When managing a business, you have to pay for some assets in advance, such as rent or insurance. In the accounting cycle, these advance payments are recorded as prepaid expenses.

Now, you probably have a few questions.

Are prepaid expenses an asset or expense account? How do I record a prepaid expense in my accounting books?

This guide has the information you’re looking for and provides examples suited for small businesses.

Read on for an in-depth look at the following topics:

- What Are Prepaid Expenses?

- Journal Entries for Prepaid Expenses

- Examples of Prepaid Expenses

- Automate Prepaid Expenses with Accounting Software

- Prepaid Expenses FAQ

What Are Prepaid Expenses?

A prepaid expense (also known as prepayment) is a payment made in advance for an expense that hasn’t occurred yet.

But what does it mean for an expense to occur?

On the accrual basis of accounting, expenses get recognized when they are used, consumed, utilized, or have expired, not when they get made.

So, prepaid expenses are payments for purchases that will be consumed throughout two or more accounting periods. An accounting period can be a month, a quarter, or a full fiscal year.

These payments in advance can be for equipment, supplies, rent, insurance, and anything else the business pays for before using it.

What Type of Account is a Prepaid Expense?

You may be thinking: a prepaid expense is an expense account, right? It’s in the name!

That’s a fair assumption, but as we mentioned, expenses are not recognized when you pay for them, but when they get used.

That’s why prepaid expenses are first recorded as assets in the balance sheet.

As the asset value starts to decrease, the prepaid expense is removed from the balance sheet and expensed in the income statement.

In simpler terms, prepaid expenses are assets that turn into expenses as their value drops. This recognition of expenses is done through adjusting entries.

We’ll go into more detail about adjusting entries as we go along, but first, let’s check out how to make journal entries for prepaid expenses.

Journal Entries for Prepaid Expenses

To make a journal entry, you first need to understand the concept of double-entry bookkeeping and debits and credits.

In double-entry bookkeeping, every transaction affects two accounts equally at the same time, where one account is debited and the other is credited.

For prepaid expenses, the two main accounts you’ll need to focus on are assets and expenses. These accounts are increased by debits and decreased by credits.

Now, this might seem a bit confusing to grasp, so let’s check out an example.

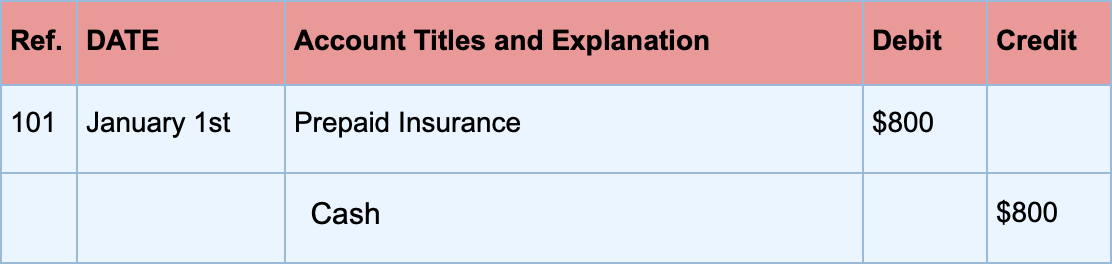

Let’s assume your business purchases insurance for 8 months for $800. To create the journal entry for this transaction, first, you have to debit the Prepaid Insurance account for $800.

Why? Because prepaid insurance is an asset account, and as we mentioned, assets are increased by debits.

Then, to keep the transaction balanced, you have to credit Cash, since it decreases, for $800.

Here’s how the journal entry should look like:

Want to learn more about the different types of accounts that come in useful for today’s small business? Head over to our guide on the chart of accounts.

Adjusting Entries for Prepaid Expenses

Adjusting entries are journal entries necessary in order to convert assets into expenses.

Keep in mind that adjusting entries do not record any new business transactions. They just adjust the accounts so that expenses are recognized at the time they incur.

To illustrate, let’s assume a construction company purchases $10,000 worth of office supplies in January. As time goes by and the supplies get used, you have to make adjusting entries on your financial statements to convert these supplies into an expense.

Now, it would be ridiculous to make an adjusting entry every time an employee sits on their office chair or uses the paper shredder.

Instead, you can come up with an estimate of how much supplies are assumed to have been used at the end of each month (or year, depending on the type of supply).

Depreciation of a Prepaid Expense

We mentioned that in order to convert an asset into an expense you have to estimate how much that asset depreciates over time.

