GSTR-9 is an annual return to be filed yearly by taxpayers registered under GST. It consists of the details regarding the outward and inward supplies made/received, tax liability and input tax credit availed during the relevant financial year under different tax heads that are: CGST, SGST, IGST and HSN codes.

GSTR-9 is a consolidated statement of all the monthly and quarterly returns, like GSTR-1, GSTR-2A, GSTR-3B filed in that year. Though GSTR 9 is quite complex, this return helps in the extensive reconciliation of data for 100% transparent disclosures.

This article will take you through the most frequently asked questions for GSTR-9.

50 Most Frequently Asked Questions for GSTR-9

1.Who is liable to file GSTR 9?

All registered taxpayers are liable to file GSTR 9 except:

- Casual Taxpayers

- Input Service Distributors

- Non-resident taxpayers

- Taxpayers deducting tax at source/collecting tax at source under Section 51 of 52

What needs to be noted is that composition taxpayers have to file GSTR-9A and eCommerce operators have to file GSTR-9B

2. If the business has shifted from Regular to Composition Scheme or vice versa within the same FY, what are the implications in the Annual Return? How are the computations to be done?

In the scenario where the business of an assessee is shifted from Regular to Composition or vice versa, the turnover and purchases have to be segregated in the following manner:

- Turnover of a period where the assessee is registered under Regular Scheme: should be reported in GSTR-9

- Turnover of a period where the assessee is registered under the Composition Scheme: should be reported in GSTR-9A

- Segregate Purchases: Compute the purchases for the period during which an assessee was registered as a Regular taxpayer and report the same under GSTR-9 to claim ITC. However, ITC cannot be claimed for the purchases made during the period where the assessee was registered under Composition Scheme.

3. Is it mandatory to file Form GSTR-9?

Yes, it is mandatory to file form GSTR-9 by the normal taxpayers

4. I got my registration cancelled in the financial year. Can I file Form GSTR-9?

Yes, the annual return needs to be filed even if the taxpayer has got his GST registration cancelled during the said financial year.

5. During the Year if there is an error between CGST, SGST and IGST interchanged in reporting, but the gross value of the taxes matches, can the same be correctly reported in GSTR 9?

If CGST, SGST and IGST are interchanged while reporting in GSTR-1, the same cannot be correctly reported in GSTR-9. Table 9- Details of taxes paid of GSTR-9 cannot be edited except the tax payable column.

However, the assessee can correctly report the actual taxes payable under their respective heads while updating Table 9. This correct reporting however does not lead to automatic intra-adjustment of tax under CGST, SGST and IGST.

The shortfall of tax needs to be paid off while filing GSTR-3B of the subsequent month or by filing DRC-03. The taxes paid in excess erroneously can be claimed as a refund. What needs to be kept in mind is that there is no interest liability on taxes shortly paid in such cases.

6. A sales figure that was originally reported as B2C sales in GSTR-1, was later corrected to B2B sales, how should the reporting be done?

Table 4 of GSTR-9 requires classification of both- B2B and B2C supplies. In this case, the assessee will be required to report the sales as B2B in Table 4 of GSTR-9 even when wrongly reported in GSTR-1 as B2C.

7. Sales that were originally reported as “With the payment of taxes”, was later corrected to “Without payment of Taxes”, should this be reported in Table 4C?

Irrespective of the wrong reporting done in GSTR-1 as ‘with payment of taxes,’ it is essential that correct reporting is done in GSTR-9. The correct reporting would be done in Table 5A and not in Table 4C of GSTR-9.

8. Can I revise the GSTR-9 which has been filed?

No. Currently, GSTR-9 does not permit any revision after filing.

9. What are the preconditions for filing Form GSTR-9?

The preconditions for filing form GSTR-9 are:

- Taxpayers must have an active GSTIN during the relevant financial year as a normal/regular taxpayer even for a single day.

- The taxpayer has filed all the applicable returns forms- Form GSTR-1 and Form GSTR-3B of the relevant financial year before filing the Annual Return- GSTR-9.

10. Can I file Nil Form GSTR-9?

Nil Form of GSTR-9 can be filed under these conditions:

- Not made any outward supply (i.e. sales)

- Not received any goods or services (i.e. purchase)

- No other liability to report

- Not claimed any credit

- Not claimed any refund

- Not received any order creating demand

- There is no late fee to be paid

To mention a few of the most common scenarios that will make you eligible for Nil Form GSTR-9.

