Do you know around 16% of the average American’s budget goes to transportation?

Whether you are a newbie or an experienced businessman, you will require a vehicle for business use at some point or the other. No matter buying a vehicle for commercial use is way different than for personal use, it can prove to be a smart move if done the right way. There are a few things that can be considered while buying a vehicle for a small business. Let’s take a look in this article:

Table of Contents

- Should you Buy a Used or New Vehicle?

- How Should you Buy a Vehicle for your Small Business?

- Should you Buy or Lease Vehicles for your Small Business?

- Who Can Own the Company Vehicles?

- Should you Track your Company Vehicles?

Should you Buy a Used or New Vehicle?

Now the question arises whether you should buy a used or new vehicle. Let’s take a look at the advantages and disadvantages of buying a new vehicle and a used vehicle:

New Vehicle Advantages

One of the most important benefits of buying a new vehicle for a small business is that it includes a warranty. Having your own vehicle under warranty saves you the hassles of repairs. This is because new vehicles require fewer repairs as compared to old vehicles, thereby reducing the maintenance costs.

Since a new vehicle is equipped with new technology, your business can benefit a lot from it. For example, if you purchase a new car, it will have better gas mileage and lower emissions, thereby allowing you to save money. You can even opt for a hybrid or electric car, this can further lower your expenses.

There are some dealers who provide new vehicles at affordable prices by offering competitive financing. No matter write-offs are available for new vehicles, you will require an upfront investment or down payment in order to purchase a car for business use.

New Vehicle Disadvantages

One of the major disadvantages of buying a new vehicle is depreciation. The worth of the vehicle reduces when it is driven a lot. According to Carfax data, a car reduces 10% of its value in the first month and then keeps on depreciating.

Another disadvantage is the cost. A new vehicle is quite expensive as compared to the used one. You will have to shell out a few dollars in order to buy a new vehicle for your small business. Also, buying a new car would mean increased taxes and insurance rates. In case you have specific requirements like cleaning vans or service trucks, then you will have to bear more costs. But you can save money on car insurance with no deposit necessary by comparing quotes from multiple companies.

Used Vehicle Advantages

One of the most important benefits of buying a used vehicle is cost savings. There are some situations when you can even sell your vehicle for nearly the same price you purchased it for. In case you don’t have the money to purchase the vehicle, you can opt for a loan.

Another advantage of buying a used vehicle is that you can save a lot on auto insurance. Depending on the type of vehicle and the number of employees using the vehicle, insurance rates are lower for used vehicles. The rates are lower usually for used cars and trucks. If there is a constraint on the cash flow, purchasing a used vehicle is a better option.

Always remember to go through consumer reports while buying a used vehicle. You can even check out the consumer insight platforms to resolve your queries regarding used vehicles.

Used Vehicle Disadvantages

As compared to new vehicles, used vehicles are less reliable and can lead to increased maintenance costs. Frequent breakdowns and repair issues can increase your hassles, which can further lead to cash flow delays.

When buying a used vehicle, you may have to compromise on the color and features of the vehicle. For some businesses, this is not an issue, while some businesses require special vehicles that meet their needs. This can be challenging in the case of a used vehicle. Some businesses do require modern tools such as fleet tracking software, which is generally not present in a used vehicle.

When you buy a new vehicle, you may not be aware of its full history. This can result in higher operating expenses.

Make sure you always inspect a used vehicle before buying it. You can even check whether services such as Certified Pre-Owned (CPO) are available in your area. Such services can help to examine a used vehicle and thus provide business owners with more satisfaction and peace of mind.

It's crucial to find dependable sellers who guarantee quality and value. One practical choice for small businesses prioritizing cost efficiency without compromising reliability is investing in reliable used day cab trucks. These trucks can serve varied transportation needs while ensuring substantial savings.

How Should you Buy a Vehicle for your Small Business?

In the previous section, we discussed whether you should buy new or used vehicles. But do you know the procedure to buy a vehicle for your small business? Here’s a look at the steps given below:

Register your Company as an LLC or other Business Entity

Prior to buying a vehicle in your company’s name, you need to ensure that your company is registered with the state as a separate business entity besides you. In case you work as a sole trader or proprietor, you can still buy the vehicle for business use. However, in such cases, you will be personally liable for the vehicle.

In case you want to buy the vehicle with cash, you will require a formal business structure in order to put the vehicle in the name of the business.

If you are a sole proprietor and have your business name registered with the state as a "dba", then you can purchase and register a vehicle in that name. However, in such cases, you will be personally responsible for that vehicle.

An Employer Identification Number (EIN) is Required From the IRS

Even though you don’t have any employees, you will still require an EIN as it identifies your business legally for tax and financial purposes. An EIN will be required to open a bank account in the name of your business where you can further establish credit.

