The GSTR-9C is a statement of reconciliation among GSTR 9 for a fiscal year and the taxpayer's audited income statements. It is primarily a yearly audit form for all tax-paying citizens with a taxable income of more than two crores in a given fiscal year. Together with the GSTR-9C audit form, the taxpayer must also complete the reconciliation statement and the audit certification.

In accordance with this form, the law enforcement agencies have also launched the GSTR-9C format in notification No. 49/ 2018 – Central tax dated September 13, 2018. This guide will cover the fundamentals of GSTR-9C, including what it is and how to file it.

What Is GSTR-9C?

Basically, an audit form for taxpayers, the GSTR-9C was introduced on September 13, 2018, the GSTR-9C audit form was introduced - filed every fiscal year by taxpayers that had a turnover of more than 2 crores and certified by a CA. It is essentially a statement of reconciliation statement among the yearly return submitted in GSTR-9 and the audited accounting statements of the taxpayer.

The GSTR-9C form includes the taxpayer's taxable and gross turnover from their financial statements, reconciled with the relevant figures after uniting all of their GST returns for the fiscal year, as well as any differences divulged by the reconciliation. The distinction, as well as its rationale, should be stated explicitly. For each GSTIN, a GSTR-9C is to be issued.

Note: According to CBIC notifications, the cap for the GSTR-9C for FY 2018-19 and FY 2019-20 has been increased to Rs. 5 crores.

Who Must Prepare and Submit GSTR-9C?

Each taxpayer obligated to have their financial statements inspected must file GSTR-9C. GSTR-9C must only be arranged and certified by a Chartered Accountant or Cost Accountant. It should be submitted by the taxpayer on the GST website, with other paperwork such as a printed version of the Annual Return and Audited Accounts in form GSTR-9. This description applies to all tax-paying citizens who are required by GST law to have their Annual Accounts audited.

Note: According to CBIC notifications, the cap for the GSTR-9C for FY 2018-19 and FY 2019-20 has been increased to Rs. 5 crores.

When to File GSTR-9C?

The deadline to file GSTR-9C for the fiscal year 2020-2021 is December 31, 2021. The due date for submission of Annual returns for GSTR-9 and GSTR-9C is the same. Generally, the GSTR-9C should be filed on or before December 31 of the following audited fiscal year. The Government, however, has the authority to extend the deadline if it deems it necessary.

Importance of GSTR-9C

This GST statement of reconciliation must be prepared by a Chartered Accountant or Cost Accountant. Any discrepancies between the figures disclosed in GST returns and the Audited Accounts should be documented by the CA, along with the reasons for the discrepancy.

This statement serves as a foundation for GST officials to confirm the authenticity of the GST reports filed by tax-paying citizens. This is due to the CA's obligation to accredit any supplementary liability resulting from the reconciliation exercise and GST audit in GSTR-9C.

Contents of Form GSTR-9C

The GSTR-9C is divided into two parts. Part A constitutes a form for the collection of tax information, while Part B is a certification form that must be finished by a CA. These two parts are so named as:

- Part-A: Reconciliation Statement

- Part-B: Certification

Part-A: Reconciliation Statement

The numbers mentioned in audited accounting statements are at the PAN level. As a result, the revenue, tax paid, and ITC received on a specific GSTIN (or State/UT) must be extracted from the organization's audited accounts.

As per the Union Budget of 2021, the following changes were made to Sections 35 and 44 of the CGST Act:

- Every applicable tax-paying citizen is required to file a self-certified statement of reconciliation that reconciles the values in the consolidated accounting statements and the yearly returns.

- As per a CBIC notification, some tax-paying citizens could be spared from having to file the annual returns and statement of reconciliation.

The Reconciliation Statement is divided into five parts:

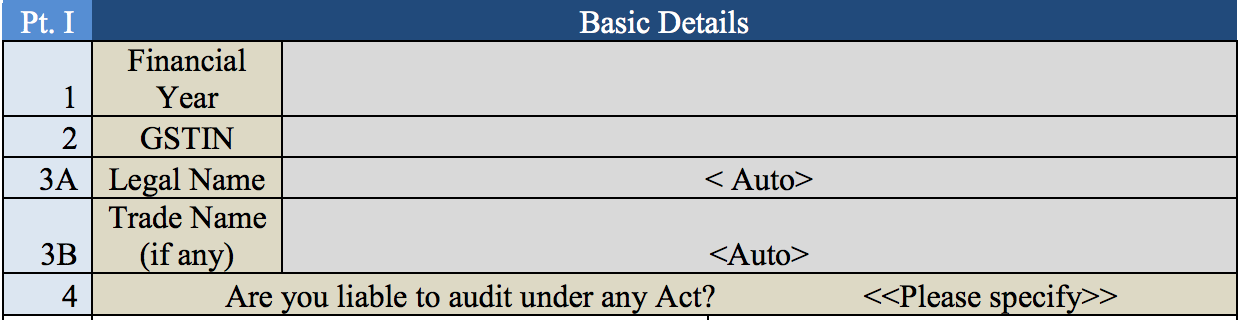

Part-I: Basic Details

The GSTIN, fiscal year, trade name, and legal name are all to be entered in the very first section of the GSTR-9C form. You will also be required to indicate if you are subject to audit under any other law.

Part-II: Reconciliation of turnover declared in audited Annual Financial Statement

This entails the filing of the gross and taxable revenue announced in the Annual Return along with the audited income statements. It should be noted that almost all audited accounting statements are at the PAN level. This may necessitate segmenting the audited accounting statements at the GSTIN level for reporting in GSTR-9C.

Part-III: Reconciliation of tax paid

This provision mandates GST rate-specific accounting of the tax obligation that emerged as a result of the accounts and was paid as noted in the GSTR-9, along with any differences. Furthermore, it necessitates tax-paying citizens to specify the additional liability resulting from unreconciled discrepancies discovered during reconciliation.

Part-IV: Reconciliation of ITC

This section comprises a reconciliation of taxpayers' acquired and used input tax credits as disclosed in GSTR-9 and as mentioned in the Audited Financial Statement.

