A cash flow statement is an essential instrument for financial management. It records an organization's profitability. This statement is one of three major reports that help determine a company's success. In addition, it is typically helpful in developing a cash prediction to plan for the short future.

The information obtained from the cash flow statement helps make educated decisions to regulate corporate operations. In this article, we will look at the various aspects of a cash flow statement.

Topics covered in this article:

- What Is a Cash Flow Statement?

- How do Cash Flow Statements work?

- Cash Flows from Operations

- Cash Flows From Investing

- Cash Flows From Financing

- How do I calculate my cash flow?

- What is free cash flow?

- Limitations of the Cash Flow Statement

Let's Start!

What Is a Cash Flow Statement?

The cash flow statement is an accounting document that summarizes all cash inflows received by a company from ongoing activities and outside sources. It also covers all outgoings used to fund corporate operations and investment.

The company's financial statements provide market participants with a picture of all the activities that happen within the firm. It also shows how each activity adds to the firm's earnings. It is the most obvious of all income statements since it tracks cash generated by the firm in three ways: operations, investment, and financing. Net cash flow is the total of these three components.

These three elements of the cash flow statement can assist buyers in determining the worth of a firm's shares or the firm.

Next, let's look at how the cash flow statement works.

How do Cash Flow Statements work?

Every firm that sells or offers its shares to the public is required by the Securities and Exchange Commission to produce financial reports and statements. The balance sheet and income statement are the two most important financial statements.

The cash flow statement is an important document that provides interested parties with information about all the transactions that occur within a firm.

Accounting has two types: accrual and cash. Because most public firms employ accrual accounting, the income statement does not correspond to the company's cash position. On the other hand, the cash flow statement is concerned with cash accounting.

Profitable businesses sometimes cannot manage cash flow effectively, so the cash flow statement is essential for businesses, analysts, and investors. The cash flow statement has three categories: operations, investment, and financing.

Consider a corporation that sells a product and gives its customers credit for the purchase. Even though the sale is part of the revenue, the firm may not receive money until later. The corporation generates a profit and pays income taxes, but the firm may pull in just about the same amount of cash as the sales or revenue numbers show.

There are three types of cash flow statements: operations, investing, and finance. Let's look at them one by one.

Cash Flows from Operations

This is the initial portion of the cash flow statement, and it contains cash flows from operating activities (CFO) and payments from all functional business operations. The cash flows from the activities segment start with net earnings and then unify all non-monetary items, affecting company processes into cash items. In other words, it is the firm's net income in cash form.

This section details cash inflows and outflows directly related to a company's principal business operations. For example, these tasks may involve purchasing and selling merchandise and services and paying employees' wages. Other types of inflows and outflows, such as investments, mortgages, and dividends, are not a part of it.

Companies can create enough positive cash flow to support operational expansion. However, if there is not enough, they may have to gain external growth finance to expand.

Cash Flows From Investing

This component of the cash flow statement examines cash flows from investments, which are the outcome of investment profits and losses. The amount spent on land, machinery, and technology is also a part of this statement. This is the part where analysts check for variations in capital expenses.

When capital expenditure increases, it usually shows that cash flow will decrease. However, this is not necessarily bad because it may signal that a firm is investing in its future developments. Businesses with greater capital expenditure are often ones that are expanding.

While good cash flows in this segment are desirable, investors prefer organizations that create cash flow through company operations rather than investing and financing. For example, businesses can produce cash flow by selling machinery or assets within this division.

Cash Flows From Financing

The last element of the cash flow statement is cash flows from finance (CFF). This section summarizes how the company uses the cash. It is a measure of cash flow between a firm, its owners, and its creditors. Debt or stocks are often used to derive it. Companies typically present these numbers of shareholders every year in a company's 10-K report.

Economists use the cash flows from the finance segment to calculate how much money the firm has distributed through dividends or share buybacks. It is also essential to determine how a corporation gains funds for operational expansion.

It notes all the cash collected or repaid via capital fundraising activities, such as equity or debt, as are loans got or repaid.

When the cash flow from finance is positive, more money is coming into the firm than is leaving. When the figure is negative, it may show that the corporation repays debt, pays dividends, or repurchases stock.

Now, you should have a basic understanding of all three types of cash flow statements. Next, let's look at how you can calculate your cash flow.

How do I Calculate my Cash Flow?

If you're concerned about having to do a slew of complex calculations to determine your cash flow, don't be! There is a quick and simple approach to studying your cash flow.

A statement of cash flows is a helpful report. If you use an accounting tool, you can quickly generate a Statement of Cash Flows. If you have a bookkeeper or an accountant on your team, they can generate the report.

Running a cash flow statement allows you to discover trends in your cash flow and forecast and plan for financial peaks and troughs.

What is Free Cash Flow?

Free cash flow is a cousin of operating, investing, and financing cash flow in the cash flow universe. It's related, but not the same. Free cash flow refers to the remaining cash in your firm after you've paid your operational and continuing capital costs.

Required capital costs are investments necessary to keep your firm running, such as updating machinery and equipment, acquiring inventory, and investing in R&D. Free cash flow is the amount of money you have available to spend on things like extra investments or payments to your company's shareholders. But, of course, you get to decide what you do with your extra income!

The free cash flow formula is:

Cash flow from operations - Capital expenditures required = Free cash flow

Your operational cash flow is at the bottom of the Operating Activities section on your statement of cash flows. It's the "Net cash from operational operations" line. Next, run a balance sheet report in your bookkeeping application and search for the Fixed Assets section to locate your capital costs. These will be your capital outlays.

Here's an illustration:

Maggie owns and operates a parlor. She runs a cash flow statement at the end of the year and has $45,550 in operational cash flow. She then does a balance sheet calculation and calculates that her capital costs, including a new stove and display coolers, total $15,550.

$45,550 – $15,550 = $30,000

(Operating cash flow)–(Capital expenditures) = (Free cash flow)

Maggie has a cash flow of $30,000 available. She may now decide whether she wants to use the money to make further investments in her firm, take it out as an owner's draw, or spend it on something else.

Limitations of the Cash Flow Statement

Negative cash flow is not always a red flag without more investigation. For instance, poor cash flow can occasionally result from a company's decision to develop its business at a specific point in time. However, it is a positive thing in the long run.

Analyzing variations in cash flow from one period to the next gives the investor a clearer understanding of how the firm operates and whether it is on the verge of bankruptcy or success. We should see the CFS with the other two financial statements.

That's it! That's all the essential information about the cash flow statement. Now, let's move on to the next section and look at some of the most frequently asked questions.

Frequently Asked Questions

What is the difference between net income and cash flow?

Net income is gross income minus expenses in an accounting period. Cash flow is determined by changes in cash balances from one accounting period to the next.

What exactly is after-tax cash flow?

We calculate cash flow after taxes, or CFAT, by deducting non-cash items from net income, such as depreciation and restructuring charges.

Is it possible for cash flow to be negative?

When your expenses exceed your income, you have a negative cash flow. It suggests poor receivable management and a misunderstanding of how to handle credit. Negative cash flow is acceptable for a short period, but recurrent negative cash flow might lead a corporation to fail.

What happens when a company's cash flow is negative?

When cash flow is negative, firms cannot pay their debts and need to borrow money or pay interest, negatively affecting their bottom line.

With that, we have reached the end of the article. Let's take a quick summary of everything we have covered in this article.

How can Deskera Help You?

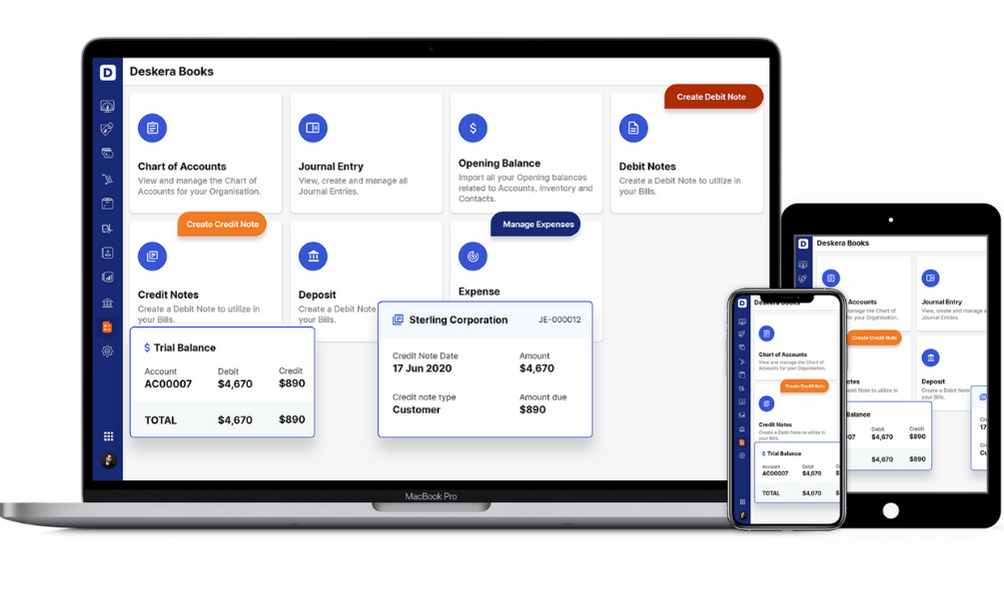

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs from creating invoices, tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- A cash flow statement is an accounting report that summarizes all cash inflows received by a firm from continuing activities and external capital sources

- Every firm that sells or offers its shares to the public is required by the Securities and Exchange Commission to produce financial reports and statements

- The cash flow statement is an important document that provides interested parties with information about all the transactions that occur within a firm

- There are three types of cash flow statements: cash flow from operations, investing, and financing

- The cash flows from the operation segment start with net earnings and then unify all non-monetary items, affecting the company's processes into cash items. In other words, it is the firm's net income in cash form

- Cash Flow from Investing: The cash flow statement examines cash flows resulting from investment profits and losses. The amount spent on land, machinery, and technology is also a part of the statement

- Cash flows from finance measure cash flow between a firm, its owners, and creditors. Debt or stocks are often used to derive it.

- To calculate your cash flow, you can use an accounting tool to generate a Statement of Cash Flows quickly. If you have a bookkeeper or an accountant on your team, they can generate the report

- Free cash flow refers to the remaining cash in your firm after you've paid your operational and continuing capital costs

- Free cash flow is the amount of money you have available to spend on extra investments or payments to your company's shareholders

- Poor cash flow can occasionally result from a company's decision to develop its business at a specific point in time, which is positive in the long run

Related Articles