11. A GSTR-3B was filed with wrong (excess) outward supplies and tax paid on the same, but the actual/correct supplies were declared in GSTR-1 for the same period. In that case, would it be possible to get a refund of the excess amount paid?

If the taxes are paid in excess by mistake in GSTR-3B, they can be claimed as a refund as per Section 54 of the CGST Act. Another option is that the excess amount can be adjusted against tax payments of subsequent periods. However, this cannot be claimed through GSTR-9. The refund needs to be claimed by making an application for the same on the GST portal.

12. Form GSTR-9 return is required to be filed at the entity level or GSTIN level?

Form GSTR-9 return is required to be filed at the GSTIN level, i.e. for each registration. This means that if a taxpayer has multiple GST registrations under the same PAN in the same or different states, he would be required to file annual returns for each registration separately.

13. Can the date of filing Form GSTR-9 be extended?

Yes. In case if the date of filing Form GSTR-9 is extended, it will be informed by the Government.

14. In which tables of Form GSTR-9, the details are required to be provided?

The tables of Form GSTR-9 in which details are required to be provided are:

- Table 4: Details of advances, inward and outward supplies made during the financial year on which tax is payable- Enter/ view the summary of the outward/inward supplies made during the financial year.

- Table 5: Details of outward supplies made during the financial year on which tax is not payable- Enter/view the summary of non-taxable outward supplies made during the financial year.

- Table 6: Details of ITC availed during the financial year- Enter/view the summary of ITC availed during the financial year.

- Table 7: Details of ITC reversed and ineligible ITC for the financial year- Enter/view the summary of ITC reversed or ineligible for the given financial year.

- Table 8: Other ITC related information- Enter/view the ITC availed during the financial year

- Table 9: Details of tax paid as declared in returns filed during the financial year- Enter/view tax inclusive of interest, late fee, penalty and others as paid during the given financial year.

- Table 10,11,12,13: Details of the previous Financial Year’s transactions reported in the next Financial Year- Enter/view the summary of transactions reported in the next financial year

- Table 14: Differential tax paid on account of declaration- Enter/view the total tax paid on transactions reported in the next financial year.

- Table 15: Particulars of Demands and Refunds- Enter/view particulars of demands and refunds during the financial year

- Table 16: Supplies received from composition taxpayers, deemed supply by job workers and goods sent on approval basis- Enter/view the summary of supplies received from composition taxpayers, deemed supply by job workers and goods sent on approval basis.

- Table 17: HSN wise summary of Outward Supplies made during the financial year

- Table 18: HSN wise summary of Inward Supplies received during the financial year

15. Do I need to provide/update details in all the tables in Form GSTR-9 before filing?

You are required to provide/update details only in those tables which are relevant to your business.

16. Can I change the details after clicking on the ‘Proceed to File’ button?

Yes. Details can be changed/edited before filing the Form of the GSTR-9 return. However, the auto-populated data that will not be editable are:

- Table no. 6A- Total amount of tax crest availed through Form GSTR-3B (the total of Table 4A of Form GSTR-3B)

- Table no. 8A- ITC as per Form GSTR-2A (Table 3 and 5 thereof)

- Table no. 9, except the tax payable column

17. What happens after the ‘Compute Liabilities’ button is clicked?

After the ‘Compute Liabilities’ button is clicked, details provided across various tables are processed on the GST portal, and any late fee liabilities, if applicable, are calculated. The late fee is calculated only if there was a delay in filing the annual return beyond the due date.

18. Can I file Form GSTR-9 return without paying the late fee (if applicable)?

No. You cannot file Form GSTR-9 without paying for the applicable late fees.

19. In Form GSTR-9, can additional liability not reported earlier in Form GSTR-3B be declared?

Yes. Additional liability that was not reported earlier at the time of the filing Form GSTR-3B can be declared in Form GSTR-9. The additional liability so declared would have to be paid through Form GST DRC-03.

20. If a LUT had not been executed and sales had been reported as “Without Payment of Taxes,” should the same now be treated as Exports with payment of taxes?

Non-execution of LUT is a procedural non-compliance. Such a non-compliance cannot turn the nature of the transaction from ‘exports without payment of tax’ to ‘exports with payment of tax.’ A taxpayer hence needs to report the transaction under Table 5 of GSTR-9 as ‘exports without payment of taxes.’ Penal consequences, if any, will have to be dealt with.