Furthermore, it requires an accounting of expenses booked in accordance with the Audited Accounts, with a breakdown of qualified and unqualified ITC, as well as the reconciliation of the qualified ITC with the amount claimed in accordance with GSTR-9. This pronouncement will be made after taking into account any ITC rollbacks that have been claimed.

Part-V: Auditor’s Recommendation on additional Liability Due to Non-Reconciliation

The auditor must disclose any tax obligation discovered during the reconciliation activity and GST audit that is owed to the taxpayer. This can be due to a failure to reconcile turnover or ITC as a result of:

- Amount paid for supplies that are not contained in the Annual Reports (GSTR-9)

- Erroneous arrears to be made

- Other outstanding claims to be resolved

Part-B: Certification

As per Notification No: 56/2019 issued on 14th November 2019 For FY 2017-18 & 2018-19, the following changes were made:

- Slight amendments have been made to the declaration section, including the declaration of the auditor, which now instead of "true and correct" reads "true and fair" before their signature and stamp/seal.

The GSTR-9C can be licensed by the CA who performed the GST auditing or any other CA who didn't perform the GST audit for that specific GSTIN.

The distinction between the two lies in the fact that if the CA validating the GSTR-9C didn't perform the GST audit, they should build their viewpoint in the statement of reconciliation in the Books of Accounts audited by another CA.

Detailed Format of GSTR-9C

Part-A: Reconciliation Statement

Part 1: Basic Details

As previously stated, this part contains the GSTIN, FY, trade name, and legal name. The tax-paying citizen must also specify whether or not they are subject to audit under some other law.

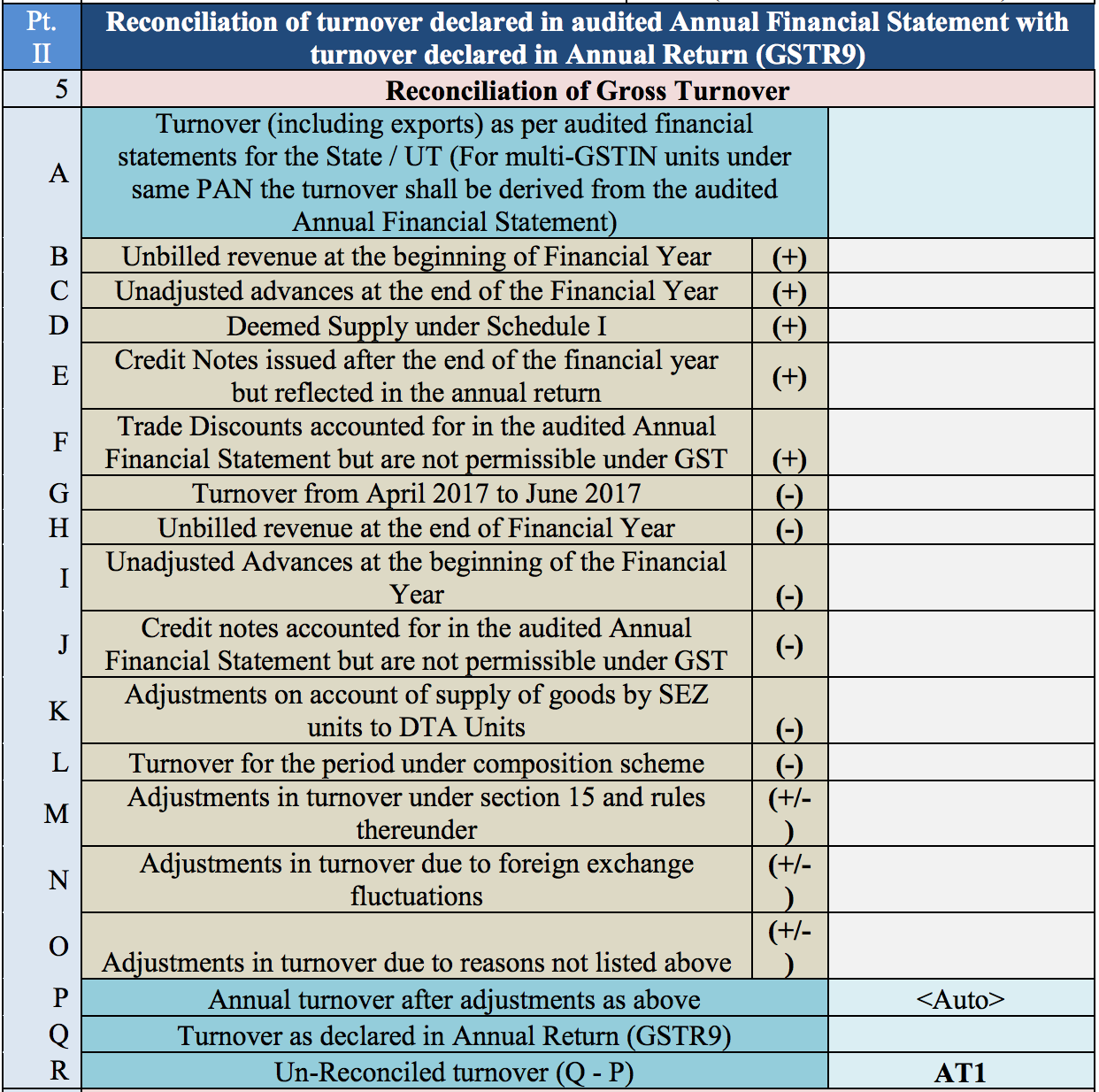

Part-II: Reconciliation of turnover declared in audited Annual Financial Statement

Part 2 will require you to provide information of your turnover from your audited Annual Financial Statement. Section 5 contains information about reconciling your gross revenue. This entails reporting taxable and gross revenue for the following:

- The turnover, including exports, as stated in the audited accounting statements of the state.

- The reimbursable revenue that was documented at the start of the fiscal year.

- Any unadjusted arrears remaining at the end of the fiscal year.

