Do you know that around 93% of the small businesses in the USA have benefited from a stimulus package? This particular package was signed by the U.S. Federal Government into law and is regarded as one of the most successful packages for small businesses.

This stimulus package is known as the Paycheck Protection program, a loan program to provide assistance with cash flow and operations for the small businesses running in the U.S.

This article will cover everything about the Paycheck Protection program, starting from the eligibility to the final loan process.

The article covers the following:

• What is a Paycheck Protection Program (PPP)?

• What is the PPP loan for businesses in the U.S.?

• Who all are eligible for the PPP loan?

• What are the different uses and purposes of PPP loans?

• What's the concept of payroll Expenses in the PPP program?

• How can one apply for the PPP loan?

• How much loan can be granted through PPP Funding?

• What is the procedure for applying for a PPP loan Forgiveness?

• What's the effect of PPP loan Forgiveness for taxes?

• Specimen of PPP Application Form

What is a Paycheck Protection Program (PPP)?

The Paycheck Protection Program (PPP) is a crucial loan program originated from the Coronavirus Aid, Relief, and Economic Security (CARES) Act that allocates $349 billion for American small businesses.

With the help of PPP, the government assists American small businesses with loans to support payroll, certain expenses, and maintaining the cash flow statement.

The government has a track record of dispersing 100 percent federally guaranteed loans back by the Small Business Administration (SBA).

In addition to the PPP, there is a governing regulation under the Paycheck Protection Program Flexibility Act to allow for more time to spend the funds and make loan forgiveness easier.

What is the PPP loan for businesses in the U.S.?

The PPP loan is introduced explicitly for small businesses operating in the USA.

After the first introduction of the PPP loan, on December 27, 2020, the U.S. Federal government announced a second stimulus package as a top-up to the program with an additional $285 billion in funding and updating eligible expenses.

The businesses have the option to apply for two PPP loans if they used up their first PPP loan or have experienced a 25% over the more significant decrease in the revenue.

Let's take a look at the overview of the PPP loan program:

- The PPP loan program is eligible for all the small businesses running their operations in the USA.

- The PPP loan has a maturity rate of 2 years at an interest rate of 1%.

- The PPP loan covers expenses for 24 weeks starting from the loan of the disbursement date.

- The PPP loans have a time strength of five years.

- While applying for the PPP loan, there is no collateral or a personal guarantee.

- The PPP loan program is free without any fee.

- The PPP loan program can be forgiven for small businesses and turn into a non-taxable grant.

- The businesses do not need to make loan payments until their forgiveness application is being processed or ten months after the 24-week covered period ends.

Who are all eligible for the PPP loan?

As per the Paycheck Protection Program (PPP) and Small Business Administration (SBA) are concerned, the following are the groups of people and institutions eligible for the PPP loan:

- Sole proprietorship

- Independent contractors

- Self-employed individuals

The eligibility criteria for all three groups are as follows:

- In the case of a sole proprietorship, the proprietor needs to submit a schedule C from the tax return file showcasing the net profit earned from the sole proprietorship.

- In the case of independent contractors, the contractors need to submit form 1099-MISC in addition to Schedule C.

- In the case of self-employed individuals, the individuals need to submit a payroll tax filing reported to the Internal Revenue Services (IRS)

If the sole proprietor, contractor, or individual wants to apply for the second PPP loan, then there is one set of criteria that they need to fulfill.

They will be required to show a 25% or greater than 25% reduction in their revenues. This can be presented by comparing the revenue between the quarter of the current year with the quarter in the previous year.

For example, businesses can compare the quarter in 2020 with the same quarter in 2019.

Let's say the business recorded $40,000 of sales revenue in the second quarter of 2019. In this case, the business needs to record a $30,000 or fewer sales revenue in the quarter of 2020, such that it can become eligible for the 2nd PPP funding.

What are the different uses and purposes of PPP loans?

As per the primary purpose of a PPP loan, then at least 60% of the PPP loan should be used to fund the businesses' payroll and employee benefit costs.

