In the fast-paced world of small business, efficient invoice management is crucial for maintaining healthy cash flow and fostering strong client relationships. Invoice management encompasses the entire process of creating, sending, tracking, and processing invoices.

This process ensures that businesses receive payments promptly while keeping accurate records for financial reporting and tax purposes. Effective invoice management also involves handling disputes and discrepancies, reconciling accounts, and maintaining good communication with clients. Streamlining these tasks can significantly impact a business's financial health and operational efficiency.

Unfortunately, many businesses still rely on manual processes, which can be both time-consuming and error-prone. On average, it takes about 14.6 days to process an invoice manually. This delay can significantly impact your business operations, especially when timely payments are essential for sustaining operations.

Moreover, around 39% of invoices contain errors, leading to further delays and potential disputes. Shockingly, nearly half of global respondents (49%) spend more than five days per month just processing invoices, diverting valuable time and resources from core business activities.

To address these challenges, many small businesses are turning to comprehensive solutions like Deskera ERP. Deskera ERP offers a suite of tools designed to streamline invoice management, reduce errors, and accelerate payment cycles. By automating key processes, Deskera helps businesses save time, enhance accuracy, and improve overall financial management.

With features such as real-time tracking, customizable templates, and seamless integration with other business systems, Deskera ERP is an invaluable asset for any small business looking to optimize its invoicing procedures.

What Is Invoice Management?

Invoice management is a process that includes invoicing clients for products or services they’ve purchased, and making timely bill payments to vendors and suppliers.

Invoice management can typically be done in two ways, manually or the automated way.

Managing your invoices manually is generally time-consuming and it includes creating invoices using a text editor like Word. The same applies for making your invoices using Excel.

Bill payments have to also be done manually using different apps and interfaces, or sometimes even in-person via mail.

It goes without saying, doing invoice management manually can lead to a ton of accounting errors that will simply make you waste more time and money.

That’s why most businesses have moved on from the age of pen and paper to faster, more reliable, and less costly invoice management systems.

An invoice management system is an online platform designed to automate most of your invoicing processes, saving you time, money, and a whole lot of stress. These systems include features such as premade invoice templates, notifications and alerts for upcoming invoices, intuitive and easy-to-use dashboards, direct bank integration, automatic tax calculation, and much more.

Key Components of the Invoicing Process

Efficient invoicing is critical to maintaining a smooth cash flow and ensuring that businesses get paid on time. Here are the key components of the invoicing process:

Invoice Creation

- Details Gathering: Collecting all necessary details such as client information, products or services provided, quantities, and agreed prices.

- Invoice Template: Using a standardized template that includes the company's branding, contact information, and legal disclaimers.

- Invoice Numbering: Assigning a unique invoice number for tracking and reference purposes.

Invoice Delivery

- Delivery Method: Choosing an appropriate method for sending invoices, such as email, postal mail, or through an online invoicing platform.

- Timing: Sending invoices promptly after the goods or services have been delivered to avoid payment delays.

Payment Terms

- Due Date: Clearly stating the payment due date to set expectations for when payment should be received.

- Payment Methods: Providing multiple payment options to make it easier for clients to pay (e.g., bank transfer, credit card, PayPal).

- Late Fees: Specifying any late fees or penalties for overdue payments to encourage timely payment.

Follow-Up and Reminders

- Automated Reminders: Setting up automatic reminders to be sent to clients before and after the due date to prompt payment.

- Personal Follow-Up: Personal follow-up calls or emails to clients if payment is not received within the agreed timeframe.

Payment Processing

- Recording Payments: Accurately recording received payments in the accounting system.

- Acknowledgment: Sending a payment receipt or acknowledgment to the client to confirm receipt of payment.

Reconciliation

- Account Reconciliation: Regularly reconciling invoices and payments to ensure all accounts are accurate and up-to-date.

- Dispute Resolution: Addressing any discrepancies or disputes promptly to maintain good client relationships.

Reporting and Analysis

- Financial Reports: Generating reports on outstanding invoices, paid invoices, and overall cash flow to monitor financial health.

- Performance Metrics: Analyzing key metrics such as average payment time and invoice error rates to identify areas for improvement.

Record Keeping

- Document Storage: Storing copies of all invoices, receipts, and related correspondence for legal and accounting purposes.

- Data Security: Ensuring that all financial data is securely stored and protected against unauthorized access.

By managing these components effectively, businesses can ensure a smooth and efficient invoicing process that supports timely payments and healthy cash flow.

Invoice Management & Accounts Payable

The key to an effective supply chain is paying back vendor invoices on time. Suppliers who get regularly paid without delay, deliver goods and services without complications.

Accounts payable (or AP for short) is the account that represents the balance your business owes to these creditors and vendors. It’s recorded under the balance sheet, as a current liability.

AP can also be referred to as the department that deals with the entire invoice payment process, from verifying invoices against the purchase order to issuing the payment in the end.

Now, how is the recording of AP under the balance sheet done?

First, you have to make a journal entry where you credit accounts payable and debit the corresponding expense account. Then, when your business pays back the invoice, another double-entry is created where cash is credited while accounts payable is debited.

