The whole world is still grappling with the impact of the Covid-19 pandemic as new variants pop up unexpectedly in some areas on the planet. While many employees have been forced to face job loss or even change their profession, employers also are required to run an apt payroll for the workers.

Apart from managing employee salaries, withholding certain taxes from it, and running the business successfully, the business owners also have to give various types of taxes to the state government and the federal government in the United States of America. This involves paying a particular tax rate for the individuals who have been left unemployed for no fault of theirs in this pandemic. In this article, we are going to understand what is SUTA and the ongoing SUTA tax rate 2022 applicable to the employers. We will be covering the following points in this blog -

- What is SUTA?

- Who will pay SUTA tax?

- What factors are checked while calculating SUTA rates?

- How is the unemployment tax rate calculated?

- What is the SUTA wage base?

- How to get the SUTA rate?

- Will SUTA tax rate 2022 increase?

- Conclusion

- How Can Deskera Assist You?

- Key Takeaways

What is SUTA?

The State Unemployment Tax Act or SUTA is also called the state unemployment insurance (SUI). It is also known as the re-employment tax and is applicable to employers. It is a part of the business’s payroll taxes. As per the available data, this tax is determined by the state government and it also decides which employers are eligible to pay this tax. The eligible employers will pay the SUTA tax as per the SUTA tax rate 2022 for the ongoing financial year.

The main purpose of this employer’s tax is to accumulate funds for the state’s unemployment insurance. It helps the state government to cover the benefits which are offered to the displaced and unemployed workers who have been removed from their job due to pandemic crisis that is no fault of their own. If a business owner fails to pay this tax or neglects it, then it can have an adverse impact on his business. He might be required to pay hefty fines to the state government, give huge penalty fees or even face criminal charges.

Who will pay SUTA tax?

According to the available information on the internet, the rule states that in most states of America, the SUTA tax is applicable only to the employers and not the employees working in the organization. In contrast to this, the social security tax is also withheld from the employee paychecks. However, some employees working in a few states need to understand the SUTA tax rate 2022 as it is applicable to them. The few states in this developed country in which the employees have to pay the unemployment taxes are

o Alaska

o Pennsylvania

o New Jersey

The businesses in these three states in the U.S. are required to withhold the SUTA tax from their employee wages and pay the collected taxes to the state government while filing income tax for the financial year. According to the available information, most employers who have employed a single employee are required to pay this tax. There might be certain exemptions applicable to the business owners depending on the state and how many weeks the employee has been employed with the business.

What factors are checked while calculating SUTA rates?

The employers will be required to pay the SUTA tax rate 2022 as decided by the state government. According to the information available, there are multiple factors considered by the state government while calculating this tax rate. It includes -

- The age of a business

- The ongoing turnover rate of the industry in which the employer’s business operates

- The total number of former employees who have filed unemployment claims

As per the rule, these taxes are usually calculated at the end of month following the quarter-end. If all the employees of the organization have been working in only one state, then the employer has to pay this tax as per the state’s tax rate. An employer’s SUTA rate is often referred to as the contribution rate. This is determined using the employer’s experience rating. However, if the employer has multiple branches and has employees working in different states, then he has to submit the SUTA tax payments to the state government as applicable for each state. This means he would have to consider the SUTA tax rate 2022 for each state differently while paying the taxes. This rate can change annually and is based on the evaluations done by the state unemployment agencies. Each state agency sends the calculated tax rate notice along with a breakdown of how it has been calculated to the employer for his better understanding.

How is the unemployment tax rate calculated?

The employers are known to give this tax based on their experience rating. It has been observed that the states in the U.S. heavily rely on the reserve ratio method to calculate the employer’s experience rating. The employers need to pay their tax contributions to a pre-assigned account. It is this account which is used to pay the unemployment benefits to the former employees of the company or business throughout the year.

The reserve ratio for an employer is calculated as -

Reserve ratio = (Employer account balance) / (Employer’s average taxable payroll for three years)

This ratio is usually denoted in percentage.

As per the available data, the state unemployment agency makes use of this contribution rates for positive-rated employers as well as negative-rated employers on an yearly basis. Te employers who have positive reserve ration are provided with a low tax rate where as the employers wth a negative ratio are given a substantially higher tax rate. Before filling the SUTA tax rate 2022, the employer must visit his state’s agency website for further information.

What is the SUTA wage base?

