Your company's profit and loss statement track Net Sales and costs for a certain accounting period. As a result, it calculates your company's net profit. The difference between your sources of revenue and the costs associated with those sources of revenue is your Net Profit.

Your income statement depicts your company's financial performance over a period of time. The profit and loss statement also includes the constant revenue and costs sections. Net Sales, Cost of Goods Sold (COGS), Gross Margin, Selling and Administrative Expenses, and Net Profit are examples of these categories.

In this article, we are going to discuss what is net sales, how to calculate net sales and review the net sales formula. To understand what is net credit sales, we need to have an in-depth overview of the other related concepts.

Introduction to Net Sales

The amount of a company's gross sales less returns, allowances, and discounts is known as net sales. Externally, net sales calculations are not always obvious. They are frequently taken into account when presenting top-line revenues on the income statement.

Understanding Net Sales

The income statement is a financial statement used to analyze a company's revenues, revenue growth, and operating expenditures. The income statement is divided into three sections, each of which aids in the examination of direct, indirect, and capital expenses. Net sales may be shown in the income statement's direct costs section.

In the field of net sales, companies may not give a lot of external openness. Because of the various components that go into calculating net sales, it may not apply to every organization and sector. Net sales equate gross revenue minus applicable sales returns, allowances, and discounts. Net sales costs have an impact on a company's gross profit and gross profit margin, but net sales exclude the cost of goods sold, which is often a major driver of gross profit margins.

Adjustments are done to identify and report net sales if a company has any returns, allowances, or discounts. In the direct costs section of the income statement, companies may report gross sales first, then net sales and cost of sales, or they may only show net sales on the top line and then go on to costs of goods sold. Cost of products sold, general expenditures, and administrative expenses are not included in net sales and have varying implications on income statement margins.

What Impacts the Cost of Net Sales?

Gross sales are a company's total unadjusted sales. Companies that employ accrual accounting document their transactions as they happen. When cash is received, organizations that use cash accounting are booked. Some firms may not require a net sales forecast, but the majority do.

The three primary charges that might affect net sales are sales returns, allowances, and discounts. After a corporation records revenue, all three costs must be expensed. As a result, in order to enable adequate performance analysis, each of these sorts of charges will need to be accounted for across a company's financial reporting.

Sales Returns

Returns are a typical occurrence in the retail industry. These businesses enable customers to return an item for a full refund if they do so within a particular amount of time. This can make financial statement reporting more difficult.

Customers must be refunded by companies that accept sales returns. A sales return is often recorded as either an increase in sales returns and allowances against sales revenue or as a direct reduction in sales revenue. As a result, it debits a sales returns and allowances account (or the sales revenue account directly) and credits a cash or accounts receivable account. This transaction results in a revenue drop on the income statement.

The sales return can frequently be resold. This necessitates the insertion of extra notations in order to account for the item as inventory.

Allowances

Allowances are less frequent than refunds, although they may be necessary if a corporation seeks to reduce previously booked income. A seller may offer a partial refund to a buyer who claims that products were damaged during shipment or that the wrong goods were received in order. The same sorts of notations would be necessary for this scenario. A seller would need to credit an asset account and debit a sales returns and allowances account. This journal entry shows up on the income statement as a revenue drop.

Allowances for net sales are typically distinct from write-offs, which are sometimes known as allowances. A write-off is a cost deduction that reduces the value of an asset in inventory. Companies make adjustments for inventory write-offs or write-downs owing to losses or damages. These write-offs happen before, not after, a transaction is made.

Discounts

Many invoicing businesses will provide their customers' discounts if they pay their fees on time. 1/10 net 30 is an example of discount terms in which a customer receives a 1% discount if they pay within 10 days of a 30-day invoice. Retroactive notations are essential since vendors do not credit for a discount until a customer pays early.

Discounts are recorded similar to as refunds and allowances are. A seller will credit assets and debit a sales discount contra-account to revenue. The discount is deduced from gross sales on the income statement by the amount of the journal entry.

Example

Consider the following situation. The following table shows ABC Firm's gross sales as well as additional data such as allowances and discounts.

Net Sales = Gross Sales – Sales Return – Sales Allowances – Discount

= $5,000,000 – $50,000 – $20,000 – $40,000

= 4,890,000

Implications of Net Sales

When a corporation discloses its gross sales vs. net sales in full, it might be a source of interest for external examination. If the gap between a firm's gross and net sales is greater than the industry average, the company may be giving bigger discounts or generating excessive returns as compared to rivals.

