Say you are an entrepreneur. Well, you have two options to choose from when you set about recruiting: independent contractor vs. employee. An employee works for the employer in return for a reasonable, fixed salary. Independent contractors, in contrast, are individuals or companies that serve clients at a specific rate.

Both have their strengths and weaknesses, making it tricky to choose between them. These two terms differ in aspects like degree of control, ability to subcontract, sustainability of relationships, independence, degree of work done, all of which are integral parts of the employer's company. However, the choice is straightforward if you can see the difference between an independent contractor vs. employee.

Table of Contents

- What is an employee?

- What is an Independent Contractor?

- Some common examples of an independent contractor:

- How to work with an independent contractor?

- Risks of Misclassification between the independent contractor vs. employee

- Reduce the risk of misclassification

- The IRS 20 Factor Test

- Key Differences between independent contractor vs. employee

- Why is it necessary to restrict between an independent contractor vs. employee

Who is an Employee?

Full-time employees typically work for one employer, who directs and manages the work to be performed according to the time and place of work. Employees are also entitled to the statutory benefits of W-2 employees.

An employee is defined as a person who works for an employer regularly for a fixed payment called salary. Employment-related conditions are described in a contract called an employment contract. Contracts can be entered into orally or in writing, either explicitly or implicitly. Organizations have complete control over their employees' work: what, how, and when. There is an entire process for hiring employees called the recruitment process. Employee work may be limited by part-time, full-time, or temporary employment.

Employees are hired for specific jobs, and each job has its obligations, duties, responsibilities, and powers. They are paid monthly based on their qualifications, experience, skills, performance, and status.

Who is an Independent Contractor?

Independent contractors typically act as independent businesses and may work for multiple clients. The independent contractor will charge for the completed work and provide the employer with his tools and equipment. Employees are responsible for both individual and employer taxes. An independent contractor can be a consultant, accountant, lawyer, engineer, or any other professional qualification holder, providing his services to a business, client, principal, or third party on behalf of his client and who operates as a neutral person. He is paid on a freelance basis.

The independent contractor can apply his judgment to the way the order is fulfilled without the control or influence of the client. In addition, an independent contractor is solely responsible for the project's outcome. Before hiring an independent contractor vs. employee, you must clearly understand the difference:

- The independent contractor works for himself and is not technically employed by the company in which he works

- Independent contractors provide invoices for their work, and the company that pays them does not deduct taxes from the payment as self-employed entrepreneurs are subject to self-employed tax

- Employers can control the work that independent contractors do for them, but not how it is completed

Some common examples of an Independent Contractor

Here are a few common examples of independent contractors:

1. Real estate agents

Realtors usually work independently but work within a larger agency that helps handle commissions in exchange for promoting sales.

2. Freelance writer and graphic designer

Freelance writers usually work as independent contractors and sell their work to publications. Similarly, freelance graphic designers can create graphics for one-off projects for many companies. Work deliverables are outlined in the contract, executed when the freelancer deems appropriate, and rewarded for each task completed.

3. IT Professionals

This can get tiresome as several IT professionals are employed as regular employees. When performing short-term or specific project work for which a completion schedule exists, they usually act as independent contractors.

How to work with an Independent Contractor?

When working with an independent contractor, there are some simple tactics you can use to avoid confusion in the IRS and ensure your work meets your needs:

- Do not treat an independent contractor as an employee and draw a clear line between independent contractor vs employee.

- Independent contractors should not be allowed to use company equipment that they can be expected to have.

- For freelance writing and graphic designing jobs, independent contractors usually do not work in the field.

- Use a written contract with the contractor, and don’t let them work on your behalf unless the contract or agreement is fully fulfilled.

- Do not allow long, extended deadlines. This is a common mistake that the IRS finds among employers with independent contractors.

- Ultimately, if long-term work from the independent contractor is required, the DOL and IRS may enquire if a regularly scheduled employee should be assigned to that role.

Risks of Misclassification between an independent contractor vs. employee

Self-employment is now a viable career option, and many companies are recognizing the benefits of hiring an independent contractor vs. employee. Companies need the flexibility that independent contractors can provide, and their skill is highly sought after. In addition, independent talent can provide expertise, financial savings, and on-demand staffing flexibility to companies.

However, as the use of independent resources increases, companies also need to adapt how they manage their employees. Compliance is closely tied to the commitment of an independent contractor.

Improper management of independent contractors risks misclassifying workers and can lead to audits, penalties, fines, litigation, and more.

Reducing the risk of misclassification between an independent contractor vs. employee

Misclassifying people into independent contractor vs. employee can cause significant problems with the DOL and IRS. The IRS has a strict definition for determining whether a worker is an independent contractor vs. an employee. Therefore, accurately classifying all employees is very important to the business. Misclassifying employees can result in severe fines and penalties.

The IRS has created an IRS 20 Factor Test - independent contractor vs. employee- to avoid this mistake. This 20-point test allows employers to identify the needs and reasons and decide whether to hire an independent contractor vs. employee. The IRS commonly uses this test to determine when and prosecute US employers for worker misclassification.

