Form GSTR-3B is a simplified summary return, and the purpose of the return is for the taxpayers to declare their summary GST liabilities for a particular tax period and discharge these liabilities. A normal taxpayer is required to file GSTR-3B returns for every tax period.

This was the Government of India’s way to relax the requirements from the businesses that have recently transitioned to GST. Small taxpayers with an aggregated turnover of less than 5 crores can file GSTR-3B on a quarterly basis. The tax liability will then be auto-populated from GSTR-3B to GSTR-1 while filing returns.

What needs to be remembered is that a GSTR-3B form should be submitted by any business that is liable to file the monthly returns GSTR-1, GSTR-2 and GSTR-3. This remains true even if the taxpayer has no business activity (Nil Return). For taxpayers who have chosen to file GSTR-1 or GSTR-2B on a monthly or quarterly basis, GSTR-3B will be auto-generated by the system and be available on the GSTR-3B dashboard page.

This article will guide you through the steps of filing GSTR-3B on the GST Portal.

Steps for filing of GSTR-3B on the GST Portal

Step 1: Logging in to the GST Portal

- Access the www.gst.gov.in URL. The GST home page will be displayed.

- Here, you will have to log in to the GST Portal with valid credentials.

Note:

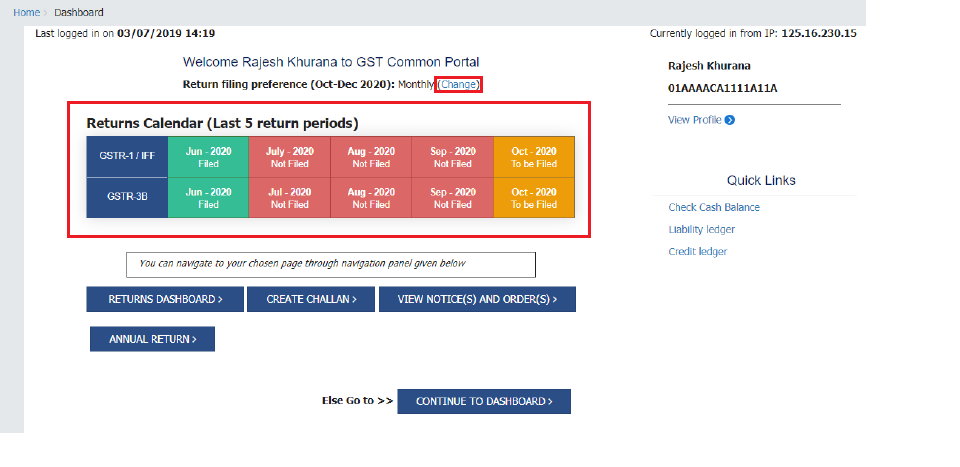

- The Returns Calendar for the last 5 return periods with their status (Filed, Not Filed, To be Filed) will be displayed.

- To change your return filing preference, click the “change” link. This will direct you to the opt-in quarterly page.

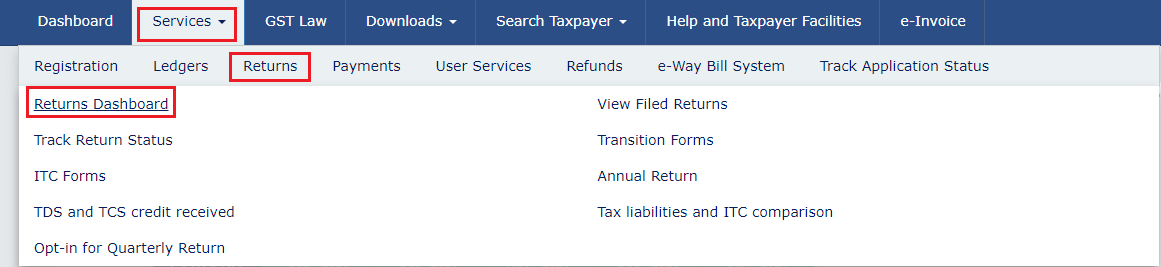

Step 2: Accessing the Returns Dashboard

Click on the Services > Returns > Returns Dashboard option.

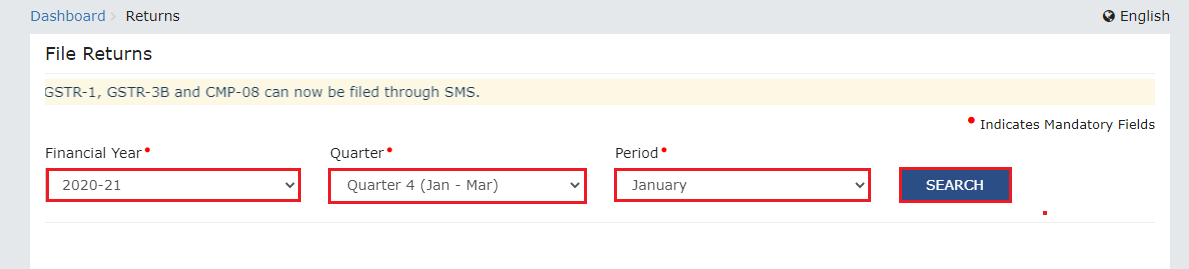

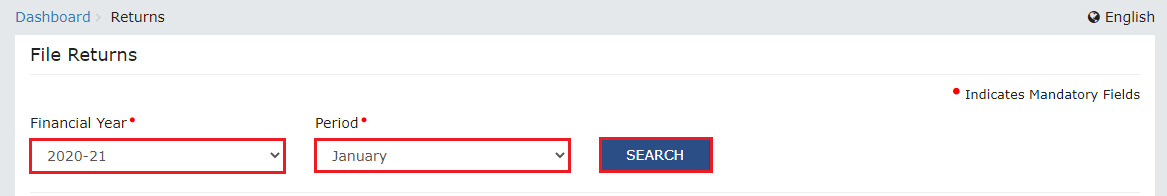

Step 3: File Returns Page

- The “file returns” page will be displayed. Here, from the drop down list select the “financial year, quarter (quarter 1-4) and period (month)” for which you want to file the return.

- Click the “search” button.

Note:

- In case you are a quarterly return filer, you will have to file GSTR-3B for the last month of the quarter. For example, June, September, etc. In such a case, form GSTR-3B tile will not be available if you select M1 or M2 of the quarter.