21. Reverse Charge has been paid, but wrongly reported in GSTR-3B in 3.1.a as against 3.1.d. How can this be rectified while filing GSTR-9?

In such a scenario, the assessee would be required to make a correct reporting under GSTR-9 by disclosing the reverse charge paid under Table 4G even though wrongly reported under GSTR-3B.

22. Can a refund be claimed for credit notes which cannot be adjusted in 2018-19 for FY 2017-18?

No. A refund of credit notes which could not be adjusted in FY 2018-19 (pertaining to FY 2017-18) cannot be claimed as the incidence of tax on such supply has been passed to the recipient.

23. Which Tables in Form GSTR-9 has auto-populated data from filed Form of GSTR-1 and Form GSTR-3B?

The tables below in Form GSTR-9 have auto-populated data filled from Form GSTR-1 and Form GSTR-3B of the relevant financial year:

- Table 4- Details of advances, inward and outward supplies made during the financial year on which tax is payable.

- Table 5- Details of outward supplies made during the financial year on which tax is not payable.

- Table 6A- Total amount of input tax credit availed through Form GSTR-3B (the total of Table 4A of Form GSTR-3B)

- Table 6G- Input Tax Credit received from ISD

- Table 6K- Transition Credit through TRAN-I (including revisions if any)

- Table 6L- Transition Credit through TRAN-II

- Table 9- Details of tax paid as declared in returns filed during the financial year

24. Which table from Form GSTR-9 has auto-populated data from Form GSTR-2A?

Table No. 8A- ITC as per GSTR-2A (Table 3 and 5 thereof)

25. Can I edit auto-populated data from filed Form GSTR-1 and GSTR-3B in Form GSTR-9?

Yes, you can, except for the data mentioned in the below tables:

- Table 6A- Total amount of input tax credit availed through Form GSTR-3B (the total of Table 4A of Form GSTR-3B)

- Table 8A- ITC as per GSTR-2A (Table 3 and 5 thereof)

- Table 9: Details of tax paid as declared in returns filed for the financial year (except tax payable column)

26. Can there be any credit reported in GSTR-9 which has not been claimed in the GSTR-3B filings?

Any additional credit which has not been claimed in GSTR-3B can be claimed in GSTR-9. However, if there is any credit claimed in the filed TRAN-1, it has to be reported in GSTR-9 under Table 6K/6L or Table 13, as applicable.

27. What happens if we file with more than 20% deviation in values. For Example, ITC difference between claimed and 2a? What can I expect next from the government and how do I respond?

One thing that needs to be remembered is that the majority of the details in the Table of GSTR-9 will be auto-populated from GSTR-1 and GSTR-3B. A taxpayer can edit these auto-populated values, but if the difference is more than 20%, then the cells will be highlighted in red. This will be followed by a confirmation message pop-up asking, “if the taxpayer wants to proceed despite the deviation.” GST authorities can issue a notice asking the assessee to reconcile the ITC claimed in GSTR-3B and system-generated Form GSTR-2A. If there is any differential tax amount, it will have to be paid.

28. If there is a difference between GSTR-3B and GSTR-2A, how can the same be rectified in GSTR-9?

The difference between auto-populated ITC details from GSTR-2A and those declared in GSTR-3B would have to be explained in GSTR-9 under the following mentioned heads:

- Table 8E- ITC available but not availed

- Table 8F- ITC available but ineligible

29. No reversal of ITC was done while filing GSTR-3B in the past. How to go about it now while filing form GSTR-9?

In case you have missed any reversal of ITC in the past months GSTR-3B, it can be done in the subsequent months of GSTR-3B. These will then have to be correctly reported in Table 7 of GSTR-9. If this leads to the creation of excess liabilities, they will have to be paid off.

30. I want to bifurcate the ITC into Capital goods, Input and Input Services. How can I do it?

It is Table 6B of GSTR-9 which requires the bifurcation of ITC into capital goods, inputs and input services. This means that your accounting books need to be maintained in a manner such that purchases attributable to output supply of goods, output services and capital goods can be identified. It is based on this that the ITC would be differentiated. However, what needs to be kept in mind is that there is no difference in the treatment of ITC between goods and services.

31. I want to show missing outward supply details of GSTR-3B for the previous FY in the current FY. How can I show that?

In case if you have missing outward supply details of GSTR-3B for the previous financial year, it should be reported correctly under Table 10 of GSTR-9. Such outward supply details should be net of credit/debit notes.

