As of 9th May 2020, less than 1% of the 31 million Americans collecting unemployment benefits were doing so through work-sharing programs. This highlights how this lucrative unemployment benefit is used so little.

Work-share programs are also known as shared-work programs or short-time compensation programs that are designed in the manner that aids financially stressed businesses to avoid laying off workers while the workers get financial benefit through the same system.

It does so by letting a business reduce the working hours of all or part of its workers, for which the workers get a prorated unemployment benefit from the respective state as a way to recoup the lost wages.

This unemployment benefit gained more popularity when the USA was struggling with attacks from COVID-19, wherein the individual states of the USA had started opening their economies in phases. During this phase, though businesses were opening up, several were able to do so only in phases, therefore requiring this unemployment benefit to help the businesses as well as workers alike.

To know how this segment of federal expansion of jobless benefits of the unemployment system is lucrative for workers as well as businesses, you need to first understand it, including the local work-share programs offered by each state of the USA.

This article on work-share programs, as well as the local work-share program offered by states, will help you with the same by covering the following topics:

- What is a Work-Share Program?

- Rationale Behind Work-Share Programs

- Why are Work-Share Programs Considered as Win-Win by Employers and States?

- How Can it be Made Easier for Employers to Use Work-Share Programs?

- How Can Work-Share Programs Be Further Incorporated into the Existing UI System?

- State-Wise Work-Share Programs

- Table for State’s Requirements to be Eligible for Work-Share Programs

- Some of the Details to be Included in the Work-Share Plan Application

- How Can Deskera Help?

- Key Takeaways

- Related Articles

What is a Work-Share Program?

Work-share programs, also known as the shared-work programs or short-time compensation programs, are joint programs between an employer and their state unemployment insurance office. It is basically a healthier and more preferable alternative to layoffs.

Through work-share programs, employers are encouraged to temporarily reduce the working hours of their employees during an economic downturn like the COVID-19 pandemic rather than laying them off.

The main benefit of work-share programs is that it allows employers to keep their employees, therefore retaining top talents and their skilled workforce, whose full-time schedule is then reestablished once the economic conditions improve.

Through this approach, the employees will not only continue to be paid for the hours they work but also collect prorated unemployment benefits that will help them cover for the hours that they lost.

For example, as a business owner, you reduced everyone’s working hours by 25% to avoid layoffs. The employees affected by this reduction would qualify for 25% of the weekly unemployment benefit amount.

Rationale Behind Work-Share Programs

The main rationale behind work-share programs is that they give employers a way to respond to the decrease in demand for their business goods and services by reducing the working hours rather than by laying off workers.

This approach will ensure maintenance of the employer-employee connection while simultaneously reducing layoffs and even supporting all those workers whose working hours were cut.

This approach is best used in cases where the drop in demand for your business’s goods and services is for temporary reasons like, for example, a pandemic caused a recession.

Several researches have proved how layoffs of employees lead to undesirable outcomes for the society at large in terms of decreased long-term earnings, health problems, and other such adverse outcomes whose effects last for generations.

In the case of employers, layoffs lead to a future cost for them as well because if, as an employer, you engage in layoffs, then once the demand picks back up, you will have to incur additional expenses and spend additional resources on searching, hiring and training the relevant employees. This, in turn, will definitely have a wider brunt on your returns on investment for an economic downturn that is temporary.

Studies have shown that had work-share programs been available during the Great Recession throughout the USA rather than just in its 17 states and had its take-up-rates been similar to those in the European counterparts; then it would have been able to save up to 1 million jobs or 1 in 8 of the net jobs that were lost during the Great Recession.

Why are Work-Share Programs Considered as Win-Win by Employers and States?

A few of the reasons due to which work-share programs are considered as win-win by employers and states are:

- Through work-share programs, employers will be able to retain their talented employees while also being able to cut costs during challenging economic times.

- In work-share programs, state unemployment insurance offices are responsible for paying only partial unemployment benefits.

- During economic downturns, employees will get to keep their jobs; only their working hours will be reduced.

- During economic downturns, employees will not have to look for a new job, and in fact, due to cuts in their working hours, they will even receive unemployment benefits through a work-share program.

Note: Employers who are interested in participating in their state’s work-share program must submit a work-share plan and get it approved by their respective state first. Also, all the states of the USA do not have a work-share program, and for those who do, their rules vary by state.

However, most of the states have set hourly reduction ranges for employees to be eligible for this unemployment benefit. Additionally, some of the states may also require employers to add a certain number of employees to the work-share program.

How Can it be Made Easier for Employers to Use Work-Share Programs?