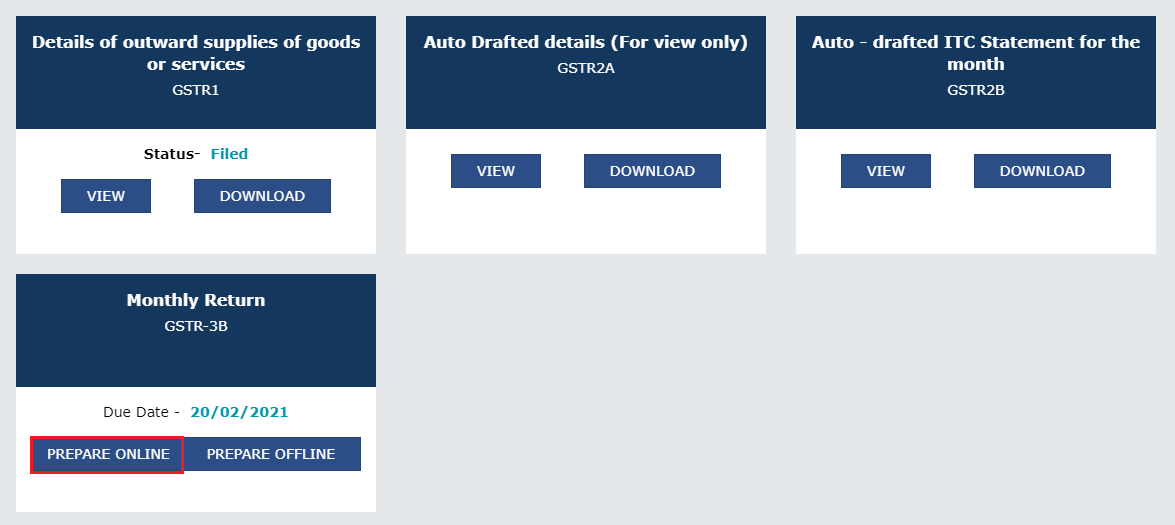

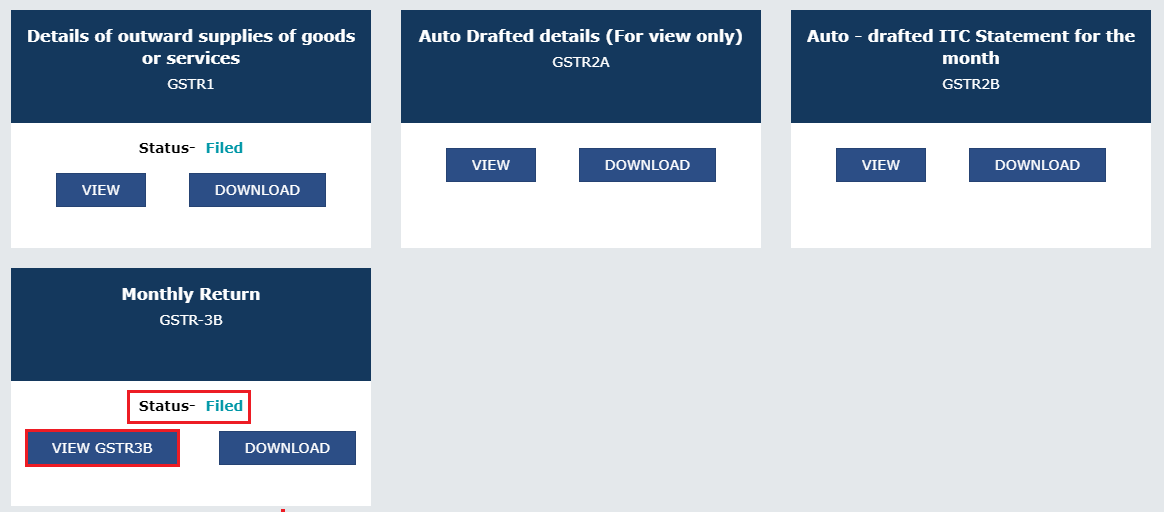

Step 4: Detailed File Returns Page

A detailed file returns page is displayed. This page displays the due date of filing the returns which as a taxpayer you are required to file (using separate tiles).

In the Form GSTR-3B tile, click on the “prepare online” button.

Note:

- In the case of auto-population from Form GSTR-1 or Form GSTR-2B, only the first question will be displayed on the questionnaire page.

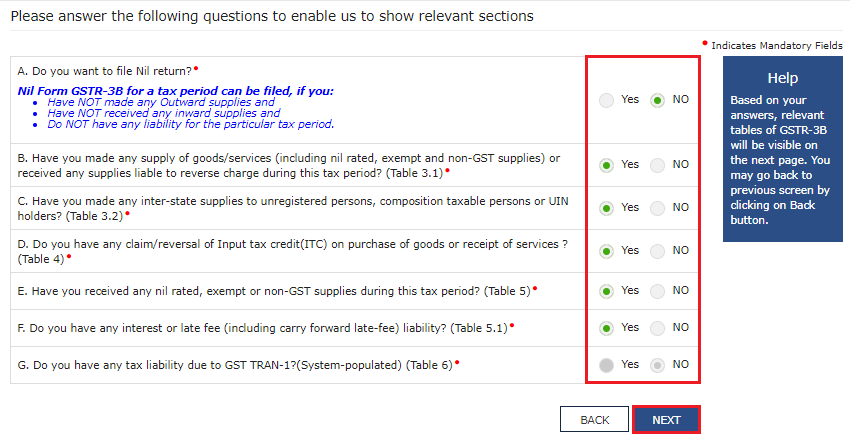

Step 5: Answering the Questions to Get Relevant Tables on Form GSTR-3B

- A list of questions will be displayed.

- Answer all the questions to show the relevant sections of Form GSTR-3B as applicable to you.

- Click the “next” button.

- Based on your answers, relevant tables of Form GSTR-3B will be visible on the next screen.

- You can go back to the previous screen by clicking on the “back” button.

Step 6: File Nil Return

Nil return can be filed by you if you have not made any outward supply (sales), have Not received any goods/services (purchase) and do not have any tax liability for that tax period. The steps for filing Nil Return on GSTR-3B are:

- Select “yes” for Option A. Click the “next” button.

- Preview Draft GSTR-3B (as will be shown further in the article)

- File GSTR-3B (as will be shown further in the article)

- Download the Filed Return

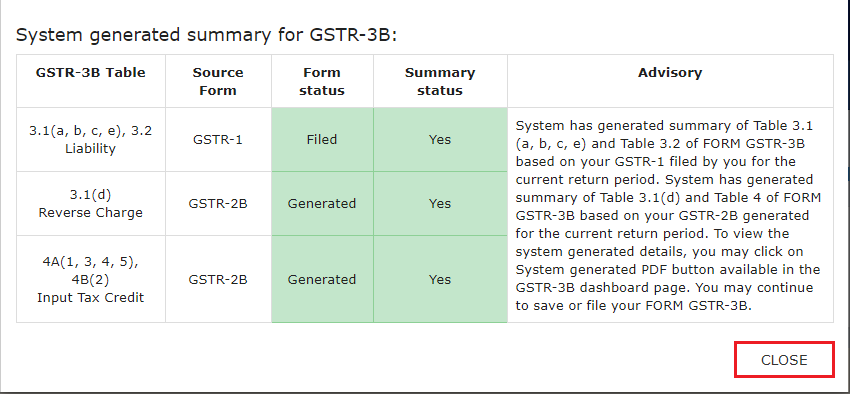

Step 7: File Non-Nil Return

- The system generated summary for GSTR-3B is displayed. The page that you would have landed upon would be displaying the details of the GSTR-3B table, Source Form, Form Status, Summary Status and advisory.

- Click the “close” button to view the Form GSTR-3B- monthly return page.

