In the United States, the decision between renting and buying a home is a big one many face at some point in their lives. This decision has long-lasting financial and lifestyle implications, and it's important to understand the pros and cons of both options before making a choice.

According to the U.S. Census Bureau, the homeownership rate in the country was 63.9% in the third quarter of 2020, while the rental rate was 36.1%. This means that while a significant portion of the population chooses to own their homes, there is still a large number of people who choose to rent.

There are several factors to consider when comparing renting and buying, including monthly costs, long-term financial benefits, and lifestyle preferences. On the one hand, renting can be more affordable in the short term, as it typically requires a smaller upfront investment and has lower monthly costs.

Renters also can move if their financial or personal situation changes, and they are not responsible for maintenance and repair costs.

In this ultimate comparison of renting and buying, we will take a detailed look at the costs and benefits of both options. Whether you are a first-time homebuyer or a seasoned homeowner, this guide will provide the information you need to decide whether renting or buying is right for you.

Here's what we shall cover in this post:

- Understanding the Basics of Renting vs. Buying

- Pros and Cons of Renting vs. Buying

- Flexibility and Lifestyle

- Financial Considerations

- Homeownership vs. Renting: The Psychological Benefits

- Impact of the Housing Market on Renting vs. Buying

- Future of Housing

- Conclusion

- Key Takeaways

Understanding the Basics of Renting vs. Buying

Renting

Renting a home is a popular option for many people, particularly those not ready or able to buy a home. Renting can be attractive for several reasons, including financial flexibility, less responsibility for maintenance and repairs, and the ability to move easily when needed.

Here are some basics of renting that can help you decide if it's the right choice for you:

- Renting can be more affordable than buying a home, particularly in areas with high home prices such as in New York. Renters typically do not have to pay for property taxes, homeowner's insurance, or costly repairs, making it easier to budget monthly expenses.

- One of the primary benefits of renting is the short-term commitment. Lease agreements usually run for a fixed period, typically six or twelve months, making it easy to move out when needed.

- Landlords are responsible for maintenance and repairs to the property, which can save renters time and money.

- Some rental properties offer amenities such as swimming pools, fitness centers, or laundry facilities, which can be a convenient perk for renters.

- Rent increases can be a disadvantage to renting. Landlords may increase the rent when the lease is up or after a certain period, making budgeting for rent expenses difficult.

- Renters may have limited control over the property, including the ability to make changes or renovations. Additionally, some rental properties may have restrictions on pets, smoking, or other activities.

Buying

Buying a home is a major financial decision requiring much research and consideration. Here are some basic points to consider when considering buying a home.

- Before you start looking at homes, it's important to figure out how much you can afford to spend. This means looking at your income, expenses, and debt to determine how much you can comfortably afford to pay for a monthly mortgage.

- Once you have a budget, it's time to start looking at neighborhoods. Consider factors like proximity to work, schools, and other amenities, as well as the overall cost of living in the area.

- A good real estate agent can help you navigate the buying process, from finding the right home to negotiating a fair price. They can also provide valuable insights about the local real estate market and guide you through buying a home's legal and financial aspects.

- Before you start making offers on homes, it's a good idea to get pre-approved for a mortgage. This will give you a better idea of how much you can afford to spend and help you stand out as a serious buyer when you make an offer.

- Once you find a home that meets your needs and fits within your budget, it's time to make an offer. Your real estate agent can help you draft an offer that considers factors like the current real estate market, the home's condition, and any other contingencies you might need.

- If your offer is accepted, it's time to move forward with the closing process. This involves inspections, appraisals, and other legal and financial considerations to ensure that the home is a good investment and that the transaction is fair to all parties involved.

Pros and Cons of Renting vs. Buying

When deciding between renting and buying a property, one important factor to consider is the responsibility for maintenance and repairs. Here are some pros and cons of renting and buying :

Pros of Renting

- Minimal Responsibility: When renting a property, the landlord is usually responsible for the majority of the maintenance and repairs. This means that renters can save a lot of money and time by not having to worry about maintenance and repairs.

- Immediate Attention: When something goes wrong in a rented property, tenants can call the landlord or property manager to report the issue. Landlords are required to fix the issue as soon as possible to maintain the property's habitability.

- Predictable Costs: Renters typically know what they will be paying for rent and utilities each month. As a result, they can budget accordingly and plan for other expenses.

Cons of Renting

- Limited Control: Renters have limited control over their living environment. They can't make major property changes and must abide by the landlord's rules and regulations.

