Goods and Service Tax (GST) was introduced to eliminate the existing flaws in indirect taxes and enhance tax compliance, reducing the effects of high taxes on end consumers. Its implementation, intended to stimulate corporate and economic growth in India.

Further on, GST e-invoice, the generation of a digital invoice for goods and services given by a business organization at the government's GST portal. The primary motivation for implementing E-invoicing is to reduce the number of fraudulent invoices.

Before adopting the GST law, the government was concerned about tax leakage and fraud through fraudulent invoices.

Simply put, the concept of a GST e-invoice creation system has been introduced to reduce GST evasion. Through Notification No.69/2019 – Central Tax, the CBIC announced a set of standard portals for preparing e-invoices.

This article is a detailed explainer of the know-how on e-invoicing under GST. We will also cover what e-invoicing is and who is liable to abide by this reform.

What is E-Invoicing under GST?

The GST Council resolved to introduce an e-Invoicing system in its 35th meeting, which applies to particular groups of people. The production of invoices via the GST site is not included in e-invoicing. That would be a fabrication. Instead, e-invoicing entails submitting a pre-generated standard invoice to a centralized e-invoice system.

An electronic invoice, often known as an e-invoice, is a digital document transmitted between a supplier and a buyer and certified by the government's tax system.

Let's make it very clear; an e-invoice is not considered data in unstructured formats such as PDF, Excel, or Word. Neither paper invoices have been scanned nor documents processed with the help of optical character recognition.

E-invoice is created when e-invoicing software makes structured invoice data in formats such as XML or EDI. Structured invoice data is issued using web-based forms.

Business-to-business (B2B) invoices are digitally created in an e-invoicing format and authenticated by the Goods and Services Tax Network under the proposed e-invoicing system. This mechanism ensures that all firms use the same form when reporting invoices to the GST gateway.

The government released a draught of an e-invoice for public comment in August 2019, which the GST Council then updated to comply with their regulations. Not only does the standard format make compliance easy, but it also ensures compatibility between GST ecosystems because it is used throughout industries.

Goods and Service Tax Network (GSTN) will electronically authenticate all business-to-business (B2B) invoices under the new e-invoicing system. All firms will continue to create bills on their respective Enterprise resource planning (ERP) systems, as they have in the past.

To adapt to the new standardized format, ERP vendors must make changes to their schema.

Schema assures an e-invoice is machine-readable and compatible across all platforms. The invoice can be exchanged effortlessly across different systems such as Tally, SAP, and others. As a result, e-invoicing allows suppliers and purchasers to exchange invoices in a structured electronic format.

The Invoice Registration Portal (IRP), operated by the GST Network, will issue an identifying number against each invoice under the electronic invoicing system (GSTN). The National Informatics Centre launched the first IRP at einvoice1.gst.gov.in.

All invoice information will be sent in real-time from this site to the GST and e-way bill portals. Because the data is transferred directly from the IRP to the GST site, it will eliminate the requirement for manual data entry for filing GSTR-1 returns and generating Part-A of e-way bills.

E-invoicing under GST applies to whom?

Under GST, this new reform of e-invoicing applies to all taxpayers having a turnover of more than Rs 500 crore since October 1, 2020.

From January 1, 2021, it became applicable to all taxpayers with a turnover of more than Rs 100 crore. Furthermore, taxpayers with a turnover of more than Rs 50 crore are also liable to abide by the norm effective from April 1, 2021.

E-invoicing is only applicable to B2B invoices; it does not apply to B2C bills. B2B invoices, on the other hand, require both e-way bills and e-invoices, whereas B2C invoices require e-way bills (wherever e-way Bill is applicable).

In most circumstances, where e-way bill production is necessary, the transporter ID will need to be mentioned at the source. As a result, invoice sorting will be required and, to some part, automated, as doing so would involve a significant amount of time and work.

The GST registered persons whose aggregate turnover in the fiscal year exceeds Rs.50 crore will be subject to the e-invoicing system. Special Economic Zones (SEZ) units, insurance, banking, financial institutions, NBFCs, GTA, passenger transportation service, and the sale of movie tickets are exceptions.

What is the need for e-invoicing?

Currently, a seller's invoice must be written and reported to two different systems: GST Portal and e-Way Bill.

Businesses create invoices using various software, and the taxpayer enters the invoice details in a GSTR-1 return using a relevant API. The same data is mirrored in a GSTR-2A, which is available to receivers with a 'view only' permission. Transporters must also generate the e-Way bill, either immediately or manually inputting the invoices into an excel sheet or JSON.

The GST council introduced the new return system to put an end to this never-ending trail of paperwork.

How will e-invoicing help?

The procedure of producing and uploading invoice details will stay the same under the e-invoicing system as deployed on October 1, 2020. It will be done directly or through a GST Suvidha Provider by importing the excel tool/JSON or via API interface (GSP). The data will flow smoothly into GSTR-1 preparation as well as e-way bill generating. The e-invoicing system will be the key to making this possible.

