In the past 5 years, the field of financial reporting of India has seen major changes. These changes are aligned with our economic activities, which have been crossing the national boundaries more and more. With the increasing movement beyond the national borders and expanding economic activities within the country, the need to have standard reporting requirements and complying with them has become a must.

This has made it trickier for the organizations to present their financial statements in accordance with the reporting requirements of the country that they are based in. This article will take you through the reporting requirements followed in India, known as IFRS.

What is IFRS?

IFRS is an acronym for International Financial Reporting Standards. IFRS are a set of accounting rules for the financial statements of public companies. By complying with IFRS, their financial statements are supposed to become consistent, transparent and easily comparable around the world. Such statements hence enable investors, auditors, government regulators and business operators to make informed decisions.

IFRS has been adopted by 120 countries, including countries of the European Union. The United States however follows a different system known as GAAP (i.e. Generally Accepted Accounting Principles).

IFRS are issued and maintained by the IASB, i.e. International Accounting Standards Board. These standards, established in 2001 replaced the older IAS (i.e. International Accounting Standards). The main objective of IFRS is to enable easy interpretation of the financial statements from company to company and country to country. It hence addresses functions like record keeping, account reporting and other such aspects of financial reporting.

What is IASB?

IASB is also known as the International Accounting Standards Board is an independent body that was formed in 2001 with the sole responsibility of establishing IFRS. IASB had said that it set the standards to “bring transparency, accountability and efficiency to financial markets around the world.”

IASB succeeded IASC, i.e. International Accounting Standards Committee which was earlier given the responsibility of setting up international accounting standards. Based in London, IASB also provided the conceptual framework for financial reporting that was issued in September 2010. This provides a conceptual understanding and the basis of accounting practices under IFRS.

IFRS vs GAAP

The USA public companies are required to use a rival accounting system known as the GAAP. The GAAP standards were developed by the Financial Standards Accounting Board (FSAB) and the Governmental Accounting Standards Board (GASB).

In the case of the SEC, i.e. The Securities and Exchange Commission has said that it would not switch to IFRS, however, it is considering a proposal to allow IFRS information to supplement US financial filings.

Some of the differences between IFRS and GAAP are:

- IFRS is not as strict in defining revenue and allows companies to report their revenue sooner. Hence, a balance sheet that is using this system might show a higher stream of revenue as compared to the GAAP version of the same balance sheet.

- IFRS has different requirements for reporting business expenses as well. For example, if a company has spent money for developmental purposes or as an investment for the future, it does not necessarily have to be reported as an expense. It can be capitalized instead.

- GAAP allows a company to use either of two inventory cost methods- First In, First Out (FIFO) or Last In, First Out (LIFO). However, under IFRS, LIFO is banned.

Hence, the largest difference between IFRS and GAAP is that IFRS is principle-based whereas GAAP is rule-based. Rule-based frameworks are more rigid with less room for interpretation whereas principle-based frameworks allow more flexibility. Both the frameworks however come with their own pros and cons. These are, using a standard that fits the rule but does not represent the principle behind it is a downside of GAAP whereas taking an overly liberal interpretation of the standards is a potential drawback to the IFRS.

