Do you know that every state in India follows the distinct shops and commercial establishments Act? Do you have an idea that the businesses/industries/units that come under these Acts are predefined?

There is a proper procedure to register a new business under every state’s Shops and Commercial Establishments Rules 1966 and a stipulated process for closure of businesses/units.

Here we will discuss the Jammu and Kashmir Shops and Commercial Establishments Rules 1966 – what kind of businesses come under the Act, how they need to register, and mainly about the leave surrender form.

The Jammu Kashmir form E surrender of the certificate of registration (leave surrender form) is particularly for businesses and organizations running in the state of Jammu and Kashmir that need to be registered under the Act. If there is discontinuation or closure of business, the same is to be notified to the labor Department using the leave surrender form.

Table of Contents

- About the Jammu and Kashmir Shops and Commercial Establishments Rules 1966

- What is the Leave Surrender Form (Jammu Kashmir form E surrender of the certificate of registration)?

- Sample of the Leave Surrender Form

- Important Definitions Also Considered in the Leave Surrender Form

- Who is an "Employee"?

- What is an "Establishment"?

- About the Registration of Establishments (without which the Leave Surrender Form cannot be fulfilled)

- Business Registration

- Exceptions

- Application of the Act and the Leave Surrender Form to Other Organizations and Individuals

- Renewal of Registration

- Loss or Destruction of Registration Certificate

- Notification of Changes

- Notice of Closure under the Leave Surrender Form

- Conclusion

- How Can Deskera Assist You?

- Key Takeaways

About the Jammu and Kashmir Shops and Commercial Establishments Rules 1966

The Jammu and Kashmir Shops and Establishments Act, 1966, received the consent and approval of the Governor on 28th October 1966 and was published in Government Gazette dated 29th October 1966 in the Seventeenth Year of the Republic of India. The Amendments were made, and a new version - Jammu and Kashmir Shops and Establishments Rules, 1968 was established on 28th October 1968

This Act extends to the whole of the state of Jammu and Kashmir.

What is the Leave Surrender Form (Jammu Kashmir form E surrender of the certificate of registration)?

All establishments should fill Form E (leave surrender form) for closure of their establishment - Surrender of certificate of registration to Labour department whenever they shut down operations of their establishment.

Sample of the Leave Surrender Form

Inclusions of the Leave Surrender Form

The leave surrender form E comes under Rule 9(1) of the Jammu and Kashmir Shops and Commercial Establishments Rules 1966, which clearly states the purpose of discontinuation of an establishment.

Here are its inclusions:

- Addressed to the Inspector of Jammu and Kashmir Shops and Commercial Establishments – every state has its authorized inspector who checks, verifies, and audits proper documentation and records maintenance of every shop and establishment. In Jammu Kashmir, the inspector appointed under the Jammu and Kashmir Shops and Commercial Establishments Rules 1966 is referred to in the leave surrender form

- In the application, the applicant must enter the registration number of the shop/establishment in the leave surrender form as it was given at the time of registration; the registration process and the eligible businesses are discussed below

- The date when the shop/establishment has been or will be closed down should be mentioned in the leave surrender form

- The reason why the employer or owner is closing down the business should also be mentioned in the leave surrender form

- The employer/owner must attach the certificate of registration along with the leave surrender form

- The authorized signatory/legal representative/or the employer/owner must sign the leave surrender form mentioning the place and date when the form was signed, along with the name and physical address of the establishment

Important Definitions Also Considered in the Leave Surrender Form

Here are some important definitions related to the Jammu and Kashmir Shops and Establishments Act, 1966, for better clarity on terms used in or around the leave surrender form:

- "Closed" should be reported under Form E, specifically mentioned in the leave surrender form. It means not being open to customer service and not to business related to the facility

- "Commercial Facility" means a place of business engaged in, related to, or related to any business, trade, or profession, or activities in connection with any business or profession. Only the commercial facilities will be considered in the leave surrender form

- A branch that conducts advertising, consignment, transfer, or commercial agency activities, or a branch that is an official division of a factory or industry, or commercial enterprise

- Insurance companies, companies, banks, securities companies, and stock exchanges

- However, this excludes factories, stores, residential hotels, restaurants, cafeterias, theatres, and other public entertainment and entertainment venues. These do not come under the leave surrender form

Who is an "Employee"?

- In the case of a shop, a person who is fully or primarily employed by the shop in connection with the shop's business, whether monthly, daily, or contractually

- In the case of factories, those who are temporarily or primarily employed as office workers in such factories

- In the case of a trading branch, a person who is fully or primarily employed in connection with the branch's business, including Peon

- In the case of a restaurant or inn, a person who is wholly or primarily employed to prepare or serve food or drink, serve customers, or clean some of the facilities or the equipment used in those facilities. Alternatively, you may be employed as a clerk or cashier or in connection with a restaurant or restaurant business

- In the case of theatres or other public entertainment facilities, waiters, cashiers, clerks, door attendants, guides, cleaners, or anyone in other duties. One of these institutions includes an apprenticeship, but not the employer's family

- "Employee" means any person who owns or ultimately manages the operations of the Facility, including managers, agents, or other persons engaged in the management or management of the Facility

What is an "Establishment"?

