Businesses often deal with a lot of numbers and ratios that define how healthy it is in terms of finances, operations, and efficiencies. Operating profit ratio is also one of the numbers that tell you about the performance of your business in terms of money earned for every dollar worth of goods sold.

In short, operating profit margin is a number that depicts how much margin your business has over the sales prices of its goods or services. It is typically calculated by dividing operating income by the net sales of your business.

Long story short, a higher operating profit ratio means that your business is earning well. Let’s look into this financial health metric in a little detail. Here is what this blog has planned out for you:

- What is operating profit margin?

- How do you calculate operating profit margin?

- Importance of operating profit margin

- Limitations of operating profit margin

- How to improve operating profit margin

- Industry benchmarks of operating profit margin

What is Operating Profit Ratio?

Operating profit ratio is a metric that is obtained by dividing the operating income of a business by its net sales. It is a ratio that depicts how much profit a business is making for each dollar worth of sales it is making. Operating profit ratio does not account for tax or interest in the numbers it deals with.

In simpler, broader terms, it is the ratio of earnings and revenues of a business. Consider the earnings of your business to be like a salary and the revenue of your business like a return on investment. The division of these two numbers will tell you about the feasibility of the processes.

The primary significance of operating profit ratio is giving an insight into the efficiency of businesses in managing their core production and delivery expenses. Operating profit ratio helps you understand how to keep the costs of operations streamlined to be able to get better margins on your products while keeping the sales prices competitive, and still be able to cater to periodic discounts and offers.

The profitability of the operations of your business is reflected in the operating profit ratio. The higher the ratio, the better your business is considered to be. High variance in operating profit ratio typically depicts a business profile that is risky – given that its earnings and sales keep fluctuating for the ratio to be so volatile. However, this percentage cannot compare companies operating in separate industries.

For investment purposes, search for stocks of companies with a relatively stable operating profit ratio; not only does it provide an insight into its core production practices, but also of the status of its sales and earnings.

Let’s understand how to calculate operating profit ratio using different business metrics through examples.

Calculating Operating Profit Ratio

There are various ways to calculate operating profit ratio. To begin with, a very straightforward formula is:

Operating Profit Ratio = (Operating Income / Revenue) x 100

Components of Operating Profit Ratio

Operating income is a function of many other variables: it is the figure you obtain by subtracting all the operating expenses from the gross revenue (total earnings from all the sources before deduction of taxes). Operating expenses typically include outflows like wages, Cost of Goods Sold (COGS), rents, CAPEX, etc.

Net sales is the total sales of a business (gross sales) minus the allowances, discounts, and returns. However, this figure does not account for COGS.

How to Calculate Operating Profit Ratio

Operating profit ratio is obtained by dividing the operating income by net sales. Inferring into this formula, it can be expressed as a percentage value signifying profits per unit currency of sales. In other words, operating profit margin gives an insight into the operational expense management efficiency of a business by means of margin on every successful sale.

There are several ways to obtain the operating profit of a company to use in the operating profits ratio:

Operating Profits = Revenue – (Direct Costs + Indirect Costs)

Operating Profits = (Net Profit, before paying tax + Non-Operating Expenses) – Non-Operating Earning

Operating Profits = (Gross Profit + Operating Income from Other Sources) – Other Operating Expenses

Similarly, the Net Sales can be calculated thus:

Net sales = (Sales in Cash + Sales in Credit) – Sales Returns

Let’s look at this with an example. Say a company A has the following credentials:

|

Revenue |

$500,000 |

|

Direct Cost |

$200,000 |

|

Indirect Cost |

$150,000 |

|

Total Sales |

$10,00,000 |

|

Sales Returns |

$100,000 |

To calculate operating profit ratio, we need operating profits and net sales from the data above.

Operating Profits = Revenue – (Direct Costs + Indirect Costs)

OP = $500,000 – ($200,000 + $150,000)

Operating Profit = $150,000

Now, we need Net Sales.

Net sales = (Sales in Cash + Sales in Credit) – Sales Returns

NS = $10,00,000 - $100,000

Net Sales = $900,000

Therefore, our Operating Profits Ratio would be calculated thus:

Operating Profit Ratio = (Operating Income / Revenue) x 100

OPR = ($150,000/$900,000) x 100

Operating Profit Ratio = 16.67%

Typically, an operating profit ratio of about 20% is considered good, and below 5% is considered low. Let's see how significant operating profit ratio is.

