According to the IRS, around 100 million Americans, or roughly 70% of those filing taxes in the United States, are eligible to file their tax returns for free.

The IRS should be able to accept most Americans' 2022 tax returns for free.Other tax-preparation programmes may allow even more Americans to file their 2022 tax returns for free or at a reduced cost.

Tania Brown, a certified financial planner located in Atlanta and financial coach at SaverLife, a nonprofit focused on financial stability, said many other underutilised services might help people this tax season.

Table of contents

•What is an IRS Free File?

•Why was the Free File Alliance formed?

•Eligibility for Free File

•A Step-by-Step Guide to Using the Free File

•Who Should Make Use of the Free File?

•What Are Fillable Tax Forms That Can Be Filed For Free?

•How Free File Fillable Tax Forms Work

•Electronic Filing's Benefits

IRS Free File?

In 2001, the Internal Revenue Service (IRS) was required by the federal Office of Management to begin giving free tax preparation and filing to eligible taxpayers.

As a response, the IRS established the IRS Free File Alliance in 2003.

Several private-sector tax software companies have partnered with the IRS free file to offer free services to practically all taxpayers who meet specific criteria.

If your income exceeds the eligibility threshold, you may be eligible for more limited assistance.

Since 2003, the IRS Free File programme has filed almost 60 million returns. However, according to the Bipartisan Policy Center, IRS Free File is greatly underutilised by eligible taxpayers, implying that many more people are entitled to use them to file their taxes for free.

IRS Free File allows you to prepare and file your federal tax return online utilising guided tax preparation, an IRS partner site, or Free File Fillable Forms. For a federal return, it's safe, simple, and free.

You will leave the IRS.gov website and go on the IRS Free File provider's website once you pick your desired IRS Free File provider.

Then, to prepare and file your return, you must create an account on the IRS Free File provider's website, which may be accessed via IRS.gov.

Even though there was an almost 50% increase over the previous year, the programme might potentially benefit more people.

If your yearly gross income in 2021 was less than or equal to $73,000, you can file your federal taxes for free using one of the Free File software products.

Furthermore, some products allow you to file your state taxes for free. Step-by-step instructions and help for filers are usually included with the software.This year, it may be even more vital for Americans to use the programme because it will allow them to submit their taxes electronically.

To avoid delays, the IRS recommends that customers file online and get any refunds by direct deposit this year.

The IRS's Volunteer Income Tax Assistance and Tax Counseling for the Elderly programmes, known as VITA and TCE, respectively, provide free basic tax preparation services.

VITA and TCE are designed for low-income filers with an annual income of $58,000 or less, those with disabilities, limited English speakers, and those over the age of 60.

Tax specialists donate their time to assist qualified individuals in preparing and filing their tax returns.

Pre-pandemic, these alternatives were typically held in person, but many will operate differently this year.Due to the crisis, some places have closed; some will conduct the programme online, while others will conduct it in person.

What Is an IRS Free File?

The IRS Free File Program is a public-private cooperation between the IRS and several large tax preparation and filing software providers, all of which provide their services for free.

It provides two free online solutions for preparing and filing federal income tax returns:

Free online tax preparation and filing at an IRS partner site is provided by Guided Tax Preparation.

This service is provided at no cost to eligible taxpayers by our partners. Only taxpayers with an adjusted gross income of $73,000 or less are eligible for free IRS Free File guided tax preparation.

Free File Fillable Forms are electronic federal tax forms that you may fill out online for free, similar to a paper 1040 form.

You should be able to prepare your tax return if you choose this option. For taxpayers with an adjusted gross income (AGI) of more than $73,000, it is the sole IRS Free File option available.

Because the tax filing season does not begin until January 24th, eligible individuals can get a head start on their taxes by using the Free File software to e-file.

Free File is available to more than 70 per cent of all taxpayers, or nearly 100 million people.

The income ceiling for free federal tax services is $1,000 greater this year than it was last year.