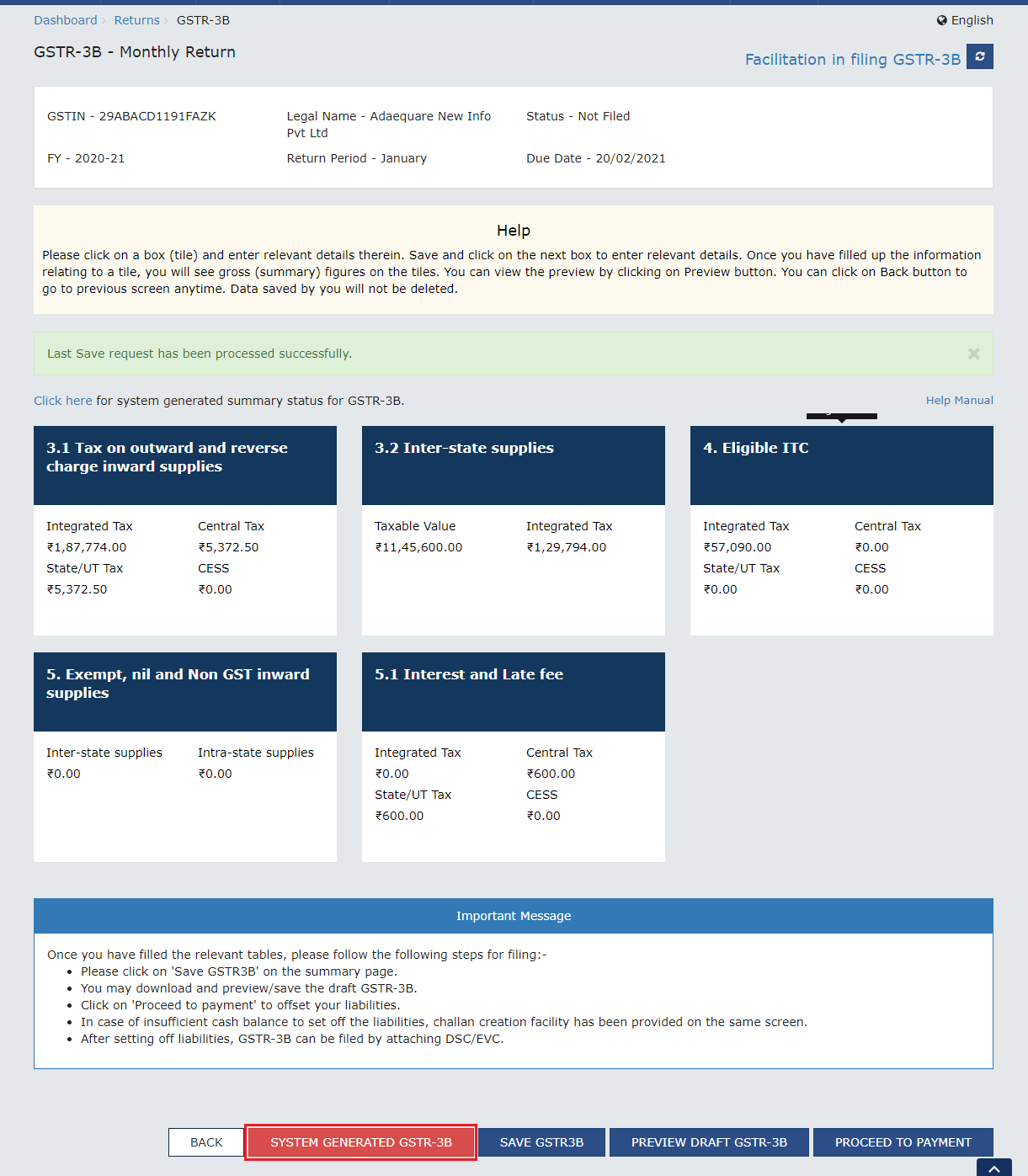

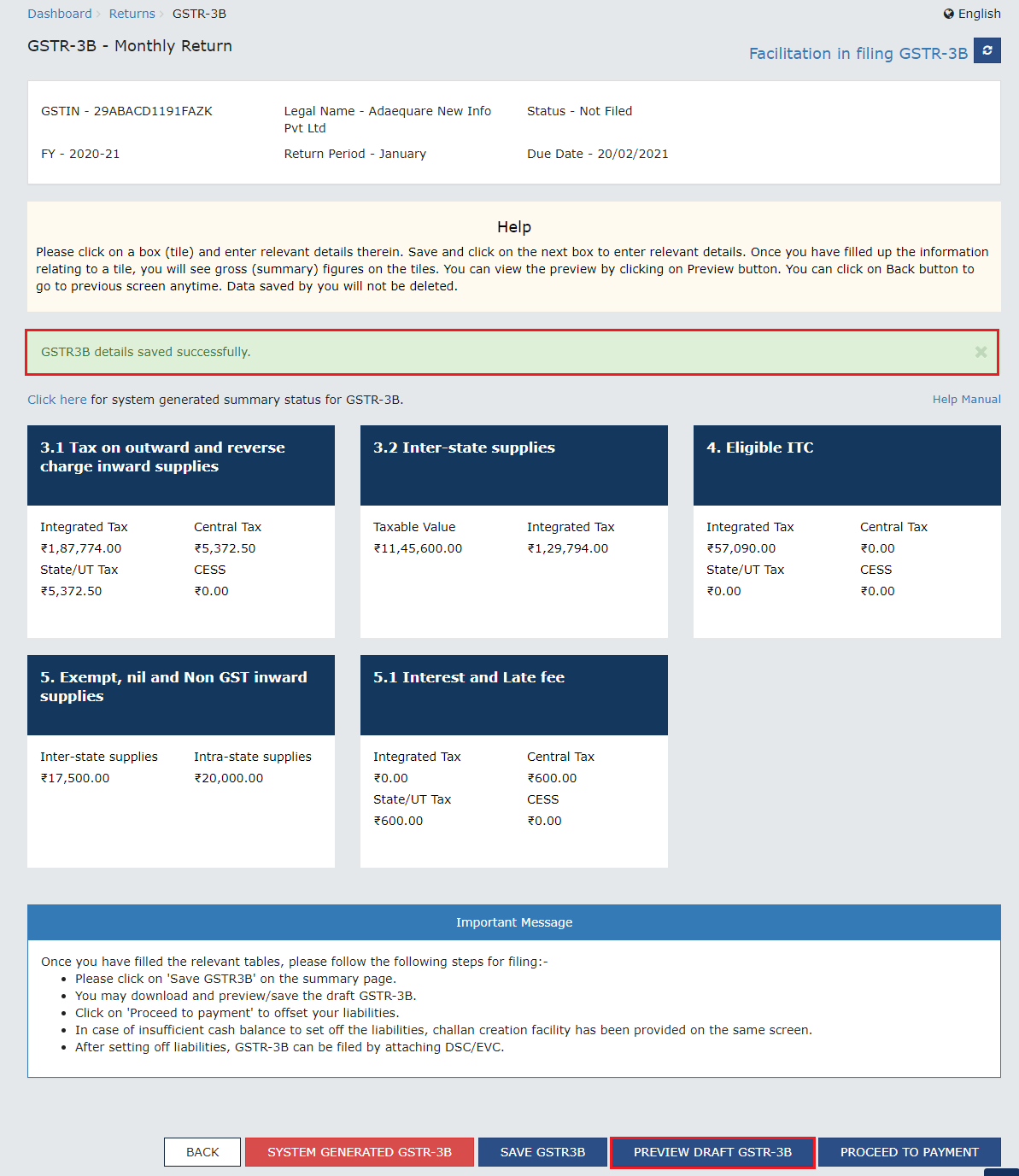

Step 8: Form GSTR-3B- Monthly Return Page

- Once the Form GSTR-3B monthly return page is displayed, click on the “system generated GSTR-3B” button to download as well as view the system-computed details from Forms GSTR-1 and GSTR-2B (monthly or quarterly) in Form GSTR-3B.

- You would also be able to edit the auto-populated values if needed. You would be able to file GSTR-3B with the edited values without facing any restrictions from the system.

- If you have opted into filing both GSTR-1 and GSTR-3B quarterly and have filed GSTR-1 and opted to/out to file the IFF for the first 2 months of the quarter, the details in PDF will be generated on a monthly basis.

Note:

- Based on the selection made on the previous page, applicable tiles will be visible to you for providing the details.

- While the system does give auto-populated values as an assistance to the taxpayers, the taxpayers will have to ensure the correctness of the values being reported and filed in GSTR-3B in all respects.

