Form IX – Form of Summons is a government application document that pertains to the Minimum Wages Act of 1948.

For the working-class population of any country, the government sets a minimum wage each year, below which no employer can reduce their remuneration. The Minimum Wage Act of 1948 has thus been enacted to prevent unfair compensation to floor workers by industries. This is primary legislation that has been put in place to ensure the well-being and survival of this sect of a country’s population.

It is mandatory for all the industries that employ floor workers – whether skilled or unskilled – to abide by this law and pay a sum that is at least equal to the minimum wage stipulated by the active government in their region.

Additionally, the industries are also required to provide other benefits to the workers, like overtime pay and paid leave, in accordance with the mandates of this Act. Let’s look at the Minimum Wages Act of 1948 in more detail and study the IX Form – Form of Summons by covering the following topics:

- What are Minimum Wages Mentioned in IX Form – Form of Summons?

- What Are The Components of Minimum Wage in IX Form?

- What is The Minimum Wages Act of 1948 Mentioned in IX Form – Form of Summons?

- Major Objectives of the Minimum Wage Act

- Where is the Minimum Wages Act Applicable?

- Wages Covered Under Section 2 of the Act

- Procedure for Fixing Minimum Wages

- Wage Payment Responsibility

- Deduction from Wages Applicable Under the Act

- IX Form – Form of Summons

- Fields in IX Form – Form of Summons

- Wrapping Up

- How Can Deskera Assist You?

- Key Takeaways

What are Minimum Wages Mentioned in IX Form – Form of Summons?

In India, minimum wages have been defined as the lowest income legally permissible for skilled or unskilled workers that would still ensure a sustainable standard of living for the earner, and at the same time would also provide for a basic level of comfort. The basic minimum wage also seeks continuous improvement in the standard of living for the workers.

No industry can employ a wage worker for compensation at a lower value than the stipulated minimum wage for that region.

The whole idea behind setting a legal minimum wage for floor workers was to abolish the exploitation of workers and prevent slave labor. Ideally, the individual state governments are responsible for determining the minimum wages for workers in their state. They are also responsible for revising these wages every five years in lieu of inflation and other factors that impact the cost of living.

What Are The Components of Minimum Wage in IX Form?

Much like any other salary given to an employee, wage workers are also entitled to a minimum wage that is comprised of various components and bonuses. Here is a brief list of the components of minimum wage as they appear in the IX Form.

- The basic wage that the employer pays to the worker – is the amount that is agreed to and is mentioned in the labor contracts

- Payments and allowances that are related to performance and shift-related work or irregular hours (or any other special situation)

- Fixed payments that are paid off monthly or weekly based on the turnover generated

- Third-party payments of the nature of tips or any other agreement reached between the employee and employer

The sum total of all the amounts mentioned above should not be less than the minimum wage stipulated by the government of the region where the employer is stationed.

Additionally, there are a few components that are not counted towards the minimum wage:

- Overtime pay that a worker has earned

- Allowance for leaves

- Profit shares

- Allowance for expenses

- End of year allowances

- Special payments

- Payments pertaining to pension and savings schemes

These payments are counted as separate from the minimum wage.

What is The Minimum Wages Act of 1948 Mentioned in IX Form – Form of Summons?

The Minimum Wages Act was enacted by the Central Legislative Assembly in the year 1948. The major aim of putting this act in place is to prevent forced, unfair labor. Under this act, the central and state governments both are empowered to prescribe the minimum wages in their areas of jurisdiction. The wages thus prescribed need to be adhered to by all institutions that employ wage workers – whether skilled or unskilled.

Let’s look at this act in a little more detail to understand IX Form – Form of Summons and the situations when it is invoked.

Major Objectives of the Minimum Wage Act

Every worker needs money to survive. The government, thus, determines the cost of living for a wage worker periodically based on factors such as daily calorie requirements, family members, education, medical support, etc. and fixes a minimum wage for the workers that helps them bear these costs.

Listed below are the major objectives of the Minimum Wages Act of 1948.