- The presumed supply as specified in Schedule I.

- All credit notes approved following the fiscal year's end but included in the annual report.

- Trade rebates, taking into account in the annual audited accounting statements but not permitted under GST.

- The revenue for the months of April, May, and June.

- The unbilled turnover that's determined at the end of the fiscal year.

- The unadjusted advances, calculated at the fiscal year's start.

- Credit notes that are taken into account in the audited annual accounting records but are not permitted under GST.

- Any adjustments resulting from goods supply by SEZ to DTA units.

- The period's turnover under the composition scheme.

- Any turnover adjustments made in accordance with Section 15.

- Any changes in turnover as a result of currency fluctuations.

- The annual turnover after all the above adjustments have been made. This field is auto-populated.

- The turnover declared in the annual return, GSTR-9.

- The unreconciled turnover, which is calculated as the difference between lines P and Q above. (Q - P)

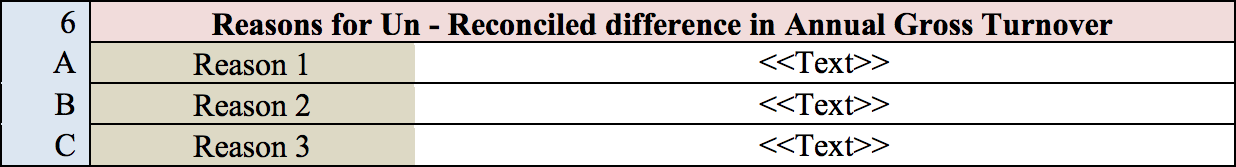

Section 6 allows you to mention any potential causes for unreconciled discrepancies in the yearly gross turnover that might have occurred.

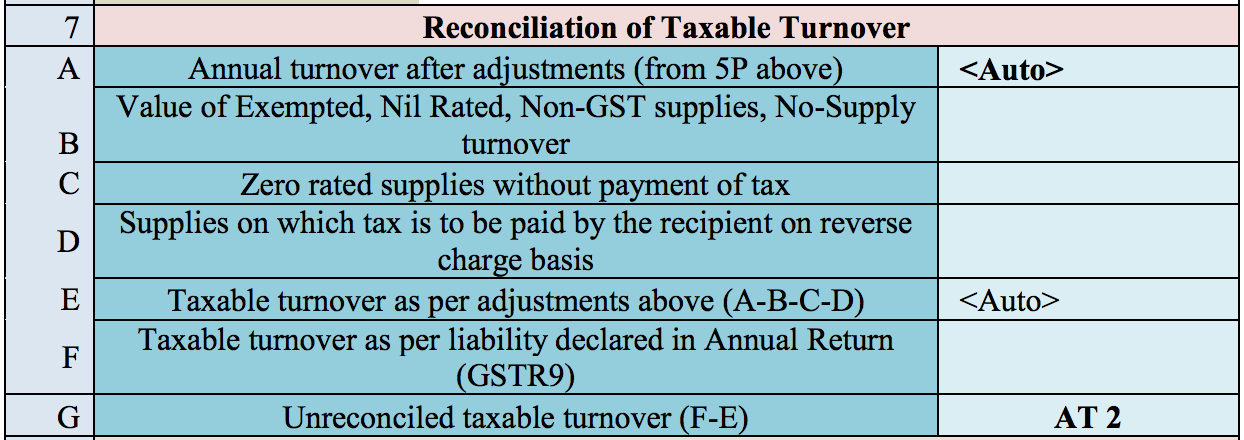

You must fill in the succeeding attributes related to the taxable turnover's reconciliation in this section:

- The yearly turnover after all modifications, the annual turnover. This value is pre-filled.

- The total value of excluded, zero-rated, no-supply turnover, and non-GST supplies.

- The cost of supplies for which no tax was paid.

- The cost of supplies for which the recipient must pay tax under reverse charge.

- The taxable turnover after making the changes listed in the preceding lines (A-B-C-D).

- The taxable revenue in relation to the obligation listed in the annual report (GSTR-9).

- The unreconciled taxable turnover's value (F-E).

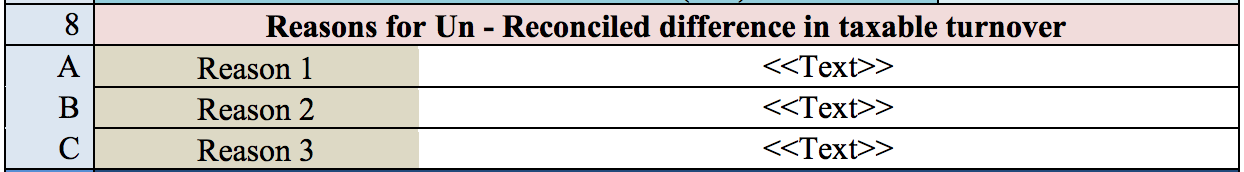

Section 8 enables you to mention reasons for discrepancies between the taxable turnover obtained from Section 7's line E and the taxable turnover stated in the yearly returns.

