Are you planning to open a small business for a long time? Although it's a great idea to present your product in front of your potential customers, at the same time, you must also care about the taxes. Many times, the entrepreneurs forget about business tax write-offs while being engrossed in work and forget to mention the deductions which could prove useful while filing income tax.

A small business owner faces the challenging task of managing multiple priorities and is bound to have too many things on his plate. It can involve onboarding employees, managing project deadlines, marketing products and even ensuring good company culture to retain the talented professionals for a successful business.

In this article, let us understand the different tax deductions that a business owner might overlook while filing the tax. We are going to cover the following points in this article -

- What is the difference between tax credits and tax deductions?

- What tax deductions can be used in business write-offs?

- What deductions can be counted as business write-offs?

- Conclusion

- How can Deskera Assist you?

- Key Takeaways

What is the difference between tax credits and tax deductions?

If you are a business owner who wants to understand the different business tax write-offs, then you must know the difference between tax credits and tax deductions. This information will prove useful for any individual who is going to file the income tax and income tax return for the ongoing financial year. According to available information, there are two ways in which a small business owner can save on taxes in the current financial year. They are -

- By claiming tax deductions

- By taking advantage of tax credits

A tax deduction lowers the tax liability for a business owner by reducing the table income. It includes the deductions that an entrepreneur incurs for the business expenses throughout the year. For instance, a small business owner can add deductions that are related to startup costs, insurance inventory etc. He would have to subtract these deductions in front of the gross annual income to understand how much tax he must pay to the government. In comparison to this, tax credit happens when a business owner gets a dollar-for-dollar deduction on his tax bill. It implies that if a small business owner has got a tax credit of five hundred dollars then he would be paying five hundred dollars less in taxes.

According to the IRS website, the common tax credits a business owner must pay attention to are as follows -

a. General Business Tax Credit

b. Alternative Fuel

c. Paid Family and Medical Leave

d. Small Business Health Insurance Premiums

e. R&D Tax Credits

f. Employer-Provided Child Care Facilities and Services

g. Work Opportunity Tax Credit

What tax deductions can be used in business write-offs?

As per the available information, every small business owner is going to incur some cost for carrying out his services for the customers. The IRS has defined this cost as a business expense. To be counted as a business expense for the entrepreneur, this expense must be ordinary and necessary. It can be counted as business tax write-offs if the business continues to operate well and make a profit.

It means when a business owner is going to deduct some expense on the tax return, then he wants to lower his taxable income by reducing the tax liability. By doing this step, he is reducing the amount of tax he owes to the IRS every financial year. In short, he is saving more money to invest back in the business.

What deductions can be counted as business write-offs?

An individual taxpayer can claim multiple standard tax deductions to reduce his tax burden by lowering the taxable income. However, entrepreneurs who are running small businesses do not have this option. A small business owner has to be very specific while including the business tax write-offs. He needs to itemize and file for them specifically as business tax deductions. However, if you are a small business owner who has just ventured into the market, it is very much possible that you have very little to almost nil idea about what qualifies as tax deductions.

A small business owner should always have an inquisitive approach to knowing about what can be counted as business tax write-offs. To make it simpler for the business owners with start-ups, here is a list of what can be counted as deductions from the tax -

- Petty cash

As per the information, available from trusted sources, a small business owner can use petty cash as deductibles for the business tax write-offs. Here, petty cash refers to the money that a business owner can use for small purchases or for handling minor expenses in his business.

However small these purchases look at that time, it is possible to add up over a significant time as the demand for them increases after hiring new employees or adding new projects for the company’s growth. This total can be deducted from the business expenses and it is bound to make a significant difference in the business owner’s annual gross income.

A small business owner must track the purchases made for the company throughout the year by keeping records. Proper bookkeeping is the solution to maintaining good records. He must the receipts of every expense made

Petty cash refers to money you use as a business owner for small purchases and other minor expenses for your business. While these purchases may be small, they add up over time, and the total deducted amount from these expenses can make a significant difference when taken out of your gross income. A detailed log of the expense transactions must be kept by the business owner to avail maximum benefits from filing these costs.