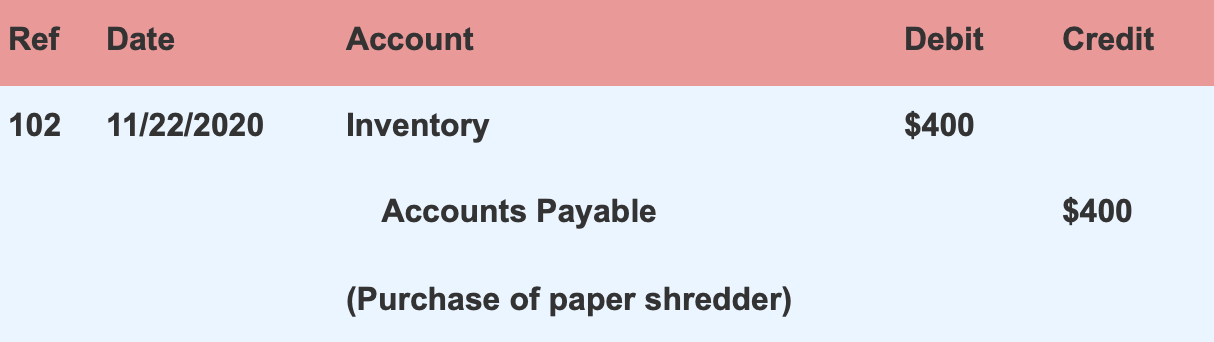

Accounts Payable Practical Example

Say you receive an invoice of $400 for purchasing a paper shredder for your office.

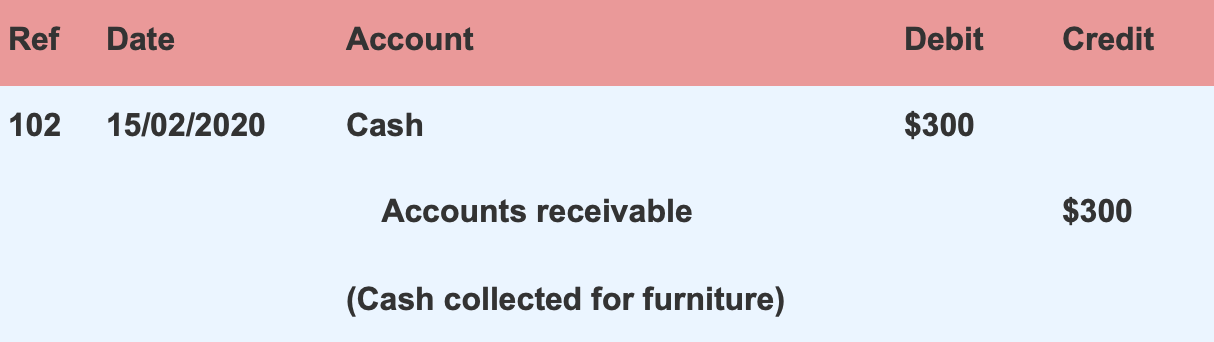

The entry for this transaction would look like this:

Once the invoice is paid off, then the following second entry gets created:

To learn more about analyzing and recording your business’ financial data, head over to our guide on the accounting cycle.

Invoice Management & Accounts Receivable

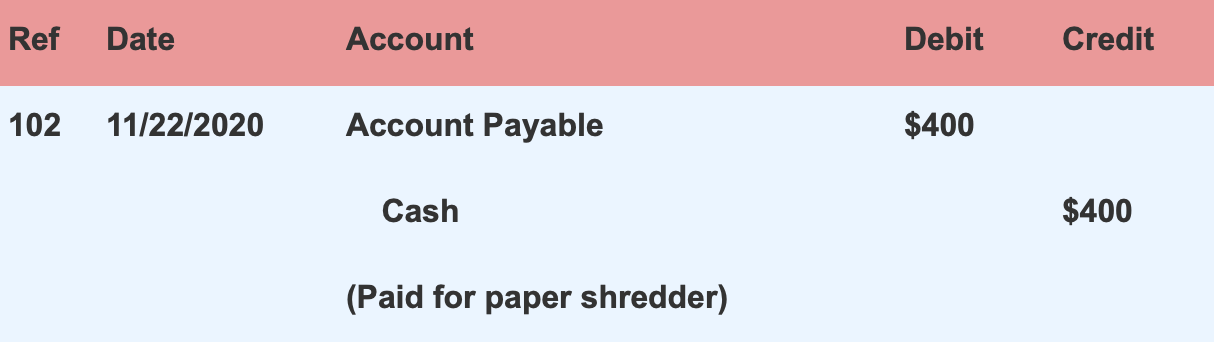

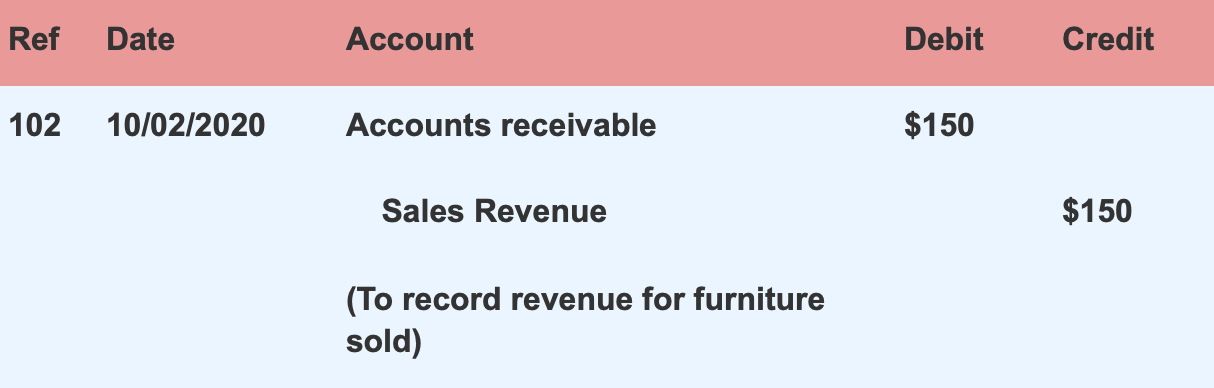

When you’re on the side of the supplier who is issuing the invoice, the transaction gets recorded into accounts receivable as an asset. Accounts receivable is the opposite of accounts payable.