Open Business Bank Accounts

Once you get your EIN, you can easily set up bank accounts for your business. You need to research thoroughly in order to find out the bank that best suits your requirements.

Based on the type of your business, you would require different bank accounts. At least one operational account will be required. In case you have employees, you will require a separate payroll account. A separate sales tax account will be required for retail sales.

Improve your Credit Score

You can apply for business credit using your business name and EIN. You can begin by applying for a basic credit card. In case you are a contractor or a supplier, you can easily get credit from suppliers. Once you have credit, make sure you do all the payments on time. This way you will be able to improve your credit score. Thus, you can easily purchase a vehicle in your company’s name this way on favorable terms. However, this may take up to 2 or 3 years for the process of building up the credit.

Look for a Good Dealer or a Manufacturer

Once you have built your business credit, the next step is to make the purchase. For this, you need to find out a good local dealer who has ample experience in his field. You can even seek recommendations from your family or friends regarding this respect. In case you require several vehicles for your fleet, you can even directly contact the manufacturer for fleet purchases.

Consider Financing Options

In case you are not willing to pay cash for your vehicle, check out the financing options available. Do some research and grab the best possible deal. In case, you don’t find a good deal, you can even opt for a lease.

Get Insurance

If you plan to buy the vehicle solely for business purposes, don’t forget to buy optimal commercial auto insurance.

Prepare the Documents

Make sure you make the agreement using your business name and EIN, even though you are personally signing the agreement. Don’t forget to include the business title while signing the documents.

Registering your Vehicle

There are various steps that you need to follow to register your vehicle:

- Complete the Tag and Title Application

If you want to register your vehicle with the state, you need to complete the tag and title application that each state has. To complete this, you will have to use your business name and EIN to get your vehicle registered under the company’s name. the application will be available at your local DMV

- Collect Purchase Documents and Proof of Identity

Once the tag and title application are submitted, you'll require documents to prove the owner of the vehicle. For this, you will need a bill of sale, finance agreement, or title. You'll also require a driver’s license issued by the state. The rules of every state vary. Some states will ask for a driver’s license for all the business owners. For example, in case you own an LLC with 3 other members, driver’s licenses will be required of all the 4 members. Proof of insurance should also be given in order to get the vehicle registered. You are also required to provide proof of your business. For this, a copy of your business license will be required. There are various other documents that you may require including a partnership agreement, articles of incorporation or organization, employer tax registration, etc. provide the documents according to your state laws.

- Submit the Application to DMV

Make sure you submit the application and documents to the DMV (Department of Motor Vehicles). Don’t forget to keep a copy of the documents with yourself before submission. Remember that you will have to pay a fee for title and registration. You may even have to pay taxes. However, you need to check with your DMV about the amount that needs to be paid and the acceptable modes of payment.

- Inspect your Vehicle

There are some states and cities that require safety inspections for all registered vehicles. Only then tags will be issued. Do check with your DMV regarding these laws.

- Receive your Tags and Registration Papers

Once the application is received and processed, you will get your tags and registration through the mail. Keep a record of the tag number as it can be helpful to conduct another inspection and renew your registration. Once this is done, you will have to pay the inspection fees using a business bank account. Try to use your business bank account to clear all vehicle expenses. This will help to segregate your personal and business expenses. However, if your employees are paying these expenses, you need to reimburse the money. Always remember to keep receipts of vehicle expenses, including insurance, maintenance costs, and fuel as these expenses are tax-deductible.

Should you Buy or Lease Vehicles for your Small Business?

Whether you should buy or lease vehicles depends on various factors. Leasing is a good option in case your fleet has a higher turnover rate and requires maintenance in various locations whereas you should consider buying if your fleet has a lower turnover rate, experiences frequent wear and tear, and you don’t prefer vehicle replacement flexibility.

Lease agreements can be difficult to understand as the language is not simple. An accountant can help you in this regard. He will help you understand the financing options and know about the hidden fees. Seeking help from an accountant is a good idea, but there are some things to consider while leasing a business vehicle:

The Manufacturer’s Suggested Retail Price (MSRP)

The price on the sticker of the vehicle is known as MSRP. It helps to determine the initial balance of your lease. This term is quite important while comparing the costs of the vehicles as lease payments are based on this.

Residual Value

The term describes the value of the vehicle at the end of the lease. If you are looking for the best-priced lease, you will have to check the residual value. The residual value is lower for long-term leases. This is because when you return the vehicle, it will be older.

Estimated Annual Mileage

If you want to lease company vehicles, you need to understand there is a mileage limit that you cannot exceed. In case you already know that the fleet of vehicles you require will exceed the mileage limit, then you will have to opt for a high mileage lease for your business. You can even track the miles on the odometer so that you remain within the limit.