2. Home office deduction

If you are a small business owner who has started office from home, then your entire business operates from home itself. In this case, a small business owner qualifies for a home office deduction in business tax write-offs. According to the available data, home-based businesses are pretty common and is mostly used by sole proprietor where the individual is a single owner of his company.

The business owner needs to be operating at a profit for the previous financial year if he wants to use this in business tax write-offs. It is only then he would be able to deduct the expenses for the home office by mentioning the money spent on housing costs such as property tax, rent, utilities and much more.

If the business of a small business owner from his home qualifies for the tax deduction, then he would have to measure the square footage area of his office to the total area size of the house. This ratio will help him understand what he can deduct from the tax.

3. Car expense

A small business owner may use his car for business. In such cases, he can include the deduct the car expenses incurred in business tax write-offs. The different car expenses in business use for a small entrepreneur can be because of travelling from one work location to another, going to business meetings at a distant remote place, or visiting the clients/ customers at a pre-decided or factory location. A small business owner can also opt to rent out a temporary workplace apart from several regular places of work.

A small business owner can use two ways to deduct the business mileage expenses on his tax return - actual expenses or the standard deduction. Irrespective of the method he wants to prefer, he should keep proper records to decide which method to follow. In this record, he must also include the information about what was the business purpose of the car’s use. It is necessary to maintain this log for two reasons, namely -

a. To record mileage for every trip - It helps to show the reason for business travel purposes

b. Proper record of expenses - It gives the exact amount of expenses

It is important to note here that the small business owner must be able to provide proper details such as the cost of car expenses, the date from which he started using his car for business purposes, the mileage for each business use and the total miles covered by the vehicle for a year. The log should also provide details related to the business destination and purpose for each business trip. An industrialist can consider using a mileage app to help track and distinguish between business versus personal mileage of the vehicle.

4. Charitable contributions

The small business owners can also use charitable contributions they have made in the financial year as business tax write-offs. As per the law, the business tax deductions include any kind of charitable deductions as long as the company falls in the category given below -

· Partnership

· S-Corporation

· Limited Liability Corporation

As per the rule, the deductions from charitable contributions cannot be more than 10 per cent of the total income of the business. An entrepreneur or industrialist must remember that if the owner decides to donate his company’s old equipment or furniture to some third party or an individual/ group in need of them then it won’t be counted as business tax write-offs if he has already its full depreciation value for a previous deduction.

5. Retirement savings

A sole proprietor or a self-employed business owner can make certain contributions to retirement savings account or even plan possible deductions on his tax return. The different types of small business retirement plans that are eligible for business tax write-offs for deductions are -

· Self-employed simplified employee pension (SEP) plan

· Solo 401 (k)

· Keogh or HR-10 Plan

· Savings incentive match plan for employees plan (SIMPLE)

If the small business owner wants to know which of the above-mentioned plans would be best suitable for him and his business to have possible good tax savings, then he should interact with a tax consultant or retirement planning expert.

6. Miscellaneous Business Expenses

The list of deductions in tax is not small and can vary as per the region. Moreover, a small business owner needs to spend on various items each year and many of them can be included in the business tax write-offs. As per the rule, if the expense is ordinary and necessary for the daily operations of the business, then the small business owner cal include them in the list of miscellaneous business expenses and they would be considered deductibles. The owner must keep a track of the cost of these expenses in case it is required to show to the IRS. The list of possible deductible business expenses for a small business owner can include any of the following items -

· Seminars and trade shows

· Postage

· Business gifts

· Club or membership fees

· Parking and tolls

· Website and internet costs

· Bank and credit card fees

· Bad debt expense

· Postage

· Industry publication subscription costs

7. Business startup costs

When a small business owner is establishing his business, he is bound to have capital expenditures such as start-up and organizational costs. As per the available information, IRS is known to separate the startup costs from the organizational costs. Startup costs can be defined as the cost a small business owner uses while creating an active trade or business for his company. He can also use it for investigation of the product creation or the purchase of a trade or business. In opposition to this, organizational costs can be defined as the cost incurred by the business owner to create a corporation or partnership or a limited liability company. It includes different costs such as a legal and professional fee to form the legal entity of business and fees for registering it.

