According to the Tax Foundation, an independent research organization, Florida has had one of the lowest tax burdens in the country for decades. Florida's people and businesses will face the fifth-lowest tax burden in 2021.

This means that processing payroll in Florida isn't difficult, especially if you're familiar with federal regulations—there aren't many state-specific rules, and employees don't have as many safeguards as they do in other states, such as California. Hence this article will provide a complete guide to Florida Payroll taxes. Following are the topics covered:

- Florida Taxes

- Florida’s Tax Exclusions & Exemptions

- Running Payroll in Florida—Step by Step Guide

- Forms for Payroll

- Calculator for Payroll Taxes

- Key takeaways

Florida Taxes

Companies in Florida must pay a variety of taxes, ranging from corporate income taxes to sales taxes, but the SUTA is the only payroll tax.

Social Security and Medicare

The federal government requires you to pay FICA taxes. They account for 7.65% of the employee's pay. You must also deduct the same amount from the employee's take-home pay and remit it to the IRS along with your half.

Use Tax

Despite the fact that it applies to all taxable things purchased in Florida, use tax is primarily intended to charge customers for out-of-state online transactions.

Even if no tax was charged at the time of purchase, or if the tax was charged at a rate lower than the Florida sales and use tax rate, state sales tax must be paid on internet or other out-of-state transactions.

While this includes taxable things purchased in Florida, it primarily relates to items purchased outside of the state and delivered to Florida. Residents of Florida are obligated to record these sales and pay the use tax on them. Because your employees are required to report purchases and pay the necessary use taxes on their own, you won't need to factor this tax into your payroll system.

Estate Tax

For retirees, veterans, investors, and everyone else, Florida is an estate tax haven. The proceeds from willed or inherited properties are not shared by the state or local governments. The state receives no part of what is left to an individual in their will.

Income Taxes

Florida's low tax burden stems from the absence of an income tax, making it one of only seven states in the country without one. Despite the fact that the state constitution prohibits such a tax, Floridians must nevertheless pay federal income taxes. Personal income taxes are not levied in Florida, nor in any of its localities, making payroll easier and putting more money in your employees' pockets.

Corporate Income Tax

While individuals are exempt from paying income taxes in Florida, this is not the case for all types of businesses. Unless exempt, companies and artificial entities doing business, earning or receiving money in Florida, including out-of-state businesses, must file a Florida corporate income tax report. Even if no tax is due, they must file a return. Individuals, sole proprietors, estates of decedents, and testamentary trusts are exempt from filing a return and are not required to do so. S Corporations are normally excluded, unless they owe federal income tax. The corporate income tax rate in Florida is 5.5 percent.

Reemployment Taxes (SUTA)

Florida increased its minimum reemployment tax to 0.29 percent on Jan. 1, 2021, in order to restore the trust fund for unemployment benefits.

Although Florida's state unemployment insurance tax (SUTA) is referred to as a "reemployment tax," it functions similarly. If you paid at least $1,500 in total wages in a calendar quarter, had at least one employee for any part of a day in at least 20 distinct weeks in a calendar year, or are subject to FUTA, you must pay this tax. There are three differences:

- Domestics (household): If you paid $1,000 or more in any calendar quarter.

- Agriculture: If you paid at least $10,000 in total wages in a calendar quarter or had at least five employees for any part of the same day in at least 20 separate weeks in a calendar year, you are liable.

- Nonprofits: If you have four or more employees on the same day in any part of a calendar week for 20 weeks in a calendar year.

Employees of a church, single proprietors, partners or members of an LLC, students employed by the college they are enrolled in, insurance agents, real estate agents, commission-only barbers, and anyone under the age of 18 distributing newspapers are not protected.

SUTA is deducted from an employee's first $7,000 in earnings by the state. The tax rate for new firms is 2.7 percent. After that, the state will determine your rate, which will range from 0.29 percent to 5.4 percent, based on your employment history.

Eligible businesses must also pay the Reemployment Tax. Formerly called the Unemployment Tax before being renamed in 2012, this tax is used to give partial, temporary income to workers who lose their jobs through no fault of their own, and who are able and available to work.