Taxpayers can locate free federal return choices that fit their needs at www.IRS.gov/FreeFile.

Through the Free File Program, taxpayers can claim credits like the Advance Child Tax Credit, Recovery Rebate Credit, and other benefits like the Earned Income Tax Credit (EITC) early.

Taxpayers can also utilise IRS Free File to prepare and file their federal and state tax returns using their smartphones or tablets.

Through its involvement in the Security Summit Initiative, the IRS Free File Alliance and its members continue to prioritise the protection of taxpayers' personal information.

The Alliance and its members are active partners in the Security Summit Initiative, along with the IRS, state tax authorities, and others in the tax industry, to provide further identity theft precautions for tax filing.

IRS Free File Forms allows taxpayers who are familiar with the law and do not require tax preparation assistance to electronically complete and file their federal income tax.

IRS Free File has introduced millions of Americans, many of whom could not otherwise afford tax software, to the efficiency and ease of e-filing by making industry-leading tax software available at no cost.

The programme has helped the IRS progress its e-filing initiative while also filling a significant demand for affordable, high-quality tax software. In a poll conducted in 2021, 97 per cent of participants stated that they would use the IRS Free File programme again.

The Free File Alliance's mission

Since 2003, the IRS has teamed with the IRS Free File Alliance, a consortium of eight industry-leading tax software providers, to enable low and middle-income Americans to prepare, complete, and e-file their federal tax returns online.

The IRS Free File Alliance is dedicated to providing free access to the industry's best online tax preparation software to 70% of taxpayers. Since its beginning, IRS Free File has processed over 65 million tax returns.

Why was the Free File Alliance formed?

The Quicksilver Task Force of the Office of Management and Budget (OMB) established 24 e-government initiatives as part of the President's Management Agenda in November 2001.

These projects aimed to increase electronic capabilities between government and government, government and industry, and government and citizens.

IRS Free File was one effect that directed the IRS to provide taxpayers with free and secure online tax return preparation and filing services.

The IRS collaborated with the tax software sector to develop a solution in response to this OMB mandate. As a result, the IRS Free File Alliance, LLC was formed.

Why is the IRS collaborating with private industry rather than making its software available for free to the public?

The private industry has a demonstrated track record of providing the best technology and services available, thanks to its existing expertise and experience in computerised tax preparation.

Using a PPP allows government customers to benefit from the finest of industry resources.

For several years, several private-sector companies have given free e-filing to a select group of taxpayers; how is this strategy different?

IRS Free File is a multi-year partnership between the IRS and the Free File Alliance to provide more taxpayers with free services. The services must be accessed through IRS.gov to be a real IRS Free File.

Taxpayers can easily use the IRS Free File at IRS.gov/freefile, which provides a list of participating free services on a single online page.

Free File Alliance companies provide both free preparation and free e-filing services as part of our agreement. To qualified taxpayers, filing a federal tax return is free.

Eligibility for Free File

Your ability to use the IRS Free File programme is determined by your adjusted gross income (AGI). For example, if your AGI for the 2021 tax year was $73,000 or less, you could have prepared and filed your return using the IRS Free File software.

If your AGI is higher than the threshold, you can still use the IRS website to fill out free, fillable tax forms. You will not, however, receive the interactive, individualised assistance that IRS Free File offers.

Keep in mind that the IRS Free File income threshold is based on your adjusted gross income, which is the amount of money left over after certain deductions.

Because this does not necessarily include all of your earnings for the year, you may be qualified even if your salary exceeds the level.

Age & Other Restrictions

According to the Bipartisan Policy Center, the IRS establishes restrictions and limits on how many taxpayers Free File software vendors can service each year.

As a result, some alliance members have set additional eligibility requirements of their own.

Only three of the 12 IRS Free File Alliance members in 2019 had no age limit, according to the Bipartisan Policy Center, while five could only be utilised by taxpayers under the age of 60.