Part 3: Reconciliation of tax paid

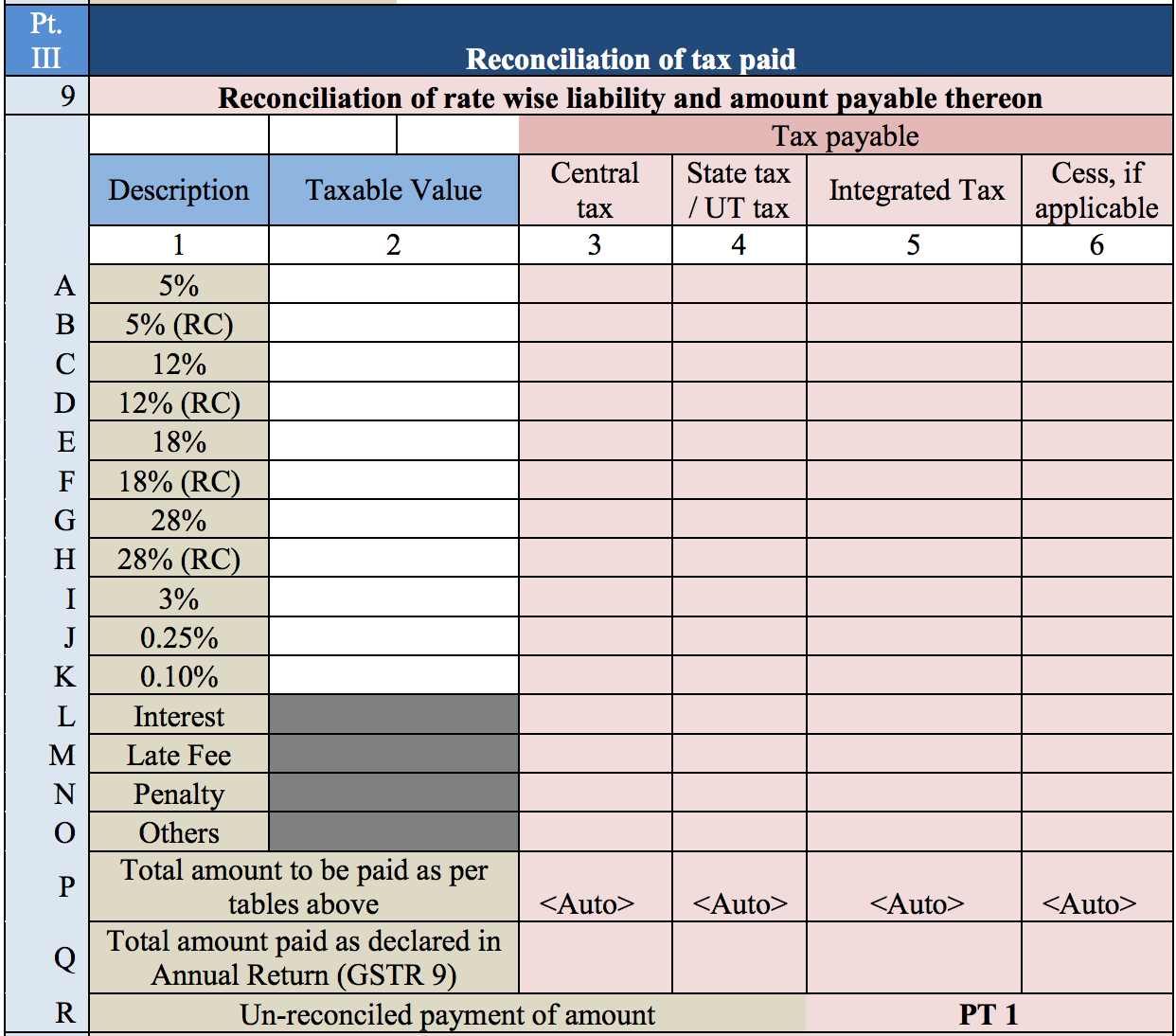

Part 3 gathers data on the taxes you've paid. Section 9 requires you to enter the taxable income, state and central governments' tax, inclusive tax, and cess value for tax rates: 5%, 12%, 18%, 28%, 3%, 0.25, and 0.10%.

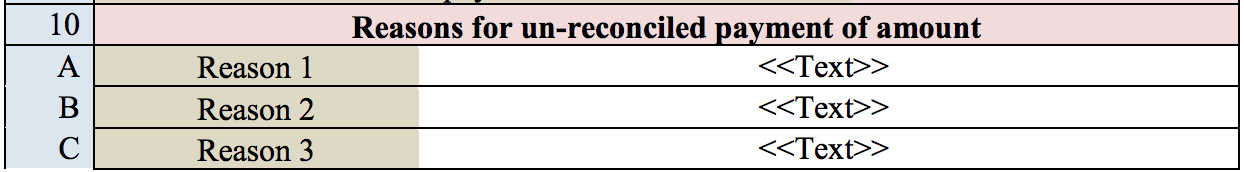

Section 10 allows you to explain why there is a discrepancy in the complete amount of income tax paid as shown in the statement of reconciliation and the total amount of tax paid.

