A SaaS company is a company that hosts an application and provides services to the customers through that application, which is accessible using the internet. SaaS stands for Software as a Service and refers to the software/s that sits on the SaaS company’s server with the user being able to access it remotely.

With the increasing spread of the internet and therefore digitization, SaaS companies have been growing exponentially over the years. Considering this fact and the fact that SaaS customers usually pay a subscription fee to access the applications, the performance of the SaaS companies can be gauged based on two primary metrics- ACV (annual contract value) and ARR (annual recurring revenue). These two metrics are those that will add value to your role as a sales, marketing, or management professional.

This article will hence focus on the following topics:

- What is ACV?

- How to Use ACV?

- What is ARR?

- How to Use ARR?

- ACV vs. ARR- What is the Difference?

- How to Calculate ACV and ARR?

- How Can Deskera Help You with Sales, Revenue, and Their Metrics?

- Key Takeaways

- Related Articles

What is ACV?

ACV is an abbreviation for Annual Contract Value. Annual Contract Value is a metric that shows you the worth of types of business contracts, specifically ongoing customer contracts, by averaging and normalizing its value over one year. Annual Contract Value is a metric that helps measure the value of all your customer accounts irrespective of which type of an account it is. For example,

- Monthly Subscription Account

- Differently Priced Plans Account

- Multi-Year Contract Accounts

And so on.

The calculations done by this metric are often based on the recurring revenue generated by a single client or by a single account. They hence tend to not include the initial or one-time setup, training, or administrative fees. This is because these are not those revenues that would lead to long-term gross profits. They are instead those operating incomes that help to meet the operating expenses.

How to Use ACV?

Considering that ACV (Annual Contract Value) helps in normalizing your contract amounts, it can be used for the following purposes:

- Compare the customers whose contracts differ in type or duration

- Discover which accounts will provide the greatest revenue value

- Better service individual clients, especially those with the most significant long-term potential

What is ARR?

ARR is an abbreviation of Annual Recurring Revenue. Annual Recurring Revenue is a metric that will show you the amount of recurring income that you are generating from all your subscription accounts. This hence means that through ARR you would be able to calculate the following:

- Measure the total dollar value of your recurring revenue on an annual basis.

- It does not take one-time fees or charges into account, and hence your account receivable and account payable are calculated accordingly to give you a clear picture of your cash flow as well as how you can improve your cash flow.

- It lets you measure your revenue at a given point in time.

Further on, Annual Recurring Revenue also helps to measure the following momentum from all your business functions and services:

- Annual Recurring Revenue from new customers

- Annual Recurring Revenue from existing customers who renew

- Incremental increases or expansion in Annual Recurring Revenue from upgrades and add-ons

- Incremental decreases or contraction in Annual Recurring Revenue from downgrades

- Annual Recurring Revenue losses or revenue churn

The Annual Recurring Revenue for each of these components is measured and reported in either the absolute value, the relative value, or as incremental changes from period to period.

How to Use ARR?

Annual Recurring Revenue is a measure of the predictable income and is hence a good metric for measuring the financial health of your business. It is also helpful for the following purposes:

- Tracking revenue growth over time

- Pinpointing income fluctuations from subscription renewals, upsells, or cancellations. You would then be able to use customer feedback to know the reasons behind the same and hence form a strategy that will help win customer loyalty, improve your customer’s retention, and increase the ratio of returning customers.

This metric will hence become a key performance indicator for analyzing and improving your sales strategy incorporated in your sales funnel and in your marketing as well as retention strategies. You need to keep in mind that if your SaaS company deals in monthly subscriptions, you should also include MRR (Monthly Recurring Revenue) as your performance measuring metric.

ACV vs. ARR- What is the Difference?

The critical point of confusion between both of these metrics is that they both measure annualized contract values. Despite this, they have some key differences, which I will be highlighting in the table below:

To better understand the difference, let’s take up this numerical example:

Customer A is on a $1500 annual subscription plan, so their ACV is $1500.

Customer B is on a $500 annual subscription plan, so their ACV is $500.

Customer C is on a $1000 annual subscription plan, so their ACV is $1000.

However, in this scenario, your ARR would be $3000 ($1500 + $500 + $1000)

How to Calculate ACV and ARR?

When calculating your company's Annual Contract Value and Annual Recurring Revenue, what matters is not that you have the same formula as the other companies, but instead that everyone in your company involved in calculating and analyzing this metric uses the same formula.

How to Calculate ACV?