It represents the cash your customers owe you from purchasing products.

Again, just like in AP, you have to make a double-entry to record the invoice in the balance sheet.

In this case, you first have to debit accounts receivable and credit the sales account. Then after the customer sends the payment, cash is debited while accounts receivable credited.

Accounts Receivable Practical Example

Here’s a practical example to better understand the process.

Let’s assume you issued an invoice to your customer for $150 worth of products. This is how that transaction would look like:

After the client pays back, it is recorded as shown below:

What Are the Steps of the Invoice Management Process?

1. Send a Purchase Order to the Vendor

Invoice management starts with creating and sending a purchase order to the vendor.

A purchase order is an official request for a product or service, sent from you as a buyer, to the vendor, to authorize all of the details of a purchase.

This document should include an itemized list of the purchase, desired quantity, and agreed-upon prices. You can also add any additional notes or requests regarding the order.

Now, although a purchase order usually contains the same elements as an invoice, they are not the same thing. An invoice is sent by the seller to request payment, while the purchase order is the official demand for a good or service.

2. Review Invoice Details

After getting your hands on the ordered goods, and receiving the supplier invoice, it’s time to process it to accounts payable.

Before doing so, however, you should always confirm there aren’t any inconsistencies from the original order.

Double-check these three main invoice elements:

- The invoice due date (i.e: payment terms)

- List of products & services

- Total cost

If you notice any errors, give your supplier a call or email to discuss the issue and request another invoice.

3. Choose Preferred Payment Method

Invoices usually come with different kinds of payment methods, so you can choose whichever option suits your business best.

The four most common types of payment methods are:

- Cash. Cash is mostly used for small, up-front purchases. However, it’s not a safe option since it can get easily misplaced, lost, or stolen.

- Checks. Checks are relatively cheap and secure, but they’re a time-consuming option.

- Online credit card payments. These are fast, easy, and secure.

- Automatic billing and mobile payments. These are processed automatically through accounting software. You can make payments by simply integrating your bank account and credit cards with the software and pressing Send.

Create Invoices for Customer Purchases

After paying back all your bills, it’s finally time for you to sell products and get paid in return.

The first step is creating an invoice with all of the appropriate invoice elements.

With premade invoice templates and invoicing software, this process can be done within seconds. However, if you want to start from square one and create your own invoice template, you’ll need the following elements:

- Header with the word “Invoice”

- Business and client contact details

- Invoice number

- Name and description of the product or service

- Cost per unit and the total amount

- Billing date

- Due date

- Terms of payment

These are just the basic elements an invoice needs to be considered a legally-binding document. Not all invoices follow this exact same format, though.

Depending on the industry, clients, or products sold, you’ll have to deal with various invoice types that serve different purposes and include additional details.

Want to learn more about the main elements of a professional invoice? Head over to our guide on how to make an invoice & get paid faster.

Send Out the Invoices

There are three main methods you can send an invoice with:

1. Physically in person, by fax, or through snail mail. This is the most traditional and outdated way of sending an invoice. It includes printing out the invoice, putting it in an envelope, stamping it, and dropping it by the post office or delivering it in hand.

2. Email. When sending an invoice via email make sure to include:

- A subject line with the invoice number

- The attachment of the invoice in pdf

- A short professional message

3. Invoicing software. This is the fastest and easiest way to send an invoice. All you have to do is fill in the invoice information on the online software, and press Send.

After sending the invoice, the next step is to make a double-entry to record it into accounts receivable, as we previously explained.

If you’re using invoicing software, however, you won’t have to worry about bookkeeping because the invoice will automatically create entries in their respective accounts.

What is Invoice Management Software?

Invoice management software is a digital solution designed to streamline and automate the invoicing process for businesses. For small businesses, efficient invoicing is critical to maintaining cash flow and reducing administrative burdens. Small business invoicing software allows companies to create, send, track, and process invoices electronically, significantly enhancing accuracy and efficiency.

An invoice management system typically includes features such as customizable invoice templates, automated reminders, and real-time tracking. This type of software reduces the likelihood of errors and accelerates payment cycles, making it easier for businesses to manage their finances. By integrating with other financial systems, invoice management software also helps in maintaining accurate records for reporting and tax purposes.

Choosing the best invoicing software for small business depends on specific needs, but many solutions offer scalable options to grow with the business. Invoicing software for small business not only simplifies billing but also improves cash flow management, allowing owners to focus more on core activities and less on administrative tasks.

Need for Invoice Management Software and Challenges Addressed

In the competitive landscape of small business, efficient invoicing is vital for maintaining cash flow and ensuring timely payments. The need for invoice management software arises from the necessity to streamline and automate the invoicing process, reducing manual errors and administrative burdens.

