You’re probably thinking: unearned revenue has to be a revenue account, right?

The word revenue is in it!

Well, although that’s a fair assumption, unearned revenue is in fact considered a current liability. It’s recorded under a business’ balance sheet, along with other types of liabilities, assets, and owner’s equity.

But what makes unearned revenue a liability? How is this liability account recorded?

That’s exactly what we will be answering in this guide, along with everything else you need to know about unearned revenue in accounting.

Read on to learn about:

- What Is Unearned Revenue?

- What Type of Account Is Unearned Revenue?

- How to Record Unearned Revenue

- Go Digital with Accounting Software

- Unearned Revenue FAQ

What Is Unearned Revenue?

Plenty of businesses offer services that their clients have to pay in advance for, such as rent, prepaid insurance, newspaper subscriptions, annual gym memberships, and so on.

In accounting, these prepayments are recorded as unearned revenue.

By definition, unearned revenue (or deferred revenue) is cash received from a customer for a service that hasn’t been provided yet. So, this profit is labeled as “unearned” since it is still an obligation for the business.

Now, keep in mind that the recording of unearned revenue is only valid for businesses that use the accrual basis of accounting.

In accrual accounting, businesses must comply with several accounting principles that dictate when bookkeeping is done.

One of these principles relates to revenue recognition and states that revenue should be recorded when it is earned, rather than when cash is received.

With cash basis (the alternative accounting method to accrual) on the other hand, unearned revenue doesn’t exist as an account because revenue is only recorded once cash flows in.

What Type of Account Is Unearned Revenue?

As we previously mentioned, unearned revenue is an obligation that the business is yet to settle.

If a prepaid good or service becomes undeliverable (or even if the client cancels their order) the business must pay the client back as it is liable for the delivery or completion of that good or service.

That’s why unearned revenue is considered a current liability account under the balance sheet.

Deferred revenue is reported as a current liability and not a long-term one as prepaid goods and services are typically delivered (or cancelled) within one fiscal year.

If that’s not the case and the service has a delivery date that exceeds 12 months, then unearned revenue is listed under long-term liabilities.

Other liabilities in accounting include accounts payable, bank account overdrafts, accrued expenses, income tax payable, capital leases, and so on.

To learn more about the different accounts in financial accounting and how to record them, head over to our chart of accounts guide.

How to Record Unearned Revenue

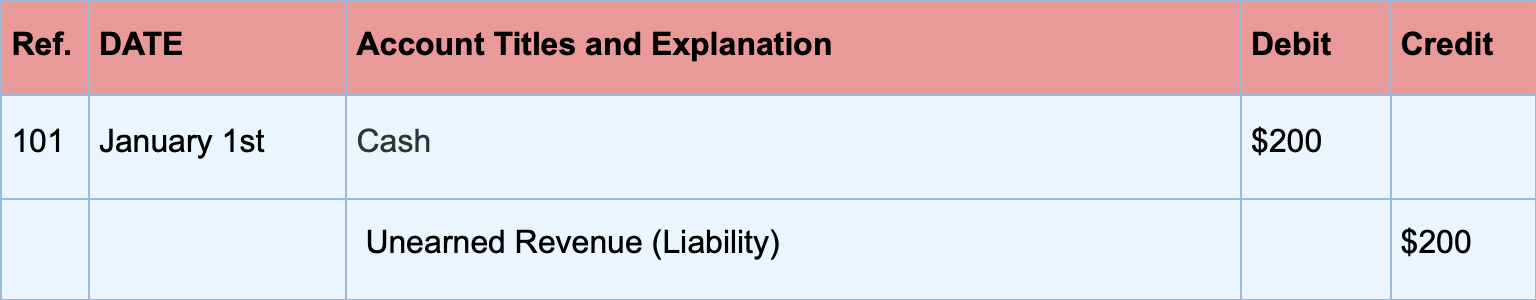

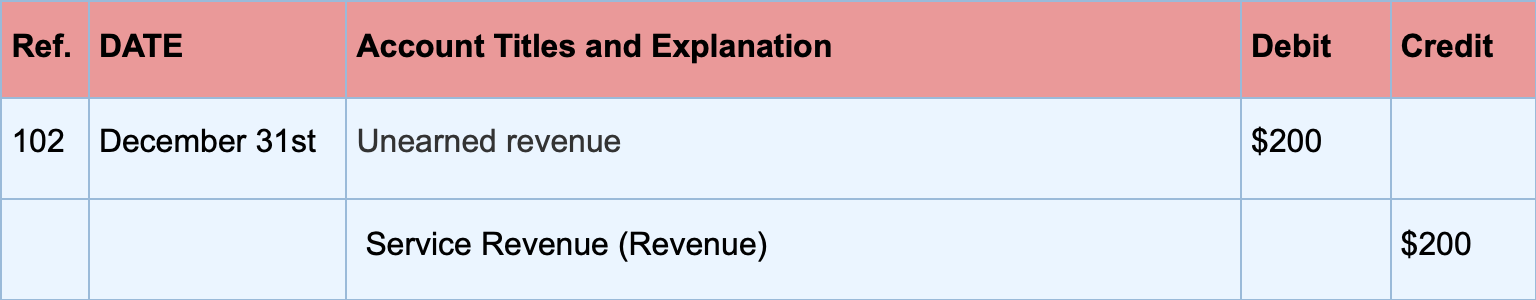

To record unearned revenue, you need to make two journal entries: one to recognize the prepayment, and another to convert it into service revenue as it is earned.

Prepayments are recorded as a credit to Unearned Revenue and a debit to the Cash account.

Then, once the order or service is completed, an adjusting entry is made which debits Unearned Revenue and credits Service Revenue (or Sales Revenue).

To understand what that means, let’s take a look at an example:

A customer pays $200 for an annual gym membership from company XYZ. At this point in time, the revenue is recognized as a liability through the following journal entry:

After the membership period ends, unearned revenue is converted into service revenue with this adjusting entry:

Go Digital with Accounting Software

With accounting software like Deskera, you can automate and streamline most tasks in your accounting cycle, gaining more clarity and control in a matter of seconds!

Deskera is an award-winning cloud-based accounting software that integrates directly with your business bank account. Its many features include automated journal entries, invoice creation and scheduling, issuing credit notes, financial reports, inventory management, advanced CRM pipelines, helpdesk, and even a Human Resources Information System.

Available on desktop, Android and iOS devices!

Still not convinced? Experience the powerful tools of Deskera with a free trial.

Sign up today and say hello to the future of accounting.

Unearned Revenue FAQ

#1. How Do I Calculate Unearned Revenue?

Unearned revenue is pretty straightforward to calculate.

It is the sum of all customer deposits and/or advance payments for products and services. It increases with every additional payment clients make and decreases as time passes and that revenue becomes earned.

#2. What’s the Difference Between Unearned Revenue and Deferred Expenses?

Deferred expenses, or prepaid expenses, are payments that you make in advance, for services such as insurance coverage - you pay in advance for a cost you have yet to incur.

Conversely, unearned revenue refers to cash received from a customer that hasn’t been earned yet.

Key Takeaways

And that’s a wrap!

Remember to record your unearned revenue as a liability so you have a clear picture of how much profit your business is making.

Related Articles