Companies essentially have two alternatives when it comes to raising funds for commercial purposes: equity financing and debt financing. The majority of businesses employ a combination of debt and equity financing, but each has its own set of benefits.

One of the most significant benefits is that equity financing requires no return and gives additional working capital that can be used to expand a company. Debt and equity finance are typically available to businesses.

The selection is frequently based on the most convenient type of financing for the firm, its cash flow, and the importance of maintaining control for the company's substantial shareholders. The debt-to-equity ratio depicts the percentage of debt and equity in a company's finances.

Table of contents

- What is equity financing?

- Capitalization of Debt

- Debt Financing Vs Equity Financing

- Is Debt Financing Riskier Than Equity Financing?

- How to Obtain Equity Finance?

- How would you prefer to pay for your loan?

- Key Takeaways

What is equity financing?

The process of selling a piece of a company's equity in exchange for funding is known as equity financing. The proprietor of Company ABC, for example, may require funds to expand the company. This investor now owns 10% of the business and will be consulted on future business decisions.

The main advantage of equity financing is that the money obtained is not repaid, debt or equity financing. Of course, a company's owners want it to succeed and provide a decent return to equity investors, but unlike debt funding, there are no mandatory payments or interest fees with equity financing when choosing from debt or equity financing.

The corporation will not be put under any additional financial hardship as a result of the equity transaction. Because no monthly payments are necessary with equity financing, the corporation has more capital to invest in the company's growth.

There is, in fact, a considerable disadvantage when choosing from debt or equity financing. You'll have to give the investor a portion of your company in exchange for funding.

When you make decisions that influence the company, you'll have to split your earnings and consult with your new partners. The only way to get rid of investors is to buy them out, which will nearly always be more expensive than the money they gave you in the first place in debt or equity financing.

Capitalization of Debt

Debt finance is the process of taking out a loan and repaying it with interest. A loan is the most prevalent form of debt financing. Debt finance can limit a company's operations by preventing it from pursuing opportunities outside of its core business. A low debt-to-equity ratio is favoured by creditors, which advantages the company if it needs more debt funding in the future.

Debt finance offers a lot of benefits. Your relationship with the lender ends when you pay off the debt. Then there's the fact that interest paid can be deducted. Finally, because loan instalments are fixed, it is simple to budget ahead of time, debt or equity financing.

What if the economy fails again, and your company runs into problems? What if your company doesn't expand as quickly or as successfully as you had hoped? Debt is a recurring cost that must be paid on a regular basis. This could impede your business's capacity to expand, debt or equity financing.

Finally, even if you run a limited liability corporation (LLC) or another type of firm that separates commercial and personal matters, the lender may still compel you to put your family's assets up as collateral, debt or equity financing.

If you're interested in debt financing, the Small Business Administration (SBA) has collaborated with select banks to offer a guaranteed loan programme that makes it easier for small businesses to get funds.

Debt Financing Vs Equity Financing

ABC intends to expand its business by constructing new plants and purchasing new machinery. It expects to need $50 million in capital to fund its expansion.

Company ABC decides to use a combination of debt and equity financing to generate capital. For the equity financing component, it sells a 15% ownership in its company to a private investor in exchange for $20 million in cash. It secures a $30 million firm loan from a bank with a 3% interest rate for the debt financing component. The loan has a three-year repayment period.

With the scenario described, there could be a plethora of possible combinations that result in different outcomes. If Company ABC were to raise funds solely through equity financing, the owners would have to give up a larger percentage of future profits and decision-making authority.

If they simply used debt financing, their monthly expenses would be higher, leaving them with less cash on hand for other uses and a heavier debt load to repay with interest, debt or equity financing. Businesses must choose the best option, or a mix of possibilities, that they have.

Points to Consider

Several factors influence whether one is best for you, including your current and projected profitability, your dependence on ownership and control, and whether or not you qualify for one.

Why Would a Business Opt for Debt Rather Than Equity Financing?

Debt financing is preferable over equity financing when a corporation does not want to give up any stock. If a corporation believes in its numbers, it would not want to miss out on the earnings it would have to provide to shareholders if shares were assigned to another person in debt or equity financing.

Is Debt a Better Investment Than Equity?

Debt can be less expensive than equity depending on the kind of your firm and how well it runs, but the opposite can also be true. Your equity money is virtually free if your business does not produce a profit and closes. You must repay the loan plus interest even if you do not generate a profit after taking out a small business loan through debt financing when choosing from debt or equity financing.