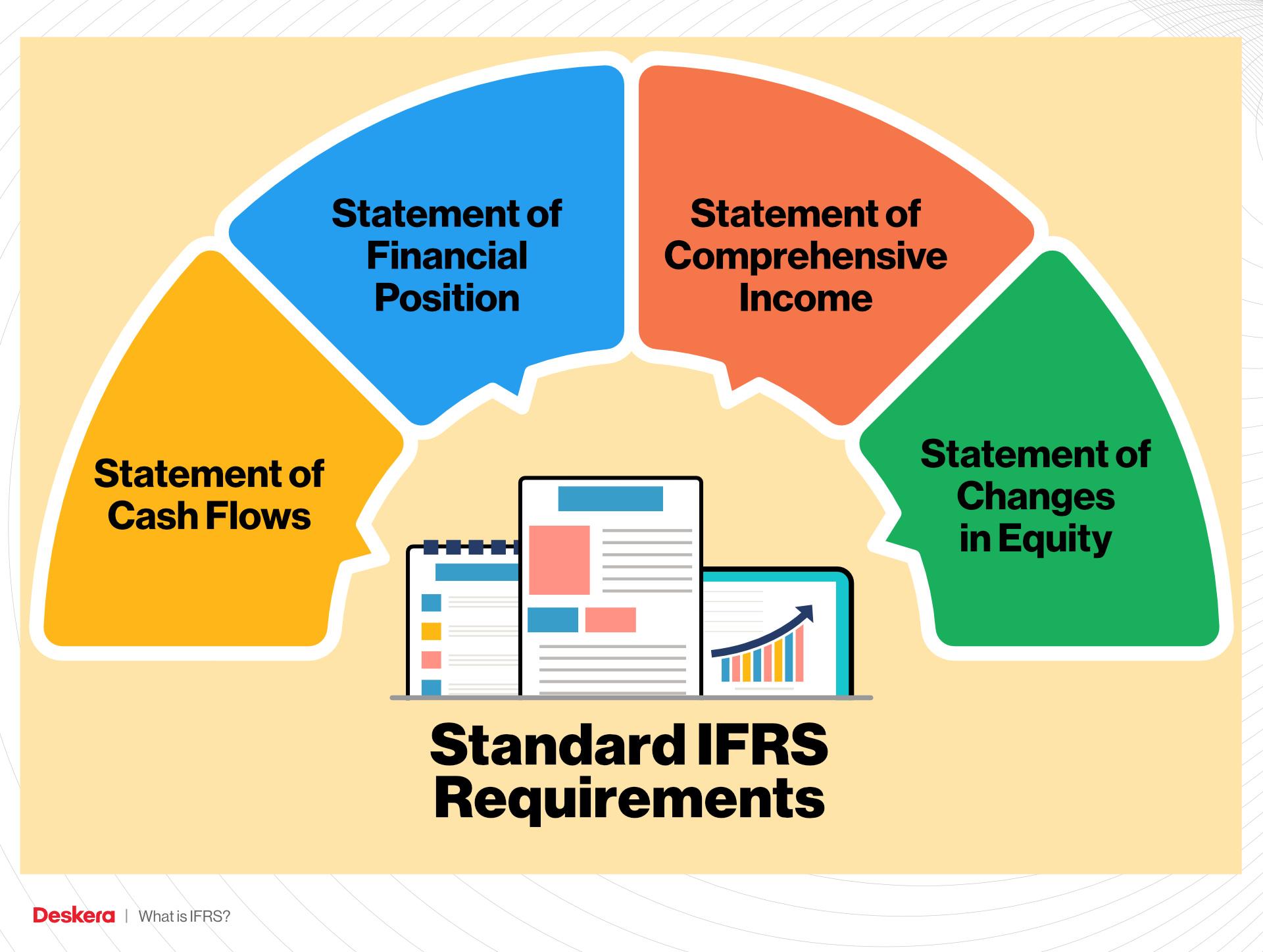

Standard IFRS Requirements

IFRS covers a wide range of accounting activities. The certain aspects of business activities for which IFRS has set mandatory rules are:

- Statement of Financial Position: This is the balance sheet. IFRS influences the ways in which the components of the balance sheet are reported.

- Statement of Comprehensive Income: This can take the form of one comprehensive income statement or be differentiated into 2 parts: a profit and loss statement and a statement of other income, including property and equipment.

- Statement of Changes in Equity: This statement is also known as the statement of retained earnings. This financial statement records the company’s change in earnings or profit for the given financial period.

- Statement of Cash Flows: This report summarizes the company’s financial transactions in a given period, separating cash flow into operations, investing and financing.

In addition to these basic reports, all the companies are also required to give a summary of their accounting policies. In order to see the changes in the profit and loss, the report submitted is often seen side by side with the previous reports. The statement of financial position of an earlier period is more likely to be included when:

- An entity applies an accounting policy retrospectively

- When an entity retrospectively restated an item in its financial statement

- When an entity reclassifies an item in its financial statement

Additionally, what needs to be also taken care of is that the parent company must create separate accounting reports for its subsidiary companies.

List of International Financial Reporting Standards (IFRS)

When considering all the accounting standards followed to date, they include those that were established by IASC between 1973 and 2001 and those issued by IASB post-2001. In this section of the article, we would be listing all the IAS and IFRS in force to date.

Benefits of IFRS

Modern economies rely on cross-border transactions and the free flow of international capital. The amount of international capital flows is expected to rise in the coming years, which has hence increased the need to have global accounting standards. Having global accounting standards like IFRS has these benefits:

Single Set of Accounting Standards Around the World

Instead of using multiple national accounting standards based on the country’s preference where the business is set up, adopting IFRS will enable the agencies from different corners of the world to apply the same accounting standards in every transaction.

This will lead to an increase in transparency, hence enabling more cross-border investments. It would also decrease the cost of capital while providing higher liquidity during each transaction.