Every state is known to determine its tax wage base each year. It is the maximum amount an employee’s paystub which is taxable as per the state tax in a calendar year. The employers are known to pay the tax until they meet this wage base. All the employers within a state in America will have the same SUTA tax wage base. For instance, in 2021 the employers in Washington has a wage base for this tax as 52,700 dollars. It means the non-exempt employers in Washington need to pay SUTA tax on their employee wages till each employee earns this much amount.

The state-wise wage bases for 2021 for SUTA is as give below -

- Alabama: $8,000

- Alaska: $43,600

- Arizona: $7,000

- Arkansas: $10,000

- California: $7,000

- Colorado: $13,600

- Connecticut: $15,000

- Delaware: $16,500

- District of Colombia: $9,000

- Florida: $7,000

- Georgia: $9,500

- Hawaii: $47,400

- Idaho: $43,000

- Illinois: $12,960

- Indiana: $9,500

- Iowa: $32,400

- Kansas: $14,000

- Kentucky: $11,100

- Louisiana: $7,700

- Maine: $12,000

- Maryland: $8,500

- Massachusetts: $15,000

- Michigan: $9,500

- Minnesota: $36,000

- Mississippi: $14,000

- Missouri: $11,000

- Montana: $35,300

- Nebraska: $9,000; $24,000*

- Nevada: $33,400

- New Hampshire: $14,000

- New Jersey: $36,200

- New Mexico: $27,000

- New York: $11,800

- North Carolina: $26,000

- North Dakota: $38,500

- Ohio: $9,000

- Oklahoma: $24,000

- Oregon: $43,800

- Pennsylvania: $10,000

- Puerto Rico: $7,000 (2020)

- Rhode Island: $24,600; $26,100**

- South Carolina: $14,000

- South Dakota: $15,000

- Tennessee: $7,000

- Texas: $9,000

- Utah: $38,900

- Vermont: $14,100

- Virgin Islands: $32,500

- Virginia: $8,000

- Washington: $56,500

- West Virginia: $12,000

- Wisconsin: $14,000

- Wyoming: $27,300

* Nebraska’s standard wage base is $9,000, while the wage base for experienced employers is assessed at $24,000.

**Rhode Island has a two-tier wage-based system. The first number indicates the wage base for the majority of employers in Rhode Island, while $26,100 is the highest assessed rate.

