The impact of COVID-19, particularly on the business world, couldn’t have been predicted. According to reports, it is the most horrible global crisis since WW II. Businesses have faced immense losses.

It began with mass layoffs and closures just a few weeks into the crisis. Second, the risk of closure was negatively associated with the expected length of the crisis. Third, many small businesses were financially fragile. Hence, to rescue the business from the wrath of Covid, US provided them with a Paycheck Protection Program loan. This launched in 2020 and continued in 2021 a second draw of PPP loan.

If you are also looking to apply for a second-draw PPP loan, then this article is everything you need. We will tell you how to apply for a second draw PPP loan and discuss what it is and its benefits all in this article.

This article covers the following:

- What is a second draw PPP loan?

- Who is eligible for a second draw PPP loan?

- What are the changes in the second draw PPP loan after the first draw PPP loan?

- How much is granted in the second draw PPP loan?

- What is the list of documents required to apply for a second draw PPP loan?

- How to fill out the PPP loan application?

- How should form 1040 schedule filers fill out the PPP second-draw loan application?

- How can Deskera assist you?

- Key takeaways

What is a Second Draw PPP Loan?

In 2020, the federal government’s Paycheck Protection Program (PPP) provided forgivable loans to more than 5 million U.S. businesses as a way to help them make it through the coronavirus crisis.

A forgivable loan is a type of loan that allows borrowers to have the balance of their loan either partially or totally forgiven if they meet certain conditions. In 2021, many of those same businesses also got the opportunity to apply for a forgivable second-draw PPP loan, which can provide more short-term assistance.

Who is Eligible for a Second Draw PPP Loan?

There is a criterion to qualify for a second draw PPP loan. If you or your business received an initial PPP loan, you may qualify for the second round of funding, provided you meet the following requirements:

- You are eligible for a second draw PPP loan if you have less than 300 employees.

- If you have used or will use the full amount of your first PPP loan.

- If you have experienced a drop of at least 25% in annual gross receipts or for any quarter of 2020, compared with the same quarter in 2019.

- Have not permanently closed. Businesses that have temporarily closed or suspended operations can receive a second-draw loan.

Second-draw PPP loans are available to businesses such as:

- Selected nonprofit organizations

- Self-employed individuals.

- Independent contractors.

- Sole proprietors.

- Housing cooperatives.

- Small agricultural cooperatives.

- Veterans’ organizations

- Tribal businesses.

- Businesses that receive a ‘Save Our Stages’ grant cannot receive additional PPP loans.

Second Draw PPP Loan Ineligible for:

- Those entities are excluded from eligibility under the CARES Act or Consolidated First Draw PPP IFR.

- A business concern or entity primarily engaged in political activities or lobbying activities, as defined in section 3 of the Lobbying Disclosure Act of 1995 (2 U.S.C. 1602), including any entity that is organized for research or for engaging in advocacy in areas such as public policy or political strategy or otherwise describes itself as a think tank in any public documents;

Note: in FAQs 57 and 58, the SBA clarified (a) “lobbying activities” is as defined in section 3 of the Lobbying Disclosure Act ( 2 U.S.C. 1602), and (b) none of the proceeds of a First Draw PPP Loan or Second Draw PPP Loan may be used for

(1) “lobbying activities.”

(2) lobbying expenditures related to a state or local election; or

(3) expenditures designed to influence the enactment of the legislation, appropriations, regulation, administrative action, or executive order proposed or pending before Congress or any state government, state legislature, or local legislature or legislative body.

- Any business concern or entity:

(i) for which an entity created in or organized under the laws of the People’s Republic of China or the Special Administrative Region of Hong Kong, or that has significant operations in the People’s Republic of China or the Special Administrative Region of Hong Kong, owns or holds, directly or indirectly, not less than 20% of the economic interest of the business concern or entity, including as equity shares or capital or profit interest in a limited liability company or partnership; or

(ii) that retains, as a member of the board of directors of the business concern, a person who is a resident of the People’s Republic of China;

- Any person required to submit a registration statement under section 2 of the Foreign Agents Registration Act of 1938 (22 U.S.C. 612);

- Any person or entity that has been approved for a grant under the Shuttered Venue Operation (“SV0”) Grant Program under section 324 of the Economic Aid Act (if the borrower received a PPP loan after December 27, 2020, and the borrower is subsequently approved for an SVO grant, the amount of the SVO grant received will be reduced by the amount of a First Draw or Second Draw PPP Loan.