In accounting, this estimate is known as depreciation.

The most commonly used formula businesses use to calculate their depreciation is the straight-line method:

Depreciation = Cost of the asset / estimated useful life

And again, depreciation remains an estimate, because typically you can’t know with certainty the useful lifespan of supplies and equipment that are relevant to your business.

Examples of Prepaid Expenses

#1. Prepaid Insurance Example

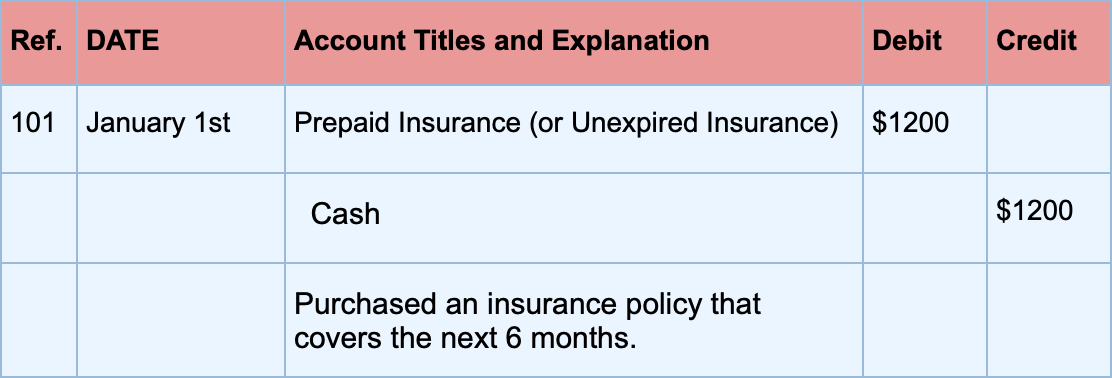

Company XYZ purchases a 6-month insurance policy for $1200 at the beginning of the year. This prepaid expense is first recorded as an asset like this:

Since the insurance is valid for 6 months, then the corresponding expense for each month would be:

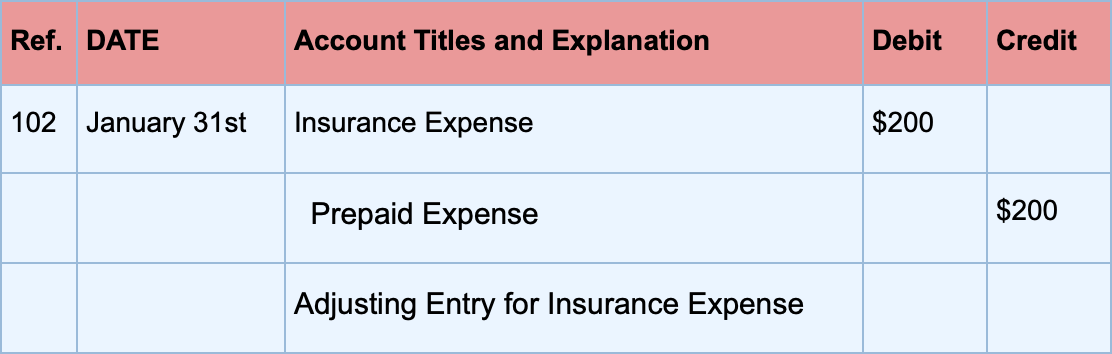

$1200 / 6 months = $200 per month

So, at the end of January, and for the next 6 months, there will be an adjusting entry as shown below:

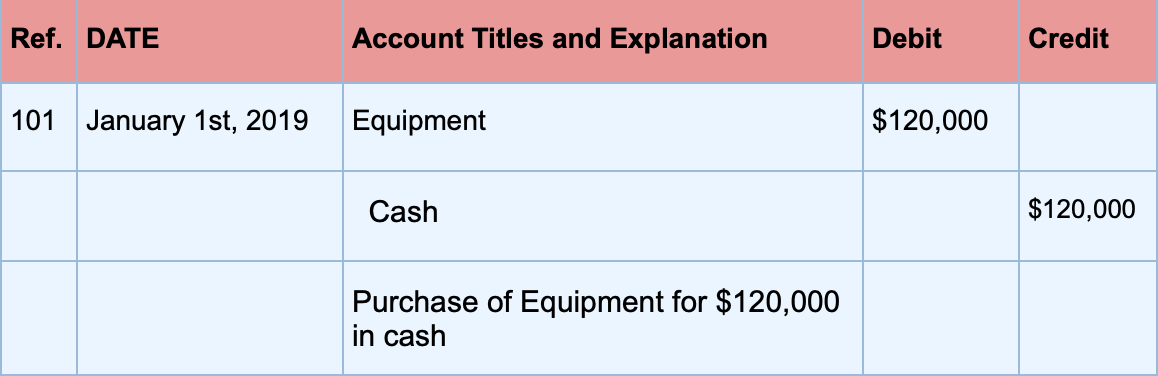

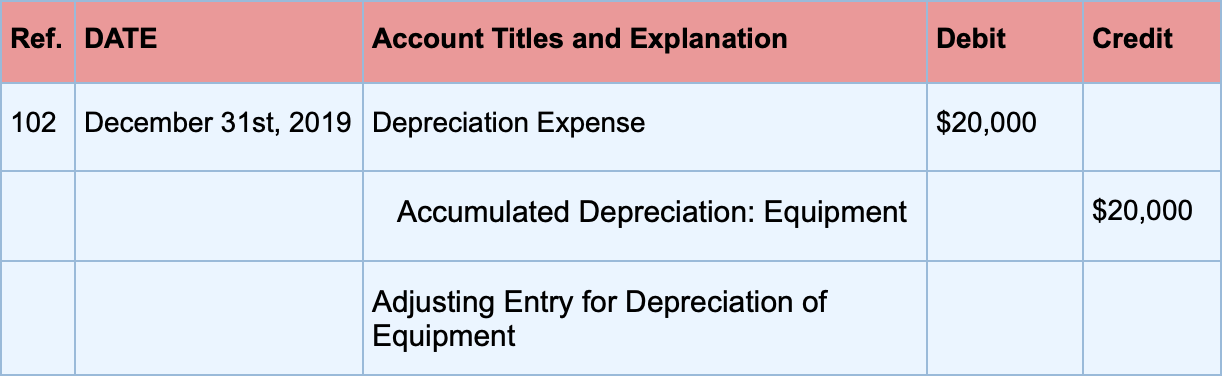

#2. Depreciation Example

Company XYZ buys all of its equipment for $120,000 at the start of the business, with an estimated life of 6 years.

First, the prepayment for these pieces of equipment is recorded as an asset:

With the straight-line method, the business can figure out how much the equipment will have depreciated at the end of each year.

$120,000 / 6 years = $20,000 per year

So, the adjusting entry at the end of the year would be:

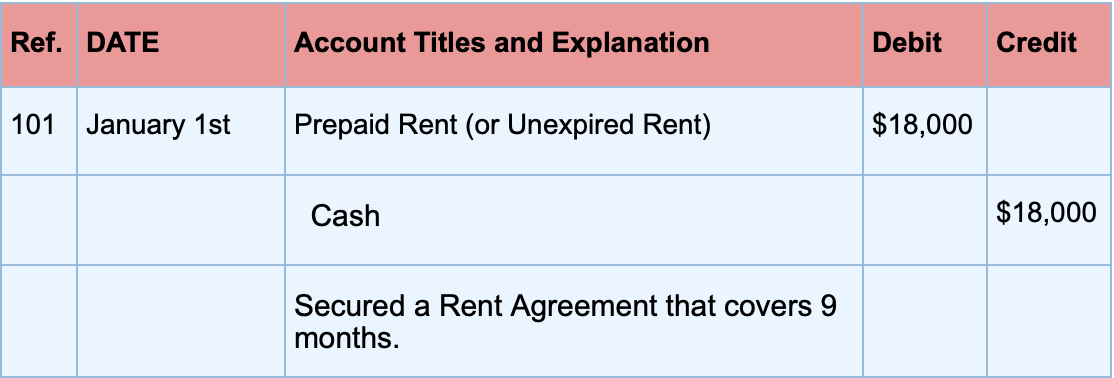

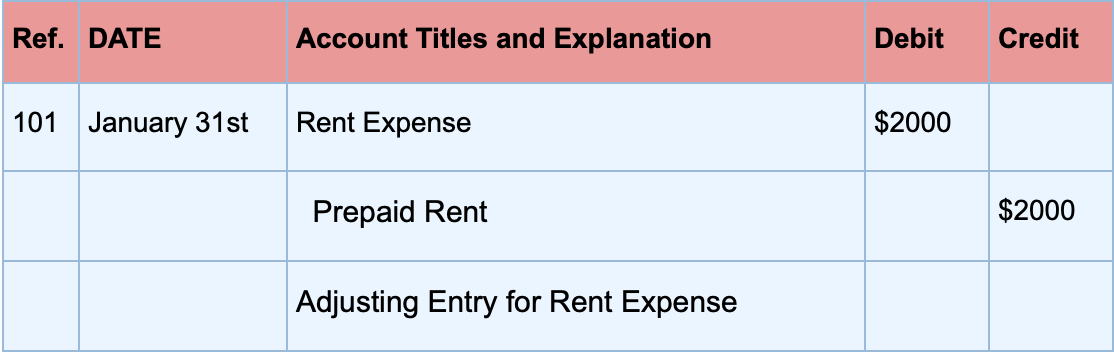

#3. Prepaid Rent Example

Company XYZ secures a 9-month rent agreement in January for $18,000. The journal entry for this prepayment is:

Since the rent agreement covers a 9-month accounting period, the corresponding expense for each month would be:

$18,000 / 9 months = $2000 per month

The adjusting entry at the end of January would look like this:

Want to learn more about recording financial transactions and doing accounting for your small business? Read our comprehensive guide to small business accounting.

Automate Prepaid Expenses with Accounting Software

As a small business owner, you probably don’t have time to manually adjust your accounts or worry about recording prepaid expenses.

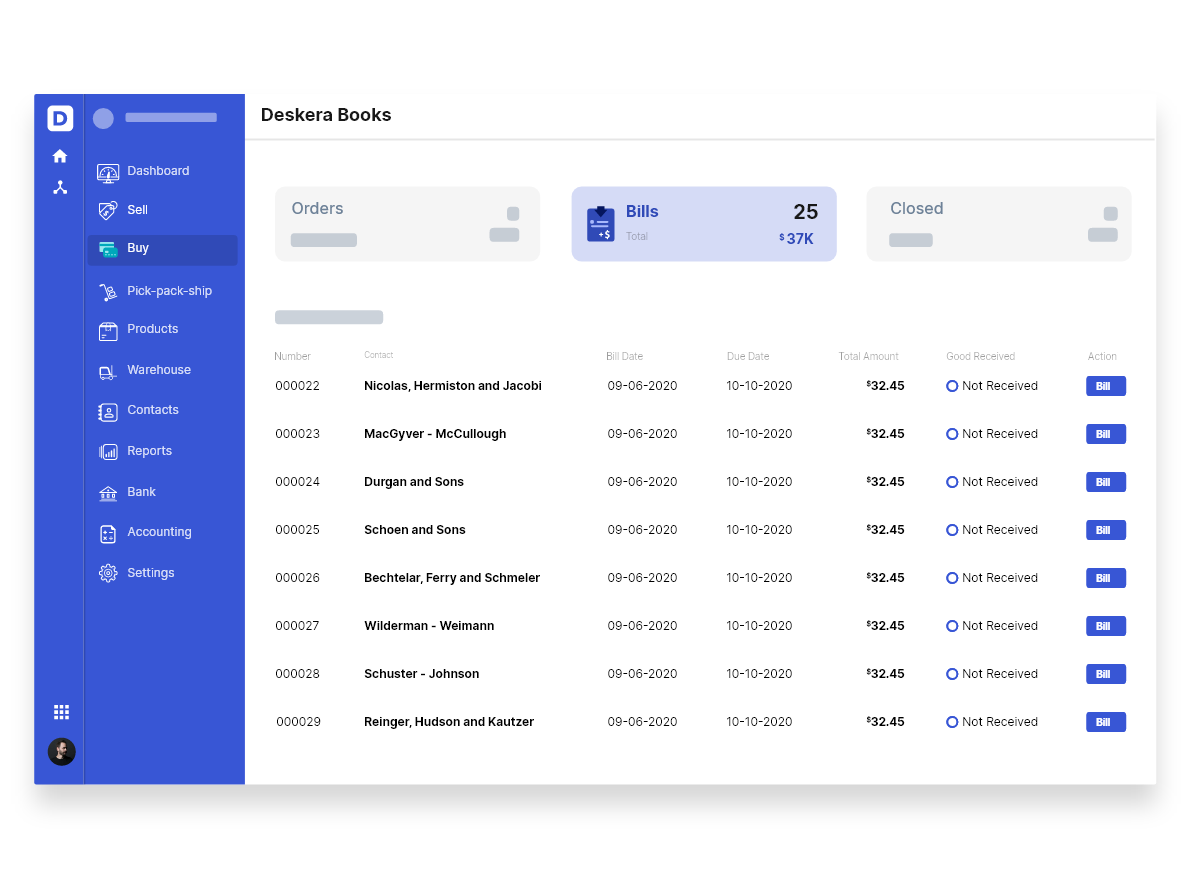

That’s why most businesses nowadays use online accounting systems instead, as they help streamline accounting and make managing finances twice as easy.

