Do you know about the relevance of ESIC - Employees' State Insurance Scheme of India (ESIC)?

What are the benefits that the workers can avail of getting registered under the ESIC?

As defined in the Employees’ State Insurance Act, 1948, these are the benefits that the employees who have been registered under the ESIC can avail themselves:

- Medical benefit

- Maternity benefit

- Sickness benefit

- Pension benefit

- Dependent benefit

- Disablement benefit

- Funeral and confinement expenses

The ESIC claim form 9 pdf is a form submitted by the employees as a claim for any kind of illness, temporary or permanent disablement or even to avail of maternity benefits. Here we will talk about what the form is all about and how employees can fill out this form to claim the various benefits assured by ESIC - Employees' State Insurance Scheme of India.

Table of Contents

- What is the Employees’ State Insurance Scheme?

- What is the Applicability of the ESIC – ESIC employee registration form?

- What is the ESIC claim form 9 pdf?

- Sample of ESIC claim form 9 pdf

- ESIC claim form 9 pdf - Format

- List of Benefits Provided by ESIC and Their Conditions

- Unemployment allowance based on Rajiv Gandhi Sharmik Kalyan Yojana (RGSKY)

- How can you enroll yourself in the ESI program?

- Other compliance other than ESIC claim form 9 pdf under the Indian National Insurance System (ESIC) of employees

- Conclusion

- Key Takeaways

What is the Employees’ State Insurance Scheme?

The Employees’ State Insurance Scheme is an integrated measure of social insurance as set out in the state employee insurance law. It protects workers from the effects of illness, childbirth, disability, and death from occupational accidents and provides medical care to the insured employees and their families, as defined by the National Employee Insurance Act of 1948.

What is the Applicability of the ESIC – ESIC employee registration form?

- The ESIC employee registration form is applicable in all states of India except Nagaland, Manipur, Sikkim, Arunachal Pradesh, and Mizoram. It also applies to Union Territories like Delhi, Chandigarh, and Pondicherry

- The ESIC employee registration form applies to non-seasonal factories with 10 or more employees

- The rules have been extended to shops, hotels, restaurants, cinemas (including previews), road transport companies, and newspapers with more than 20 employees

- The system has been extended to private health and educational institutions that employ more than 20 people in certain states/UTs

- The existing wage limit for legal compensation is Rs 21,000 per month as of January 1, 2017

What is the ESIC claim form 9 pdf?

ESIC claim form 9 pdf is all about applying for sickness benefits, temporary or permanent disability, childbirth benefits, and other benefits also. To apply for illness, temporary disability, or childbirth allowance, the employees must submit the ESIC claim form 9 pdf to the relevant branch. Any person who makes a false statement for the benefit of himself or others will be punished by imprisonment with work for up to 6 months or a fine of up to Rs. 2,000 / or both.

Sample of ESIC claim form 9 pdf

ESIC claim form 9 pdf - Format

To make an ESIC claim form 9 pdf as part of the Employee National Insurance (ESI) system, you must complete and submit the relevant form available on the ESC portal. Some forms include Form 72, Form 23, Form 24, Form 15, and so on. The State Employee Insurance System (ESI) is designed to protect the interests of workers in medical emergencies such as childbirth, illness, permanent or temporary disability, work-related death, or injury.

It is an insurance system that promotes income or the ability to earn. This is a self-funded social security system in which the employer bears 4.75% of the wage and the employee bears 1.75% of the wage for which the ESIC claim form 9 pdf is filled.

However, before submitting ESIC claim form 9 pdf, employees should be aware of the following:

- If an employee misrepresents this form, he may be sentenced to 6 months in prison or a fine of Rs 2000, and in some cases, both will be applicable

- ESIC claim form 9 pdf must be submitted immediately to the relevant ESIC office

- The insured employee must collect a final receipt before resuming activities through the ESIC claim form 9 pdf

- The ESI system operates by the guidelines of the Employees’ State Insurance Act, of 1948 and is managed by the Employees' State Insurance Corporation, an autonomous body of the Ministry of Labor and Employment. The ESI scheme is intended for workers with a monthly income of 21,000 rupees or less

