If you’ve been maintaining and running a small business, chances are you’ve come across differences in figures between the bank balance in your books of accounts and the customer records maintained by your bank. These differences usually stem from transactions that occurred over the days immediately preceding the day in which you check the difference. For instance, you may have deposited a check from your customer yesterday and instantly credited your books. But banks often take 2 to 3 business days to clear checks and reflect these balances in accounts. Thus, your books have a discrepancy.There are many such instances that can affect the numbers in your books of accounts, and the numbers reflected in say your passbook.

Though currency transfers are faster, and notifications are made promptly, timing differences and errors still occur from time to time, making bank reconciliation process an extremely crucial aspect of accounting, especially for small businesses.

In this article we will understand -

- What is Bank Reconciliation Statements- How BRS works?

- Bank Reconciliation Statements- Purpose and Benefits

- Best Practices for Bank Reconciliation Statements.

What is Bank Reconciliation Statements- How it works

When preparing a bank reconciliation statement, you or your accountant will first gather a comprehensive list of all transactions since the last time the balances between your records and the bank records were matched.

Then, you’ll proceed to eliminate the transactions which appear in both sets of records, leaving you with transactions that appear only in your books of accounts or in the passbook. This also results in the identification of manual errors made by you (or the bank, as the case may be) like wrong totals, or incorrect entries, or accidental debits/credits.

These transactions may include (not an exhaustive list of transactions)

- Customers’ cheques deposited by you in the bank, but not cleared till date.

- Customers’ cheques bounced due to insufficient funds

- Your cheques not yet deposited by vendors / cleared by the bank till date

- Deposits in Transit

- Direct deposits by customers without notifications

- Interests/ Charges

- Errors/mistakes/frauds.

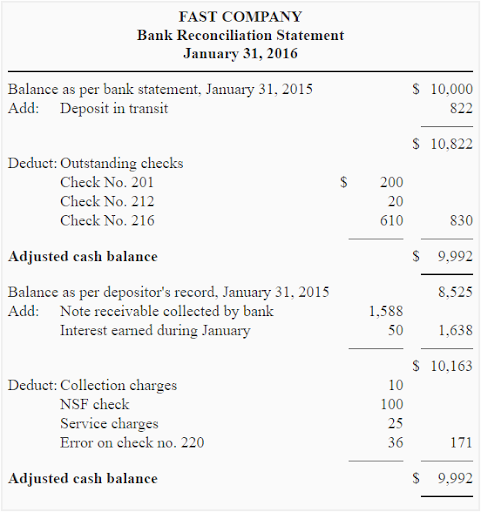

After noting the differences between the two records, you prepare a form/statement called the bank reconciliation statement outside your books of accounts. In this form, you start with the bank balance as per your records, note down the transactions which are correctly reflected in the passbook, but not in your cashbook (for instance bank charges, direct deposits, etc.,), but not in your books of account to arrive at the modified bank balance.

After arriving at the modified bank balance, you take into account all the other differences, which should lead you to the balance as per your bank’s records.

Bank Reconciliation Statements Purpose and Benefits

The most fundamental purpose of a Bank Reconciliation Statement is to check any cash manipulations/frauds and errors pertaining to your bank accounts. It’ll also help you make sure that transactions aren’t left out in your or your bank’s records. Here are some of the key benefits of maintaining a Bank Reconciliation statement

- Track differences in the two sets of records: Every single penny earned is important. Bank Reconciliation statement helps you reconcile the differences between the two sets of records - yours and your bank’s.

- Error Detection and Fraud Prevention: Knowing that checks and balances are in place to detect fraud is often a good deterrent for any employee to commit fraudulent activities. Bank Reconciliation statement also helps track honest mistakes and manual errors, helping you get the accurate data that you need.

- Transaction Status Updates: Maintaining a Bank Reconciliation statement will give you reliable data on the transactions that are completed, and those that are still in process.

- Tracking Fee & Interests Charged: Hidden charges and transaction fees may often be levied by banks without adequate notification or overlooked amidst the hundreds of transactions that your business conducts. Maintaining a bank reconciliation statement will help you stay in track of what’s best for your business.

Maintaining a Bank Reconciliation Statements is not made mandatory as per any laws, rules, or regulations. The effects of this statement are not reflected in your books of account (unless errors are rectified as a result of this). This statement is categorized as a memorandum statement, i.e., statements or records made for your benefit outside of the books of accounts. However, it is crucial to understand the importance of Bank Reconciliation Statements and ensure that you regularly maintain them.

Best Practices For Bank Reconciliation Statements

- Maintain Bank Reconciliation Statements regularly. While once a week is recommended, do ensure that you do it at least once a month.

- Consider external employees to maintain Bank Reconciliation Statements , to prevent a fraudulent accountant manipulating the bank records and the BRS statement,

- Optimize account structures, make sure to follow a specific template, so that you don’t miss out on any transactions,

- Seek automated solutions, and establish proper controls to prevent errors from occurring in the first place.

For a comprehensive list of things to be kept in mind while preparing a bank reconciliation statement, take a look at this document released by the Association for Financial Professionals.

To Conclude

It is almost always recommended to use automated solutions instead of manual accounting systems. The advantages are numerous - ease of use, increase in reliability, and more. Especially in the case of Bank Reconciliation Statements, using accounting software will likely eliminate common mistakes in manual preparations.

You can check here how easy it is to make a BRS with Deskera's cloud accounting software. For more such accounts-related information gold mines, make sure to subscribe to the Deskera newsletter!