Interest, Taxes, and Fees

Make sure you consider the interest and taxes on lease payments. Such type of fees adds up quickly and are often written in the small print on lease agreements. Even though you can negotiate the charges related to leasing, the interest rates are usually fixed. Down payment, security deposit, and administrative fees are some other types of fees that you need to consider while leasing.

Deducting Lease Costs

In the cases of large business purchases, most people consider the tax deductions. You can write off your company’s leased vehicle in two ways, standard mileage or the actual expense method. In case you use the standard mileage rate, you won’t be able to switch to the actual expense method in later years.

Who Can Own the Company Vehicles?

If you are using a vehicle for business, it can be owned by either the business, the business owner, or the employee. Based on the ownership status of the vehicle, tax breaks can vary. You can contact your accountant to check out which ownership option works best for you.

Should you Track your Company Vehicles?

Yes, you should track your company vehicles once you have purchased them. Tracking can be done using GPS technology to enhance driver accountability and provide outstanding customer service to your clients.

How Deskera Can Assist You?

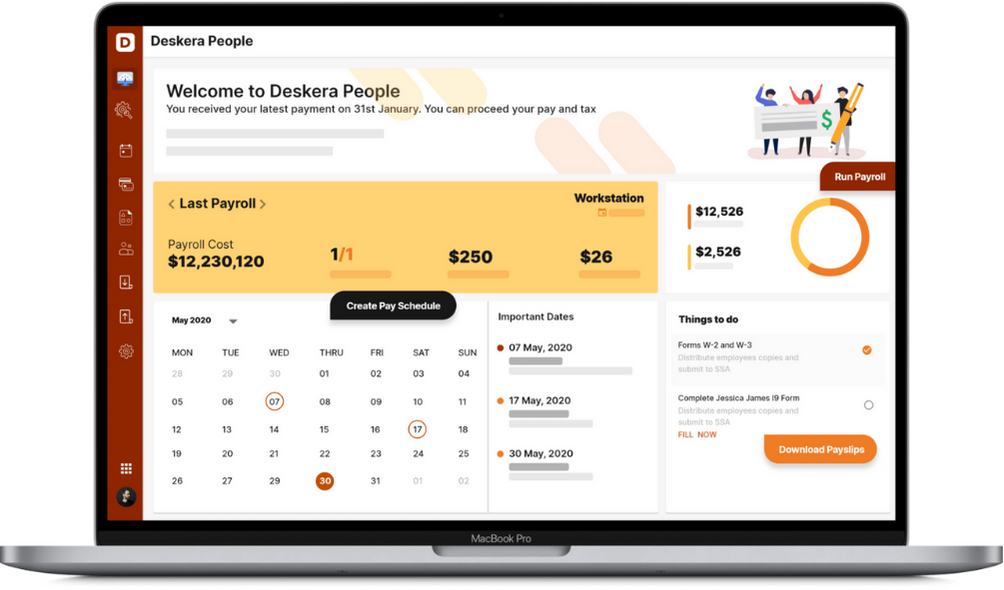

As a business, you must be diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Buying a vehicle for a small business is not an easy task. There are various things that need to be considered before buying a vehicle for a small business

- You can either buy a used vehicle or a new vehicle, depending upon your specific business requirements

- One of the most important benefits of buying a new vehicle is that it includes a warranty. This reduces the hassles of costly repairs and maintenance

- Also, a new vehicle is equipped with the latest technology unlike a used vehicle

- Even though buying a new vehicle has a lot of advantages, there are a few disadvantages as well

- One of the main disadvantages of buying a new vehicle is depreciation. The value of the vehicle reduces considerably after it has been used. Also, the initial cost of the new vehicle is quite high as compared to a used vehicle

- One of the most important benefits of buying a used vehicle is cost savings. There are some situations when you can even sell your vehicle for nearly the same price you purchased it for

- On the other hand, a used vehicle has disadvantages as well. As compared to new vehicles, used vehicles are less reliable and can lead to increased maintenance costs

- There are various steps to follow in order to buy a vehicle for your small business

- You need to register your company as an LLC or other business entity, then you are required to get an EIN from the IRS. Once this is done, you need to open a business bank account. Then you need to follow the steps to make the purchase

- Once you follow the steps involved in buying the vehicle, you need to get your vehicle registered

- In case you are thinking of leasing the vehicle, there are various factors to consider such as the Manufacturer’s Suggested Retail Price (MSRP), residual value, estimated annual mileage, interest, taxes, and fees, lease costs, etc.

- If you are using a vehicle for business, it can be owned by either the business, the business owner, or the employee

- You should track your company vehicles once you have purchased them

Related Articles