- Inconvenience: Renters may experience inconvenience if the landlord or property manager is slow to respond to maintenance requests. They may also have to deal with the inconvenience of having repair workers in their homes.

- Dependence on the Landlord: Renters must rely on the landlord to make all necessary repairs and may not have control over the quality of the repairs.

Pros of Buying

- Control: When you own a property, you have complete control over the maintenance and repairs of the property. You can hire the contractors of your choice and make the repairs on your own schedule.

- Increased Value: When you invest in property and make necessary repairs and upgrades, the value of the property will increase. You can sell the property for a profit or use the equity to purchase another property.

- Personalization: When you own a property, you can make it your own by making changes and improvements to suit your tastes and needs.

Cons of Buying

- Responsibility: Homeowners are responsible for all maintenance and repairs, which can be costly and time-consuming.

- Unexpected Costs: Homeowners may face unexpected repair costs, such as a new roof or furnace, that can quickly add up.

- Lack of Flexibility: When you own a property, it's not easy to pick up and move on short notice. Selling a property can take months, and there are costs associated with selling a property, such as closing costs, real estate commissions, and transfer taxes.

Flexibility and Lifestyle

Renting and buying both have their advantages and disadvantages when it comes to flexibility and lifestyle. Here are some points to consider when deciding whether to rent or buy a home:

Flexibility in the location: One of the main benefits of renting is the flexibility to move around more easily, as leases are typically shorter than the commitment required to buy a home.

This can benefit people who like to travel or frequently move for work or want to explore different neighborhoods before settling down.

Customization and control: Homeownership provides more control and flexibility over customizing a home to fit specific preferences and needs. On the other hand, renters are often limited in their ability to make significant changes to a property, such as renovations or even painting walls.

Financial flexibility: Renting may offer more financial flexibility, as renters are not responsible for maintenance and repair costs that may be unexpected and costly.

This can be particularly beneficial for those who prefer not to be tied down by large expenses and want to focus their resources elsewhere.

Lifestyle preferences: Ultimately, the decision to rent or buy often comes down to personal lifestyle preferences. Some people may prefer the stability and long-term investment that homeownership offers, while others may value the freedom and flexibility renting provides.

Financial Considerations

As an individual, one of the most significant decisions you may have to make in your lifetime is whether to buy or rent a house. Although both options have their advantages and disadvantages, financial considerations are usually the primary factor to consider.

Here are some factors to consider when thinking about the financial implications of renting vs. buying a home:

- Initial Costs

One of the biggest advantages of renting is the low upfront costs required to move in. In most cases, renters only have to pay a security deposit and the first month's rent, while homebuyers have to come up with a substantial down payment, closing costs, and other fees.

For many individuals, coming up with this amount of money can be a significant hurdle to homeownership.

- Monthly Payments

Renters generally pay less per month than homeowners. When you rent, you pay a fixed amount each month, including rent, utilities, and other fees.

However, as a homeowner, you must pay your mortgage, property taxes, and other expenses associated with homeownership, which may vary from month to month.

- Tax Implications

Homeowners can take advantage of various tax deductions and credits that are not available to renters. For example, you can deduct mortgage interest, property taxes, and some closing costs. These deductions can significantly lower your tax liability.

- Appreciation

One of the most significant financial benefits of homeownership is the potential to build equity in your home as it appreciates over time. This equity can be used for other investments, such as real estate or business ventures. As a renter, you do not have the opportunity to build equity in the same way.

- Maintenance and Repairs

One of the biggest downsides of homeownership is the responsibility for maintenance and repairs. As a homeowner, you are responsible for all repairs and maintenance on your property, which can be expensive and time-consuming. However, as a renter, these costs are the responsibility of the landlord.

- Resale Value

When you purchase a home, you have the potential to sell it later for a profit. However, if you are unable to sell your home for more than you paid, you may be forced to take a loss. As a renter, you do not have the opportunity to make a profit from your living situation.

Building Equity and Long-Term Investment

While renting offers flexibility and low initial costs, owning a home can provide the benefits of long-term investment and building equity. Here are some points to consider when weighing the pros and cons of renting versus buying from the perspective of building equity and long-term investment:

Building equity: One of the key advantages of buying a home is the ability to build equity. Equity is the difference between what you owe on your mortgage and the current value of your home.

As you make mortgage payments, you increase your equity in the home. Over time, the value of the home may also appreciate, further increasing your equity.

Long-term investment: Homeownership can be a long-term investment that provides financial benefits over time. While buying a home can be expensive upfront, homeownership can be a sound financial decision over the long run.