You may be eligible for a discount on your federal unemployment insurance taxes if you pay SUTA (FUTA). This can reduce your 6% FUTA tax rate to 0.6%.

Reemployment tax reports are due by the following dates:

Sales Tax

With limited exceptions, such as groceries and medication, the state levies a 6% tax on the sale or rental of items. In addition, counties can impose local taxes on top of the state tax, and the majority do so—in 2012, 55 of Florida's 67 counties added a local sales tax to the state tax.

In 2012, seven counties added 1.5 percent to the sales tax, raising the total sales tax to 7.5 percent in those counties; in 2013, that number will rise to eight counties.

Workers’ Compensation

Every employer with four or more employees, including government agencies, employment agencies, and employee leasing organizations, is obligated to provide workers' compensation. Workers' compensation insurance is required for construction workers with even one employee.

Exceptions include:

- Homeowners who hire someone to do construction work that isn't related to the property's sale or lease.

- Domestic workers

- Inmates in state prisons or county jails

- Agricultural employment performed by a legitimate farmer with less than five full-time employees or 12 seasonal workers.

- Professional sportsmen and women

- Labor mandated as part of a sentence

Workers' compensation insurance can be purchased for about $1.30 for $100 of payroll processed through private insurance companies.

Tax on Intangibles

Taxes on intangible items, such as assets, investments, and services, are not required in Florida. Intangible things, such as investments, are no longer subject to state taxation in Florida. In 2007, the law requiring that tax was removed.

New Hire Reporting

Federal and state regulations both require you to report new hire and rehires to the Florida New Hire Reporting Center within 20 days of their start date. You could be fined up to $25 per person if you fail to report them or up to $500 per new employee if you do so on purpose. You could be punished if you don't report yourself; if you're self-employed, you must report yourself.

Florida's existing employment rules also ban the consideration of a number of variables throughout the recruiting process. Race, color, religion, sex, age, country of origin, and health issues including AIDS, sickle cell, genetic conditions, and so on are among them.

PTO Policy

Because it's feasible to nullify all outstanding PTO expenses at the start of a new year, monitoring Paid Time off (PTO) in payroll administration is easier for business owners in Florida. In addition, Florida law allows you to avoid paying out unused PTO or rolling them over from year to year.

However, many firms in Florida provide paid time off to their employees for a variety of reasons, including vacation, jury duty, voting leave, and bereavement leave. You don't have to provide PTO for all of these reasons; you can use your discretion to decide when and how your employees will be compensated for hours they didn't work.

Labor Laws

Florida labor laws encompass a wide range of labor-related concerns, including minimum wage, overtime, breaks, leaves, and severance pay. In some cases, state and federal laws overlap, while in others, only one level of regulation applies.

For example, the state legislation mandates a mandatory meal break for minor employees under the age of 18, whereas adult employees' mealtime is governed by federal labor rules.

Adult employees are not entitled to meal breaks, according to federal law. Those who provide lunch breaks of less than 20 minutes must pay for them, but those who provide breaks of 30 minutes or more can go unpaid as long as the employees are free to do what they choose during that period.

Federal labor laws also govern overtime regulations. Employers are not required to pay for any leave, including sick leave, holiday leave, jury duty leave, voting leave, or bereavement leave, under any law at any level.

Employers are also not required by law to provide severance pay when employees leave, yet they will be held liable for the severance provisions established in their employment contracts and policies.

Child Labor Laws

If a kid is 16 years old or older, federal law allows them to work for any amount of hours. Florida's state laws, on the other hand, are far more complicated.

Minors under the age of 14 are not permitted to work unless in exceptional circumstances; minors aged 16 and up are not permitted to work for more than 30 hours per week and must not work during school hours (except in career education programs) or at times earlier than 6.30 a.m. or later than 11.30 p.m.

Minors under the age of 16 are not permitted to work for more than eight hours during the school day or for more than six days in a week. Minors are likewise prohibited from working in dangerous occupations under state legislation.

Payment Obligations

Despite the fact that no legislation in Florida requires firms to pay their employees within a set time frame, they are nonetheless obligated to plan regular paydays.

