Running a successful business involves handling and managing multiple things. A business owner is responsible for giving appropriate employee payroll according to their position. However, the question arises for a business owner who is the sole proprietor of his business

as he might have questions about how to pay himself as a sole proprietor! In this article, we will consider doubts related to this question and understand how a business owner or self-employed can pay himself for his professional work. We are going to cover the points given below in this article -

- What is a sole proprietorship?

- What are the pros and cons of a sole proprietorship?

- How to pay myself as a sole proprietor?

- How much to pay to self as a sole proprietor?

- How to file the taxes as a sole proprietor?

- Conclusion

- How can Deskera Assist you?

- Key Takeaways

What is a sole proprietorship?

According to the definition given by IRS, a sole proprietorship can be defined as an unincorporated business entity which has a single owner. Furthermore, the spouse can also own and operate this business entity under sole proprietorship. As per the available information, a sole proprietor need not file business formation papers with the state government. It means, that if you are running a business on your own and have not registered with the state, then it implies that you already have a sole proprietorship. It means if a business owner begins to offer goods or services to the customers, he is working as a sole proprietor.

Hence, all the business profits will pass through this single business owner and get reported on his personal income tax forms. In addition to it, he would have to pay the state as well as federal income tax on all the profits apart from the self-employment tax. While doing this, he needs to understand how to pay myself as a sole proprietor to ensure appropriate income for every project handled.

The examples of sole proprietorships are -

- Freelance writers/professionals

- Consultants

- Bookkeepers

What are the pros and cons of a sole proprietorship?

This type of business has its own set of advantages and disadvantages. Before you understand how to pay myself as a sole proprietor, let us get to know about its benefits and drawbacks.

Pros

- Easy to start - A sole proprietorship need not be registered or incorporated with the business in a state. The business owner that is the sole proprietor just needs to get the required business licenses and permits from the state or local government as per the requirement.

- A sole proprietor has very minimum legal necessities - The sole proprietors are not required to keep a hefty bunch of documentation for maintaining the legal status of their business

- Ease in management - As there are no other business partners involved, a sole proprietor has complete management of the business unless he has decided to involve his spouse in it. Furthermore, as all the profits are in his name, his business financial, personal and legal situation will remain the same.

- Simplicity in taxes: The sole proprietor needs to report his business income and loss in the personal income tax return for the financial year. It means he just needs to attach a Schedule C to the Form 1040 tax return.

Cons

- Unlimited personal liability: The sole proprietors need to face unlimited personal liability which means they are themselves responsible for the debts and obligations in their business. It implies the creditors can even ask for personal assets to get money from the sole proprietor if there are some issues in the business.

- High tax: The sole proprietor need to pay a high-income tax and self-employment tax on the total income of his business.

- Extra work - If the individual is thinking of how to pay myself as a sole proprietor, he should be ready to do a lot of work. He has to look into all aspects of business, including marketing, leadership, finance, strategic approach to complete projects within deadline and every other responsibility. It can cause a lot of pressure on a single person and can result in a quick burnout, thus impacting his health or other areas of life.

How to pay myself as a sole proprietor?

Once you have understood how a sole proprietor works, you should know how to pay myself as a sole proprietor if you are planning to work professionally in this role. It will give you a sound understanding of how much to pay yourself if you are going to pay yourself in the business.

As per the rule, a sole proprietor is an accountant himself who can clear his monthly dues at his own will. It means if I am working as a freelancer and want to pay myself as a sole proprietor, I can simply take out the money from the concerned business bank account at any time and pay myself any time. According to the rule, if my business is making good profits, then the money kept in my business bank account would be considered ownership equity. It is calculated as the difference between the business's assets and liabilities. This transaction would be counted as a draw and is not considered the salary of the paystub for the sole proprietor. As per the available information, if a business owner wants to perform a draw, then he needs to write a check to himself. Furthermore, this check is not subjected to any kind of taxes such as federal income tax, FICA tax or the state income tax by the government. It is because the IRS treats business profits and a sole proprietor’s income as a single thing.

It means if a business owner has deducted the business expenses on Form 140 Schedule C meant for the sole proprietors or by using Form 1065 for the partners, then the remaining profit would be counted as personal income.

However, if you are a sole proprietor who files the personal income tax return once a year, then you need to pay yourself consistently. To ensure this, you must check out the financial projections if the business is just launched in the market or the previous financial performance if the business has been in the industry for quite some time and then estimate the profits made in the business. Based on these calculations, he can decide the consistent salary pay myself as a sole proprietor. Furthermore, if the business is doing better than expected and has given excellent ROI, then the sole proprietor can give himself a quarterly or annual bonus!

The steps to pay myself as a sole proprietor would be -

- Set up a separate business bank account to keep personal and professional accounts separate

- The business bank account can be opened in own name or on a different name

- If the business owner wants to have it under a different name, then the sole proprietor needs to file a DBA

- Once the accounts have been set up appropriately, the business owner must write a check for the amount he needs to withdraw.

- This check would be characterized as owner’s equity or a disbursement.

- The sole proprietor then needs to deposit in his bank account

How much to pay to self as a sole proprietor?

If you are a business owner and wondering how much to pay myself as a sole proprietor, you would first need to calculate the number of profits your business expects to make for a particular period. Based on this, you can decide the paycheck you should draw from the business account.