In this case, debt financing is more expensive in debt or equity financing. However, if your company sells for millions of dollars, the amount you pay shareholders could be far larger than if you merely paid a loan and kept ownership. Every case is different in debt or equity financing.

Is Debt Financing Riskier Than Equity Financing?

It is debatable. If you are not profitable, debt financing is riskier since your lenders will put pressure on you to repay the loan. However, if your investors want you to make a big profit, which they generally do, equity financing might be dangerous. If they are dissatisfied, they may try to negotiate for lower-cost shares or divest entirely in debt or equity financing.

Businesses can obtain necessary funds through debt and equity finance. Which one you need is determined by your business objectives, risk tolerance, and desire for control. Many organisations in the initial stage would seek equity financing, whilst those that are well established and have a good credit score may choose typical debt financing options such as small business loans.

When should you finance?

First and foremost, you must assess whether your company genuinely need funding. Obtaining a small business loan or raising equity may not be the best course of action for your firm at this time. However, you may still expand your firm slowly and safely by using a technique known as bootstrapping, which entails providing the funds yourself, debt or equity financing.

Paying back lenders and dealing with investors are major duties that, if handled improperly, can put your firm on the verge of bankruptcy. Raising external capital, on the other hand, can be the key to growth for many organisations if done correctly, debt or equity financing. Once you've assessed whether you have a valid need for more capital, you have two choices: debt or equity financing.

Finding investors prepared to offer your business money in exchange for a percentage of future profits and a vote in how things are operated is called equity financing. Debt financing refers to receiving a loan that is repaid over a set period of time until the main amount plus interest is paid off, debt or equity financing.

Equity financing's ins and outs

Friends and family: In many circumstances, your friends and family can provide the first round of equity investment (which is where it gets its clever name). Typically, these investments are for lesser sums of money with lower stakes in ownership. They assist business owners in laying a solid basis on which to build a viable product, debt or equity financing.

Angel investors are individuals who provide financing to a startup company when it is still in its early stages. Angel investors often spend $25,000 to $100,000 on a company that can demonstrate that its idea has validity and that its founders are motivated to succeed.

Venture capital: This type of funding is provided by a larger group of investors. Millions of dollars in equity financing are frequently provided by venture capital firms, including not only startup cash but also funds to drive a company's growth.

Private equity, unlike other forms of equity funding, is only available to enterprises with a track record of profitability. In many cases, private equity investors want to build value to a firm and then sell it for a profit several years later.

Whatever sort of equity financing you pick, keep in mind that investors put up money in exchange for a share of future profits. They may also want a say in how your company is run. These are important details to be aware of before taking the plunge.

Advantages of equity financing

So, what is it about equity finance that makes it so appealing? The key advantage of this type of financing is that it enables you to obtain funding without any past business expertise. Businesses may also look for equity financing to help fund a risky business strategy or start a company in a high-risk industry like new technology.

Because investors seek a percentage of the company's revenues rather than regular repayments that begin immediately, you can take advantage of the brief reprieve and focus on strategies that bring long-term rewards.

Disadvantages of equity financing

What are some of the disadvantages of equity financing? You'll have to give up some control. While debt funding may determine how the money is spent, the lender will have no control over the direction the company takes. Furthermore, the lender is no longer a member of the corporation once the loan is paid off. In contrast, equity financing requires the company to pay a percentage of all profits for the duration of the investor's participation.

How to Obtain Equity Finance?

Equity funding might take some time to set up since, unlike a bank loan, getting in front of the right investors and pitching your company's concept takes effort. If you're considering raising funds, it's critical to understand where your firm is in its life cycle so you can plan your pitch accordingly. A seed stage pitch should be considerably different from a series A pitch, for example.

Raising capital at critical junctures is advantageous because it demonstrates the company's potential and allows investors to envision how you'll become profitable in the future, debt or equity financing.

Once you understand the types of investors you should be looking for and have prepared a pitch deck that illustrates your vision, you should make a list of all the VCs that focus on your industry at the appropriate investment stage in debt or equity financing.

Cold outreach to investment firms you want to meet with or using your network for introductions is both part of the process. It's all about who you know or how you can find out who you know, debt or equity financing.

The ins and outs of debt financing

Let's look at what debt finance, or borrowing money, includes. Depending on their needs, small businesses can pick from a range of debt financing options:

Business credit cards and lines of credit: Revolving debt is the term for this situation. Interest is charged on the outstanding debt on a monthly basis, debt or equity financing.

