Is the prospect of filing taxes in 2022 for your sole proprietorship business stressing you out? Do you want a better understanding of the USA's state and federal government taxes that you would be required to pay as a sole proprietor to ensure complete tax compliance?

If you are here, it means that you are that someone and I promise that by the time you have completed reading this article, you will know all that is needed about sole proprietorship tax rates.

A sole proprietorship is the most common type of business and the simplest one at that. It is an unincorporated business owned and managed by one individual. In this type of business, there is no differentiation between your business and you- the owner. This means that you are entitled to all the profits earned by your business while also being responsible for all your business’s debts, losses, and liabilities.

While you do not need to take any formal action for being a sole proprietor as the status is automatically yours from your business activities and as long as you are the only owner. Nevertheless, you would be required to obtain the necessary licenses and permits. The regulations for the same vary from industry to industry, state, and locality.

For tax purposes, a sole proprietorship is considered a pass-through business. This means that the profits or losses of the business will pass through to the owner’s, i.e., your personal tax return. However, if you are the sole member of a domestic limited liability company (LLC), and you choose to treat the LLC as a corporation, then you would no longer be a sole proprietor.

How do Sole Proprietors Pay Income Tax?

Through Form 1040, a sole proprietorship is taxed through the personal tax return of the owner. It is on Schedule C, Profit or Loss from Small Business, that you will have to present your calculated business profit.

In order to complete Schedule C, the income of your business will have to be calculated in a manner that includes all your incomes, expenses, cost of goods sold for the sold products, and even the costs for a home-based business. Through this calculation, i.e., income minus expenditure, you will get your net income, which in the case of sole proprietors is the amount of taxable business income.

For the income tax purpose, this net income or loss of the business is entered on Line 31 of the owner’s Schedule C so that it is included along with all the other incomes, losses, expenditures of the owner and spouse. In case if your business has profit, then your figure needs to be added to Line 3 of Form 1040. However, if in case of a loss, it will have to be deducted from your total adjusted gross income for the tax return purposes. Total adjusted gross income is the income before the exemptions and deductions.

Thus, as an owner of your sole proprietorship, you will have to pay income tax on all your income listed on the personal tax return, which also includes income from business activities. This income tax will have to be paid in accordance with the applicable tax rate for the year.

Self-Employment Tax

Based on the income of your business, you, as a sole proprietor - a self-employed individual, will be required to pay self-employment taxes (social security or medicare tax). Self-employment tax will be a part of your total sole proprietorship tax rate and is included in Form 1040 for federal taxes. It will be calculated through Schedule SE.

While regular employees make contributions to these programs through deductions from their paychecks, sole proprietors make their own contribution to it through self-employment taxes. Additionally, if you were an employee, you would have to pay only half of the amount into these programs as the remaining amount would have been paid by your employer. But considering that you are a sole proprietor, you are required to pay the full amount by yourself, though you can deduct half of the cost.

In case if your business is facing a loss, you would not have to pay self-employment tax, leading to your sole proprietorship tax rate based liability reducing by that amount. This would, however, come at a cost for you would not receive Social Security or Medicare benefit cards for that year.

For example, Sophia is a sole proprietor, a single tax filer.

- On completing her Schedule C, there was a net income of $10,000- which becomes her taxable business income.

- On this income, she has to pay 15.3% self-employment tax as part of the total sole proprietorship tax rate. This is equal to $1,530. She will get a deduction of half this amount, hence requiring her to pay $765 towards self-employment tax.

- Now, she also has a part-time job, from which she is earning $12,000.

- The Schedule C income of $10,000, the self-employment tax of $765, and her taxable work pay will all be used for calculating the income tax that she owes for the year.

Estimated Taxes

A sole proprietor is not an employee, and this hence means that no income taxes or self-employment taxes will be withheld from their pay. However, the IRS requires these taxes to be paid throughout the year, rather than just at the tax time.

This implies that one of the parts of the sole proprietorship tax rate involves you having to pay estimated tax payments each quarter (15th April, 15th June, 15th September, and 15th January of the next year), after first estimating how much tax you will owe at the end of that particular year. Depending on which state you are a resident of, you might have to pay these taxes to the state tax agency as well, in addition to the IRS.

Other Employment Taxes

If, as a sole proprietor, you have employees working for you, then this section will also become a part of your sole proprietorship tax rate. In case if you have employees, then your business will be required to pay:

- Employment taxes on their incomes which also includes withholding and reporting federal and state income taxes

- Paying and reporting FICA (Social Security and Medicare) taxes

- Workers compensation taxes

- Unemployment taxes

These are, however, deductible business expenses if your sole proprietor business pays employment taxes. In case of amounts withheld from employees and forwarded to the government by your business, they would not be deductible to your business.

Property Taxes

If you own a building or other real property like land, then you would also have to pay property taxes on the same. Property taxes, too, would become a part of your sole proprietorship tax rate. Your property taxes are based on the appraised value and tax rates for the town or city where your business is located.