In other words, they must pay their staff on a regular basis. Once you've decided on a payroll plan, you must adhere to it at all times.

The final check delivered to dismiss employees is another payment obligation that employers in Florida should be aware of. Although severance pay regulations do not apply to employers, it is usually a good idea to pay out any outstanding funds owed to dismissed employees as soon as possible to avoid legal challenges that waste time and money.

Employers must additionally pay both the state and federal governments reemployment fees if they hire at least one employee for a day, have a quarterly payroll of at least $1,500, or pay no local taxes.

As an employer in Florida, you're also responsible for paying garnishments on behalf of your employees to the appropriate authorities. A garnishment is a court order or an IRS levy that directs an employer to take a set amount of an employee's income to pay back a debt.

However, it does not apply to a salaried person who supports a family on a weekly salary of $500.

Disability Insurance

Employers are not subject to any disability taxes in Florida. However, you can continue to offer disability insurance to your employees who are unable to work due to non-job-related injuries or illnesses or who are not eligible for worker's compensation.

Group disability insurance policies with specific provisions sold by insurers, on the other hand, are subject to state regulations.

Minimum Wage and Tips

In addition to tips, Florida's current minimum wage is $8.65 per hour, with a minimum of $5.63 per hour for tipped employees. It adheres to government guidelines on minimum wage exemptions.

In 2019, Florida's minimum wage surpassed the federal rate; to prevent compliance concerns, it's best to pay the higher state rate. If you have tipped staff, your state rates will be significantly higher than the federal rates. The difference between the state minimum pay of $8.46 per hour and the federal minimum wage of $7.25 per hour is only $1.

The state wage for tipped employees, however, is $5.44 per hour, which is more than double the federal rate of $2.13 per hour.

This is significant since you'll need to compensate for a significant differential in tipped employees' weekly pay. In addition to the tips, it is your responsibility to cover whatever amount is required to make up for the minimum wage.

You should also keep in mind that displaying a Florida minimum wage banner prominently in your workplace is required by law. You must also post the Florida Reemployment Help notice in your workplace, including the eligibility conditions for unemployment assistance.

Florida's minimum wage is set to increase to $15 per hour by 2026. The Consumer Price Index for Urban Wage Earners and Clerical Workers will then be used to alter the price.

Employers in Florida can apply up to $3.02 per hour in tip credit to tip-earning employees.

Overtime

Florida respects federal overtime requirements, but considers 10 hours of work to be a legal day of work. You must pay overtime at federally specified rates (typically time and a half) for hours worked over 10 in a day unless you have a documented contract saying otherwise that the employee agrees to.

Property taxes

Property taxes are mostly levied by local governments in Florida, yet they are among the highest in the country. However, there is a long list of people who are not subject to these taxes.

In addition to these taxes, when processing payroll in Florida, you must remember a slew of federal tax rules.

FICA taxes, for example, consist of a 6.2 percent social security tax on yearly salaries under $137,700 and a 1.45 percent Medicare tax on annual incomes under $200,000.

These deductions must be matched by employers. They must also pay FUTA unemployment taxes of 6% of the first $7,000 of an employee's taxable income, although they can earn a tax credit of up to 5.4 percent if they pay state unemployment taxes.

In addition to federal and state taxes, you must account for court-ordered wage garnishments, child support, and, if available, contributions to post-tax savings accounts such as the Flexible Spending Account (FSA), 401(k), and so on.

As an employer, it is your responsibility to deduct these amounts from your employees' paychecks and submit them to the appropriate authorities on their behalf.

Other Taxes

Many additional items and services that residents pay for are taxed in Florida. Documentary Stamp Taxes are levied on papers such as warranty deeds and quit claim deeds that transfer ownership of real estate in Florida. Fuels, tobacco goods, telecommunication services, and other items are subject to additional taxes.

Employees Can Be Paid in a Variety of Ways

Employees can be paid electronically, by check, or in cash. In lieu of cash, you can pay with coupons, punch-outs, tickets, tokens, or other devices as long as they are fully redeemable in the United States.

Employees, on the other hand, should be able to get their salaries without a discount. Paying through PayPal, for example, is not permitted since PayPal charges receivers a 2.9 percent transaction fee.