32. Can input tax credit that was wrongly claimed in GSTR-3B be rectified now in GSTR-9?

In case of having excess claimed the credit in GSTR-3B, it can be reversed by reporting such an amount in Table 4 (B) 2 of GSTR-3B of the subsequent month. The same can also be disclosed in Part V Point 12 of GSTR-9.

33. Are stock transfers and cross charges within the same PAN included in aggregate turnover?

As per Section 2 (6) of the CGST Act, the term aggregate turnover includes- ‘inter-state supplies of persons having the same PAN.’ This means that stock transfers and cross charges under the same PAN are included in the aggregate turnover.

34. What are the implications of improper reporting of HSN and SAC codes?

HSN and SAC are the standardized codes assigned to each identified goods/service respectively. These codes are linked to the GST rates. This means that at the time of filing an annual return, a taxpayer will have to select the HSN code so that the system will automatically select the applicable rate. If however, you end up selecting the wrong HSN code, your tax liability will vary.

One of the other requirements of claiming ITC is that the invoice should be complete in all respects as mentioned in Section 31. This includes the need to mention the HSN code for goods and services on the invoice. Hence, if an assessee selects the wrong HSN code, it will also impact the buyer’s claim of the input tax credit.

35. If my supplier has filed his GSTR-1 after I have filed my GSTR-9, what will happen?

In this case, the details of the invoices filed by you will be reflected by the supplier in GSTR-1A. The supplier would have to accept such an invoice when he files his return because only after he does so, the recipient taxpayer will be able to claim ITC on the same.

36. Table 5F has asked to include no supply in Non-GST supply. What is ‘no supply’ and does it include all the Schedule III transactions?

The term ‘no supply’ includes all the activities or transactions that have neither the supply of goods nor the supply of services as mentioned in Section 7 (2) of CGST Act-

- Activities or transactions included in Schedule III

- Activities as undertaken by the Government/Local Authority in which they are engaged as the public authority.

37. If I have paid GST on the same invoice twice, how can I correct the same or claim the extra amount that I have paid?

If you have paid GST on the same invoice twice, in the filing of the next month’s GSTR-3B, you can adjust the extra amount paid.

38. What is the difference between GSTR-9, GSTR-9A and GSTR-9C?

- GSTR-9 is an annual return under GST to be filed once every year only by the registered taxpayers under GST under the Regular Scheme (Monthly/Quarterly).

- GSTR-9A is the annual return form to be filed by the Composition Dealers.

- GSTR-9C is the reconciliation statement between the GSTR-9 and the annual audited financial statements.

39. Is it compulsory to give HSN codes for turnover below Rs 1.5 crore?

No, it is not compulsory to give HSN code for turnover below Rs 1.5 crore.

40. What if the extra tax had been paid? Is there any provision regarding this in GSTR-9 or should we claim the refund?

No, GSTR-9 is a declaration form. This means that no tax paid or tax refund can be generated through it.

41. What are the modes of signing Form GSTR-9?

Form GSTR-9 can be signed using DSC or EVC.

- DSC: Digital Signature Certificate

DSC are the digital equivalent (but in an electronic form) of physical or paper certificates. This certificate can be presented electronically to prove one’s identity, to access information or services on the internet or to digitally sign certain documents. In India, DSC is issued by the authorized Certifying Authorities. In the case of GST portals though, it accepts only PAN based Class II and III DSC.

- EVC: Electronic Verification Code

EVC authenticates the identity of the user at the GST portal by generating an OTP. The OTP is sent to the mobile phone number of the registered mobile phone of the Authorized Signatory filled in part A of the Registration Application.

42. While filing Form GSTR-9, if I am getting a warning message that records are under processing or processed with an error, what should I do?

In such a case when the records based on the data submitted while filing Form GSTR-9 are processed with an error or are under processing at the back end, a warning message is displayed. If the records are still under processing, you will have to wait for the processing to be completed at the back end. However, for those records which are already processed with an error, you will have to go back to Form GSTR-9 and make corrections on the records which are causing errors.

43. Can a taxpayer go ahead and file his return with the data that has been auto-populated by the GSTN in the GSTR-9 return?

