As of April 4,2021 Bank of America is the only enormous bank that has been taking and handling PPP applications and announced taking 85,000 applications on one day alone, containing loan sums adding up to $22 billion.

Some small business owners are finishing their Paycheck Protection Program (PPP) loan applications and are running into common challenges. The immediate challenge presently rotates around two issues: First, how to get the loan application submitted?

Secondly, how to accurately calculate the loan sum on the application? Most banks, large and small are working with their current business-banking clients first. This puts many businesses who just use one bank helpless before that one bank. Assuming you're new to the PPP loan and how it very well may be utilized and forgiven, we will cover all these concerns in this article.

- What is PPP?

- Calculating the maximum amount that can be borrowed

- Which payroll costs are eligible for PPP?

- Eligibility

- Allowable use of loan proceeds

- Why accurate PPP application is important?

- PPP loan forgiveness

What is PPP?

The Paycheck Protection Program (PPP) is a $953-billion business loan program laid out by the United States central government in 2020 through the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to help specific organizations, independently employed workers, sole proprietors, certain not-for-profit associations, and tribal organizations keep paying their laborers.

As a general rule, you can borrow up to 2.5x your average monthly payroll, whereas accommodation and restaurant businesses with NAICS codes starting in 72 can get up to 3.5x. Still, SBA has quite certain requirements regarding what can and not be considered for these expenses.

Whenever you apply for PPP, it is your obligation to decide your loan amount as precisely as could be expected.

The Paycheck Protection Program permits businesses to apply for low-interest private loans to pay for their finance and certain different expenses. At times, the applicant might get a second draw ordinarily equivalent to the first. The advance returns may be used to deal with payroll costs, rent, interest, and utilities.

The loan might be somewhat or completely forgiven on the off chance that the business keeps its worker counts and worker wages stable. The program is executed by the U.S. Small Business Administration. The cutoff time to apply for a PPP loan was at first June 30, 2020, and was subsequently reached out to August 8. The Paycheck Protection Program was reopened on January 11, 2021.

The Paycheck Protection Program (PPP) has demonstrated to be the most popular COVID help measure for small businesses: an up-to $2 million forgivable loan intended to keep workers on the payroll.

A few financial experts have observed that the PPP didn't save as many jobs as indicated and supported an excessive number of organizations that were not in danger of going under. They noticed that different projects, like unemployment protection, aid to state and local governments, and food assistance, would have been more effective at fortifying the economy. Rivals to this view note that the PPP worked well to forestall business closures and can't be estimated on the number of jobs saved alone.

Calculating the maximum amount that can be borrowed

PPP loans are determined utilizing the normal month-to-month cost of the compensations of you and your workers. On the off chance that you're a sole proprietor or independently employed and record a Schedule C, your PPP loan is determined in light of your business's gross profit or gross pay.

The following approach, which is one of the methods contained in the CARES Act, will be generally valuable for some applicants.

Step 1: Aggregate payroll costs from the last year for workers whose principal place of residence is the United States.

Step 2: Subtract any compensation paid to a worker more than a yearly compensation of $100,000 and add any amount paid to a self-employed entity or sole proprietor in an overabundance of $100,000 each year.

Step 3: Calculate average monthly payroll costs by dividing the sum from Step 2 by 12.

Step 4: Multiply the average monthly payroll costs from Step 3 by 2.5.

Step 5: Add the outstanding amount of an Economic Injury Disaster Loan EIDL made between January 31, 2020, and April 3, 2020, lesser than any "advance" under an EIDL COVID-19 loan since it doesn't need to be repaid.

Your compensation as an owner is characterized by the manner in which your business is taxed. On the off chance that you are taxed as an LLC, your compensation is straightforwardly connected to your business' profit and is the sum you paid self-employment tax on in 2019 or 2020.

Assuming you are taxed as an enterprise, your compensation is subject to running payroll for yourself-meaning you should be remitting government and state finance taxes. Organizations paying owners through owner proceeds will not fit the bill for the PPP.

The loan calculation itself expects you to utilize your yearly compensation and the yearly compensation of any W2 worker whose place of residence is in the United States.