List of Benefits Provided by ESIC and Their Conditions

1 (b) Medical Benefits that can be claimed under ESIC claim form 9 pdf

- The insured employees will be eligible for Medical Care under Rule 60 and Medical Care for Retired Persons under Rule 61

- The employees must be insured under the ESI Act to claim under ESIC claim form 9 pdf

- The Insured / family eligible for entry into employment covered by the compulsory insurance

- This is also for the employee who is incapacitated by an occupational accident for a payment of 120 rupees / for yourself and your spouse

- This is for employees with mandatory employment (retires early, reaches retirement age, retires under VRS, or is insured for at least 5 years, then retires early

- He should be hired from day one to the day of compulsory employment and during the relevant benefit period

- This is applicable annually for appropriate medical care, comprehensive medical care, and clinical testing for the employee and his immediate family

- Primary and secondary medical facilities (excluding SST) within the ESI medical facility for the registered employee and their spouse until the retirement date

- This benefit is also granted to the widow of the dead employee registered for this benefit which can be claimed using ESIC claim form 9 pdf

Sickness allowance

- If paid for at least 78 days during the relevant contribution period, then the sickness benefit is extended up to 91 days for two consecutive illness allowances for up to 70% of the average daily salary can be claimed using ESIC claim form 9 pdf

- Under section 2 (b) Increased sickness allowance - Illness allowance for vasectomy From 7 days to the employee & 100% of the employee’s 14-day average daily income for vasectomy

- Extend 156 days of illness with 4 contribution periods and be eligible to receive a benefit in one of them through ESIC claim form 9 pdf

- 124-309 days with medical advice for long-term illnesses up to the age of 60, it can be extended up to 2 years (730 days).

- 80% of the average daily salary will be reimbursed through claims made in ESIC claim form 9 pdf

- Sickness benefits represent regular cash payments made to the employee during the period of accredited illness that corresponds to a benefit period that requires treatment and works with medical refusal. Prescribed certificates are; Forms 8,9,10,11 & ESIC (ESIC claim form 9 pdf)

- The sickness allowance is 70% of the average daily salary and is paid for 91 days in two consecutive allowance periods. Participation conditions:

- To qualify for illness, the IP must contribute for at least 78 days during the relevant contribution period

- First-time insured persons will have to wait almost nine months before receiving sickness benefits, as the relevant benefit period will not begin until after this period

- The sickness benefit shall not be paid for the first two days of the sick period unless the sick period begins within 15 days of the end of the period before the last payment of the sick benefit. These two days are called the "waiting period"

- This provision should be clearly understood by IMO / IMP. In practice, the employees who want to take sick leave for flimsy reasons usually go to the first certificate / first and last certificate within 15 days of their previous employment or a weekly leave to avoid two-day performance degradation due to the new wait time

Disablement Benefit

Temporary disablement benefit

- Unconditionally applied from the first day of starting insurance employment in the event of an occupational accident during the course and at the end of insurance employment which can be claimed through ESIC claim form 9 pdf

- If the disability lasts less than 3 days (excluding the day of the accident), there is no benefit otherwise, it will be paid for the entire period for the duration of the temporary disability

- 90% of the average daily salary paid during the accident contribution period/month/day (temporary disability pension in some cases)

- TDB is paid to employees who are suffering from an occupational accident (EI) or occupational disease and who have been temporarily proven to be incapacitated

- “Occupational accident” is defined under Article 2 (8) of the Act as an accident or personal injury caused by an occupational disease while a worker is insured. Occupational diseases occur both inside and outside the territory of India

- Certificate required for TDB: Accident reports on Form 16, Form 8, 9, 10, 11, and ESI Med.13. (ESIC claim form 9 pdf)

- TDB eligibility: Benefits are not related to the conditions under which the contribution is eligible

Permanent disability benefit

- There are no contribution conditions

- Total or partial permanent disability benefits caused by accidents or occupational illnesses resulting from or during related employment are covered

- By industrial accident at the time of properly configured ESI Evaluation of the regular benefit inner board which should be equal to the rate of incapacity caused

- The percentage of the total disability pension rate will be equal to the full TDB rate

- This can be converted to a lump sum if the daily rate benefit is up to Rs.10 or if the converted total value does not exceed Rs. 60,000 / 27 5 (a) that can be claimed under ESIC claim form 9 pdf