Reduction of Time, Effort and Expense of Preparing Multiple Reports

Having and adopting IFRS will reduce the time spent by the organizations in preparing their financial statements like balance sheets, income statements, cash flow statements, profit and loss statements.

As there would no longer be multiple standards and regulations to follow based on where the company is doing its business, there would be fewer costs associated with this process. This will directly improve your cash flow and increase the ratio of your operating income with your operating expense.

Easier Monitoring and Controlling of Subsidiaries from the Foreign Countries

When you have a global accounting system that has been implemented by more than 100 countries, you no longer have to worry about the different national accounting standards. Follow IFRS in the monitoring and controlling of your subsidiaries from a foreign country and your work is done.

IFRS has been spreading so much that it has been recommended that even the USA should adopt it instead of GAAP. In fact, there already are several American agencies that are already following IFRS as they are based in different countries, and simultaneously making GAAP reports to satisfy the domestic requirements.

More Flexibility in the Accounting Practices

IFRS follows a principle-based system and not a rule-based system like GAAP. This means that the goal of IFRS is to reach a reasonable valuation and that there can be several ways in which to reach that outcome. IFRS’s structure gives the agency the freedom to adapt to the global system to fit their specific situation, which eventually leads to the production of useful statements that are much easier to read.

Easier for All Companies to do Business in Foreign Countries

Having IFRS as the single set of accounting standards for every agency around the world would allow for more expansion opportunities as there would be fewer regulations in the way. You would also be able to streamline your operations internally, as you would know that every other agency is behaving in the same way.

Higher Return on Equity

While the reconciliation amount varies from industry to industry and country to country, the advantage always remains the same. irrespective of whether the company is operating inside of the US or outside of it, higher returns on equity have been observed on following these standards.

However, what also needs to be observed is that the difference between the net income levels for the firms following both these standards has seen a decline. The constant benefit of IFRS stays in the form of better supporting economic growth thanks to an increase in stock value, dividend payments and a strong regulatory environment.

Improved Rates of Foreign Direct Investment Around the World

IFRS has made it easier for companies to invest in one another whenever the market presents such an opportunity. With IFRS, the uncertainty in monetary transfers was arising from multiple standards. Additionally, having and understanding IFRS will make it possible to anticipate future cash flows and therefore determine returns on investment.

Additionally, there would be no home-bias for shareholders to prefer domestic firms over international firms as there would be familiarity and certainty in the financial information brought about by IFRS.

Challenges of IFRS

While adopting IFRS as the global accounting standards has lots of benefits, it does not come without its own set of challenges that are:

Requires Global Acceptance to be the Most Useful

Even if the USA decides to adopt IFRS, there would still be companies that would prefer to use their domestic standards. This means that any company that chooses to do business overseas will have to continue making at least 2+ reports in order to comply with those standards. Since the majority of the businesses in the USA operate locally, adopting IFRS will not make much sense.

Requires Global Consistency in Auditing and Enforcement

Even if IFRS is adopted as the global accounting standard, what does not change or rather become constant are the domestic political and economic systems. This means that even with improved efficiency of the audits and elimination of lack of information understanding, the political and economic systems will ensure that the comparability possible is reduced.

Increase the Amount of Work Placed on the Accountants

Implementation of IFRS will require the accountants to do a complete revision of the domestic accounting processes and strategies. This would mean that while the accountants would be required to continue with their daily work, they would also have to create the foundation for the implementation of IFRS.

Additionally, the adjustment period for shifting from one accounting standard to another would be filled with tumults and increasing risks of mistakes, with the need to have multiple reports still very much there.

Increase the Cost of Implementation for the Small Businesses

The cost of implementing IFRS and hence shifting from the domestic standards will be faced by small businesses the most, as the larger firms are more likely to already have reported being made as per the IFRS standards. Additionally, with fewer resources available to the small businesses, it would take them more time and effort to train their staff with IFRS methods.

How Can Deskera Help You with Accounting?