Want to give this a go for your business? Using accounting software like Deskera is as simple as -1-2-3.

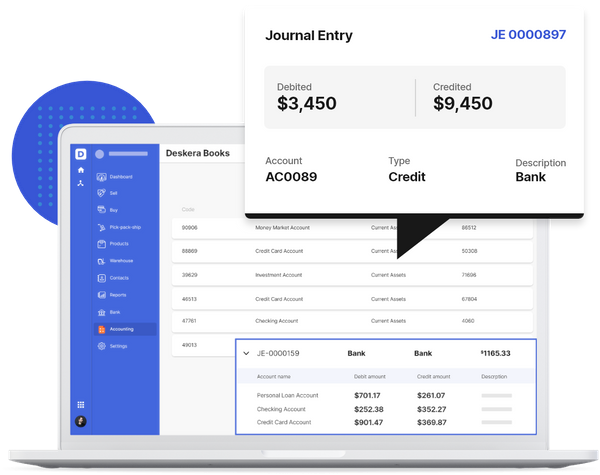

The software directly integrates with your bank account, so whenever a business expense is made, the appropriate journal entry is automatically created.

The entry is mapped to the respective accounts, which are debited and credited accordingly.

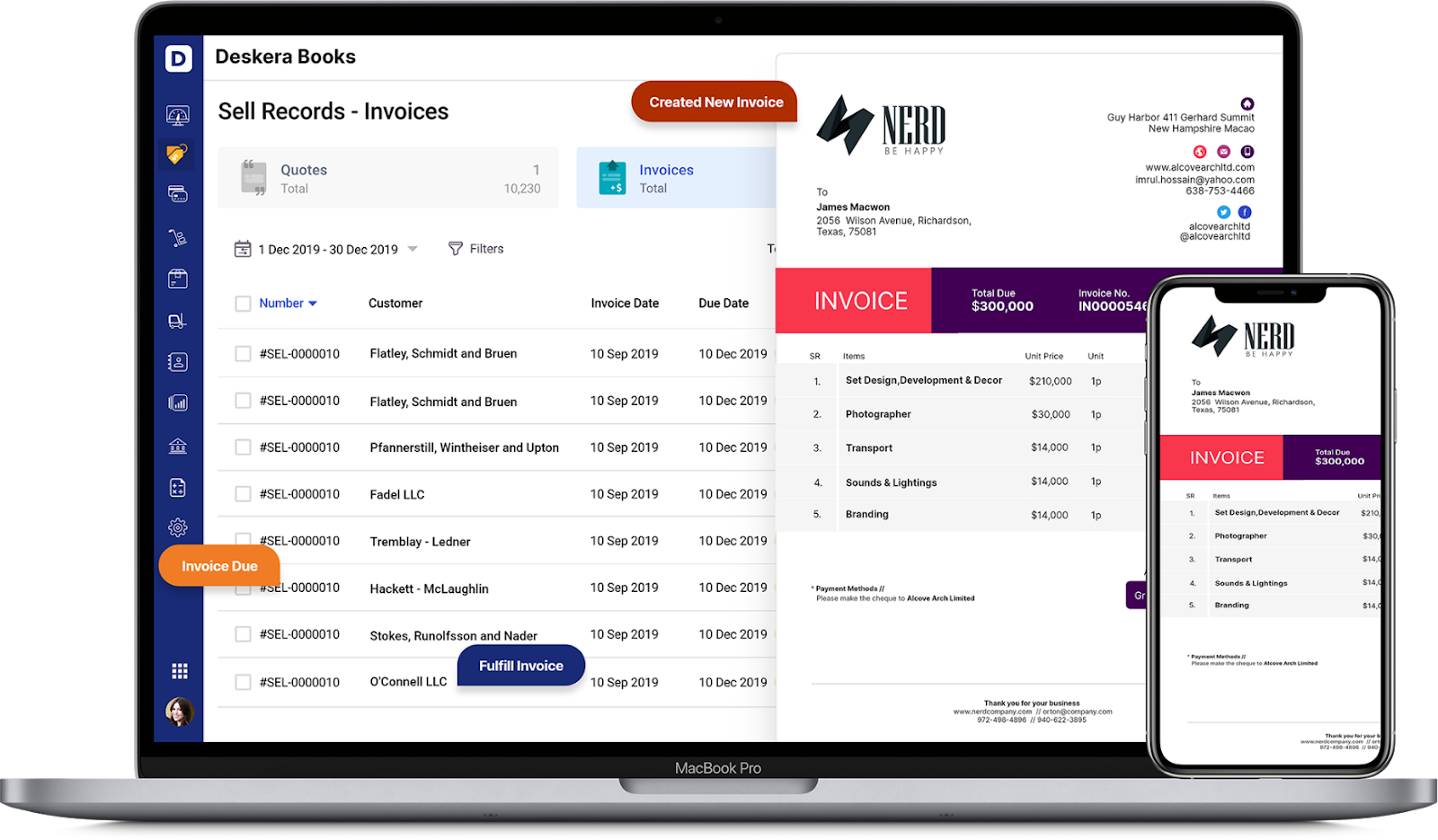

And that’s just the tip of the iceberg - the software also allows you to create invoices and share them with your clients with just a few clicks by using the Deskera Invoice Generator.

The document generator allows you to customize over 100 professional templates with your preferred colors, fonts, signature, business logo, and more.

You can also set up recurring payments, request advance deposits, and make your invoice payments, all in one place!

And the best part? You can access the software anytime, anywhere, using the Deskera mobile app.

But don’t just take out word for it - try the software out yourself right now with a free trial. No credit card details needed!

Prepaid Expenses FAQ

#1. Can I Record Prepaid Expenses in Cash-Basis of Accounting?

No, prepaid expenses can’t be recorded on the cash-basis of accounting.

Prepaid expenses are only recorded on the accrual basis of accounting because this method uses the matching principle, which indicates that revenues and expenses get recognized at the same time.

While the cash-basis records revenue when it is received, and cash when it is paid.

#2. Is a Down Payment a Prepaid Expense?

No, a down payment isn’t exactly a prepaid expense.

A prepaid expense means that you are paying the full amount for a product or service you haven’t received yet.

While a down payment is a partial payment for a certain purchase, that only represents a percentage of the full amount due. A down payment is also usually part of obtaining a loan.

#3. Can You Accrue a Prepaid Expense?

No, you can’t accrue a prepaid expense.

Accrued expenses are the opposite of prepaid expenses. Prepaid expenses are recognized as assets, while accrued expenses represent liabilities.