If a borrower receives both a First Draw and Second Draw PPP Loan after December 27, 2020, and the borrower is subsequently approved for an SVO rant; the SVO grant will be reduced by the combined amounts of both PPP loans. A PPP loan received prior to December 27, 2020, will not reduce the amount of the SVO grant).

- Any entity in which the President, the Vice President, the head of an Executive department, or a Member of Congress, or the spouse of such person as determined under applicable common law, directly or indirectly holds a controlling interest (the terms “Executive department,” “Member of Congress,” and “controlling interest” are all defined in the Second Draw Rules).

- Any publicly-traded company that is an issuer, the securities of which are listed on an exchange registered as a national securities exchange under section 6 of the Securities Exchange Act of 1934 (15 U.S.C. 78f), where the terms “exchange,” “issuer,” and “security” have the meanings given those terms in section 3(a) of the Securities Exchange Act of 1934 (15 U.S.C. 78c(a)) (except that SBA will not consider whether a news organization that is otherwise eligible or an Internet publishing organization that is otherwise eligible is affiliated with an entity, which includes any entity that owns or controls such news organization or Internet publishing organization, that is an issuer);

- an entity that has previously received a Second Draw PPP Loan

- an entity that has permanently closed or

- a tax-exempt organization described in section 501(c)(4) of the IRC.

Changes in PPP Loan Round Since Its Launch

The rules around both PPP eligibility and loan forgiveness have changed repeatedly since the launch of the PPP in March 2020, with the SBA and Treasury making multiple corrections through the end of the application period last summer.

The PPP program originally was intended to cover expenses within an eight-week window, but the government eventually expanded it to up to 24 weeks of expenses. Funds also were originally only eligible for forgiveness if at least 75% of the amount granted was used for payroll, but that’s since been lowered to 60%.

Today, borrowers can choose their loan’s covered period for loan forgiveness purposes to be any length between eight and 24 weeks. Additional expenses like operations, property damage, supplier costs, and worker protection are now eligible for full or partial loan forgiveness.

Also, the rules surrounding tax deductibility have been clarified. Businesses can claim a deduction on qualifying expenses paid for with PPP funds.

How Much Is Granted in Second Draw PPP Loan?

Borrowers can receive up to 2.5 times their average monthly payroll costs. Average monthly payroll costs can be calculated using one of the following:

- The 12 months prior to the loan.

- The calendar year 2019.

- The calendar year 2020.

Seasonal businesses, which are the businesses that have been operating for less than seven months in a year and new businesses in operation on Feb 15, 2020, but were not open for a full 12 months, will use a different equation to calculate the average monthly payroll.

- Seasonal businesses: Average total monthly payroll for any 12-week period between Feb. 15, 2019, and Feb. 15, 2020.

- New businesses: Total payroll costs divided by the number of months those costs were paid out.

Hotels, restaurants, and other accommodation, food service businesses can borrow up to 3.5 times their average monthly payroll costs. Unlike initial loans, the maximum amount for second-draw PPP loans is just $2 million. First-time PPP loans max out at $10 million.

How Can the Funds of Second Draw PPP Loan be Used?

As we have already established, businesses must spend at least 60% on payroll costs to get a second-draw PPP loan forgiven. The other 40% can be spent on the following non-payroll expenses:

- Qualifying rent or mortgage interest payments.

- Utility costs.

- Operations expenses: cloud computing services, business software, human resources, and related expenses.

- Supplier costs: payments that go to suppliers who provide essential goods.

- Worker protection expenses: expenses to employees safer during COVID-19, including personal protective equipment (PPE), drive-thru windows, sneeze guards, and outside dining enclosures.

- Property damage costs: costs related to civil unrest that occurred in 2020 that were not covered by insurance.

What Must You Keep Ready While Applying for A Second Draw PPP Loan?

Depending on your company's situation, here's a list of potentially important documents, according to the New York City Department of Small Business Services.