Some of the ways through which it can be made easier for employers to use work-share programs are:

- States should find ways through which they can expedite the process of starting up a work-sharing program and paying benefits.

- States should work on removing all those policies that negatively discourage the use of work-sharing programs, thereby pushing employers to lay off their employees during economic downturns.

For example, certain states do not allow employers to participate in the work-share program if they have heavily used unemployment insurance in the past. Other states impose higher effective unemployment insurance tax rates on employers who choose to work-share programs, like an increase in SUTA tax rates.

While these policies are set up to discourage the abuse of the UI system and therefore an abuse of work-sharing programs, they do end up discouraging a proper usage of this unemployment benefit.

How Can Work-Share Programs Be Further Incorporated into the Existing UI System?

As per the current laws, a sharp increase in a state’s unemployment rate triggers extensions to the benefits available in that state. Half of the cost of these extensions is covered by the USA Federal Government.

This same federal-state program can help in enhancing the usage of work-share programs, facilitating their increased incorporation into the existing UI system by letting the federal government cover half the cost of work-sharing programs when UI extended benefits are triggered in a state.

State-Wise Work-Share Program

In this segment of the article, we will be covering work-share programs available or not available state-wise. This will assist you in finding your local work-share program.

Alaska

Alaska has no state-level work-share program available.

Arizona

Arizona does provide a work-share program through the Arizona Department of Economic Security, thereby becoming an alternative for employers faced with a reduction in force. Through its work-share program, it allows an employer to divide the available work or hours of work among a specified group of employees instead of laying them off.

The affected employees will be allowed to receive a portion of their unemployment insurance (UI) benefits while working reduced hours. However, for an employee to be able to avail this benefit, his or her employer that the employee is currently working reduced hours for will have to complete an application, which will then have to be approved by the Department of Economic Security.

Requirements:

- To be eligible for Arizona’s work-share program, employers can reduce normal weekly hours by at least 10% and not more than 60%.

- Employers will have to continue providing health insurance during the time period they participate in the Shared Work Program. The information of the health insurance is a must-needed requirement of the Shared Work plan submitted by the employer.

Arkansas

Arkansas does offer a work-share program through Arkansas’ Shared Work Unemployment Compensation Program, which allows employers to divide the available work or hours of work among a specific group of employees rather than laying them off. In exchange for the reduced work hours, it allows the employees to receive a portion of their unemployment benefits while working for lesser hours.

Requirements:

- To be eligible for Arkansas’ work-share program, employers can reduce the usual weekly working hours by 10% to 40% max.

- During this work-share program, employers should continue to provide health benefits, retirement benefits, and other fringe benefits to their employees.

- The aggregate reduction in work in lieu of all layoffs would have affected at least 10% of the employees, and that would have resulted in an equivalent reduction in work hours.

- The plan must apply to 10% of the employees.

- The plan must provide equal treatment to all employees.

California

California’s work-share program assists all those employees whose hours and wages have been reduced in order to prevent them from being laid off by employers. This allows the employees to receive their unemployment insurance benefits, keep their current jobs, and avoid financial hardships.

Requirements:

- To be eligible for California’s work-share program, employers should have a registered business in California as well as an active California State Employer Account Number.

- The effects of the reduction in hours and wages should be felt by at least 10% of the employer’s regular workforce or a unit of the workforce, and a minimum of two employees, to be eligible for California’s work-share program.

- The hours and wages must be reduced by at least 10% to a maximum of 60%.

- The health benefits of the affected employees should be the same as before and, in fact, match the same standards as that of other employees who are not participating in the work-share program.

- The retirement benefits of the affected employees should be the same as before and, in fact, match the same standards as that of other employees who are not participating in the work-share program.

- The collective bargaining agent of employees in a bargaining unit must agree to voluntarily participate and sign the application for Work Sharing.

- To be eligible for California’s work-share program, you will be required to identify every affected work unit that needs to be covered by the Work Sharing plan, along with the full name and Social Security number of each of the participating employees.

- The employer would be required to notify its affected employees that it intends to participate in the Work Sharing program.

- The employer should identify the number of layoffs it will be able to avoid by participating in the Work Sharing program.

- Any necessary reports or documents related to the Work Sharing plan should be provided to the Employment Development Department (EDD).

Colorado

The work-share program is available in Colorado, and through this, it allows the employees to keep working while saving them from being laid off. However, the employees will be working for shorter hours than usual, in exchange for which they will become eligible to collect part of their regular unemployment benefit.

Requirements:

- The normal weekly working hours should be reduced by at least 10% to a maximum of 40% by the employer to be eligible for Colorado’s work-share program.