A merchant cash advance is a loan backed by the future credit card sales of your business. A percentage of these sales is automatically taken out on a daily basis until the advance plus fees are repaid in full.

Factoring, also known as invoice financing, is a situation in which you sell outstanding invoices in exchange for a cash advance based on a percentage of the invoice, less a fee. Term loans: A lump sum payment is made to the company for its use, and it is repaid, plus interest, on a regular basis over time, debt or equity financing.

Advantages of debt financing

What's fantastic about debt financing is that it gives you complete control over your decisions. The arrangement between the lender and the firm is totally over once the debt is repaid in debt or equity financing.

If your company has a track record and a positive cash flow, it will be considerably easier to apply for and secure loan funding. Even if your credit score is poor, you may be able to get a small business loan when choosing from debt or equity financing. However, the loan's interest rate will almost certainly increase as a result.

Disadvantages of debt financing

Unlike equity financing in debt or equity financing, most lenders require a minimum number of years in business and a certain amount of annual revenue to be considered.

You should be able to distinguish between debt and equity funding from a mile away by now. While equity financing may be your only choice if you're starting a firm from the ground up, debt financing allows established companies to preserve their ownership. It's ultimately up to you to decide which is the greatest option. But, ideally, you're on the right track today, and you'll be able to secure the capital you need to realise your expansion goals.

What is the difference between debt and equity financing?

The choice between debt or equity financing ultimately comes down to the type of business you have and if the benefits exceed the dangers. Investigate the industry norms as well as what your competitors are doing.

Examine a variety of financial products to see which one best meets your needs for debt or equity financing. If you're thinking about selling stock, make sure you do it legally and in a way that allows you to keep control of your company, debt or equity financing.

Many businesses utilise a combination of both methods of financing, in which case you can compare capital structures using a metric called the weighted average cost of capital, or WACC. The WACC is calculated by multiplying the percentage costs of debt and equity in a proposed financing plan by a weight equal to the proportion of total capital represented by each capital type.

Consider These Factors When Choosing Between Debt and Equity Financing for Your Startup

If you want to establish a new business, the first thing you'll need to figure out is how you're going to fund it. It won't matter if your new business idea is brilliant, you won't be able to switch on the lights if you don't have a stable source of funding, debt or equity financing.

You'll be able to focus on the more creative aspects of your business once you've obtained funding, and you'll be closer to making your ambitions a reality.

All business funding alternatives, in general, fall into one of two groups. With debt financing, your company borrows money from a lender and agrees to repay it (plus interest) over time. On the other hand, with equity financing, you are selling a portion of your company when choosing debt or equity financing.

While this sort of financing does not require repayment in the future, you do lose some control over your firm and may also lose some revenues. For all new business owners, both debt or equity financing have advantages and disadvantages.

The best option for you will be highly particular to your industry. In this article, we'll go over seven things to think about when deciding between debt and equity funding.

Long-Term Objectives

As the owner of your new company, it'll be vital for you to consider what you want to accomplish in the long run. What is your motivation for launching a business? In ten years, where do you want your company to be? How about twenty years? By answering these questions, you will be able to determine how financially invested you will be in your company. Though you don't have to come up with a future exit strategy right now, it's a good idea to consider, debt or equity financing.

Available Interest Rates

Naturally, the amount of money you'll need to borrow determines the opportunity cost of choosing equity over debt finance. If your organisation has access to low-interest rates or specialised loans, the total cost of borrowing will be lower. Before making any final selections, it's a good idea to look into numerous options to verify you're getting fair quotes from potential lenders. Working to improve your company's credit score can also be quite beneficial.

Limit the number of shares

You are ceding power to some level by giving up half ownership of your company. To ensure that they can still outvote all other stakeholders, many business owners will keep 51 percent of the company while selling the remaining 49 percent. If maintaining total or significant control over your company is important to you, limit the number of shares you distribute.

Requirements for Borrowing

Lenders evaluate a number of variables when deciding whether or not to give a loan. In addition to a basic financial background examination, lenders will want to see some real facts on paper. They may examine your debt-to-equity ratios, fixed monthly spending, general business plan, and other factors. These restrictions may be rather rigorous, which is why your company should plan ahead of time for its fundraising strategy.

Organizational Structure at the Present

Another aspect that determines the prospective cost of borrowing is the structure of your company. Selling shares may be more challenging if your company is already formally structured as a partnership.

If you wish to generate money through public methods, such as selling stocks on the open market, you'll also need to formally designate your company as a public corporation. Though your business structure can change in the future, the structure you have now will undoubtedly have a substantial impact on your short-term funding choices.

