Every big organization in the world started off as a little seedling - they were all "small businesses" at the genesis. Whether it be Apple, Microsoft, or Nike - at one point in time, all these corporate giants were but an idea in somebody's head.

It is the growth opportunities they harnessed and leveraged that allowed these organizations to become what they are today. However, there is another thing they planned meticulously that sling-shorted them to the top tier - finance.

The Small Business Association defines a business as "small" if it has fewer than 500 employees. According to the Bureau of Labor Statistics, the average rate of failure of small businesses is 20% in the first year, for a majority of industries for loans.

The second, fifth, and tenth years see a failure rate of 30%, 50%, and 70%, respectively. These stark figures amplify the importance for the owners of all small businesses to have a clear financial path outlined for the first ten years of the business if they wish to make it big.

Planning finances for consistent growth translates directly into arranging financial assistance for the small business in the first few years. Business development, expansion, processes, and everything else requires working capital (and a contingency buffer) in order to make it big in the future.

This is where business loans come into the picture. Especially since the world has now started to recover from the 2020 pandemic, small businesses require a little boost to get back on their feet - and this can be availed in the form of business loans.

This article discusses all there is to know about business loans in US, and how you can get one for your business.

What is a Business Loan?

A loan that is specifically released for business use is referred to as a business loan. They function a little bit differently from personal and commercial loans in that they take longer to process and typically involve putting up collateral against the debt borrowed.

A business loan also requires the borrower to furnish financial account statements to the lender. This is done so that the lending institution can estimate the borrowing capacity of the business and decide on the value of the collateral.

Despite the number of steps involved in processing a business loan, if all the documents are in order, it is a straightforward process. In fact, statistics say that the lending institutions in the US granted business loans worth approximately $15.5 trillion by June 2021! That goes to say that it isn't rocket science to avail of loans, even if you are a small business budding for greatness.

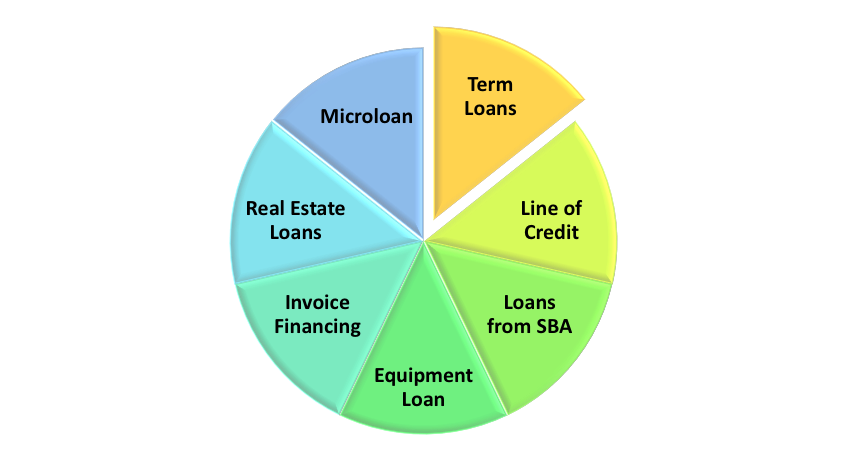

Along the same lines, business loans come in many types. Deciding on the type most suitable for your business depends on the terms of each one, the nature of fund use involved, repayment, collateral, value, etc. Here are the 9 basic types of loans small businesses can avail of in the US.

Term Loans

A term loan is a straight-forward arrangement wherein small businesses borrow a set sum of money upfront. It is then paid back to the lender with a pre-decided interest over a pre-decided term.

The most suitable scenario to opt for a term loan is when a small business is in need of working capital to run its operations (for example, vendor payments in a construction business). Additionally, small businesses prefer term loans in unique, unprecedented situations where a sudden requirement of capital emerges with no means to cater for it.

Other situations where small businesses opt for term loans are:

- Renovation investments

- Mergers and acquisitions

- Purchasing real estate

Term loans can be availed of from a bank or from online lenders.