Step 9: The Various Information Required while Filing GSTR-3B Return

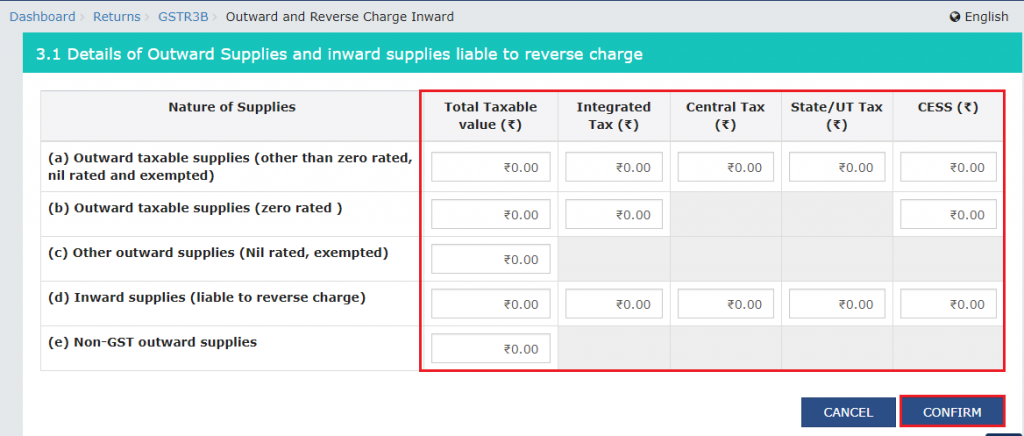

1.Summary details of outward supplies and inward supplies liable to reverse charge with taxes.

Note: Only Table 3.1 (d) is auto-populated from GSTR-2B.

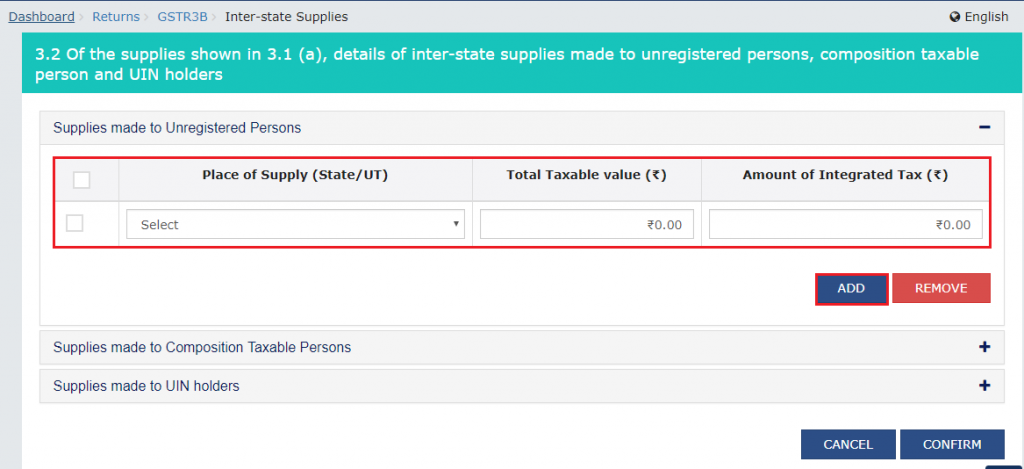

2.Details of inter-state supplies made to unregistered persons, composition taxable persons and UIN holders and taxes, out of sales entered as sl.no.1 above to be entered according to the place of supply. Although the data for this table is auto-populated from GSTR-1, it can be edited later on.

Note: Click the “Add” button to provide details of such supplies from another State. However, if you want to remove added data, select the checkbox on the left and then click on the “remove” button. The system will accept only one entry for each place of supply. You also need to note that the details of tax paid on exports cannot be entered here.