- The reduction in the working hours should affect at least two employees in your business, or a minimum of two employees in a certain unit.

- The employer must have paid as much in premiums as your former employees were paid in unemployment insurance benefits to be eligible for Colorado’s work-share program.

Connecticut

Employers of Connecticut who are furloughing workers can use the Department of Labor’s shared work program, which will help them reduce the working hours of their employees. The loss in wages suffered by the employees will be supplemented with unemployment insurance.

Requirements:

- Employers participation in Connecticut's work-share program should be in lieu of layoffs and not used for seasonal separations.

- To be eligible for Connecticut’s work-share program, the reduction in working hours should be between 10% and 60%.

- At Least two of the employer’s permanent part-time employees or permanent full-time employees should be participating in Connecticut’s work-share program.

- During the duration of the approved work-share plan, the employer cannot eliminate or reduce any fringe benefits of his or her employees.

- Employees who are affected by the reduction in working hours must certify that a written copy of the work-share plan or a summary was made available to them for inspection and comment for at least seven days.

Delaware

No work-share programs are made available in Delaware.

District of Columbia

In the District of Columbia, shared work is a voluntary program with the main purpose being providing alternatives to layoffs to employers who are facing a temporary decline in their business.

By becoming a participant of the work-share program, the employer would be able to reduce his or her employees’ working hours to cut costs rather than laying them off. By resorting to this option, they would be able to keep their entire workforce on the job and even save his or her employees from financial distress.

Requirements:

- To be eligible for the work-share program of the District of Columbia, employers should certify that the implementation of the shared work plan would be in place of temporary layoffs that would affect at least 10% of the employees in an affected unit.

- Additionally, the reduction in the working hours should be between 20% and 40%, and the same should be certified by employers.

- Employers must intend to show that all employees in an affected unit are treated equally.

Florida

To help the employers retain their workforce during times of temporary slowdown in the economic activity, Florida has made available the Short Time Compensation program, through which it encourages work-sharing as the solution for cost-cutting rather than layoffs.

For all the employees whose work hours and earnings are reduced as part of a Short Time Compensation plan to avoid total layoff of some employees, this program permits prorated reemployment assistance benefits.

Georgia

Georgia does not provide any state-level work-share programs.

Hawaii

No state-level work-share programs are made available in Hawaii.

Idaho

Idaho does not provide any state-level work-share programs.

Illinois

No state-level work-share programs are made available in Illinois.

Indiana

Indiana does not provide any state-level work-share programs.

Iowa

Iowa provides Voluntary Shared Work(VSW) Program to all the employers who are experiencing a slowdown in their business due to the impact of COVID-19 on the economy. Through this program, employers would be able to get alternatives to layoffs while simultaneously being able to retain their trained employees.

This program makes this possible by letting employers reduce the working hours and, therefore, wages of their employees, the loss of which is partially offset with unemployment insurance benefits to the affected employees.

Requirements:

- Employers must be current in filing quarterly UI reports and have paid all UI taxes owed in full.

- The VSW program should not be used by employers to combat the stress of seasonal work reductions.

- All the employees who are participating in the VSW Program must be given a notice of the same by the employers.

- Employers must certify that the VSW Program will meet all federal and state laws.

Kansas

As a result of supply chain challenges related to COVID-19, businesses in Kansas may be exploring reducing production to reduce costs and meet the reduction in business activity. It is here that the benefit of the Shared Work Program comes in the highlight, for it is an excellent alternative to a temporary, total layoff of employees. Through this program, it allows for partial workweeks and partial unemployment benefits to employees.

Requirements:

- To be eligible for Kansas’s work-share program, there must be an affected unit of two or more employees.

- There should be a reduction of at least 20% to a maximum of 40% in the normal weekly working hours and corresponding wages for a participating employee.

- aThe plan must apply to at least 10% of the employees in the affected unit.

- The plan must describe how participating employers treat the fringe benefits of each employee in the affected unit.

- Employers must certify that the implementation of a Shared Work Plan and the resulting reduction in work hours is in lieu of a temporary layoff affecting at least 10% of the employees in the affected unit and results in an equivalent reduction in work hours.

Kentucky

No state-level work-share programs are made available in Kentucky.

Louisiana

Louisiana does not provide any state-level work-share programs.

Maine

In Maine, the WorkShare program is an unemployment option with the purpose of aiding businesses in Maine in retaining their workforce during a temporary economic downturn. This program allows the employers to voluntarily reduce the hours of staff in lieu of layoffs, while this loss in income of the affected employees is partially offset through unemployment benefits.

Requirements:

- The reduction in the business activity must be temporary and not related to the seasonal or intermittent downturn.