The GSTN auto-populates several tables in the GSTR-9 return for convenience and ease of filing for taxpayers. However, this does not necessarily mean that the auto-populated data is accurate. Every taxpayer therefore must verify the auto-populated data with their accounting books and the GST returns filed. Some tables are to be manually entered in your GSTR-9 Form, which you will have to do in addition to verifying and modifying the auto-populated data. Any errors found the need to be corrected and then reported in the GSTR-9 return.

44. How important is the GSTR-1 vs Sales Register comparison to file GSTR-9?

GSTR-9 cannot be revised and hence any unreconciled differences must be adjusted before filing GSTR-9. Any differences between the Sales Register and the GSTR-1 returns can be filed manually and edited manually in Form GSTR-9.

45. What will happen if the business has filed GSTR-9, but not GSTR-9C? How will the Government identify such taxpayers?

Through GSTR-1 and GSTR-3B, the GSTN already has the records on the turnover you had for a financial year. The Government would start issuing notices based on these records.

46. What are the hacks for fixing warnings in GSTR-9? How can we adjust the warnings? For example, in case there is a difference between GSTR-3B vs GSTR-1.

There are no hacks for fixing the warnings while filing your GSTR-9 form. To not get the warnings, you will have to make sure that whatever you report in the Form GSTR-9 is accurate and you have the proper documentation to support the same.

47. Is it possible to show Non-GST turnover like Petrol, Alcohol, etc in GSTR-9?

No, it is not possible to show Non-GST turnover in GSTR-9.

48. If Table 8 is showing a negative balance other than Import, what should be done?

Table 8 can never show negative values other than Imports from SEZ. This is because Table 8A and 8B are auto-populated and negative values can arise only in case the Table 8C value is greater than the value of Table 8A.

49. What are the intricacies of filing GSTR-9 for different sectors like Manufacturing, Trading, E-commerce, Jewellery, Distributors, FMCG, Pharma and many more.

The intricacies faced by various such sectors while filing Form GSTR-9 are:

- Bifurcation of inputs, input services and capital goods is required in GSTR-9. The same was not required in the case of GSTR-3B.

- Table 15 of GSTR-9 requires the details of demands and refunds during a financial year. This means that here the taxpayer is required to perform an additional exercise to bifurcate the refunds that have been applied for, sanctioned, rejected and pending. Additionally, demands paid and pending also need to be reported.

- HSN-wise summary of inward supplies is required for filing GSTR-9. This requires going deeply through your accounting books.

- Supplies from Composition dealers are shown separately in Table 16A. This means that in case if the dealer has not maintained the data properly of the vendors concerning the composition dealer, then they would face a hard time getting such details.

- Table 16B requires details of deemed supply under Section 143 (Input and capital goods are sent to job workers and the same are not received back within a specified time). An assessee who has not maintained this data will hence have a hard time gathering it while filing Form GSTR-9.

- Table 7 requires the details of the reversal made under Rule 37, 39, 42, 43 and Section 17 (5) while filing his GSTR-3B returns. If in case the taxpayer has not shown these in the GSTR-3B returns and now wants to make a reversal, he will not be able to do the same.

- Table 8 gets auto-populated with data from GSTR-2A. Hence, if a supplier has not filed his GSTR-1 or has not made payment of taxes, then such an ITC will not get reflected in the GSTR-2A of the recipient. This increases the need to have frequent follow-ups with the supplier.

50. What happens after Form GSTR-9 is filed?

After the Form GSTR-9 is filed, this is what happens:

- ARN is generated on successful filing of the return in Form GSTR-9.

- An SMS and an email are sent to the taxpayer on his registered mobile and email id.

- Electronic Cash Ledger and Electronic Liability Register Part-I will get updated on the successful set-off of liabilities (late fee only)

- Filed form GSTR-9 will be available for view/download in PDF and Excel format.

How Can Deskera Assist You With the Accounting of Your Business?