If the small business owner fails to buy or start his business successfully, he can still use these expenses to recover some costs if they were related to a specific business opportunity. For more details, the employer can check IRS Publication 535, Chapter 8.

According to the available information, a small business owner can deduct the business startup costs up to 5000 dollars and organizational costs up to 5000 dollars in the first year of his business. The business owner who wants business tax write-offs must remember that if the start-up and organization costs exceed five thousand dollars then each should be amortized over the number of years.

8. Interests on Debts

A small business owner often uses business loans and even lines of credit to lay the financial foundation of his organization. He should keep a track of the interest he pays on the financing debt to include it in the business tax write-offs if it meets the certain specified requirements. These interest payment amounts can be counted as deductibles as they would finance the company.

Conclusion

The list of deductions for small business tax write-offs is very big and it is possible that a business owner might not have a complete idea about it. It can cause him a great loss if he fails to add the appropriate business deductions while filing tax or even the tax returns for a particular financial year. Hence, it is always advised by the tax professionals to check the deductions permitted on the IRS site so the business owner can understand what can be included in the expenses to reduce the taxable income.

How can Deskera Assist you?

Knowing how small business owners can use deductions for appropriate business tax write-offs is essential for every entrepreneur if he wants to use maximum deductibles for limiting the taxable income.

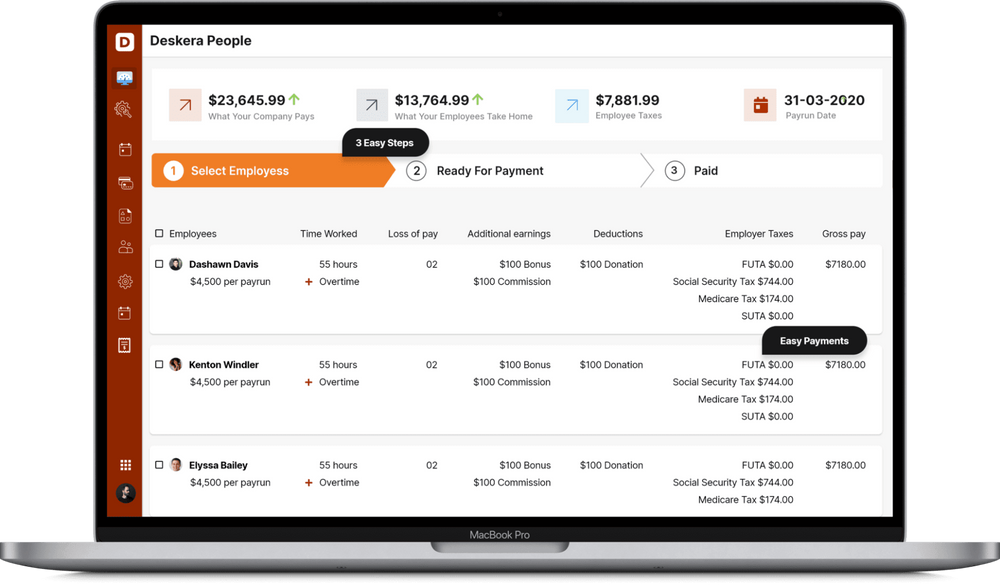

Deskera People provides tools for handling payroll, accounting, CRM and HR which can prove useful for effective business management. It will also help the small business owner concentrate properly on deductions to be included in business tax write-offs.

Key Takeaways

- A small business owner must be aware of the deductibles to be included while filing the tax forms for the financial year if he wants to have a business tax write-off to minimise the taxable income.

- A business owner can save tax in two ways - by claiming tax deductions or by claiming tax credits.

- An entrepreneur or a business owner who has just started his business must check the IRS to understand what is included in the deductibles.

- The different deductibles allowed for tax write-offs for small business owners include petty cash, charitable contributions, home expense cost, and car expenses. It also includes the miscellaneous business expenses made by the business owner.

- The small business owner or entrepreneur can also include retirement savings, interests on debts, and business startup costs from business tax write-offs.

Related Articles