If you are running a business or you are an individual working as a solopreneur in India, it is time for you to learn all about GST audits. Indian taxation system works in a very organized way. If you are someone who is making an income that crosses a threshold set by the Indian government, you become liable to pay taxes, and in GST.

It’s alright if you are confused about how does the process works, if or if you are not liable to pay the taxes and GST if you are paying the right amount, and what is a GST audit. In this article, we have covered it all for you.

GST audit is basically a check to analyze if the right amount of GST is being paid or not. It also helps the taxpayers in keeping a check on the refunds they are claiming and are eligible to claim, the tax paying credits, and the analyzation of their books in business. Everything comes handy to make things easier for a business.

On 28th May 2021, the 43rd GST Council meeting outcome was issued. It stated if a taxpayer’s turnover is up to INR2 crore, GSTR-9 shall be optional for the taxpayers. But if the turnover is less than or extends upto INR 5 crore, the GSTR-9C should be self-certified for and onwards financial year 20-21.

What is there in this article -

- Introduction to GST Audit For India

- Threshold Limit for Audit under GST by CA/CMA

- How to Rectify Returns after GST Audit if Needed?

- Audit by Tax Authorities

- Special Audit under GST

- GST Audit Applicability & Procedure: For Turnover more than Rs 2 Crores

- Need for GST Audit and meaning

- Types of GST Audit

- Qualification of GST Auditor & Eligibility

- Conclusion

- Key Takeaways

Introduction to GST Audit for India

GST Audit is a process of keeping a check on returns, examinations of the records, and maintenance of the records for and by the person who is liable to pay taxes. The objective of the entire process is to assess the taxes paid, input tax credit availed, turnover declared, refund claimed, and to analyze the extent of payable GST.

GST Audits are precisely divided into two types, understand better with this flowchart.

Threshold Limit for Audit under GST by CA/CMA

GST Audit only takes place when a person meets the threshold for turnover set by the government of India. Wondering about what the threshold turnover is? Here is the answer for you.

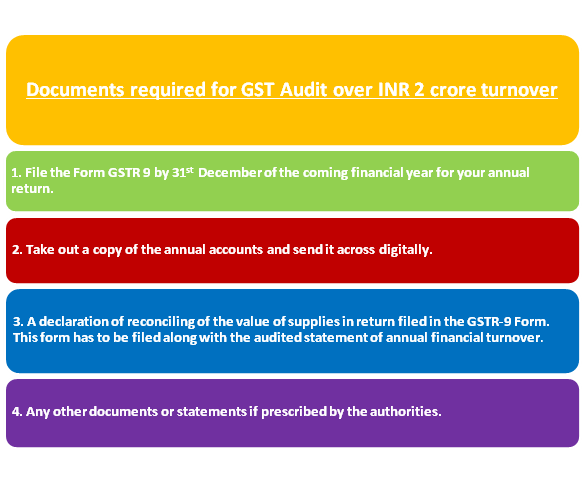

If you are someone whose turnover is exceeding the prescribed limit set by the taxation authorities of India, you are liable to pay GST. According to the current taxation rules, the prescribed limit is set for a turnover above INR 2 crores. If you are someone whose business turnover exceeds this limit, you need to hire a chartered accountant or a cost accountant. The chartered accountant or the cost accountant you hire will then conduct an audit of your books. Along with the audit of the books, you also need to file some data and documents digitally. The requirements are -

- File Form GSTR 9 by 31st December of the coming financial year for your annual return.

- Take out a copy of the annual accounts and send it across digitally.

- A declaration of reconciling of the value of supplies in return is filed in the GSTR-9 Form. This form has to be filed along with the audited statement of annual financial turnover.

- Any other documents or statements if prescribed by the authorities.

If you are a business owner and your turnover is less than INR 5crore, here is good news for you. The authorities of taxation have waived off GSTR-9C filing for FY 2018-19 and FY 2019-20 for turnover under INR 5crore.

How to Rectify Returns after GST Audit if Needed?