#4. What Are the Disadvantages of Making Prepaid Expenses?

Paying in full for a service can sometimes come with the risk of it not being delivered as promised.

If that happens, it can be difficult to get in touch with the beneficiary and ask them to return the payment.

#5. What Other Assets Besides Prepaid Expenses are Included in the Balance Sheet?

Besides prepaid expenses, a balance sheet will usually involve:

- Cash the business owns in their business bank account

- Accounts receivable

- Notes receivable

- Inventory

#6. What is the Difference Between a Prepaid Expense and Prepaid Revenue?

When a business pays for goods and services in advance, that payment is considered a prepaid expense, which is an asset.

And when a business gets paid before providing a product or service, we record that income as prepaid revenue, under liabilities.

Both of these accounts go on the balance sheet.

Key Takeaways

And that’s a wrap on our prepaid expenses guide! We hope you found it useful in understanding how prepayments work.

For a quick recap, let’s check out the main points we’ve covered:

- Prepaid expenses are advance payments for assets that will be consumed over a period of time.

- They include payments for rent, insurance, supplies, equipment, and so on.

- A prepaid expense is an asset account that turns into an expense as the value of the asset decreases.

- To create a journal entry for a prepaid expense, you have to debit the prepaid expense and credit the cash account with the appropriate amount of the expense.

- To convert assets into expenses, you need to make adjusting entries.

- In some cases, the amount of these adjusting entries has to be estimated. This happens because there aren’t always standard amounts to how long a piece of equipment or supply will be of use.

- These estimations are known in accounting as depreciation. The most commonly spread way to calculate depreciation is by dividing the cost of an asset by its estimated useful lifespan.

- To avoid manually handling recording prepaid expenses, you can automate your journal entries with accounting software like Deskera.

Related Articles