- To ensure that the workers employed in the organized sector (scheduled employment) get paid a minimum wage for sustenance and basic comfort

- To abolish worker exploitation and forced/slave labor

- To provide a guideline to the government bodies to help them fix minimum wages and revise them periodically

- To appoint advisory committees and boards that have equal representatives of the employee and the employer, both

Each state is empowered to decide the minimum wages for the workers in its jurisdiction in accordance with this Act.

Where is the Minimum Wages Act Applicable?

This Act is applicable to all the states of India barring Jammu and Kashmir. Furthermore, the applicability extends to any employer or establishment that has employed more than 1,000 employees in their respective state.

The employees belonging to any undertaking owned by the federal railway or the central government are exempt from the provisions of this Act. However, if such an establishment has the consent of the central government, the Act may have it under its ambit.

Each state has its own minimum wages that it determines based on this Act – it may also have further applicability provisions.

Wages Covered Under Section 2 of the Act

Wages, under this Act, is a term that counts all kinds of remuneration received by a wage worker that can be represented in money. However, the items on the list below are excluded from wages under this Act:

- The value of the accommodation, utilities, and medical attendance

- Other amenities

- Provident fund, pension fund, and insurance contributions

- Travel allowance

- Special expenses depending on the nature of employment

However, on discharge, the Act stipulates that gratuity is payable. You would not find these fields on IX Form – Form of Summons.

Procedure for Fixing Minimum Wages

Section (5) of the Act stipulates two different procedures to fix minimum wages in accordance with its guidelines. Both these procedures empower the respective governments to fix a wage that is fair and in line with the requirements of the Act.

Fixation by Appointment of a Committee

In order to fix a fair minimum wage, the government is required to appoint as many committees and sub-committees as needed to hold inquiries that help them discover the basis and benchmarks for the minimum wage.

Fixation by Publication of Proposals in the Official Government Gazette

The government may fix the minimum rate of the wages by publishing a proposal in the official gazette to inform the persons who would be affected by such wages.

Wage Payment Responsibility

Every employer that has wage workers enrolled must ensure that the wages are paid in accordance with the Act. To that extent, the employers may designate:

- Under Section (7) of the Factories Act, the person named as the Manager of a factory shall oversee wage payment in the case of workers employed other than the contract works

- For establishments that are industrial or other in nature, the person who supervises the establishment is liable to pay the wages

There is a special arrangement for workers in the railways for the responsibility of paying wages in accordance with the Act.

Deduction from Wages Applicable Under the Act

In the event that one of the following situations arises, the employer is eligible to initiate certain deductions from the wages of its skilled or unskilled employers:

- Deductions towards fines

- Deductions towards absence from duty on the floor. In case a worker remains absent from duty for the whole or any part of the time, deductions from wages are applicable. However, it must not exceed the wages for eight days in total

- Deductions due to damages or losses. In case of any damages while on duty, the responsible worker is liable to have a deduction on his wages. However, the amount must not exceed the value of the damage caused

- Deductions towards accommodation provided to the workers by the employer

IX Form – Form of Summons

The IX Form – Form of Summons is an application that is invoked in accordance with Sections 20 (1) and 21 of the Minimum Wages Act of 1948.

Section 20 (1) of the Act states that:

“The appropriate Government may, by notification in the Official Gazette, appoint [any Commissioner for Workmen's Compensation or any officer of the Central Government exercising functions as a Labour Commissioner for any region, or any officer of the State Government not below the rank of Labour Commissioner or any] other officer with experience as a Judge of a Civil Court or as a stipendiary Magistrate to be the authority to hear and decide for any specified area all claims arising out of payment of less than the minimum rates of wages [or in respect of the payment of remuneration for days of rest or for work done on such days under clause (b) or clause (c) of sub-section (1) of section 13 or of wages at the overtime rate under section 14,] to employees employed or paid in that area.”

It is, thus, understood that in the case of the workers’ claims of underpayment of the minimum wages as prescribed by their respective governments, the IX Form needs to be filled out. This is a form for a summons to the opponent that mandates them to appear before the hearing Authority as mentioned in Section 20 (1) quoted above, for this application (IX Form) that is entertained in accordance with the Act.