Paying GST and other taxes is all about making the right calculation first. Calculations can go wrong. Or you may submit the wrong documents at times. Whatever the reason may be, there are ways to rectify the subject of payment of interest. These omissions and mistakes can be easily discovered at the time of GST audits.

But, rectification is only possible till a point in time. You can only do the rectification till –

- The due date is not over for the second quarter or for September, which may ever be for the end of the financial year.

- The end date of filing the annual tax return.

Audit by Tax Authorities

After reading the information above, you probably would have understood the two different kinds of audits. One is arranged by the tax payer itself. The other one is arranged and instructed by the Tax authorities of India.

Here is how Tax Authorities take audits.

-

CGST/SGST Commissioner is an authorized person. They can conduct an audit on the taxpayer themselves or can assign and authorize another officer for the audit. The kind of audit or the prescribed limit of the audit is set by the authorities. The taxpayer is informed about the same later.

-

The auditee will receive a notice 15 days prior to the audit. This notice will have all the information on how the audit is going to be conducted.

-

The commencement of the audit is done by the authorized officer. Once done, the audit has to be completed with 3 months of commencement.

-

However, this time span can be extended for valid reasons. The commissioner has the power to extend the timeline by 6 months. The decision has to have valid reasons and the reasons, as well as the extension, will only be valid when recorded in writing.

Mandatory Obligations

A GST audit is a process that is divided into several folds. It is the highest grade of audits where the government is involved with the taxpayers. Thus the taxpayer has to fulfill certain mandatory obligations.

These obligations are

- Provide ease and comfort along with all the books and other documents that the auditing officer may require.

- To cooperate with the auditing team and provide information if and when needed.

Results of the Audit

Audits are carried out with a purpose. The information has to be gathered, analyzed and cross-checked to make sure the GST submitted is relevant. The right to this information is equal for the auditor as well as the taxpayer.

The auditing officer has to provide the conclusion of the audit with 30 days to provide it to the taxpayer. The timeline of 30 days is over after the findings from the audit, the reasons mentioned (if any), and the obligations are fulfilled by the taxpaying person.

If a glitch is found in any terms related to wrong claims, wrong tax payment, or wrong documents, then a rectification action is required and initiated.

Special Audit under GST

Hearing the term “Special Audit” may bring a lot of questions to your head. Here are some questions that will give you what you wish to know.

What is a Special Audit?

As the name suggests, it is a special audit that takes is carried out on the special instruction by the assistant commissioner. It depends on the case and the complications of the tax payments. The assistant commissioner can initiate the special audit if any issues are found.

Who conducts this special audit?

The assistant commissioner orders for the special audit (this order has to be in written). The audit is then conducted by a chartered accountant or a cost accountant. The commissioner nominates a chartered accountant or a cost accountant to conduct the audit.

What is the time and cost of the special audit?

The audit has to take place within 90 days of commencement. The reports can be further extended for 90 more days buy orders from the authorities. The Commissioner bears the cost of the audit.

GST Audit Procedure: For Turnover more than INR 2 Crores

GST audit is only conducted for the taxpayers who are registered under the GST act and have a turnover of over INR 2 crores. It is a mandatory practice for the taxpayer to carry out. To get the books audited, the taxpayer has to call in a charted accountant or a cost accountant for each financial year.

Here is the entire process of how to go about a GST audit.

The Procedure

- Hire an auditor – The GST auditor cannot be your in-house accountant. A GST audit is legally only conducted by a Charted Accountant, a Cost Accountant, or someone working for a Charted Accountant/Cost Accountant Firm.

- Accumulate the total – If a business has chains and branches across the state and you do not know how to find the GST estimate of it, here is what to do. Take the revenue of all the branches together, add them and then analyze. The GST will be applicable to the combined turnover of all the branches.

- Audit for all – Yes, the GST will be applicable to the total turnover of all the branches. But, the audit will be conducted on each branch separately. The audit will be conducted even if the turnover of a particular branch is not as much as INR 2 crores.