List of documents:

- Copy of photo ID for all owners who own 20 percent of the business or more

- 2019 and 2020 profit and loss statements to show revenue loss during 2020

- 2019 business tax returns; 2020 returns if available

- For partnerships include IRS Form 1065 and Schedule K-1

- For sole proprietors include IRS Form 1040 Schedule C

- Articles of incorporation

- Payroll reports with a list of gross wages paid time off, and taxes assessed for all employees for all 12 months of 2020

- 2020 employer IRS documents (including one of the following for all four quarters of 2020):

- Form 941: Employer's Quarterly Federal Tax Return. Learn how to fill the form 941 here.

- Form 944: Employer's Annual Federal Tax Return (for smallest employers)

- Form 940: Employer's Annual Federal Unemployment (FUTA) Tax Return

- Form W-3: Transmittal of Wage and Tax Statements

- Documentation to support health insurance and retirement expenses incurred as a part of payroll expenses (for example, a statement from insurance or retirement company)

Documentation of Your Payroll

If you're applying for a loan through the same lender as your first PPP and your loan is less than $150,000, you do not need to submit 2019 payroll documentation. Of course, you might want to.

The latest law allows borrowers to elect to use payroll documentation from either 2019 or 2020. If you're angling to maximize your loan amount, you might want to choose a pay period from the year you had more employees, notes Ott.

However, the amount you qualify to borrow and the forgivable amount may vary. "The small business should look at the rules on forgiveness and use of funds at the same time, so they are not surprised if they take a larger loan and have a greater amount that does not qualify for forgiveness."

For borrowers seeking loans of more than $150,000 second-draw loans are capped at $2 million the easiest way to calculate and verify payroll is to download a Cares Act Report from your payroll provider if they offer it, says Ott.

If your provider doesn't offer this report or you don't use one say, you're self-employed tax forms can be used instead. For most businesses, you will need to supply IRS Form 941; sole proprietorships or independent contractors need a Schedule C (IRS Form 1040).

To calculate your payroll costs manually, use the same method as in round one--that is, multiply 2.5 times your company's average monthly payroll for 2019 (or 2020).

The calculation is different for businesses in the hospitality industry, such as restaurants and hotels, that operate under the North American Industry Classification System (Naics) code, starting with the number 72.

These companies must multiply their average monthly payroll by 3.5 times, up to $2 million, to hit their total loan amount. The SBA provides a worksheet for this.

Proof of Revenue Losses (if any)

Eligibility for a second-draw loan comes down to three things: You need to have already exhausted an earlier PPP loan, or will do so soon; you need to have 300 or fewer employees, and you need to have experienced a revenue loss of at least 25 percent in any quarter in 2020 versus 2019. You may also use an annualized number for the full year of 2020 over 2019, according to the latest guidance.

"To determine your losses, you must first determine whether you report your taxes on a cash or accrual basis," said Ami Kassar, founder, and CEO of MultiFunding, a small-business loan adviser, in a statement. Ask your accountant if you are not sure.

If you report on a cash basis, you can simply print out your bank statements and compare your deposits (not including any PPP money you've previously received). Suppose you report on an accrual basis, meaning revenue and expenses are recorded when a transaction occurs rather than when payment is received or made.

In that case, you need to go into your accounting software, you can use Deskera for that and run quarterly comparative reports that don't include PPP money from the previous round.

Many business owners may miss out on funds because they don't realize they're eligible based on just one quarter. Borrowers seeking a loan of $150,000 or less do not need to provide the quarterly revenue information to the lender if they use the same lender as they did for their first draw.

They need only attest to the loss. If you use a different lender this time around, that lender will likely want a complete file on your business. Per the guidelines, borrowers do need to provide the quarterly revenue when applying for forgiveness whether or not they've worked with a particular lender before. First American Bank says it is asking businesses to provide those figures, but if that's not a deal-breaker can't do so immediately.

What Happens to Businesses With Unresolved PPP Loans?

In case of a First Draw, PPP Loan is under review under PPP rules and/or information in SBA’s possession indicates that the borrower may have been ineligible for the First Draw PPP Loan it received or for the loan amount received by the borrower, the lender will receive notification from SBA when the lender applies for guaranty of a Second Draw PPP Loan (“unresolved borrower”).