Pay Stub Regulations

Most employees in Florida are not covered by particular pay stub laws. If you run a labor pool, however, you must furnish day laborers with an itemized account detailing the deductions made from their compensation. However, this is simply good practice for any employee.

Paycheck Deduction Rules

There are no rules in Florida that govern what can and cannot be deducted from an employee's paycheck. It also allows you to have employees pay for uniforms so that you can deduct the cost from their wages.

It also allows you to have employees pay for uniforms so that you can deduct the cost from their wages.

The most common deductions include

• Taxes and SUTA

• Garnishments mandated by legal actions

• Employee share of benefits payments

• Uniform or tool reimbursements

• Reimbursement for damages or loss caused by an employee

Final Paycheck Laws

There are no particular laws in Florida that govern when and how final earnings must be paid to an employee.

HR Laws in Florida That Affect Payroll

The majority of Florida's human resources regulations are in line with federal labor rules. However, because there are certain differences in child labor regulations, you'll need to pay attention.

Florida New Hire Reporting

In Florida, you must report new hires within 20 days of their start date. You can report them by mailing or faxing the Florida New Hire Reporting Form to the address on the form, or reporting them electronically on the Department of Revenue Child Support Services for Employers website.

Requirements for breaks, lunches, and time off

Florida's paid time off (PTO) restrictions are in accordance with federal guidelines, which are rather lenient. We provide a basic introduction below, but our guide to PTO contains more in-depth information as well as advice on how to create a time-off policy.

Every four hours, minors must take a 30-minute break. Employers in Florida are not required to provide breaks to employees aged 18 and above, but if they do, the breaks are normally 20 minutes long and must be paid.

Sick Leave and Vacation

There are no restrictions requiring PTO in Florida, whether for vacation or sick leave.

Family Leave

In the Family and Medical Leave Act, Florida follows federal law (FMLA). Businesses with 50 or more employees for at least 20 weeks in the current or preceding year are subject to this rule. Employees who have worked for the company for at least a year and have worked 1,250 hours in the preceding year and work at a location with at least 50 employees within a 75-mile radius are eligible for FMLA leave.

State Disability Insurance

There is no state disability program in Florida, and companies are not required to acquire disability insurance. However, having both for your staff and yourself is a fantastic idea.

Laws Concerning Child Labor

Minors aged 14 and 15 are not permitted to work during school hours under Florida or federal law, although they are permitted to work up to 15 hours per week, with no more than three hours per day on school days.

Minors aged 16 and 17 may work for a total of 30 hours per week, but not during school hours. There are some exceptions for educational purposes, but 16- and 17-year-old in Florida are not permitted to work before 6:30 a.m. or after 11 p.m. There are exceptions if they have completed high school or work for their parents.

Florida’s Tax Exclusions & Exemptions

Homestead exemptions of up to $50,000 are available in Florida for primary residences, albeit only $25,000 applies to non-school taxes and the balance is split over all taxes.

Widows and widowers who were not divorced at the time of their ex-death spouse's are eligible for $500 Widow(er) Exemptions. If you have a total or permanent disability, you are also completely excused from paying property taxes.

Senior Citizen Exemptions of up to $50,000 are available in some counties and towns for people 65 and older with gross incomes under $20,000.

Florida has some of the most comprehensive exemption provisions in the country for veterans. Property tax exemptions range from $5000 to no property taxes at all, based on variables such as service-related impairments, age, and recent deployment.

Property Tax Exemptions: In Florida, homestead exemptions are provided for principal residences. Exemptions of up to $50,000 may be allowed. Only the first $25,000 of this exemption, however, is applicable to all taxes. The remaining $25,000 is for non-school taxes only.

Widows and widowers who have not remarried are eligible for $500 Widow(er) Exemptions. You are not eligible for this exemption if you were divorced at the time of your ex-death. spouse's

Exemptions for senior citizens are only available in a few counties and towns. For people 65 and older with a gross income of less than $20,000 in 2001 dollars (adjusted for inflation), they are worth up to $50,000. In addition to the Homestead Exemption, this exemption is available.