Small business invoicing software offers a range of features designed to optimize financial management, from creating and sending invoices to tracking payments and reconciling accounts.

An invoice management system addresses several challenges faced by small businesses:

- Time-Consuming Manual Processes: Manual invoicing can be labor-intensive and time-consuming, requiring significant effort to create, send, and track invoices. Invoicing software for small business automates these tasks, allowing businesses to issue invoices quickly and efficiently.

- Error-Prone Invoices: Manual processes are prone to errors, such as incorrect amounts, missing information, or duplicate entries. The best invoicing software for small business includes validation features that minimize errors and ensure accuracy in every invoice.

- Delayed Payments: Traditional invoicing methods can result in delayed payments due to slow processing times and inefficient follow-ups. Small business invoicing software provides automated reminders and real-time tracking to expedite payments and improve cash flow management.

- Administrative Overload: Managing invoices manually requires substantial administrative effort, diverting resources from core business activities. An invoice management system reduces this burden by centralizing and automating invoicing tasks, freeing up valuable time for business growth.

- Disorganized Financial Records: Keeping track of invoices, payments, and client information manually can lead to disorganized records and financial discrepancies. Invoicing software for small business ensures all financial data is accurately recorded and easily accessible, supporting better financial oversight and reporting.

- Streamlined Invoicing Process: Invoice management software automates the creation, sending, and tracking of invoices, drastically reducing the time and effort required compared to manual processes. This allows your business to handle a higher volume of invoices with ease and efficiency.

- Improved Accuracy: Automated systems reduce the likelihood of human errors that are common in manual invoicing, such as incorrect amounts, missing information, or duplicate entries. The best invoicing software for small business includes features like automatic calculations and data validation to ensure each invoice is accurate.

- Enhanced Cash Flow Management: With real-time tracking and reporting features, invoicing software for small business provides a clear overview of your outstanding invoices and expected cash inflows. This visibility allows for better financial planning and decision-making.

- Professional Appearance: Small business invoicing software often includes customizable templates, allowing you to create professional-looking invoices that reflect your brand. This professionalism can enhance your business's image and improve client relations.

- Integration with Other Systems: Many invoice management systems integrate seamlessly with other business software, such as accounting and customer relationship management (CRM) systems. This integration ensures a smooth flow of data across your business operations, reducing manual data entry and improving overall efficiency.

- Environmental Benefits: By reducing the need for paper invoices and physical storage, invoicing software contributes to more sustainable business practices, helping your company reduce its carbon footprint.

- Scalability: As your business grows, the best invoicing software for small business can scale with you, accommodating an increasing volume of transactions and more complex financial needs without requiring significant changes to your processes.

By addressing these challenges, invoicing software for small business not only enhances operational efficiency but also supports better financial health and client relationships. This makes it an indispensable tool for any small business aiming to optimize its invoicing processes.

Small Business Invoice Example

Here's an example of a typical invoice for a small business using invoicing software. This example includes all essential elements to ensure clarity and professionalism:

[Your Company Name]

[Your Company Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Website]

Invoice #: 12345

Invoice Date: July 3, 2024

Due Date: July 17, 2024

Bill To:

[Client's Company Name]

[Client's Address]

[City, State, ZIP Code]

[Client's Phone Number]

[Client's Email Address]

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product/Service 1 | 2 | $50.00 | $100.00 |

| Product/Service 2 | 1 | $150.00 | $150.00 |

| Product/Service 3 | 3 | $75.00 | $225.00 |

Subtotal: | | | $475.00

Sales Tax (8%): | | | $38.00

Total Due: | | | $513.00

Payment Instructions:

Please make checks payable to [Your Company Name]. Payment can also be made via [Payment Method (e.g., bank transfer, PayPal, credit card)] to [Payment Details].

Terms and Conditions:

- Payment is due within 14 days of the invoice date.

- Late payments may incur a late fee of [Late Fee Percentage or Amount].

- For any questions or concerns regarding this invoice, please contact us at [Your Contact Information].

Thank you for your business!

Notes:

[Optional: Add any additional notes or comments here, such as a thank you message or specific details about the services/products provided.]

This example includes all the necessary details to ensure clear communication with your clients, making it easy for them to understand the charges and make timely payments. Using small business invoicing software, you can customize and automate such invoices, saving time and ensuring accuracy.

Selecting the Best Invoicing Software for Small Business

Choosing the right invoicing software is crucial for small businesses to streamline operations, ensure timely payments, and maintain financial accuracy.

Here's a guide to help you select the best invoicing software:

Identify Your Business Needs

- Volume of Invoices: Consider the number of invoices you generate monthly or annually.

- Complexity: Determine if you need features for recurring invoices, multiple currencies, or detailed reporting.

- Integration: Assess if the software needs to integrate with existing accounting or CRM systems.

Features and Capabilities

- Invoice Creation and Customization: Look for software that allows you to create customized invoices with your logo, branding, and specific terms.

- Automation: Choose software that automates invoice generation, recurring billing, and payment reminders to save time and reduce errors.

- Payment Options: Ensure the software supports various payment methods (e.g., credit cards, PayPal, bank transfers) to accommodate client preferences.

- Reporting and Analytics: Check for reporting capabilities that provide insights into cash flow, overdue invoices, and client payment history.

Ease of Use and Accessibility

- User Interface: Opt for intuitive software with a user-friendly interface that makes it easy for you and your team to navigate and use effectively.