- The reduction in employees' working hours should be at least 10%, but not more than 50%.

- The reduction must prevent the layoff of at least 10% of the workers in the affected unit for two to six months.

- The employee participating in Maine’s work-share program must work on a full-time basis.

- Employers must file applications for WorkShare, and for more information, they can call (207)623-6783.

Maryland

In Maryland, Work Sharing (WS) is voluntary unemployment insurance (UI) program that provides employers with an alternative to layoffs when they are facing a temporary and unexpected economic downturn in business activities.

This program allows employers to divide the available hours of work amongst their employees rather than laying off a few employees. Through this program, employees will keep their jobs; however, they would have lesser hours of work, and therefore their net income will get affected. However, with Maryland’s work-share program, this loss in employees’ income will be partially compensated by receiving a percentage of their regular unemployment insurance benefits.

Note: The employees may choose not to be a part of Maryland’s work-share program.

For questions, employers can contact Maryland’s work sharing unit at ui.worksharing@maryland.gov.

Requirements:

- Maryland’s work-sharing program is not applicable when employers are facing seasonal or cyclical slowdowns, model changeovers, inventory control, or equipment maintenance.

- Maryland’s work-sharing program is not for helping employers supplement their payroll on a continuous basis through the usage of unemployment insurance benefits.

Massachusetts

The work-share program of Massachusetts is also to give employers an alternative to laying off their employees by reducing their working hours and letting them collect their unemployment benefits to compensate for their reduction in wages.

Requirements:

- Massachusetts's work-share program is voluntary, and a worker can deny participation in the same.

- As long as an employer reduces working hours as well as the pay, Massachusetts's work-share program can include salaried workers.

- To participate in Massachusetts’s work-share program, owners or officers of the corporation must be eligible to receive unemployment insurance benefits.

- The law requires at least two employees to be listed in a business’s work-share plan.

- The reduction in employees’ working hours should be between 10% and 60%, and the percentage reduction in the working hours should be the same for each of the affected employees.

- The business’s WorkShare plan can include a scheduled shutdown for up to two weeks.

- Once you approve a WorkShare plan, workers will have to work for as many reduced working hours as it is mentioned in the WorkShare plan.

Michigan

Through Michigan’s work share program, employers are given an alternative to laying off their employees and even maintaining operational productivity during the decline in regular business activity. With the work-share plan, the employees will work for reduced hours during the workweek while receiving a portion of weekly unemployment benefits to partially compensate for their reduction in income.

The advantages of participating in Michigan’s work-share program are that it lets employers avoid the expense of recruiting, hiring, and training new employees by retaining the existing employees.

Requirements:

- To be eligible for Michigan’s work-share program, all employees in the affected unit must participate in the plan.

- The reduction in employees’ working hours should be between 10% and 60%.

- The work-share plan must have at least two employees as participants.

- The plans can be in place for a period of up to 52 consecutive weeks.

- Michigan’s work-share program cannot be applied to temporary, seasonal, or intermittent workers.

Minnesota

In order to give employers an alternative to layoffs, a work-share program is offered by the Minnesota Unemployment Insurance (UI) Program. This work-share program will help employers in retaining trained and experienced staff, avoid future hiring and training costs, be able to increase the operations quickly when the business conditions improve and avoid layoffs. All of this will help the business in creating goodwill and financial stability for the workforce and the community.

Requirements:

- To be eligible for Minnesota’s work-share program, the employer’s UI tax account balance should be paid in full, including interest, fees, and penalties.

- Temporary, seasonal, or intermittent workforce cannot be participants of this work-share program.

- The owner or officer information on your UI employer account must be complete and up to date.

Mississippi

No state-level work-share programs are made available in Mississippi.

Missouri

Missouri’s Shared Work Unemployment Compensation Program gives employers an alternative to laying off employees during periods of reduced business activity. Through this program, instead of laying off employees, employers would be able to divide the available work among that specified group of affected employees.

In exchange for the reduced earnings from the employer, the affected employees would receive a portion of their unemployment benefits while working for reduced hours to compensate for the loss. However, in order to participate, the employer would have to complete and submit an application to the Division of Employment Security (DES) for the affected unit within the company for its approval.

Requirements:

- To be eligible, there must be an “affected unit” of three or more employees.

- The reduction in the weekly working hours and corresponding wages for the participating employees must be reduced between 20% and 40%.

- The work-share plan must apply to at least 10% of the employees in the affected unit.

- To be eligible for Missouri’s work-share program, the employers will have to certify that the fringe benefits provided by them to the employees will continue to remain at the same level, as when the employees were working for normal hours, or to the same extent as other employees who are participating in the work-share program.