When you pay off your mortgage, you own your home outright, and it can provide a valuable asset for you and your family.

Potential for appreciation: While the real estate market can be volatile, over the long term, home values have historically appreciated. If you buy a home, you can sell it later for more than you paid, providing a potential return on investment.

Market fluctuations: While the potential for appreciation is a benefit of homeownership, it's important to keep in mind that the real estate market can be volatile.

There is no guarantee that your home will appreciate in value, and it's possible that you could lose money if you have to sell during a downturn in the market.

Down payment and upfront costs: One of the primary barriers to homeownership is the upfront cost of a down payment, closing costs, and other fees associated with buying a home. Renting can be a more affordable option in the short term, as it requires lower upfront costs.

Tax Benefits

Tax benefits are important when deciding whether to rent or buy a home. Here are some of the pros and cons of renting and buying with respect to tax benefits:

Tax Benefits of Buying a Home

- Mortgage Interest Deduction: Homeowners who itemize their deductions on their tax returns can deduct the interest paid on their mortgage loan. This deduction can significantly reduce the homeowner's taxable income.

- Property Tax Deduction: Homeowners can also deduct the property taxes they pay on their homes from their taxable income.

- Capital Gains Tax Exemption: If the homeowner sells their primary residence for a profit, they may be able to exclude up to $250,000 (or $500,000 for married couples) of the gain from capital gains tax.

Tax Benefits of Renting a Home

- No Property Tax or Mortgage Interest Deductions: Since renters do not own the property they are renting, they do not get any tax deductions for property taxes or mortgage interest.

- Rental Deduction: Renters who use a portion of their home as a home office may be able to deduct a portion of their rent as a business expense on their tax returns.

- Moving Expenses Deduction: If a renter moves for a job, they may be able to deduct their moving expenses on their tax returns.

Homeownership vs. Renting: The Psychological Benefits

The decision to own or rent a home can significantly impact an individual's psychological well-being. While the financial considerations of homeownership versus renting are well-known, important psychological benefits come with each choice. This section will explore some of the key psychological benefits of homeownership versus renting.

Sense of pride and stability: Owning a home can bring a sense of pride and accomplishment that comes with achieving a significant milestone in life.

Homeownership provides a sense of stability and permanence that renting cannot match, as the homeowner has control over the property and can make modifications to the home as they see fit.

Sense of community: Homeownership also provides a sense of community, as homeowners tend to stay in their homes longer than renters.

This allows for the development of relationships with neighbors and a sense of belonging to a community. Homeowners are also more likely to be involved in local events and initiatives, as they have a vested interest in the area.

Sense of personalization: Homeowners can personalize their living space to fit their personal taste and style, as they have control over the design and decor of their homes. This sense of personalization can lead to increased satisfaction and happiness with the living space.

Sense of security and privacy: Homeownership provides a sense of security and privacy that renting may not offer. Homeowners have the ability to install security systems and control who has access to their property, which can create a greater sense of safety and control over one's living environment.

Sense of investment and financial freedom: Owning a home can provide a sense of investment in one's future as homeowners build equity and may see their property value increase over time. This can lead to greater financial freedom and stability, as homeowners can sell their home or use it as collateral for loans.

On the other hand, renting also has its psychological benefits, such as:

Sense of mobility and flexibility: Renting can provide a sense of mobility and flexibility, as renters can move to a new location without the constraints of owning a home. This can be particularly beneficial for those who enjoy traveling or may need to relocate for work.

Sense of financial flexibility: Renters are not tied to a mortgage and can use their money for other investments or experiences. This sense of financial flexibility can lead to greater freedom and control over one's financial situation.

Sense of simplicity: Renting can be more straightforward than homeownership, as renters do not have to deal with the maintenance and upkeep of a property. This can lead to reduced stress and a greater sense of ease in one's living situation.

Impact of the Housing Market on Renting vs. Buying

The housing market significantly impacts both renting and buying options, as it affects the availability, affordability, and overall quality of housing. Here are some ways in which the housing market can influence the decision to rent or buy:

Affordability

The state of the housing market can affect the affordability of buying a home. In a seller's market, where demand is high, and supply is low, home prices can increase, making it more difficult for prospective buyers to afford a home.

In contrast, a buyer's market, where supply exceeds demand, can lower home prices and make buying more affordable. On the other hand, renting can offer more affordable monthly payments without the initial costs of a down payment or closing costs.