A Step-by-Step Guide to Using the Free File

On its website, the IRS free file provides access to the alliance members' tax preparation software. You are not compelled to utilise any particular service; instead, you can choose the one that best suits your needs.

When you click on the link, the IRS free file site will direct you to that provider's website, where you may examine eligibility conditions and learn more about what they have to offer.

After that, you must register an account, and the software provider will guide you through the process of filing your tax return step by step.

To get started, you'll need documents like last year's tax return, your social security number, and W-2s, among other things.

Based on your responses, the software will ask you a series of questions and find tax breaks and the best filing alternatives for you.

Both preparation and filing of federal returns are provided free of charge.

Free, Fillable Forms

If your income exceeds the eligibility level for IRS free file software providers, you have another option: The Internal Revenue Service (IRS) also provides free, fillable tax forms.

The most significant change is that there will be no helpful programme nudges to guide you through the ins and outs of filling out these forms.

They're still available online, but you'll have to enter all of the information yourself, so you'll need to know where to put it.

The forms don't check for errors in the same way that free software does, and they can only do very basic calculations.

After you've completed your return forms, you can e-file them. You are not required to print the forms and mail them in.

There are just free, fillable federal tax forms accessible. This service cannot be used to prepare your state tax return.

Who Should Make Use of the Free File?

IRS Free File is thought to be the best option for those with simple tax issues. Although the software applications offer a variety of tax forms, they only include the most frequent ones, therefore this programme is not for you if you return:

It necessitates the completion of enigmatic tax forms. Multiple schedules are included. Includes earnings from a company you own.

You'll also need to know how to communicate in English. Only two software suppliers will be able to serve customers who speak Spanish in 2021.

IRS Free File may be the greatest alternative for filing your taxes quickly and affordably if your tax situation is very simple and you are familiar with both computer software and the English language.

What Are Fillable Tax Forms That Can Be Filed For Free?

The Internal Revenue Service (IRS) offers electronic forms available to taxpayers on its website called IRS Free File fillable tax forms.

They are digital replicas of the hard-copy forms that people use to file their tax returns. The digital forms were created by the IRS for advanced users who already know the forms they need.

In 2009, the IRS launched the Free File fillable fax forms as an effort to facilitate the transition to a digital filing system.

Since then, the number of errors in income tax filing has decreased thanks to these electronic forms. Free File fillable forms have been utilised by over 46 million individuals.

Individuals and families with an individual or family income of $73,000 or less in the 2021 tax year can also use any of a variety of professional tax software products that have partnered with the IRS to offer their services for free through Free File. Of course, any taxpayers are invited to use the IRS.gov website to obtain free tax forms. The only free tax preparation programme that is income-based is TurboTax.

IRS Free File is a collaboration between the IRS and about 20 software companies. The software includes a step-by-step guide to help you complete your taxes quickly and correctly.

It assists you in obtaining tax benefits such as the Earned Income Tax Credit. Your tax information is kept safe and secure by providers who employ cutting-edge technology.

You can also e-file for free, which implies a quick refund and an IRS free file electronic receipt. When you combine e-filing with direct deposit, you can obtain a refund in as little as ten days.

If you owe, you can file early and pay by automatic withdrawal any time before the April tax deadline.

IRS Free File software packages are ideal for anyone wishing to save money, whether they are first-time taxpayers searching for a simple introduction or seasoned do-it-yourselfers.

Although some services offer state tax preparation for free or for a fee, IRS Free File is just for federal tax returns.

IRS Free File Forms is a more simple option for folks who are comfortable preparing their tax returns. It has no income restrictions and can be used by anyone. It does not, however, support state tax returns.

Most of the free tax preparation services offered by corporations like H&R Block that offer many versions have no income restrictions.

Rather, you are charged according to the complexity of your tax return and the tax topics included by each version. It makes no difference how much money you earn.

You may qualify for the IRS Free File programme if your adjusted gross income (AGI) is $72,000 or less, but your tax-related concerns are advanced (self-employment and capital gains).