Importance of Operating Profit Ratio

In the end, businesses run in order to profit from their operations and all the activities they invest time, money, and manpower into. If for every dollar invested, a company isn’t generating returns; or for every dollar, in sales, the margin dips lower and lower, which translates into problems with the operational and production cost efficiency.

It is best to maintain an operating profit ratio that's close to 20%. Companies can establish a protocol for operations and production lines, manage supply chains better to bring the operating costs down, operating income up, and boost their marketing efforts to increase sales.

For all the insights that this metric provides, it is difficult to glean a complete picture from this number. Let’s discuss the limitations of operating profit ratio.

Limitations of Operating Profit Ratio

Operating profit ratio, in the end, is just a number derived from static values that represent only the instantaneous picture of a company’s performance. While it does provide information about how well a company has planned its operations, the metric itself is too narrow to provide a bigger picture of the overall standing of the company.

Ideally, this number is used by investors to compare two companies in the same industry by keeping their business models and annual revenues as constants or similar. For example, say company A has an operating profit ratio of 17% while company B has this value at 19%. It is safe to say here that investing in company B shows better promise given the fact that its operating profit ratio proves its efficiency.

Another gaping hole in the operating profits ratio is the absence of accounting in it. The interests on debt and taxes that a company is liable for are not reflected in this ratio. It goes to say that even if operating profit ratio looks decent, the company may be feeding most of its profits into squaring off accumulated debts.

To make matters more complicated, operating profit ratio differs across industries – so this number will do little to help you build a diverse portfolio.

Ways to Improve Operating Profit Ratio

There are ways that help you get closer to the 20% mark and beyond by starting a best-practice culture at your company that helps you bring down your operational costs. Let’s see what they are.

Reduction in Cost of Goods

Acquiring the raw material for your production process is the first step in any business. Try to work with your suppliers in models that help you bring down the cost of raw materials and supplies that you need for your business.

An often overlooked factor is product packaging – on the surface, it seems like a minor expense, but it adds up a lot. Reducing the cost of goods leaves more room for higher margins in your product pricing.

Reduction in Wastage

If you are in the business of working with perishables, it is best to inculcate meticulous inventory management in order to reduce wastage. Wastage leads directly to an increase in acquiring raw material, while your business incurs losses on the one that has gone bad and needs to be disposed of.

Inventory management helps you plan your supplies better and phase your production efficiency.

Automation

Automation may be a one-time heavy investment. However, for the long term, it works to cut the recurring manpower costs which further brings down operating expenses. This gives you a better operating profits ratio by reducing production costs.

Boost Marketing

Pour more into effective marketing. Deploy Agile or any other method that suits your products – help shoppers spend more on your business. The more sales you make, the higher your profits. You can also try cross-selling to your shoppers to increase their basket size.

How can Deskera Help You?