Florida residents who are legally blind are eligible for $500 blind person exemptions.

Homeowners with a total and permanent handicap are eligible for a total and permanent disability exemption. All property taxes are waived for quadriplegics who utilize their property as a homestead. Others who use a wheelchair for movement or are legally blind and have a gross income of less than $14,500 in 1991 dollars (adjusted for inflation) are also exempt from paying property taxes.

Exemptions for veterans come in a variety of shapes and sizes.

• A veteran who has been documented as disabled by 10% or more in war or service-related incidents is eligible for a $5,000 extra exemption on any owned property.

• Due to their service, an honorably discharged veteran who is totally and permanently crippled or uses a wheelchair for movement may be exempt from all property taxes. This benefit can be transmitted to a surviving spouse in some cases.

• An honorably discharged and handicapped veteran who was a Florida resident at the time of enlistment and was 65 or older may be eligible for an additional exemption. The impairment must be permanent and have resulted from military service.

The property tax will be reduced by the percentage of the disabled person. Military personnel who were deployed during the previous calendar year may be eligible for waivers based on the percentage of time they were deployed.

Running Payroll in Florida—Step by Step Guide

Payroll in Florida is rather straightforward. The basic stages are outlined here, with an emphasis on Florida regulations. Consult our page on how to do payroll for further information on general payroll methods.

Step 1: Register your company as an employer. You'll need your Employer Identification Number (EIN) and an account with the Electronic Federal Tax Payment System (EFTPS) to file at the federal level (EFTPS).

Step 2: Fill out the DR-1 form and mail it or submit it online to a Department of Record Service Center. For assistance, consult the DR-1 completion guide. To submit the paperwork and pay taxes online, enroll in e-Services. To refresh your recollection regarding the current payroll legislation in Florida, go back to the first section of this tutorial.

It's easier to comply with Florida's payroll regulations because of their light requirements, but you should still do your homework. Failure to comply with any payroll law in the state can result in hefty fines.

To understand more about the fine details of these regulations, see your legal adviser or refer to the resources listed at the end of this booklet.

Step 3: Create a payroll system. You have three options: do it by hand (which we don't advocate), set up an Excel payroll template, or use a payroll service.

Step 4: Collect employee payroll paperwork in step four. It's easiest if you do it throughout the on-boarding process. W-4, I-9, and Direct Deposit information are all included on payroll forms.

There are no state-specific forms in Florida. After thoroughly researching Florida payroll legislation, the following stage in setting up your payroll system is to gather correct documentation for your employees. These materials will assist you in determining what should be entered in various columns of an employee's payroll system slot.

The information on your employee's W-4 form might help you figure out how much you need to withhold from their paychecks for state and federal taxes. Your employees can update the information on their W-4 forms at any point during the year to reflect recent life events that are tax-related.

You'll also need an I-9 form to verify your employees' identity and ability to work in the United States. This form must be completed by your employees on their first day of work, and you must complete the employer component within three business days.

If you wish to give your employees the choice of receiving direct deposits instead of paper checks, they must fill out a document to that effect.

Step 5: Collect, evaluate, and approve time-sheets in step 5. You can utilize a paper time sheet or sign up for time and attendance software that is either free or inexpensive.

Step 6: Work out your payroll and pay your staff, including taxes. Employees can be paid in a variety of methods (cash, check, direct deposit), and federal taxes should be transferred via the EFTPS. This is usually the most difficult part of the procedure, but payroll software can make it easier. To maintain track of your employee's working hours, you can use a time-sheet, attendance systems, or digital time. When computing earnings from working hours, you can only use the ordinary hourly rate for the first 40 hours of the week; any additional hours must be considered as overtime, which pays 50% more than the regular hourly rate. When estimating your employee's compensation, you must account for overtime, tips, commissions, PTO, and other factors in addition to their working hours.

The calculation of a salaried employee's compensation is much simpler than that of an hourly employee. All you have to do is divide their annual salary by the number of paydays in a year.