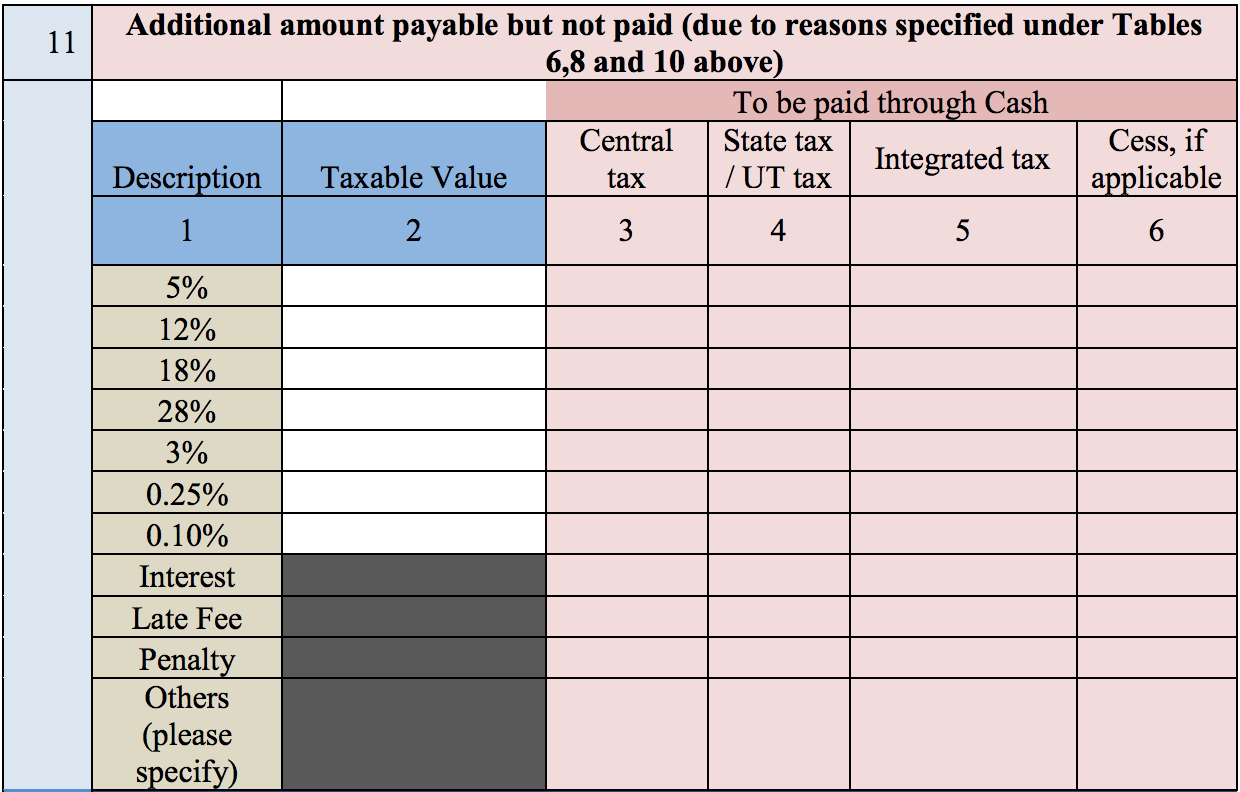

Section 11 contains information about any taxes that are due but have not yet been paid due to the factors stipulated in Sections 6, 8, and 10.

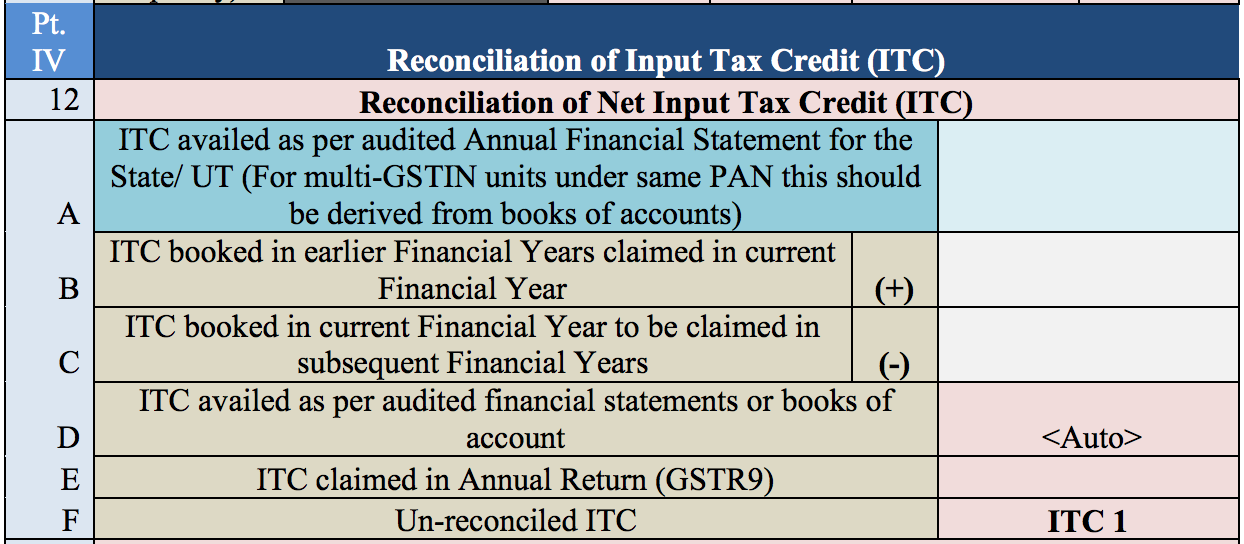

Part 4: Reconciliation of ITC

Part 4 includes instructions for reconciling your ITC. Recognize the worth of the ITC received in the following categories under Section 12:

- The ITC is granted in accordance with the state's or UT's audited yearly accounting statement. This value should be deduced from the audited accounts if there are multiple GSTINs under the same PAN.

- The ITC discussed in the transactions for the previous fiscal years but not used in the current fiscal year.

- The ITC mentioned in the current fiscal year's accounts but not used until the following fiscal year.

- The ITC received in accordance with the audited accounting statements.

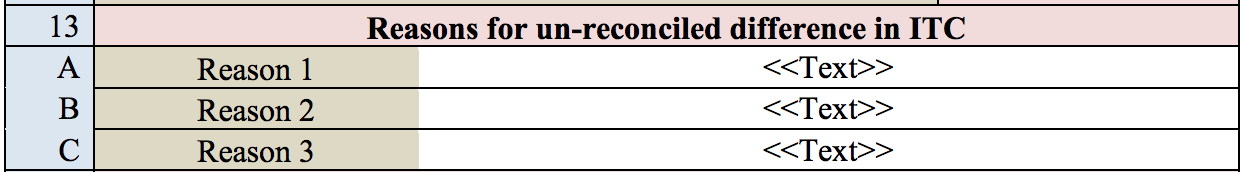

Section 13 allows you to mention any explanations for a discrepancy between the yearly returns filed and the ITC claimed on the audited financial statement.

