The number of individuals pursuing health insurance from the beginning of the SEP opportunity on February 15 through March 31 addresses a significant increment from 2020 and 2019 when 209,000 and 171,000 consumers pursued health insurance respectively.

A Qualifying Event for health insurance plan is a significant event that influences an individual health insurance needs and qualifies that individual to make changes or purchase a health plan immediately, regardless of whether it's outside of open enrollment dates. This article will help us learn in-depth about Qualifying Life Events. Following are the topics covered:

- What is a Qualifying Life Event (QLE)?

- 4 Basic Types of QLEs

- QLE Effective Date

- Is a New Job a Qualifying Event?

- What to do after a QLE?

- SEPs- Special Enrollment Period

- Required Documents

- Key takeaways

What is a Qualifying Life Event (QLE)?

Because of IRS rules, you can't make changes to your health insurance benefits outside of your employer's yearly open enrollment period except if you experience a qualifying life event (QLE).

A Qualifying Life Event (QLE) is a life change that permits you to change your insurance coverage mid-plan year. A change in your situation - like getting married, having a child, or losing health coverage - can make you qualified for a Special Enrollment Period, permitting you to sign up for health care coverage outside the yearly Open Enrollment Period.

You have 30 days from the date of your qualifying event to present your mentioned change to Human Resources or your benefits administrator. You will be approached to include:

1. Supporting reports see "Required Documents" underneath, and

2. The date the change happened.

Outside of the special enrollment period, your main chance to roll out an change is during your organization's annual open enrollment or then again assuming you experience another qualifying life event.

4 Basic Types of QLEs

The most well-known examples include

Loss of health coverage

- Losing existing health coverage, including job-based, individual, and student plans

- Losing qualification for Medicare, Medicaid, or CHIP

- Turning 26, and losing coverage through a parent's plan

Note:

- In the event that you or your dependent(s) lose government-provided coverage, you'll have up to 60 calendar days following the date you lose coverage to make changes to your benefits elections.

- For any other QLEs, you have 30 calendar days to make changes following the date you lose coverage.

Changes in household

- Getting divorced or married

- Having a child or adopting a child

- Death in the family

Changes in residence

For employer-sponsored health plans, changes in residence sometimes qualify on the off chance that the employee no longer has coverage on their current plan.

- Moving to a different ZIP code or district

- A student moving to or from the place they go to school

- A seasonal worker moving to or from the place the two of them live and work

- Moving to or from a shelter or other transitional housing

Other qualifying events

- Changes in your income that influence the coverage you meet all requirements for

- For a Dependent Care FSA, a change of the cost of services or your dependent's eligibility, for instance, your child reaches age 13 and is presently not qualified under a DCFSA

- Gaining membership in a governmentally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder

- Becoming a U.S. resident

- Leaving incarceration (prison or jail)

- AmeriCorps individuals beginning or finishing their service

QLE Effective Date

At the point when the change goes into effect upon your employer's group roles. A few managers make the coverage retroactively accessible from the date of the qualifying event. For some, coverage is successful as of the first of the month after the qualifying event.

Be that as it may, there is one special case. For the birth of a child, coverage is generally accessible as of the birth date.

Special Enrollment Period Examples:

Having been held back from enrolling during Open Enrollment because of a genuine medical condition or a natural disaster

-Assuming that somebody working in an official capacity forestalled enrollment, committed an error in enrollment, gave wrong data, and so forth.

-Assuming that a technical error occurred or if wrong policy data was displayed on the Exchange

-Applying for Medicaid or CHIP during open enrollment yet being considered ineligible after open enrollment ended

-Acquiring another dependent or becoming dependent on another person because of a court request

-Getting through domestic abuse or spousal abandonment and signing up for a new, personal health policy

-Documenting and winning an appeal after a wrong eligibility determination

Is a New Job a Qualifying Event?

Finding another line of work isn't viewed as a qualifying event for special enrollment. Notwithstanding, acquiring new work might set off a special enrollment period for the group coverage at the new position, should the business offer it. Getting employer-based coverage will set off a disenrollment period for other coverage.

Health Insurance Qualifying Life Events

- You get divorced

- You get married

- You have a child or adopt a child

- The death of a person residing in your home reduces your reported family size;

- You experience a change in family size that impacts what you report to the public authority for your family tax subsidy

- You have a change in income either an increment or decrease and need to report it to change your tax subsidy

- You have an increase in pay and never again fit the bill for Medicaid;

- You lose your employer's health insurance coverage

- Your health care coverage plan drops your coverage, despite the fact that you've paid your premiums;

- Your COBRA coverage expires

- You turn 26 years of age and can never again remain on your parent's medical services plan

- You move to a different ZIP code

- You are set free from prison

- You experience domestic abuse

- You are released from the Armed Forces

- While applying for health care coverage, a mistake is made, either a human or technical blunder - which brings about you not obtaining coverage.

