You have meritoriously set up your own small business, and now you wish to understand the factors you need to keep track of.

Taxes, of course, can be one of the most daunting aspects for most startup owners. Taxes for business owners are paid differently from the taxes for employees. While employees need to file their taxes once a year, small business owners must file every quarter.

The business structure you opted for when starting your business is instrumental in determining what taxes you will pay. You could be a sole proprietor, partnership, corporation, S corporation, or a Limited Liability Company (LLC). The taxes vary based on these business structures.

If all the taxation and tax requirements tend to overwhelm you right now, we hope to erase the intimidation around the topic through this article!

The following points aim to assist you in learning about the quarterly taxes, and what you should expect from the process of the payment of these taxes:

- Quarterly taxes: What are they?

- Who must submit quarterly tax returns?

- Who is exempt from quarterly tax returns?

- How are quarterly taxes determined?

- How to pay Estimated Quarterly Taxes?

- What are the estimated tax deadlines for each quarter in 2022?

- Penalty for not paying quarterly taxes

- Latest Updates for 2022 Taxes

- How can I simplify making quarterly tax payments?

- Quarterly taxes FAQs

- How can Deskera Help You?

- Key Takeaways

Quarterly Taxes: What are they?

Quarterly taxes refer to the estimated tax payments made to the IRS and filed in advance of the annual tax return. This implies that you are required to pay your tax in four installments in a year (every quarter) instead of a single big payment. These amounts vary and depend on the estimated income of your business for that year.

The term ‘estimated’ implies that you estimate the amount prematurely; they have not occurred till you fill out your tax return. Individuals and organizations need to follow this systematized way of making the monthly payments toward their outstanding ultimate income tax obligation, thanks to the quarterly taxes and their deadlines.

Who must submit quarterly tax returns?

The quarterly taxes are for everyone who expects to owe a minimum of $1,000 in taxes from their income. The annual tax threshold for corporations is $500. Additionally, you generally won't need to file quarterly taxes if your federal tax withholdings total at least 90% of the amount you will owe for the whole year. These taxes must be filed by every individual who finds themselves in any of the following categories:

- Self-employed

- Partnerships

- Sole proprietorship

- S corporation shareholders

- Corporations

Who is exempt from quarterly tax returns?

We have partly answered this in the previous section. Anyone who is not expected to make estimated payments of over $1,000 is exempt from the quarterly tax filing.

It is much easier for the employees as they may not pay the estimated taxes by receiving a salary from their employers.

Form W-4 can be utilized to file quarterly taxes by the employer on behalf of the employee. The employer withholds a part of the employee’s salary to pay this estimated tax. So, while the employee is still paying the quarterly tax, they do not necessarily have to be mindful of the deadlines, as it has been taken care of by the employer.

How are quarterly taxes determined?

You may determine your quarterly taxes simply by estimating your total income expected for the year. You can check the previous year’s figures and verify if this year’s totals will come up to the same numbers. In that case, you can start with the same total.

If not, then you will be required to work on your financial documents and calculate the new amount that you expect to pay. Of course, you must consider your expected quarterly income for doing so.

With this rough idea, you can now begin estimating your owed quarterly tax amount through the steps mentioned in the following points:

- Compute your expected income for the quarter.

- Calculate your adjusted gross income or the AGI once you have applied all the tax deductions.

- Next, multiply the AGI by the applicable tax rate. This will give you the estimated income tax you owe.

- Now, you must calculate your self-employment tax which is required for the payment of Social Security and Medicare taxes. You can arrive at this number by utilizing your total expected income which comes from the first step above.

- When you add your estimated self-employment taxes and the estimated income tax owed, you will arrive at the estimated tax for the year.

- Once you have your estimated tax for the year, divide it by four to get the amount for the quarterly taxes. That gives you your estimated quarterly tax amount.

How to pay Estimated Quarterly Taxes?

Not having enough cash on hand to pay quarterly taxes is one of the major challenges. Owners of businesses will probably utilize their revenue to pay off debt and make investments to expand the company. Owners of businesses and independent contractors need to keep in mind that any income they get is taxable. They should set aside money to cover the owed taxes.

Calculate your owed quarterly tax amounts to discover how much you should pay each quarter. Individuals can calculate and file their quarterly taxes using IRS Form 1040-ES. Corporations can submit their quarterly payments using Form 1120-W.

By connecting your bank account to EFTPS.gov, often known as the electronic federal tax payment system, you can streamline the payment procedure.

Additionally, each state has its own payment procedure for unpaid taxes. You can configure a direct debit for the withdrawal of funds automatically. Although there is a service charge involved, you can also pay with a credit card.

What are the estimated tax deadlines for each quarter in 2022?