- To be eligible for Missouri’s work-share program, the employers will have to certify that the implementation of a shared work plan and the resulting reduction in working hours is in lieu of a layoff that would affect at least 10% of the employees in the affected unit and that would result in an equivalent reduction in work hours.

- In order to be eligible for Missouri’s work-share program, the employers should have submitted all quarterly contribution and wage reports that were required to be filed for all past and current periods. Additionally, the employers should also have paid all the taxes due for all the past as well as current periods.

Montana

Montana does not provide any state-level work-share programs.

Nebraska

No state-level work-share programs are made available in Nebraska.

Nevada

Nevada does not provide any state-level work-share programs.

New Hampshire

The WorkShare initiative of New Hampshire is to assist workers in staying at work, returning to work, and getting ready to work.

Requirements:

- In order to be eligible for New Hampshire’s WorkShare initiative, the employers must be in good standing with the New Hampshire Department of Labor.

- The employers should also be able to certify that by reducing the number of working hours between 10% and 50% in a specific class unit, they are being able to prevent layoffs of full-time or permanent part-time employees.

- The reduction in employees’ working hours should be made equally across all of them in a specific area.

- Employers must not stop providing health care benefits that are already in place.

- A WorkShare plan cannot start before 21 calendar days after the submission of the plan. The plan also cannot exceed 26 weeks. However, a new plan can be submitted at the completion of an existing one.

- The WorkShare plans will not be approved for seasonal employment during the off-season or as a subsidy for intermittent employment.

New Jersey

New Jersey’s Shared Work Program is an alternative to layoffs for employers. An employer who has at least ten employees will be able to apply to the division for approval to provide a Shared Work Program.

The main purpose of this program is to stabilize an employer’s workforce during a period of an economic downturn by allowing the sharing of the available work after a reduction in the total working hours.

Under an approved Shared Work program, employees who have had their working hours reduced and therefore their incomes affected may receive “short-time” unemployment benefits for the last hours of work. They would continue to receive this despite working for lesser hours while also receiving their health insurance, pension coverage, and other benefits as were given by the employer when they were not a participant of the work-share program.

New Mexico

No state-level work-share programs are made available in New Mexico.

New York

New York’s work-share program is aimed at helping employers to retain their trained staff while avoiding their layoffs. Through New York’s work-share program, employees while working for reduced hours will be able to receive partial unemployment insurance benefits. Full-time, part-time, and seasonal employees are all eligible for New York’s work-share program.

Requirements:

- To be eligible for New York’s work-share program, the businesses must have employed at least two full-time employees working in New York for four consecutive calendar quarters.

- The employers must have paid UI contributions or, in lieu of contributions, elected reimbursement of benefits paid to your former employees.

- The reduction in the working hours and corresponding wages should be between 20% and 60%, as mentioned in the shared work plan.

- The shared work plan must be applied to those employees who, in normal circumstances, work for a maximum of 40 hours per week.

- The shared work plan must replace the layoff of an equal percentage of employees.

- In the shared work plans, the employers should not eliminate or reduce fringe benefits unless it is being done for the entire workforce and not just for the affected employees.

- The shared work plan must not extend beyond 53 weeks, and if the employer wants to continue it, then they will be required to submit the request for a new plan when nearing the end of the previous one.

Note: When the work-share program is in effect, the employers cannot hire new employees for the unit of the employees that are being covered by the plan. Also, if there is a collective bargaining agreement in effect, the collective bargaining agent must agree to take part in the shared work plan.

North Carolina

North Carolina does not provide any state-level work-share programs.

North Dakota

No state-level work-share programs are made available in North Dakota.

Ohio

Ohio’s SharedWork is a voluntary layoff aversion program. Through this program, it is made possible for employees to keep their jobs and for employers to retain their trained staff during a period of reduced business activity.

Under the SharedWork Ohio plan, the participating employer reduces the affected employees’ working hours equally. The participating employees continue working for the reduced hours each week, in exchange for which the Ohio Department of job and family services (ODJFS) provides eligible individuals an unemployment insurance benefit in proportion to their reduced working hours.

Requirements:

- In order to be eligible for Ohio’s SharedWork program, the employers must have at least two affected employees that do not work on a temporary, seasonal, or intermittent basis.

- To be eligible for Ohio’s SharedWork program, employers must be current on all Ohio unemployment insurance reporting, contributions, reimbursements, interest, and penalties due.

Oklahoma

Oklahoma does not provide any state-level work-share programs.