Assuming you have workers and pay yourself compensation as well, you ought to have the option to download a payroll report through your finance supplier. Many payroll suppliers are in any event, offering PPP reports that let you know all that you really want to know for your loan application. Here is an example below which illustrates this method

Example: Note: No employees make more than $100,000

Annual payroll: $240,000

Then, the Average monthly payroll: $20,000

Multiply by 2.5 = $50,000

Hence, Maximum loan amount= $50,000

Different calculation methods

Method 1: C-Corporations, S-Corporations, and Non-Profits

Step 1: Aggregate payroll costs from the last year for workers whose principal place of residence in the United States.

Step 2: Subtract any compensation paid to a worker more than a yearly compensation of $100,000 and additionally any amount paid to a self-employed entity or sole proprietor in overabundance of $100,000 each year.

Step 3: Calculate average monthly payroll costs by dividing the sum from Step 2 by 12.

Step 4: Multiply the average monthly payroll costs from Step 3 by 2.5.

Assuming this is your second PPP loan and your business is allocated a NAICS code starting with 72, this is mentioned in box B of the 1120-S tax form or Schedule K Box of the 1120 tax form can multiply by 3.5 rather than 2.5.

Method 2: Sole Proprietors and other businesses reporting on Schedule C – No Employees

Step1: Find your 2019 or 2020 IRS Form 1040 Schedule C gross receipts amount, this is Line 7 of Schedule C.

- If your Schedule C Line 7 is more than $100,000, cap it at $100,000 to finish the calculation.

- If your Schedule C Line 7 is zero or a net loss, you are not qualified for a PPP

Step 2: Calculate the average monthly net profit sum divide the sum from Step 1 by 12

Step 3: Multiply the average monthly net profit amount from Step 2 by 2.5 If this is

your second PPP loan and your business is allocated a NAICS code starting with 72, this is mentioned in box B on the Schedule C, you can multiply by 3.5 rather than 2.5

Method 3: Sole Proprietors and other businesses reporting on Schedule C – With Employees

Step 1: Compute 2019 or 2020 payroll, involving the same year for all items

- Your 2019 or 2020 Form 1040 Schedule C Line 7 minus lines 14, 19, and 26

- 2019 or 2020 gross wages and tips paid to your workers

- 2019 or 2020 employer contributions

Step 2: Calculate the average monthly payroll amount divide the sum from Step 1 by 12

Step 3: Multiply the average monthly payroll amount from Step 2 by 2.5. Assuming it is

your second PPP loan and your business is relegated a NAICS code starting

with 72, this is Mentioned in box B on the Schedule C, you can multiply by 3.5 rather than 2.5

Method 4: Partnerships and other businesses reporting on Form 1065

Step 1: Compute 2019 or 2020 payroll, involving the same year for all items by adding the following:

- Net earnings from self-employment of individual general partners in 2019 or 2020. This is taken from Box 14 and of the 1065 K-1 statement. This is diminished by section 179 cost allowance claimed, unreimbursed partnership expenses claimed, and depletion claimed on oil and gas properties, multiplied by 0.9235. The net earnings from self-employment are covered at $100,000 per partner.

- Consolidate payroll costs from 2019 or 2020 for all workers whose principal place of residence is in the United States. See our Payroll Costs Summary decide this

- Take away any compensation paid to a worker in excess of $100,000. See Payroll Costs Summary for a clarification.

Step 2: Calculate the average month-to-month net profit amount, divide the sum from Step 1 by 12

Step 3: Multiply the average month-to-month net profit sum from Step 2 by 2.5. On the off chance that this is your second PPP loan and your business is assigned a NAICS code starting with 72, this is mentioned in box C on 1065 can increase by 3.5 rather than 2.5

Method 5: Farmers and Ranchers – No Employees

Step 1: Find your 2019 or 2020 IRS Form 1040 Schedule F line 9 gross pay, on the off chance that you are utilizing 2020 and you have not yet recorded a 2020 return, fill in Schedule F and compute the value. In the event that this sum is more than $100,000, decrease it to $100,000. Assuming this sum is zero or less, you are not qualified for a PPP loan.