Unless a due date comes on a weekend or legal holiday, estimated tax payments are normally submitted incrementally on the following quarterly tax dates: April 15, June 15, September 15, and January 15 of the following year.

The following dates apply to 2022:

The second quarter is just two months long, in contrast to the first quarter's first three calendar months of the year (April 1 to May 31). The following three months (June 1 to August 31) are considered the third quarter, while the following four months (December through March) are considered the fourth quarter.

Payments are due on the following or the next business day if a due date falls on a weekend or legal holiday.

Penalty for not paying quarterly taxes

If an individual or organization fails to file quarterly taxes, the IRS may impose penalties. The IRS calculates the penalty separately for each mandatory installment. The number of days past due is first calculated, and then the effective interest rate for the payment period is multiplied by that number. The IRS typically levies a fee of 0.5 percent of the amount owed each month.

How to avoid penalties?

The fundamental guideline for avoiding a penalty is that at least 90% of your tax liability for the quarter or year must be paid. You won't ever be penalized for underpayment as long as you follow that procedure.

This rule has one significant exception. Farmers and fishermen only need to pay 66 2/3 percent of their tax obligation if farming or fishing account for at least two-thirds of their total income.

The best approach to guarantee that you would not incur any penalties is to pay all of your tax debt from the previous year. This is also known as the safe harbor rule.

However, we must discuss the caveats of the safe harbor principle. If your AGI was $150,000 (or more) last year or $75,000 if you filed as married filing separately this year, you must pay 110 percent of the liabilities from last year in order to comply with the safe harbor provision. Fishermen and farmers are exempt from this law.

Latest Updates for 2022 Taxes

There are some adjustments that you must be mindful of when you are filing the 2022 taxes by utilizing the 2021’s tax bill. This section takes us through those important adjustments.

American Rescue Plan Changes

The American Rescue Plan Act is the third coronavirus stimulus package. It was enacted on March 11, 2021, and included significant modifications for the 2021 tax year. While some of these modifications are still in effect for the 2022 tax year, others have not been renewed.

The maximum yearly Child Tax Credit was enhanced under the American Rescue Plan from $2,000 per child to $3,000 per child between the ages of 6 and 17 and $3,600 for each child under the age of six. The price increase persisted until 2021. The expanded credit extension legislation for 2022 has not received a nod. The credit will decrease to $2,000 and become partially refundable for the tax year 2022.

The cap on investment income was increased for 2021 from $3,650 to $10,000. This $10,000 amount will be linked to inflation and therefore, will be updated annually going ahead.

How can I simplify making quarterly tax payments?

Unlike the employees' taxation where the taxes are automatically dedicated from their paychecks, the small business owners need to pay their estimated taxes from the revenue or their income. Therefore, it is extremely crucial to realize that your income is not fully spendable.

For this purpose, you must create an estimated taxes account where you can keep a certain amount segregated from the rest of the funds. This will help you recognize the money for your taxes and the one for your operational expenses.

Apart from this, the following measures can guide you in simplifying your quarterly tax payments.

Hiring an expert or an Accountant

Being a small business owner, things related to taxes may be new to you; yet, they do not have to be intimidating. You can seek ways that make your filing simpler. Hiring an accountant can help you accomplish an easy filing.

An expert professional or a certified accountant can be instrumental in simplifying taxation for you. You can be sure of the numbers and the calculation, along with the process that entails filing. They can help you with the bookkeeping part of your business and also manage your quarterly tax payments. Additionally, it would be an advantage at the end of the year when you make your annual tax filing.

Implementing Accounting Software

Besides doing your homework by gathering accurate numbers in your financial statements, you may also implement and invest in efficient accounting software. It can help you manage your expenses and also calculate your estimated taxes, and also save you a lot of time.

Quarterly taxes FAQs

Q: How can I pay my estimated taxes?

A: Paying the estimated taxes entails a simple procedure. All you need to do is fill out Form 1040-ES and mail it to the IRS. Attach the check within the mail. Alternatively, you can opt for online payments through IRS Direct Pay.

Q: What happens when I do not pay my estimated taxes?

A: A large bill awaits you at the end of the year at the time of filing your tax return if you do not pay your estimated taxes. Without a doubt, you will also have to pay up the amounts for penalties attracted due to late payment of the quarterly taxes.

Q: Can I postpone paying my estimated tax?

A: The IRS requires taxpayers to make regular and on-time tax payments. If you've already paid enough in projected taxes with your prior installments, postponing or skipping an expected tax payment may be an option.

You might be eligible to avoid making Estimates tax payments if your total tax bill at the end of the year is less than $1,000 or if you have already paid almost all of it.

Q: Am I allowed an extension for quarterly taxes?

