It was found out by Schwab in 2018 that 401(k) was the most popular method for saving money for retirement, with 98% of people preferring it, with the second option being saving in a savings account which was preferred by 61% people. This was further supported by the conclusion of the U.S. News, 2019, which said that the compound annual average growth rate of 401(k) plans is 14.2%.

Betterment in 2020 found that the main motivator for 75% of the participants of the 401(k) plan was concern and retirement readiness. In fact, AmericanBenefitsCouncil found that despite the low salaries and high debt loads, 82% of the millennials participated in the 401(k) plans.

These statistics show how the popularity of the 401(k) plan is on the rise. For every individual, choosing the right plan for your future is always important, and in the light of the rising competition and expenses, it is so now more than ever. Thus, you should know all about what your ideal 401(k) plan should look like, and this article will help you in knowing that by covering the following topics:

- What is a 401(k) Plan?

- How Do 401(k) Plan Work?

- 15 of the Most Common Questions Asked by Employees About 401(k) Plans

- Summary Plan Description (SPD) and How They Will Answer Several of Employees' Questions With Ease

- How Can Deskera Help with 401(k) Plans?

- Key Takeaways

- Related Articles

What is a 401(k) Plan?

A 401(k) plan is a company-sponsored retirement account to which employees can contribute income, while the employers may match the contributions. It was designed by the United States Congress to encourage Americans to save for their retirement.

How Do 401(k) Plan Work?

Out of the several benefits that 401 (k) plans offer, one of the main benefits that it offers is tax savings. In the case of 401(k) plans, there are two options that an employee can choose from as both come with their distinct tax advantages. These are:

- Traditional 401(k) - In this type of plan, the contributions of the employee would be deducted from their gross income. This means that the money will come from the employee’s payroll before income taxes have been deducted. Thus, the employee’s taxable income will be reduced by the total amount of contributions he or she makes in a year. This can then be reported as a tax deduction for the tax year. In this case, no taxes would be levied on the contributed earnings until the employee withdraws the money, usually during his or her retirement.

- Roth 401 (k) - In this case, the employees’ contributions are deducted from their after-tax income. Thus, there is no tax deduction in the year of the contribution. However, when the money is withdrawn, usually during the retirement period of the employee, no additional taxes are levied on the contribution amount or even on the investment earnings.

However, Roth 401(k) is not offered by all employers. If the employer does offer it, then the employee can choose one from both the options, or he, or she can even design a mix of both up to the annual limits on their tax-deductible contributions.

Also, the employer may choose to pay part or all of your contribution to the 401 (k) plan. Lastly, for your 401 (k), you would get to choose among a number of investment options, usually mutual funds.

15 of the Most Common Questions Asked by Employees About 401(k) Plans

Some of the most frequently employee asked 401(k) questions are:

1. What is a 401(k) plan? Why is it called that?

401(k) plan is a retirement plan wherein cash will be taken out of your current payroll up to the contribution limit set by you in compliance with the IRS rules. The money thus saved will fill in the gap in your employment income when you are ready to enter the next phase of your life. 401(k) plan is called so after the section of the tax code that governs it.

2. What happens to the contributions you make under your 401(k) plan?

The contributions that you make towards this plan will be invested at your discretion into one or more funds provided in the plan. Thus, these investments will grow the money you have contributed to your 401(k) account. Despite these contributions and their growth through investments, you will not be required to pay any taxes on the same as long as you do not take a distribution.

3. Do employers play any role in the employees’ 401(k) plan? If yes, what is it?

Considering that the traditional 401(k) plans are set up and maintained by your employers, they are also known as employer-sponsored plans.

In addition to this role of employers in your 401(k) plan, another role is also how they will often match your contributions. This means that your employers are agreeing to contribute a set percentage of money to your 401(k) plan if you are also contributing some percentage to it.

For example, if your company has a 50% match policy and you are contributing 8% of your annual salary to your 401(k) plan. In that case, your company would contribute 4%, making your total contribution for the year equal to 12% of your annual salary.