Step 7: Deduct Federal & State Payroll Taxes

Then, from each employee's earnings, calculate and subtract any appropriate taxes. The following is a list of the most important taxes that you must deduct on behalf of your employees:

- Federal Income Tax: Based on the tax withholding tables published in the most recent version of IRS Publication 15-A, you can figure out how much each employee owes in federal income taxes.

- FICA (Federal Insurance Contributions Act): This includes Social Security and Medicare. Take note of your total income for the year and the income restrictions for the deductions.

- Savings Account Contributions: You're also in charge of sending contributions on behalf of your employees to various social welfare programs, such as health insurance, life insurance, 401(k), and so on.

- Garnishments: If you receive a notification to garnish your employee's wages, respond quickly to avoid legal complications.

- Miscellaneous Deductions: Finally, make sure you've taken into account all of the deductions you're required to make from your employees' paychecks, such as loan repayments from banks and other lending organizations.

Step 8: Process Payroll

After you've determined all of your tax withholding and net pay, the following step is to figure out how you'll distribute your paychecks. You have the option of manually processing the paycheck by tearing check leaves from a dedicated cheque-book and writing out the checks. Direct deposits are a faster way, but they come with a one-time setup cost for each employee as well as a small transaction fee for each deposit.

You can also use payroll software to entirely automate the process or outsource the delivery of paychecks to a professional employment organization (POE).

Step 9: Submit payroll tax returns to the federal and state agencies. For federal taxes, including unemployment, follow the IRS's guidelines. The IRS allows you to order official tax forms.

Step 10: Keep track of your payroll records. It's crucial to retain records for all employees, including those who have been fired, for several years. More information about keeping payroll records can be found in our article. There are no special document storage laws in Florida, therefore follow the federal recommendations.

Finally, you should document and store all of your payroll records so that they are easy to find when it comes time to submit them to the appropriate federal and state agencies. Details such as these should be included in your payroll records:

- The employee's full name and Social Security

- The employee's full name and Social Security number

- The employee's address, including ZIP code

- The employee's schedule

- The total number of hours worked each day

- The kind of compensation (hourly or salaried)

- The regular pay rate

- Overtime and other earning

- All deductions from their salary

- Total amount paid each payday

- Payment dates and period covered

Step 11: Complete your year-end payroll tax returns. W-2 (for workers) and 1099 (for non-employees) are the government forms (for contractors.) These must be obtained by employees and contractors by January 31 of the following year. There are no additional forms in Florida.

Forms for Payroll

The only form you'll need is the one required by Florida for businesses to file reemployment taxes.

Federal Payroll Forms

- Florida New Hire Reporting Form

- W-4 Form: Used by companies to figure out how much tax to deduct from employee paychecks.

- W-2 Form: Report total annual wages received (one per employee)

- W-3 Form: Report total wages and taxes for all employees

- Form 940: Report and calculate unemployment taxes owing to the IRS;

- Form 941: Report quarterly income and FICA taxes deducted from paychecks

- Form 944: This form is used to report annual income as well as FICA taxes deducted from paychecks.

- 1099 Forms: Used to report non-employee pay and assist the IRS in collecting taxes on contract labor.

Other Florida Withholding Forms

Employers Quarterly Report (RT-6): This form is used to file reemployment tax withholding. If you are liable for SUTA, you must do this every calendar quarter, whether or not you have anything to claim that quarter. If you need extra space, use the RT-6a, and follow the directions on the RT-6N.

Calculator for Payroll Taxes

A payroll or income tax calculator for Florida is an easy-to-use tool for calculating, paying, and forecasting your employer-related taxes. If you're searching for a rough estimate, try the following quick calculation:

Step 1: Take the employee's pay

Step 2: Multiply that figure by 0.06.

Step 3: The final figure is the amount you owe in payroll taxes.

How Deskera Can help You?