The standard formula for calculating Annual Contract Value for a single account is:

ACV= Total Contract Value/ Number of Years

For example, if a customer X signs a five-year-long annual subscription contract with the total value being $5000, then its Annual Contract Value would be:

ACV= 5000/5 = $1000

However, what if, for example, a customer Y opts for a two-year, monthly subscription contract at $300 per month? This is how you will have to use the ACV formula to normalize customer Y’s contract over one year:

Annual subscription rate= $300 x 12 months = $3600

Total contract value = $3600 x 2 years = $7200

Therefore, ACV = $7200/2 = $3600

Hence, the prime benefit of the annual contract value as a metric in sales for SaaS companies lies in the fact that it allows the comparison of various types of recurring revenue accounts.

Now, to calculate ACV across multiple contracts, you can use the following formula:

Average ACV = Total ACV of Contracts/ Number of Contracts

The two methods of using this formula will now be discussed.

Method 1

As per this method, you will have to calculate the ACV for each of your accounts individually and then add those amounts together. The result you get will have to be fitted in the formula given above. For example,

Customer A has an ACV of $2500

Customer B has an ACV of $4000

Customer C has an ACV of $2500

Total ACV of the contracts = $9000 ($2500 + $4000 + $2500)

Average ACV = $9000/ 3 = $3000

However, this method can become tedious when you have many signed contracts and an ACV to calculate. In such a scenario, batching your calculations would be more viable. Method 2 will show you how.

Method 2

For example, assume that you have 10 customers with different subscription contracts, and you want to know your average ACV for all those 10 accounts.

Two are on one-year contracts worth $40,000 each.

Five are on three-year contracts worth $90,000 each

Three are on five-year contracts worth $100,000 each

The first step would be to batch calculate the ACVs for each contract. Here’s how:

ACV = $40,000/ 1 = $40,000 x 2 contracts = $80,000

ACV = $90,000/ 3 = $30,000 x 4 contracts = $1,20,000

ACV = $100,000/5 = $20,000 x 3 contracts = $60,000

Then, you will tally the total ACV for all your contracts.

Total ACV = $80,000 + $1,20,000 + $60,000= $2,60,000

Plugging this result in the formula given above:

Average ACV = $2,60,000/10 = $26,000

By doing this calculation, you found out that each of your customer contracts is worth $26,000 on average this year. In the following year, if your one-year contracts do not renew or you do not get new clients, then your average ACV will change.

However, there is no standard benchmark for a good or a bad ACV, and it is because of this that as a metric, it is most valuable only when clubbed with other sales or revenue metrics like ARR.

How to Calculate ARR?

Calculating ARR has a fast and easy method by following its standard as well as accurate method. This is by subtracting your non-recurring income from your annual revenue for the previous year. Hence,

ARR = Total Annual Revenue - Non-Recurring Revenue

However, the limitations of this formula lie in the fact that it does not take into account how the customer subscriptions may have changed in the meantime. This brings us to the standard formula for calculating ARR, which is:

ARR= ARR at the beginning of the Year + ARR gained from new customers + ARR gained from subscription upgrades - ARR lost to subscription downgrades - ARR lost to customer churn

For example, you have 200 annual customer subscription contracts on the first day of January, each yielding $2000 in recurring revenue. Assuming that over the coming months, everything stays unchanged and that you do not have any non-recurring revenue. In such a case, your ARR would remain equal to your total annual revenue from the previous year, i.e., $ 400,000 (200 x $2000).

Now, throughout the year, let’s assume that your company,

- Gains 20 new $2400 customer subscriptions (20 x $2400 = $4800)

- Upsells 20 of the existing customers to $2600 subscriptions (20 x $600 = $12000)

- Has 10 existing customers downgrade to $1800 subscriptions (10 x $200 = $2000)

- Has 5 existing customers cancel their subscriptions (5 x $2000 = $10,000)

To calculate your ARR in real-time, you will have to plug these events into your formula as they occur. Here’s how:

ARR = $400,000 + $4800 + $12000 - $2000 - $10,000 = $404,800

And hence the company is showing a positive growth trend.

How Can Deskera Help You with Sales, Revenue, and Their Metrics?