Any of these Qualifying Life Events makes the way for health care coverage adjustments if you choose.

What to do after a QLE?

1. With any QLE, the initial step is to refresh your or your family member's data in the Defense Enrollment Eligibility Reporting System (DEERS).

2. Once your change shows in DEERS, you might make any eligible enrollment change on the web, via mail, or by telephone.

If no action is taken

Assuming that you stay eligible for your present health plan and wish to proceed with coverage following a QLE, you don't have to make a move.

In the event that you're not currently in a health plan and don't sign up for one, you'll just be qualified for care at a military hospital or facility assuming space is accessible.

While resigning from active duty, you should make an enrollment decision within 90 days of your retirement.

Making Enrollment Changes When You Haven't Experienced a QLE

On the off chance that you and your family haven't experienced a QLE, you can sign up for or make changes to your health plan during the Open Season. Open season happens each fall, starting on the Monday of the second entire week in November to the Monday of the second entire week in December.

Would you be able to give a QLE for a future change?

This question comes up a lot explicitly for those expecting a child. You can exclusively present a QLE for an event that has happened, not a future date.

It's valuable to take note of that, specifically and for the birth of a child, coverage is generally retroactively available as of the birth date. See the "QLE Effective Date" segment above for additional subtleties.

SEPs- Special Enrollment Period

Your Qualifying Life Event (QLE) quickly starts a Special Enrollment Period (SEP) when it happens. At the point when you enter that Special Enrollment Period, you or your family can pick another thorough health plan without penalty. You can likewise change your current healthcare coverage.

Additional QLE protections might apply, contingent upon your QLE conditions. For instance, assuming you have a child, adoption, or childcare relationship, you can sign up for an ACA health plan for as long as 60 days after the event and coverage can begin the day of the event.

If You Don't Use Your Special Enrollment Period

You don't need to change your health care coverage on the off chance that you would rather not. Assuming you lost your plan, be that as it may, you might have the option to pursue temporary health insurance. On the off chance that you were incapacitated for part of the 60 days, you might have the option to claim an extra SEP with the assistance of a health care coverage specialist.

Affordable Care Act administrators have indicated that a lack of information about COBRA isn't a qualifying life event. As a general rule, you can't claim a Special Enrollment Period exclusively in light of the fact that you didn't know about your SEP. It's as yet possible to get medical coverage after open enrollment, even without a qualifying life event.

No Penalties for Using a Special Enrollment Period

Assuming you utilize Special Enrollment, you won't pay extra month-to-month premiums. Affordable Care Act protection plans should acknowledge your application, similarly as though you were applying during open enrollment.

Everybody's Special Enrollment Period Is Unique

Since the Special Enrollment Period is anything but a particular time frame, your special enrollment will be not quite the same as other people. Despite the fact that you can sort out your own SEP, it's anything but a recurring event.

Special Enrollment for Unrelated Products

Taxes and other healthcare items might advance their special enrollment periods. These are not equivalent to Special Enrollment Periods for Affordable Care Act plans.

Assuming you some way or another missed every one of their emails about open enrollment, you could be stuck without medical coverage for the following year. Write in your calendar for the insurance enrollment season.

Don’t Wait to Change Coverage

Changes in life happen consistently. Commonly when these life events happen, your medical coverage plan is the last thought on your mind. Be that as it may, not having sufficient insurance coverage can be genuinely and monetarily risky should an unexpected accident happen.

Without rolling out a change in time, you could be with no coverage and will not have the option to add it when you really want it. Ensure changing your health insurance policy would only bring you peace of mind.