State Sales, Excise, and Franchise Taxes

This is yet another section that is a part of your sole proprietorship tax rates. As a sole proprietor, you would be required to pay state sales taxes on the taxable products and services sold by your business. Additionally, you might also have to pay excise (use) taxes just like other business types would pay.

To know the exact details of the state sales and excise taxes that you might owe, you should check with your state department of revenue. Under typical conditions, a sole proprietorship is not liable to pay franchise taxes as these are levied by the states on corporations and other types of state-registered businesses.

Deducting Business Tax Payments

The taxes that your business pays can be deducted as business expenses from the amount that you owe through your sole proprietorship tax rates. However, the federal income tax paid by you cannot become a deductible business expense.

Tips for Filing Your Sole Proprietorship Tax Return

- You will be taxed on all profits of the business, i.e., your total income - total expenses. This is regardless of how much money you actually withdraw from your business. This means that at the end of the year, even if you have left money in your company’s bank account for covering future expenses or expanding your business, you will be required to pay taxes on that money.

- Just like any other business, you can deduct your business expenses like, for example, the money you spent in pursuit of profit, including operating expenses, product, and advertising costs, travel expenses, costs of business-related meals, etc. In fact, you can even write off certain start-up costs, costs of business equipment, and other assets that you purchase for your business.

- As a sole proprietor, you might even qualify for the new pass-through tax deduction established by the Tax Cuts and Jobs Act. Up to 20% of net business income earned by the sole proprietors may be deducted as an additional personal deduction. However, if in case your income is over $315,000 (if married and filing jointly) or $157,500 (if single), then you must have employees or depreciable business property to take this deduction. Here, the deduction is limited to a percentage of employee wages or business property costs. Lastly, the same deduction is not all available for those sole proprietors who provide various types of personal services and whose income exceeds $415,000 (if married and filing jointly) or $207,500 (if single). This deduction is in effect from 2018 through 2025.

- As a sole proprietor, some of the forms that you might have to file are:

Will Incorporating Your Business Cut Your Tax Bill?

Unlike a sole proprietorship, a regular corporation, also known as the “C” corporation, is considered a separate entity from its owners for taxation purposes. This means that owners of the “C” corporation do not have to pay taxes on the corporation’s earnings unless they actually receive money as compensation for their services (salaries and bonuses) or as dividends. The corporation itself will pay all the taxes on all profits left in the business.

However, unlike the prior law, which had tax rates ranging from 15% to 35% that corporations paid, the new tax rate as changed by the Tax Cuts and Jobs Acts is a single flat tax of 21%. This tax rate is lower than the individual rates at certain income levels, which also affects the sole proprietorship tax rate. For instance, the top 37% individual rate is applicable when income is over $600,000 for married couples and $500,000 for those who are single.

However, the corporations do not benefit from up to 20% pass-through tax deduction as established by the Tax Cuts and Jobs Act which does cut the effective sole proprietorship tax rate by 20%. This hence means that only the corporations who have higher income levels and want to leave some profits in the business will benefit from the 21% corporate tax rate.

For example, if you are a manufacturing company and you want to buy some more inventory and choose to leave $50,000 in the business for the same, in that case, as a sole proprietor, that amount would be considered as “retained profits” and would be taxed at your marginal individual tax rate which can be as high as 37%. On the other hand, if you incorporate, that amount of $50,000 would be taxed at a fixed 21% corporate tax rate.

However, corporate taxation is more complex and time-consuming than sole proprietorship taxation, and saving a few thousand dollars might not be worth all the extra hassle. So, before incorporating your sole proprietorship to cut your tax bills, properly analyze your pros and cons.

How Can Deskera Help You with US Sole Proprietorship Taxes?