If the lender receives notification that the borrower for a Second Draw PPP Loan is unresolved, the lender will not receive an SBA loan number. The SBA will resolve the issue related to the unresolved borrower expeditiously and notify the lender of the process to obtain an SBA loan number for the Second Draw PPP Loan, if appropriate.

The SBA issued additional guidance to lenders on (i) First Draw PPP Loan increases after enactment of the Economic Aid Act regarding the reapplication and request process in SBA Procedural Notice 5000-20076 effective January 13, 2021.

(ii) Procedures for addressing unresolved issues on Borrower First Draw PPP Loans effective January 26, 2021.

(iii) Revised SBA PPP procedures for addressing hold codes on First Draw PPP Loans and Compliance Check Error Messages on First Draw PPP Loans and Second Draw PPP loans effective February 10, 2021.

(iv) Second notice of revised procedures for addressing hold codes and compliance check error messages on PPP loans effective March 29, 2021.

Safe Harbor for Certifications Concerning Need for a Second Draw PPP Loan

In updated FAQ 46, the SBA confirmed that all borrowers of Second Draw PPP Loans must certify in good faith that current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant.

However, the SBA further stated: “Because Second Draw PPP Loan borrowers must demonstrate that they have had a 25% reduction in gross revenues, all Second Draw PPP borrowers will be deemed to have made the required certification concerning the necessity of the loan in good faith. The loan amounts received by borrowers for First Draw PPP Loans and Second Draw PPP Loans will not be aggregated.

Deadline for The Second Draw PPP Loan

In the Extension Act, the last day for lenders to submit applications for Second Draw PPP Loans is May 31, 2021, and the SBA will have an additional 30 days to process the applications submitted before June 1, 2021.

On May 4, 2021, the SBA informed lenders that the SBA would stop accepting new PPP applications because it was basically out of funds. The remaining funds available for new applications are $8 billion set aside for community financial institutions and a $6 billion set aside for PPP applications still in review status or need more information due to error codes.

On May 2, 2021, the SBA reported that it had approved about $258 billion from the program’s reopening on January 11 through May 2. Borrowers should contact their lenders to learn when they will begin accepting Second Draw PPP Loans applications.

Eligible lenders are SBA 7(a) lenders and any federally insured depository institution, federally insured credit union, eligible non-bank lender, or Farm Credit System institution that is participating in the Paycheck Protection Program.

On January 8, 2021, the SBA announced that to promote access for smaller lenders and their customers, the SBA will initially only accept Second Draw PPP Loan applications from community financial institutions starting on January 13, 2021.

On January 13, 2021, the SBA announced opening its portal to PPP-eligible lenders with $1 billion or less in assets for Second Draw PPP Loan applications on Friday, January 15, 2021.

The portal fully opened on January 19, 2021, the portal fully opened to all participating PPP lenders to submit Second Draw PPP Loan applications.

At least $25 billion is set aside for Second Draw PPP Loans to eligible borrowers with a maximum of 10 employees or loans of $250,000 or less to eligible borrowers in low- to moderate-income neighborhoods. Given these priorities, some borrowers may have to wait.

After borrowers who are given priority access Second Draw Loans, we expect availability to be on a first-come, first-served basis. The funds may go faster now that forgiveness and tax rules are clearer.

On February 24, 2021, businesses and nonprofits with fewer than 20 employees were given a 14-day exclusive application period. It appears that some lenders require PPP borrowers to apply for forgiveness on their First Draw PPP Loan before they file to seek a Second Draw PPP Loan. This is not a requirement of the SBA and the Department of Treasury.

So, borrowers should discuss this requirement with their lender and, if appropriate, consider other lenders that will process the Second Draw PPP Loan application without having to file for forgiveness on their first PPP loan.

Please note that the SBA does require that the First Draw PPP Loan forgiveness application be submitted before or simultaneously with the loan forgiveness application for a Second Draw PPP Loan that is more than $150,000.

How to Apply for a Second Draw PPP Loan?

You need to do a few things when applying for a second draw PPP loan.

Calculations that you must carry out:

- A calculation to demonstrate a 25 percent reduction in revenue.

- A calculation to determine the maximum loan amount.