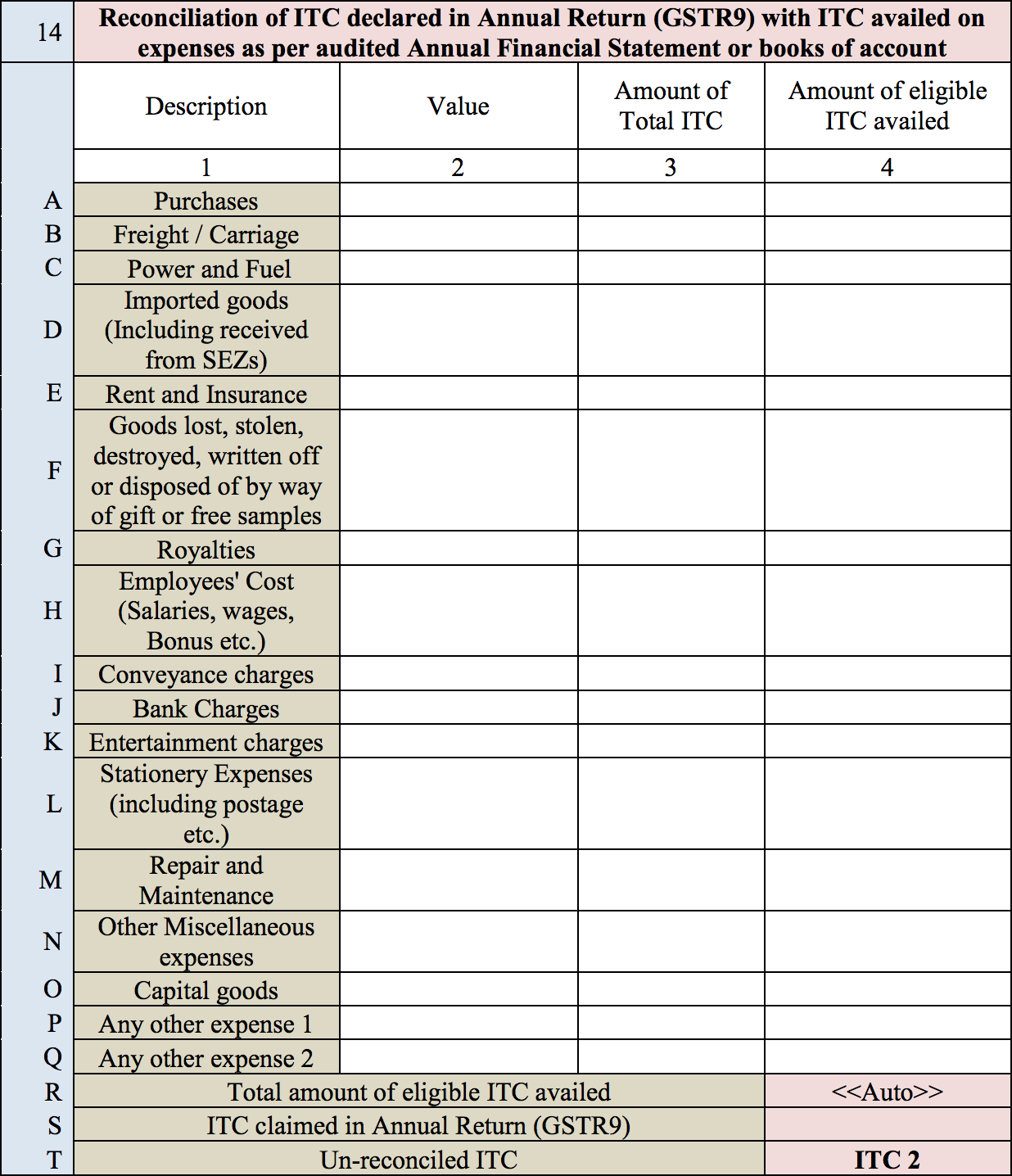

Section 14 requires you to explicitly state the valuation, overall ITC amount, and amount of appropriate ITC claimed for each expense category.

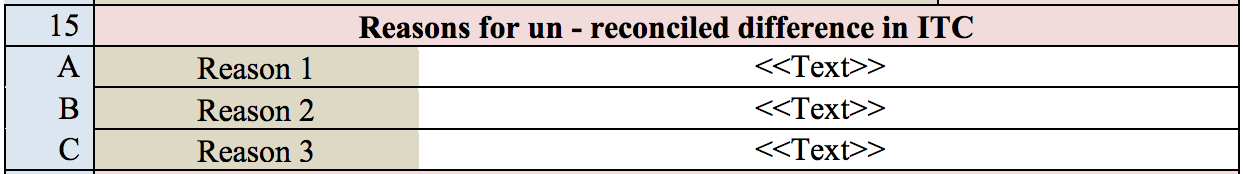

Section 15 necessitates the reasons for any discrepancy between ITC availed for separate expenses (mentioned in Section 14's line R) and the ITC received according to the annual return (mentioned in line S).

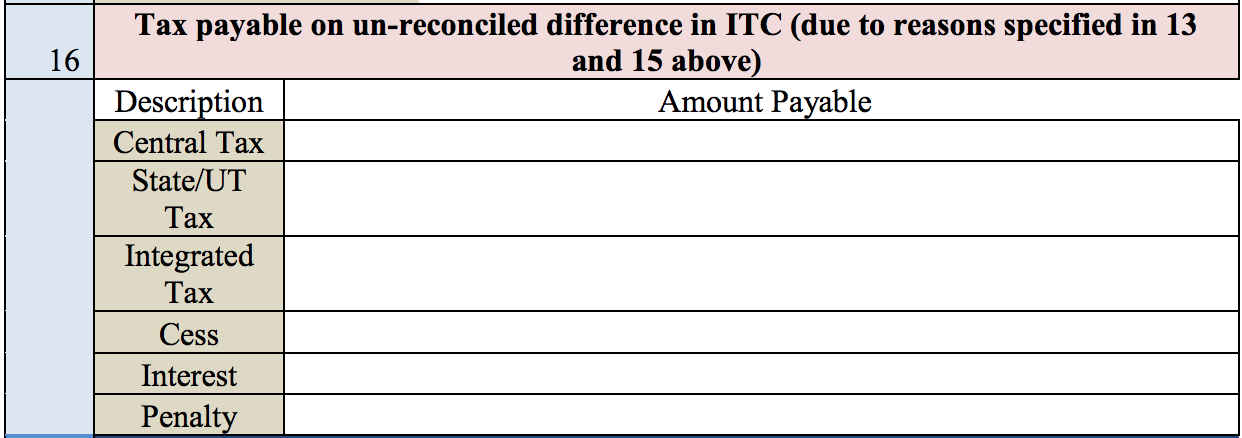

Fill in the central and state tax, integrated tax, cess value, interest, and penalty payable in relation to the unreconciled differences described in Sections 13 and 15.