- Accessibility: Consider cloud-based solutions that allow you to access invoicing data securely from anywhere, especially if you have remote or mobile workforce.

Customer Support and Training

- Support Options: Evaluate the availability and responsiveness of customer support, including online resources, tutorials, and dedicated assistance.

- Training: Ensure the software provides adequate training materials or onboarding sessions to help you and your team get started quickly.

Security and Compliance

- Data Security: Prioritize software that offers robust security measures, such as data encryption and secure servers, to protect sensitive financial information.

- Compliance: Verify that the software complies with relevant data protection regulations (e.g., GDPR, HIPAA) and financial reporting standards.

Cost and Scalability

- Pricing Plans: Compare pricing models (e.g., subscription-based, per invoice) and choose a plan that fits your budget and invoicing volume.

- Scalability: Select software that can grow with your business, accommodating increased invoicing needs and additional features as your business expands.

User Reviews and Reputation

- Feedback: Research user reviews and testimonials to gauge customer satisfaction, reliability, and the software's performance in real-world scenarios.

- Reputation: Choose a reputable vendor with a track record of providing reliable invoicing solutions and excellent customer service.

By carefully evaluating these factors, you can select invoicing software that meets your specific business requirements, enhances efficiency, and supports your long-term growth objectives.

Implementing Invoice Management Software

Implementing invoice management software is a strategic decision that can streamline operations, improve cash flow management, and enhance overall efficiency for small businesses.

Here’s a step-by-step guide to successfully implement invoice management software:

Planning and Preparation

- Assess Current Processes: Evaluate existing invoicing processes to identify pain points, inefficiencies, and areas for improvement.

- Set Objectives: Define clear goals for implementing invoice management software, such as reducing invoice processing time or improving payment collection rates.

- Allocate Resources: Determine the budget, personnel, and time required for implementation, including any training or IT support needed.

Choosing the Right Software

- Select Software: Based on your business needs and evaluation, choose the best invoicing software that aligns with your goals and offers the necessary features (refer to previous section on selecting the best invoicing software).

- Customization: Customize the software settings, invoice templates, and workflow to fit your business requirements and branding.

Data Migration and Integration

- Data Transfer: If transitioning from manual or another system, ensure smooth data migration to avoid data loss or discrepancies. Follow the software provider's guidelines for importing existing data.

- Integration: Integrate the invoicing software with other relevant systems, such as accounting software or CRM platforms, to streamline data flow and ensure consistency across departments.

Training and Onboarding

- Staff Training: Provide comprehensive training to employees who will use the invoicing software. Cover basic functionalities, advanced features, and troubleshooting.

- User Adoption: Encourage user adoption by demonstrating the benefits of the new software, addressing concerns, and providing ongoing support during the transition period.

Testing and Quality Assurance

- Pilot Testing: Conduct pilot tests or a trial period with a smaller subset of invoices to identify any issues or areas for improvement before full deployment.

- Quality Assurance: Ensure that the software functions as expected, including accurate invoice generation, payment tracking, and reporting capabilities.

Implementation Timeline and Rollout

- Timeline: Develop a realistic timeline for the implementation process, taking into account key milestones, testing phases, and potential setbacks.

- Rollout Strategy: Gradually rollout the software across departments or teams, starting with those handling the highest volume of invoices, to minimize disruptions and facilitate smooth adoption.

Monitoring and Evaluation

- Performance Metrics: Establish metrics to monitor the software’s performance, such as invoice processing time, payment collection rates, and user feedback.

- Feedback and Adjustments: Gather feedback from users and stakeholders to identify any issues or areas for improvement. Make necessary adjustments to optimize system functionality and user experience.

Continuous Improvement

- Updates and Upgrades: Stay informed about software updates, patches, and new features released by the vendor. Implement updates promptly to benefit from enhanced functionalities and security improvements.

- Process Optimization: Continuously review and optimize invoicing processes based on performance data and user feedback to maximize efficiency and ROI.

By following these steps and investing in proper planning, training, and ongoing support, small businesses can successfully implement invoice management software to streamline operations, improve financial management, and support long-term growth objectives.

Tips for Optimizing Invoice Management

Optimizing invoice management is essential for small businesses to improve cash flow, enhance efficiency, and maintain strong client relationships.

Here are some effective tips to optimize your invoice management process:

Set Clear Invoicing Terms and Conditions

Clearly outline payment terms, due dates, accepted payment methods, and any late payment penalties on your invoices. This reduces confusion and sets expectations upfront.

Use Consistent and Professional Invoice Templates

Design standardized invoice templates that include your company logo, contact information, and clear itemized details of products or services rendered. Consistency reinforces your brand and professionalism.

Automate Invoice Generation and Sending

Leverage invoice management software to automate the creation, delivery, and tracking of invoices. Automating repetitive tasks saves time, reduces errors, and speeds up payment processing.

Implement Regular Invoice Reminders

Set up automated reminders for clients nearing or past their invoice due dates. Gentle reminders can prompt timely payments and reduce instances of overdue invoices.

Streamline Payment Processes

Offer multiple payment options (e.g., credit cards, online transfers) to make it convenient for clients to pay invoices promptly. Consider integrating payment gateways directly into your invoicing software.

Monitor and Track Invoice Statuses

Use software features to track the status of invoices in real-time, from creation to payment receipt. This visibility helps identify bottlenecks and address overdue payments promptly.