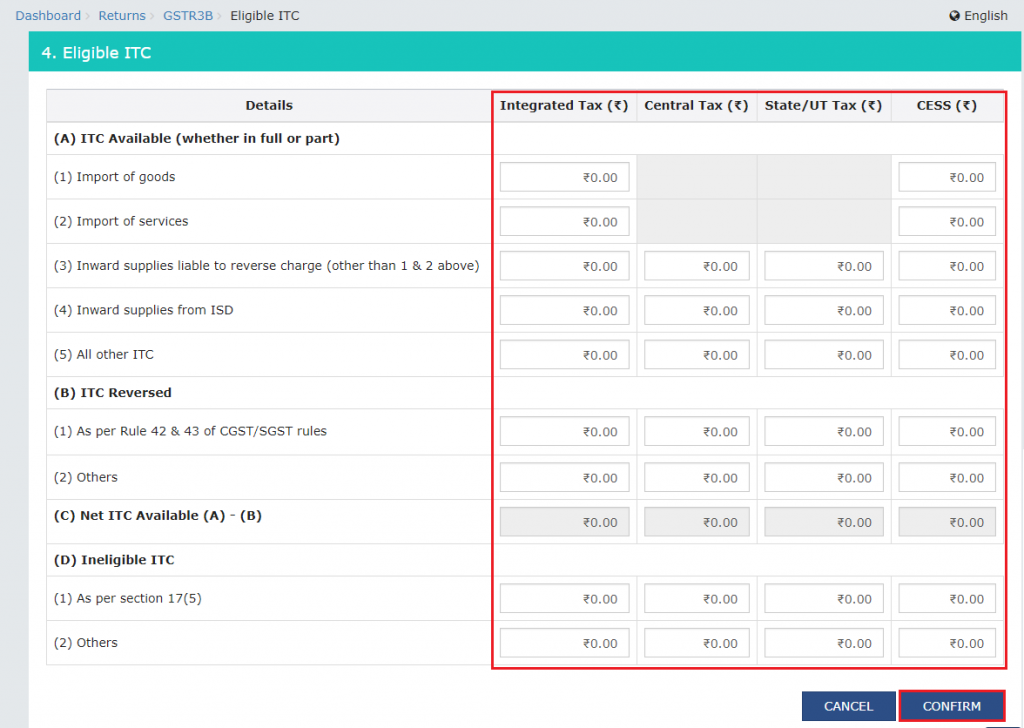

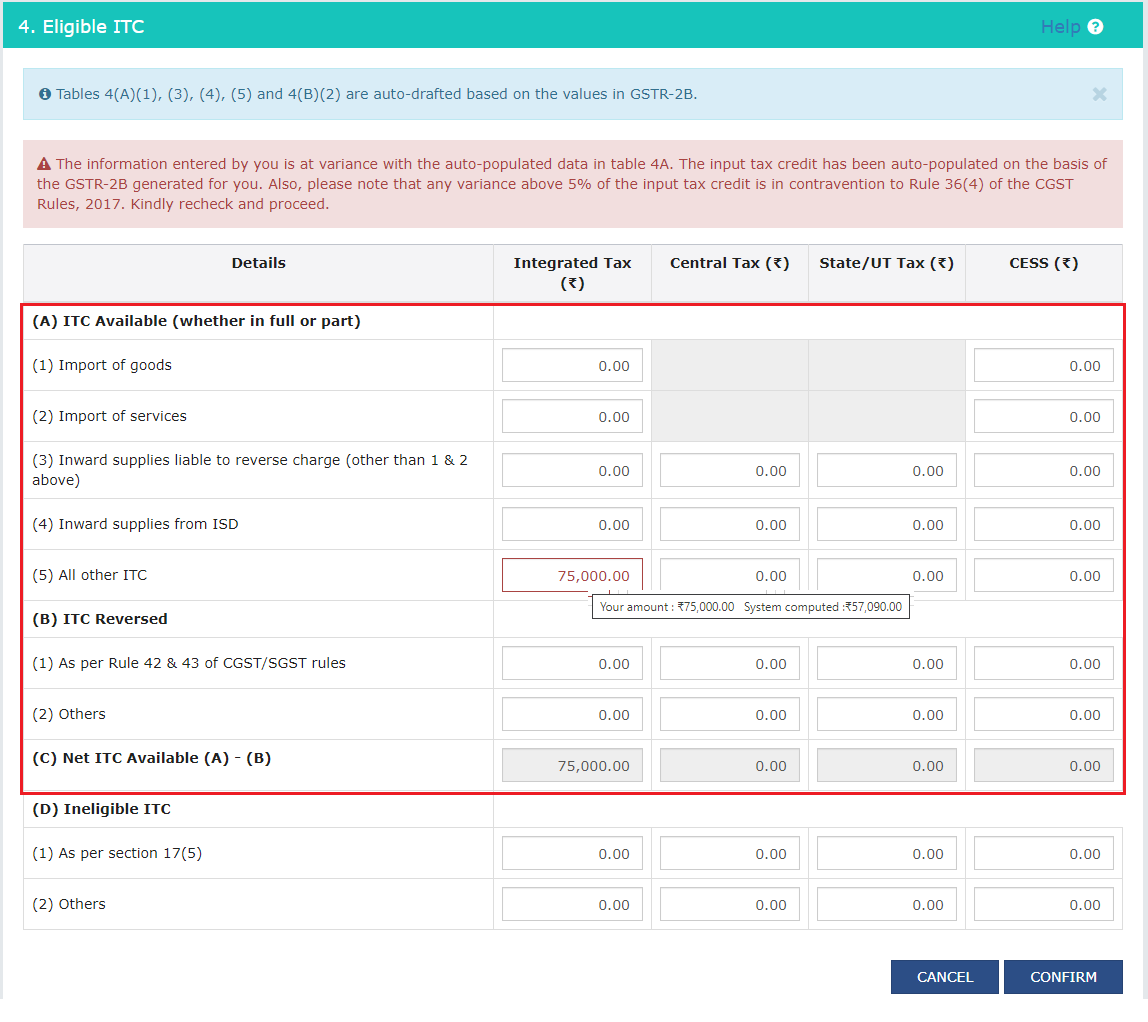

3.Summary details of eligible input tax credit claimed, input tax credit reversed and ineligible input tax credits. Note: The details of ITC claimed/reversed are auto-populated from Form GSTR-2B in the Form GSTR-3B. These can be added upon or modified.

However, if the data entered by you is in upward variance (5%) with the auto-populated data in table 4A, then such fields will be highlighted in red color and the updated tile on the dashboard will be in red color as well.

On the other hand, if the data entered by you is in downward variance (0%) with the auto-populated data in Table 4B, then such fields will be highlighted in red color and the updated tile on dashboard will be in red color as well.

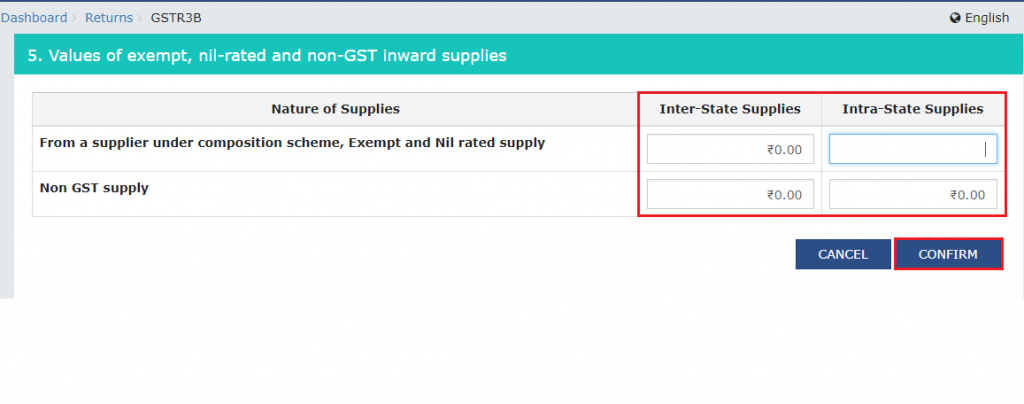

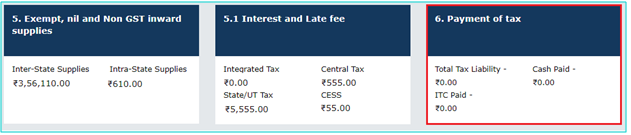

4.Summary details of exempt, Nil and Non-GST inward supplies as either intra-state or inter-state supply.

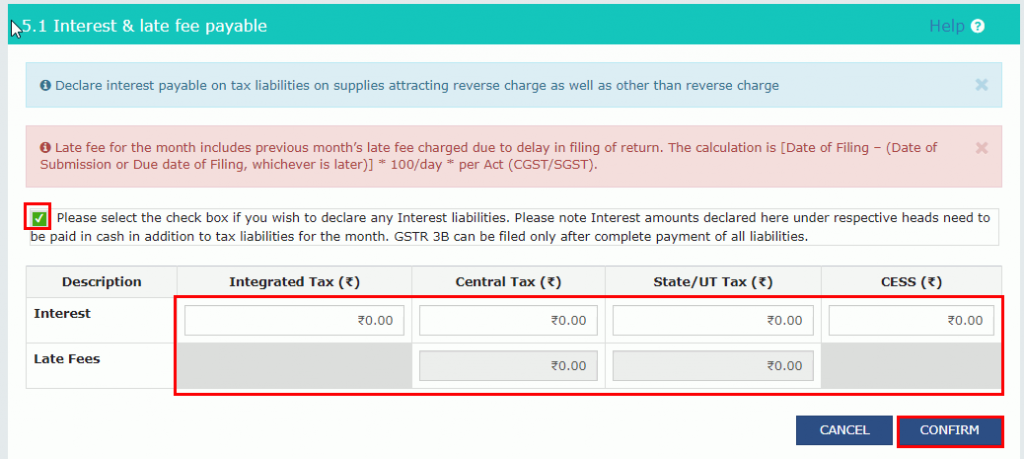

5.Details of Interest and Late Fee under each tax head- IGST, CGST, SGST/UTGST and Cess. The late fee is system-computed based on the number of days passed after the due date of filing.

6.Provide details of payment of taxes, interest and late fee.

Note:

- You can click on “add” or “delete” to make modifications in the respective tiles. Once data is entered on a tile, click on “confirm.”

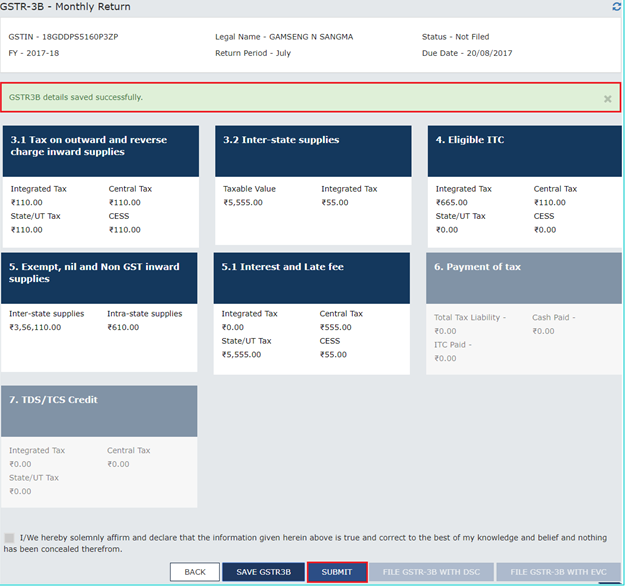

Step 10: Save to File GSTR-3B Form

- Click on the “save GSTR-3B” button at the bottom of the page after all details are added. You can also click on the “save GSTR-3B” button on the GSTR-3B main page to save the data entered at any stage and come back later for edits.