The IRS 20 Factor Test for an Independent Contractor vs. Employee

These are the 20 elements that the IRS suggests to assess whether you have hired an independent contractor vs. employee:

- Guidance: If the client or the company guides its people about when, where, and how work should be done, it indicates an employment relationship.

- Amount of training: Asking a worker for training provided by the company indicates employment as the company decides how to work.

- Degree of Business Integration: Employees whose services are integrated into their business operations or who significantly impact the company's success may be considered employees.

- Level of personal service: Companies that claim that a particular person does the job and claim a level of control indicate their employment relationship. In contrast, independent contractors are usually free to subcontract.

- Auxiliary Worker Management: If a company hires, monitors, and pays a worker's auxiliary worker, this management indicates a possible employment relationship. If the employee manages the hiring, supervision, and payment of helpers, this contract represents an independent contractor relationship.

- Relationship continuity: A long continuity in the relationship between a company and an employee indicates an employment relationship. That said, contracts with independent contractors may include ongoing relationships for multiple consecutive projects.

- Schedule flexibility: Individuals whose hours or working days are set by the company normally can qualify as their employees.

- Demand for full-time jobs: Full-time jobs let the company manage most of a person's time, which helps in the quest for employment.

- The need for on-site services: The use of employees on company premises, especially if they can perform work elsewhere, indicates a potential employment relationship.

- Work Order: If an entity needs to perform work in a particular order, the control indicates an employment relationship.

- Reporting Obligations: This regulation indicates potential employment relationships if employees are required to report on the status of the project in writing or verbally regularly.

- Terms of Payment: Employees are paid on an hourly, weekly, or monthly basis based on a convenient salary distribution of flat rates. The independent contractors get commissions or payments upon completion of a project.

- Payment of travel or travel expenses: Independent contractors usually pay for their travel expenses. Employees, on the other hand, are directly reimbursed by the company for any kind of travel or other business expenses.

- Equipment: Independent contractors generally work using their own equipment, tools, and materials whereas all these tools are provided by the company to its employees.

- Investing in Facilities: Independent contractors maintain their work facilities. In contrast, most employees rely on their employers to provide them with work opportunities.

- Realizing profits or losses: Employees who receive a given salary and have little opportunity to make significant profits or losses from their work are usually employees.

- Working for Multiple Companies: Individuals who perform the services of multiple independent companies at the same time may qualify as independent contractors.

- Open to the public: If the employee makes the service public regularly, this will support the search for an independent contractor.

- Termination management: The company's unilateral retirement rights suggest an employment relationship. The ability of a company to terminate a relationship with an independent contractor usually depends on the terms of the contract.

- Right to dismissal: Most workers can resign from the company without liability. Independent contractors may not terminate service without liability unless permitted by the contract.

Key Differences: Independent Contractor vs. Employee

The applications, tests, and definitions of independent contractor vs. employee are different. The Internal Revenue Service (IRS) and the Department of Labor (DOL) have stipulated fundamental definitions and rules regarding the status of independent contractors and employees. Independent contractors need to fill out the IRS Form W-9, and employees fill out the IRS W-4 Tax Form. Nevertheless, it is imperative to implement a classification process that establishes guidelines for hiring and managing independent employees. Misclassifying your employees can have expensive legal consequences that negatively impact your business.

1. Relationship: Independent Contractor vs. Employee

An independent contractor has a business-to-business relationship with the employer, who may be a single trader or an incorporated company. An employee is a contracted worker who earns a salary from a company.

2. Expertise: Independent Contractor vs. Employee

Employees usually receive job-related training, but independent contractors bring specific expertise to a project or task. Self-employed people come and work from almost every sector of the economy. Still, most people have a high degree of knowledge in that sector, and they can offer specific skills that require special training, certification, or education.

3. Control: Independent Contractor vs. Employee

Independent contractors are free to do additional work for other clients, whereas employees are under a contract and cannot work for other companies

4. Completion of tasks: Independent Contractor vs. Employee

Unlike traditional employees, whose work may include various obligations and responsibilities, an independent contractor is only responsible for providing the services listed in the contract or scope of work (SOW). It lays the foundation for a good partnership and outlines the expectations of both parties. You need to include details of the work to be done, a timeline, steps to manage changes, and payment terms.

5. Payment: Independent Contractor vs. Employee

Regular employees work for a specific salary, whereas independent contractors invoice for their work. Payments should be discussed in the initial contract negotiations.

6. Working hours: Independent Contractor vs. Employee

Independent contractors are their business units, so clients cannot determine their working hours.

7. Monitoring: Independent Contractor vs. Employee

The manager usually instructs employees, but clients cannot instruct independent contractors on operating.

8. Taxes: Independent Contractor vs. Employee

The client typically fills out Form W-9, requesting the correct name and taxpayer number (TIN) of the independent contractor, and fills out Form 1099-MISC to report the payment. As a client, you don't have to worry about the withholding tax of the contractor you hire. Independent contractors need to be aware of their tax liability.

9. Benefits: Independent Contractor vs. Employee

Hiring an independent contractor has many financial benefits for employers as they are not liable to pay traditional benefits such as stock options, health insurance, and severance pay.