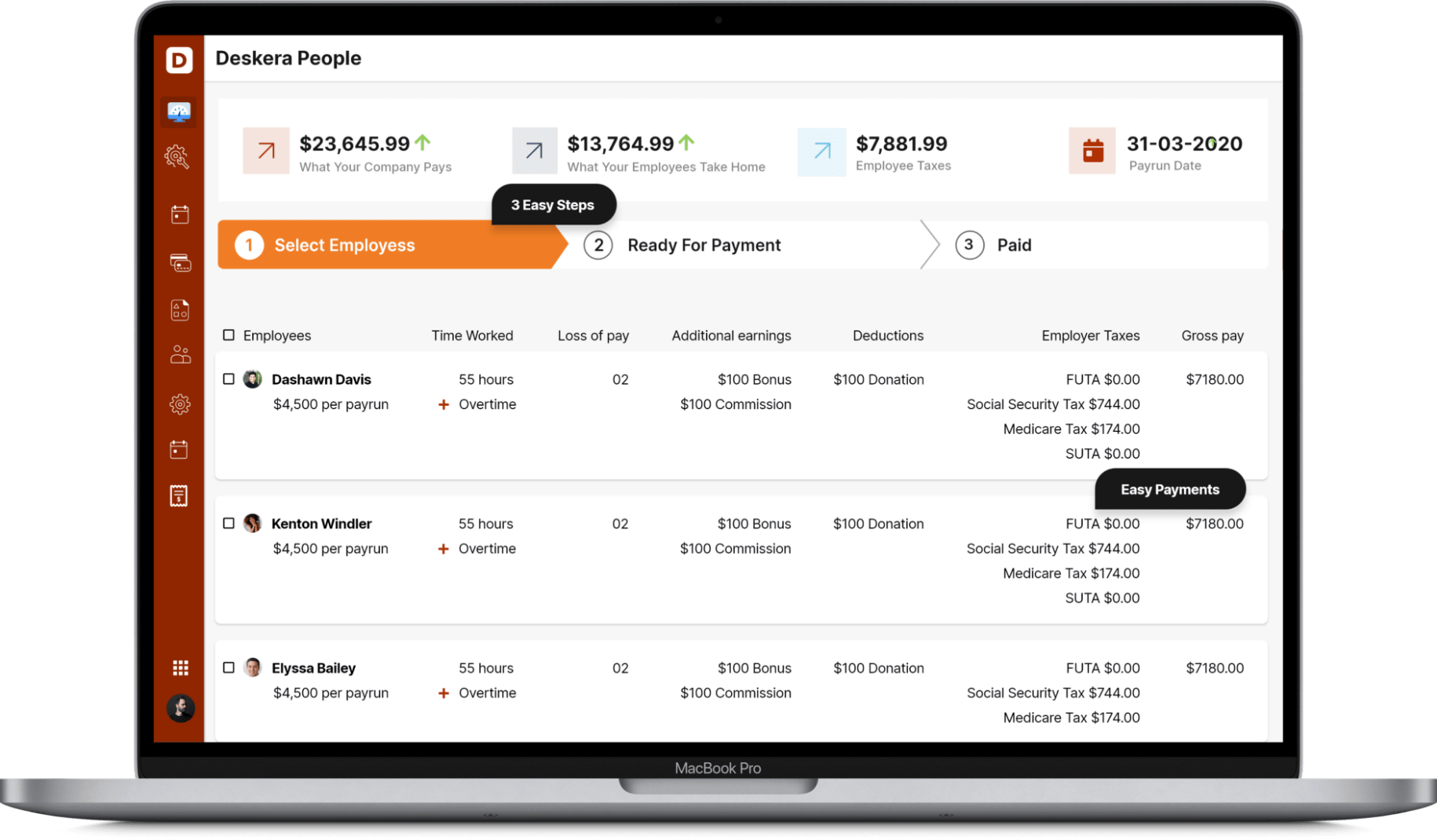

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- Payroll tax compliance in Florida necessitates that businesses be able to afford payroll taxes. Failure to do so can result in both civil and criminal sanctions. Businesses should consult with tax attorneys to verify that they are taking advantage of all available exemptions, deductions, and tax breaks.

- The Florida payroll tax rate is 6% of the first $7,000 in earnings for each employee. Employers must pay this rate in addition to the 5.5 percent corporate income tax rate. Employee wages in Florida are subject to a payroll tax.

- Florida payroll taxes are paid by both companies and employees. If either party has specific queries concerning their Florida payroll taxes, tax lawyers can provide legal counsel.

Related articles