Step 2: Divide the sum from Step 1 by 12

Step 3: Multiply the average monthly payroll costs from Step 3 by 2.5

Method 6: Farmers and Ranchers – With Employees

Step 1: Compute 2019 or 2020 finance involving the same year for all items by adding the following:

- The difference between your 2019 or 2020 Form 1040 Schedule C line 9 gross pay sum and the amount of Schedule F lines 15, 22, 23, and 37, up to $100,000 on an annualized premise

- 2019 or 2020 gross wages and tips paid to your workers

- 2019 or 2020 employers contributions

Step 2: Calculate the average monthly payroll amount divide the sum from Step 1 by 12

Step 3: Multiply the average monthly net profit sum from Step 2 by 2.5

Method 7 - Seasonal Businesses

Step 1: Combine payroll costs for the time period noted above for all workers whose place of residence is in the United States. See Payroll Costs Summary which distinguishes what is an eligible payroll cost.

Step 2: Divide the outcome from Steps 1 by 3 to get your average monthly payroll cost

Step 3: Multiply the average monthly payroll costs from Step 3 by 2.5. In the event that this is your second PPP loan and your business is relegated a NAICS code starting with 72 can multiply by 3.5 rather than 2.5

Which payroll costs are eligible for PPP?

On the off chance that you maintain a business with workers, you'll have to decide your eligible payroll costs to compute your PPP loan sum. Essential subtleties are given in the directions to every strategy; here, we delve somewhat more profound into what you can include. As indicated by PPP rules and guidelines, you might utilize either schedule year 2019 or 2020 data to work out your payroll.

Most third-party payroll processing organizations offer elements that permit you to handily pull finance reports that can be utilized for your PPP application. Check with your supplier to see what tools are accessible.

Payroll costs comprise of pay to workers place of residence in the United States as pay, wages, commissions, or comparative remuneration; or comparative pay. You can acquire these figures from any of the following sources:

- Annual payroll from finance processor records

- IRS Form 940- Annual payroll is displayed in Box #3 in this report

- IRS Form 941- Annual payroll is evaluated by adding Line 5c-Column 1 for each quarter (Q1-Q4) to decide the yearly payroll cost

- State quarterly wage unemployment insurance tax filing forms from each quarter

- For a seasonal business, a payroll report for any 12-week time frame chosen by the seasonal employer starting February 15, 2019, and finishing February 15, 2020

- Cash tips in light of business records of past tips or on the other hand, on the off chance that you don't have these records, a sensible, good faith estimate of such tips.

- Payment for parental, family, medical, or sick leave, vacation, and allowance for separation or dismissal, You can get this data from payroll processor records

- Employee advantages, for example, group medical services or group disaster protection, disability, vision, or dental insurance (including premiums), and retirement.

You can get these figures from these sources:

- Payroll processor records

- Account statements

- Invoices

In the event that you are a Schedule C or Schedule F organization, if it's not too much trouble, reference your loan calculation method as the standards are method-specific·

In the PPP Loan Calculator, you’ll see line items for each of these payroll costs; simply enter Once you know your total annual payroll costs, you’ll simply divide that number by 12 to calculate your average monthly payroll costs. Here’s an example:

Eligibility

To be qualified for the Paycheck Protection Program, a candidate should be a small business, sole proprietor, independent contractor, self-employed person, 501(c)(3) not-for-profit association, 501(c)(19) veterans association, or a tribal business.

Candidates who work as a sole proprietorship, a self-employed entity, or an eligible self-employed individual probably have been in procedure. Different sorts of candidates more likely than not been in procedure on February 15, 2020, and should have either had paid representatives or paid independent contractors. The candidate and its affiliates should likewise:

- Have 500 or fewer workers around the world, including its U.S. furthermore foreign subsidiaries; or

- Meet the Small Business Administration's industry size standards based on the average number of workers, or on the other hand

- Have a substantial net worth that didn't surpass $15 million on March 27, 2020, and an average net gain that didn't surpass $5 million for the two full monetary years prior to the date of the PPP application.

The candidate should be situated in the United States or its possessions. The candidate's primary activities should be situated in the United States or its possessions or, then again, the candidate's business should make a critical contribution to the economy of the United States. A candidate is ineligible for a PPP loan if:

- It involved with any activity that is unlawful under government, state, or local regulation; or

- It is a household employer, for example, an individual utilizing caretakers, maids, or other household workers; or

- It is a passive business, for example, flexible investments or a private equity firm; it is in bankruptcy proceedings at the time of application or before the loan proceeds are disbursed; or

- It is a public hospital that gets half or a greater amount of its funding from state-or local government sources, except Medicaid; or

