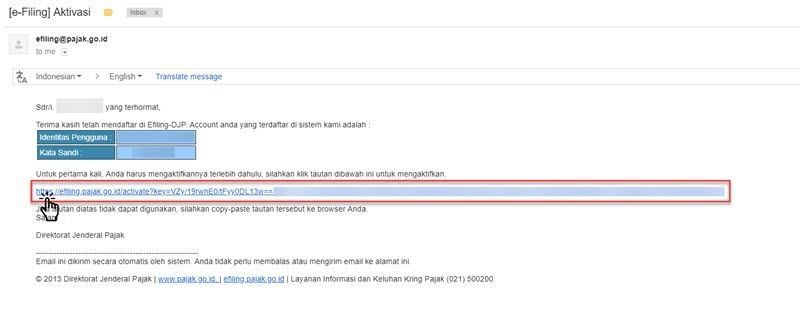

Step 3 - Create an account on the DGT Online e-Filing website

If everything has been prepared, you can immediately enter the EFIN number, NPWP, and security code, then click the "Verify" button.

In addition, you will also be asked to enter an email address and set a password for your e-Filing account. Ensure the email address is active and still accessible because it will be used to send the account activation link.

Step 4 - Account activation via a special link

After that, the system will automatically send the taxpayer identity (NPWP), password, and activation link to the email address that you have registered. You can immediately click on the activation link.

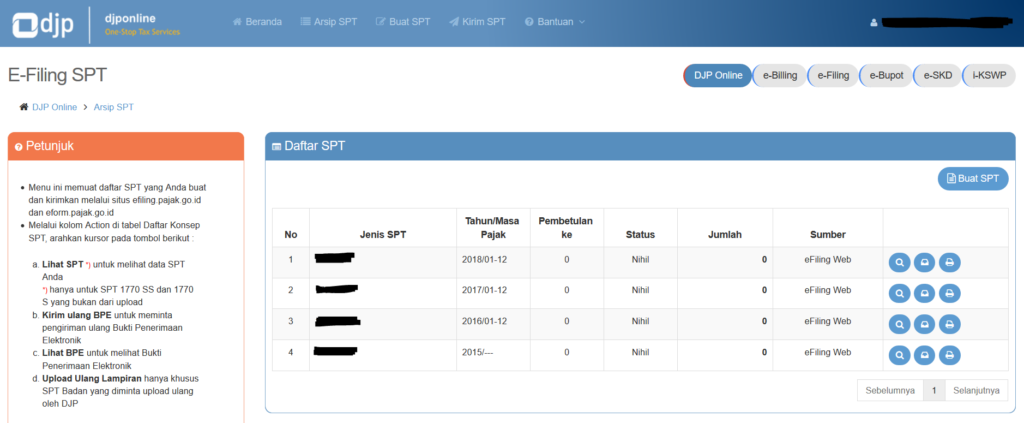

How to File Tax SPT PPh 21 DJP Online?

Step 1 - Login to your DJP Online e-Filing account

If the account has been activated successfully, you can now log in to your DJP Online e-Filing account. Enter your NPWP, password, and security code. After that, click on the "login" button, and you will go to the DJP Online e-Filing service system page.

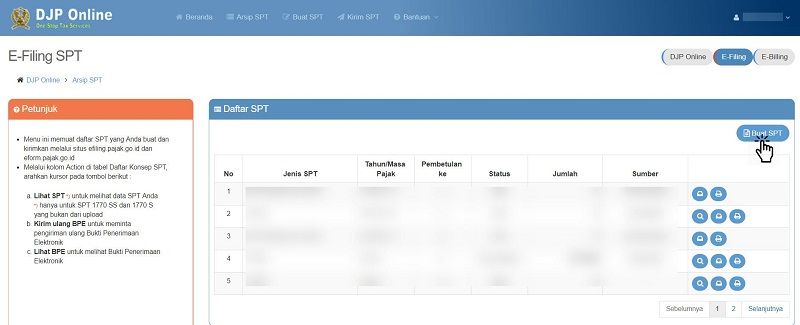

Step 2 - After having an account for e-Filing, please log in and enter the e-Filing page. If you want to report the SPT, click "e-filing.

Step 3 - If you want to report the SPT online, click "Create SPT."

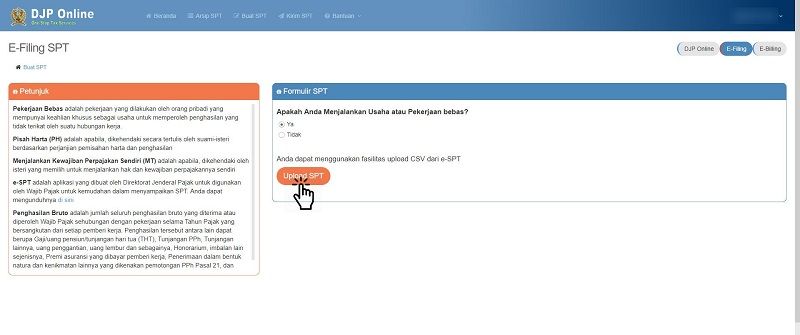

Step 4 - You will go to the SPT page. Then, answer the question: are you running a business or an independent job? If you run a free business or job, you can use the CSV upload facility. If not, you will have to fill out the tax returns one by one.