Dependent Benefits

- Unconditional benefits for the medical status of a widow receiving dependent benefits

- From the first day of employment of the insured and during employment of the insured

- For a widow receiving the benefits of dependents can be claimed through ESIC claim form 9 pdf

- Paid to the survivor of the insured who died as a result of an employment injury under Rule 58 increase. This will be paid to the widow for life until her remarriage and each legitimate or adopted son up to the age of 25 and for each legitimate or adopted unmarried daughter up to the age of 25 or until marriage, whichever comes first

- For frail children until frailty continues

- 90% of the average daily salary of dependents on an annual basis at a fixed rate

will be provided

- Medical facilities that provide primary and secondary health care within the ESI (excluding SST) using ESIC claim form 9 pdf

- Medical facilities pay 120 rupees per year to the widow of a deceased employee who receives a dependent allowance

Maternity Benefits

- 70 days contributions made during 1-2 consecutive contribution periods will be paid using ESIC claim form 9 pdf

- 26 weeks for two surviving children and 12 weeks from the third surviving child will be granted using ESIC claim form 9 pdf

- 6 weeks for miscarriage and 12 weeks for foster mothers using ESIC claim form 9 pdf

- 100% of average daily income will be provided

- Maternity Expenses

- The insured woman and the insured associated with his wife receive a medical bonus paid for childbirth costs where the required medical facilities are not available under the scheme

- Up to 2 deliveries - Rs.5,000 per case through ESIC claim form 9 pdf

Other Benefits

Funeral expenses

- The registered employee should have been entitled to ESI benefits

- This will be paid out on presenting the death certificate of the oldest survivor/person who is paying the funeral expenses

- This will be a one-time payment to cover the insured's funeral expenses

- A Maximum of Rs.10,000 will be provided

Unemployment allowance based on Rajiv Gandhi Sharmik Kalyan Yojana (RGSKY)

- The unemployment is insurable for 78 paid contribution dates for each contribution period, involuntary unemployment due to factory closure/miniaturization, with uninsured employment for the past two years. Unemployment due to 40% of permanent disabilities due to involuntary accidents

- Included up to 24 months of unemployment allowance for the entire duration of insured employment can be claimed through

- Includes up to one year of vocational training to improve the skills of the insured receiving unemployment benefits

- The total fee charged by a government-approved / accredited body is refunded by ESI C1

- Unemployment allowance at a rate of 50% of the last average 0-12 months daily salary and 25% of the average of 13-24 months of daily salary

- Self and family health care while receiving unemployment allowance

- Vocational rehabilitation allowance under Rule 60

- At least 40% of disabilities due to industrial injuries under the age of 45

- Training in all areas of the government - Institution or government

- Facilities accredited according to the standards of the National Vocational Rehabilitation Center/Facility

- Normal fare / 2nd class rail/bus fare, if applicable for commuting

- Costs charged by the center or Rs.123 / day, whichever is greater

How can you enroll yourself in the ESI program?

Companies that employ 10 or more people must be registered within the framework of the ESI system. You can do this by logging in to the ESIC portal www.esic.in and submitting the requested information. A 17-digit code number will be generated and sent to your employer's email ID along with your registration form and ESIC access data. The employer can then log in using the access data and enter the required information. If there is a registration problem, the employer can send an email to ESIC's IT desk (itcare@esic.in).

Other compliance other than ESIC claim form 9 pdf under the Indian National Insurance System (ESIC) of employees

To claim under the ESI program, beneficiaries must complete and submit the relevant ESI form. The form is available on the ESIC portal. The details of the various ESI forms available are as follows:

- Form 72 - to request a duplicate ESIC smart card

- Form 23 - This form is the life certificate form required to claim a permanent disability allowance

- Form 24 - This form is a declaration and certificate for claiming disability allowance

- Form 22 - This form is used to charge funeral expenses

- Form 20 - This form can be used to claim maternity benefits after the insured's death

- Form 19 - This form must be submitted to apply for maternity benefits and termination of employment

- Form 16 - This form can be used to file a recurring disability benefit claim

- Form 15 - This is the form used to claim the interests of dependents

- Form 14 - This is a permanent disability benefits claim form

- Form 12 - This is the employer's accident report form

- Form 11 - Accident Book

- Form 9 - This form is used to claim illness, temporary disability, and childbirth benefits - ESIC claim form 9 pdf