Furthermore, Section 21 talks in detail about the eligibility and applicability of deduction on the minimum wage, which can also be challenged in the case of discrepancies through the IX Form.

Fields in IX Form – Form of Summons

The IX Form is a one-page form that constitutes of the following fields:

|

Wage Slip |

|

|

Name of Establishment: _______________ |

Place: ____________ |

|

Name of employee with father’s / husband’s name |

|

|

Designation |

|

|

Wage Period |

|

|

Rate of wages payable: |

|

|

a. Basic |

|

|

b. D.A. |

|

|

Total attendance/unit of work done |

|

|

Overtime wages |

|

|

Gross wages payable |

|

|

Total deductions |

|

|

Net wages paid |

|

|

Pay in-charge |

Employee’s signature/thumb impression |

The form captures the following details of the wage worker:

- Number of working hours they put in

- The overtime they did

- The gross wages payable to them in accordance with the Act

- The deductions in wages they have incurred

- The net wages that the employer owes them

The form also captures the basic wage the worker is entitled to and the dearness allowance they get.

Wrapping Up

The minimum wage, for a shop floor worker, is a necessary source of sustenance that must not be toyed with. As such, it is important to put safeguards in place that would ensure that fair and lawful payments are duly made in exchange for the hard work of such workers.

It is to contest the unfairness and underpayment in these minimum wages that IX Form has been introduced as a summons. The form assists the hearing authority in determining and deciding the case of wage underpayment. It can be viewed as an instrument through which workers can get their due in a civil manner.

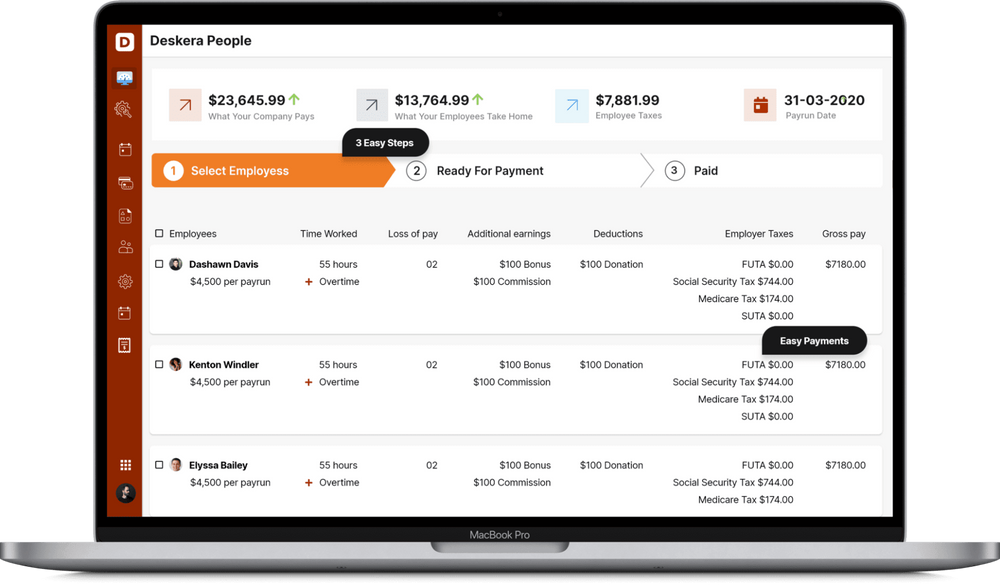

How Can Deskera Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

Through the Minimum Wages Act of 1948, the government has deployed a guiding mechanism to abolish the unfair slave trade in India. By ensuring that workers of each state get paid a minimum wage that helps them sustain and live to a certain level of comfort, the Act puts lawful machinery in action through appointed hearing authorities and representatives.

To that end, the IX form is a single-page application that captures the wage details of workers. It is required to be submitted in case they wish to contest the wages paid to them (if underpayment happens). The application is submitted to the appointed authority who, then, sits for the hearing and decides on the case based on the information furnished, and in accordance with the Act.

Related Articles