Oregon

In order to minimize layoffs, employers should consider using Oregon’s work-share program. By using this program, employers will be able to prevent layoffs by reducing the working hours of workers (not salaried workers), while the unemployment insurance benefits help in offsetting the employees’ lost wages due to the same.

Through Oregon's work-share program, a worker can receive benefits for up to 52 weeks. The work share payments that a worker receives are deducted from the available maximum benefit amount on their unemployment insurance claim. If there is a remaining balance, the workers may be able to draw regular benefits if needed, as long as they are otherwise eligible to receive them.

Requirements:

- To avail the benefits of Oregon’s work-share program, employees must qualify for Oregon unemployment insurance benefits.

- The work-share plan must cover at least three employees.

- To be eligible for Oregon’s work-share program, the reduction in weekly working hours and wages should be between 20% and 40%.

- Employees under the work-share plan must have worked for the employer for six months continuously on a full-time basis or for a year if he or she has worked on a part-time basis. This should be so before the employer submits the work-share plan.

- Work-share plans can last for a maximum of a year.

- Work-share benefits cannot be received by employees who have already used all of their regular benefits or have an unemployment insurance claim against another state.

- Work-share benefits are not paid if the employee is working more than the reduced hours that are not within the 20% and 40% limitations. However, it might be possible for a worker to qualify for regular benefits under these circumstances if their earnings are less than their weekly benefit payment amount and they work less than 40 hours.

- The employee must be available for work to the work share employer.

Pennsylvania

Pennsylvania offers Shared Work as an alternative to layoffs when there is a slowdown in business activities, thereby reducing the available work for employees. Through this program, instead of employers laying off employees in response to lesser available work, he or she rather divides the available work amongst all employees by reducing the working hours and collecting a portion of their unemployment compensation or UC benefits.

In order to get more information, employers can contact the Employer Information Centre at 877-785-1531 or send an email to SharedWork@pa.gov.

Requirements:

- In order to participate in Pennsylvania’s Shared Work program, an employer must have at least two participating employees, not including corporate officers.

- To be eligible for Pennsylvania’s Shared Work program, an employee must be employed in the department or unit for at least three months immediately preceding the date the plan is submitted to the department for approval. Also, all the employees who are working for 40 hours or more each week while the work-share plan is in effect will be excluded from participation.

- The reduction in the working hours as mentioned in the work-share plan should be between 20% and 40%.

- All the employees who are participating in the same Shared-Work plan must be treated equally, with the same percentage of reduction in working hours for all. However, an employer can have multiple Shared-Work plans to cover different departments, units, or shifts. For example, a Shared-Work plan of one department may reduce employees working hours by 25% while another reduces it by 40%.

Rhode Island

Rhode Island’s work-share program is aimed at assisting employers who are facing economic downturns by connecting their employees with unemployment insurance to partially replace the wages lost due to a reduction in working hours.

Requirements:

- To be eligible for Rhode Island’s work-share program, the reduction in working hours should be between 10% and 50%.

- Either the employer’s entire operation or only specific shifts, units, or departments can participate in Rhode Island’s work-share program. This is to be chosen by the employer.

- As a part of this program, employers should not reduce or eliminate the employee’s benefit. Same fringe benefits must be provided by the employer to the employee. If there is a reduction in them, it should be for all the employees.

- If the workers are covered by a collective bargaining agreement, their union must approve the WorkShare plan prior to implementation.

- For a non-union workplace, employers need to make sure that they have informed about the WorkShare plan to each of the affected employees before its implementation.

- If there is no work performed during a week when an employer is on WorkShare, the covered employees will receive a full week of UI benefits in lieu of their WorkShare benefits.

South Carolina

No state-level work-share programs are made available in South Carolina.

South Dakota

South Dakota does not provide any state-level work-share programs.

Tennessee

No state-level work-share programs are made available in Tennessee.

Texas

Texas’s Shared Work Program is designed in a manner that gives the employers of Texas an alternative to laying off employees. This program was developed by the Texas Workforce Commission (TWC) to help employers and employees withstand economic downturns in the business.

Texas's Shared Work program allows employers to supplement their employees’ lost wages as a result of reduced work hours with partial unemployment benefits.

Requirements:

- For each of the employees, the reduction in their working hours can be different, as long as it is between 10% and 40% each week, depending on the work-share plan specifications. In such cases, the TWC will be calculating the number from the number of hours the employer specifies as normal full-time employment for each participating employee.

- At least 10% of the employees in an affected unit must have a reduction in hours applied on them.

- A shared work plan must also specify how the affected employees will be notified in advance of the plan (if possible).