- After you have saved, a message is displayed on the top of the page confirming that your data is successfully saved.

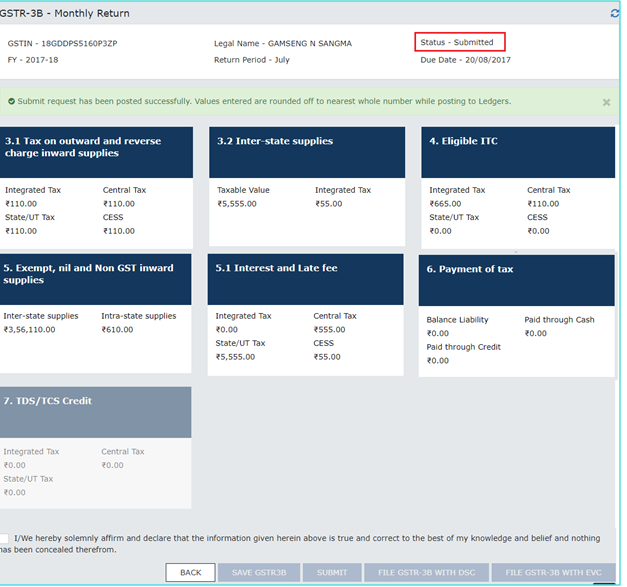

Step 11: Submit the Form GSTR-3B

- Once all the details are saved, click on the “submit” button at the bottom of the page.

- Your finalized GSTR-3B return form is submitted.

- A success message is displayed at the top of the page.

- Once the form is submitted, the added data is frozen and no changes can then be made to Form GSTR-3B.

- The ITC and Liability ledger also gets updated on submission.

- The status of the GSTR-3B is changed to “submitted.”

Step 12: Preview Draft Form GSTR-3B

- Scroll down the page and click on the “preview draft GSTR-3B” button to view the summary page of Form GSTR-3B for your review.

- This button will download the draft summary of your GSTR-3B for your review before you file it.

Note:

- It is recommended that you download the draft summary page and review the entries made in different sections before proceeding with the payment.

- The PDF file generated would bear the watermark of draft as the liabilities are yet to be offset.

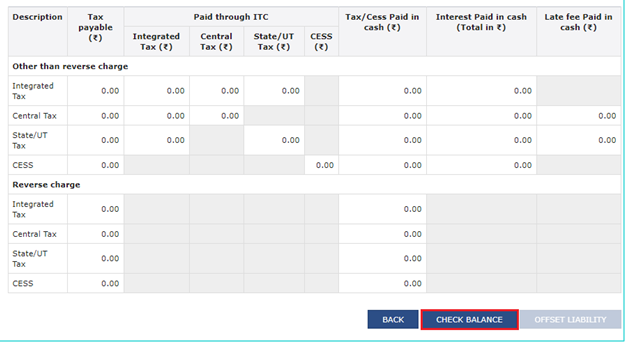

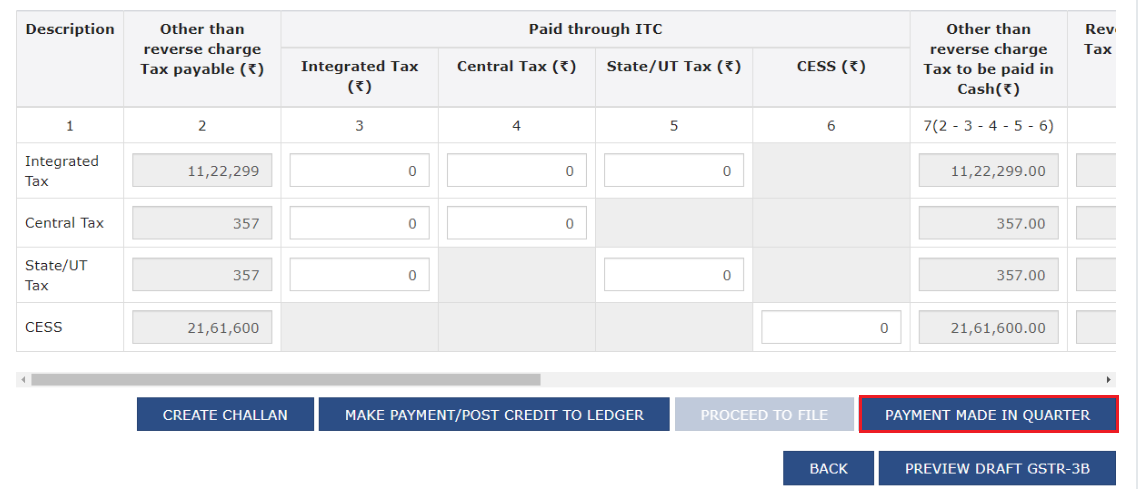

Step 13: Payment of Tax

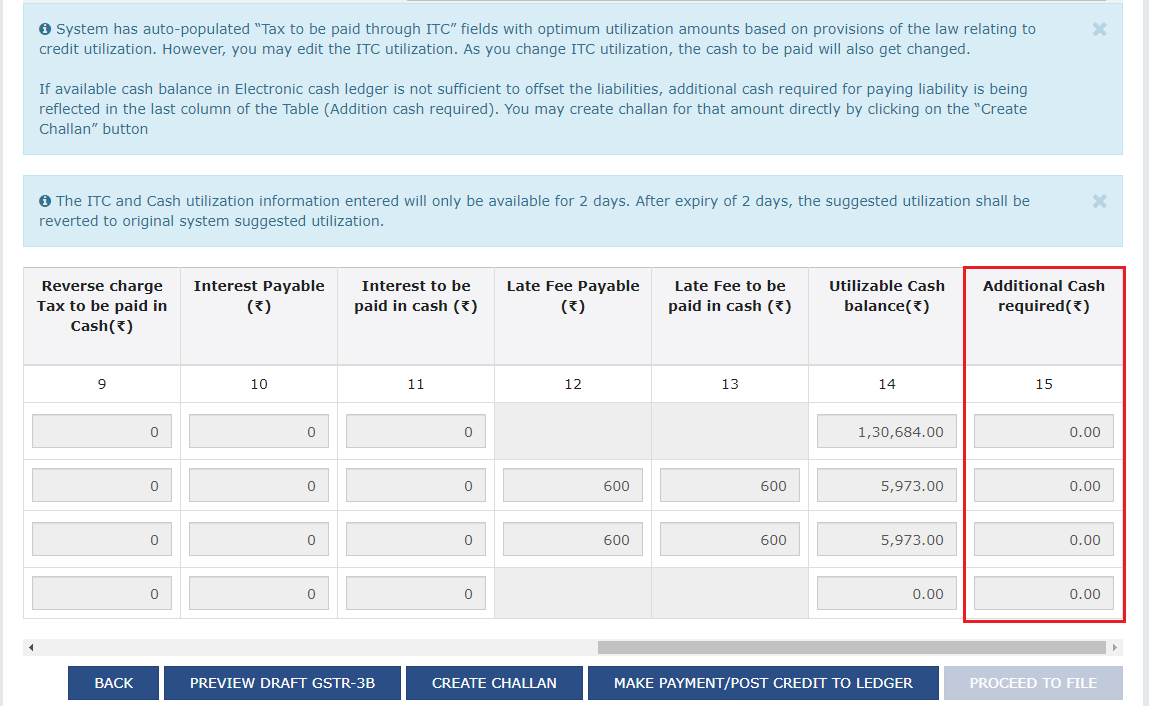

The “payment of tax” tile is enabled only after the successful submission of the return. To pay the taxes and offset your liabilities, follow these steps-

- Click on the “payment of tax” tile

- Tax liabilities as declared in the return, along with the credits is updated in the ledger on submission of GSTR-3B.

