Mr. Subramaniam Iyer who recently joined one of the industries in Karnataka wanted to know everything about the labour laws in Karnataka. He is appointed as an employer at one of the Industries in Bengaluru and wasn’t aware of the kind of records he needs to prepare or the labour laws in Karnataka that he should diligently follow for the benefit of his employees and to be compliant with the laws in the state. For people like him, this is a comprehensive guide to the labour laws in Karnataka.

There are not one, but many labour laws in Karnataka that the employers and employees working in Karnataka should be aware of. The list comprises major laws like the leave and Annual Holiday Law, The Karnataka Labour Welfare Fund Act, 1965, The Karnataka Payment of Wages Rules, 1963, The Karnataka Minimum Wages Rules, 1958, and the recent amendments in the labour laws in Karnataka.

Table of Contents

- About Karnataka

- Leave Rules For Karnataka as per the labour laws in Karnataka

- Karnataka Public Holidays List 2022 as per the Labour Laws in Karnataka are:

- Some of the most important Labour Laws in Karnataka

- Labour Department Act & Rules Labour Laws on Industrial Relations under the labour laws in Karnataka

- Karnataka Trade Unions Regulations, 1958 Labour Laws On Social Security under the labour laws in Karnataka

- The Karnataka Labour Welfare Fund Rules 1968 under the labour laws in Karnataka

- The Unorganised Workers Social Security Act 2008 ] Labour Laws On Wages under the labour laws in Karnataka

- Minimum Wages Act 1948 under the labour laws in Karnataka

- Labour Laws On Working Conditions under the labour laws in Karnataka

- Contract Labour (Regulation and Abolition) Act, 1970 under the labour laws in Karnataka

- The Karnataka Payment of Wages Rules, 1963 under the Labour Laws in Karnataka

- The Karnataka Labour Welfare Fund Act, 1965 (“KLWFA”) under the Labour Laws in Karnataka

- The Karnataka Minimum Wages Rules, 1958:

- Amendments in Labour Laws in Karnataka

- Conclusion

- Key Takeaways

About Karnataka

Karnataka is a state in southwestern India and is surrounded by the Arabian Sea to the west, Goa to the northwest, Maharashtra to the north, Andhra Pradesh to the east, Tamil Nadu to the southeast, and Kerala to the southwest. Bangalore is the capital of Karnataka in southern India. Due to its role as India's leading source of information technology, it is considered the "Silicon Valley of India".

Bangalore's economy accounts for over 87% contribution to the overall economy of the state of Karnataka and also accounts for 98% of the state's software exports. The creation and success of high-tech companies in Bangalore have led to the growth of information technology in India.

Leave Rules For Karnataka as per the labour laws in Karnataka

According to the Karnataka Shops & Establishments Act, the following leaves in a year will be sanctioned to all employees:

|

Item |

Qty |

Remarks |

|

Annual / Privileged / Earned Leave (AL/PL/EL) |

18 days |

|

|

Casual Leave (CL) |

NA |

|

|

Sick Leave (SL) |

12 days |

During the first 12 months & further continuous service |

|

Maximum AL/PL that can be carried forward |

30 days |

|

|

Working hours in a day |

9 |

|

|

Total hours in a week |

48 |

|

|

Rest Interval |

1 hour |

Rest after 5 hours of work |

Karnataka Public Holidays List 2022 as per the Labour Laws in Karnataka are:

|

Date |

Day |

Location |

|

Jan 1 |

Saturday |

New Year Day |

|

Jan 15 |

Saturday |

Makara Sankranti |

|

Jan 26 |

Wednesday |

Republic Day |

|

Mar 1 |

Tuesday |

Maha Sivarathri |

|

Mar 17 |

Thursday |

Holi |

|

Apr 2 |

Saturday |

Ugadi |

|

Apr 10 |

Sunday |

Sri Rama Navami |

|

Apr 14 |

Thursday |

Dr.B.R.Ambedkar's Birthday/Mahaveer Jayanthi/Souramana Ugadi |

|

Apr 15 |

Friday |

Good Friday |

|

May 3 |

Tuesday |

Basava Jayanthi/Khutba-e-Ramzan |

|

Jul 10 |

Sunday |

Bakrid(Eid-ul-Adha) |

|

Aug 5 |

Friday |

Varamahalakshmi Vratha |

|

Aug 9 |

Tuesday |

Last Day of Moharam |

|

Aug 15 |

Monday |

Independence Day |

|

Aug 19 |

Friday |

Sri Krishna Janmashtami |

|

Aug 31 |

Wednesday |

Varasidhi Vinayaka Vrata |

|

Sep 25 |

Sunday |

Mahalaya Amavasya |

|

Oct 2 |

Sunday |

Gandhi Jayanthi |

|

Oct 4 |

Tuesday |

Mahanavami/Ayudhapooja |

|

Oct 5 |

Wednesday |

Vijayadasami |

|

Oct 9 |

Sunday |

Eid Milad/Maharshi Valmiki Jayanthi |

|

Oct 24 |

Monday |

Naraka Chaturdashi |

|

Oct 26 |

Wednesday |

Balipadyami/Deepavali |

|

Nov 1 |

Tuesday |

Kannada Rajyothsava |

|

Nov 11 |

Friday |

Kanakadasa Jayanthi |

|

Dec 25 |

Sunday |

Christmas |

Some of the most important Labour Laws in Karnataka

The various labour laws in Karnataka, along with the compliances to be made by the employer have been detailed below.

Labour Department Act & Rules Labour Laws on Industrial Relations under the labour laws in Karnataka

- Industrial Disputes Act, 1947

- Industrial Employment (Standing Orders) Act, 1946

- Trade Unions Act, 1926

Karnataka Trade Unions Regulations, 1958 Labour Laws On Social Security under the labour laws in Karnataka

- Building and Other Construction Workers (Regulation of Employment and conditions of service) Act, 1996

- Building and Other Construction Workers Welfare Cess Act, 1996

- Karnataka Labour Welfare Fund Act, 1965

The Karnataka Labour Welfare Fund Rules 1968 under the labour laws in Karnataka

- Maternity Benefit Act, 1961

- Maternity Benefit (Karnataka) Rules 1966

- Payment of Gratuity Act, 1972

- Payment of Gratuity (Karnataka) Rules 1973

The Unorganised Workers Social Security Act 2008 ] Labour Laws On Wages under the labour laws in Karnataka

- Equal Remuneration Act, 1976

- The Karnataka Subsistence Allowance Act 1988

- The Karnataka Payment Of Subsistence Allowance Rules 2004

Minimum Wages Act 1948 under the labour laws in Karnataka

- Minimum Wages (Karnataka) rules, 1958

- Payment of Bonus Act, 1965

- Payment of Wages Act, 1936

Labour Laws On Working Conditions under the labour laws in Karnataka

- Beedi & Cigar Workers (Conditions of Employment) Act, 1966

- Beedi and Cigar Workers(Conditions of Employment) Rules-1969

- Child Labour (Prohibition and Regulation) Act, 1986

- Child Labour (Prohibition and Regulation)(Karnataka) Rules 1997

Contract Labour (Regulation and Abolition) Act, 1970 under the labour laws in Karnataka

- Inter-State Migrant Workmen (Regulation of Employment and conditions of service), Act, 1979

- Inter-State Migrant Workmen (Regulation of Employment and condition of service), Karnataka Rules, 1981

- Karnataka Industrial Establishments (National & festival holidays) Act, 1963

- Karnataka Industrial Establishments (National and festival holidays) Rules 1964

Karnataka Shops & Commercial Establishments Act, 1961 under the labour laws in Karnataka

- Karnataka Shops And Commercial Establishments Rules 1963

Motor Transport Workers Act, 1961 under the labour laws in Karnataka

- Motor Transport Workers (Karnataka) Rules 1964

Plantations Labour Act, 1951 under the labour laws in Karnataka

- Plantations Labour (Karnataka) Rules 1956

Sales Promotion Employees (Condition of services) Act, 1976 under the labour laws in Karnataka

- Working Journalists & Other News Paper Employees (condition of services) & Miscellaneous Provisions Act, 1955

The Karnataka Payment of Wages Rules, 1963 under the Labour Laws in Karnataka

The Karnataka Payment of Wages Rules, 1963 as specified under the Labour Laws in Karnataka applies to employees who earn wages by working in factories, industries, or other facilities and earn wages of up to Rs. 24,000 / -monthly.