What is the Process to create an E-Invoice?

Step 1

Create an invoice using existing infrastructure; however, remember that the invoice must have all mandatory data specified by the E-invoice schema.

The taxpayer must ensure that PEPPOL guidelines have adjusted the ERP system. He might work with the software service provider to incorporate the e-invoice standard set, i.e., e-invoice schema (standards), and at the very least have the mandatory parameters reported by the CBIC.

If all of the mandatory fields in the present infrastructure are not synchronized, the taxpayer is advised to invest in IT-enabled infrastructure.

Step 2

Authorization of invoices and creation of a unique IRN (Invoice Registration Number) is needed. The created invoice must be uploaded to the E-invoicing site to generate an IRN.

A person can generate IRN in two ways,

-For direct API connectivity or integration via GST Suvidha Provider (GSP), the computer system's IP address can be whitelisted on the e-invoice portal.

-To mass upload invoices, download the bulk generating program. It will create a JSON file that can be uploaded to the e-invoice portal to generate IRNs in large batches.

Following that, the taxpayer must create a conventional invoice using that software. He must provide all relevant information, such as the billing name and address, the supplier's GSTN, the transaction value, the item rate, the GST rate that applies, the tax amount.

Step 3

After you've decided on one of the alternatives above, create an invoice in your ERP or billing software. After that, upload the invoice details, essential fields to the IRP using the JSON file, an application service provider (app or GSP), or a direct API.

Step 4

The IRP will serve as the e-invoicing and authentication's central registrar. There are a variety of alternative ways to communicate with IRP, including SMS and mobile apps.

IRP will check for duplicates, confirm the essential details of the B2B invoice, and generate an invoice reference number (hash) for future reference.

IRN is constructed using four parameters: Seller GSTIN, invoice number, FY in YYYY-YY, and document type (INV/DN/CN). IRP generates the invoice reference number (IRN), signs the invoice digitally, and creates a QR code for the supplier in Output JSON.

Lastly, the supplier will be notified of the e-invoice generation by email (if provided in the invoice).

For GST returns, IRP will deliver the authenticated payload to the GST portal. If relevant, information will also be sent to the e-way bill portal. For the appropriate tax period, the seller's GSTR-1 is auto-filled. As a result, the tax liability is determined.

A taxpayer can continue to print his invoice with a logo as is now done. All taxpayers must record invoices in electronic format on IRP under the e-invoicing system.

What are the benefits of e-invoicing under GST?

Standard reporting and no duplication: B2B invoices are only recorded once, removing the need to report the bill in numerous forms and, as a result, lowering the risk of errors and duplication.

Ensures compatibility across systems: The standardization of the invoice format makes it easily accessible. Thus, allowing the generated invoice to be operable among different software.

Ensure smooth processing for the buyers: Once uploaded to the GST portal for authentication, the e-invoice will be shared with the buyer via the e-mail address specified on the e-invoice. This allows the buyer to reconcile his purchase order with the e-invoice and accept/reject the invoice in real-time.

GST Returns Will Be Auto-Generated: There will be a proper record of a business's overall Sales and Purchases, and as a result, GST returns will be ready for filing under the new GST system. In ANX-1, B2B transactions will be auto-populated.

E-way Bill: The system for generating E-invoices should be used instead of the e-way bill. Based on current information, E-invoicing will make it easier to develop an e-way invoice because the taxpayer will only need to update vehicle details.

The details in Part-A of the e-way bill will be auto-populated from the GST portal-authenticated e-invoice.

There are fewer chances of data reconciliation between the books and the GST returns filed. It will eliminate mismatch mistakes by resolving data reconciliation for GST Sales.

Real-time invoice entry from the supplier will result in faster input tax credit processing on the recipient's side, resulting in quicker and more accurate credit availability.

Reduce tax evasion and fraud: Because the new method requires real-time data entry, there will be a reduction in tax evasion and fraud instances.

The new reform ensured that invoices are generated before a transaction; real-time access to data reduces the scope of invoice manipulation.

Hence, it reduces the capacity of fake GST invoices even further, and similarly, only genuine Input Tax Credit (ITC) can be claimed.

Input tax credit and output tax details are readily available for tracing one-to-one, making it easier for tax inspectors to trace false input credit. As a result, it will be simple to check the authenticity of the Refund for Unused Credit.

What are the restrictions of e-invoicing under GST?

The new amendment might be a step toward curbing frauds and tax evasions but it also has a few loopholes that need to be discussed. Let's take a look:

- The new system only allows B2B invoices to be e-invoiced, neither B2C invoices nor supply bills.

Thus, B2B invoices necessitate e-way bills and e-invoices, whereas B2C invoices only necessitate the generation of e-way bills (wherever e-way bill is applicable).