Establish a System for Dispute Resolution

Develop a protocol for handling invoice disputes swiftly and professionally. Clear communication and documentation can resolve issues and maintain positive client relationships.

Regularly Review and Update Processes

Periodically review your invoicing processes for inefficiencies or areas needing improvement. Update workflows, templates, and software settings to optimize efficiency and accuracy.

Integrate Invoicing Software with Accounting Systems

Integrate your invoicing software with accounting or ERP systems for seamless data flow. This integration improves financial reporting accuracy and reduces manual data entry.

Ensure Compliance with Tax and Financial Regulations

Stay updated on tax regulations and ensure your invoicing practices comply with legal requirements. Proper compliance avoids penalties and maintains financial integrity.

Train Staff and Foster Collaboration

Provide training and ongoing support to employees using the invoicing software. Encourage collaboration between departments (e.g., finance, sales) to streamline invoicing processes and resolve issues efficiently.

Monitor Key Performance Indicators (KPIs)

Track KPIs such as average payment time, invoice error rates, and client satisfaction metrics. Use these insights to make data-driven decisions and continuously improve your invoicing operations.

By implementing these tips, small businesses can optimize their invoice management processes, reduce administrative burdens, improve cash flow, and enhance overall financial efficiency. Investing in effective invoicing practices contributes to sustainable growth and operational success.

Automating Invoice Management with Deskera ERP

Switching from manual invoice management to an online invoicing system can be a life-changing decision for your small business accounting.

Now, you’re probably thinking: how do I decide which invoice management system is the right one for my business?

Well, the right invoicing system will help you streamline and automate almost every part of your invoicing process.

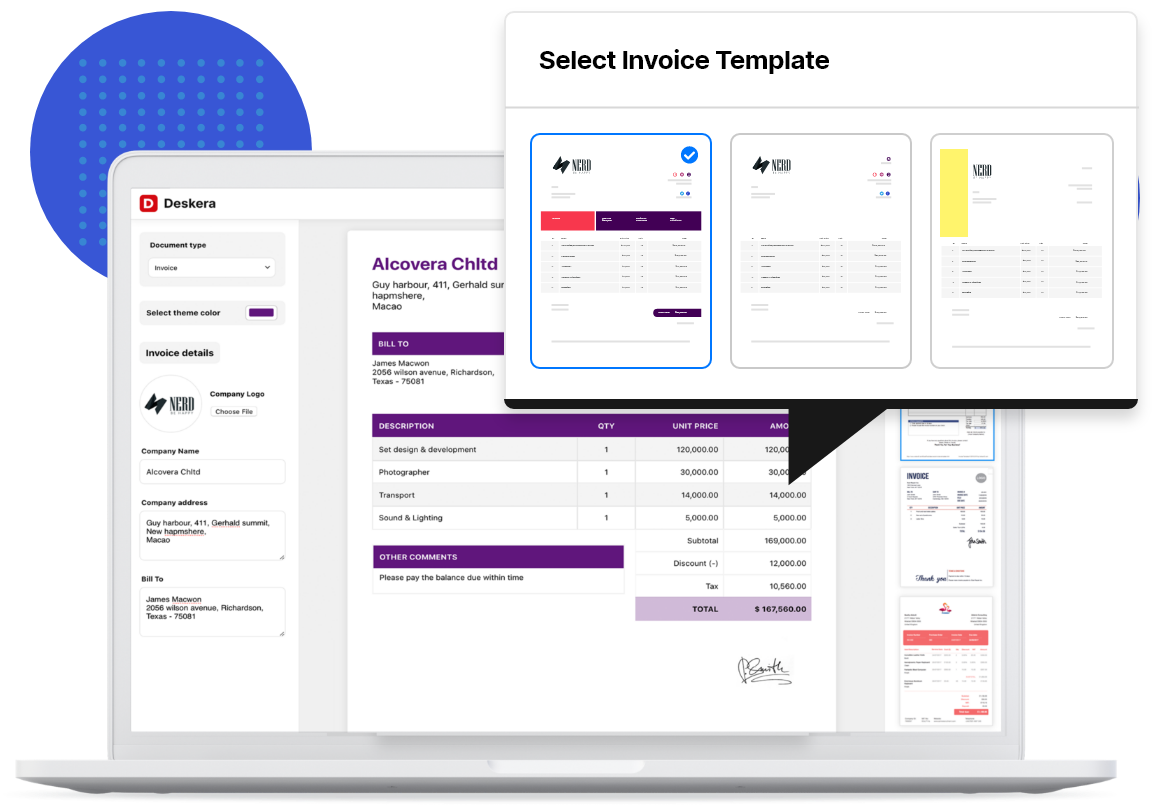

With intuitive cloud accounting software like Deskera, creating and sending invoices is as easy as 1-2-3.

Deskera offers over +100 professional premade invoice templates you can personalize with your business logo, color scheme, font, and more. Then, you just fill in the information on the left sidebar with the appropriate invoice elements, and you’re done!

Press Share, and wait to get paid!