Line of Credit

Business lines of credit are one of the most popular forms of business loans in the US. They are precisely what they sound like - credit. Just like you can spend as, and when you wish using your credit card, small businesses can draw funds from their business lines of credit as and when the requirement of funds arises.

A business line of credit helps small businesses set up a cushion of finance to fall on, in case there are gaps in their cash flows. Here are some other utility areas for business lines of credit:

- Contingency fund

- Covering cash flow gaps in case of delays in payment by the client

- Managing recurring expenses in case of cash inflow gaps

Credit lines can be secured or unsecured. When availing of from a bank, they usually require collateral.

Loans from SBA

The Small Business Administration of the US is a great enabler for small businesses to make their mark in the markets. The SBA isn't a lending agency; rather, it functions as the partial guarantor for the loans a small business applies for with a lending institution, such as a bank. By doing this, the SBA encourages the lending institution to lend the money to the business, and the business to seek a loan.

This arrangement is a great enabler for businesses with a good line of credit. If a small business is unable to qualify for a traditional bank loan, they can opt for SBA loans to establish some working capital and get the ball rolling. Although it does become possible for small businesses to get financed through this method, they still need a high-quality profile to have SBA as their part-guarantor.

If you are a business that doesn't qualify for a traditional loan, SBA loans are for you.

Equipment Loan

As the name suggests, loans meant exclusively to assist equipment lease or purchase are termed equipment loans. It is a type of asset-based financing that is provided to businesses to acquire new assets. The best part about these loans is that the equipment itself functions as the collateral, so there is no requirement of putting up other assets against the loan taken.

Small businesses that are new or just made their space in the market can take this loan for new or used equipment. Equipment loans can even be availed by businesses that do not have stereo-typically ideal lines of credit.

Depending on the age, finances, and business credit of your small business is, the interest rates are quite competitive and sometimes quite reasonable. It varies anywhere between 8% to 30%.

If your business needs machinery, computers, vehicles, or any other high-value equipment, you can push for an equipment loan.

Invoice Financing

Loans against invoices are a very interesting type of asset-based financing. If your business is struggling with gaps in the cash flow due to outstanding invoice payments, it reflects badly on your year-end financial statements. To fill these gaps, you can take your invoices to the lending institutions and take loans to balance out your sheets.

The interesting part is that, in a way, your unpaid invoices serve as the collateral against which the lending institution releases funds to you. This is helpful when there are many invoices that are unpaid by clients, and your business needs to cover operating and standing expenses. It also helps to maintain a healthy cash flow statement at the end of the year.

Real Estate Loans

Every business needs a space to work out of. If your small business is in the process of acquiring property to set up work, it may be a good time to seek out a real estate loan from a reliable lending institution.

Much like equipment or other asset-based loans, a real estate loan needs no collateral. The property you purchase using this loan acts as the insurance for the lending institution in case of loan non-repayment.

One thing to note is that lenders usually do not release the entire cost of property in loans - there is a term called Loan-to-Value. The LTV of any property is typically 75% to 80% of its cost, which means that if you look to purchase an office space worth $100,000, you are eligible for a loan of a maximum of $80,000. The rest you must cover yourself.

Microloans

Loans that amount to a maximum of $50,000 are called microloans. Businesses that need a start-up capital to find these loans extremely attractive, because the qualification terms prescribed aren't very demanding or stringent.

New businesses that need immediate capital to set up operations apply for this loan. Additionally, businesses that require urgent financing of an amount that doesn't qualify for traditional loans also avail of microloans.

Small businesses can approach non-profit lenders for microloans. The SBA sometimes partners with these lenders to help small businesses get started with their microloans. The typical repayment term for microloans is up to 6 years.

Business-use Personal Loans

If you are planning to set up a fresh business, using a personal loan to start the process is one method. Though these loans are termed personal, they can be used for anything. Also, since these are personal loans, you need a solid credit score (above 650) and stable finances to get one. Interest rates are highly variable and the payment term is usually a maximum of 5 years.

However, if you get assessed and find that you qualify for a business loan, it is better to opt for that instead. It gives you more capital at more competitive interest rates to work with.

