Investors, shareholders, and the general public expect companies to disclose their financial reports for the clarity of the company’s standing in the market. This clarification helps the Investors understand how their money is being used, the shareholders understand if their investment in the company has growth or not, and the general public can make a well aware decision of investing in the company.

The best way of providing investors and the general public with an up-to-date financial report of a company is through an interim financial report or statement. As the name suggests, it refers to the financial report of a company covering a timespan of less than a year. The report is filed before the annual financial reporting cycle. The reports are filed for a duration of last six or five months, or whatever as per your preference.

Interim reports come in handy when you want to let the investors, analysts, and shareholders know about your company’s financial performance within a specific period of time. These reports are commonly filed by companies to also highlight the material changes to the general public.

As simple as it sounds, some complex features can easily confuse you. This is why acquiring a thorough knowledge of the subject is necessary. Here is a complete guide that can help you understand the Interim Financial Statement and its various characteristics in detail. It will also deliver useful insights on the importance and benefits of filing an Interim Financial Report and the process of filing it.

What will you find in the article -

- About Interim Financial Statements

- Difference Between Interim Financial Statements and Annual Financial Statements

- Standards to Be Included in the Interim Financial Report

- Why Do You Need to File an Interim Financial Statement?

- The Most Important Part of Interim Reports: Profit and Loss Statement

- Are Interim Financial Reports Audited?

- How to File or Make an Interim Financial Report?

- Difference Between IFRS and US GAAP Standards

- Frequently Asked Questions

- Key Takeaways

About Interim Financial Statements

The financial statements that are filed by a company for a period of less than a year, are referred to as interim financial statements or reports. The primary objective of filing an interim financial statement is to provide an insight into your company’s financial performance and material changes to shareholders and analysts. These statements are most often issued by publicly-held companies and are not audited.

IAS 34 applies if a company or organization publishes an interim financial report that follows all the standards necessary for IFRS Standards. These statements can be issued in any period prior to the financial year. Just like any other official statement, certain rules and standards need to be maintained while filing an interim statement. As suggested by the International Accounting Standards Board, the following aspects should be clearly mentioned in an interim financial statement:

- Income

- Statements indicating the firm or issuing entity’s financial position

- Condensed statement of profit and loss

- Alterations in equity with explanatory notes

An interim financial report is very beneficial as it provides a timely view of a company’s operations and financial aspects. With an interim financial report, you don’t have to wait for an entire year for accessing this information. Also, the year-end financial reports take months to access even after they have been released. Another major benefit of releasing these reports is the shareholders, public, and analysts are informed about major company changes like bankruptcy, the resignation of directors, and an alteration in the fiscal year.

A good example of such a report is a quarterly financial statement as it is issued before year-end within a period of 3 months. It is a concise report of unaudited financial statements, which include income reports, balance sheets, cash flow reports, etc. Quarterly statements are filed within a few weeks after the quarter period has ended.

Difference Between Interim Financial Statements and Annual Financial Statements

When looked from an analytic perception, Interim and annual financial statements are fairly the same with similar aspects like income reports, balance sheets, and cash flow statements. However, there are a few differences that are vividly noticed between the two. The most obvious is the coverage period, which is a complete year for the annual financial reports and less than a year for the Interim statements. An interim report also should not necessarily have some disclosures that are required in an annual one. Interim reports can be shorter than the Annual reports. Other differences are noticed in the following areas:

Components

The annual statement should consist of a statement of financial position, profit and loss report, equity changes report, cash flow statements, and notes of financial statements.

The Interim financial statement should have a condensed statement of the company’s financial position, a condensed statement of profit and loss, cash flows, and selected notes.

Auditor Opinion

Positive assurance for the Annual Financial Statements and negative assurance for the Interim Financial Statements.

Purpose of Issuance

An annual report gives the complete and transparent information of a company’s financial position, cash flow, and financial performance. This entire information helps in knowing the results of the management's ranks and the resources they utilize.

An interim report provides information on a company’s performance and position before the year-end so the investors, creditors, and public are aware of the filing entity’s ability or capacity to generate cash flow and revenue. It also assists in knowing about the company’s financial liquidity.

Auditing

Interim statements are not audited because of the short time frame. Given the time-taking process of auditing, only annual financial reports are audited as they are released at the year-end.

Standards to Be Included in the Interim Financial Report

The government of India has no law on mandatory filing of interim financial reports. the IFRS or International Financial Reporting Standards do not make it mandatory for firms to file an interim financial report, many companies do that either by choice or because of the local regulations.

Companies aiming to file an interim financial statement should submit it in a ‘condensed’ format. In this case, the simplified presentation and disclosure requirements of IAS 34 apply. The following standards need to be included in an Interim financial report:

- Condensed statement for the financial position: This should contain information till the end of the current interim period and at the completion of the immediately next financial year.

- Condensed statement of profit or loss: This condensed statement requires all the profit and loss information of the current interim period and for the year to date.

- Condensed statement of equity changes: Should be filed for the ongoing year to date and also for the interim period of the next financial year, which will be considered for comparison.

- Condensed statement of cash flows: The statement should include details like the sources of cash flows, and other information for the current year to date and the next financial year.

- Self-explanatory notes: For condensed financial statements, headings and sub-totals should be necessarily included along with self-explanatory notes.

Why Do You Need to File an Interim Financial Statement?

The government of India or the law of the country in no sense makes it mandatory to file an interim financial statement. But it is regarded as a healthy practice and in some areas, even the local laws may make these reports a necessity at times in certain cases. A primary benefit of filing an interim financial report is you can find great insights into how your company is performing before the year-end. Following are the major advantages of interim statements:

Protection From Future Troubles: When you file an interim financial statement of your company, you gather lots of details like the cash flow, revenue, equity changes, etc. This helps in analyzing your company's performance and also detecting troubles if any. Since these statements are filed before the end of a fiscal year, you would have enough time to strategize your business and recover losses or financial issues that have occurred. So, Interim Financial Reports can actually safeguard you from future financial troubles.

Thorough Bookkeeping: Filing an interim financial statement requires a multitude of information, which you can utilize for further growth. You have all the information in one place and this can assist you in keeping a record of every minute financial detail. You will have the crucial information at your disposal whenever you require it.

Easy Loans: The best part of filing an interim financial report is you can get assistance in getting quick bank loans. With the previous fiscal year long gone, you may be asked about your company’s fresh financial records. An interim report can provide proof that you are not in debt and that the company is capable enough to afford a business loan. An interim statement will portray a positive image of your company in front of the bank.

Higher Chances of Closing a Deal: Clients often prefer a detailed overview of your company’s financial performance before closing a deal. A yearly report may not easily convince them if the previous year is long gone. So, you need something fresh to present to them. This is where the Interim Financial Statements can make your day. These fresh details will increase your chances of getting the deal and impressing your client.

Effective Future Planning: With an overview of your company’s financial condition to date, you will have an opportunity of mending and fix points where you could have done better. This will help you plan the future course of action with more precision.

Reports have also revealed that firms and companies that provided appropriate and timely interim financial reports were able to obtain covid relief funding. Your chances of attaining such opportunities go up when you have all the details of the company’s financial information and tax returns.

The Most Important Part of Interim Reports: Profit and Loss Statement

The most important and commonly used part of an interim financial statement is the profit and loss part and the balance sheet. With a piece of clear information on your company’s profit and cash flow, you will have an idea of how it's performing. Keeping a close eye on expenses will assist you in finding out new ways of earning more money to cover those expenses.

If you wait for an annual financial statement, then you can easily miss out on many opportunities. Sometimes companies fail to track their records of losses and enter into huge debts. A regular review of your income can assist you in avoiding such circumstances.

A balance sheet is a summary of what your business owns and owes during a specific time duration. Despite getting an annual one, you can gather a balance sheet for an interim period to get a fair idea of your debts, loans, and revenue.

Keeping a close eye on these two aspects and reviewing them regularly can help you pick out the negative and positive alterations occurring in your company. You will have a more vivid idea of aspects like the total equity, expenses, retained earnings, working capital, cash flow, etc. Generating these reports at least quarterly can provide you with deep insights and benefit your business in ways you can’t even imagine. Having a crystal clear sight of every minute financial detail of your company will yield positive results.

Are Interim Financial Reports Audited?

To answer this question that comes out of curiosity for a lot of people, no, Interim Financial Reports are not audited as they have not been made mandatory by the IFRS or GAAP. These reports are released by the companies for their own information and to keep the public, investors, and analysts informed about the company’s financial performance and condition.

However, companies can still hire an outside auditor to review their interim financial reports. The accounting practices in interim reports must be the same as adopted for the annual reports.

How to File or Make an Interim Financial Report?

Big firms can effortlessly hire financial analysts and other professionals for making an interim financial report. But a small company may save that budget and prefer utilizing the same money somewhere else. The process of preparing a financial statement may seem daunting and complex. However, companies, especially the start-ups and mid-sized ones can do the task all on their own by using any accounting software of your choice. There are many accounting softwares that you can utilize for this purpose. Here are the processes you can adopt for making an interim financial statement:

Insert the Expenses

All the expenses of your company including the debit and credits, bills, EMIs, etc should be clearly entered and all these bank feeds should be up-to-date. These dates will be entered into the ‘accounts payable’ field of the accounting software. You should also remember that the issuing date for a specific bill should be added and not the current date. Numbers can be confusing, which is why you need to be careful with them.

Enter all the Sales

Some individuals consider deposits as sales income, which is wrong. For this step, you will be needing the Daily Report, which is also known as the Z-tape feature of accounting software. It is an option available that helps in correctly entering the sales in the software. If you have enables the ‘pay later’ scheme in your business then the open invoices should also be mentioned in the receivable section of the accounting software you are using.

It is crucial to check all the accounts in your balance sheets so there is no room for error. From credit accounts to lines of credit cards, everything needs to be apt. This will enable you to detect missing or duplicate transactions, which if left unnoticed can error your interim financial statement.

Other Additions

Comparative statements of the previous year should be added to the Interim Financial Report. Aspects like profit & loss, balance sheet, etc of the preceding fiscal year should be added.

By following the above-mentioned points and using an accounting software of your choice, you can easily prepare an Interim Financial Report. Since you will be showing this report to investors, analysts, and other key shareholders, everything should be clear and accurate.

Difference Between IFRS and US GAAP Standards

Though a company is not obligated to file an interim financial report, some areas may still require you to do so because of the local laws. While issuing any kind of financial statement, certain regulations need to be followed. IFRS and GAAP standards can be different in some aspects and you need to be aware of them, especially the companies reporting for dual filers and those opting for conversion. Here are the major differences between IFRS and GAAP standards:

- The US GAAP offers some leniency on cost allocation to interim periods based on the expired time estimation, benefits, and other factors linked to the interim period. IFRS standards, on the other hand, do not provide any leniency here. The costs can be deferred at the interim reporting date only if the same can be done at the annual reporting date. There are also certain GAAP rules for property taxes that may not comply with the IFRS standards.

- Under IAS 34 of IFRS standards, if any losses have occurred due to variation in costs, they should be mentioned in the interim period of their occurrence. The company should not wait to include them in the annual fiscal year report. However, the US GAAP standard allows such losses to be deferred because interim financial statements are a crucial part of the annual reports.

- The IFRS standards ensure that companies account for alterations in tax laws enacted during an interim period. It advises the companies to do so either by mentioning the change in its occurrence of the interim period or by adjusting the estimated annual effective tax rate. But the US GAAP expects companies to recognize the tax changes in the interim period statement only.

- Companies with exposure to numerous tax countries and distinct taxable income categories should file individual effective tax rates for each jurisdiction and income category under IFRS Standards. If utilizing more particular rates might result in a realistic approximation of the effect, a weighted-average rate across jurisdictions is utilized. The US GAAP is slightly different here, it allocates the projected annual income tax expense or benefit to interim periods using a single overall estimated annual effective tax rate.

Frequently Asked Questions

Are Interim Financial Statements Audited?

Interim Financial Reports are not a necessity. Neither US GAAP nor IFRS has made filing an interim report a mandatory affair. So, these statements are not audited. However, if a company wants they can always hire a professional analyst or accountant for auditing them.

Should Interim Financial Statements be Prepared in a Summarized Format?

Interim financial reports are usually a brief representation of a company’s financial performance within a particular time period before the fiscal year ends. There are no specific standards that need to be followed while preparing these reports. This is why they are not as lengthy as the annual financial reports.

How can I prepare an Interim Financial Report?

Most small and mid-sized companies choose to do this using accounting software. With the emergence of technology and AI, these softwares can make the job pretty easy. All you need to do is enter the necessary details and check if all the values, dates, and amounts are accurate.

What Should I add to an Interim Financial Report?

As per the standards, an interim financial report should consist of information like cash flow, profit and loss, selected explanatory notes, and a balance sheet. All of these components should be in a condensed format. These are the minimum requirements, if you wish you can add more details that you believe the analysts and shareholders should be aware of.

Which IFRS Standard Deals With the Interim Financial Report Filing?

The IAS 34 of IFRS standards deals with the filing of an interim financial report. Though the organization has not laid strict standards for the preparation of an interim report, some suggestions have been made by them. You can find them in this guide above.

How can Deskera Help You?

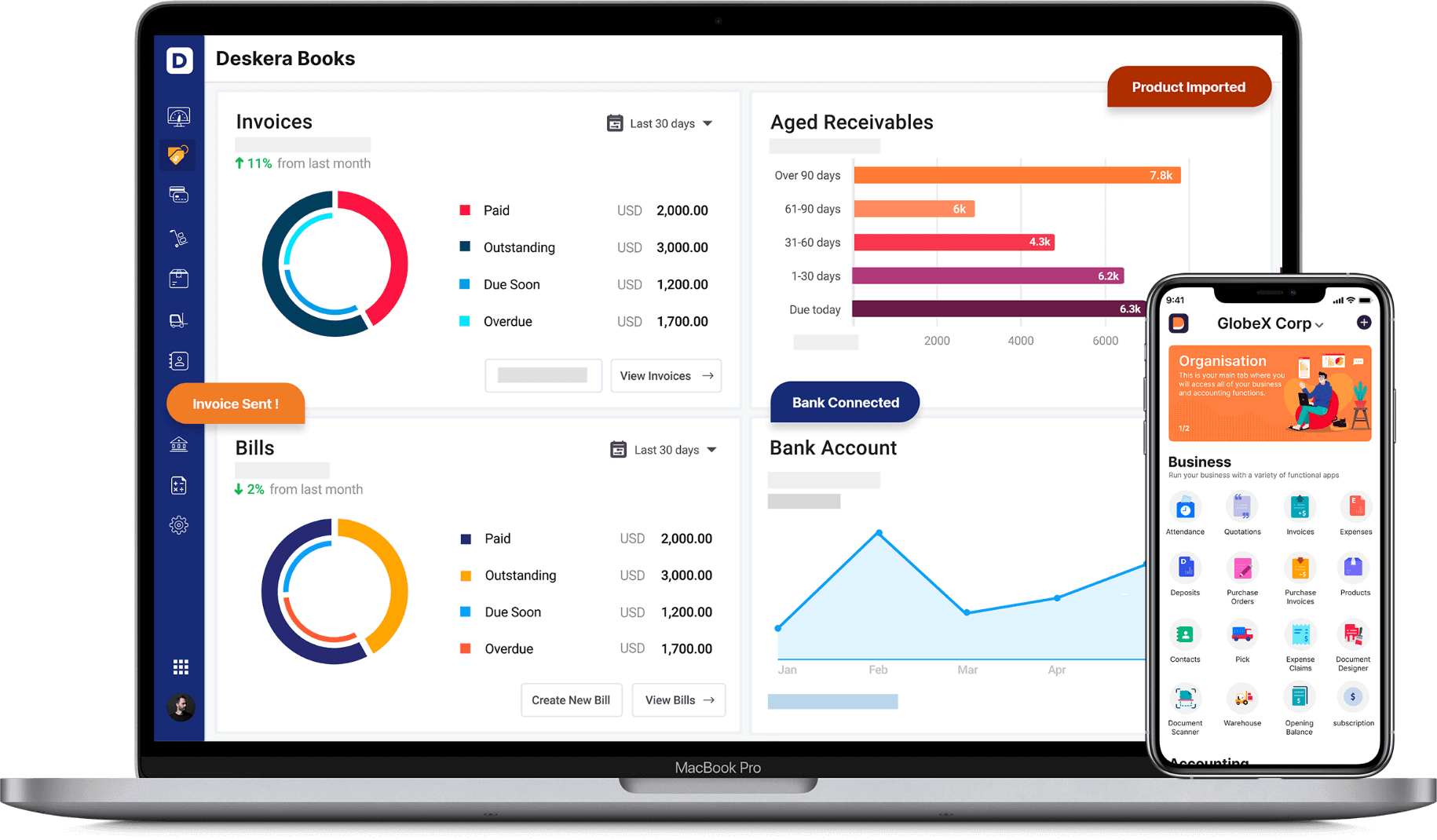

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Learn about the exceptional and all-in-one software here:

Key Takeaways

This guide is designed to provide in-depth information on interim financial reports. If a company wants to make the public, analysts, and shareholders aware of its financial performance before the year-end, it can do so by filing an Interim Financial Report. There is no cap on the time duration for an interim report and a quarterly report is the most common example of an interim financial statement.

The report should at minimum consist of condensed statements of cash flow, selected explanatory notes, a balance sheet, and profit and loss information. These reports are not audited as they have not been made mandatory either by IFRS or by US GAAP.

Making an Interim Financial Report can benefit you in many ways. It keeps you updated on your company’s financial condition. If there have been any losses during the interim period, you can still earn revenue and cover the damages by the year-end. It also helps the shareholders and analysts understand your company’s growth. These reports are most useful when you wish to impress your client through the company’s most recent financial achievements.

Related Articles