Term of Repayment in the Future

While many company loans have simple flat-rate payback agreements with a fixed interest rate, others have far more complicated repayment arrangements. For some years, some loans, for example, will not require any payments. If this is the case, you'll need to calculate both the average total interest rate and the time value of money.

If you borrow from a single venture capitalist or angel investor, you may be able to negotiate terms that aren't available with traditional bank loans. These investors may offer a sophisticated mix of loan and equity financing to emerging businesses.

Access to the Stock Markets

You'll need to be able to identify folks who are actually interested in buying shares if you want to fund your firm using stock. Despite what some entrepreneurs believe, there isn't a ready-made counsel of venture capitalists prepared to fund new businesses with little or no due diligence.

You'll need to flesh out your company strategy, meet with a range of people, and be willing to make concessions if you want to acquire money through stock. For some business owners, the lack of debt that only equity financing can provide compensates the time it takes.

How quickly do you need money?

With debt financing, you'll save a lot of time and money because you'll get the money quickly, usually within a few days to a few weeks. Money can be used for both short and long-term endeavours. Short-term financing is a sort of revolving loan used to cover expenses such as inventory and materials.

Long-term debt finance is a sort of instalment loan used to cover costs such as machinery, equipment, and startup costs. The terms of debt financing are clear and clearly forth from the beginning. You already know how much you'll owe and when you'll have to repay it.

Obtaining equity funding takes longer in debt or equity financing. Business owners and investors will wrangle over the investment package, or how much of the firm will be given up in exchange for money, and a significant amount of time will be spent assessing the company's future value.

When engaging with several investors, different viewpoints on what that value should be in the end might complicate things, requiring even more effort and negotiation. Furthermore, equity financing requires a significant amount of legal work, making it the more time-consuming alternative from debt or equity financing.

Do you want to maintain complete control over your business?

Debt financing allows you to maintain control over your company. Lenders aren't looking for a piece of your company; all they want is confirmation that you'll be able to repay the debt. Debt financing has the downside of requiring you to take out a loan and make a monthly payment with interest, debt or equity financing.

If you choose equity investment, you will relinquish some influence over your company. Your investors may wind up controlling the majority of your company, depending on the conditions of the arrangement, which means you may be voted out of the company you founded in debt or equity financing.

If equity financing is the difference between success and failure for your company, it's worth giving up some control. Consider the case below: Which would you prefer: 80 percent of something or 100 percent of nothing? Furthermore, keep in mind that when you take out an equity loan, you're giving up more than just power; you're also giving up future value. Giving up 10% of a $100,000 company feels much less meaningful than giving up 10% of a $10,000,000.00 company.

Do you possess the qualifications required for the type and amount of funding?

Before selecting whether to go with equity or debt financing, one of the most critical factors to examine is cash flow. Are you the one who has it? What stage are you at, and how much money do you have for that level?

Lenders look at your ability to repay the loan amount plus interest when it comes to debt financing. They'll consider not only your company's long-term viability, but also the borrower's financial status, debt or equity financing.

How would you prefer to pay for your loan?

If you've taken out a loan with debt financing, you'll have to start paying it back within 30 to 45 days, regardless of whether you've made your first sale. If you chose a revolving line of credit, it, too, must be paid back on time in debt or equity financing. This means that your ability to repay lenders is an important factor to consider when taking up debt financing in debt or equity financing.

If you default on a loan, it will have a negative influence on your credit and your ability to obtain finance in the future. The good news is that you can quickly determine how much debt financing will cost you if you want to take out a loan, debt or equity financing.

There are no payments made along the way with equity financing. Instead, repayment is contingent on a long-term exit strategy. It could be a sale to another company, a refinancing, or a future round of equity financing that returns money to investors plus a profit. In other words, you will not be required to provide any cash flow from the outset, debt or equity financing.

When you choose stock financing, you are handing away a portion of your company's future value to investors, thus it's critical to understand the implications of equity payout. If you give up a 10% interest in your firm, it could cost you a lot or a little, depending on the company's success or failure. If your firm collapses, your debt is usually discharged, and you owe no money and have no ongoing obligations, debt or equity financing.

Both debt and equity financing have advantages and disadvantages. Before determining how you'll get financing for your business, consider all of your options.

Equity financing sources

Self-funding

Self-financing, sometimes known as bootstrapping, is frequently the initial step towards obtaining money. It necessitates the use of both personal and business funds. Before they agree to lend you money, investors and lenders will want you to self-fund.