- The employer should specify an estimate of how many employees would be laid off if he or she is not a participant of a shared work plan. This is because the purpose of a shared work plan is to give an alternative to laying off employees.

- If an employer is providing fringe benefits before becoming a participant of a shared work plan, then he or she is obligated to continue providing them to the affected employees. Some of the examples of fringe benefits are holiday or sick leave, health insurance, retirement benefit, and paid vacations.

- To enhance their job skills, employees who are participating in the shared work plan can participate in training programs like employer-sponsored training or commission-approved training.

Utah

Utah does not provide any state-level work-share programs.

Vermont

No state-level work-share programs are made available in Vermont.

Virginia

Virginia does not provide any state-level work-share programs.

Washington

Washington provides a voluntary business sustainability program known as the SharedWork to provide employers with the flexibility and opportunity of retaining their employees at reduced working hours.

To have their questions answered, employers can call the Employment Security Department (ESD) at 800-752-2500, Option 3. The agency will need a contact at your company who can confirm hours worked by your Washington employees.

Requirements:

- At least two permanent employees must be enrolled in the SharedWork plan by the employers to be eligible for it.

- To be eligible for Washington’s SharedWork plan, employers must comply with IRS, state, county, and municipal laws, rules, and ordinances.

- To be able to avail the benefits of Washington’s SharedWork plan, the employees must be hired permanently.

- Also, the employees must be eligible for regular unemployment benefits, apply for benefits, and submit weekly claims.

- To get the benefits of Washington’s SharedWork plan, the employees must be available and able to work for all the available work hours as offered by his or her SharedWork employer.

West Virginia

No state-level work-share programs are made available in West Virginia.

Wisconsin

Wisconsin’s work-share program is designed in a manner that aids employers as well as employees. Through this program, a qualified employer would be able to reduce the number of working hours across a working unit instead of laying off employees in that unit.

All the workers who are affected by this uniform reduction in working hours as per an approved work-share plan will receive unemployment benefits that are prorated for the partial work reduction.

Requirements:

- The work-share plan must include at least two employees who are working from Wisconsin.

- The reduction in working hours must be a set percentage between 10% and 60% of the normal working hours of each week of each employee. This reduction has to remain consistent every week.

Note: The reduction in working hours will be calculated against an individual employee’s normal weekly work hours, which cannot exceed 40 hours in a week for calculation purposes, even if a salaried worker typically works for more than 40 hours per week.

- Participating employees of Wisconsin's work-share program should be regularly employed by the employer.

- Full-time, part-time, salaried, and exempt employees can participate in Wisconsin's work-share program.

- Seasonal and temporary employees or staff employed on an intermittent basis cannot be a part of this program.

- Only those employees who have been employed by the employer for at least three months on the effective date of the work-share program can be its participants.

Wyoming

Wyoming does not provide any state-level work-share programs.

Table for State’s Requirements to be Eligible for Work-Share Programs

For all the states of the USA that offer work-share programs, they have some requirements, fulfilling which employers would be eligible to participate in the work-share programs and avail its benefits. These are:

In addition to these two criteria, some of the states might also require the employer’s employees to have worked for a certain period of time to be eligible for participation in work-share programs.

Additionally, they might also require the employers to be in good standing with their respective state’s unemployment tax account to qualify for the work-share programs.

Some of the Details to be Included in the Work-Share Plan Application

When an employer is making a work-share program plan to submit to his or her respective state, substantial information will have to be provided in order to be approved. Some of the things that you might have to report are:

- Employee hour reductions

- Names and social security numbers of affected employees

- The number of employees facing layoffs

- Starting date

- Certified statement signifying your application complies with state law

- Signature

How Can Deskera Help?