- The Karnataka Payment of Wages Rules, 1963 ensures regular, and timely salary payments and prevents arbitrary deductions and fines. The employer is obliged to continue to pay the wages of all employees a monthly wage

- The salary period cannot exceed one month. Wages are paid to employees by the 10th of each month

- Upon termination of the employment relationship, the wages due to the employee must be paid two working days after the termination of the employment relationship

- If the closure of the provision leads to the termination of the employment relationship, the salary will be paid to the employee within the second day from the termination of the employment relationship

- The employer must ensure that the worker's wages are paid on the day of the week. The employer is entitled to allowable deductions from the employee's salary under the provisions of the labour laws in Karnataka and must avoid arbitrary and unauthorized deductions

- The employer is entitled to a fine if he abstains from the law. Employees should be allowed to be heard, as set out in the Principles of Natural Justice

- Employee fines cannot exceed 3% of pay during the pay period. This fund can only be used for purposes that can be approved by the established authorities. Under the Karnataka Payment of Wages Rules, 1963, employers must keep records of penalties, losses, or deductions for damages and deposits on Form 1, record wages on Form III and shall submit an annual report on Form IV at the end of each financial year

The Karnataka Labour Welfare Fund Act, 1965 (“KLWFA”) under the Labour Laws in Karnataka

As a crucial component of the labour laws in Karnataka, the Labour Welfare Fund law is a state law and is a fund administered by state authorities. Employers and employees donate to the Social Security Fund. This pension fund is intended to support the improvement of employees' working conditions and to guarantee their social security. KLWFA applies to organizations that employ or have employed more than 50 people in the past 12 business months. All employers and employees must donate to the fund.

Employees are required to donate Rs. 3. The employer must donate Rs. 6. per month.

Employer and employee contributions must be paid by the employer to the Board by January 15th of the following year. By the Karnataka Labour Welfare Fund Act, 1965 Act, employee contributions can be withheld in the form of wage deductions. Employers need to maintain a record of employees for whom the Karnataka Labour Welfare Fund Act, 1965 does not apply.

He must keep the wage records for these employees specified on Form A and the combined payroll and penalties on Form B. A copy of each extract from Form B must be sent to the Welfare Commissioner every year from the employer until or before January 31st.

The Karnataka Minimum Wages Rules, 1958:

The Minimum Wage Act of 1948 (the "MW Act") allows the Karnataka government to set minimum wages for employees who work in various scheduled jobs. The MW Act applies to all employers who employ one or more employees.

The MW Act requires all employers to pay a minimum wage set by the state government. Under the MW Act, employers are required to pay employees the minimum wage set by the central government at the time of notification. Overtime is paid if the worker works longer than normal working hours.

- If an employee works in different job categories with different wage rates, the employer must pay the employee the minimum wage indicated in the different categories

- According to the Karnataka Minimum Wages Rules, 1958, the pay period cannot exceed one month and for companies with fewer than 1000 employees and other companies, employees are paid before the 7th-day deadline and for the rest, the deadline is on the 10th day of the last day of the previous pay period

- In the event of termination of the employment relationship, these employees are entitled to remuneration within two working days from the date of termination of the employment relationship

- Notices in English and regional language indicating employee payment dates must be prominently displayed on the premises. The employer has the right to make allowable deductions from the employee's salary by the provisions of the Karnataka Minimum Wages Rules, 1958 Act

- The employer sets a weekly holiday as employees are supposed to work 6 days a week

- Working hours should be 9 hours a day, with a break of 30 minutes after every 5 hours. Overtime is paid to employees at double the normal wage

The employer must maintain the following records:

- Register of fines - Form I

- Register of deductions - Form II

- Register of returns - Form III

- Overtime register - Form IV

- Register of wages - Form V

- Wage slips provision to employees - Form VI

- Muster roll - Form VII.

According to a recent amendment in the labour laws in Karnataka, the Karnataka Labour Department has proposed revised rates of Minimum Wages in 8 Scheduled Employments which are:

- Automobile Engineering (Production, Assembling, Body Building, Servicing, and Repairing Works)

- Clay Pots, Ceramics Stoneware, and other Allied Industries

- Fish Catching, Fish Processing, Fish Peeling, Shrimp/Crab Processing, and Frog Leg Exporting Industry

- Foundry (including Machinery or Excluding Machine Shop)

- Industry

- Security Agencies (Office Staff & security Staff & Including Industries)

- Employment in cleaning Toilets, Bathrooms, Scavenging of Under Water Drains (Excluding Urban Local Bodies & Panchayat Raj Works)

- Urban Local Bodies, Town & Village Panchayats

- Veneer Industry Gazette Notification

Amendments in Labour Laws in Karnataka

1. License Extension under Karnataka Factory Rules

Government of Karnataka vide notification No: LD 40 KABANI 2018 (p-3) dated 07.03.2020 has amended Rule 5(2) of Karnataka Factories Rules,1969. As per the amended labour laws in Karnataka, the licensing renewal period has been increased to 10 years or more but not exceeding 15 years along with the payment of required fees under sub-rule (1) for each year.