Availability

In a tight housing market with more prospective buyers than available homes, renting may be the more viable option. In some cities, the cost of renting is lower than that of owning due to high demand and limited availability of homes. In areas where housing inventory is low, renting may be the only option for some people.

Investment Potential

The housing market's fluctuations can affect a homebuyer's potential return on investment. During a seller's market, home prices are likely to increase, which can offer an opportunity for the homeowner to build equity and realize a return on their investment.

However, home prices may decrease in a buyer's market, and the homeowner may lose equity. On the other hand, renters do not have to worry about these fluctuations and can invest their money elsewhere.

Interest Rates

Mortgage interest rates are a significant factor in determining the affordability of homeownership. In a low-interest-rate environment, homeownership may be more affordable, while in a high-interest-rate environment, homeownership may be less affordable.

This can also affect the decision to refinance, lowering monthly mortgage payments and making homeownership more affordable.

Maintenance Costs

The state of the housing market can affect the costs associated with maintaining a home. In a seller's market, where demand is high, contractors and home improvement stores may increase their prices due to high demand.

In contrast, during a buyer's market, homeowners may have more negotiating power with contractors, leading to lower prices for repairs and improvements.

Future of Housing

The housing market has undergone significant changes in recent years, and the future of housing remains uncertain. In particular, the decision to rent or buy a home has become increasingly complex, with various economic and demographic factors impacting the market.

Here are some predictions and projections for renting vs buying in the future:

Sharing Economy

As more people are drawn to the flexibility and affordability of sharing services like Uber and Airbnb, the idea of shared housing may become more popular. Co-living spaces involving multiple people living in the same apartment or house could become a more common option.

Demographic Changes

The population's aging will significantly impact the housing market, with many baby boomers downsizing and moving into smaller homes or assisted living facilities. This could create opportunities for younger people to purchase larger homes at more affordable prices.

Technology

Technology is already transforming the real estate industry, and this trend will likely continue. Virtual and augmented reality technologies will allow prospective buyers to tour properties remotely, while blockchain technology may be used to streamline the buying and selling process.

Remote Work

As more people work from home, the importance of location may become less significant. This could lead to a shift in the housing market as people become less tied to specific regions and more focused on finding affordable and comfortable living arrangements.

Economic Factors

Economic trends, such as interest rates and inflation, will significantly impact the housing market. As interest rates rise, the cost of borrowing money to purchase a home will increase, potentially making renting a more attractive option.

Sustainability

As the impact of climate change becomes increasingly evident, the importance of sustainable housing options will become more pronounced. This could lead to an increased demand for green homes and a shift in how homes are designed and constructed.

Government Policy

Government policies, such as tax incentives and zoning regulations, will continue to shape the housing market. Policies that encourage sustainable development and affordable housing could have a significant impact on the renting vs. buying decision.

Cultural Shifts

Cultural changes, such as the trend toward minimalism and decluttering, may impact the type of homes people are interested in purchasing. Smaller, more efficient homes may become more popular as people seek to reduce their carbon footprint and live more sustainably.