However, the remaining 40% of the PPP loan can only be used for the following purposes:

- Payment of utilities

- Mortgage of interest payments

- Rent and lease payments

- Property damage caused due to public disturbances not covered by the insurance

- Operational expenses like software and accounting needs

- Worker protection funds

- Costs due to suppliers like the cost of goods sold

It is important to note that if the business utilizes the amount based on the guidelines mentioned above, the business can be eligible to receive 100 percent of the loan forgiveness; that will sooner or later be converted into a tax-free grant sooner or later.

While filing for the PPP loan, the businesses need to certify that they will appropriately spend the funds and bifurcate the 60:40 ratio.

If they don't spend the funds correctly, it might be declared as fraud and can be debarred from the entire program.

What's the concept of Payroll Expenses in the PPP program?

The Payroll Expenses in the PPP loan are the payroll costs that refer to the amount paid to each employee working in the small business.

Following are the brief inclusion of the payroll cost under the PPP program:

- Salary, wages, commission, tips, and bonuses to be paid to each employee. The amount is capped at $100,000 on an annual basis.

- The state and local taxes are assessed on the compensation to the employee.

- The employee benefit expenses include costs for vacation, family medical, or sick leave allowances.

- The payment required for the provision of the health care benefits, including the insurance premium of the employee

- The payment of any retirement benefit to be given to the employees

If in the case of a sole proprietor or independent contractor, the payroll costs include wages, commissions, income, or net earnings from self-employment capped at 100,000 dollars on an annual basis for each employee.

However, there are certain exemptions in which the payroll costs are not covered:

- The payments made to the independent contractors

- The S Corps and C Corps owners who aren't on payroll

- Fringe benefits like commuter benefits

- Any kind of petrol reimbursement

How can one apply for a PPP loan?

The application process for the PPP loan is based on meeting and verifying the requirements mentioned in the program.

The step-by-step procedure for the application of PPP loan are

Step 1: Verification

Step 2: Acknowledgement

Step 3: Financial Documentation

Step 1: Verification

As a part of the application process, there is a list of requirements that a small business is asked to verify, which are as follows:

- Verification of the current economic uncertainty that will make the loan necessary to support your ongoing operations

- Verify the declaration of funds to be used to retain the workers, maintain the payroll costs, and make mortgage and utility payments.

- Verification of the documentation that verifies the number of full-time equivalent employees working in your organization.

- Verification of the payroll and amounts of payroll cost covered mortgage interest payments, covered rent payments, and covered utilities for the 24 weeks after getting the loan.

Step 2: Acknowledgement

After the verification list, the business will get an acknowledgment box where they need to submit the acknowledgment clarifying that the lender can calculate the eligible loan amount based on the tax documents.

It is essential to know that the tax documents should be identical to those submitted to the IRS.

Step 3: Financial Documentation

The documentation phase is the most crucial process under applying for the PPP loan.

The businesses need to provide the payroll and bookkeeping records which acts as proof to their payroll expenses that include the following:

- Payroll tax filings

- Payroll tax forms from 2019 or 2020

- Form 1099-MISC records

- Payroll processor records

- Schedule C for a sole proprietorship

One thing to note is that the documentation process for businesses and self-employed individuals can differ from each other.

Let's take a look at brief:

- If the business has employees, then the easiest way to get their prices information is by downloading the payroll report provided by the payroll provider.

- If the entrepreneur runs more than one business, they need to get separate bookkeeping done for each business. These separate records can act as a benefit to prove the expenses for loan forgiveness.

- In the case of a self-employed individual, it is vital to get retroactive bookkeeping to calculate net profit. It will act according to schedule C that must be submitted during the PPP loan application process.

How much loan can be granted through PPP Funding?

The amount of loan granted through the PPP funding is based on the following:

- The maximum amount of PPP loan that one can receive is based on the monthly average payroll costs or one-year period before the application. Multiply it by 2.5, which can go up to a maximum of $2 million.

- The businesses belonging to the food and accommodation industries are eligible for 3.5 times the average variable cost and the maximum of $2 million.

- For seasonal employers, monthly average payroll costs are calculated based on the 12 weeks.

For example, February 15, 2019, and February 15, 2020.

What is the procedure if one wishes to apply for PPP loan Forgiveness?

As per the Paycheck Protection Program, businesses and individuals can apply for the forgiveness of the loan taken after the completion of 24 weeks from the loan signing date.