Note: You should try to maximize your employer’s match as it would be more beneficial to you, and it will also be free from taxation as long as it is sitting in your 401(k) account. However, depending on your plan type, it might be taxed upon distribution.

However, what you should also keep in mind is that it is not mandatory for employers to match your contributions. While it is a common practice in larger companies, your employer might not be following it if he or she is going through a tight financial situation or if their net profits are not as high.

Irrespective of the fact that matching your contribution is a type of profit-sharing, some employers choose to follow it because doing so offers them some benefits like their taxable income can be deducted up to a certain amount.

4. Are all 401(k) plans created equal?

This is one of the most important 401(k) plan questions, as it brings to light that all 401(k) plans are not created equal. 401(k) plans that have the following qualities are more advantageous than the others:

- The ability to participate right away- Several companies require their employees to be working for one month to 3 months to even a year in certain cases before they become eligible for joining this retirement plan. Thus a 401(k) plan that lets you participate sooner and take advantage of the (any) employer match to your contribution is more beneficial than the others.

- A generous 401(k) match- A generous 401(k) match is one where the more you contribute, the more your employer will contribute, which will only mean more money for you in your retirement years.

- Immediate vesting- This is in reference to how you would not get to keep your employer’s contributions to your 401(k) account until you are vested in the plan. Being vested in the plan means that you would be the owner of these contributions, and thus, you would be able to freely take them with you when you leave the company.

For example, many employers follow a scheme wherein the longer you stay with them, the larger percentage of the contributions to your 401(k) account you would be able to take with you when leaving. Other companies offer a scheme wherein after working for a certain time period for the company, usually a long time period, you would be able to keep the entire match contributions with yourself.

- Low expenses or the company pays most fees- There are fees associated with establishing and maintaining your 401(k) accounts. Having an employer who covers these fees in full or in part would be more beneficial to you.

- Automation- Having automatic enrollment, deductions and filings will make your life considerably easier.

5. When should I start contributing and therefore begin my 401(k) account?

This is another of the crucial 401(k) questions. One of the prime things you need to know in order to get the answer to this question is that the earlier you start working on your 401(k) account, the better it will be for you. This is because the more money you are able to save now, the more you will have at your disposal during your retirement years.

6. How often should I contribute to my 401(k) plan, and how much?

This is one of the common yet important 401(k) questions as it will become one of the determining factors of whether you would be participating in the 401(k) plan or not. Generally, 10% is the accepted amount of contribution for each pay period. This, however, is not a standard, as you should choose to invest as much as you can afford so that you can maximize your retirement savings.

While deciding how much you want to contribute and how frequently, you should take into consideration other areas that might require your financial attention. These can include, but are not limited to:

- Emergency funds and shorter-term savings, having enough of these will ensure that you do not need to use money from your 401(k) account before your retirement.

- At the very least, try to contribute as much as your employer matches as this is a guaranteed return on the match, irrespective of whether it is 50 or 100 percent.

Remember, you would be able to adjust your contributions per pay period throughout the year. This means that if you want to catch up on your retirement savings, you can very well opt to contribute 25% of your salary for four months. Once you have caught up, you can go back to reducing your contribution to the minimum that your employer match requires. This depends on your financial situation.

7. What is the maximum amount that I can contribute annually?

While these limits change with changes in inflation, the annual limit to how much you can add to your 401(k) account in the tax year 2022 is a maximum of $20,500. However, if in case you are 50 or older, then you can contribute $6,500 more, up to the total of $27,000, to catch up. In the tax year 2021, this limit was set at $19,500, extendable under the same conditions up to $26,000.

8. What about taxation on my 401(k) plan?

The traditional 401(k) plans are tax-deferred, which means that you would not have to pay taxes until you withdraw money from your 401(k) account. Thus, your 401(k) contributions, as well as that matched by your employer, would not be taxed while they are in your 401(k) account.

However, once you withdraw them, known as “distribution,” you will have to pay income taxes on the same as the local, state, and the federal government will now take it as regular income. In addition to you having to pay income taxes, you would also have to pay any penalties that you might have incurred, for example, a penalty for withdrawing money from your 401(k) account too soon.