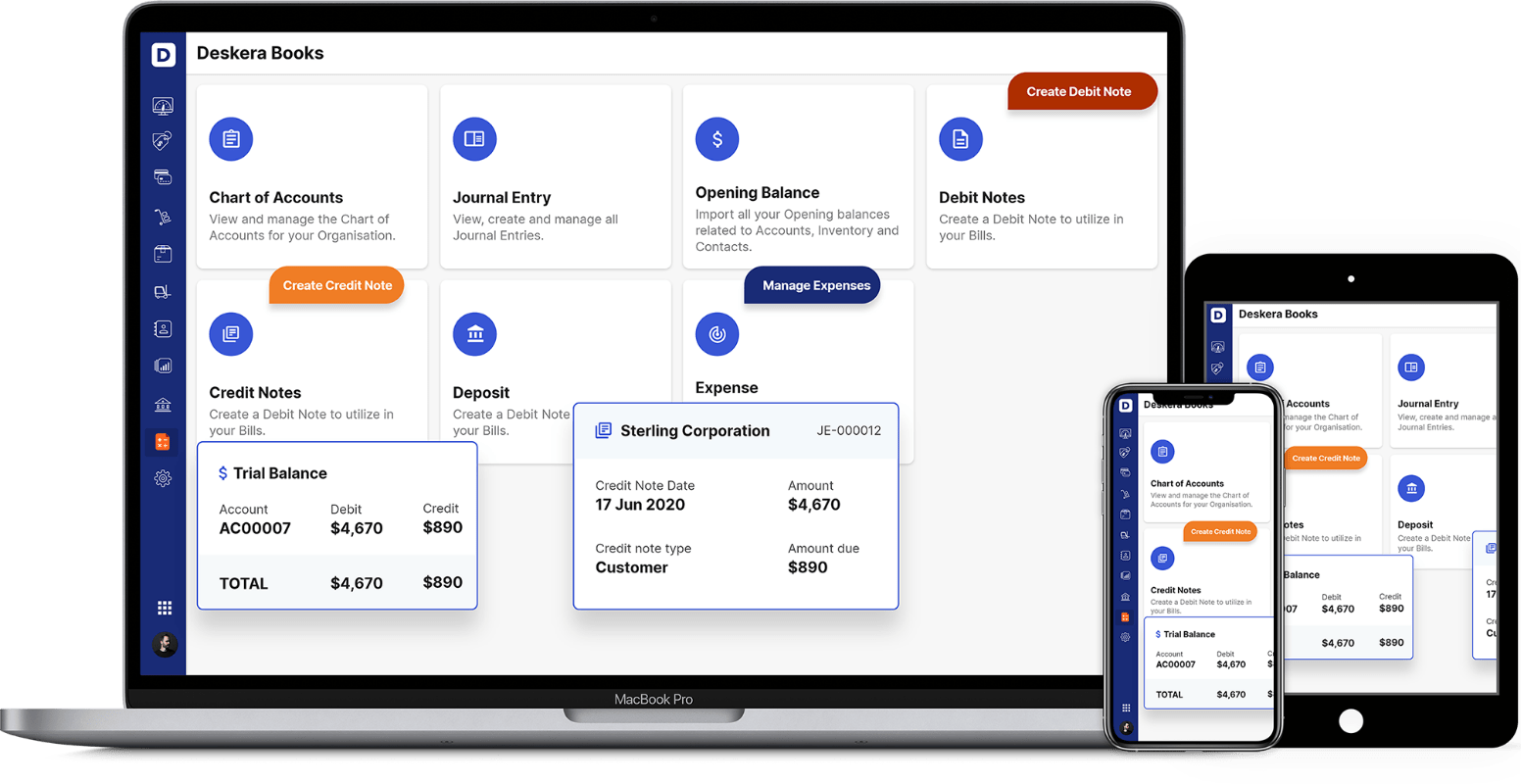

An online accounting and invoicing application, Deskera Books is designed to make your life easier. This all-in-one solution allows you to track invoices, expenses, and view all your financial documents from one central location.

The platform works exceptionally well for small businesses that are just getting started and have to figure out many things. As a result of this software, they are able to remain on top of their client's requirements by monitoring a timely delivery.

Thanks to our well-designed and well-thought-out templates, you can now anticipate that your work will become simpler. A template can be used for multiple actions, including invoices, quotes, purchase orders, back orders, bills, and payment receipts.

Take a small tour of the demo here to get more clarity:

Lastly, you would be able to assess all the reports- be it income statement, profit and loss statement, cash flow statement, balance sheet, trial balance, or any other relevant report from your laptop and your mobile phone.

Deskera Books hence is the perfect solution for all your accounting needs, and therefore a perfect assistant to you and your bookkeeping and accounting duties and responsibilities.

Operating Profit Ratios can be Boosted (Conclusion)

While they are just static numbers, they are important nonetheless. Operating profit ratios are the benchmarks of profitability. Not only do they provide the public with an idea of your business's performance, but also show the businesses a mirror. If the ratio is low, there is work to be done; if the ratio is high, there is still scope for increasing it.

This metric is also industry-dependent; some industries like agriculture have operating profit ratios as high as 90%. With that said, your business can adopt a slew of best practices and modern methodologies to maximize efficiency and minimize wastage.

Key Takeaways

- Operating profit ratio is the ratio of operating income of a company and its revenue. It is expressed in percentage. It reflects how well a company is able to manage its production costs while boosting sales

- For every dollar worth of sale, the profit a company makes on the dollar is depicted by operating profit ratio. This figure helps investors decide between companies when trading. Generally, an operating profit ratio of 20% or higher is good. This number should not dip below 5%

- While this is an important financial ratio for any company, it does have its limitations. Lacking accounting for interest on debt and taxes paints an incomplete picture of a company's financial position. With that said, there are ways to improve operating profit ratio, like reducing waste, reducing the cost of material, automation, etc.

- Pitched together in tandem with other financial ratios of a company, the operating profit ratio can prove to be a useful tool

Related Articles