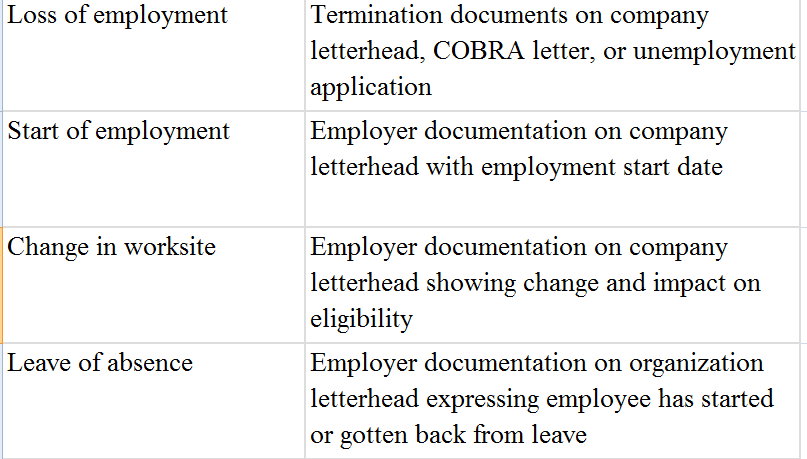

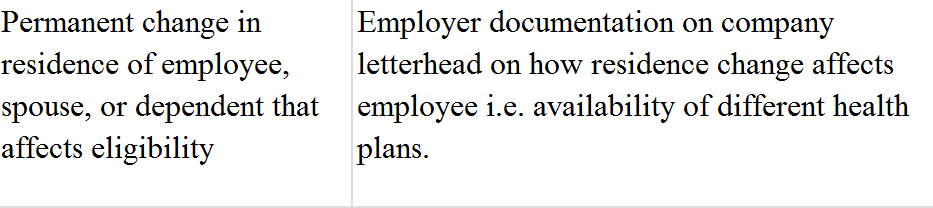

Required Documents

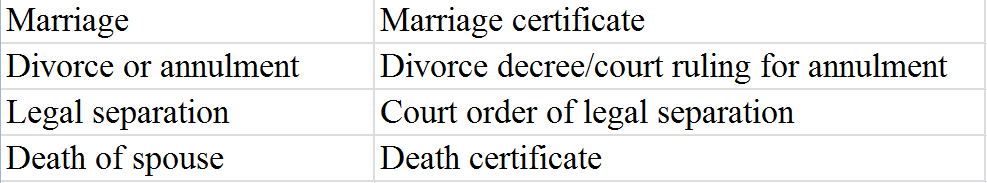

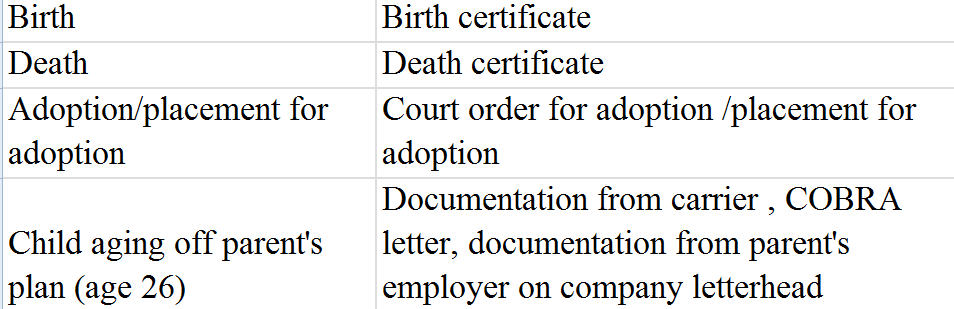

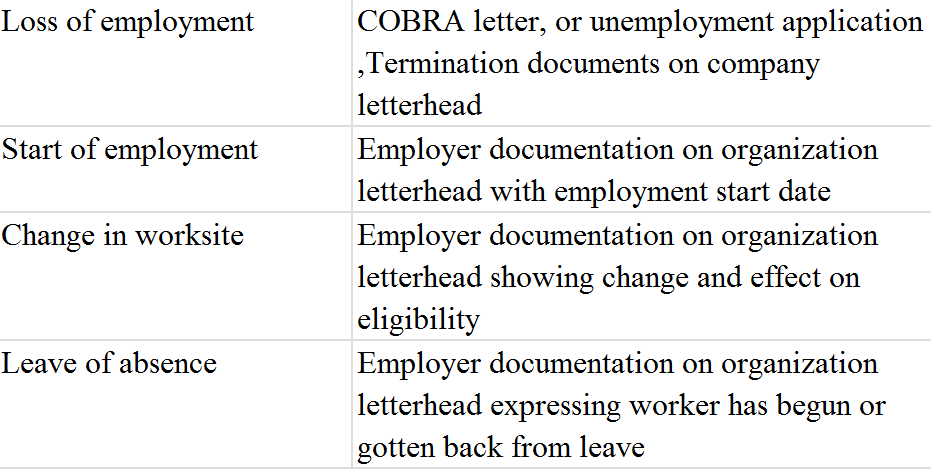

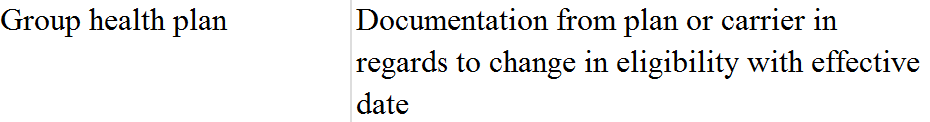

Below are examples of qualifying life events and supporting documents.