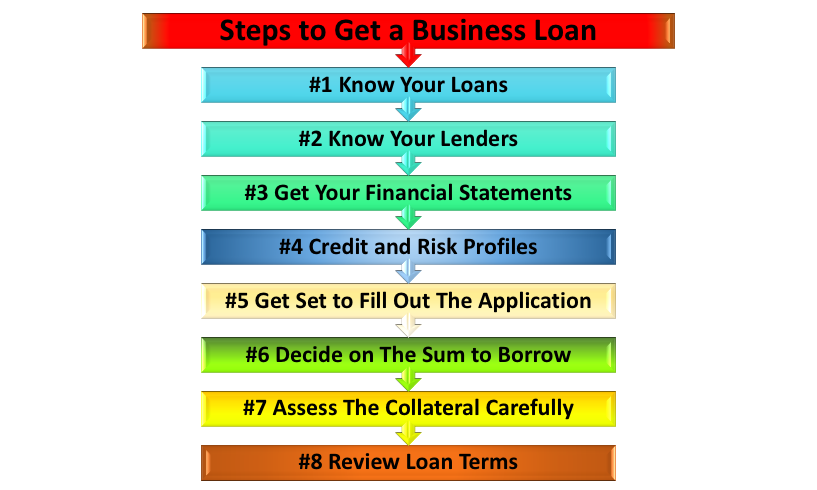

Steps to Get a Business Loan

Usually, the process to get a loan release for business use is quite straightforward. However, a little preparation in advance doesn't hurt - it helps you ready yourself for the process of assessment. Here are the steps you need to take to get a business loan issued.

#1 Know Your Loans

The first step to take when eyeing a loan is to know the types of business loans available to you. Depending on the nature of fund use, there are various options you can choose from that would provide you with suitable repayment arrangements and collateral.

As described earlier, based on the requirement, you can take equipment loans, invoice financing, term loans, business line credits, etc. The kind of loan your business can utilize optimally depends on the kind of capital use you have planned for it.

#2 Know Your Lenders

There are numerous avenues you can research to find a lender that provides you with a loan on suitable terms in US. One of the places you can search is online. Online lending is gaining traction today because of its relatively easy processing and lesser time taken for fund release. Since everything is mostly digital, it can be handled remotely.

Reputed lending outfits such as Swift Capital and Fundera provide various kinds of business loans to small businesses - short-term loans, cash advances, and more. Alternatively, you can explore large commercial banks to lend you the capital you need - names like JP Morgan, Citibank, and the like. The loan process with these institutions will be more rigorous and time-consuming than the online lenders.

The third method to availing of business loans is P2P: basically, there are agencies that work as middlemen between your business and a bank to facilitate quick loan disbursal. Their decisions are relatively quickly made. A few examples of P2P agencies are LendingClub, Prosper, and FundingCircle. Another option is borrowing from banks that work with SBA guarantees, as discussed earlier. Such a guarantee helps the decision-making process for approving your loan, which makes traditional borrowing simpler.

#3 Get Your Financial Statements

This is the step where your business will need the assistance of an accountant. Make sure all your financial statements - balance sheet, profit and loss statement, cash flows - are thorough and honest. Whether or not the sum for your loan gets approved depends on how sound your business financials are.

The lending institution will meticulously scrutinize your debt-to-equity ratio, EBITDA, gross margins, cash flow, accounts receivable, and payable to assess your repayment capability. If your answers to these questions aren't found satisfactory, it is likely that your application will get rejected.

#4 Credit and Risk Profiles

The ultimate decision on whether or not your application for the loan will be approved relies heavily on how secure a lender feels to let you borrow their money. For this purpose, a lender studies the credit and risk profiles of your business. It involves assessing whether or not your business has enough cash flow remaining after considering all the debts that are currently active.

Additionally, lenders also look at business assets and investors - because having more of these reflects positively on the financials of a business. Credit and risk profiles also contain information on your financial statements.