- A owner of 20% or a greater amount of the business is imprisoned; or

- A owner of 20% or a greater amount of the business is by and by dependent upon a prosecution, criminal data, arraignment, or different means by which formal criminal charges for criminal offenses are brought in any jurisdiction; or has been sentenced for a crime within the last year; or

- A owner of 20% or a greater amount of the business is on one or the other probation or parole, which started within the most recent five years for a crime including misrepresentation, pay off, theft, or a false statement in a loan application or an application for government monetary help, and inside the most recent one year for different lawful offenses; or

- The candidate, the business owners, or any business possessed or managed by the candidate or the business' owners have at any point gotten a direct or ensured loan from any bureaucratic organization that is right now delinquent or has defaulted within the most recent seven years and made a loss to the central government; or

- The business is possessed entirely or partially by an undocumented outsider. A candidate isn't expected to show that it can't find credit somewhere else, yet it is expected to ensure, with honest intentions, that current economic uncertainty makes this loan request important to help the continuous operations of the candidate.

Every business might get just a single PPP loan.

Allowable use of loan proceeds

PPP loan proceeds may commonly be utilized for payroll costs. Payroll costs incorporate gross compensation and wages, tips, holiday pay, furlough pay, severance pay, vacation leave, sick leave, bonuses, and other pay paid to workers, up to $46,154 per worker.

Payroll costs likewise incorporate the business' expense for medical coverage benefits for its workers and retirement benefits for its workers, neither of which is counted against the $46,154 limit per worker. Employer-paid state taxes assessed on worker pay, for example, state unemployment tax, are permissible finance costs.

Emergency Paid Sick Leave and Emergency Family Medical Leave, the employer's portion of government-backed retirement and Medicare expenses, and federal unemployment should be excluded from payroll costs.

On account of an independent contractor, sole proprietor, or independently employed individual, admissible payroll costs incorporate proprietor remuneration replacement, up to 15.38% of their self-employment profit, up to $20,833. Medical coverage benefits and retirement benefits for a proprietor of the business are not suitable payroll costs.

PPP loan returns may likewise be utilized for certain non-payroll costs. Allowable non-payroll costs incorporate business payments of home loan interest, other interest, lease, and utilities, like power, gas, water, phone, internet, and transportation utility expenses assessed by state and local legislatures.

PPP loan proceeds can't be utilized to repay outside self-employed entities that offer types of services to the business, nor to remunerate workers whose main living place isn't in the United States.

Assuming that the business works globally, PPP loan proceeds should just be utilized to support its activities in the United States and its possessions.

Why accurate PPP application is important?

Ensuring your profit is accounted for appropriately will augment the loan amount you are qualified for. Also, assuming the numbers you give your bank and the SBA are erroneous, you will run into issues getting your loan forgiven. In the event that you give monetary data, you're not positive about, you free your business up to penalties that incorporate an audit, or potential fines and prison time.

To give you the certainty your application numbers are right, you really need to have a solid accounting setup. Precise and cutting-edge books will permit you to appropriately finish up your Schedule C.

New application forms were released on March 3, 2021

A great deal has changed with regard to PPP loan necessities. To get the subtleties on eligibility, the covered period, tax-deductibility, and how to apply for forgiveness, see this complete aide on PPP round 2. Be that as it may, we'll give you the speedy variant beneath:

There are eight versions of the PPP first-draw application form and three versions of the second-draw form. It's ideal to utilize the most recent forms, which is what we have connected in the pointers beneath:

- First-draw PPP borrowers, those getting a PPP loan for the first time who don't document Form 1040 Schedule C should utilize this form.

- Second-draw PPP borrowers, those getting a second PPP loan who don't document Form 1040 Schedule C should utilize this form.

- First-draw PPP borrowers, those getting a PPP loan for the first time who do record Form 1040 Schedule C and choose to utilize gross pay to make the loan maximum calculation should utilize this form.

- Second-draw PPP borrowers, those getting a second PPP loan who do record Form 1040 Schedule C and choose to utilize gross pay to make the loan maximum calculation should utilize this form.

Is PPP loan first-come, first-served basis?

In their final rule, the SBA responded to various inquiries concerning the PPP loan with specific responses and instances. One inquiry responded in their final rule and direction on April 4 was amazingly short: "Is the PPP first-come, first-served basis?" The truth of limited funds has some small-business owners asking their banks to get their applications ready for action.