Remember, even though you would not be paying tax on your contributions until you withdraw them, you would continue to be responsible for the full amount of your payroll taxes- i.e., social security and medicare taxes on your payday.

Also, when you withdraw from your 401(k) account, you would have to pay income tax on the employer’s contributions, but not their share of payroll taxes on the same amount.

9. What if I have an old 401(k) plan? What should I do about it, for example, if my employer changes?

In case you are leaving the company that you had established your 401(k) plan with, you would have some of these options to weigh:

- Leave assets in your previous employer’s plan.

- Move the assets into a rollover IRA or a Roth IRA.

- If allowed, roll over the assets to your new employer’s workplace savings plan.

- Cash-out or withdraw the funds; however, this is not a recommended option if you are younger than fifty-nine and half years, as withdrawal under these circumstances will lead to you having to pay additional penalties.

Which of these options you opt for on changing your company with which you had set up a 401(k) plan will depend on your goals for your retirement plan and on your current financial situation as well.

10. How long will I have to wait before I can use my money from the 401(k) account?

This again is an often asked 401(k) question due to concerns of restrictions on the same and penalties if the rules are not followed. This concern is well-placed because, typically, you would not be able to withdraw money from your 401(k) account before you turn fifty-nine and half years old.

If, however you do withdraw before it, then you would incur a 10% early withdrawal penalty from the IRS in addition to the income taxes that you would be already paying according to your tax bracket.

This penalty imposed by the government is to discourage people from using up their savings before their retirement age when they would need more than ever for their day-to-day expenses.

The only two ways by which you would be able to dodge paying this penalty on early withdrawal are:

- If you are at least 55 years old and you are retiring from the company that is currently sponsoring your 401(k) plan, then you would be able to withdraw monthly income from your 401(k) plan without having to pay any penalties for the same. However, you will owe income tax to the government on the amount you withdraw.

- Suppose you resort to a Section 72(t) distribution which is a substantially equal periodic payment exception through which you would generally be given the least retirement pay-out available. This option can be used by anyone who has a 401(k) plan, irrespective of their age. Under this option, your distributions will have to be “substantially equal” payments based on your life expectancy. Once these distributions begin, they will continue for a period of five years or until you reach the age of fifty-nine and a half - whichever is the longest.

Note: Usually, your employer is required to give you a “summary plan description” annually and upon request from you. This summary will address early retirement options in your 401(k) plan. However, if you roll over your 401(k) into an IRA, then this option would no longer be available to you.

11. How many 401(k) plans can I have?

While there is no legal limit on the number of 401(k) plans that you can have at a given time, you can only contribute new money to the plan at your current employer. It is because of this reason that it usually does not make sense to keep your 401(k) plans from your previous companies open.

In fact, by consolidating all your old 401(k) plans with your current one or opting for an IRA, you would be simplifying things for yourself as you would be able to monitor your investments better, as well as be able to maintain control over your accounts.

12. How do I know whether I am on track in my 401(k) plan or not?

Virtually, it is quite common for all 401(k) plans to have a feedback system that will help the participants in knowing how their savings plan is working and how well or not well they are doing with it.

Such a feedback system often involves the usage of color-coding like red indicates good, and green indicates bad. In addition to this, there might also be projected income replacement ratios displaced on your statements. In fact, nearly all have tools available on a website that you can use to model different savings and investment rates. You should thus visit your plan’s website for all such details and insights.

13. How to assess whether my 401(k) plan is good or not?

This again is a common and essential 401(k) question as knowing the most common characteristics of a good 401(k) plan will help you in assessing whether your 401(k) plan is good or not. These characteristics are:

- Availability of low-cost (non-index fund) investment options

- Prevalence of index funds

- Availability of investment advice with your 401(k) plan

- Availability of projection tools with and for your 401(k) plan

- Feedback mechanism on how you are doing and how is your 401(k) plan doing

- Senior management’s support for your 401(k) plan

- How well you understand your plan will be the main determinant of how your 401(k) plan is.

