During this pandemic, what was something every employee across the globe expecting from the State or their Employers? Yes, we are talking about the Employee benefits offered by various states to their employees.

More than 14 million workers have built professions in Texas, from farmlands and oil derricks to the developing tech center points in Austin. State regulation expects that businesses give a few fundamental advantages, like sick leaves and paid vacations, disability insurance, health inclusion, and unemployment benefits.

Following are the topics included in this guide:

- Workers’ Compensation

- Health care benefits

- Disability insurance

- Retirement benefits

- Unemployment insurance

- Child care benefits

- Paid time off

- COVID-19 Stimulus Checks for Individuals

- Benefits offered by Texas Workers Commission

Workers’ Compensation

The Texas Department of Insurance supervises worker’s compensation administration, yet, it doesn't pay benefits which insurance carriers do. Besides, the actual state doesn't give any compensation or health advantages to workers with business-related wounds. Assuming you want benefits, your managers should have worker's compensation insurance.

COVID-19 effect on Workers’ Compensation in Texas

Directly following the COVID-19 pandemic, the state Division of Workers' Compensation (DWC) has rolled out a few functional improvements to make worker’s payments simpler for residents. A new notice declared the accompanying changes, among other significant stages for now:

- DWC filings that required payment with a money order no longer need one.

- Filings and consent orders that regularly require signatures can be electronically endorsed without sworn explanations, affirmations, or authorization.

- New claims revealing codes have been executed.

Texas laborers' compensation takes into consideration charging and repayment of some telemedicine and telehealth services in lieu of on-site medical care.

Health care benefits

Similarly, with paid off, Texas doesn't expect managers to give group health care coverage to workers, however, most businesses actually offer the benefit. Assuming they do, state insurance laws command how that inclusion is proposed to workers, for example, who is qualified, assuming dependents are qualified, and when health care coverage benefits should start for recently enrolled workers.

But, managers can select to self-fund worker medical advantages. Rather than depending on an outsider to give coverage, a business can pay for their workers' covered health claims. Texans can likewise get health care coverage under the Affordable Care Act. The government Tax Cuts and Jobs Act endorsed in 2017 wiped out the penalty for people who don't buy health insurance, known as the individual mandate.

In spite of this, it didn't end a business's "shared responsibility" to give medical service. Association health plan rules were made to permit independent ventures in participating states to arrange health care coverage inclusion as a solitary, bigger element. This permits organizations to haggle for lower rates and better coverage because of the enormous number of plan participants across the independent companies haggling together. AHPs are a possibility for Texas organizations.

COVID-19 effect on Health care benefits in Texas

Following the novel COVID, Texas authorities say most state-directed health plans are "forgoing some or all of the cost for buyers" for fundamental testing connected with COVID.

Disability insurance

While private workers don't get disability insurance from the state, public representatives working at the state, county, and civil level-including workers for advanced education and nearby school districts do through the Texas Income Protection Plan given by the Employees Retirement System (ERS) of Texas.

Transient disability gives 66% of a member's month-to-month pay with benefits for as long as five months. Beneficiaries should either involve all their sick leave or hang tight for a 30-day time frame prior to collecting short-term disability. Long haul disability benefits cover 60%, are payable until the member gets back to work or arrives at their maximum benefit period, and are dependent upon a 180-day waiting up period.

People can enlist for disability insurance through an external supplier, however, a customary fee will emerge from their checks each payroll interval. Residents might be qualified for Social Security disability coverage or Supplemental Security Income.

COVID-19 effect on disability insurance in Texas

Since the state to a great extent depends on government programs for people with disabilities, officials have not given a lot of direction as far as changes in handicap insurance due to the COVID emergency.

Retirement benefits

There are as of now no state-ordered prerequisites for employers in Texas to give any kind of retirement plan to representatives. Public representatives are qualified through the ERS with its Texas Employees Group Benefits Program.

Entrepreneurs can give the advantage all alone, however, they should stick to the government Employee Retirement Income Security Act (ERISA) of 1974, which commands that representatives who work somewhere around 1,000 hours in a year be given the choice to join an annuity or retirement plan.

COVID-19 effect on retirement benefits in Texas

Overall similar regulations and necessities actually apply during the COVID-19 emergency.