There's a potential situation that Bank of America and the local area banks could guarantee all of the $350 billion available as the other enormous banks keep on postponing in getting their applications fully operational. A portion of the bigger banks, and their small business clients, might be forgotten about assuming they're last to get their applications ready for action.

Secretary Mnuchin was interviewed by journalists concerning whether the $350 billion was sufficient and reacted that assuming the funds run out that they'd return to Congress to demand more. President Trump repeated that message and said that assuming the funds run out they would "right away" demand more from Congress.

The drive has bipartisan support, yet it's disturbing for some small business entities who are now anxious to have to depend on a second bill and funding measure to permit them to enjoy this program.

Who qualifies for a second-draw loan?

Assuming you're keen on getting a second PPP loan, it's ideal to make sure that the PPP the guide we referenced above for every one of the subtleties however the abbreviated form is, the following organizations are qualified:

- The people who have under 300 full-time, part-time, or seasonal workers

- The people who have utilized or allocated everything of the primary draw PPP loan

- Organizations that can show they have encountered a revenue reduction of no less than 25%

Covered period

Beforehand, borrowers were expected to choose either an 8-week or 24-week covered period. Presently, new borrowers might choose any period somewhere in the range of 8 and 24 weeks as their covered period. On the off chance that you have a current PPP loan from the first round, your covered period will remain something similar.

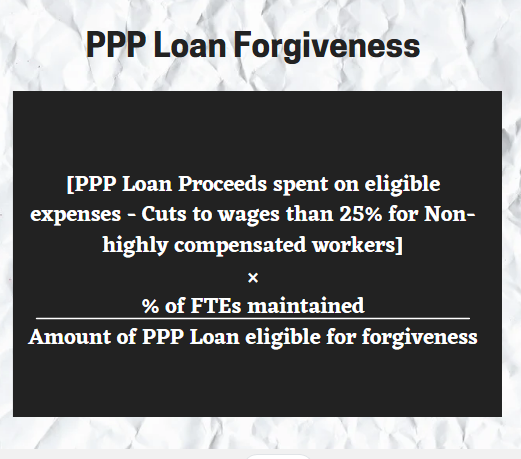

PPP loan forgiveness

Borrowers might be Eligible for Paycheck Protection Program (PPP) loan forgiveness. Borrowers with loans under $150,000 will have a new, one-page application for forgiveness. Borrowers won't be expected to submit documentation and, all things being equal, will be approached to affirm the number of workers that were Held because of their PPP loan, the assessed sum spent on payroll costs, and the complete loan value.

Tax-deductibility of PPP forgivable expenses

The new bill explains that expenses paid for utilizing PPP money are tax-deductible, and the loan isn't considered as pay, so it won't be taxed. This applies to current and future loans.

First Draw PPP Loan forgiveness terms

First Draw PPP loans made to qualified borrowers meet all requirements for full loan forgiveness if during the 8-to 24-week covered period following loan payment:

- Employee and remuneration levels are kept up with, the loan proceeds are spent on payroll costs and other qualified costs, and

- At least 60% of the returns are spent on payroll costs.

Second Draw PPP Loan forgiveness terms

Second Draw PPP loans made to qualified borrowers fit the bill for full loan forgiveness if during the 8-to 24-week covered period following loan payment:

- Employee and pay levels are kept up within a similar way as expected for the First Draw PPP loan,

- The loan proceeds are spent on finance costs and other qualified costs, and

- At least 60% of the returns are spent on payroll costs.

PPP Schedule A Worksheet Employee Information

To finish up the application, let us take a look at the PPP Schedule A Worksheet now on page 4 of the application. You'll have to work out data about workers' hours and wages to plug that data back into the application.

Table 1: List workers who:

- Were employed by the Borrower anytime during the covered period whose place of is in the United States, and

- Received compensation from the Borrower at an annualized rate of not less than or equivalent to $100,000 for all payroll intervals or were not utilized by the Borrower

Table 2: List workers who:

- Were utilized by the borrower anytime during the covered period whose place of residence is in the United States, and

- Received payment from the Borrower at an annualized rate of more than $100,000 for any payroll interval.