Typically, businesses will seek to meet or exceed industry averages. Returns are frequently resold swiftly and without any problems. Allowances are usually the consequence of transportation issues that cause a corporation to reconsider its shipment or storage practices. To stay competitive in their sector, companies that give discounts may opt to cut or expand their discount terms.

Let’s have a look at the difference between Gross Sales and Net Sales to understand Net Credit Sales.

Difference Between Net Sales and Gross Sales

|

S. No. |

Now, let’s deep dive into Net Credit Sales.

What are Net Credit Sales?

An Introduction

Firms set credit arrangements that allow customers to purchase products or services on credit, resulting in net credit sales. Total sales in income statements also include credit sales. The net credit sale statistic is used by management to track receivables and determine how consumers are paying off their bills. As a result, the number for net credit sales is frequently used to determine accounts receivable turnover.

These sales are comparable to net sales on the income statement in that they reflect gross sales less returns, allowances, and discounts. They differ from net sales, however, because of the payment method utilised in this scenario. Payment is made immediately for net sales, while payment for net credit sales is deferred until a later date.

Companies with lenient credit standards have a high percentage of net credit sales. While granting high amounts of credit might be an excellent method to boost sales, it can also come with a number of drawbacks. For starters, a company's financial issues might be exacerbated if certain consumers fail to pay on time.

Definition

Net credit sales are revenues made by a company that it extends to consumers on credit, less all sales returns and allowances. Any sales for which money is paid promptly in cash are not included in net credit sales.

The idea may be used as a foundation for other statistics like days sales outstanding and accounts receivable turnover, as well as an indicator of a company's overall amount of credit extended to its customers. When a corporation has a flexible credit policy, granting significant amounts of credit to even clients with questionable payment histories, net credit sales are likely to be greatest.

Key definitions are:

· Sales returns. A credit given to a client as a result of a fault with a product or service they received.

· Sales allowances. A customer's price is reduced owing to a difficulty with the sale transaction that does not include the supplied items or service.

Calculating Net Credit Sales

It is necessary to first determine gross sales before determining net credit sales. This number indicates the total dollar value of all sales-related client interactions. Ignore the source of the transaction or the method of payment when computing total sales.

The second stage entails calculating the amount of cash sales. Add up all-cash sales and remove them from total sales. Similarly, any items returned for whatever reason should be accounted for. Any concessions or discounts given to clients should also be accounted for and removed from gross sales.

Calculating net credit sales would be much easier if cash sales were recorded separately. In the same way, sales returns and allowances should be tracked separately.

Net credit sales = Sales on credit – Sales returns – Sales Allowances

Example

The ABC Enterprise is a furniture selling company that generated $100,000 of gross sales in its most recent month. Of this amount, customers paid $20,000 in cash for new furniture. During the month, ABC issued a refund of $5,000 to a customer who returned a furniture, and also granted a sales allowance of $1,000 to a customer in exchange for not returning a furniture having a fault. Therefore, ABC's net credit sales were $74,000. Let’s incorporate this situation into the formula.

Gross Sales = $100,000

Cash Sales = $20,000

Sales Returns = $5,000

Sales Allowance = $1,000

Net Credit Sales = Gross Sales - Cash Sales - Sales Returns - Sales Allowances

Net Credit Sales = 100,000 - 20,000 - 5,000 - 1,000 = $74,000

Advantages & Disadvantages of Net Credit Sales

Advantages

· Provides Break-up: Net credit sales tend to provide a flawless image by separating values between sales returns and sales allowances, allowing the company to see the genuine picture of the amount that may be realised at any given time.

· Monitor Receivables: Keeping an eye on a company's total net credit sales allows management to keep a close eye on the total receivables it expects to receive. An rise in the same might result in liquidity issues for the organisation, prompting management to exercise caution in this area.

· Preservation of Ratios: By assisting a firm in understanding its total receivables after accounting for any net credit sales, it is able to assess its current liquidity ratios, which are often cash and quick ratios.

· If the ratios begin to degrade, it is a warning indication for the firm. As a result, it makes it easier to maintain the company's target ratios, and any departure or difference will alert management to take remedial action.

· Facilitates the Creation of Ledger: A corporation may have a tendency to create a receivable account in the name of each client and monitor the corresponding amount with each customer. This action provides essential segregation through the construction of ledger books, compelling the corporation to take the appropriate collective action against the needed client who is overdue on the payment.