There are 4 versions of the Second Draw PPP Loan Form:

Version 4|Effective: 2021-03-18.

Version 3|Effective: 2021-03-03.

Version 2|Effective: 2021-02-17.

Version 1|Effective: 2021-01-08.

How to Fill the Application?

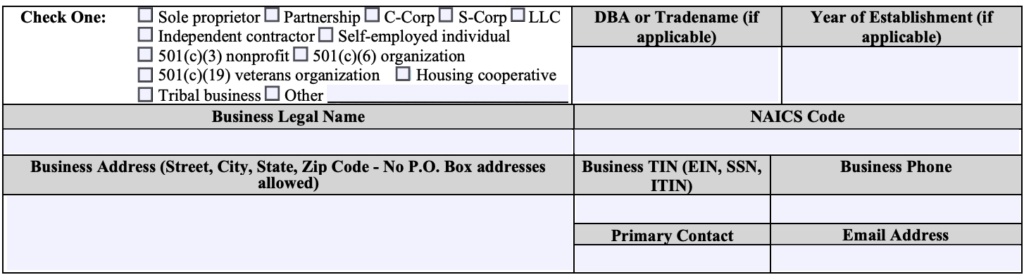

Step 1: Basic Info

Let's start with the basics of every form- The basic details. Check your entity type, enter your business name and address, DBA name, and the year your business was established. Then, fill in your NAICS code.

If you don’t know what this is, use the NAICS lookup tool. Enter your industry type in the field on the left that is marked 2017 NAISC Search. Then, enter your TIN and your contact information.

If you are a non-citizen, lawful U.S. resident, enter your ITIN here. Finally, choose the primary contact (probably you), and fill in your business phone number and email.

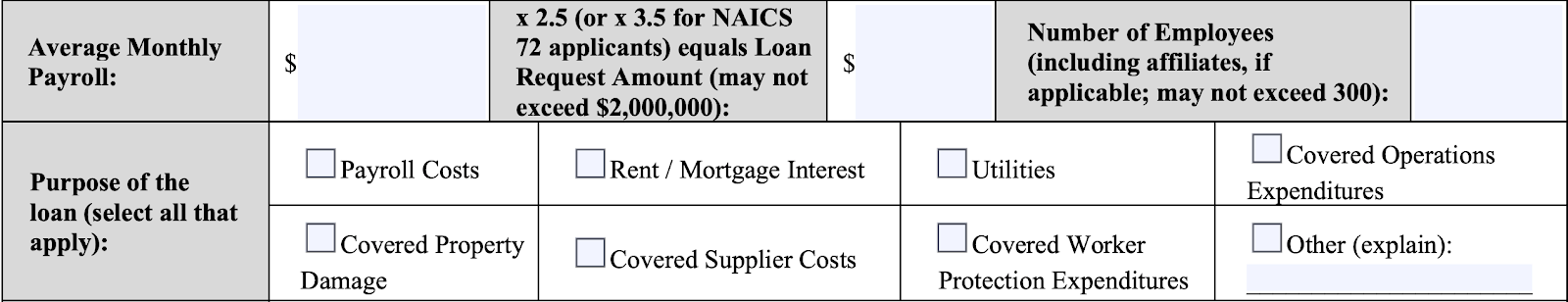

Step 2: Calculations

Next up, you have the calculations to take care of. You must calculate your payroll costs (which include employee wages, PTO, group healthcare benefits, retirement benefits, state and local taxes).

For most businesses, your loan amount will be 2.5 times your monthly payroll costs (up to $2 million), but if your business is classified under code 72 in NAICS, you may be eligible for up to 3.5 times your monthly payroll amount.

In order to calculate how much you can borrow, you must know your payroll cost. Once you know your total annual payroll costs, you’ll simply divide that number by 12 to calculate your average monthly payroll costs.

You’ll need to exclude any employee wages over $100,000 from your monthly payroll costs. So, if you pay an employee $120,000 per year, you can only count $100,000 of their wages in your total payroll costs. The last step is to multiply your average monthly payroll cost by 2.5 or 3.5.

Thirdly, find and fill in your PPP first-draw SBA loan number. If you don’t know your first-draw SBA loan number, contact your lender, who will have it.

Note: The SBA Customer ID Number is not the same thing as your PPP first-draw SBA loan number.