The SUTA tax rate for the year 2021 were as follows -

|

State |

SUTA

New Employer Tax Rate |

Employer

Tax Rate Range (2021) |

|

Alabama |

2.70% |

0.65% – 6.8% |

|

Alaska |

2.57% (2.07%

comprises employer share; 0.50% comprises employee share) |

1.5% – 5.9% |

|

Arizona |

2.00% |

0.08% – 20.6% |

|

Arkansas |

3.10% |

0.30% – 14.2% |

|

California |

3.40% |

1.5% – 6.2% |

|

Colorado |

1.70% |

0.71% – 9.64% |

|

Connecticut |

3.00% |

1.9% — 6.8% |

|

Delaware |

1.80% |

0.3% – 8.2% |

|

District of Columbia |

2.7% or average rate

of employer contributions in the preceding year (whichever is greater) |

N/A |

|

Florida |

2.70% |

0.29% – 5.4% |

|

Georgia |

2.70% |

0.04% – 7.56% |

|

Hawaii |

5.20% |

0.01% – 6.6% |

|

Idaho |

1% |

0.207% – 5.4% |

|

Illinois |

3.18% |

0.2% – 6.4% |

|

Indiana |

2.50% |

0.5% – 7.4% |

|

Iowa |

1.00% |

0.0% – 7.5% |

|

Kansas |

2.70% |

0.2% – 7.6% |

|

Kentucky |

2.70% |

1.0% – 10% |

|

Louisiana |

Varies |

0.09% – 6.2% |

|

Maine |

2.31% |

0.69% – 6.01% |

|

Maryland |

2.60% |

2.2% – 13.5% |

|

Massachusetts |

2.42% |

N/A |

|

Michigan |

2.70% |

6.8% – 8.1% |

|

Minnesota |

Varies |

0.1% – 0.5% +

experience rating |

|

Mississippi |

1.0% (first year),

1.1% (second year), 1.2% (third year) |

0.0% – 5.4% |

|

Missouri |

2.38% |

0.0% – 6.0% |

|

Montana |

Varies |

0.0% – 6.12% |

|

Nebraska |

1.25% |

0% -5.4% |

|

Nevada |

2.95% |

0.25% – 5.4% |

|

New Hampshire |

2.70% |

N/A |

|

New Jersey |

2.8% (0.425%

comprises employee share) |

0.4% – 5.4% |

|

New Mexico |

1.0% or industry

average rate (whichever is greater) |

0.33% – 5.4% |

|

New York |

3.13% |

0.6% – 7.9% |

|

North Carolina |

1.00% |

0.06% – 5.76% |

|

North Dakota |

1.02% (positive

balance), 6.09% (negative balance) |

0.08% – 9.69% |

|

Ohio |

2.70% |

0.3% – 9.3% |

|

Oklahoma |

1.50% |

0.3% – 7.5% |

|

Oregon |

2.60% |

1.2% – 5.4% |

|

Pennsylvania |

3.69% |

1.2905% – 9.9333% |

|

Rhode Island |

1.16% |

1.2% -9.8% |

|

South Carolina |

0.55% |

0.06% – 5.46% |

|

South Dakota |

1.20% |

0% – 9.5% |

|

Tennessee |

2.70% |

0.01% – 10% |

|

Texas |

Varies |

N/A |

|

Utah |

Varies |

0.2% – 7.2% |

|

Vermont |

1.0% (most employers) |

0.4% – 5.4% |

|

Virginia |

2.50% |

0.1% – 6.2% |

|

Washington |

Varies |

0.0% – 6.86% |

|

West Virginia |

2.7% (most employers) |

N/A |

|

Wisconsin |

3.05% (payroll <

$500,000), 3.25% (payroll > $500,000) |

0% – 12% |

|

Wyoming |

Varies |

0.48% – 9.78% |

As these rates are subject to change each year, the employer must visit the official government website for SUTA tax before filing the tax. The changed SUTA tax rate 2022 have been as follows for the different states -

|

State |

2022 Employer Tax Rate Range |

|

0.05%-6.1% |

|

|

1%-5.4% |

|

|

0.08%-20.93% |

|

|

0.3%-14.2% |

|

|

1.5%-6.2% |

|

|

0.75%-10.39% |

|

|

1.9%-6.8% |

|

|

0.3%-8.2% |

|

|

0.1%-5.4% |

|

|

0.04%-8.1% |

|

|

0.2%-5.8% |

|

|

0.252%-5.4% |

|

|

0.725%-7.625% |

|

|

0.5%-7.4% |

|

|

0%-7.5% |

|

|

0.2%-7.6% |

|

|

0.5%-9.5% |

|

|

0.09%-6.2% |

|

|

0.053%-6.16% |

|

|

1%-10.5% |

|

|

0.94%-14.37% |

|

|

0.06%-10.3% |

|

|

0.06%-9.5% |

|

|

0.2%-5.6% |

|

|

0%-6.75% |

|

|

0.13%-6.30% |

|

|

0.0%-5.4% |

|

|

0.3%-5.4% |

|

|

0.1%-8.5% |

|

|

0.5%-5.8% |

|

|

0.33%-6.4% |

|

|

2.1%-9.9% |

|

|

0.06%-5.76% |

|

|

0.08%-9.69% |

|

|

0.8%-10.2% |

|

|

0.3%-7.5% |

|

|

0.9%-5.4% |

|

|

1.2905%-9.9333% |

|

|

1.2%-9.8% |

|

|

0.06%-5.46% |

|

|

0%-9.3% |

|

|

0.01%-10% |

|

|

0.31%-6.31% |

|

|

0.3%-7.3% |

|

|

0.8%-6.5% |

|

|

0.33%-6.43% |

|

|

0.33%-6.02% |

|

|

2.1-7.6% |

|

|

1.5%-8.5% |

|

|

1.5%-8.5% |

|

|

0%-8.5% |

How to get the SUTA rate?

If you are an entrepreneur or a small business owner who has just entered the business and have no idea of how to set up the SUTA tax,here is a guideline for the same. While each state has its very own process to register a new employer and to set up his state unemployment tax account, a few common things followed by all the states are -

- Employer Identification Number: EIN helps the IRS to identify an employer’s business on tax returns

- Electronic Federal Tax Payment System (EFTPS): Every employer must enroll in the Electronic Federal Tax Payment System which is abbreviated as EFTPS. It permits the employers to pay the employment taxes online or over the phone.

- A new hire reporting account: The employer must set up a new hire reporting account. It enables the state government to collect information related to child support, do identification of fraud recipients of the unemployment insurance and also assists in prevernting the unlawful welfare assistance.

- Proof of worker compensation insurance: This insurance policy assists the employees who have been injured on the job with wage protection and even provides medical benefits.

Every employer must report his SUTA tax liability according to the SUTA tax rate 2022 to the respective state government and make the tax payments electronically.

Will SUTA tax rate 2022 increase?