Family or friends

Offering a partnership or a portion of your company to family or friends in exchange for equity is a common strategy to raise funds. However, carefully analyse this choice to ensure that it will not have an adverse effect on your relationship.

Investors from the private sector

Investors might put money into your company in exchange for a piece of the earnings and equity. Investors might also contribute expertise and guidance to your company, debt or equity financing.

Venture capitalists

These are frequently major corporations that make significant investments in new startups.

Stock market

Floating on the stock market, also known as an Initial Public Offering (IPO), entails publicly offering shares to raise funds. You also run the danger of not being able to raise the capital you require owing to weak market circumstances.

Crowdfunding

Crowdfunding is a method of raising funds in which you ask a large number of people to invest in or donate to your product concept or project. It is usually accomplished through the use of the internet.

For your product concept or project, some websites provide a crowdfunding platform.

There are four different sorts of crowdfunding that you can utilise to raise funds for your company. Each seeks funds in a different method, and the persons involved may have various tax obligations, debt or equity financing.

Donation-based crowdfunding

A contributor makes a payment to your business without obtaining anything in return in donation-based crowdfunding. This is most commonly used to fund one-time projects.

Crowdfunding based on equity

Equity-based crowdfunding is a method for small and medium-sized businesses to raise funds. Typically, a large number of investors will contribute small sums of money in exchange for firm shares.

Equity Financing Benefits

A different source of funding

The fundamental benefit of equity financing is that it provides enterprises with an alternative to debt financing. Angel investors, venture capitalists, and crowdfunding platforms can help startups that don't qualify for substantial bank loans afford their expenditures, debt or equity financing.

Because the company does not have to repay its shareholders, equity financing is seen as less risky in debt or equity financing. Investors typically think long term and do not expect a quick return on their money. It permits the firm to reinvest cash flow from operations to grow the business rather than relying on debt repayment and interest.

You have access to business contacts, management skills, and other funding options. Equity funding can also assist a corporation's management. Some investors are personally driven to help a firm flourish and desire to participate in its activities, debt or equity financing.

Their successful experiences enable them to provide critical assistance in the form of business contacts, management skills, and alternative financial sources. Many angel investors and venture capitalists are interested in assisting enterprises in this way. During the early stages of a company's development, it is crucial to choose debt or equity financing.

The Disadvantages of equity financing

Ownership and operational control dilution

The fundamental downside of equity financing is that it requires business owners to relinquish a portion of their ownership and control. If the business becomes profitable and successful in the future, a portion of the profits must be distributed to shareholders in the form of dividends, debt or equity financing.

Many venture capitalists demand a 30 percent to 50 percent equity share, especially from firms with little financial experience. Many business owners and founders are hesitant to give up so much control of their company, which limits their equity funding alternatives.

Inadequate tax shelters

When compared to debt, equity investments offer no tax advantages. Dividend payments to shareholders are not tax deductible, but interest payments are. As a result, the cost of equity borrowing rises, debt or equity financing.

Equity financing is thought to be more expensive in the long run than debt financing. This is because investors seek a larger rate of return than lenders. Investors take on a lot of risks when backing a business, therefore they seek a higher return.

To manage your costs and expenses you can use many available online accounting software.

How Can Deskera Assist You?