"Establishment" means stores, commercial facilities, residential hotels, restaurants, restaurants, theatres, or other public entertainment or places of entertainment to which this Act applies, and the declared establishment under the government bulletin as an institution within the meaning of this law.

These will be considered in case of closure under the leave surrender form

- "Factory" has the same meaning as given in [Jammu & Kashmir Factory Act, 1957]

- "Inspector" means an inspector appointed under this Act

- "Labor Commissioner" means a person so appointed by the Government for the provisions of this Act and in areas designated by the Government

- "Certificate of Registration" means a certificate of registration of an entity which is required while submitting the leave surrender form

- "Shop" means a facility where goods are sold, wholesale, or both, or services are provided to customers, whether in the same location, offices, warehouses, etc. Includes a shop, warehouse, or workplace; doesn't include factories, commercial facilities, residential hotels, restaurants, dining rooms, theatres, other public entertainment or entertainment venues, or businesses attached to factories

- "Form" means the form attached to these rules. The leave surrender form is one of the important forms under the Act, which is also called the Jammu Kashmir form E surrender of the certificate of registration

About the Registration of Establishments (without which the Leave Surrender Form cannot be fulfilled)

Business Registration

The declaration required under Section 6 for business registration is submitted by the employer/owner to the supervisory authority in the district where the business is located, using Form A. The same needs to be submitted and mentioned in Jammu Kashmir form E surrender of the certificate of registration – the leave surrender form.

The registration process for certain kinds of shops and establishments under the Act includes the following charges:

|

[(i) |

Shops and Commercial Establishments with 20 or more employees (not covered under Factories Act) |

Rs. 2000/- per annum |

|

(ii) |

Shops and Commercial Establishments with 10 to 19 workers (Not covered under Factories Act) |

Rs. 1000/- per annum |

|

(iii) |

Private Middle Schools |

Rs. 800/- per annum |

|

(iv) |

Shops and Commercial Establishments with 5 - 9 employees (Not covered under Factories Act) |

Rs. 500/- per annum |

|

(v) |

Band-Saw Mills, Shops, and Commercial Establishments with 3 - 4 workers (Not covered under Factories Act) |

Rs. 300/- per annum. |

|

(vi) |

Shops and Establishments with less than 3 workers |

Rs. 150/- per annum |

|

(vii) |

Shops and Commercial Establishments run by the Owners without any employees |

Rs. 50/- per annum |

If closed down, the above firms, which are registered under the Jammu and Kashmir Shops and Establishments Act,1966, would need to fill the leave surrender form - Jammu Kashmir form E surrender of the certificate of registration.

However, in the case of renewal, licenses that are renewed for two or three years, respectively, receive a 50% or 10% discount on the total fee otherwise paid.

The business register based on Article 6 (3) shall be under Form B and is classified into the following categories:

- Shops

- Business establishment

- Residential hotel

- Restaurants and pubs

- Theatres and other public entertainment or entertainment venues. The facility must be registered in the appropriate category to which it belongs. The registration certificate issued by Section 6 (3) must be in Form C

Exceptions

The Act does not apply to certain individuals and groups. These groups are also exempt from filing the leave surrender form. These are:

- People whose work sporadically, such as travelers, convertors, guards, and caretakers

- Federal or State Government (excluding commercial branches) or municipal and Reserve Bank of India, State Bank of India, and Life Insurance Corporation offices

- A facility for the treatment or care of the sick, frail, poor, or madness

- A bazaar, fair, or exhibition for the sale of charitable or other non-profit works

- Dining car stalls and light meal areas at stations and railways

- Commercial facilities engaged in the transportation of people and goods by car, and those who are exclusively employed in this activity

- Non-resident clubs

- Law firms

Application of the Act and the Leave Surrender Form to Other Organizations and Individuals

Notwithstanding the provisions of this Act, the Government declares, by notice in the Government Bulletin, this Act or a group of organizations or individuals subject to that provision.

For the time being, from the date specified in the notice, it will not be considered a group of establishments or groups of individuals to which this Act or its provisions apply.

- If you make such a declaration under subsection (1), each such entity or group of individuals is considered to be a group of entities or groups of individuals to which this Act applies and is subject to this Act

- The rules apply to the entities or individuals in this group

- The Government shall, by notice in the Government Bulletin, provide for a permanent or designated period of establishment or group of establishments to which this Act applies, or an individual or group of individuals to which this Act applies

- You can be exempt from all, or any of these, and the same will be considered while filling the leave surrender form, which denotes the closure of the establishment

Renewal of Registration

For renewal of registration, each registered establishment must submit the officially completed Form A and Form C to the appropriate inspector by March 31 of each year.