14. Should I take a 401(k) loan?

Knowing the answer to this 401(k) loan will save you from making one of the worst investment decisions ever. While you might be tempted to take a 401(k) loan because of your financial circumstances because a 401(k) plan cannot reject your loan request because there is no underwriting, and also because you get to pay interest to yourself, it is still the worst decision you could make.

This is because your balance is protected from attachment by creditors in the event of your bankruptcy and thus should only be used for your retirement and for keeping that phase of your life secure.

Additionally, if you take out, say, for instance, $10,000 for a loan out of your 401(k) plan, which was actually engaged in an investment that was earning you 12% interest, by taking out the loan, you turned that into an investment that will earn 5% to 7% interest-only (that you yourself would be paying as your loan will be a part of your 401(k) plan account investment portfolio).

Thus, the interest you pay to your own plan in exchange for a loan would most likely be lower than the interest rate it would be getting paid from other investment sources. Additionally, the interest on a 401(k) loan is not tax-deductible, while interest on loans like home equity loans is tax-deductible.

15. Should I roll over prior employer 401(k) plan balances?

It is recommended that you roll over your prior employer’s 401(k) plan balances into your current employer's 401(k) plan and not into a rollover IRA as the costs of doing that would be much lower.

Summary Plan Description (SPD) and How They Will Answer Several of Employee’s Questions With Ease

A summary plan description (SPD) is typically included in the employee handbook and has details that you will need to understand and manage your 401(k) plan account. It is required by the Federal Government that your employer provides you with the same.

An SPD should include (but is not limited to) the following:

- Information on how you can get started

- Importance of naming your beneficiary

- 401(k) plan rules, eligibility requirements, vesting schedules, and other documents outlining the operation and management of the plan

- Details on how you can make changes to the paycheck deduction amount and how long it will take to process those changes, for example, one pay period or 30 days.

- Will your employer allow you to take out money from your retirement plan in the form of a 401(k) loan?

- Whether your company is offering you additional benefits like contribution matching? If it does, the same would be mentioned in the SPD.

In case any changes are made to the 401(k) plan, which is likely as they evolve with your needs, your employer would be required to send you a copy of the SPD either annually or whenever you request one.

How Can Deskera Help with 401(k) Plans?