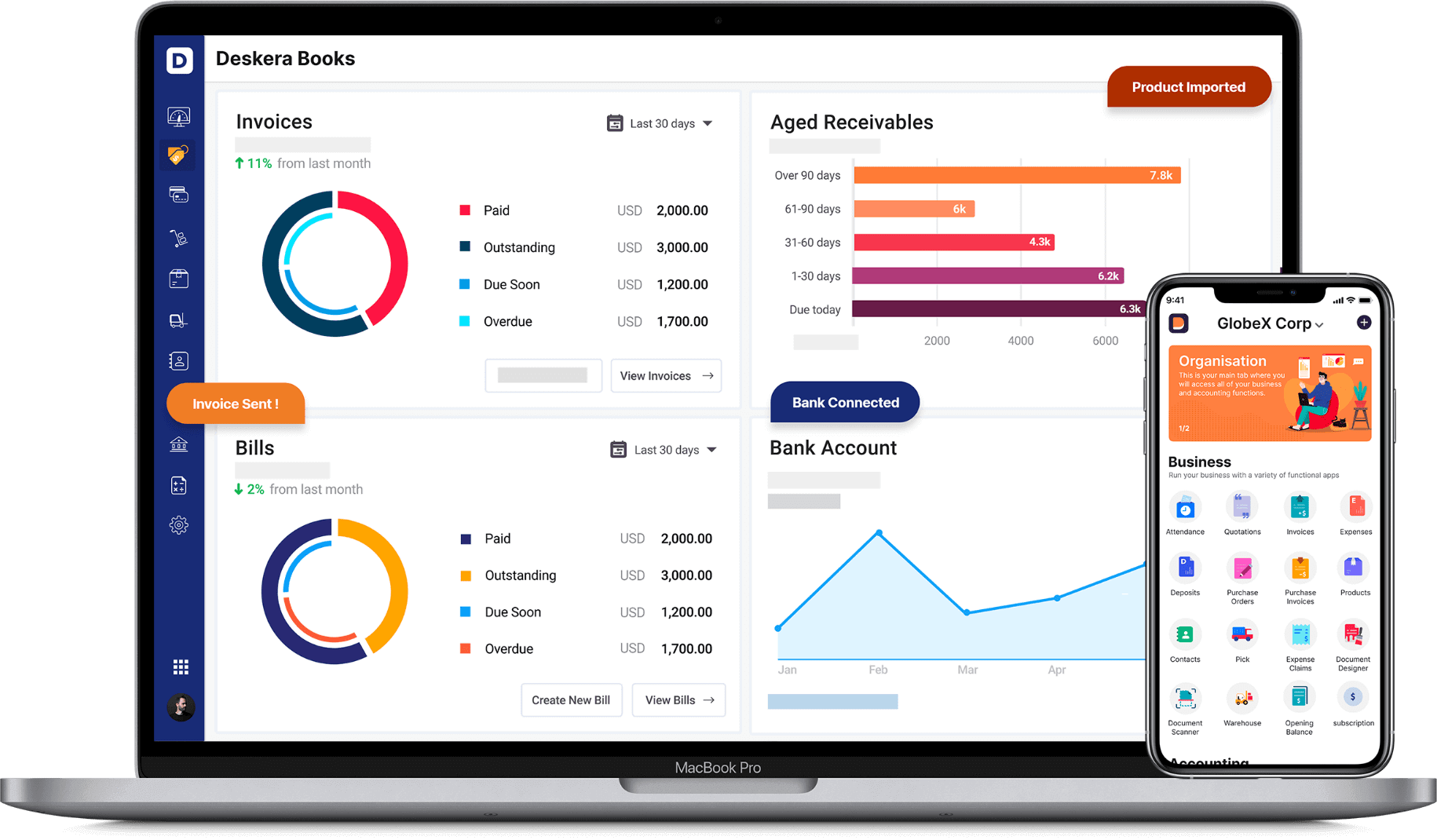

Deskera Books software helps with the automation of your accounting processes and improves your business efficiency. It is an online invoice, accounting and inventory software for your business that helps with tracking expenses, get real-time updates on your inventory and helps with inventory management.

Deskera books will ensure easy bank integration and preparation of automatic bank reconciliation statements that will also detect errors and prevent fraud. Deskera Books also helps in managing your sales and orders from start to finish. Create estimates and convert them into invoices on completing the order. While your business is occupied with the fulfilment of orders, Deskera Books will also keep a track of the cost of goods sold. This will help in knowing your profit margin at the end of the transaction.

Deskera books will let you receive and record your online payments, hence also letting you track your financial KPIs in real-time. With automated accounting, Deskera books ensure that it takes care of all the compliance and reporting requirements, leaving more time for you to focus on your business and customers such that you win customer loyalty, improve customer retention as well as encourage returning customers.

Key Takeaways

IFRS is used in a wide range of countries and jurisdictions. Being compliant with IFRS makes it easier to receive investment and business credit as it brings transparency, strengthens accountability and contributes to economic efficiency. By having IFRS, an accounting standard that is followed by more than 100 countries in the world, you are also signing up for a system that is principle-based, flexible and adaptable as per the situation.

Related Articles