Legal Marital Status

Number of Dependents

Employment Status of Employee or Spouse

Gain/Lose Eligibility for Other Group Coverage (HIPAA special enrollment)

Employment status of Employee or Spouse

Place of Residence

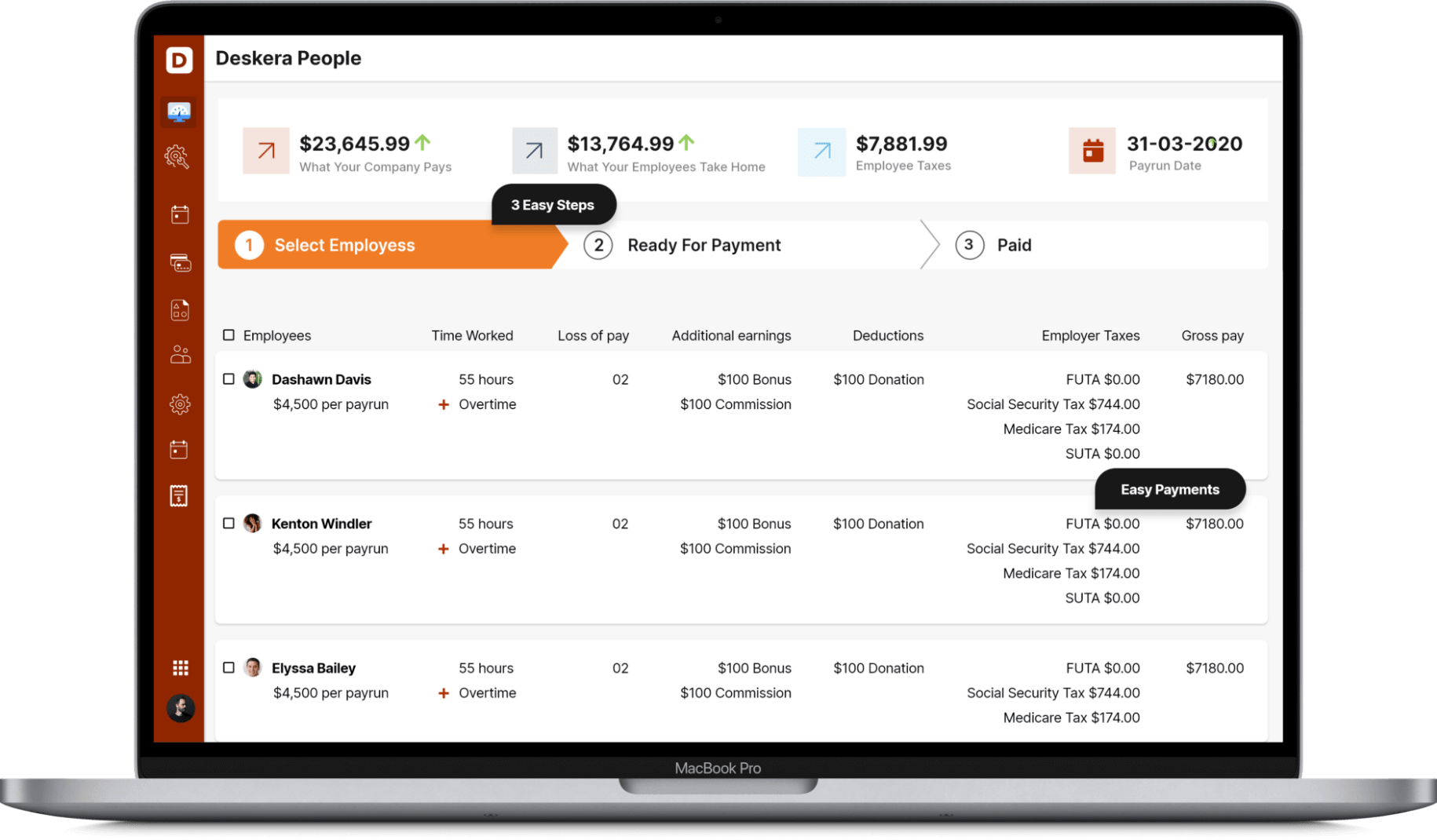

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Select the payroll schedule and pay different groups of employees/contractors on different pay schedules, such as weekly, semi-monthly, monthly, and more.

Key takeaways

- Assuming you quit your place of employment to form your own business, you have 60 days from the last day of work to get new healthcare coverage. When the 60-day window has passed, you need to hold on until the regular Open Enrollment Period to acquire health insurance coverage or update your present coverage.

- On the off chance that you're between enrollment, and periods and haven't encountered a qualifying life event, there are options, similar to short-term insurance, to overcome any barrier. Like that, you can assist with assuring that you're not without insurance at any point.

- A qualifying life event, to the extent that health insurance goes, is a change in the situation, for example, getting divorced or married, a change in residence, or an employment loss which makes an individual qualified to sign up for health care coverage outside of the yearly Open Enrollment Period.

Related articles