In most cases, where e-way bill generation is required, the transporter ID must be mentioned at the source. As a result, invoice sorting will be required, which will necessitate some automation; otherwise, a significant amount of time and effort will be expended.

- Since most frauds occur in B2C invoices where there is no question of claiming an ITC, once e-invoicing is fully implemented for all types of invoices, e-invoicing's main goal or benefit will be realized.

It should be noted that the last invoice number cannot be used to generate a new e-invoice. A taxpayer must revise the invoice number and correct any errors and create a new e-invoice on the IRP.

- It is not possible to partially cancel an e-invoice. Even a minor change would need complete cancelation. Cancellation of e-invoices on the IRP is permitted within 24 hours. Cancellation cannot be made on the IRP after 24 hours; it has to be done on the GST portal.

- To ensure a smooth flow of invoice data to the Invoice Registration Portal (IRP) and e-invoices back to the ERP system, businesses must interface their ERP systems with GST Suvidha Provider (GSP) or Application Suvidha Provider(ASP) or IRP.

APIs have been made available by the GSTN for this purpose. Because most ERPs used by different businesses may be adjusted, it allows for variations to the standard e-invoice structure.

Non-integration of ERPs, on the other hand, could be a problem for organizations that generate many bills.

- E-invoicing is solely applicable to B2B invoices. As a result, a distinct workflow for delivery challans, bills of supplies, job tasks, and other similar activities is required. It takes a lot of time and effort to create separate workflows for different sorts of transactions.

In addition, the QR code must be printed in the current invoice format (scanning the QR code identifies the IRN). Please note that ERP integration is not required because the IRP also offers an excel-based bulk e-invoice generating tool.

What are the Elements of an E-Invoice?

The defined taxpayers must confirm that the accounting/billing software used to generate the invoice supports the set parameters. The information is then uploaded to the Invoice Registration Portal (IRP) to obtain an Invoice Reference Number (IRN) for each document. The generated invoice will be referred to as an e-invoice.

Necessary documents that the e-invoicing system will cover:

- The supplier's invoices

- The supplier's credit notes

- The recipient's debit notes

- Any other document required by GST law must be submitted as an e-invoice by the document's originator.

The GST invoicing rules must be followed while creating an e-invoice. Apart from that, it should suit each industry's or sector's invoicing system or policies in India. For businesses, certain information is required, while the rest is optional.

Many fields are also made optional, allowing users to fill in only the relevant areas. It also includes a description of each field as well as sample inputs for those that are interested. Certain essential information from the e-way bill format, such as the sub supply type, are now included in the e-invoice.

Mandatory sections of the invoice include the following:

- Basic information

- Information about the supplier

- Information about the recipient

- Details on the invoice item

- total number of documents

How Can Deskera Help With Your Business Accounting?