This is a collaboration between the IRS and the Free File Alliance, an industry group that includes TurboTax and other major personal tax preparation software vendors.

Because you're using the same goods, whether you're a paying user or you came in through IRS Free File, the services appear and work the same.

It's simply that you aren't getting charged for them. However, you are limited to using the company's free customer assistance options.

Keeping Your Data Safe

If you choose the Fillable Forms option, the IRS will protect your personal tax information from unauthorised access.

If you're using a commercial product, be aware that these companies use security procedures that are at least equivalent to those used by banks to protect your data.

They can't use or reveal your personal information for anything other than tax return preparation unless you give them your informed consent.

This is all fantastic information, and it should reassure anyone concerned about tax scams. That's excellent news because most Americans are anxious about their personal information being stolen if they submit their taxes online.

How Free File Fillable Tax Forms Work

These tax forms are used by the IRS to expedite the receipt of income tax refunds. On the IRS website, taxpayers can fill out fillable tax forms for free.

Once a taxpayer downloads the forms, they can complete them without printing them by inputting their information immediately on a computer, phone, or tablet.

The taxpayer then signs the form on the computer before filling it with the IRS online. The return is then sent to the agency using the most up-to-date encryption technology.

The IRS Free File fillable forms do not provide any assistance in filing and do not include state tax forms, unlike many commercial tax preparation software packages that systematically examine the information.

For filing assistance, you can go to an IRS free file partner site, and state tax forms can be added for a cost.

An individual or family must have a taxable income of $73,000 or less in the 2021 tax year to be eligible for Free File.

Please note that most taxpayers' 2021 tax returns will be due on April 18, 2022, one day later than usual owing to the District of Columbia's Emancipation Day holiday on April 15th.

Due to the Patriots' Day holiday in those states, persons who live in Maine or Massachusetts have until April 19, 2022, to file.

Getting Started with IRS Free File

You'll need specific information in advance to file your taxes digitally utilising the free fillable tax forms.

To properly fill out the forms, you'll need your adjusted gross income (AGI) from the previous year's tax return, as well as your Social Security number, as well as that of your spouse and any dependents if you have any.

You'll also need access to records about your annual income, such as your W-2, which shows your annual pay, receipts, and evidence of any Social Security or unemployment compensation benefits.

You'll also need your identification number and five-digit pin, or your previous year's AGI, which may be found on your tax return, to file using the IRS Free File Fillable tax form. If you can't locate your AGI, the IRS free file provides an online tool to help you find it.

Electronic Filing's Benefits

Because the data from a return is transmitted immediately to the tax agency's computers, e-filing saves time and money for the IRS.

According to the IRS, filing online with tax preparation software reduces taxpayer calculation errors and missing entries.

According to the IRS, most taxpayers who e-file and provide direct deposit information should expect to receive any due refund within 21 days assuming their tax return is error-free.

Another advantage of e-filing is that the tax filer receives an acceptance or rejection notification within 48 hours after transmitting the tax return, frequently within 24 hours.

Acceptance indicates that the documents have been received and are in the system, but rejection informs the taxpayer that the IRS has rejected the return.

The rejection notice will provide details on what has to be changed on the return for it to be accepted.

If you e-filed your tax return before the deadline but were rejected afterwards, you have a five-day grace period to modify and resubmit it. You must then submit a corrected paper return.

What should you do if your income exceeds $73,000?

If your gross yearly income in 2021 was more than $73,000, the IRS free file has another free option available, but it requires you to prepare your taxes yourself.

People can use the IRS Free Fillable Forms service to fill out online tax forms, which they can then either electronically file with the IRS or print and mail to the agency.

IRS Free Fillable Forms, unlike other tools, does not provide any direction or step-by-step instructions; instead, it does basic computations on the numbers you enter into the forms.

It's also only for federal taxes, while residents of several states can use local programmes to complete state filings.