Filling in the section on the 25 percent revenue reduction

In order to qualify for a second-draw loan, your business must have experienced a loss of 25 percent in revenue. You must know how to calculate this, use gross receipts to make the calculation, choose an eligible time period, and provide proper documentation to certify the revenue loss. Let’s dive into each step!

Gross receipts

You must make the 25 percent revenue reduction calculation using “gross receipts. For-profit businesses can count gross receipts as all revenue in whatever form received or accrued in accordance with the entity’s accounting method, i.e., accrual or cash from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances but excluding net capital gains and losses.

For 501(c) organizations (including non-profits and veterans organizations), gross receipts are “the gross amount received by the organization during its annual accounting period from all sources without reduction for any costs or expenses” Gross receipts include contributions, gifts, and grants, membership dues or fees, gross sales, and investment income.

Note: Forgiven PPP loan proceeds and EIDL advance grants are not included in gross receipts for any business.

Different Time frames for the calculation

Any business that operates all four quarters of 2019 can use one of two times frames to calculate quarterly or annual revenue. For quarterly, you’ll compare your revenue from any quarter in 2020 to the same quarter in 2019.

Keep in mind that you must compare the same quarter. You can’t, for example, compare the second quarter of 2020 to the third quarter of 2019. The process to calculate your annual revenue reduction is the same: simply divide your total 2020 gross revenue by your total 2019 gross revenue.

You can choose the time frame that’s most beneficial for you. For example, if your total annual revenue reduction in 2020 is 20%, but in the second quarter of 2020, you had a 40% reduction. You can use the second quarter’s revenue reduction to qualify for a second draw loan. Got it?

Businesses that were not operating within the first two quarters of 2019, but were operating during Q3 and Q4 of 2019 may choose any quarter in 2020 and show that gross receipts of that quarter are at least 25 percent less than either the third or fourth quarters of 2019.

Businesses that were only in business during Q4 of 2019 must show that any quarter of 2020 yielded 25 percent less revenue than the fourth quarter of 2019. Any business that did not operate in 2019, but was in business by February 15, 2020, must demonstrate that gross receipts in one of these: Q2, Q3, or Q4 were at least 25 percent less than in Q1.

Once you have made your calculation, you need to use documents to certify the 25 percent reduction in revenue. You need to certify to the government that the calculations that you have made are accurate.

For instance, if your loan is over $150,000, you must provide these with the application form. For loans under $150,000, you will need to provide these when you are seeking loan forgiveness.

Use one of these sets of documents to certify the reduction:

- Quarterly financial statements; if they have not been audited, you attest that they are accurate by signing and dating the first page and initialing all other pages. Make sure you identify the line items that are gross receipts. Learn about the 4 Main Financial Statements in our article.

- Bank statements that demonstrate deposits from the relevant quarters or years. Make sure you identify which deposits are the gross receipts (instead of capital infusions that would not count).

- Using an annual timeframe to make your revenue reduction calculation, you may use a yearly IRS income tax filing. Haven’t filed a 2020 tax return yet? Fill out the tax return forms and make sure to sign and date them.

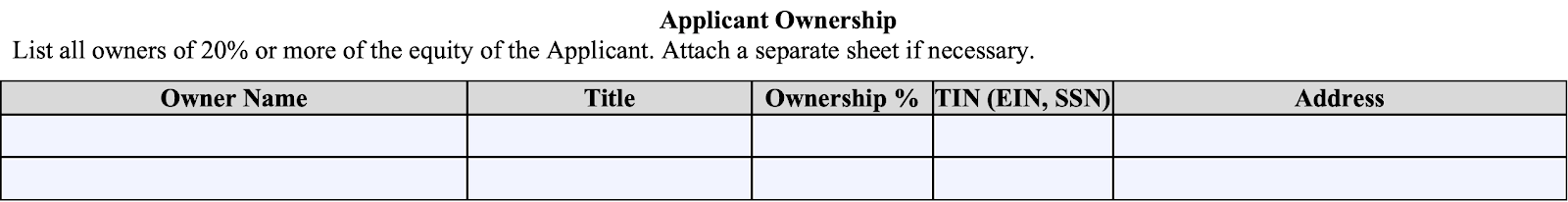

Step 3: List Business Owners

Next up is listing business owners. Simply fill out the ownership table by listing each owner (either an individual or parent company) who holds 20% or more equity in the business.