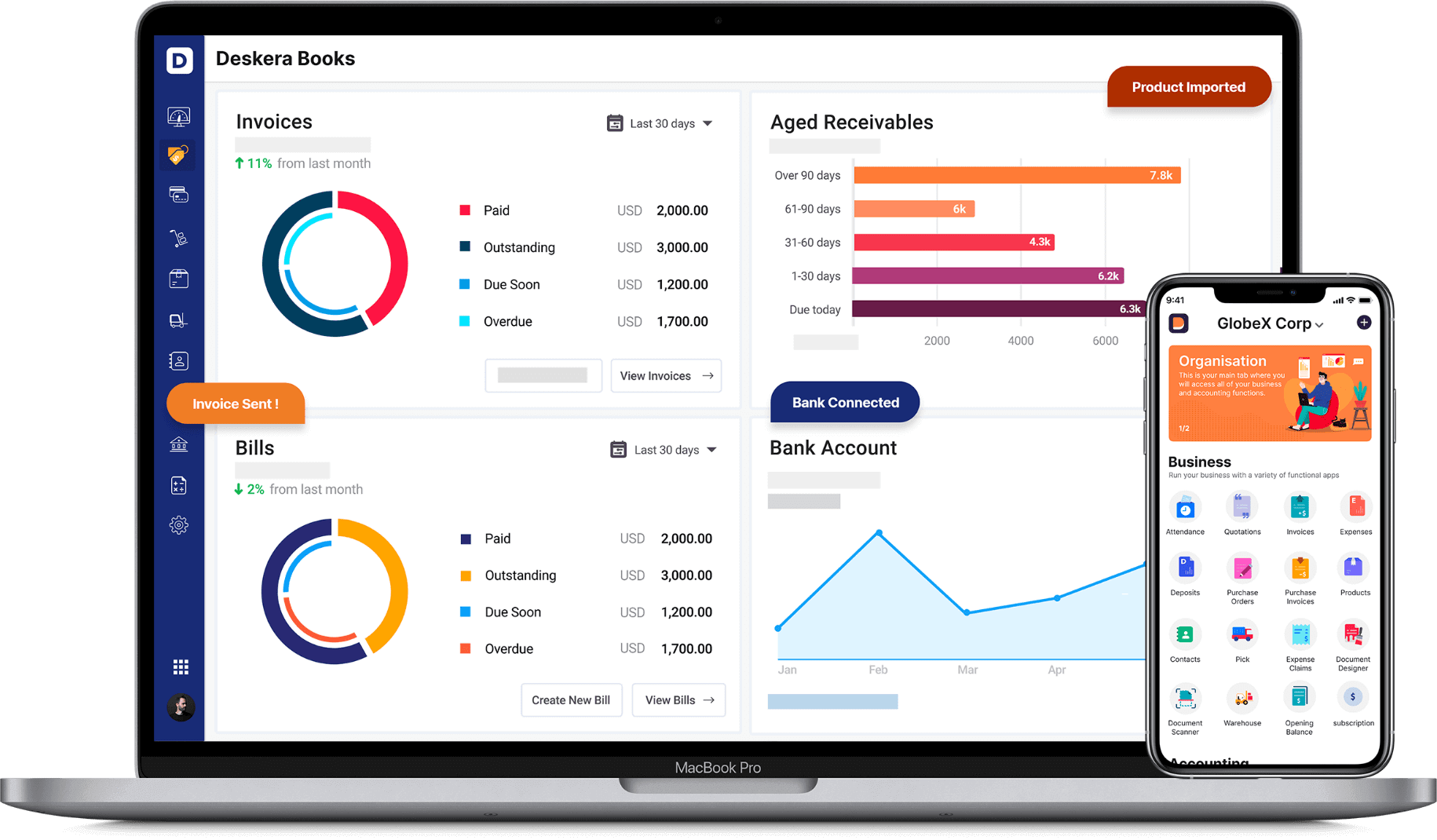

Deskera Books is an online accounting, invoicing, and inventory management software that is designed with the sole purpose of making your life easier. It is a one-stop solution that caters to all your business needs like creating invoices, tracking expenses, getting insights through financial KPIs, creating financial reports and financial statements, and so much more.

This platform works exceptionally well for all the small businesses that are being set up or need some help, especially in accounting. Whether it is recording your operating income, account payable, account receivable, or even returns on investments, or it is about updating your debit and credit notes, Deskera Books has made it all very easy as well as accessible.

In fact, the software comes updated with pre-configured accounting rules, invoice templates, tax codes, and a chart of accounts, to name a few, which makes it super easy for you to comply with sole proprietorship taxation. Deskera Books will also allow you to transfer your data from your previous accounting software by just updating the details on the spreadsheet available on Deskera Books.

Deskera Books also allows you to add your accountants to your Deskera Books accounts for free. You will just have to invite them. Once they are in, they would be able to check your financial reporting and statements like profit and loss statements, income statements, cash flow statements, balance sheets, and bank reconciliation statements. Your accountants will be able to help you navigate through all the taxation regimes in a faster and more efficient way through Deskera Books.

Key Takeaways

If you are a sole proprietor owning your own business, then your business, as well as your personal income, would be taxed together in accordance with the federal and state income tax brackets and tax rates.

Additionally, you might also be able to avail the 20% pass-through tax deduction, which will cut your effective sole proprietorship tax rate by 20%. However, as a sole proprietor, you would be required to pay several taxes (as applicable) like:

- Self-employment tax

- Estimated taxes

- Property taxes

- State sales, excise, and franchise tax

This brings us to the several advantages that you would have as a sole proprietor:

- It is the simplest and least expensive business structure to establish with limited legal costs for getting the necessary licenses and permits.

- You would have complete control over all business operations and decisions.

- Your business is not taxed separately, hence making it easier to fulfill all the tax reporting requirements of a sole proprietorship. Also, tax rates for this business structure are the lowest amongst all.

However, some of the disadvantages of being a sole proprietor are:

- There is no legal separation between you and your business, which makes you personally liable for all the debts and obligations incurred by your business. This also extends to any liabilities incurred as a result of employee actions.

- You would face challenges when raising money. You would not be able to stock in the business, hence limiting the investor opportunity, and banks would be hesitant in giving loans because of the additional risks in case of no repayment.

- While you get complete control, all the burdens of the business will also be imposed on you.

One of the best ways to ensure that you are complying with US sole proprietorship taxes is by keeping your business accounts and accounting separate from your personal accounts and accounting. Your records should be accurate and updated on a real-time basis, and one of the best ways to do so is through software like Deskera Books.

Related Articles