Are your real estate goals getting affected because of the accounting involved in the process?

Having been around the properties and dealing with a host of clients each day, it could undoubtedly be excruciating to look after the accounts, too. Well, the primary reason for this could be the lack of support or knowledge about accounting and accounting cycles.

The real estate sector has evolved tremendously over the years and involves a lot of transactions, complying with a lot of state regulations, and so on. Amidst all this, an integral and essential part of the industry is accounting which every property manager must keep a record of. If you are a property dealer who finds it intimidating to catch hold of the accounting part, then this post is surely going to help you.

We have brought together the most crucial aspects of real estate accounting in this post, which are:

- Who Uses Real Estate Accounting?

- Why is Real Estate Accounting Important?

- Real Estate Accounting: Best Practices

- Real Estate Accounting Regulations

- Bookkeeping and the 5 Accounting Elements

- Real Estate Taxes

- Real Estate Tax Savings

- Asset Management

- Staff Management

- Real Estate Accounts

Who Uses Real Estate Accounting?

Real estate accounting is used for the purpose of property management which is a process that involves enormous sums of money. To record and track the transactions of these sums is referred to as real estate accounting.

If you are an individual who finds themselves in any of the following categories, then you must be familiar with real estate accounting:

- Own a real estate agency

- Managing properties for clients

- Maintaining housing association accounts

- Manage a construction company

- Oversees an investment trust

- Provide real estate services

Why is Real Estate Accounting Important?

Understanding how real estate accounting works will help you run your business more effectively, and understanding how to manage your books will allow you to monitor your progress. This enables you to see if you are making a profit and which properties are performing well. Additionally, it will enable you to compare your financial performance over time, estimate your cash flow, calculate your tax return, and make timely bill payments.

The task of managing bookkeeping can sometimes seem overwhelming. Accounting for real estate is crucial to maintaining financial statements and identifying growth potential.

Real Estate Accounting: Best Practices

The following are some real estate accounting best practices for beginners:

Use cloud-based accounting software

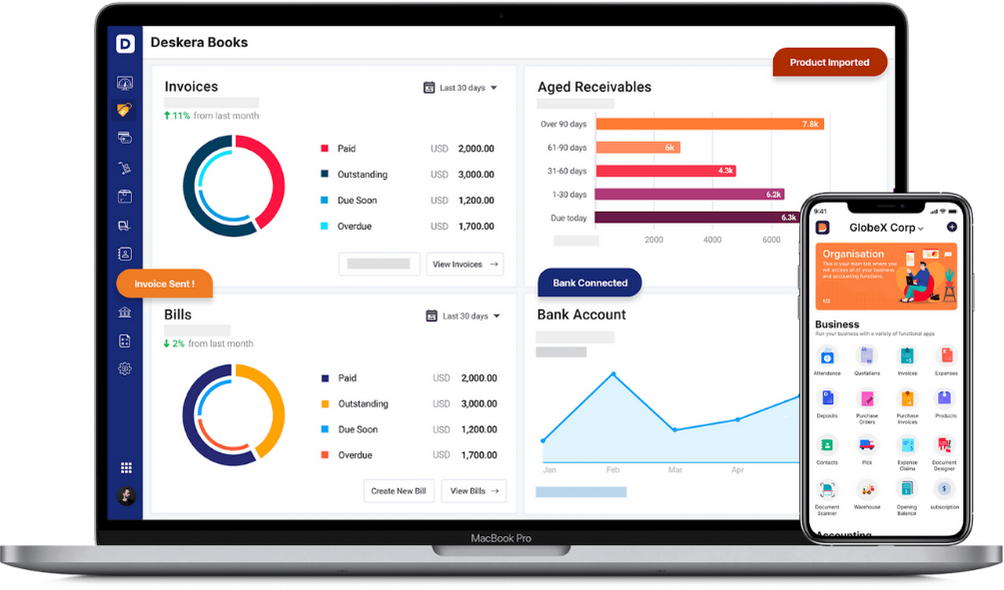

The best decision an entrepreneur can make is to use cloud-based accounting software since it allows them to access financial information anytime, anywhere. It also allows them to share data with their team. Deskera, for instance, provides an entirely fresh perspective on accounting. It’s a platform that not only lets you have all your accounting elements in one place but also enables you to keep a tab on each of them. You can assess and analyze everything you need to in real-time.

Take a look.