The PPP loan can only be forgiven in the following circumstances:

- The businesses used the loan proceeds to cover payroll and mortgage, interest, rent, and utility costs.

- The business maintains the employee and compensation levels.

Following is the step-by-step procedure for the application of PPP Loan Forgiveness:

Step 1: Record Maintenance of Expenses

Step 2: Application for Forgiveness of PPP Loan

Step 3: Final Decision

Step 1: Record Maintenance of Expenses

The business needs to maintain and keep records of accurate bookkeeping to prove the expenses during the loan period.

The details to which are as follows:

1. Payroll expenses

It includes salaries, wages, vacation, parental, family, medical and sick leaves with the cap of $ 100,000 annually

2. Rent

As per the lease agreement with effect before February 15, 2020

3. Utilities

As more extended services begin before February 15, 2020

4. Mortgage interest

As long as the mortgage value was signed before February 15, 2020

5. Operations expenditures

It includes any kind of software, cloud computing, or other resources and accounting needs used to operate the business

6. Property damage costs

It includes any kind of cost from damages due to public disturbances that are not covered in insurance occurring in 2020

7. Workman protection expenditures

It includes any kind of personal protection equipment or property improvement provided to workers' and compliance with March 1, 2020

It is important to note that the businesses need to spend 60% of the loan amount on the payroll in order to qualify for the forgiveness of the entire loan.

Step 2: Application for Forgiveness of PPP Loan

After meeting with 60% of funds and 24 weeks period criteria, the businesses can apply for forgiveness through the lender by online portals.

Step 3: Final Decision

Finally, once the lender has received the application, you will get to know the final decision within a matter of 60 days, starting from the date of application accepted by the lender.

What's the effect of PPP loan Forgiveness for taxes?

The PPP loan forgiveness has a direct effect on the tax filing process.

The forgiven PPP loan amount will not be considered part of taxable income for businesses and individuals.

If expenses are covered under the PPP loan, then the costs will be deductible under the Income Tax.