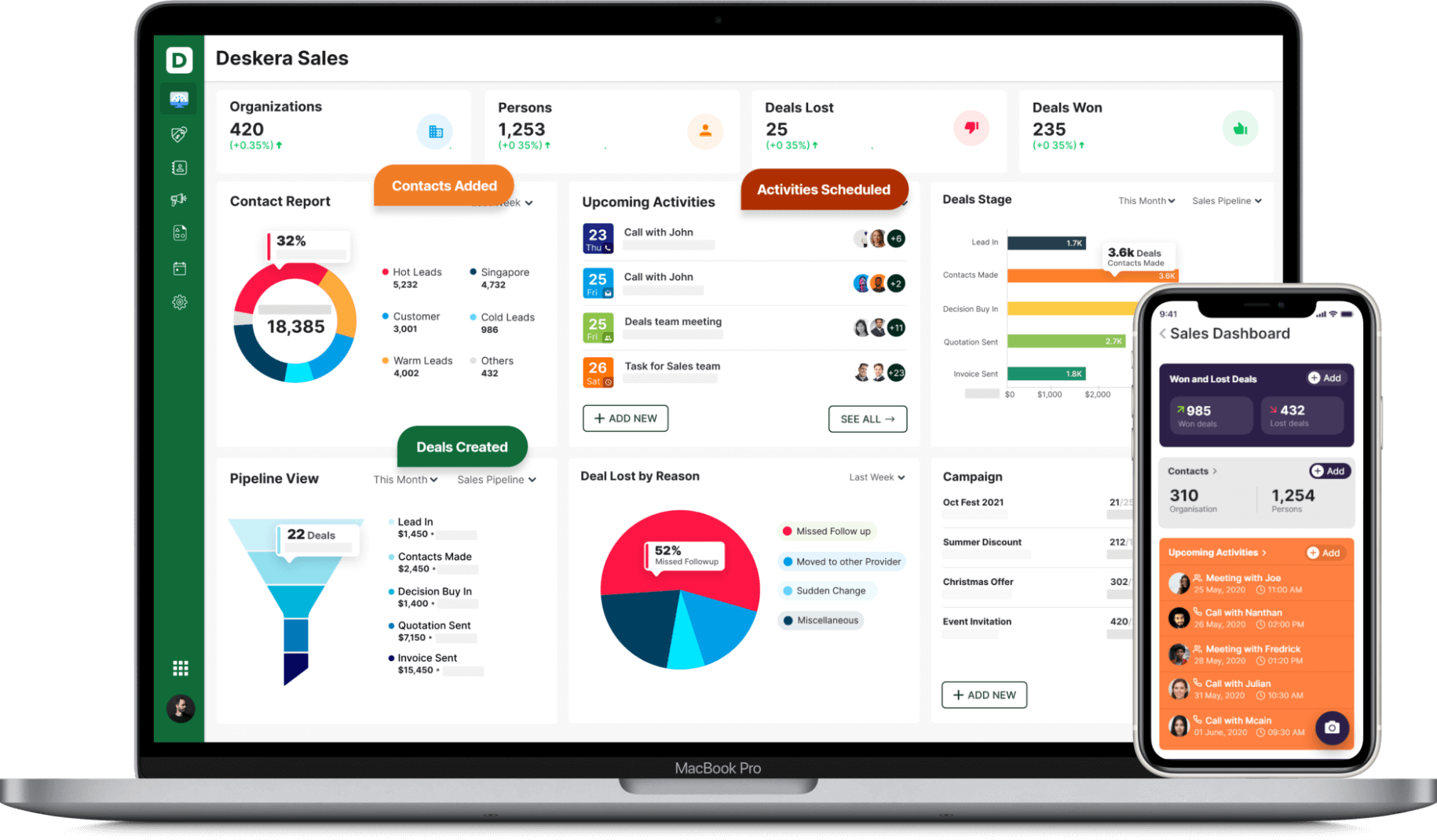

Deskera is that all-in-one software that comes equipped with all the products that will make your business functions easier. When it comes to sales, it is Deskera CRM that you want to resort to. Deskera CRM is a new, powerful, and easy-to-use software equipped with contact and deal management, sales pipelines, email marketing campaigns, customer support, and insights and reports.

By tracking the sales from their beginning to the end, Deskera CRM can also measure sales and revenue metrics like ACV and ARR. This will help you in identifying your upsell and cross-selling opportunities, designing strategies that will help in increasing your net profits, understanding your sales cycle as well as identify and incorporate the voices of your customers.

The insights learned by you will help your customer success manager, sales executive, marketing managers, your CEOs, CFOs, and all such people involved with the sales and revenue functioning of the company to make better decisions.

Further on, you will also be able to run your marketing campaigns better with Deskera CRM as by observing the sales and revenue trends, you would have identified your marketing attribution as well. In the end, this will help you ensure that your financial statements like profit and loss statements, income statements, and balance sheets remain healthy.

Key Takeaways

While SaaS companies have been growing in popularity and use, keeping the growth constantly in a positive trend is equally essential for the success of your business. This can be tracked and ensured through metrics such as Annual Recurring Revenue (ARR) and Annual Contract Value (ACV).

These metrics will help in:

- Tracking all your subscriptions and repeat customers

- Setting up of separate recurring revenue streams

- Viewing the growth in new or cancelled recurring revenue payments

- Knowing your average revenue for a year

- Plan your further sales and marketing strategies

This hence means that these metrics are most useful for:

- Sales representatives so that they can initiate a retention strategy and negotiate a contract extension

- Sales and marketing managers so that they make profitable decisions or recommendations as well as track the team’s performance

- The C-suite professionals who would then be able to set annual budgets and make revenue forecasts

These metrics will hence help you stay on top of your business strategies at all times to maximize your sales, profits and ensure customer satisfaction.

Related Articles