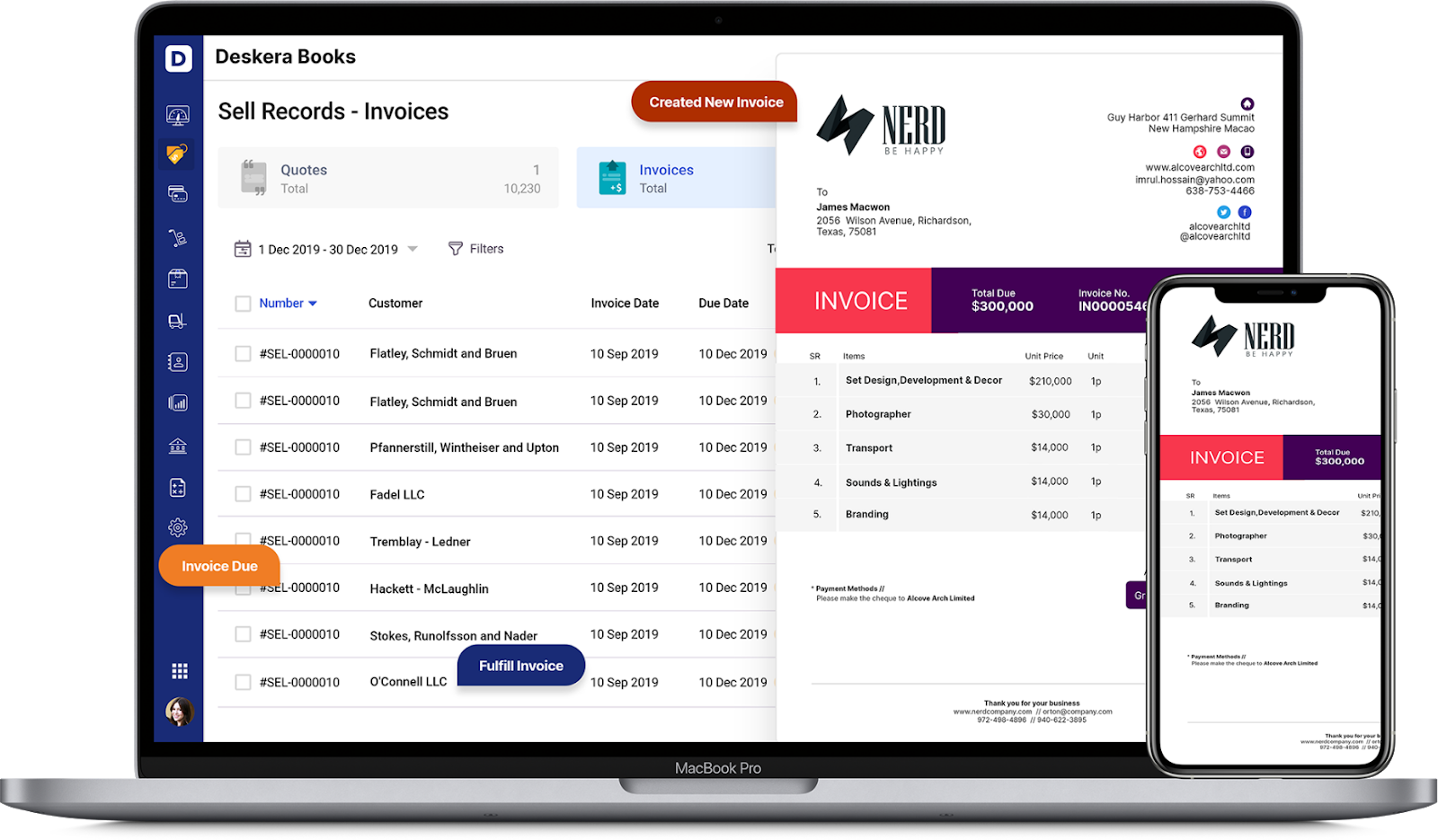

To overview your invoices, and manage outstanding payments, you can head over to the Deskera Sell dashboard.

From that same dashboard, you can also automate other parts of your accounts receivable with features such as recurring payments, advance deposits, tax compliance, and more.