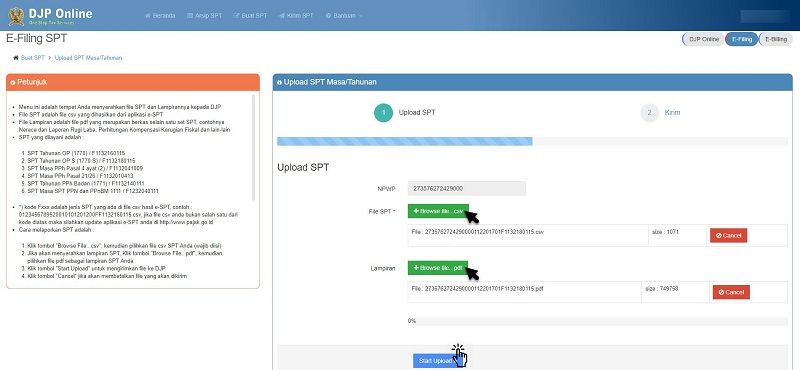

Step 5 - To use the CSV upload facility, click "Upload CSV." Then upload the CSV file and support PDF documents.

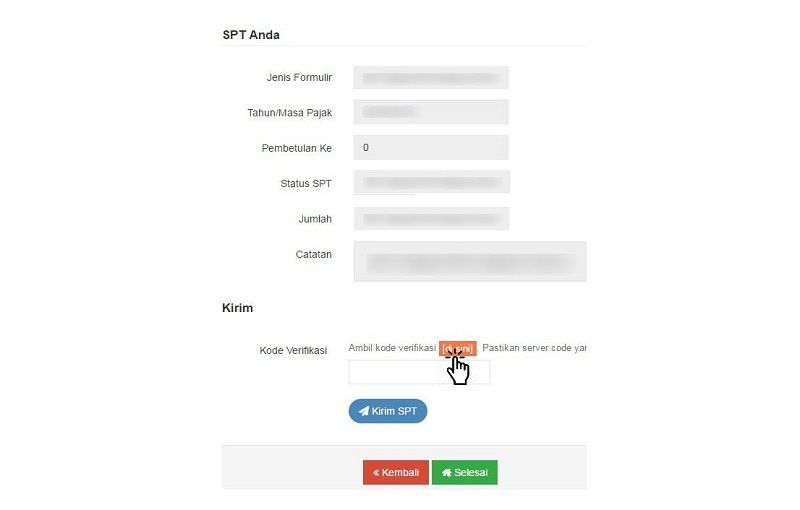

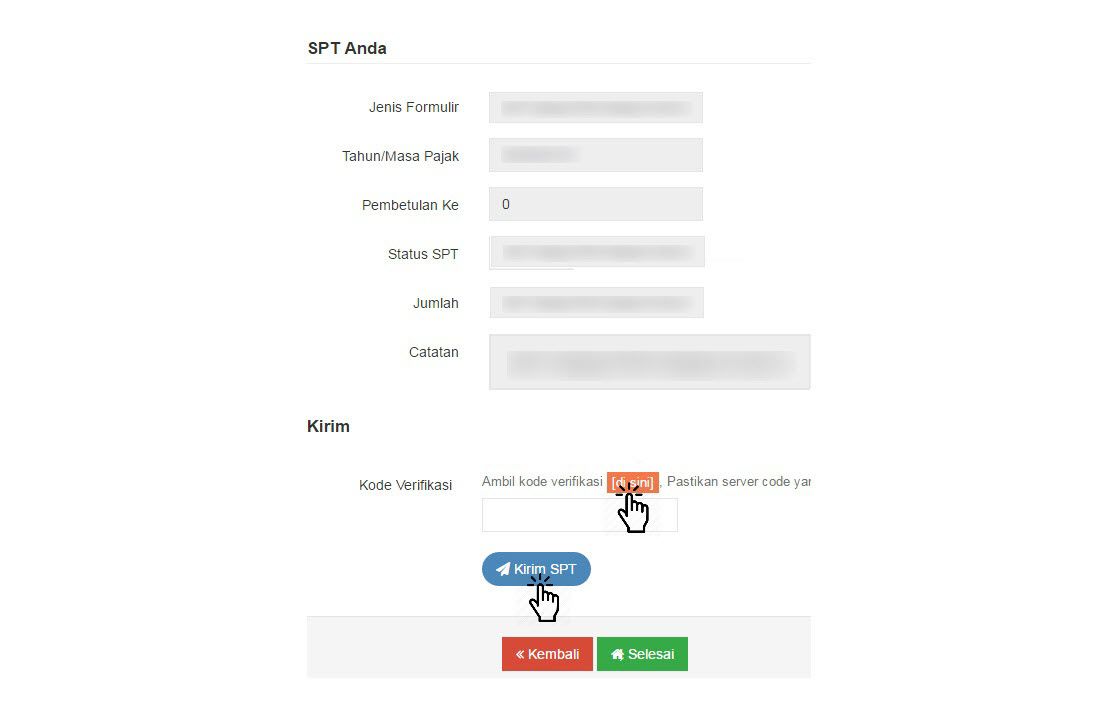

Step 6 - Next, you will go to the SPT submission page. To send a verification code to your email, click "here."

Step 7 - Then, check your email inbox. Copy the verification code and paste it into the box provided. After that, click "Send SPT."

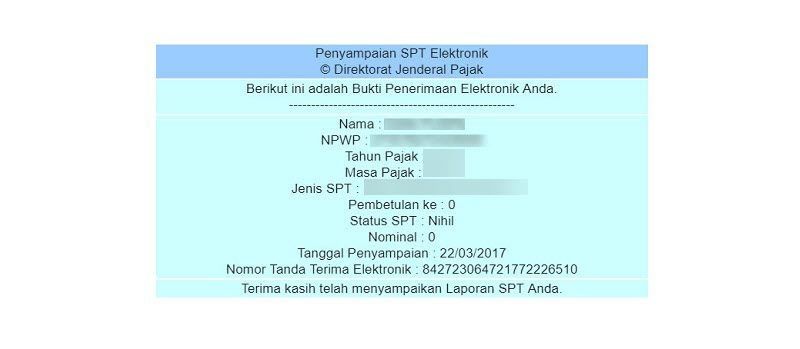

Step 8 - If the e-Filing is successful, an Electronic Receipt (BPE) will be sent to your email.

Due Dates

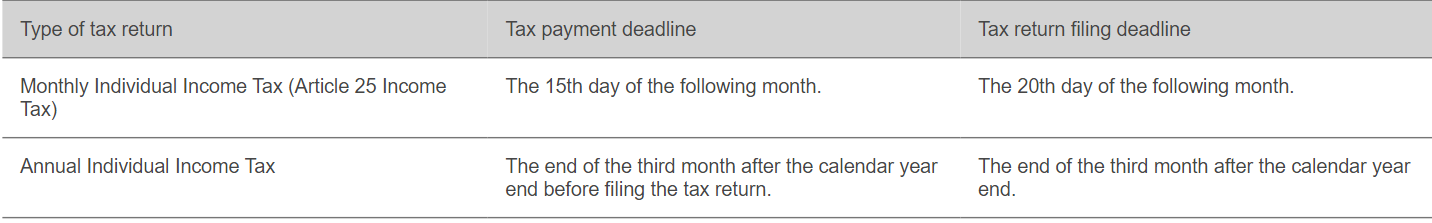

A summary of individual tax obligations is as follows:

Penalty for Late Submission

The amount of the penalty charged if you are late in filing an SPT online is the same as the amount of the fine set for late manual tax filing. Delay for:

- Other periodic SPT reports will be subject to a fine of Rp 100,000,

- Annual Income Tax Return for Individuals, especially starting from the 2008 Tax Year, will be subject to a fine of IDR 100,000

- The annual corporate income tax return is subject to a fine of Rp. 1,000,000.

Thus, Directorate General of Taxes (DGT) of the Ministry of Finance, e-Filing is a method of submitting electronic tax returns online and real-time via the internet using the DGT website.

Key Takeaways

With the points mentioned above, you have understood how the Indonesia Payroll works, with the various elements like residency status, work permits, social security contributions, personal reliefs, taxes, forms, and filing.

Following are the topics we have covered in this article:

- Work-permits in Indonesia

- Employees basic rights

- Mandatory payroll components

- Income Tax And Statutory Contributions in Indonesia

- Tax Rates in Indonesia

- NPWP registration process

- Social Security Programs in Indonesia

- BPJS Kesehatan and BPJS Ketenagakerjaan

- Personal Reliefs And Deductions

- PTKP Rates and Categories

- Office/Occupational and Pension Cost

- THR calculation

- PPH21 Calculation,methods,components

- Annual Individual Income Tax Reports in Indonesia

- Steps to Register for DGT Online

- Steps to Register DJP Online e-Filing

- File Tax SPT PPh 21 DJP Online

- Due dates for filing and penatly for late submission

With Deskera People, you can run your payroll for your employees in Indonesia more accurately and efficiently with fewer errors. Also, you can auto-calculate various contributions such as PPH21, BPJS.

Get your free trial of Deskera People today.