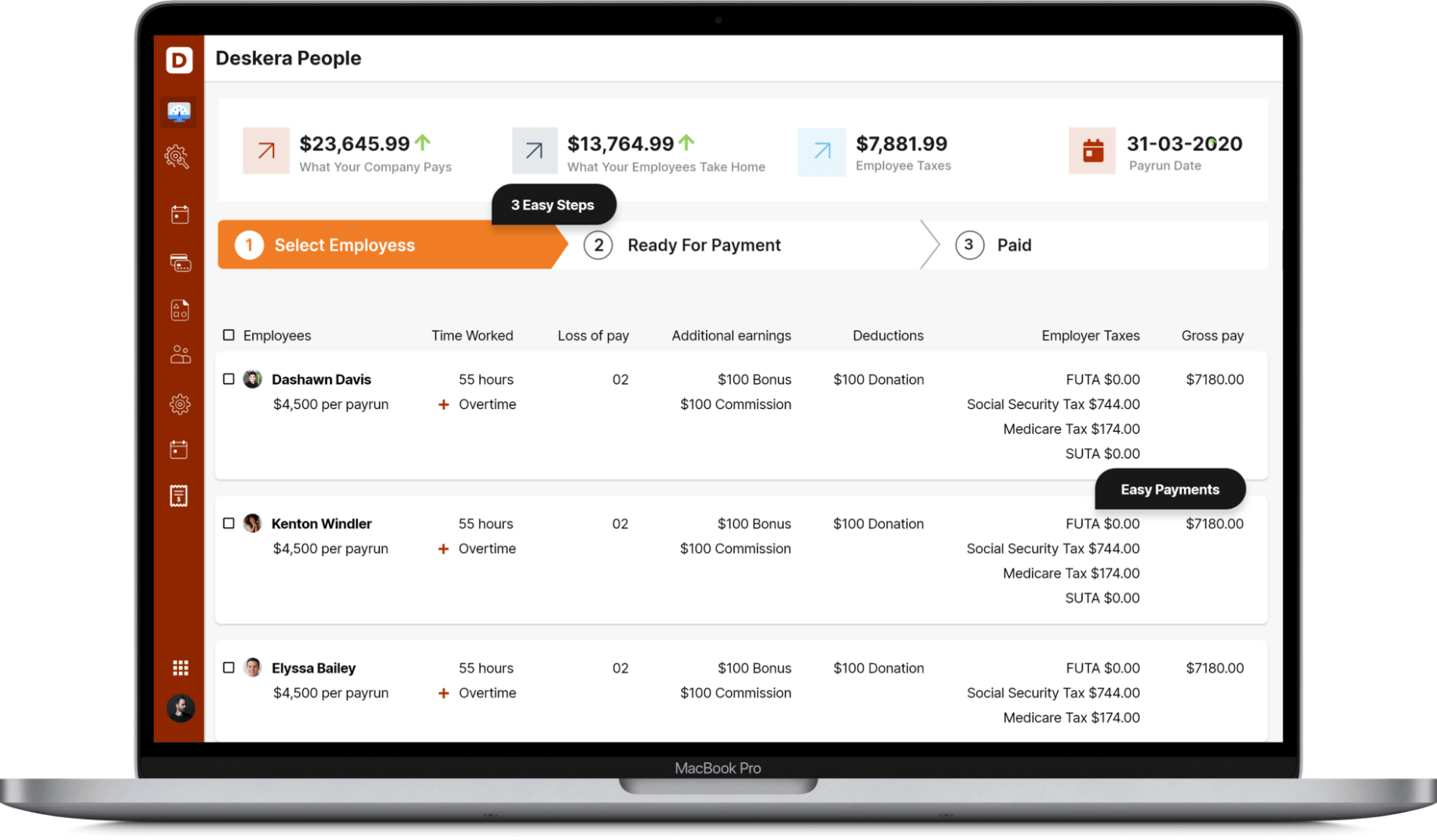

How Can Deskera Help you?

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions.

Key takeaways

- Payroll costs incorporate compensation, pay, commission, and tips, as well as medical, vacation, parental and sick pay. It likewise incorporates payment for group medical services benefits, including insurance payments paid.

- All first-draw borrowers can get 2.5 times payroll costs; most second-draw borrowers can likewise borrow 2.5 times payroll costs. Just a little fragment of second-draw borrowers will be qualified to get 3.5 times payroll costs.

- Another standard empowers self-employed borrowers who finish up Form 1040, Schedule C to compute the PPP loan sum in view of either net pay or net profit. The reason for this change was to assist independently employed people with getting bigger PPP loans.

Related Articles