If you are a nonprofit organization and don’t have an owner with ownership percentages, you’ll likely be asked to provide information on your authorized signatories. This can be a single control person such as the president, CEO, or director, whoever has signatory authority.

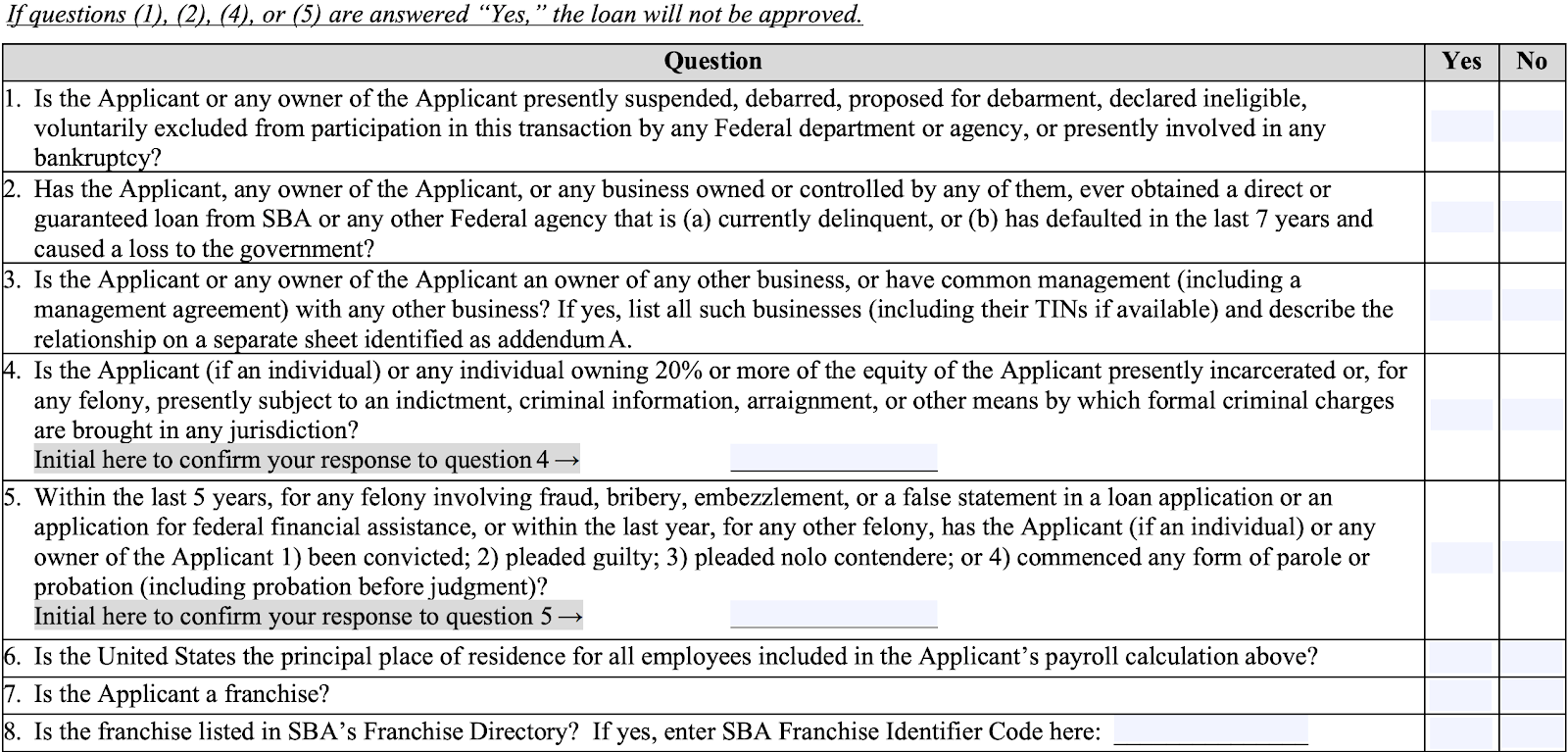

Step 4: Answer the Questions

Next up is a list of questions that you are required to answer. Depending on the answers/information you provide, A brief questionnaire follows that, depending on your answers, may result in your loan not being approved or require you to provide more details.