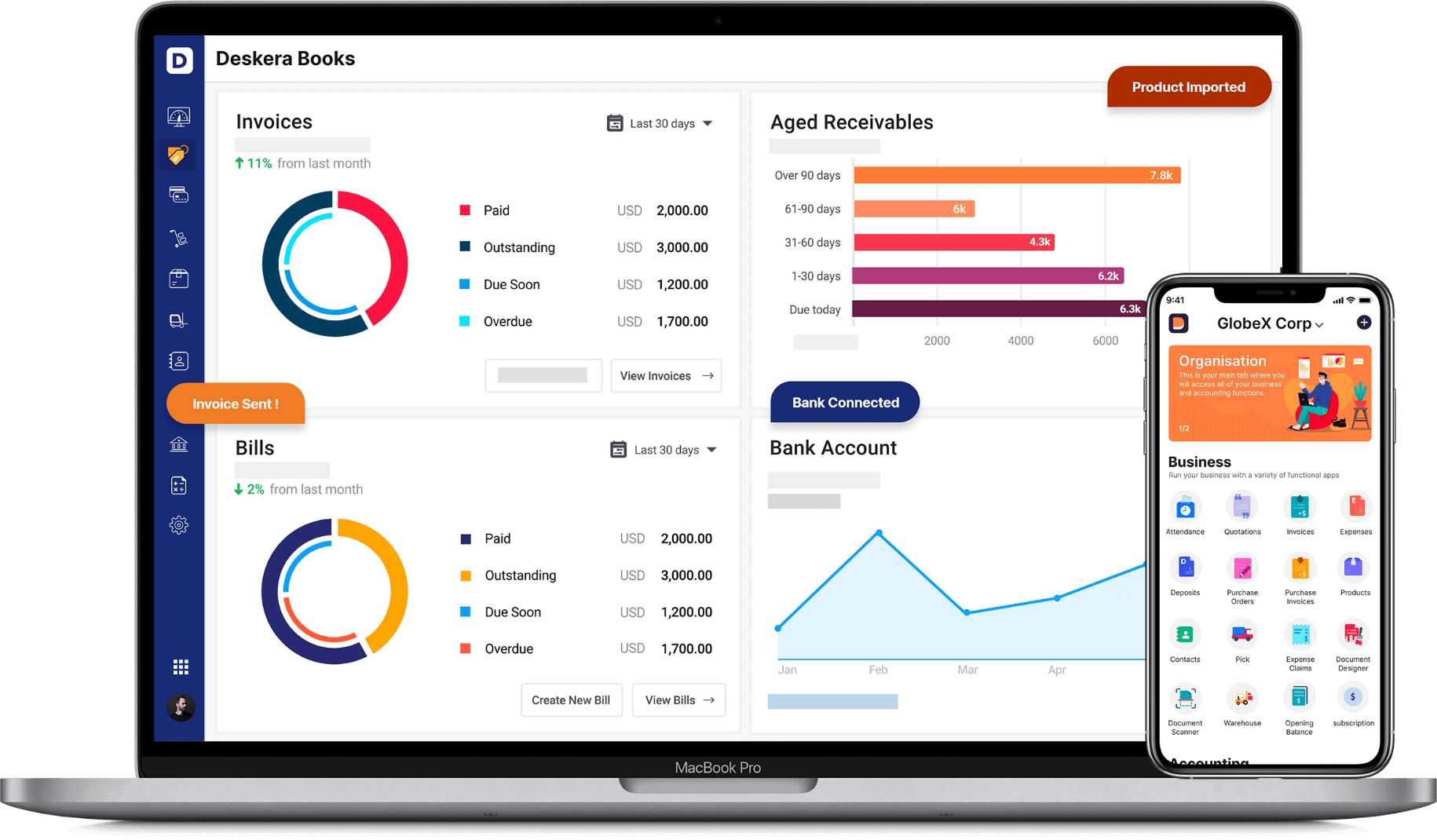

Deskera Books is software that will handle all your accounting for you. Be it creating a balance sheet, or other financial statements like income statements, bank reconciliation statements, profit and loss statements or cash flow statements. It will also generate and send the invoices on your behalf, to ensure that your cash flow is improved.

In addition to this, it will also help in keeping a track of all your account receivables and account payables so that you can calculate your tax liabilities accordingly. Deskera books are equipped to keep a record of all your debit and credit notes, along with tracking your financial KPIs.

Deskera Books hence has a business dashboard that will make sure your accounting is always done perfectly to save all your time, resources and improve your customer retention after securing your customer’s loyalty. Irrespective of whichever country you are based in, Deskera Books will continue to be your best accountant.

Key Takeaways

GSTR-9 is an annual tax return to be filed yearly by taxpayers registered under GST. With all the specifications involved in filing the GSTR-9 Form, it has made the businesses practice accounting that is detailed, precise and even time-taking. The Government of India has been doing everything in its power to simplify the process, be it through auto-populated data filing or digital signature.

Related Articles