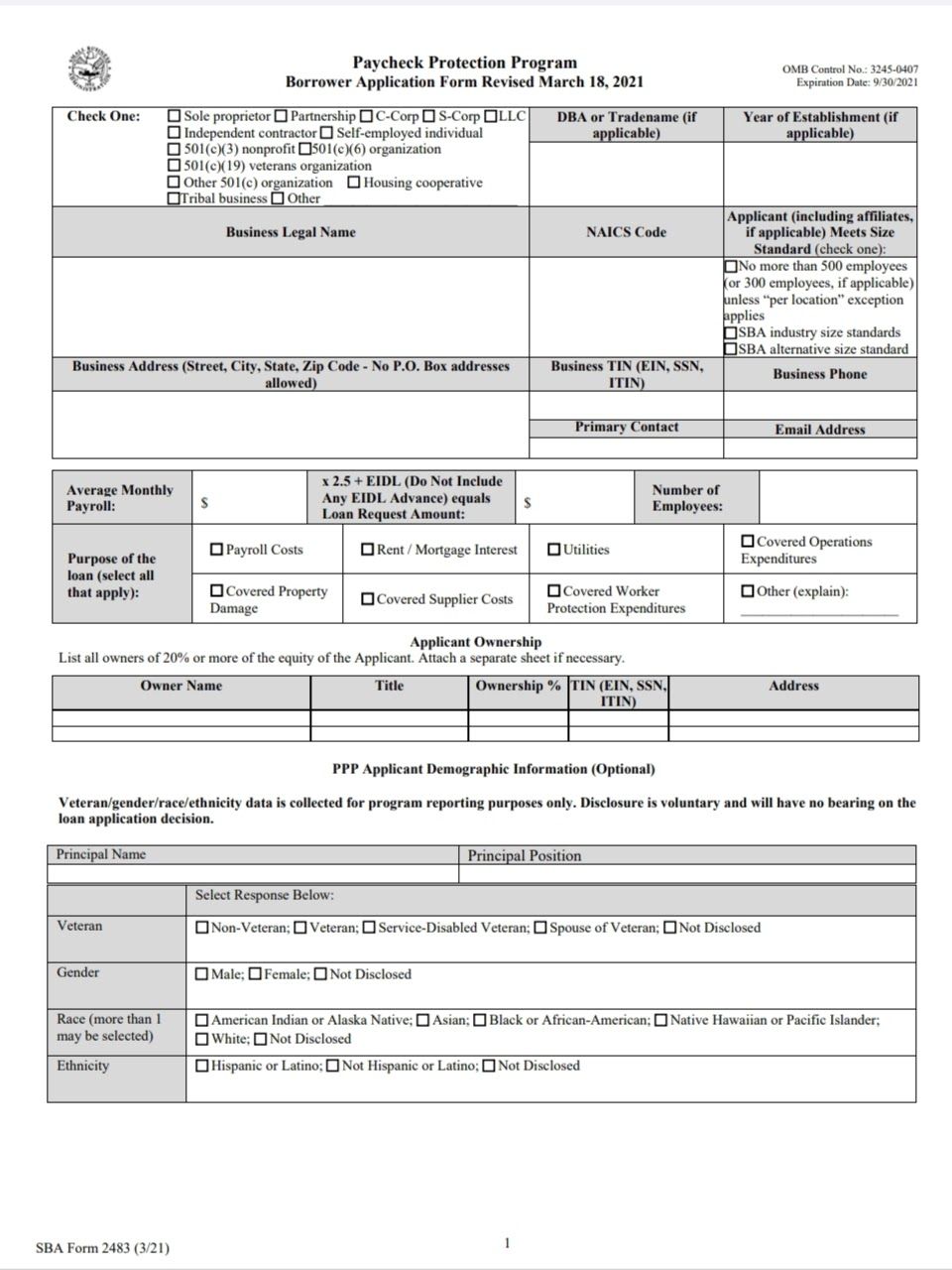

Specimen of PPP Application Form

The PPP Borrower application form is a 7-page document that includes the specifications and instructions required at the time of applying for the PPP loan.

Let's take a look at the set of pages in brief:

Page 1

Page one consists of the general information of the borrower applying for the PPP loanIt includes information related to trade name, year of establishment, legal business name, business address, business phone, email address, the purpose of the loan, applicant ownership, and other details.

Following is the specimen of page 1 of the PPP loan application form:

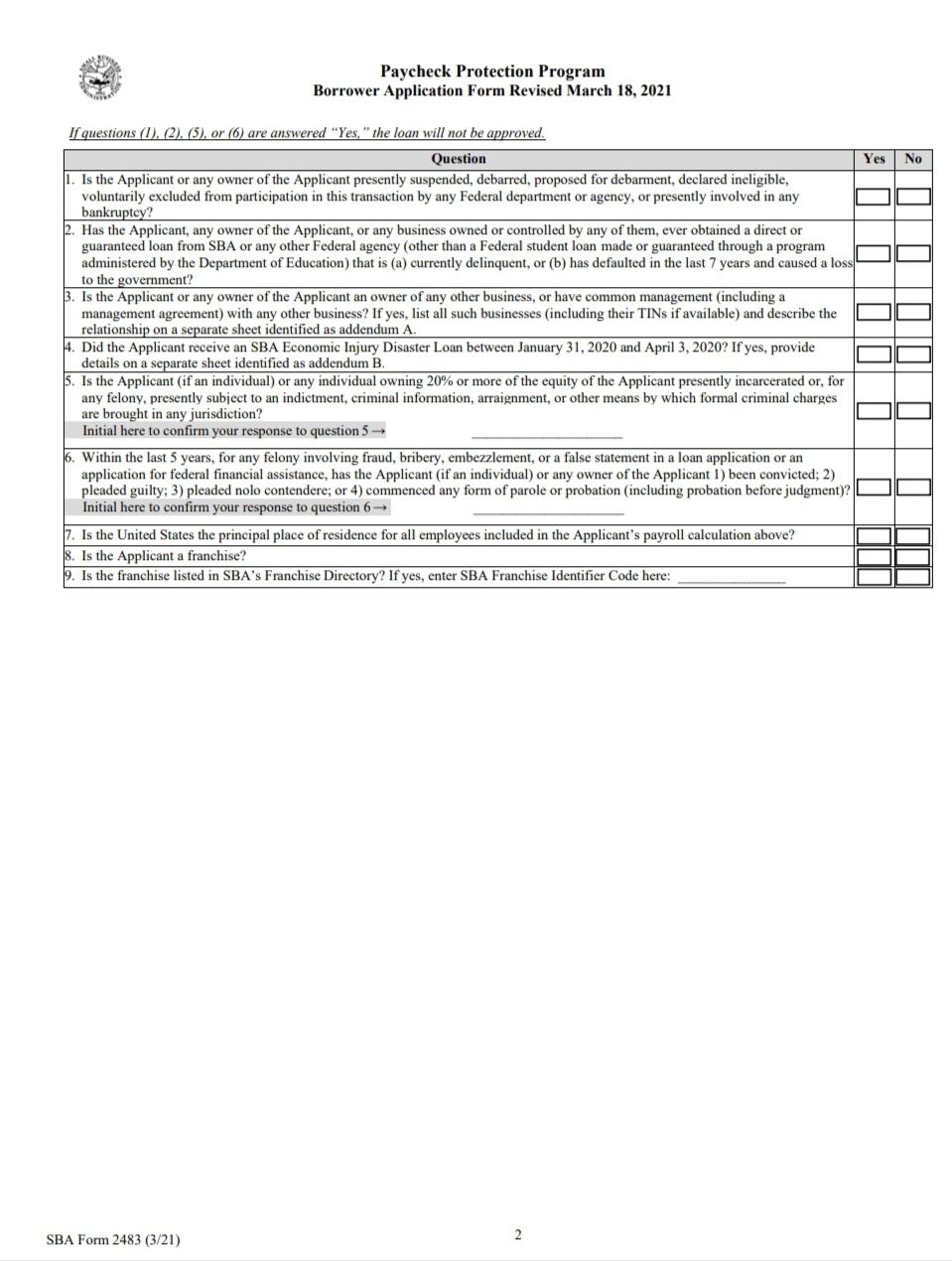

Page 2

The page consists of the Yes or No type of questions to be answered by the borrower.

The questions are generally based, and the instructions are mentioned at the start.

Following is the specimen of page 2 of the PPP loan application form:

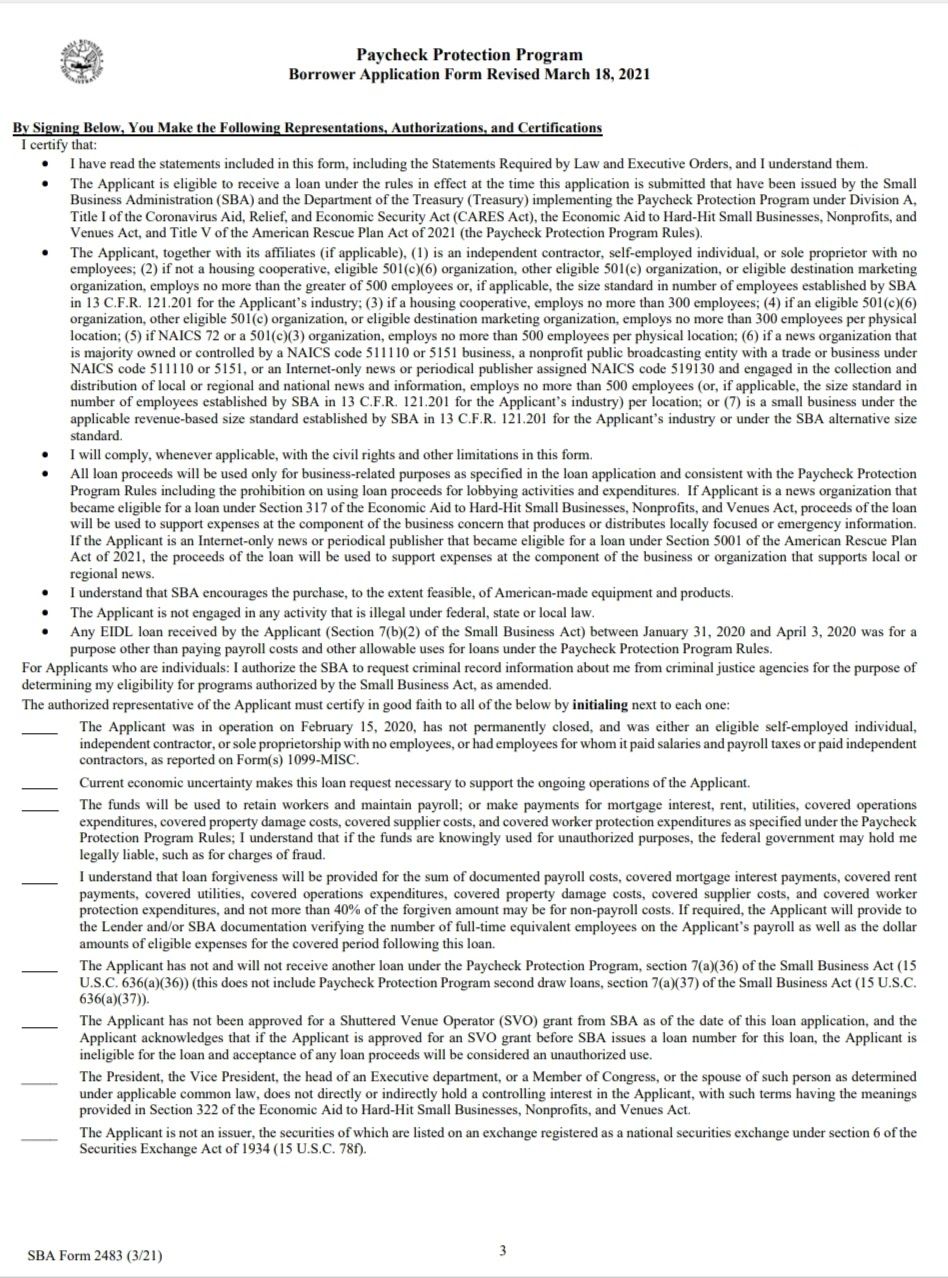

Page 3

Page 3 is the main acknowledgment document that needs to be submitted by the borrower.

It includes all the sets of representations, authorizations, and certifications required to be declared by the borrower.

Following is the specimen of page 3 of the PPP loan application form:

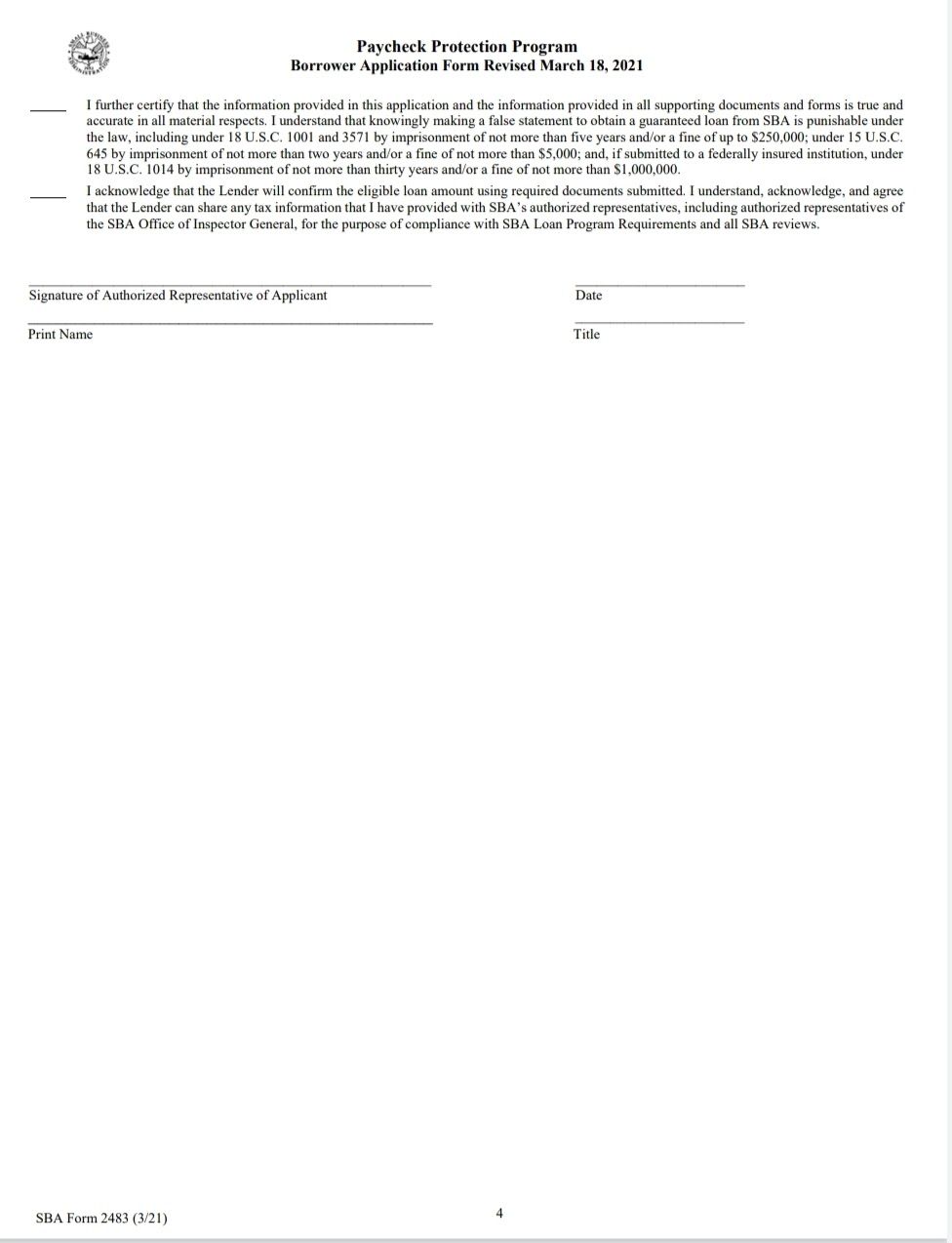

Page 4

The page is the extension of Page 3 that includes the final words of the acknowledgment. The borrower needs to put a tick mark beside every set of acknowledgments that will get evaluated by the lender.

After the final check, the borrower will sign the document along with the date and title mentioned.

Following is the specimen of page 4 of the PPP loan application form:

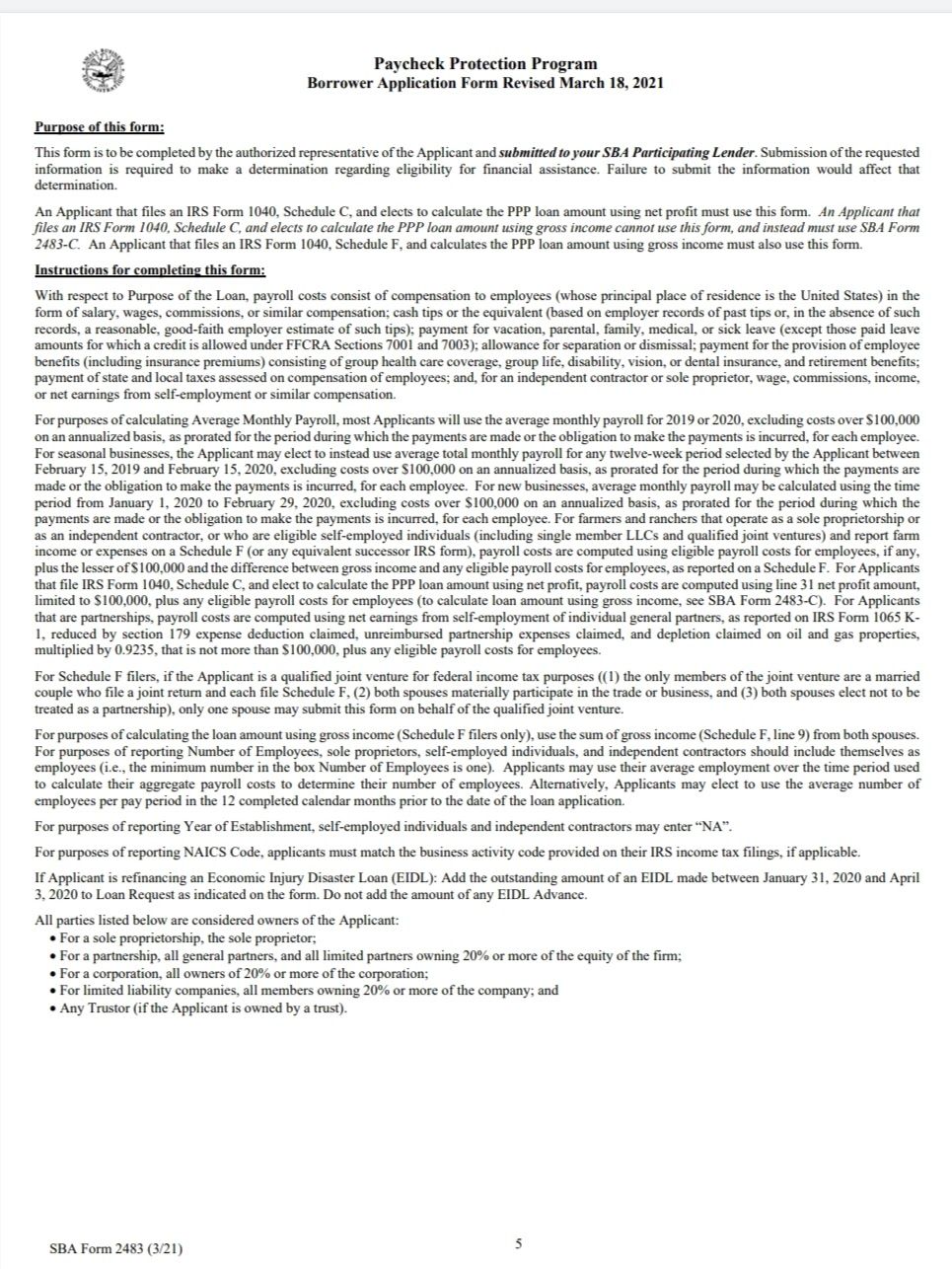

Page 5 to Page 7

Pages 5-7 share the purpose of the PPP loan form along with the list of instructions for completing the form.

It is advised to check out the instructions and details before filling out the application form.

The borrower is required to comply with a series of acts like the Paperwork Reduction Act, Privacy Act, Right to Financial Privacy Act, Freedom of Information Act, Equal Credit Opportunity Act, and others.

Following is the specimen of page 5 of the PPP loan application form:

Following is the specimen of page 6 of the PPP loan application form:

Following is the specimen of page 7 of the PPP loan application form:

How Deskera Can Assist You?

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

With over 800 million dispersed under the Paycheck Protection Program, it is definitely a rising opportunity for all businesses to benefit from the program.

This article covered everything about the PPP and related aspects of PPP loans, its application process, funding, and forgiveness of the loan amount.

Let's take a look at the key takeaways of the article:

- The Paycheck Protection Program (PPP) is a loan program originated from the Coronavirus Aid, Relief and Economic Security (CARES) to assist the American small business to support payroll expenses and maintain the cash flow statement.

- The PPP loan program is funded by the Small Business Administration and governed by the Paycheck Protection Program Flexibility Act.

- The eligibility criteria for the PPP loan are divided into three groups; sole proprietorship, independent creators, and self-employed individuals.

- The uses and purpose of the loan are divided as 60:40 ratio, where 60% is to be used for payroll and employee benefit expenses and the remaining 40% for payment of utilities, property damages, or operational expenses.

- The payroll costs under the PPP program include salaries, wages taxes, and retirement benefits provided to the employee and capped at $100,000 annually.

- The procedure to apply for the PPP loan is divided into three stages.

- The stages are categorized as verification, acknowledgment, and financial documentation.

- The amount of loan granted through the PPP funding is based on average payroll costs or one year period before the application.

- The business and individuals can apply for the forgiveness of the loan taken after the completion of 24 weeks from the loan signing date.

- There is a three-step process for applying for the forgiveness of the PPP loan.

- The process includes three stages; record maintenance of expenses, application, and final decision.

- The forgiven PPP loan account will not be considered part of taxable income for the business and individual.

- The PPP loan application form is a 7-page document that includes specifications instructions required at the time of applying for the PPP loan

Related Articles