Digitize your business

There needs to be some form of evidence for each of your transactions in the ledger. This can be accomplished with the use of technology. You can also take clues from the latest digital trends in accounting and finance that help you. Mobile applications and portable scanners can go a long way to helping you instantaneously scan receipts. Digital receipts are a great convenience, especially if you have lost receipts or need them for financial audit purposes.

Outsourcing your accounting process

Hiring professionals like certified CPAs or accountants is certainly a good practice, especially when you are not completely aware of the accounting process. This would not only ensure an accurate recording and reporting but also take away a lot of your burden. This way, you could lay more emphasis on your core business activities rather than be worried about accounting.

Real Estate Accounting Regulations

Private companies must follow specified accounting standards mandated by the government. This accounting regulation is intended to achieve the following:

- Investor protection

- Maximize the contribution of industry to the GDP

- Make wealth more widely distributed

Accounting standards are set by the nonprofit organization, Financial Accounting Standards Board or FASB. It is FASB's official role to set accounting standards in the United States; therefore, FASB standards are viewed as the authority in this concern. All the standards set by the organization are accessible on the FASB website.

Using incorrect or dishonest accounting practices can land you in hot water. There could be honest errors that can be amended. However, the ones that are done deliberately to mislead can lead to legal prosecution. Therefore, it is of the utmost importance to be extremely cautious while treading the accounting path.

There are a lot of regulations in American accounting. While these regulations must be complied with, for new or small businesses, the task could be an uphill one. To avoid getting in trouble, we would recommend hiring an expert professional who will be able to handle it all for you.

Bookkeeping and the 5 Accounting Elements

Bookkeeping is a term with which most people are well acquainted. However, it is almost always used interchangeably with accounting. It is important to note that the two differ in more ways than one. This section aims to clear up the differences between the two as well as showcase the characteristics of each of them.

Bookkeeping

Bookkeeping refers to the process of recording all the financial transactions taking place in your company. You must maintain and ensure accuracy while reporting your income as it would be scrutinized at the time of IRS audits.

This leads us to learn about double-entry bookkeeping:

Apart from making it easy to understand accounting, this system gives us a very useful equation to further ease up the process:

This equation states that the sum of your liabilities and equity must produce the total number of assets you have. It simply helps us to reduce the number of errors in the process.

We shall learn more about these terms in the next section.

5 Accounting Elements

In the accounting landscape, there are five elements identified as the basics of accounting. These are as follows:

Asset

An asset is a term used for the possessions of a company that are used for the benefit of the company. Assets can be further categorized as fixed and current assets. In real estate, properties can be termed principal assets.

Equity

Equity is the difference between assets and liabilities that determines the value of the company. It is given by the following equation:

In the case where the owners have different amounts of equity within a company, then there must be a separate accounting process for each one.

Liability

It is a term that refers to the money that the company owes, and therefore, it can be said to be the opposite of the asset. Also, like assets, the liabilities are also categorized into two types: Fixed liabilities and current liabilities. Fixed liabilities are debts that need to be paid over a period of time. Current liabilities refer to the debts that need to be paid within the span of a year.

Expenses

Any amount that you pay except for debts is called an expense. Being a real estate brokerage firm, you can say that the salary you pay to your employees is your expense.

Income

You receive income every time you sell a good or service. In real estate, income can come from collecting rents from the tenants.

By reporting and recording these elements, you can get a complete grip of your accounts and finances.

Real Estate Taxes

Emphasizing good accounting practices brings in the advantage of tax savings. As someone in real estate, you must be aware of the various taxes that apply to the field. The real estate tax or the property tax, as it is commonly known, is a tax levied on immovable properties. The properties like land, plots, buildings all come under this class.

The tax amount varies and depends on the size and value of the property. The property tax also varies based on the following factors:

- Location of the property

- Type of Property

- Age of the property

- What is it used for

Personal Property Tax

You may have to pay a personal property tax on these items if they generate income for your business. Personal property taxes are taxes imposed on your movable property. The tools, equipment, and vehicles that your business owns, as well as furniture you place in rental homes, might be subject to taxation.

Real Estate Tax-Saving Strategies

If you plan properly, your real estate business could benefit from numerous tax advantages. A solid accounting system is therefore crucial. Let's review a few important tax-saving strategies.