Unemployment insurance

The Texas Workforce Commission (TWC) directs unemployment benefits, which give transitory relief to qualified Texans who regard themselves as unemployed or managing seriously decreased work hours. The advantage is subsidized by charges gathered from organizations. Unemployment benefits range from $69 each week to $521 each week. Gauge your week after week benefits by visiting the TWC's Unemployment Benefits Estimator.

To apply for unemployment benefits in Texas, you should meet the accompanying necessities:

- Be completely or to some extent unemployed

- Have acquired a base available compensation while working in Texas

- Should not have been given up for any wrongdoing

- Be genuinely and intellectually equipped for getting back to work

- Be accessible for regular work

- Should effectively look for employment

You can document an unemployment guarantee by following these means:

- Make another TWC ID and sign on to the office's Unemployment Benefit Services page.

- Answer an underlying survey to decide if you can keep filing on the web or need to call the TWC telecenter.

- Assuming you're ready to proceed on the web, continue to file your claim by filling in all mentioned data.

Assuming your application is approved by the TWC, you should demand your payment every two weeks. Reserves are delivered on a TWC debit card or through direct deposit. The solicitation can be made on the web or by telephone.

COVID-19 effect on unemployment in Texas

The TWC has stretched out its call center hours to 8 a.m. to 6 p.m. Monday through Friday and 8 a.m. to 5 p.m. on Saturday. The office has likewise updated its media communications framework and is searching out extra staffing to help the interest.

During the emergency, the TWC is deferring its necessity for unemployment beneficiaries to look for work. Moreover, the state is deferring the one-week waiting up period before candidates begin getting payments.

As indicated by the TWC, it requires roughly 21 days for residents to get unemployment benefits from the time they apply. Since Texas Governor Greg Abbott proclaimed COVID-19 a calamity on March 13, 2020, the TWC can backdate a claim to March 8 assuming an individual was unemployed and incapable to file during that time.

On the off chance that an individual expected to file a claim after March 13 and couldn't in view of expanded volume at the TWC, the office will backdate their claim to the Sunday preceding the date they lost their employment.

Alongside the state's standard unemployment benefit, Texans can take advantage of the national government's Pandemic Emergency Unemployment Compensation (PEUC), which gives up to 13 extra long stretches of Unemployment inclusion and $600 more in the week after week benefits. All Texans who fit the bill for unemployment will naturally get the PEUC. This payment might show up independently from the standard unemployment payment.

On the off chance that a resident isn't qualified for the PEUC or normal unemployment, they might be qualified for Pandemic Unemployment Assistance (PUA), which gives as long as 39 weeks of advantages to the people who customarily don't fit the system for unemployment, for example, the independently employed and provisional laborers.

That program begins with unemployment that started on or after January 27 and closures at the latest December 31, 2020.

For employers, COVID-19 has welcomed the Shared Work program, which permits them to decrease week by week work hours by a minimum of 10% and something like 40%, for a minimum of 10% of workers. Managers are then ready to enhance the lost wages with partial unemployment benefits. A business that had to close down because of the pandemic can record a mass unemployment claim for the impacted workers for their benefit.

Notwithstanding the necessities spread out by the state, unemployment benefits in Texas should maintain the Federal Worker Adjustment and Retaining Notification (WARN) Act of 1988. This act requires employers with at least 100 representatives to give a 60-day notice to all workers in case of a layoff or leave of absence.

Child care benefits

Texas offers a child services program that finances costs for low-pay families. Families with kids under 13 years of age can apply for monetary help for child care on the Texas Child Care Solutions site.

Qualification for the monetary help requires the accompanying:

- Children should be younger than 13 years of age;

- Guardians should be working, going to school, or taking an interest in training;

- Guardians are getting public help;

- Guardians are getting or requiring protective services;

- Families are low-pay.

Child care administrations are led through the state's Workforce Solutions office, and qualification necessities shift between service regions. Sometimes, local boards may have a waiting list for sponsored services.

By claiming the Child Tax Credit(CTC), you can decrease how much money you owe on your government charges. How much credit you get depends on your pay and the quantity of qualifying kids you are claiming. Due to the COVID-19 pandemic, the CTC was extended under the American Rescue Plan of 2021.

The IRS prepaid a large portion of the total credit sum in regularly scheduled payments from July to December 2021. Whenever you file your 2021 tax return, you can guarantee the other portion of the absolute CTC.