Pages 2 and 3 of the application list the certifications and authorizations that you must make as a PPP loan applicant. Basically, it requires that you attest you will follow the PPP rules and regulations.

How Form 1040, Schedule C filers should fill out the PPP second-draw loan application

If you are a sole proprietor, an independent contractor, or a self-employed individual (with or without employees), you may file Form 1040, Schedule C with the IRS. If you do, this means you have some options. Any small business that files this form may elect to make the loan calculation using gross income or net profit.

Note: This article summarizes aspects of the law. It does not constitute legal advice. For legal advice for your situation, you should contact an attorney.

How Can Deskera Assist You?

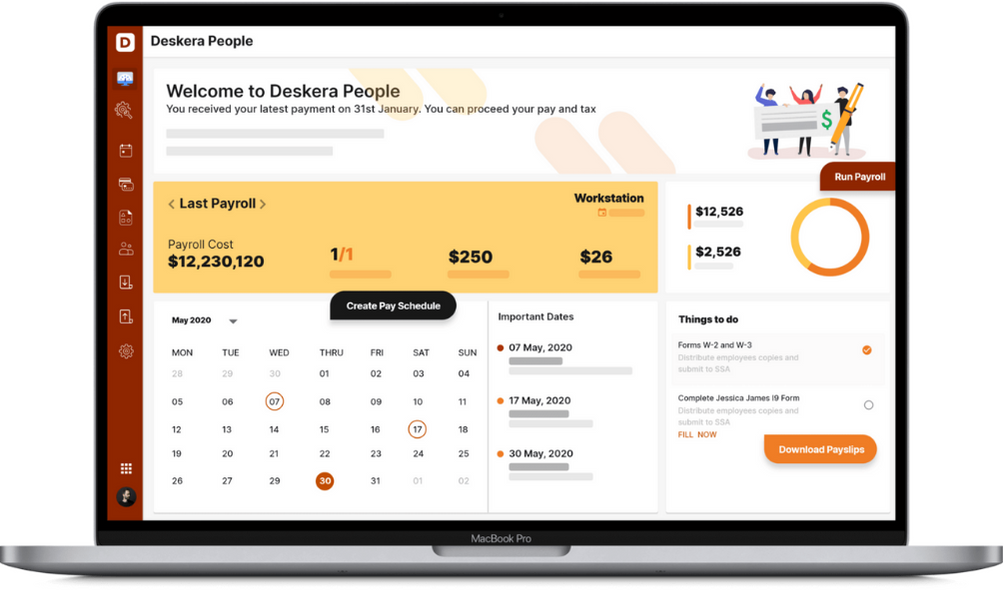

As a business, you must be diligent with employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways:

- Paycheck Protection Program (PPP) provided forgivable loans to more than 5 million U.S. businesses as a way to help them make it through the coronavirus crisis.

- You are eligible for a second draw PPP loan if you have less than 300 employees.

- Businesses that are eligible for a second draw PPP- loan include selected nonprofit organizations, self-employed individuals, independent contractors, sole proprietors, housing cooperatives, small agricultural cooperatives, veterans’ organizations, tribal businesses, and businesses that receive a ‘Save Our Stages’ grant cannot receive additional PPP loans.

- The rules around both PPP eligibility and loan forgiveness have changed repeatedly since the launch of the PPP in March 2020.

- There are 4 versions of the Second Draw PPP Loan Form:

- In order to qualify for a second-draw loan, your business must have experienced a loss of 25 percent in revenue.

- You must make the 25 percent revenue reduction calculation using “gross receipts.

- You must make the 25 percent revenue reduction calculation using “gross receipts. For-profit businesses can count gross receipts as all revenue in whatever form received or accrued in accordance with the entity’s accounting method.

- Any business that operated all four quarters of 2019 can use one of two times frames to calculate revenue: quarterly or annual.

- If you are a sole proprietor, an independent contractor, or a self-employed individual (with or without employees), you may file Form 1040, Schedule C with the IRS.

Related Articles: