North Dakota in the United States of America is considered to be a pro-employer state. This state is known to follow all the federal guidelines laid down by the government and does not impose any state-specific payroll taxes for the employees. However, according to available data, the state is known to impose a state income tax which is considered to be the lowest in the country.

Furthermore, the employers must pay state unemployment insurance tax and even workers’ compensation insurance which is considered to be common among most states in America. Let us understand other taxes in North Dakota through this article -

We would be covering the following topics in this blog -

- Income Tax Withholding

- How to calculate income tax withholding in North Dakota?

- Register with Withholding Account

- How to Sign up for North Dakota Taxpayer Access Point?

- How to calculate payroll taxes in North Dakota?

- How to set up payroll in North Dakota?

- Key Takeaways

Income Tax Withholding

An aspiring business owner has to support the state income tax and its withholding amount in North Dakota. According to available data, the businesses have to pay for the withholding amount to the state government in the following situations -

- An employer pays wages to the employee if he gives services in North Dakota and these wages are subject to laws established for federal income tax withholding

- The business owner gives a salary to the state resident employee who works in another state. Here the employer has an exception where he is required to withhold the other state’s income tax from the wages earned in this different state.

The employer must keep in mind that certain employee wages are not considered valid for North Dakota state income tax withholding. The professionals that fall under this category are farmers, ranchers or professionals whose wages have been exempted from federal income tax withholding.

How to calculate income tax withholding in North Dakota?

If you are an employer who is just stepping into the world of business, it is critical to have accurate information about payroll taxes and other taxes in North Dakota. As per the available information, North Dakota heavily relies on the federal form W-4 to help the business owner understand the amount to be withheld from the employee’s paycheck.

If the business owner in this state needs more information on withholding, he must check -

- Guideline for Income Tax Withholding & Information Returns

- Income Tax Withholding Rates and Instructions

The employer must inform the concerned authorities with full details of the individual responsible for filing sales and withholding returns. If he has made any change of the professional for this position in his business, then the employer must see pages related to the Declaration of Managers, Members, Governor’s Partners, and Corporate Officers.

Register Withholding Account

Every employer in North Dakota is required to register for an Income Tax Withholding account with the Office of State Tax Commissioner online. This can be done through North Dakota Taxpayer Access Point (ND TAP).

The employer can use this link for online registration: https://apps.nd.gov/tax/tap/_/

The businessman can follow these steps to get started with North Dakota Taxpayer Access Point (ND TAP) -

- An employer must apply and get an approved confirmation from the sales and Use/Withholding Tax Account in ND TAP.

- In this step, the employer must go to the ND TAP page and select sign up for “Access”

- The employer must create his username and password

- He would be given an authorization code for validation based on the access code chosen in the options - business mail, personal email or phone verification

- Upon submitting this authorization code, the employer can log in to his account

- A North Dakota employer then can add access to his accounts. This can be generated by granting a specific user (employee in your organization) owner access. The other way is the business owner himself requests

- the account ownership by entering specific details of the employee.

How to Sign up for North Dakota Taxpayer Access Point?

An employer can sign up for North Dakota Taxpayer Access Point by following the instructions mentioned in this PDF document. He should be aware of the following terminologies while filling out this document.

Granting Access: An employer with owner access can grant access to an employee in his company by giving him the identification of Login ID and asking him for logging in to the portal.

Requesting Access: When a particular user is logged in to the portal, another user of the company can request access to the group by selecting the option “Add/ Grant Access” with the proper entry of the following information about the concerned taxpayer -

- Entity Type (Sole Proprietor, Corporation)

- Identification Number (SSN or FEIN)

- Type of Account (Sales and Use, Withholding, Local Lodging)

- Account Number

- Letter ID

- The employer’s TAP authorization code letter is not acceptable

How to Calculate payroll taxes in North Dakota?

Most Americans in North Dakota have very less idea about payroll taxes in this state and are seen to associate them with a Hollywood movies. Hence, an employer can make use of an online calculator for payroll taxes. In this calculator, the employer only needs to enter the information related to the employee's wages and his W-4. By entering this information, the payroll taxes for North Dakota will be calculated within a short span of time.

Link - https://onpay.com/payroll/calculator-tax-rates/north-dakota

Here is detailed information about how to calculate payroll taxes in this state -

Let us understand how to calculate the federal payroll taxes in North Dakota with an example. It will help an employer understand how to calculate all employees’ federal withholdings and even give an idea of additional taxes he is responsible for paying in this state.

Here, Gross wages are the paystub that the employee has earned in his last period. In North Dakota, for employees working on per hour basis, the employer has to multiply the ongoing pay rate by the number of hours they have worked. The businessman will calculate the gross wages for salaried employees by multiplying his annual salary by the number of pay periods in the year. An important point here to remember by the businessman is all bonuses, tips received and commissions shall be included in gross wages for the employee in North Dakota.

The employer then needs to calculate the pre-tax withholdings of employees. IT includes 401(k) accounts, health saving accounts (HSA), flexible spending accounts (FSA) or other pre-tax withholdings. The employer must subtract all these calculations from the gross wages before doing an application for payroll taxes.

According to the rule, the small businessmen must deduct federal income taxes from the employee’s salary. It can range from 0 to 37 per cent. He can get all withholding information related to payroll taxes for North Dakota in IRS Publication 15-T.

The employer must deduct and match FICA taxes to cover Medicare and Social Security taxes from the salary. The North Dakota State income tax is considered to be a progressive income tax. It implies if the employees are having a handsome salary, then need to pay a higher income tax. However, the state has the lowest state income taxes rate in America. It is found that the tax rate in this state is from 1.1% to 2.9%. However, employees who have a salary of more than 433,200$ per year will be paying higher taxes.

How do calculate the payroll taxes in North Dakota?

If you are an employer in North Dakota who has just started a business in the state, here are the steps that you should use to calculate payroll taxes -

- Figure out the gross pay of the employee

- Calculate the employee’s withholdings before 2019 or earlier and in the year 2020 or later

- The employer must then add the expenses done on reimbursements

- Do a total and calculate the amount.

How to set up payroll in North Dakota?

If you are an employer who has just established a business in North Dakota, it is obvious that you get confused about the payroll taxes and how to run them. Here is a step by step guide on how to run a payroll in this state -

- Register your business as an employer with an Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

- Set up the payroll process for your organization by implementing a payment process, determining its schedule and how you want to pay the employees. Decide on the taxes and deductions

- Collect the necessary employee payroll forms: W-4, I-9 and direct deposit information to submit to the North Dakota government for withholdings.

- Approve timesheets for the employees

- Pay the employees using a method suitable for your organization

- File payroll taxes with the state and federal governments.

How Deskera Can Assist You?

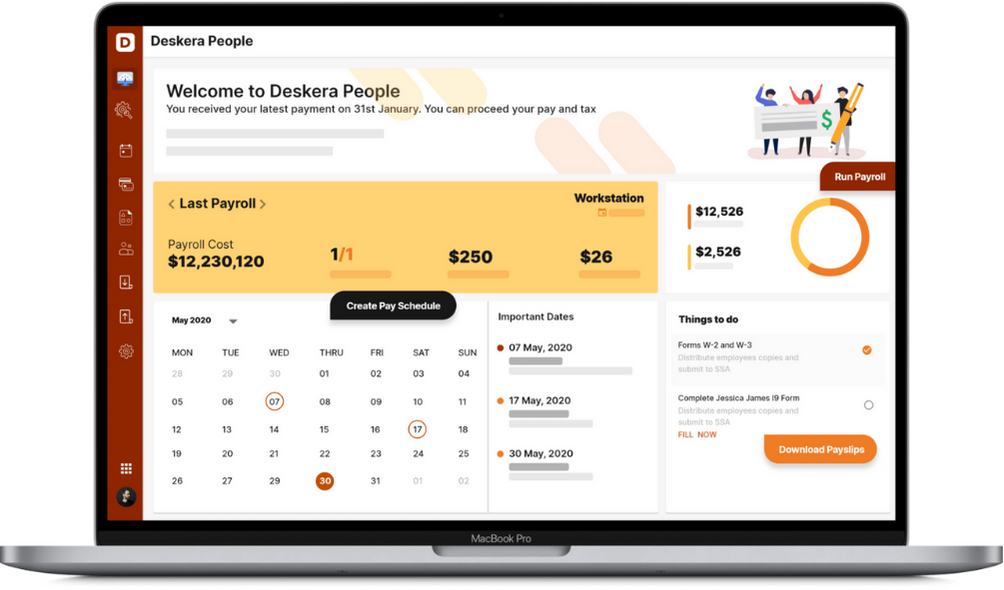

As a business, you must be diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- An employer in North Dakota can do tax withholdings from his employees through North Dakota Taxpayer Access Point (ND TAP). The employer must first register on this site.

- The employer must deduct amounts such as FICA, Medicare, HSA, and FSA for pre-tax withholdings from the employee’s paystub for payroll in this state.

- He needs to sign up on the government website and give an employee in his organization the login details of the portal for proper management of payroll taxes in North Dakota with required access.

- North Dakota has the lowest tax rate which ranges from 1.1% to 2.9%. It means employees with higher salaries end up paying more taxes.

- The employer has to set up an EIN and have an account on the EFTPS to include a payroll process for his organization in North Dakota. This will assist him to file the payroll taxes in North Dakota

Related Articles