Rental Properties

Your business can save a great deal of money on taxes if it owns rental properties. Rental properties can help you with the following:

- Deduction for depreciation

- exemption from the capital gains tax

- deductions for maintenance, repairs, and services

- Tax deductions for maintenance and upkeep

- deductions for real estate taxes

Depreciation

A building's value may decline naturally over time as it wears down. This process is called depreciation. In order to protect your income, you can record property depreciation when you file your taxes. A depreciation calculation can be done using various methods such as the MACRS method, Unit of Production method, Straight-line depreciation.

The depreciation amount can be deducted from your taxable income, thereby saving you a substantial amount.

Audit Defense

There may have been a mistake in your company's tax filing that led to an IRS audit. However, there are times when a random audit is conducted. It is better to be meticulous about your accounting than to end up with heavy penalties. Hiring a trained and skilled accountant is, therefore, advantageous. In addition to audit defense training, accountants will know how to deal with the IRS and how to gather any financial information that they need.

Capital Gains Tax

You pay capital gains tax when you sell an asset and make a profit. Depending on how long an asset was owned before it was sold, capital gains taxes may be higher or lower. If you are selling an asset strategically, you can reduce or avoid capital gains taxes.

Asset Management

In order to maximize profits, real estate businesses should maximize the profitability of each asset. You should therefore consider the following issues:

- Tracking each property's value

- Monitoring the performance of rental properties

While speaking of accounting, the property owners or managers should pay attention to the invoices, collected rent, security deposit holdings, and payments made to the contractor.

Staff Management

Being a real estate firm owner, you probably have staff members to help you out with the various business and sales processes. Now, when it comes to managing the staff, there are various components that come into the picture. Their remunerations or the salaries, the number of hours they put in the office, their payroll, commissions must be managed effectively.

You can choose to do this yourself, outsource it to an agency, or have in place software like Deskera that lets you do all this.

Real Estate Accounts

The real estate accountant prepares financial information for property management firms and real estate development companies. These accounting professionals may work for real estate companies or serve as public accountants.

Real Estate Accountants: Roles and Responsibilities

Let’s look through the roles and responsibilities of the real estate accountants and how they may help you:

- Real estate accountants use their reports and accounting records to develop and manage budgets

- Documents like leases and rental agreements, cost estimates, and annual reports can also be prepared or contributed to by these professionals

- In addition to calculating tax liabilities, real estate accountants also prepare tax returns for clients

In addition to preparing financial records and reports for their clients and employers, real estate accountants may handle property sales, rentals, and leases. They may also prepare reports detailing the development and operational costs. Additionally, accounting professionals develop revenue and expense reports, lease summaries, cash basis income statements, and other items relevant to real estate budgets.

How can Deskera Help You?

Do not let the accounting part of your business slip through the cracks while you focus on strengthening the foundations of your real estate business.

Deskera Books simplifies accounting for you and enables easy handling of online accounting and invoicing applications. With the tool, you can now access all your financial documents, invoices, expenses, and all your contacts.

Key Takeaways

Be it real estate or any other business sector, accounting has always been and shall remain an integral part of it. Without accounting, it is difficult to gauge the progress of the business. Moreover, complying with the local legal entities is also tough without a proper understanding of accounting.

The highlights pertaining to the real estate accounting are as follows:

- Real estate accounting is used for the purpose of property management which is a process that involves enormous sums of money. To record and track the transactions of these sums is referred to as real estate accounting

- Real estate accounting will enable you to compare your financial performance over time, estimate your cash flow, calculate your tax return, and make timely bill payments.

- Digitizing the business, getting a cloud-based accounting software, and outsourcing could be some of the best practices to follow in accounting

- Bookkeeping refers to the process of recording all the financial transactions taking place in your company

- The five accounting elements are assets, equity, liabilities, expenses, and income

- The property tax varies based on the factors including location of the property, type of property, age of the property, what is it used for

- A depreciation calculation can be done using various methods such as the MACRS method, Unit of Production method, Straight-line depreciation

- Having rental properties can help you save taxes just like other strategies including audit defense and capital gains tax

- A real estate owner or manager must adopt asset management by tracking each property’s value and monitoring the performance of rental properties

- Staff management is also an important part of real estate accounting where the employees’ salaries, payroll, commissions are taken care of

- A real estate accountant can play an important role in filing taxes and recording or financial data. Hiring a skilled professional can keep away mistakes in filing and other issues while maintaining financial statements

Related Articles