- These are reflected in the “tax payable” column of the payment section.

- Credits get updated in the credit ledger and the updated balance is seen when hovering on the specific headings in the payment section.

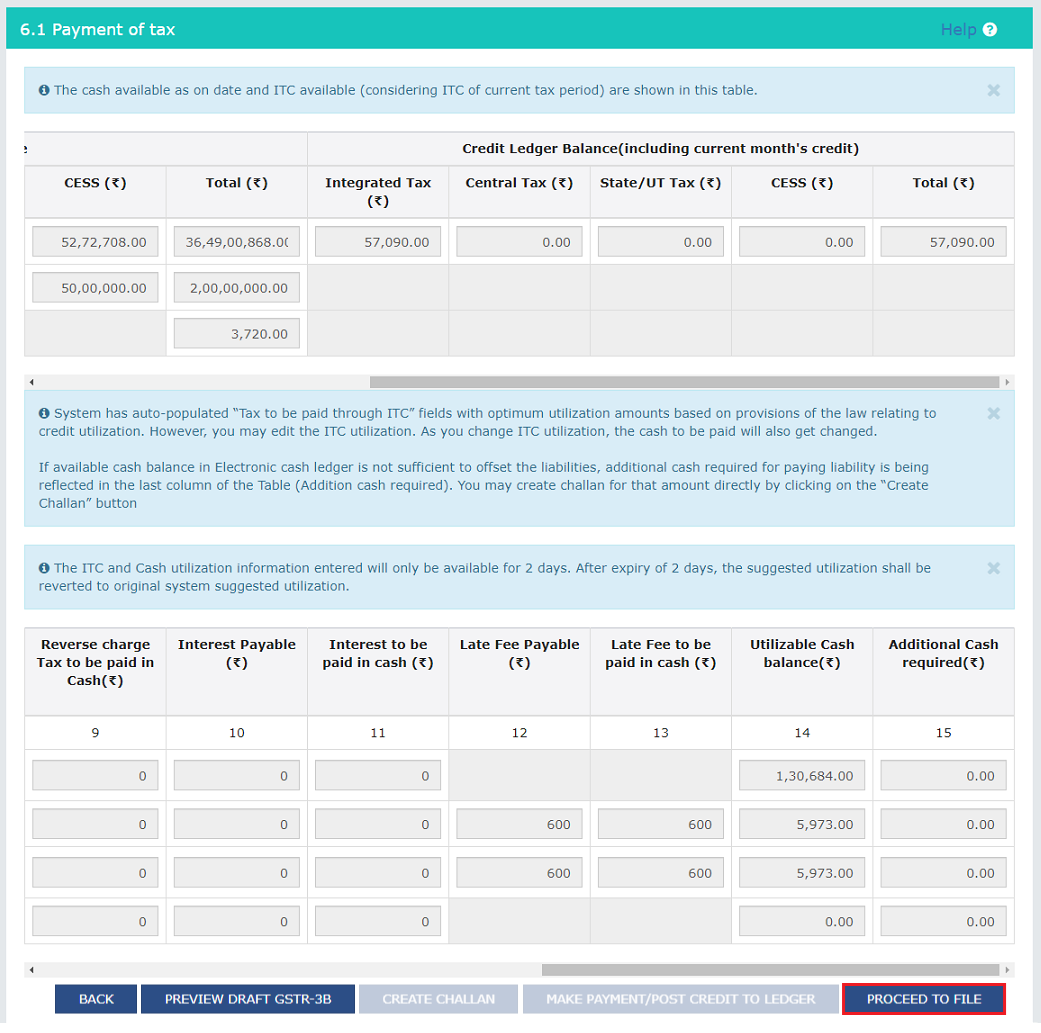

- Click on the “check balance” button to view the balance of cash and credit. This feature will hence enable you to check the balance before making the payment for the respective minor heads.

- Click the “ok” button to go back to the previous page.

- Provide the amount of credit to be utilized from the available credit (in the separate heads) to pay off the liabilities.

- While providing the inputs, make sure that you are adhering to the utilization principles because if you do not, the system will not let you offset your liabilities.

- Click the “offset liability” button to pay off all your liabilities. A confirmation message will be displayed. Click the “ok” button.

- If the cash balance in the electronic cash ledger is less than the amount needed to offset the liabilities, then click on the “create challan” button, and then click on the “yes” button.

Note:

- In case of Net Banking, you will be directed to the net banking page of the selected bank. The payment amount is shown at the bank’s website. If you want to change the amount, abort the transaction and create a “new challan.” After successful payment, you will be redirected to the GST portal where the transaction status will be displayed.

- In case of over the counter payment mode, you will have to take a printout of the challan and visit the selected bank. You will then have to pay using cash/cheque/demand draft within the challan’s validity period. Status of the payment will be updated on the GST portal after confirmation from the bank.

- In case of NEFT/RTGS payment mode, you will again have to print your challan and visit the selected bank. A mandate form will be generated simultaneously. You will have to pay using a cheque through your account with the selected bank/branch. You can also pay using the account debit facility. The transaction will be processed by the Bank and confirmed by the RBI within 2 hours. Status of the payment will be updated on the GST Portal after getting the confirmation from the Bank.

- Once the payment is made, you will receive a confirmation message on which you have to click on the “yes” button.

- On the other hand, if the cash balance in the electronic cash ledger is more than the amount needed to offset the liabilities, then click on the “make payment/post credit to ledger” button.

- If the cash balance in the electronic cash ledger is more than the amount needed to offset the liabilities but due to the ITC utilization principle, offset is not allowed, in that case, additional cash required for paying off the liabilities will be reflected in the last column of the table under the head- “addition cash required.”

- You may then create challan for that additional cash directly by clicking on the “create challan” button.

Note:

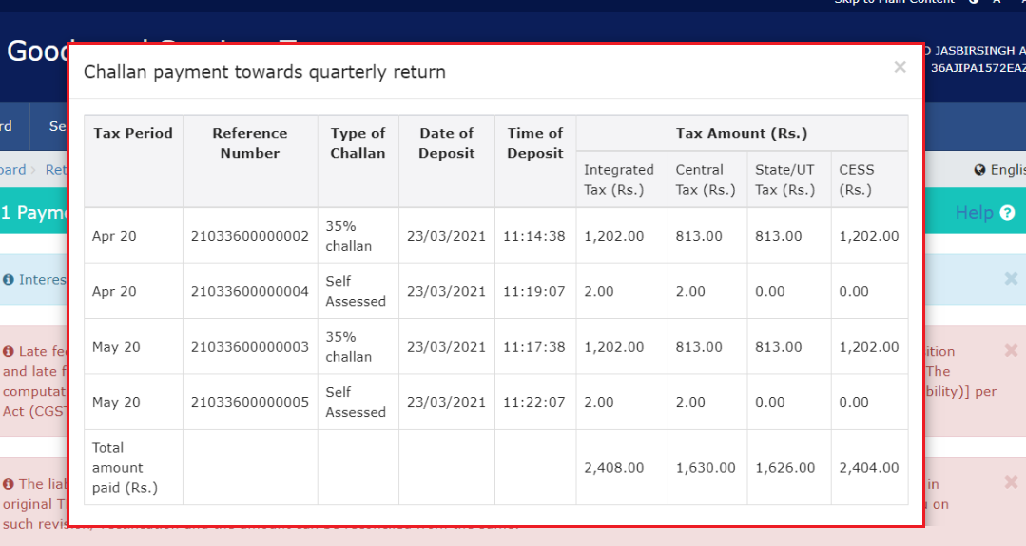

- In case if you are a quarterly return filer, you can view the payments made during the quarter using the “payment made in quarter” button.