- Form 6 - This is an employee register form

- Form 5A - If the beneficiary wishes to prepay the contributions, they must submit this form

- Form 5 - This form is used to return employee contributions

- Form 3 - This is the return of the declaration form

- Form 2 - is used to modify the registration form

- Form 1 - This is a registration form

- Form 01 - Employer registration form

- Form 1A - Family Declaration Form

- Form 142 -This form is used to claim loss of income and claims for travel allowances

- Form 105 - Certification Certificate

- Form 86 - Employment Certificate

- Form 63 - Declaration form for payment to legal heirs

- Form 53 - Insured Details Change Application

- Form 37 - Certificate of reinstatement or full-time employee

- Form 32 - Wage Contribution Statement for Disability Benefits

Conclusion

The ESIC - Employees' State Insurance Scheme of India provides several benefits to the employees which can be availed by making minor contributions by the employer and the employee. The ESIC claim form 9 pdf is to claim these benefits like – sickness, disability, death, or even maternity. When the employee, his nominee, or legal heir suffers through any of the above contingencies, they have to fill the ESIC claim form 9 pdf and they can claim the benefits.

How Can Deskera Assist You?

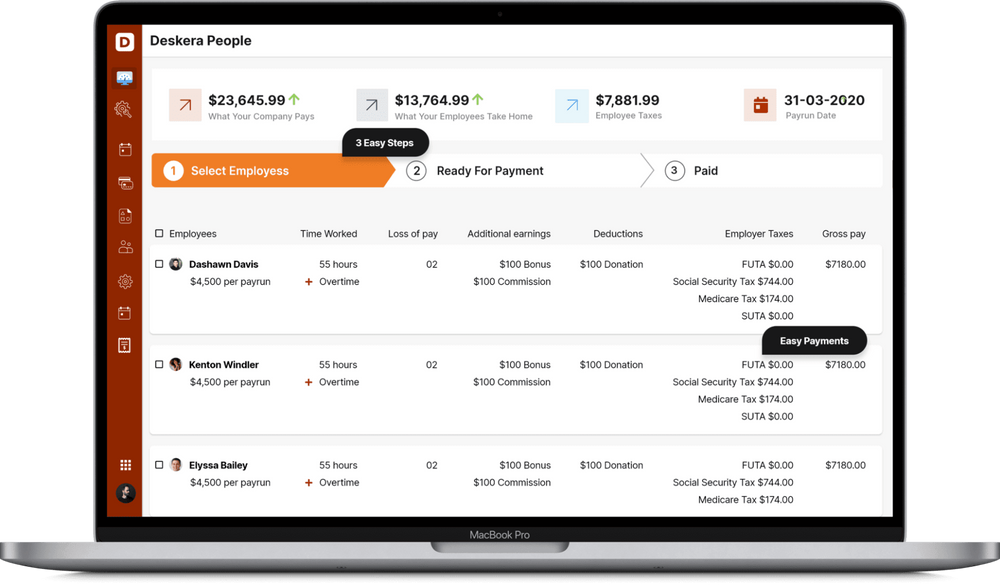

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- The registered employees can get the ESIC claim form 9 pdf to make a Claim in case of Sickness/Temporary Disablement/Maternity Benefit as provided by the Employees' State Insurance Corporation, and the Ministry of Labour and Employment, Government of India

- The ESIC claim form 9 pdf specifies all details related to the employee joining date, registration number, and date of coverage, and it should be attested by the employer as a confirmation about the employee dealing with severities

- The ESIC claim form 9 pdf can be filled to claim Sickness/Temporary Disablement/Maternity Benefit

- The ESIC claim form 9 pdf will be audited and verified before the claim of the employees is processed

- The ESIC claim form 9 pdf should be stored and maintained by the employee and the employer

- You can download the ESIC claim form 9 pdf from the portal and fill it, after which it should be immediately submitted to the concerned authorities

- Any wrong information published in the ESIC claim form 9 pdf can lead to a penalty of Rs. 2000 or 6 months imprisonment, or both

- Before the employees resume their job roles, after making a claim using ESIC claim form 9 pdf, they must collect the final acknowledgment of the form

Related Articles