According to the information available on the sources, if the sole proprietor has already set up a separate business bank account and card, then he can simply log in to the accounting software to calculate the net sales minus the expenses made. After doing this transaction, the business owner can calculate the amount that would be counted as a pay myself as a sole proprietor. The payment can be done online as there are multiple options available now.

The business owner can do this calculation every two weeks or only once a month depending n his priority and choice. It means the sole proprietor can decide the value and frequency of self-pay based on his personal goals and lifestyle. However, you must keep in mind that in the initial phase of the business when it is just in the preliminary phase, the pay should be kept minimum in case something goes wrong in the initial phases. Once the sole proprietor has met a certain stage, he can gradually start increasing the amount he has decided to pay myself as a sole proprietor.

How to file the taxes as a sole proprietor?

As simple as it is to pay myself as a sole proprietor, similarly, filing taxes is also very easy for you. When you do a draw in the business bank account, you are not liable to pay the federal or state income tax or give money for social security and medicare taxes. The sole proprietor only needs to file a Form 1040 Schedule C to the IRS once a year.

If you are a sole proprietor and want to calculate your deduction, then just add up the different business expenses for diverse categories you have done for your business. This can include advertising, car expenses or meals. The expenses can be a big list to add to the deductibles and hence, a sole proprietor must review what he has spent throughout the year by checking the IRS website to know what is considered deductibles.

The personal income tax return for a sole proprietor is easy as it is the remaining business profit once he has paid taxes and deducted the business expenses from the income.

Conclusion

Although handling the finances related to sole proprietorship looks simple, every business owner would like to have a tool that is useful for his entrepreneurship. Accounting software can make the job of bookkeeping much easier for every business owner as there would be no chance of human errors and repetition in the records.

The accounting software can assist in the easy calculation of how much to pay myself as a sole proprietor and give a correct idea about the taxes to be paid for the financial year. Furthermore, with the tool, he can categorize the payments done to himself into different categories such as owner’s equity, and disbursements. It will give him a rough idea of how much is paid to himself each year.

Whether you are a sole proprietor or a small business owner, it is always better to have a precise bookkeeping practice to ensure the accounting and payroll are up to date for business growth.

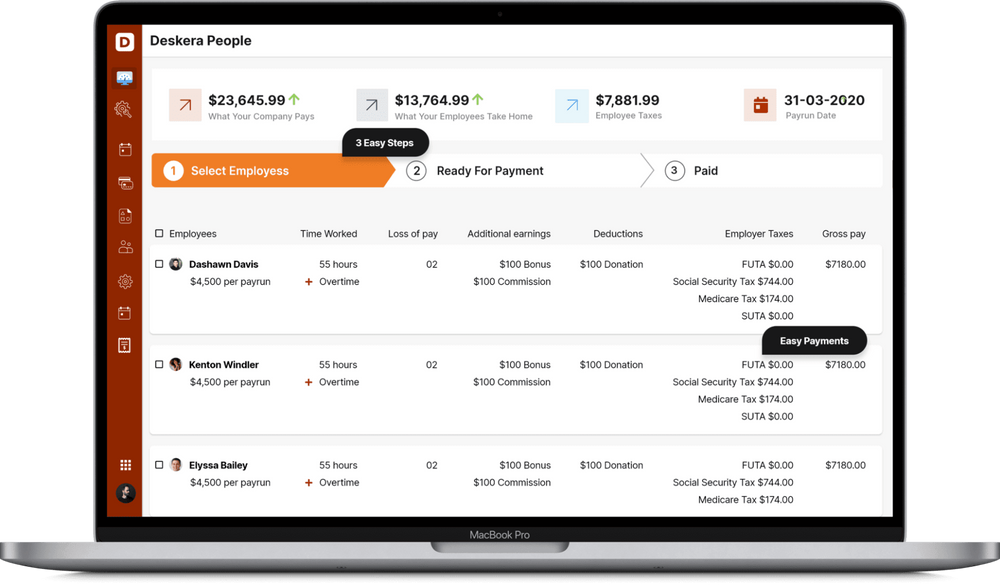

How Can Deskera Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- A sole proprietor needs to handle the different departments in an office himself. He is also responsible for paying himself an appropriate amount for the work done after handling all the deductions and taxes. The best examples of sole proprietors include freelance writers or other freelancers, bookkeepers and consultants.

- It is very easy to become a sole proprietor for a professional as there are no legal issues involved. The proprietor can be a single business owner or decide to involve his/ her spouse in it.

- The drawback of this profession is there is a lot of liability on the sole proprietor. He needs to give a high tax every year as compared to the other professionals.

- If an individual is planning to become a sole proprietor and start his own business after completion of education, he must keep two separate bank accounts - personal and business to avoid any confusion in the monetary transactions.

- To pay myself as a sole proprietor, the business owner needs to write a check from his business account to deposit it in a personal savings account. He can do an online transaction after doing appropriate deductions as given from the IRS site.

- The sole proprietor can decide his payment based on expenses made and the tax. In the initial phase, the owner must keep less amount for himself until his business is firmly established. He can then go on increasing the self-payment with time.

- The sole proprietor is not liable to pay any state or federal income tax to the government. He should just follow the list of the deductions on the IRS while filing a personal income tax return as the payment is being done to a personal account.

Related Articles