COVID-19 effect on child care benefits in Texas

Since subsidized child care is given by the state, the TWC has made changes to its strategies to help those families in need. Tracing all the way back to March 1, children can accumulate absences without losing future qualifications or repayments. Labor force development boards can repay suppliers for the full subsidy sum during the crisis, and they can give supplemental installments to suppliers that stay open during the emergency.

Guardians who lose their jobs during this time can get an extended timeline to look for new work while additionally getting child care help. Fundamental laborers will likewise get priority service and admittance to a quicker enlistment process for child care help. The state gauges that around $240 million has been shipped off different child care sheets to assist with financing this drive.

Paid time off

As per the Texas Payday Law, managers are not expected to give paid or unpaid leave. Sick leave or vacation or any installment for un-worked hours is viewed as an incidental advantage and not needed for private-sector organizations. The state picks to let entrepreneurs settle on the choice to offer paid time off. A few urban communities have either passed or ordered laws requiring organizations in their towns to give paid sick leave.

Texas organizations are additionally not expected to pay out any unused paid leave. The federal Family and Medical Leave Act takes into consideration as long as 12 weeks of unpaid, work-protected leave. And, after it's all said and done, that only applies to organizations with at least 50 workers that are "positioned inside 75 miles of the workers" who are taking leave; the worker additionally needs to meet specific qualification prerequisites.

COVID-19 effect on paid time off in Texas

While the state doesn't expect organizations to give paid sick leave, organizations with less than 500 workers are expected to do as such under the Families First Coronavirus Response Act passed by Congress in March.

The demonstration lays out tax reductions that offset the expenses of the paid leave for employers. It likewise takes into account different measures of coverage relying upon an individual’s particular COVID-19-related need. Private ventures with less than 50 representatives, in any case, are possibly excluded from the requirement.

COVID-19 Stimulus Checks for Individuals

The IRS gave three Economic Impact Payments timelines during the COVID pandemic for individuals who were qualified:

- $1,200 in April 2020

- $600 in December 2020/January 2021

- $1,400 in March 2021

These payments were sent by direct deposit to a financial balance or via mail as a paper check or a debit card.

Benefits offered by Texas Workers Commission

- TWC's Rapid Response Unit can assist managers and impacted representatives with getting to unemployment claims and reemployment administrations in an extremely smooth out and productive way.

- TWC manages the Shared Work Program, which permits partial unemployment benefits for similarly-situated representatives whose hours are diminished by a standard sum somewhere in the range of 10 and 40 percent.

- An inquiry that may come up is whether it is permissible for a business to require a doctor's release for duty certificate or something almost identical assuming a representative is getting back from an absence brought about by something that looks or behaves like Covid-19.

- It would be great to remember that numerous representatives might have monetary issues connecting with powerlessness to pay to see a doctor, so they should consider that, and furthermore that essentially under current conditions, medical documentation should be mentioned provided that an individual is known to have been exposed to a communicable illness.

Besides, medical workplaces are practically overpowered, so giving documentation won't be high on their priority lists and tests for Covid-19 are not yet generally accessible.

- With regards to an employer’s ' overall duty under OSHA to keep a protected and solid working environment for representatives, workers who have all the symptoms of being sick might be approached to return home, yet do as such as cordially and prudently as could really be expected. Notwithstanding, the business ought to be predictable and treat all representatives who display hazardous symptoms the same.

- By and large, there is no Texas or government regulation that would disallow an organization from advising workers to remain at home assuming they have had a higher-than-ordinary level of exposure to people really tainted with the sickness. As indicated above, be reliable and don't put together self-isolation orders with respect to variables like race or national origin.

- There have been dissipated reports of ethnic segregation, especially against individuals who seem as though they may have come from Asia. The EEOC is now cautioning employers that singling workers out in view of ethnic or national origin concerns could set off a discrimination charge.