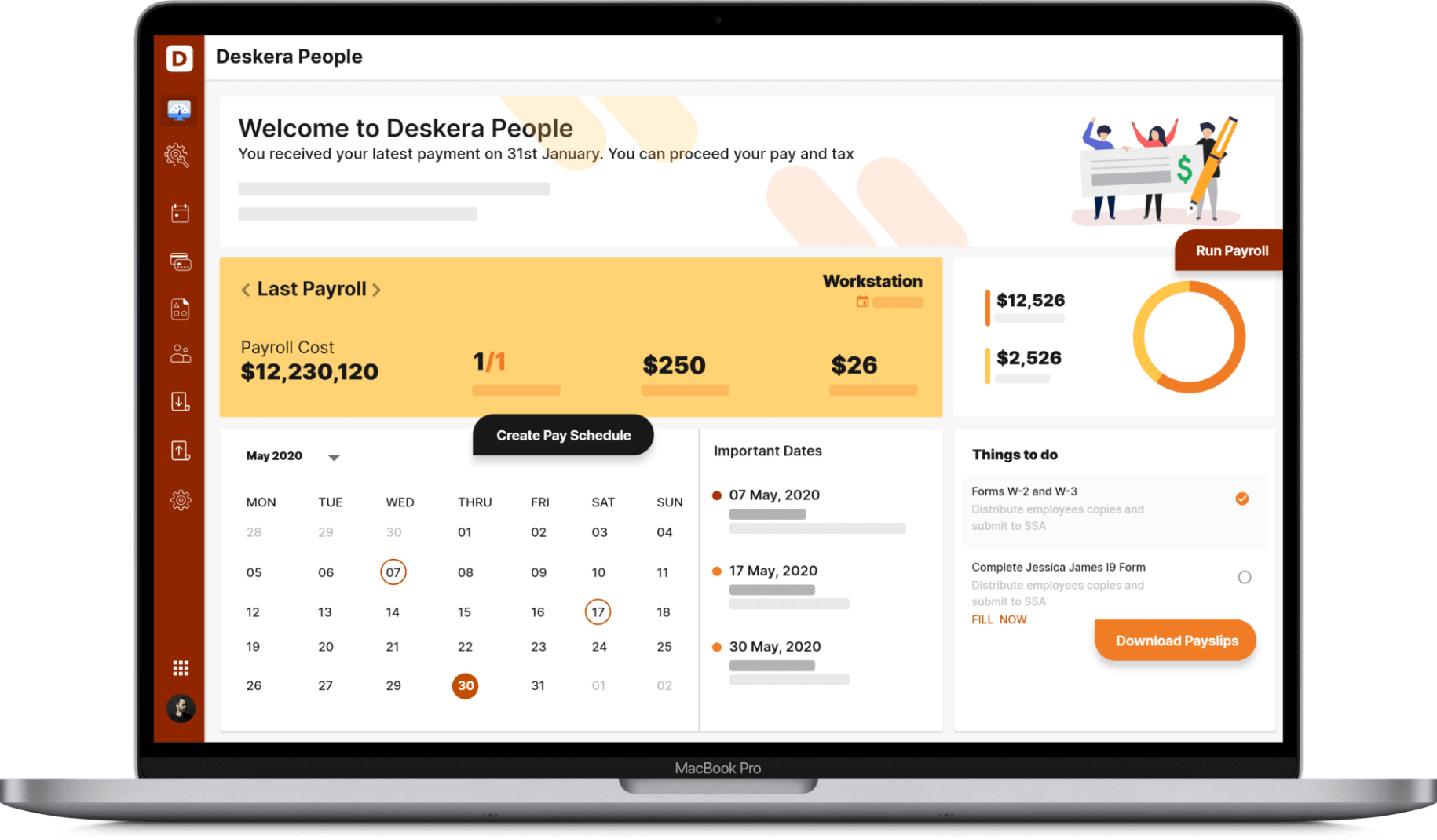

Deskera People is designed to satisfy the needs of the employers as well as of the employees. When considering how it can help with 401(k) plans, Deskera People has features that let employers create and assign custom pay components to an employee based on your requirements.

Your employer would even be able to set up your voluntary deductions, bonuses, and many such components on the same portal. These would be identified by Deskera People and automatically calculate your wages while also considering pre and post-tax deductions. As an employee, you would be able to view your payslips, apply for time offs and file your claims and expenses as well.

Deskera People hence automates employee management while increasing the efficiency for the same, with lesser usage of resources like time.

Key Takeaways

Setting up a retirement plan for yourself as well as for your family is a smart choice as it will ensure all of your security and the continuance of a comfortable life in your non-income days. There are two types of retirement plans that you can choose from:

- IRA

- 401(k) Plan

The main difference between both the plans is that in the case of the IRA, you will have to do all the heavy lifting, whereas, in the case of the 401(k) plan, most of the heavy lifting will be done by your employer, including setting up direct deposits from your paycheck. In fact, your employer might even match your contribution to the 401(k) plan.

There is, however, more to the 401(k) plan, which leads to questions related to them, starting from what is vesting and how after a certain period of working for a particular employer, you would be able to take your entire 401(k) plan balance including employer’s matching contribution due to vesting.

For 401(k) questions revolving around withdrawals from the 401(k) account, it is to be kept in mind that withdrawal in the absence of certain qualifying conditions will cause you penalties as well as administrative hassles.

Some of the other important 401(k) questions involve how you can decide your contribution amount and its frequency, can you take a 401(k) loan or not, and other such basic questions which will help you better understand 401(k) plans and which of the two retirement plans is most viable to you.

Softwares like Deskera People that automates employee management, including such voluntary employee deductions, is a boon for employers and employees alike. For an employer, it becomes management software, whereas, for an employee, it becomes a self-service portal. In both cases, it increases efficiency and accuracy while saving time and other resources.

Related Articles