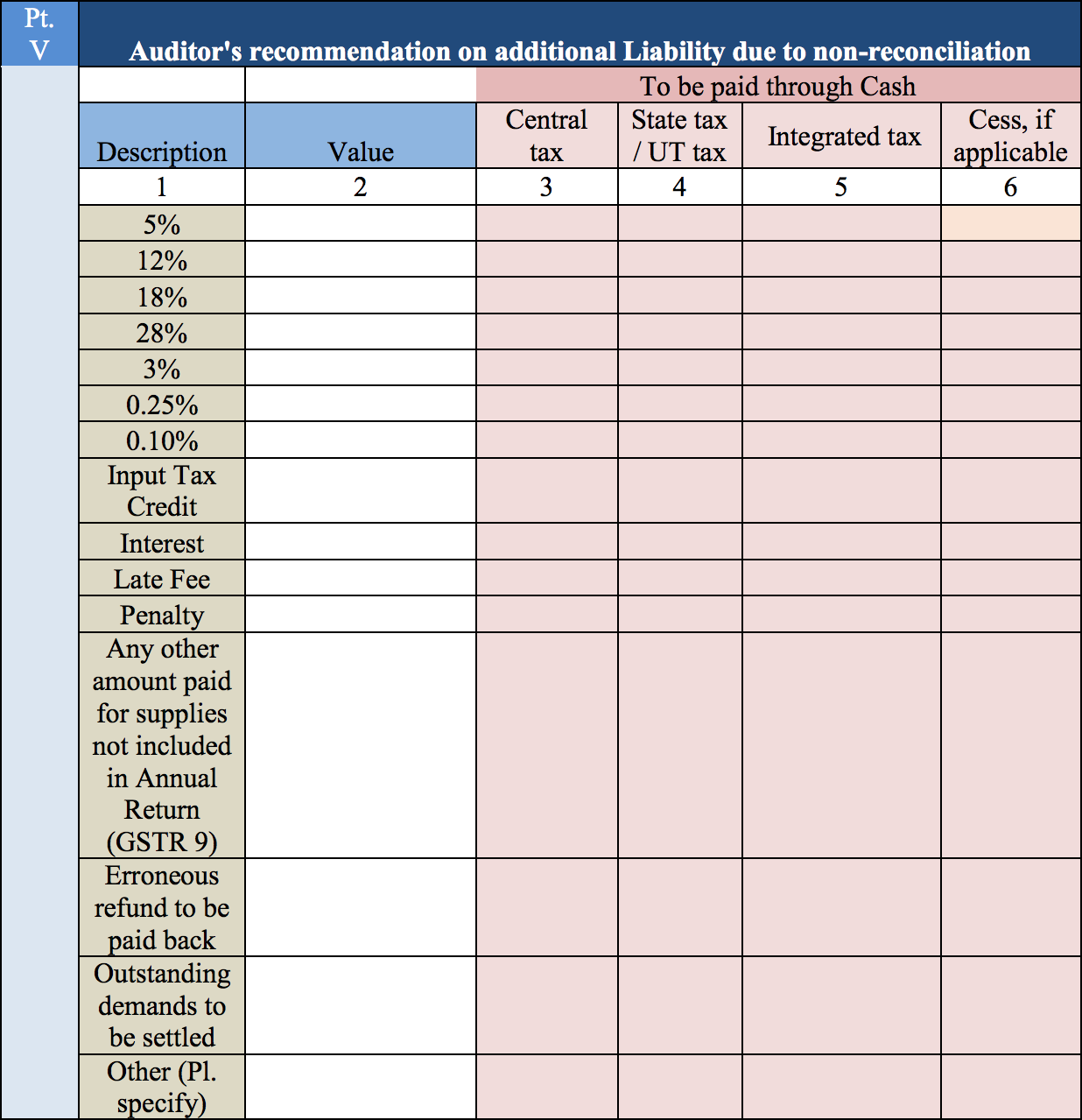

Part 5: Auditor’s recommendation on additional liability due to non-reconciliation

Part 5 includes your auditor's advice in terms of your extra tax obligation as a result of non-reconciliation. Your auditor must fill the tax payable, state and central tax, inclusive tax, and cess value for several categories, the appropriate ITC, interest, fees, and penalties, any other sums compensated but not included on the GSTR-9, and incorrect refunds to be paid.

What Has Changed in GSTR-9C Format & Filing

The succeeding adjustments were introduced to the format and reporting procedure as of December 31, 2018:

- Validation by tax-paying citizens who have registered to vote.

- Taxpayers must submit GST returns in GSTR-1, GSTR-3B, and GSTR-9.

- At the end of this return, tax-paying citizens will be provided with the opportunity to pony up any extra liability stated in this form via FORM DRC-03. In FORM DRC-03, taxpayers should choose the 'Reconciliation Statement' from the drop-down menu. It should be mentioned that such liability must be paid only by an electronic cash ledger.

Applicability of Form GSTR-9C From FY 2020-21 Onwards

Form GSTR-9C remains excused for tax-paying citizens subject to TCS and TDS provisions, input service distributors, and casual & non-resident tax-paying citizens. Additionally, taxpayers and governmental bodies with total revenue of less than or equal to Rs. 5 crores are excluded.

As a result, Form GSTR-9C has now become relevant to tax-paying citizens that have a yearly aggregate turnover of more than Rs. 5 crores for a given fiscal year. These taxpayers must self-validate or complete a willful statement of reconciliation without needing to do an audit and submit it to the tax authority on or before December 31st of the following fiscal year.

The table below chronicles the threshold applicability of both statement of reconciliation and annual returns for FY 2020-21.

| Name of the Form | Applicability - for FY 2020-21 | Due date for FY 2020-21 |

|---|---|---|

| GSTR-9 | > Rs.2 crore | 31st December 2021 |

| GSTR-9C | > Rs.5 crore | 31st December 2021 |

*Annual aggregate turnover during FY 2020-21.