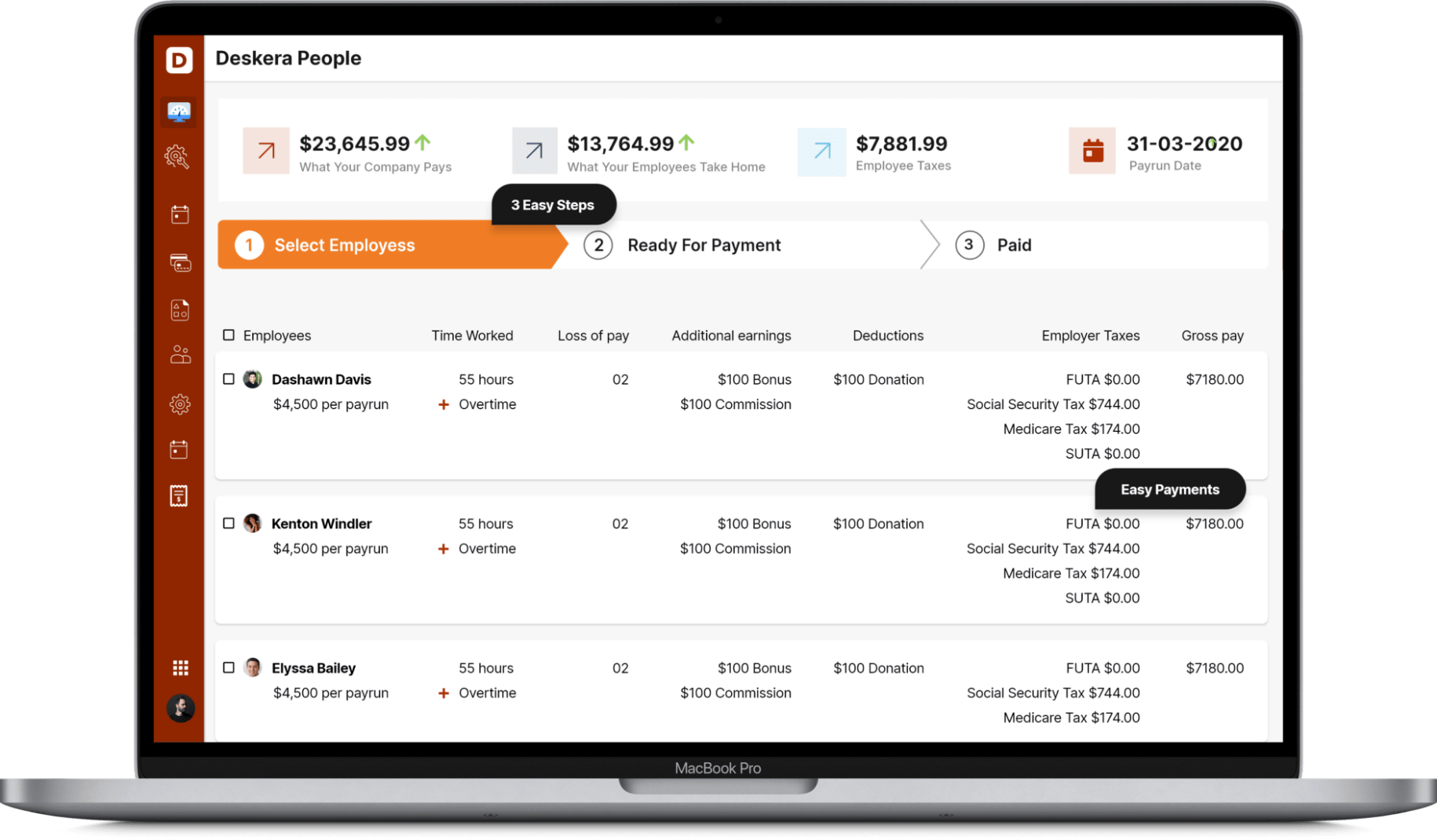

Deskera People make it simple to handle leave, attendance, payroll, and other processes so that you can focus on making the best decisions. For example, creating payslips for your employees is now simple since the platform also automates and digitizes HR tasks.

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

- The main advantage of equity financing is that the money obtained is not repaid, debt or equity financing. Of course, a company's owners want it to succeed and provide a decent return to equity investors, but unlike debt funding, there are no mandatory payments or interest fees with equity financing when choosing from debt or equity financing.

- When you make decisions that influence the company, you'll have to split your earnings and consult with your new partners. The only way to get rid of investors is to buy them out, which will nearly always be more expensive than the money they gave you in the first place

- Debt financing is preferable over equity financing when a corporation does not want to give up any stock. If a corporation believes in its numbers, it would not want to miss out on the earnings it would have to provide to shareholders if shares were assigned to another person

- Paying back lenders and dealing with investors are major duties that, if handled improperly, can put your firm on the verge of bankruptcy. Raising external capital, on the other hand, can be the key to growth for many organisations if done correctly,

- Businesses can obtain necessary funds through debt and equity finance. Which one you need is determined by your business objectives, risk tolerance, and desire for control. Many organisations in the initial stage would seek equity financing, whilst those that are well established and have a good credit score may choose typical debt financing options such as small business loans.

- Equity funding might take some time to set up since, unlike a bank loan, getting in front of the right investors and pitching your company's concept takes effort. If you're considering raising funds, it's critical to understand where your firm is in its life cycle so you can plan your pitch accordingly.

- Because the company does not have to repay its shareholders, equity financing is seen as less risky in debt or equity financing. Investors typically think long term and do not expect a quick return on their money. It permits the firm to reinvest cash flow from operations to grow the business rather than relying on debt repayment and interest.

Related Articles