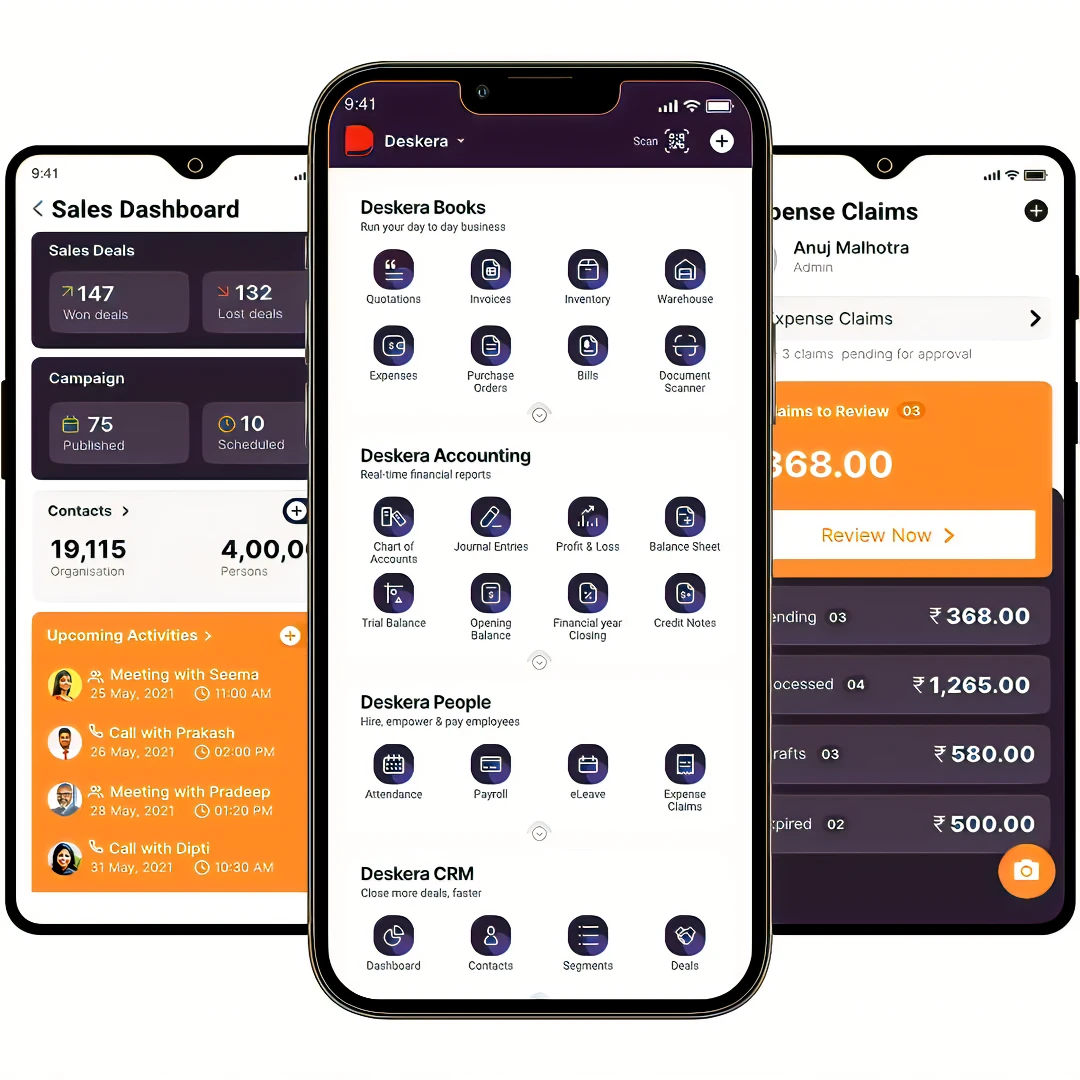

How Deskera Can Assist You?

Deskera's integrated financial planning tools allow investors to better plan their investments and track their progress. It can help investors make decisions faster and more accurately.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Conclusion

The decision to rent or buy a home is a complex and multifaceted one that requires careful consideration of a variety of factors. Renting offers flexibility, lower upfront costs, and fewer maintenance responsibilities, while buying provides the potential for long-term financial gains, stability, and customization.

Ultimately, deciding whether to rent or buy depends on individual circumstances, such as financial situation, lifestyle, and future plans. Those who prioritize flexibility, low risk, and a simpler lifestyle may prefer renting, while those who prioritize stability, equity, and personalization may be more inclined to buy.

When deciding to rent or buy, it is important to consider all costs and associated expenses, including maintenance, taxes, insurance, and opportunity costs. Consulting with a financial advisor or housing specialist can also provide valuable insights and guidance.

In the end, it is important to prioritize your personal needs and financial goals whether you decide to rent or buy. With a comprehensive understanding of the advantages and drawbacks of both options, you can make an informed decision that fits your lifestyle and budget.

Key Takeaways

- Renting offers flexibility and lower upfront costs, while buying provides the potential for long-term financial gains, stability, and customization.

- The decision to rent or buy depends on individual circumstances, such as financial situation, lifestyle, and future plans.

- Renting is a good option for those who prioritize flexibility, low risk, and a simpler lifestyle, while buying is better for those who prioritize stability, equity, and personalization.

- Renting requires less commitment and responsibility, while buying comes with added responsibilities such as maintenance, taxes, and insurance.

- Renting offers a good option for people who are just starting or looking for temporary or transitional housing. At the same time, buying is better for those who are settled in a specific area and plan to stay there for longer.

- The choice between renting and buying also depends on the current state of the housing market, interest rates, and availability of affordable homes.

- The decision to rent or buy should be based on a thorough analysis of all the associated costs, including maintenance, taxes, and opportunity costs.

- It is important to be aware of the potential risks and benefits of both renting and buying, as well as the long-term financial impact of the decision.

- Consulting with a financial advisor or housing specialist can provide valuable insights and guidance for making an informed decision.

Related Articles