· Goes into Ratio Analysis: It is used in ratio analysis to calculate ratios such as receivables turnover ratios because the numerator, which is the credit sales after subtracting the sales returns from customers, is then divided by the receivables to arrive at the receivables turnover ratio.

Disadvantages

· Delay in Collection: There may be occasions when a firm's collection troubles are caused by the acquisition of new debt through net credit sales. Debtors may fail to pay the required amount on time, impacting a firm's liquidity, which is surely not a positive indicator for the organisation.

· Additional Expenses: The amount forfeited due to sales returns issued for a breach of service conditions or a faulty product is usually an unnecessary expenditure for the company, and it might have been avoided if appropriate examination and due diligence had been in place.

· Creation of Bad Debts: As previously said, if receivables are not collected on time, it may result in the formation of bad debts, which may be a significant burden and expense for the organisation. Certain precautions may be required to be put in place to address difficulties that lead the management to be concerned about liquidity.

Bottom Line

Net credit sales, or the sum of credit sales after factoring in the effect and subtracting sales returns and allowances, are an important aspect of ratio analysis since they serve as the numerator in the computation of the receivables turnover ratio. Furthermore, it assists management in gauging and measuring the total receivables owed and therefore keeping track of the same so that no further liquidity constraint is produced as a result of such actions.

However, if net credit sales are left unchecked, they can quickly balloon into a massive quantity of receivables. It may then become a big burden for the firm, as it may result in bad debt issues, necessitating the creation of reserves for such bad debts, which are again unneeded costs for the organisation. Debtors may fail to pay on time, causing a significant financial burden on the organisation.

By giving ratio analysis and also functioning as a pre-check to help management plan out its working capital management, it may undoubtedly facilitate break up and provide a deeper grasp of facts. As a result, it becomes critical for the organisation to have a strong system of checks and balances in place to ensure that the focus on managing liquidity by keeping a close eye on receivables is not neglected.

One-Stop Solution For All Your Business Related Tasks Try Deskera for Free Today! Click here for free trial

How Can Deskera Assist You?

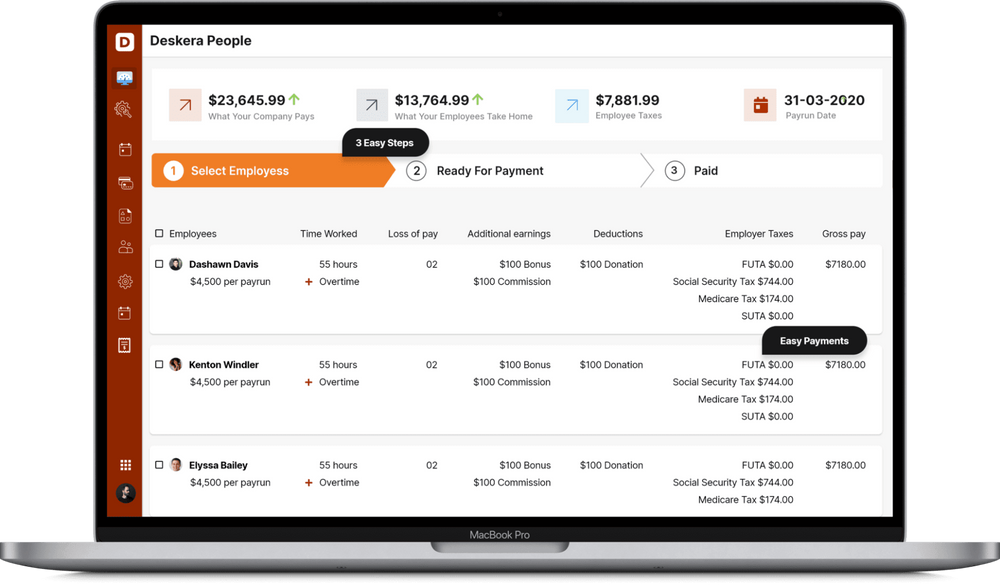

Deskera People helps digitize and automate HR processes like hiring, payroll, leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

· The amount of a company's gross sales less returns, allowances, and discounts is known as net sales.

· Net sales costs have an impact on a company's gross profit and gross profit margin, but net sales exclude the cost of goods sold, which is often a major driver of gross profit margins.

· If the gap between a firm's gross and net sales is greater than the industry average, the company may be giving bigger discounts or generating excessive returns as compared to rivals.

· Companies with lenient credit standards have a high percentage of net credit sales.

· It becomes critical for the organisation to have a strong system of checks and balances in place to ensure that the focus on managing liquidity by keeping a close eye on receivables is not neglected.

Related Articles