Summarised Table of Changes to Form GSTR-9C

Changes to the statement of Part-A: Reconciliation is as follows:

| Reference to part and/or table no. | Particulars | Changes made |

| Part-II – Tables 5B to 5N | Reconciliation of the annual turnover as per the audited annual financial statement with the turnover as declared in Form GSTR-9 | These tables are optional while filing GSTR-9C for FY 2020-21. If there are any adjustments, those can be done in Table 5O. |

| Part-III and Table no. 9 | Reconciliation of GST rate-wise liability and the amount payable | A new row is inserted below ‘K’ -0.10% to now have ‘K-1’ for other GST rates not listed above it. |

| Part-III and Table no. 11 | Any additional amount to be paid but not paid (on account of the reasons specified under Tables 6,8 and 10) | A new row ‘others’ is inserted below 0.10% to now have other GST rates not listed above it. |

| Part-IV- Tables 12B, 12C, and 14 | Reconciliation of Input Tax Credit (ITC) | These tables are optional while filing GSTR-9C for FY 2020-21. |

Part-V |

Auditor’s recommendation on any additional Liability due to non-reconciliation | Heading changed to “Additional Liability due to non-reconciliation”A new row ‘others’ is inserted below 0.10% to now have other GST rates not listed above it. |

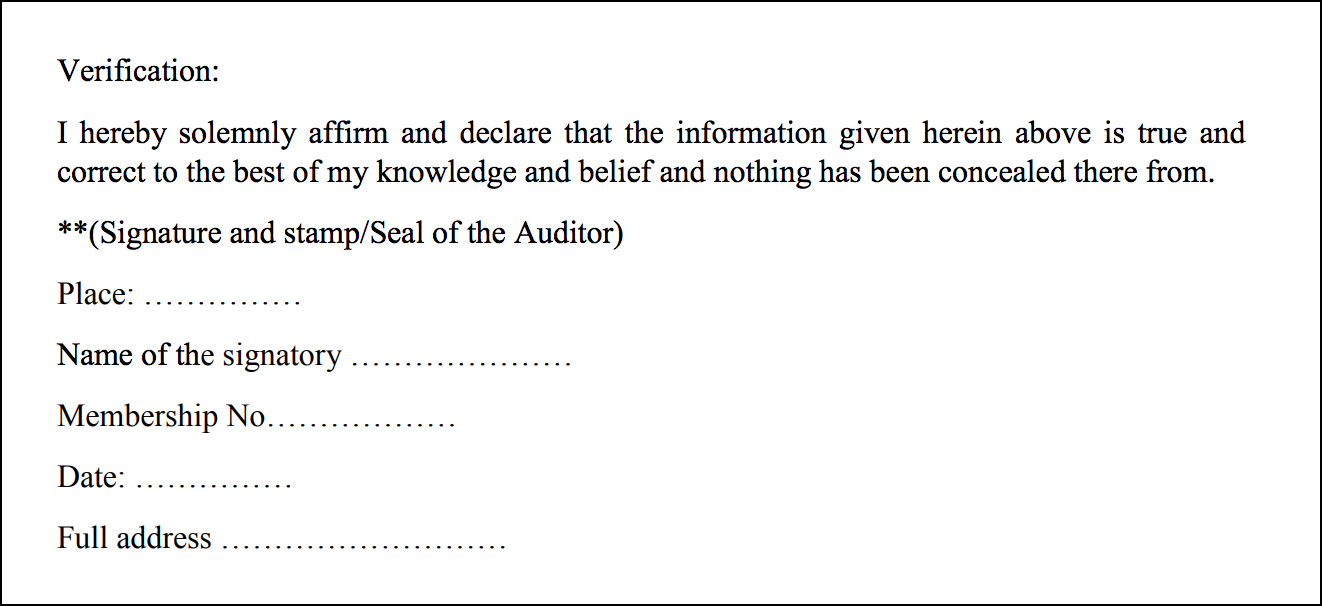

| Verification | Verification of the registered person |

Replaced by the following lines: "I hereby solemnly affirm and declare that the information given herein above is true and correct, and nothing has been concealed therefrom. I am uploading the self-certified reconciliation statement in Form GSTR-9C. As applicable, I am also uploading other statements, including financial statements, profit and loss account, and balance sheet, etc." |

| Instruction -serial no. 7 | Part V – Additional Liability due to non-reconciliation |

The wordings of the instruction are revised to remove references to the auditor and their recommendations, as follows: "Part-V consists of the additional liability to be discharged by the taxpayer due to non-reconciliation of turnover or non-reconciliation of the input tax credit. Any refund that has been mistakenly considered and paid back to the government must also be declared in this table. Lastly, any other pending demand to be settled by the taxpayer has to be declared in this Table." |

How can Deskera Help You?

Discover how you can combine accounting, finances, inventory, and much more, under one roof with Deskera Books. It's now easier than ever to manage your Journal entries and billings with Deskera. The remarkable features, such as adding products, services, and inventory, will all be available to you from one place.

Experience the ease of implementation of the tool and try it out to get a new perspective on your accounting system.

With the guiding and informative videos on how to manage and set up India GST, you can learn about and familiarize yourself with the process in just a few minutes.

Deskera Books is a time-saving strategy for managing your work contacts, invoicing, bills and expenses. In addition, opening balances can be imported and chart accounts can be created through it.

Deskera Books can handle every aspect of the organization, including inviting colleagues and accountants.

Key Takeaways

- The GSTR-9C is a quantitative declaration on GST returns validates and certified by a GST CA/CMA/Auditor for GST officials to take appropriate action and is needed to be submitted by a GST registered taxpayer who is subject to GST audit.

- The deadline for submitting GSTR-9C is December 31st of the following fiscal year, either before or after submitting GSTR-9. Because there is no special provision for late charges, a general penalty of Rs. 25,000 is applicable.

- GST Auditor validation is needed via digital signature and must be affirmed by the taxpayer via digital signature.

Related Articles