2. Karnataka Shops and Establishments permitted to remain open 24x7 for the next 3 years as amended on 02 Jan 2021

Stores in Karnataka and businesses with more than 10 employees will be open 24/7 for 3 years from January 2, 2021.

3. Karnataka Government limits work hours under the Shops and Establishments Act as amended on 20 Jul 2021

The government of Karnataka has adjusted its working hours to the provisions of the Shops and Establishments Act. The change does not require or allow employees of any organization to work more than 9 hours a day and more than 48 hours a week, and the total working time, including overtime, will otherwise be 10 hours except on the inventory and account preparation days. In addition, the total overtime of employees for 3 consecutive months should not exceed 50 hours.

4. Bengaluru BBMP provides an option to Renew Trade License from 1 to 5 years from 2022-23 as amended on 01 Feb 2022

Bangalore BBMP has amended a regulation that the trade license can be renewed for one to five years from the fiscal year 2022-23.

5. Online Registration for Karnataka Professional Tax as amended on 31 March 2022

From April 1, 2022, every employer who is registered under the Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976, will be responsible for the registration of application of certificate through an electronic online registration procedure in the way prescribed. This was declared by the Commissioner of Commercial Taxes

6. Creche Facilities in Factories in Karnataka as amended on 13 Apr 2022

The Karnataka State Government Director of Factories has issued a notice advising all factory departments to reintroduce childcare and creche facilities within their factories by the Factories Act and the Rules as specified.

Conclusion

Labour Laws in Karnataka commonly referred to as human resources law is a diverse set of laws that deal with the legitimate privileges and restrictions of employees and their organizations.

Taken as a whole, it helps in a stringent process of compliance and communication between employees, workers, trade unions, managers, and workshop representatives. That is why the labour laws in Karnataka provide for the rights and obligations of employees and companies in the workplace. It plays an important role in working in an organization and in regulating the rights and obligations of employers and working employees.

How Can Deskera Assist You?

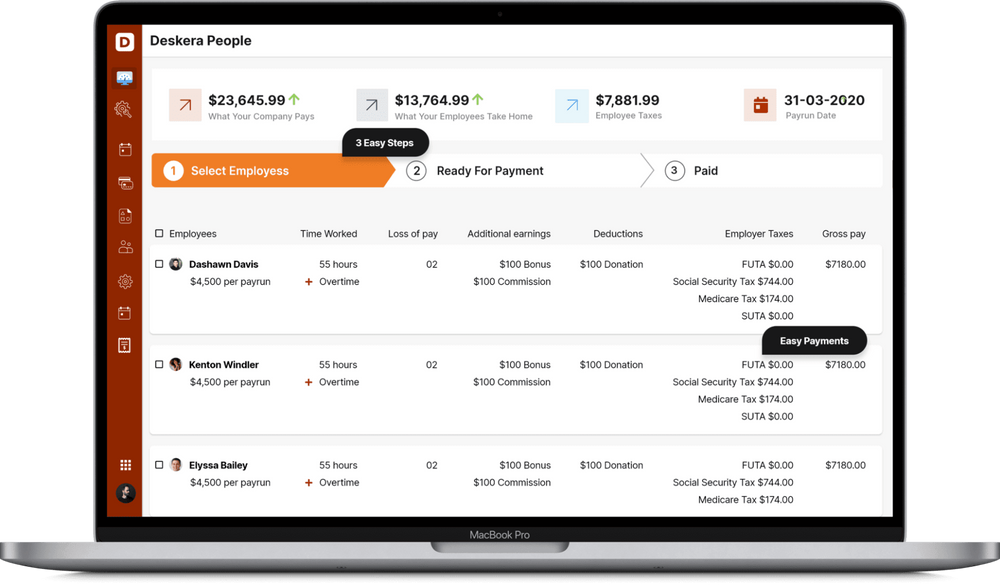

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- Labour Laws in Karnataka focus on employers' compliance with various laws and regulations under Karnataka Labour Law

- Labour laws in Karnataka are the rules and regulations as specified by the state that protects and promotes the interests of workers and employees by covering various legal aspects such as wages, equal opportunities, safety, health, holidays, working conditions, and employee welfare

- Labour Laws in Karnataka are considered to be the backbone of all organizations. As mentioned above, there is a lot of legislation in the area of labour laws in Karnataka that facilitate compliance with certain laws, as mentioned in the state and the Indian government

- There are constant amendments made to these labour laws in Karnataka which should be noted as and when they are released. A few amendments have been quoted above

- The labour laws in Karnataka focus on the working conditions of the workers and are meant to regulate the payment of wages and bonuses in any sector, trade, business, or job in the industry

Related Articles