- Clicking on that button will display the payment details in the following format:

Note:

- Once you have clicked on the “make payment/post credit to ledger” button and paid off your liabilities, you would not be able to go back and make any changes to the Form GSTR-3B.

- It is because of this reason that it is highly recommended to download the summary page of your draft GSTR-3B form and review each section with patience before making payments.

Step 14: File GSTR-3B

Click on the “proceed to file” button.

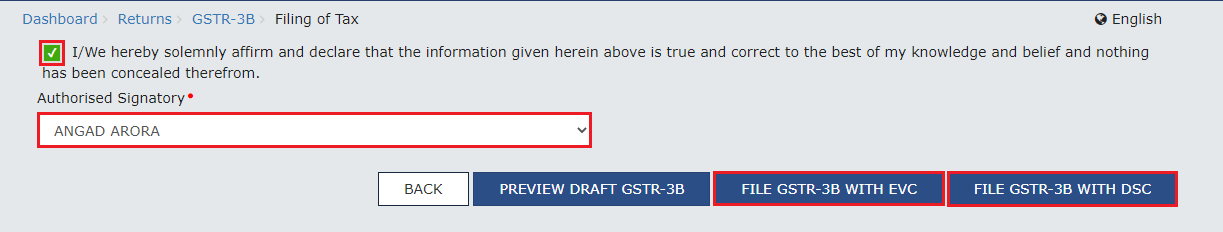

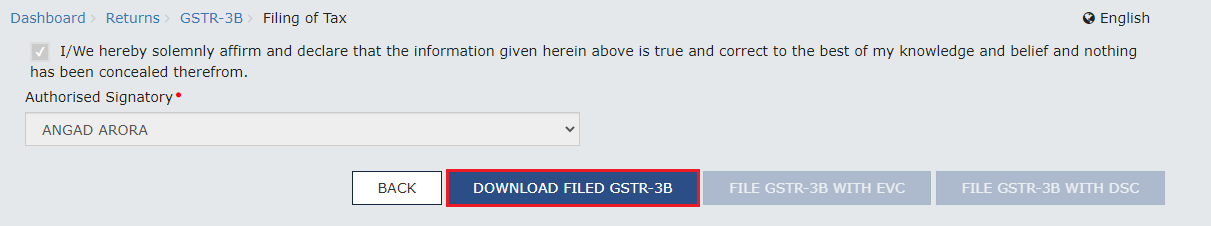

Step 15: Authorized Signatory

- Select the checkbox for the declaration.

- From the “authorized signatory” drop-down list, select the authorized signatory.

- Click the “file GSTR-3B with DSC” or “file GSTR-3B with EVC” button.

If you choose to file GSTR-3B with DSC, this will be your screen:

- Click on the “proceed” button.

- Select the certificate and click the “sign” button.

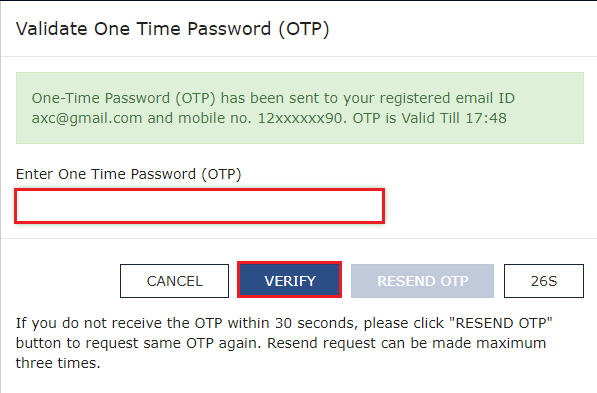

If however you choose to file GSTR-3B with EVC, this will be your screen:

The OTP sent to your registered email or mobile number with the GST Portal as authorized signatory needs to be entered.

- Click on the “verify” button.

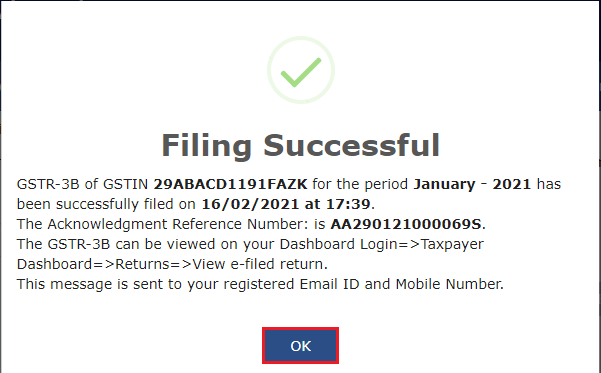

Step 16: File GSTR-3B- successfully

- Once the success message is displayed, click on the “ok” button.

- The status of your Form GSTR-3B will be changed to Filed.

- You can also download your filed GSTR-3B return by clicking on the “download filed GSTR-3B” button.

- The PDF generated would have the watermark of the final Form GSTR-3B.

Step 17: Viewing Filed GSTR-3B

- Click the “back” button. The “file returns” page will be displayed.

- Select the “financial year and return filing period (month)” for which you want to view the return from the drop down list.

- Click the “search” button.

- Click on the “view GSTR-3B” button to view your filed GSTR-3B return form.

How Can Deskera Help Your Business with Accounting?

Being an all-in-one software, Deskera aims to attend to all your business needs. When it comes to accounting for your business, it is Deskera Books that you want to rely upon. Be it tracking your financial KPIs, marketing KPIs or getting insights for optimizing your landing pages, the dashboard of Deskera Books is maintained in real-time.

It will help you with invoice creation and sending, making financial statements, analyzing the balance sheets, income statement, cash flow statement, bank reconciliation statement and profit and loss statement. The trends observed will help in improving the ratio of operating income as against operating expenses and that of account receivables as against the account payable.

The insights gained from the dashboard will also help in improving cash flow, customer retention and customer loyalty while encouraging more returning customers. Another of the main key functionality of Deskera Books is that it makes it easier to comply with your country’s taxation regimes.

In case you want to set up GST of India in Deskera Books, here is how you do that:

So, what are you waiting for? Try Deskera Books Now!

Key Takeaways

While filing GSTR-3B on the GST Portal is quite a complex and mind-wrecking process for a beginner, this guide will help you in grasping the process faster. In addition to that, having a certified GST practitioner handling all your GST returns and the filing processes will make your task so much easier.

The Government of India has aimed to make the process of adapting to GST a much simpler and easier process and has hence even made the GST portal easily accessible. Additionally, it has several cautions and instructions which will be a huge help to you. Lastly, up till the final submission of the form, the entire Form GSTR-3B can be made changes at any point in time.

So, do not worry. You will be able to file GSTR-3B on the GST portal without any major hindrances in the filing processes. Especially, with your accounting being handled by Deskera Books, this will be easier for you.

Related Articles