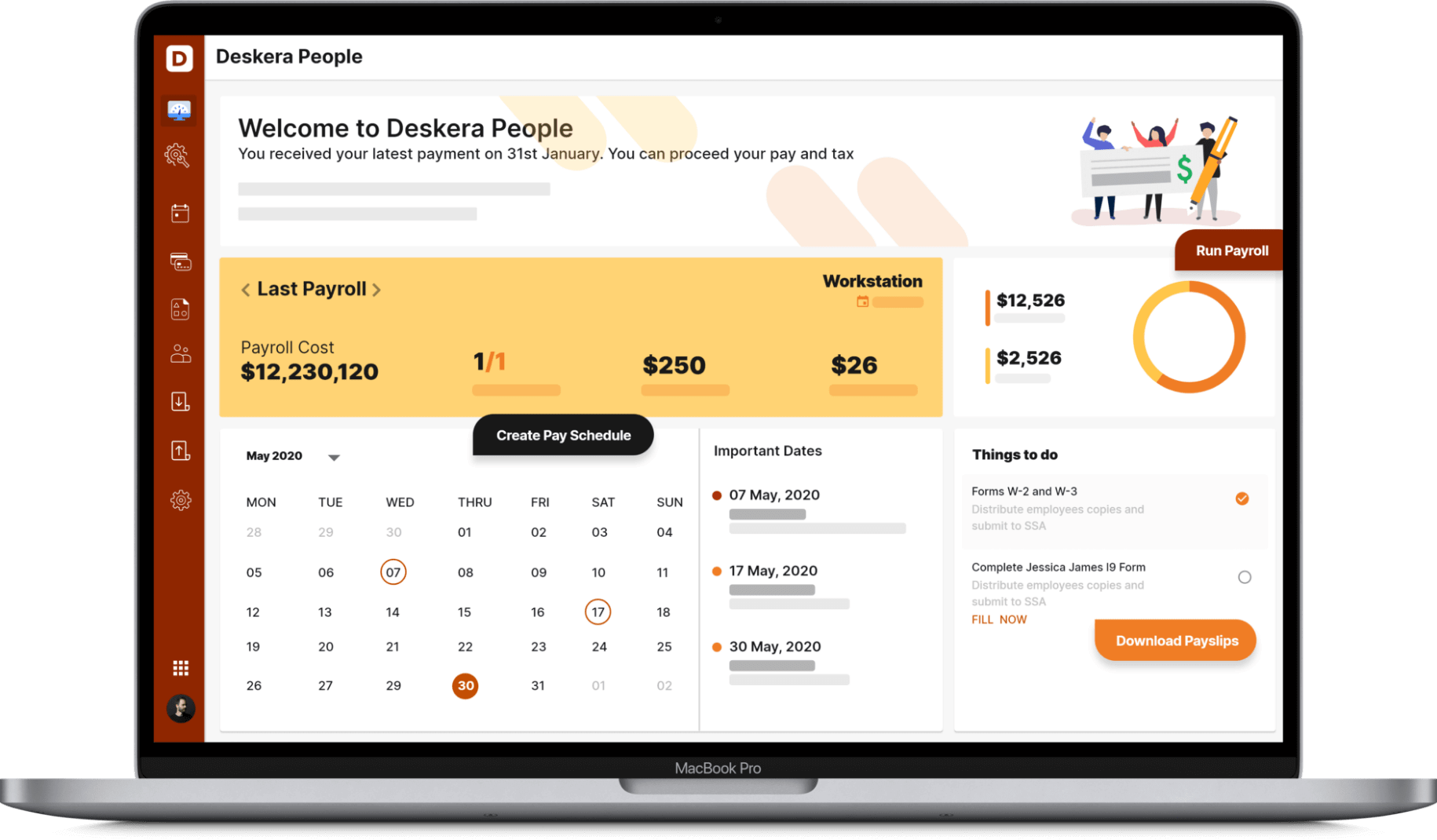

With Deskera People, you will be able to automate your payroll as well as assign custom pay components to your employees based on your requirements. These components will then be identified by Deskera People, and the wage calculations will be done accordingly.

With an employee grid, you would also be able to view essential information of your employees at a glance. The grid also comes with sorting options, letting you access the information you are looking for more conveniently and faster.

Additionally, by using Deskera People, employees will be able to view their payslips, apply for time off, and file their expenses and claims online.

Key Takeaways

The work-share programs offered by several states of the USA are aimed at reducing employees’ layoffs by giving an alternative to employers to reduce the working hours of the employees, with the reduction in wages being partially covered by unemployment insurance benefits.

This helps in retaining top talents, reduces the costs of re-hiring and re-training of new employees, brings stability in the employee market, and saves them from financial distress, which will have long-term detrimental consequences on the entire economy.

Being able to navigate through times of temporary economic downturns with the aid of these work-share programs and thereby avoid layoffs will help the employer in maintaining its goodwill in the society. Such goodwill will be vital for customer retention, customer loyalty, higher revenues and net profit ratios, and even in having a successful IPO.

Another benefit of this stability is that it will help in having healthy financial statements like profit and loss statements and balance sheet and improving business metrics as well as financial KPIs.

However, the employer will have to meet the state-specific eligibility criteria to be able to participate in the work-share program and be able to avail its benefits. These criteria involve the percentage of reduction in working hours, the minimum number of participating affected employees, time duration worked by the employee, as well as being in good standing with the tax department and unemployment tax department of the state.

To successfully and efficiently navigate the payroll of employees in these situations, Deskera People will be of huge assistance.

Related Articles