After verifying that Form, A is correct, the inspector completes the required entries for Form C and submits it to the relevant employer/owner/agent or administrator, if applicable.

The renewal fee is the same as required for registration under Rule 3 Sub-Rule (1).

Loss or Destruction of Registration Certificate

The Registrations Certificate is a crucial document that must be submitted while filling out the leave surrender form.

In case of loss or destruction of the registration certificate, the application for issuance of a duplicate copy shall be made to the relevant inspector within 7 days of loss or destruction. This may be permitted by paying a fee of 2 rupees.

All fees stipulated in these rules will be credited to the National Treasury under the appropriate heading.

Notification of Changes

Changes notified to the inspector under Section 7 must be on Form D. Changes to be notified to the inspector:

- The employer has to notify the inspector of any changes to the information contained in the declaration under Article 6 in the prescribed format within 7 days of the change

- After receiving such notice and confirming that it is correct, the inspector will change the registration of the place of business according to the notice and amend the registration certificate or issue a new registration certificate if necessary

- The inspector must be notified of the closure of the facility using the leave surrender form

- The employer must notify the inspector in writing within 10 days of the closure of the facility

- After receiving the information and verifying its legitimacy, the inspector will remove the facility from the facility registration and remove the registration certificate

Notice of Closure under the Leave Surrender Form

- Notice of closure of a facility notified to Inspectors by Section 8 shall be provided on Form E (leave surrender form) and attached with a certificate of registration for that facility

- If the employer transfers the business to another person, the inspector must be notified within 10 days after the transfer

Conclusion

Keeping records of registration, renewal, and closure of firms, businesses, shops, and establishments is integral to the Jammu and Kashmir Shops and Commercial Establishments Rules 1966.

However, the Jammu Kashmir Form E is the leave surrender form which is when the owner or employer does not want to continue with the firm and is looking for closure of all business activities and related registrations.

Keeping track of the state rules and regulations set by the Jammu and Kashmir Shops and Commercial Establishments Rules 1966 will help you keep up-to-date with the latest HR compliance and labor paperwork.

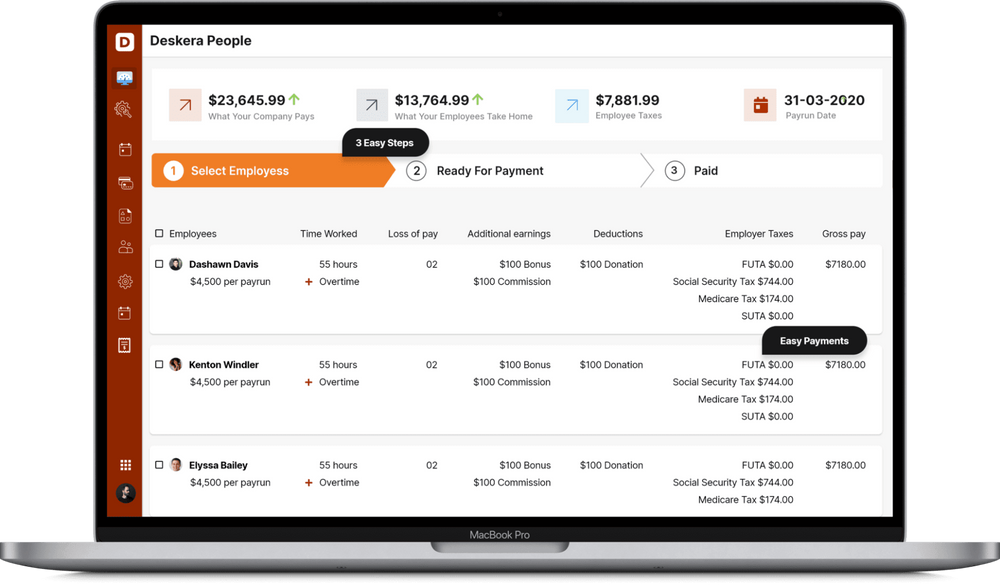

How Can Deskera Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- The Form E of the Jammu and Kashmir Shops and Commercial Establishments Rules 1966, which is the leave surrender form, refers to the closure of a shop or establishment

- If applicable to the Jammu and Kashmir Shops and Commercial Establishments Rules 1966, it applies to your business

- The leave surrender form requires you to furnish details about your facility, the date of closure, and the reason for closure, along with the appropriate signatures of the owner or an authorized representative

- The leave surrender form needs to be submitted to the inspector as assigned under the Jammu and Kashmir Shops and Commercial Establishments Rules 1966

- Records should be retained for 3 years from the year they were written

- There are relevant compliances that must be followed along with the leave surrender form, including posting specific notices to the inspector

Related Articles