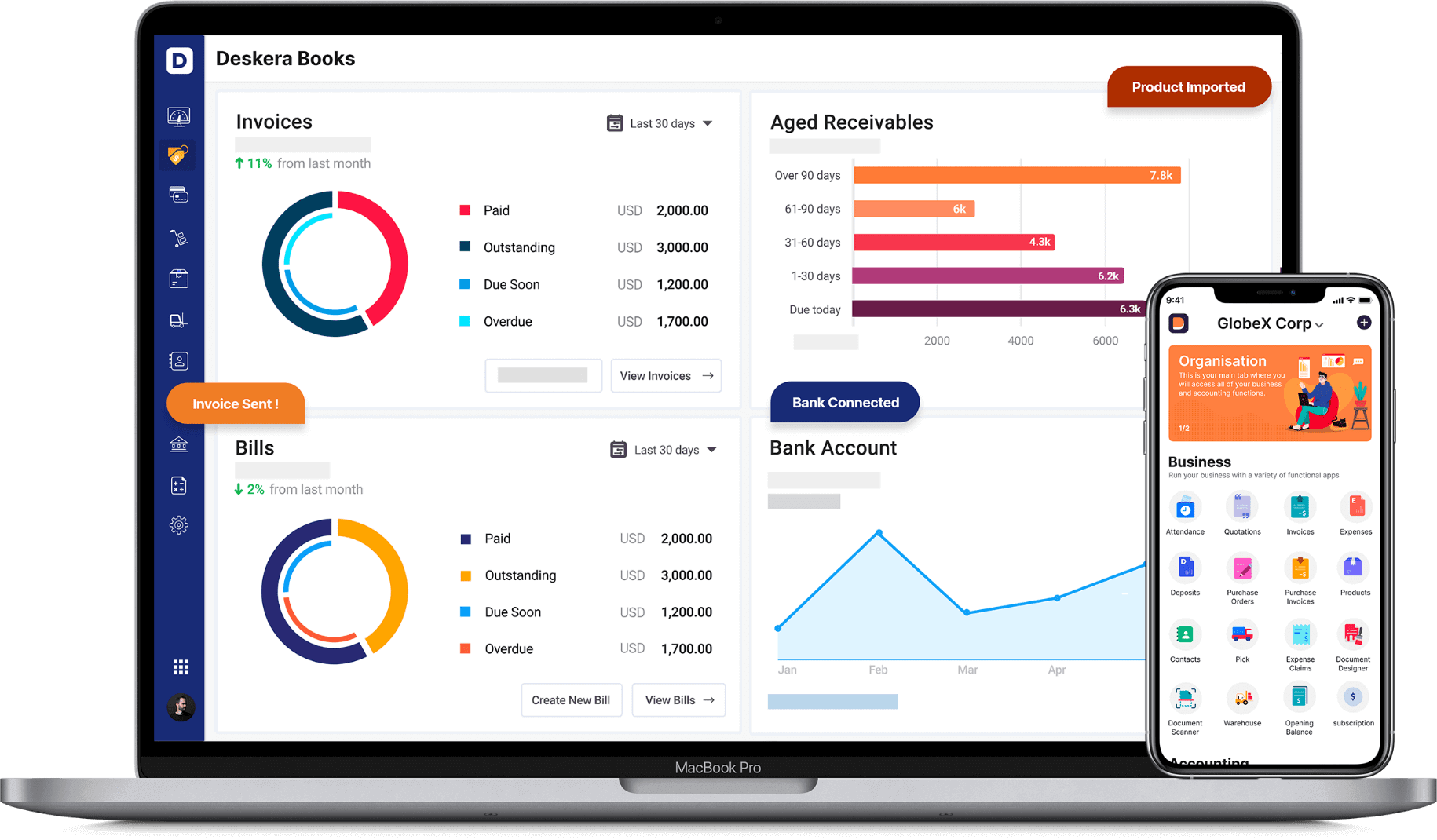

Deskera is an all-in-one software through which you can combine accounting, financial management, inventory management and many more such features using Deskera Books.

While the taxation regimes followed by most countries tend to be intimidating and nerve-wracking, the key to understanding them is by starting to understand each of their nitty-gritty. In the case of GST in India, this involves understanding the Forms GSTR-1, GSTR-2A, GSTR-2B, GSTR-3B, the difference between GSTR-9 and GSTR-9C, reverse charge mechanism under GST and many more such details.

While this all seems a lot to take in, what the businesses can be relieved about is that their accounting is handled by Deskera Books. Be it tracking of financial KPIs, marketing KPIs, journal entries, financial statements, invoices, account receivables and accounts payable, Deskera Books will do it all for them- including making it easier to comply with the taxation regime of the base country.

To learn about how to manage and set up India GST in Deskera, go through this video:

Then test out our tool through the below mentioned clickable link and you will be amazed by how easy accounting has become for you.

Key Takeaways

To combat tax evasion caused by phony invoices, the government is taking steps to authorize each invoice, which can only be done by using the GST portal to generate invoices, a process known as e-invoicing.

E-invoice does not imply the generation of invoices from a tax department's central portal. This is because such centralization will impose unnecessary restrictions on the way trade is conducted. Instead, the specified taxpayers have received a comprehensive standard format for raising invoices, including mandatory and optional fields. For invoices and credit-debit notes, this will be done on their existing ERP or accounting billing software.

Summary of the Workflow

An e-Invoice workflow had two essential components. The interaction between the business/supplier and the Invoice Registration Portal is the first stage (IRP). The supplier creates an invoice and sends the invoice's JSON file to the IRP. Before forwarding the invoice to the supplier, the IRP validates the data contained in it, generates an IRN and QR code, and digitally signs it.

The e-invoice data is sent to the GST system, where the GSTR-1 return is automatically generated. The e-invoice data is also sent to the e-way bill system, which produces Part A of the e-way bill and, if transporter details are provided, Part B. If this is not the case, Part B can be generated at a later time. As a result, e-invoicing has significantly reduced a taxpayer's workflow by eliminating multiple data entries.

Generation of invoices by separate businesses with ERPs will continue under the e-Invoicing paradigm, precisely as they have in the past. The taxpayer will be responsible for the creation of the invoice. Only the invoice generation standard, schema, and format will be given.

An e-Invoice generated by a taxpayer must be reported to the GST Invoice Registration Portal (IRP). The IRP will generate a unique Invoice Reference Number (IRN) and add the e-digital invoice's signature. It will also send it to the seller's registered email address.

The above procedure is introduced to curb tax evasions and reduce manual labor, thus eliminating the scope of data entry errors. Limitations such as no room for partially canceling or correcting minor changes in invoices can be a big issue for companies with multiple invoices. Thus, if the system applied to B2C as well, the objective of reform could be seen in a better light.

Related Articles