10. Legal aspects: Independent Contractor vs. Employee

Independent contractors do not receive the same legal protections (unemployment, taboos, workers' accident compensation) as employees. However, to protect against legal issues, it is advisable to ensure that an independent contractor incorporates basic insurance requirements into the contract.

11. Partnership: Independent Contractor vs. Employee

If self-employed people hire additional resources, keep in mind that they are solely responsible for their workers' tax obligations and filing and reporting obligations.

Why is it necessary to differentiate between an Independent Contractor vs. Employee?

When hiring new employees, you must classify them as independent contractor vs. employee. There are several reasons why it is essential to classify your team properly:

1. The law stipulates who is an independent contractor vs. employee

You can get into a contract with a regular employee, but the independent contractor can come to work only for a few days a week since he is not bound under any contract with you. Regardless of your arrangement, the evaluation of your team's work is ultimately based on the type of work they do and how they accomplish it.

2. Tax Considerations vary for both: independent contractor vs. employee

Companies are expected to pay certain taxes like state and federal payroll taxes, social security taxes, and disability insurance premiums on behalf of their employees. On the other hand, employers do not have to pay these taxes for independent contractors. Instead, the contractor bears his tax.

3. If you misclassify an employee, you may be liable for penalties

If you misclassify independent contractors, they may be able to file an unemployment claim against you. This could mean paying a considerable amount as a fine for accidental misclassification.

4. Independent contractors may have higher responsibilities

Employees can get injured at work. If you classify them properly, only employees are liable to receive worker compensation. However, under certain conditions, an independent contractor can sue you for the same. Therefore, make sure that the Workers' Accident Compensation Policy is intended for everyone who works for you, regardless of classification.

5. Employees' expectations for work are different

Some industries, such as healthcare and education, have their own set of rules and regulations that can affect employees' lives. This is not true for all, but you must document additional rules about how your employees work if you work in a highly specialized industry.

Conclusion

Therefore, there are pros and cons associated with independent contractor vs. employee. Before making a decision, clarify your needs and expectations and then choose the right person for the job. The cost of retaining an employee is higher than that of an independent contractor because you are obliged to pay.

Next, fill out Form SS8 to see the status of your employees to withhold federal labor and income taxes. The IRS will guide you with specifications on whether an employee should be treated as independent contractor vs. employee. The form can be completed by either the employer or the employee.

How can Deskera Help You?

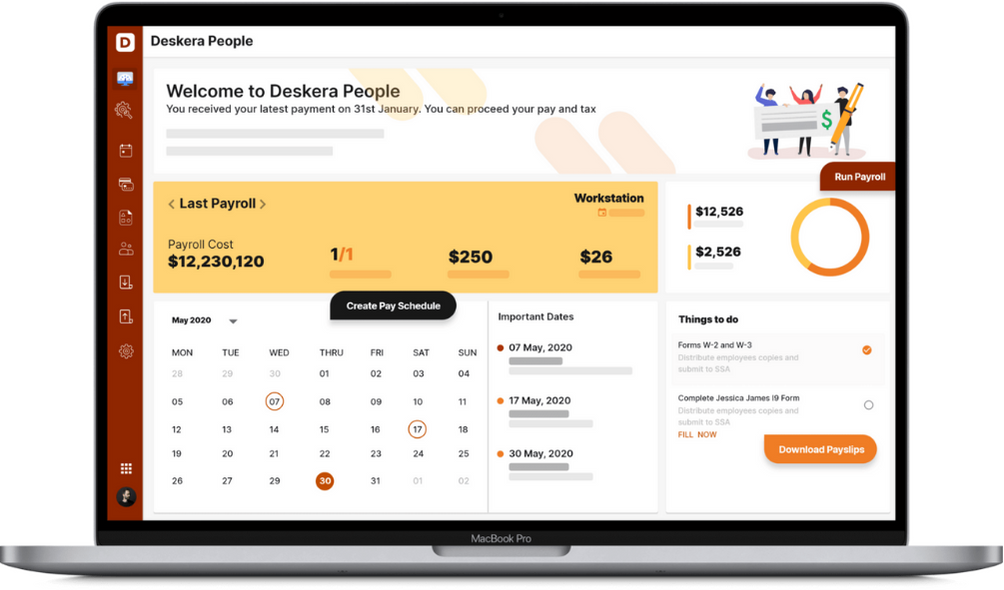

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways: Independent Contractor vs. Employee

- Independent contractors are usually project-based workers who perform their work autonomously as long as they perform the work as agreed.

- Contrary to regular employees, independent contractors are not employed by the company with which they are contracted and provide the agreed service or product.

- Employees are long-term based on company salaries and are usually not hired for a particular project.

- Freelance writers, realtors, graphic designers, and some IT professionals are examples of independent contractors.

- The commonest feature of being an independent contractor is that you are autonomous even when working with more extensive networks, teams, or agencies.

- The rights and duties of Independent contractors differ from that of employees.

- Always enter into written contracts or extend deadlines. Use best practices in conjunction with the IRS 20 factor test to avoid misclassification and risks of fines and penalties

Related Articles