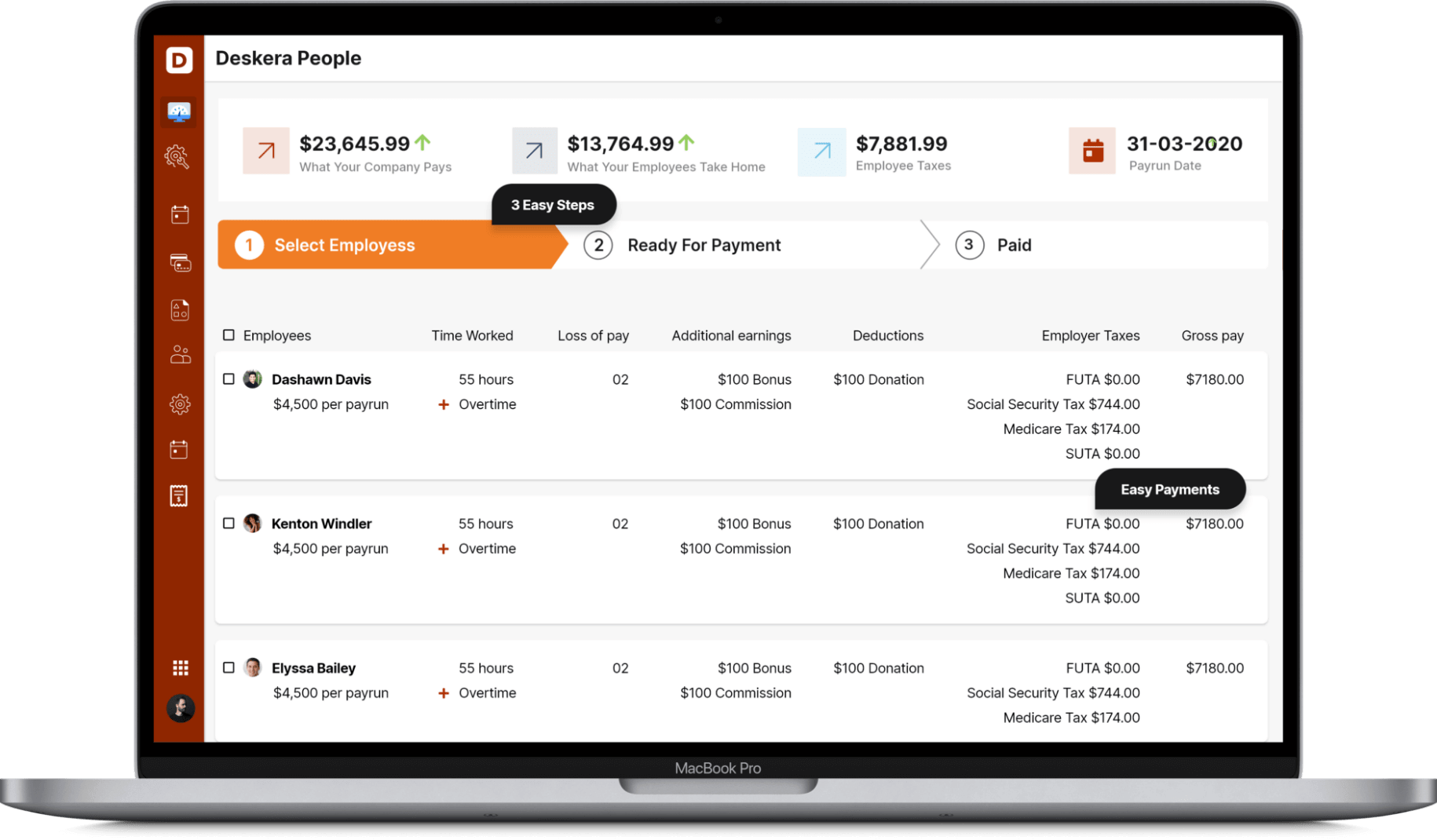

How can Deskera Help You?

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Conclusion

While the greater part of the nation keeps on working under social distancing guidelines recommended by the Centers for Disease Control and Prevention (CDC), organizations of all sizes have been affected by the COVID-19 pandemic. Therefore, state and nearby offices are being approached to move forward and deal with the Texans who have petitioned for unemployment.

Key takeaways:

- Assuming the organization offers paid leave. Paid leave guidelines ought to be followed - inability to pay for leave owed under a composed paid leave strategy is an infringement of the Texas Payday Law.

- Assuming that representatives are getting paid leave benefits. While on paid medical leave, they would not be thought of as unemployed under TWC regulations and would not have the option to claim unemployment insurance (UI) benefits.

- Any claimant who can file a claim for UI benefits should meet the qualification necessities to really draw benefits. Mostly, the petitioner should be medicinally ready to work and be accessible and effectively looking for regular work.

- Representatives on brief layoff status might be pardoned from work search prerequisites assuming that they have a return-to-work date under eight to twelve weeks later.

Related Articles