A: Chances are slim that the IRS will grant you an extension. Although you can receive an extension on the paperwork, the deadline, however, will remain unchanged. You must note that the quarterly tax filings barely require any paperwork and therefore, the extension may not be applicable.

That said, you may still file for an extension in an unavoidable scenario that requires you to request more time to file. The regular deadline is April 15, but filing an extension up to October 15 can be done.

How can Deskera Help You?

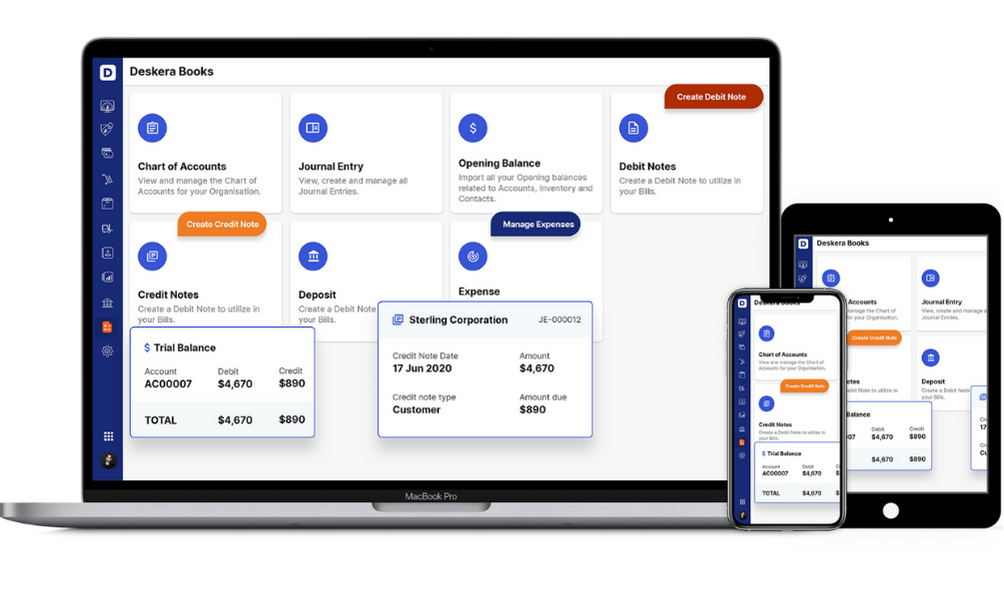

Deskera Books can assist you in automating and reducing your company's risks. Deskera makes it simpler to create invoices by automating many additional tasks and lowering the administrative burden on your team.

Register right away to receive further Deskera benefits.

Find out more about the outstanding and all-inclusive software here:

Key Takeaways

- The business structure you opted for when starting your business is instrumental in determining what taxes you will pay. You could be a sole proprietor, partnership, corporation, S corporation, or a Limited Liability Company (LLC).

- Quarterly taxes refer to the estimated tax payments made to the IRS and are filed in advance of the annual tax return. This implies that you are required to pay your tax in four installments in a year instead of a single big payment.

- The term ‘estimated’ implies that you estimate the amount prematurely; they have not occurred till you fill out your tax return.

- The quarterly taxes are for everyone who expects to owe a minimum of $1,000 in taxes from their income. The annual tax threshold for corporations is $500.

- Self-employed, Partnerships, Sole proprietorship, S corporation shareholders, and Corporations are the entities that must file the quarterly tax returns.

- Anyone who is not expected to make estimated payments of over $1,000 is exempt from the quarterly tax filing.

- Calculate your owed quarterly tax amounts to discover how much you should pay each quarter. Individuals can calculate and file their quarterly taxes using IRS Form 1040-ES. Corporations can submit their quarterly payments using Form 1120-W.

- By connecting your bank account to EFTPS.gov, often known as the electronic federal tax payment system, you can streamline the payment procedure.

- Payments are due on the following or the next business day if a due date falls on a weekend or legal holiday.

- If an individual or organization fails to file quarterly taxes, the IRS may impose penalties. The IRS typically levies a fee of 0.5 percent of the amount owed each month.

- The fundamental guideline for avoiding a penalty is that at least 90% of your tax liability for the quarter or year must be paid. You won't ever be penalized for underpayment as long as you follow that procedure.

- You can simplify making the quarterly tax payments by hiring an accountant or implementing accounting software.

- The IRS requires taxpayers to make regular and on-time tax payments. If you've already paid enough in projected taxes with your prior installments, postponing or skipping an expected tax payment may be an option.

- Receiving an extension on the payment of quarterly taxes is barely an option. Although you can receive an extension on the paperwork, the deadline, however, will remain unchanged.

Related Articles