According to the available information the SUTA tax rate 2022 are likely to remain high for the employers for the next few years for all states including those which did not borrow anything from the federal unemployment trust fund. As per the available information, due to pandemic unemployment claims, the states in America need time to rebuild their SUI reserve.

For instance, Arizona did not borrow the federal unemployment trust funds but increased their SUTA rate table in the year 2021. The max SUTA rate for 2020 was 11.8% whereas it increased to 20.6% in the year 2021. The Arizone wage base had remained at 7000 dollars which leaves the state in the middle when overall all states total employer SUI costs are compared.

If the employers are thinking about the long term impact, then it is clear that they are experiencing repercussions of the Great Recession. The rising unemployment caused by Covid-19 has affected the SUTA tax rate 2022. Furthermore, the exmployers must expect an increase in the federal unemployment taxes in the year 2022 for the 20 states that have borrowed money from the federal funds. If the federal legislature decides to extent the time to pay back these loans then it will not have any impact on the tax rate. Also, if the state government finds out an alternative way to repay the borrowed loan or decides to use the federal stimulus funds to replenish the state’s unemployment fund, the SUTA tax rate 2022 will not see any great impact.

Conclusion

The SUTA tax rate 2022 are already given in this blog for the ongoing financial year. While the Covid-19 has brought unemployment to many employees and asked them to find alternative jobs, it has also changed the way employers pay taxes to the state government and federal government in the United States of America.

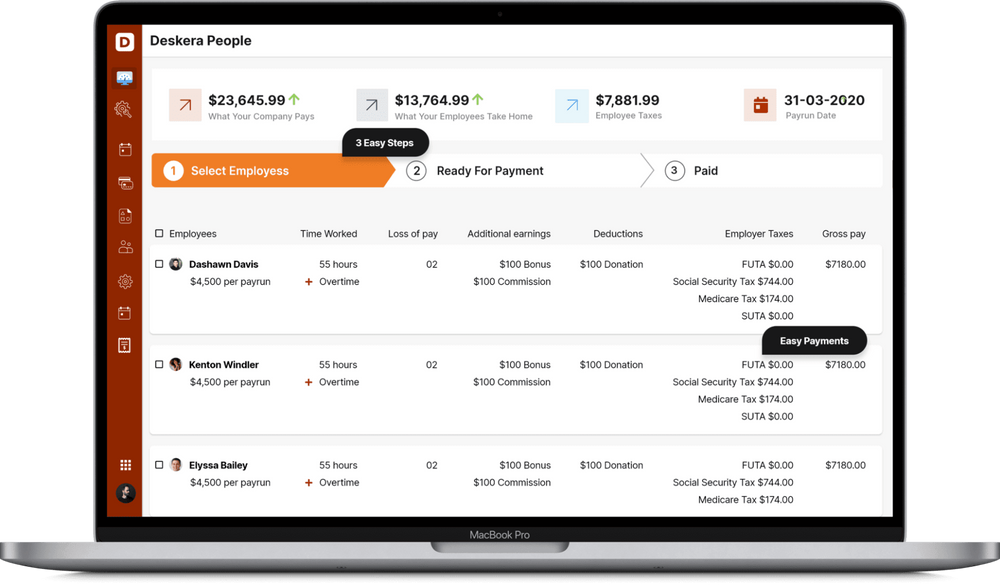

How Can Deskera Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- The unanticipated Covid-19 pandemic has affected both employees and employers when it comes to paying taxes to the state and federal government. The decision for SUTA tax rate 2022 has also been based on it.

- The employers across the various states of America are required to pay the state unemployment insurance which is another name for the State Unemployment Tax Act i.e. SUTA.

- The different factors that are checked for calculating the SUTA rate include age of business, ongoing turnover rate in the industry and number of employees who have filed for unemployment insurance.

- The experience rating of an employer is calculated to determine how much SUTA tax he needs to pay for a financial year. This is done using a reserve ration which is calculated in percentage using the formula given below -

Reserve ratio = (Employer account balance) / (Employer’s average taxable payroll for three years)

5. Every state has its own SUTA rate in America if they do not fall under the exceptional states. An employer can get rate by using his EIN, Electronic Federal Tax Payment System, a new hire reporting account and with the proof of worker compensation insurance.

6. As per the available information from the internet, SUTA tax rate in 2022 will remain high and it will be applicable to the upcoming years due to the pandemic Covid-19. It will be less only if the government decides to extend time to repay borrowed loans for the employers or finds an alternative way to limit the unemployment percentage.

Related Articles