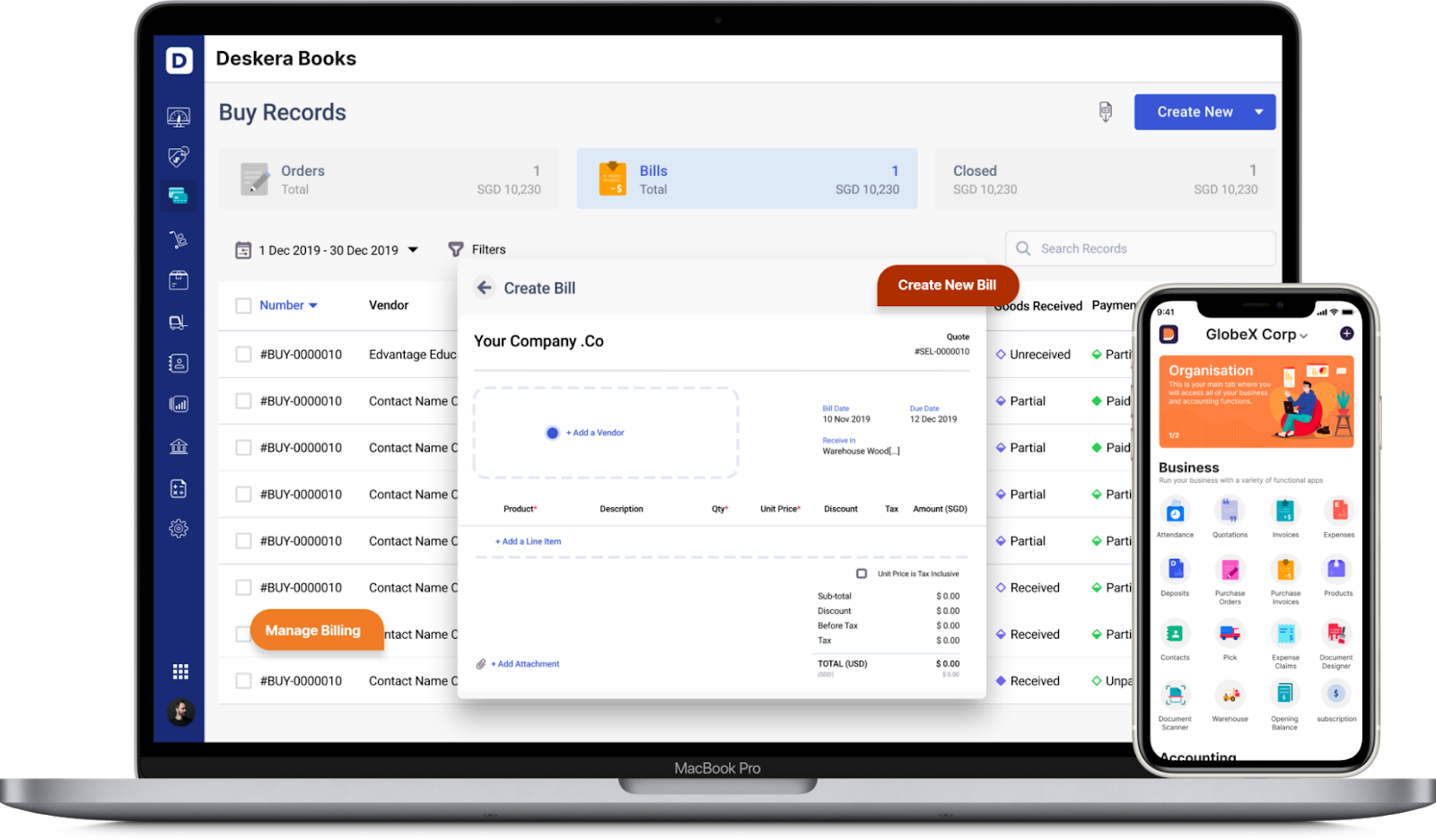

Requesting orders and making invoice payments to vendors can be done just as easily, from Deskera’s Buy dashboard.

Just enter the purchase details, press on Create New Bill, and send the purchase order over with two simple clicks!

The best part: you can access the platform anywhere, mobile, tablet, or desktop by simply downloading the Deskera mobile app.

Still not convinced Deskera is the right choice for your business?

Well, luckily you can try the software out yourself, with our completely free trial.

8+ Tips for Invoice Management

- Automate payment reminders in invoicing software, or set them up on your Google Calendar so you never miss a payment.

- Keep track of suppliers who offer early discounts, and stock up on seasonal sales.

- Avoid overspending by creating realistic budgets for your expenses.

- Open a business bank account to separate your business income from your personal finances.

- Always give your clients a call after sending out an invoice, to make sure they received it.

- Consider late payment fees to encourage clients to pay you back in time.

- Try to offer a range of payment methods such as check, cash, credit card, mobile payments, etc.

- Don’t wait more than 48 hours to issue an invoice, after services and products have been delivered.

- Use accounting software to automate most of your invoicing process.

Invoice Management FAQ

Is a Paid Invoice the Same as a Receipt?

No, a paid invoice and a receipt are not the same things. While both documents are issued by the seller, they serve different purposes.

Firstly, an invoice is issued by the seller to request payment. Once that invoice is paid, the seller creates and sends a receipt to the buyer, to confirm that the payment has been received.

How Much Time Should You Give Clients to Pay an Invoice?

The rule of thumb for paying back an invoice is net-30, which means the client has 30 days to send payment.

However, there isn’t a clear-cut answer because payment terms depend on different factors such as your business’ industry, relationship with the clients, or total amount of the invoice.

What is the Difference Between a Bill, Invoice, and Receipt?

The invoice is issued by the seller to detail the products and services purchased by the client, and to request payment. Then, this invoice is received by the customer (buyer) as a bill they have to pay.

In the end, after the customer pays, the seller issues a receipt as proof of payment.

When Is the Best Time to Send Out an Invoice?

The sooner, the better! After making sure there are no concerns with the order, immediately issue the invoice.

In situations where you’re dealing with time-consuming, large-scale projects, consider requesting advance payment or a deposit.

What Should I Do If I Send an Incorrect Invoice?

If you send an incorrect invoice, fix it by creating a new cancellation invoice. Then, issue another correct invoice (with a new reference number), and send it to the customer.

Consider writing a short apology note, explaining the situation and actions you took to fix it.

Key Takeaways

And that’s a wrap! We hope you found our guide helpful in understanding how the step-by-step invoice management process works.

Before leaving, let’s go through a recap of the main points we’ve covered:

- Invoice management is the method businesses use to issue invoices to their customers and process payments to suppliers.

- Accounts payable records debt owed to creditors, while accounts receivable represents the unpaid amount from clients.

- The main steps of invoice management include:

- Approving & sending a purchase order to the vendor

- Reviewing invoice details

- Choosing the preferred payment method

- Creating invoices for customer purchases

- Sending out the invoice

- Managing accounts payable

- Use accounting software like Deskera to automate your entire invoice management process.

Related Articles