#5 Get Set to Fill Out The Application

Loans are a sensitive matter for lenders. As such, they require every information in great detail to assess whether it is suitable to disburse a loan to your business. When filling out an application, to ensure that the lenders look at you favorably, ensure that you have the following information ready to be filled:

- Full name of the business

- Tax ID

- Complete list of all your executive officers and their backgrounds

- Structure of your company (LLC, S or C Corporation)

- Financial statements of at least 3 recent years with detailed balance sheets of the current year

- Projected financial statements of the next year to give lenders a positive view of your business

- Your State documents (incorporation certificate, certificate for good standing, etc.)

- Copies of all insurance policies registered for the company

- Available collateral

- Credit report of the business

- Tax returns

- Bank statements of the business bank

- Investor pitch deck.

#6 Decide on The Sum to Borrow

The lender will ask you the sum you seek to borrow from them. Be prepared with a well-thought-out principal that covers your expenses and leaves some wiggle-room for contingencies should they occur.

Additionally, to save the lender some trouble, assess yourself on the premises of repayment - would you be able to repay the sum you need to borrow from the lender? If your answer is "No", you can expect the same from the lender. Convince yourself first.

Next, the lender would want to know how you will use the proceeds.

- What are you going to do with the money?

- Would you use it to buy equipment or acquire another business?

- Do you need it to balance your cash flows?

Based on how you are going to use the money, the lender will decide whether or not to approve loan disbursal.

#7 Assess The Collateral Carefully

Oftentimes, lenders push for the principal business owner to provide a personal guarantee on the loan sought. Try to avoid this arrangement as far as possible because it tends to put the principal owner's assets at risk of confiscation.

To avoid this situation, your business needs to showcase all its assets and its capability of covering for the borrowed money. Convincing the lenders that their sum is secured against equal value is the best way to get approval on a business loan.

#8 Review Loan Terms

To determine whether or not a loan makes sense for your business, you need to study its terms in detail. Check the rate of interest, whether it is variable or fixed and how often it is charged - is it weekly, monthly, or annually? What is the term of the loan? Check if you are okay with how the principal is amortized over the loan term.

Study in detail the types and extent of fees involved in getting the loan (underwriting, origination fee, administrative, processing, etc.). Also, find out the conditions of loan default beforehand so that you are aware of them and they can be avoided.

When is a Good Time to Take Out a Business Loan?

Whether your small business is just starting out or it has a few years under its belt, getting a loan approved is all in its timing. Here are a few motivators that you can consider to nail the right timing to apply for a business loan so that there are maximum chances of approval.

- When your business is shiny new, you need office space to set up all your operations and house your personnel. You also require a lot of equipment, machinery, and infrastructure to get work started. The expenses here amount to five figures - which is the right time to seek out a suitable loan. Starting a business as soon as possible will get the cash flow rolling, and you should be able to pay the debt back.

- If you are considering the expansion of your current business, taking a loan would aid you in the process. This fund could be used in the research and development of new products or acquiring another business with an established base for you to take over, or marketing your business activity in a new location.

- Oftentimes businesses apply for loans to get their hands-on industry experts or persons of great influence to enhance their brand with their knowledge. Retaining these people requires financial incentives, which a brand can cater to through a loan.

In Closing

Business loans are a crucial part of any company's growth. The key is to know three points:

- Why do you need a loan

- How much do you need to borrow

- Why will the lenders agree to it

When you have satisfactory answers to all three of these questions, consider your business ready to receive funds.

The key is to keep your financial statements spotless and meticulously maintained - because they are the picture of the financial health of your business. Convincing the lenders becomes easier if your balance sheets are good.

While unpaid invoices are something you can't control, there are other factors that can spoil your statement. For example, incurring personal expenses on your business credit card. This impacts the cash flow and tax return statements of your business, which can sway how a lender sees your financials. With that in mind, it isn't alright to spend on personal requirements using your business credit card.

When asking for a loan, always keep in mind that a lender seeks to find the convincing elements in your business that guarantee his money back with interest. Whether or not your loan is approved depends on how well your business furnishes its repayment capabilities.

Related Articles