The IRS Free Fillable Forms programme is still a fantastic option if you have the time and are comfortable preparing your taxes.

When should you pay for assistance?

To be sure, some people may still want to pay for tax preparation because they don't qualify for a free programme or don't want to take the time to do it themselves.

Numerous online software packages assist consumers in filing for a fee, with offerings catering to a variety of tax issues at various pricing ranges.

If you have a more complicated return, such as itemised deductions, or if you are a sole proprietor with income or manage a small business, you may want to use a software programme or employ an accountant or other tax expert to assist you.

This year, it's critical to file an appropriate return to avoid delays in receiving any refund you're due.

To manage your costs and expenses you can use many available online accounting softwares.

How can Deskera Help You?

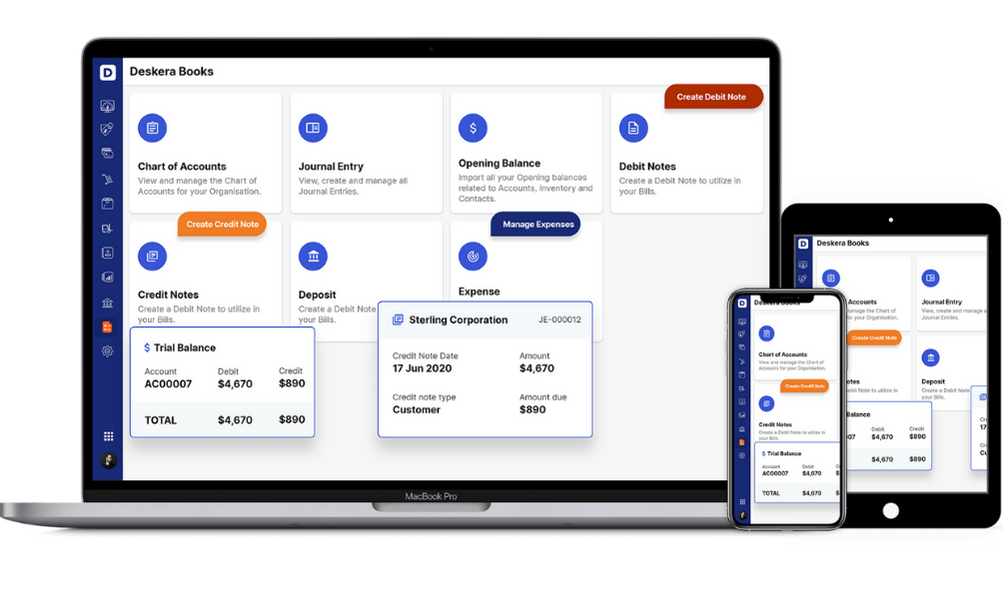

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs from creating invoices, tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- According to the IRS, around 100 million Americans, or roughly 70% of those filing taxes in the United States, are eligible to file their tax returns for free.

- IRS Free File Forms allows taxpayers who are familiar with the law and do not require tax preparation assistance to electronically complete and file their federal income tax.

- Keep in mind that the IRS Free File income threshold is based on your adjusted gross income, which is the amount of money left over after certain deductions.

- IRS Free File may be the greatest alternative for filing your taxes quickly and affordably if your tax situation is very simple and you are familiar with both computer software and the English language.

- When you click on the link, the IRS free file site will direct you to that provider's website, where you may examine eligibility conditions and learn more about what they have to offer.

- They are digital replicas of the hard-copy forms that people use to file their tax returns. The digital forms were created by the IRS for advanced users who already know the forms they need.

- IRS Free File Forms is a more simple option for folks who are comfortable preparing their tax returns. It has no income restrictions and can be used by anyone. It does not, however, support state tax returns.

- They can't use or reveal your personal information for anything other than tax return preparation unless you give them your informed consent.

- You'll need specific information in advance to file your taxes digitally utilising the free fillable tax forms

Related Articles