- Assign the Auditor – As per the GST guidelines, the taxpayer can hire the same charted accountant for all its branches over different states, or they can hire different charted accountants for different branches. (Read all the guidelines on this.)

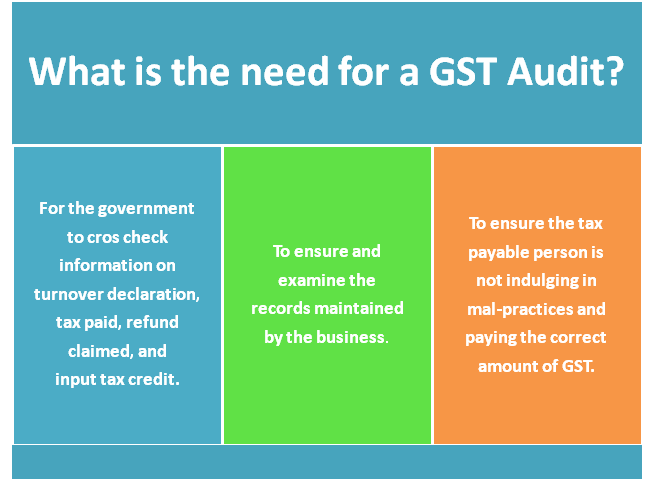

What is the Need for a GST Audit?

India’s government, like any other government in the world taxes from the moneymakers in the country. GST is a similar form of tax. The difference is, GST is a self calculated tax and has a scope for fraud. To protect the taxpayers from getting into fraud practices, the government introduced a GST audit.

The aim of the audit is –

- For the government or the authorities to analyze, cross-check, and verify the information given around the turnover of the company, taxes paid by the business, refund claimed by the taxpayer, and input tax credit.

- To ensure and examine the records maintained by the business.

- To ensure the tax payable person is not indulging in malpractices and paying the correct amount of GST.

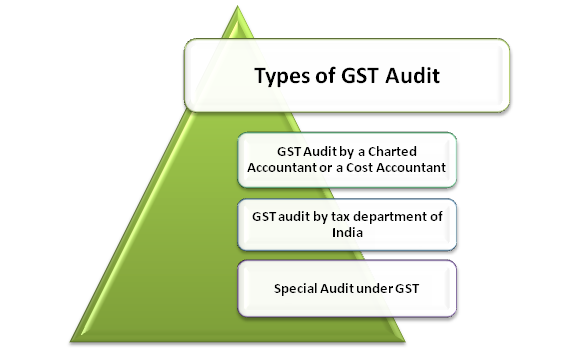

Types of GST Audit

The taxpaying authority of India has initiated three types of audits.

GST Audit by a Charted Accountant or a Cost Accountant

This is a general audit done by the taxpayer. The taxpayer hires a charted accountant or a cost accountant to conduct the GST audit for them. The charted accountant or the cost accountant then provides a copy of the audited account and a reconciliation statement.

GST audit by tax department of India

This audit is conducted by the commissioner or an officer assigned by the commissioner.

Special Audit under GST

The assistant commissioner can initiate this special audit when a glitch is found. The audit is commenced only after written notice.

Qualification of GST Auditor & Eligibility

As talked about in this article so many times, only a Charted Accountant or a Cost Accountant is legally eligible to conduct a GST audit. Your personal accountant will not be liable for the role.

Conclusion

GST audit is a mandatory practice if your business turnover reaches the threshold limit. To ensure the process is done right, you need to hire a charted accountant or a cost accountant at the beginning of the financial year. Hiring one at the beginning of the financial year is not just smart but mandatory. It is important to know and understand that a charted accountant who is a registered GST practitioner cannot conduct an audit.

Key Takeaways

- GST is applicable only on businesses with turnover over INR 2 crores

- There are three types of GST audits

- A Charted Accountant or a Cost Accountant is the only one who can conduct an audit.

- A taxpayer has to meet certain obligations while, after, and before the audit is being conducted.

- Your general accountant is not eligible to conduct a GST audit.

- You can rectify your GST submissions if there is a mistake within a period of time.