Tax season is quickly approaching, and with it comes a lot of planning and anxiety. There's so much you need to do, from gathering your W-2s to figuring out your tax-deductible expenses. But before you start crunching numbers, make sure you're keeping all your receipts!

In order to understand how much you owe in taxes this year, you first need to know what you earned and credits that may apply. Next, figure out what type of tax return you will file (Individuals filing their own taxes, couples filing jointly, etc.).

Then estimate how much tax will be due on each category of income (Income from wages, tips, self-employment income, etc.). Finally, add up the totals for each type of tax and create a yearly tax bill.

Making mistakes when preparing your tax return can have serious consequences. For example, if you forgot to report income or deductions, your refund could be reduced or even canceled.

In addition, if you file an incorrect return, the IRS may pursue civil penalties or criminal charges. Don't jeopardize your financial security with simple mistakes – follow these tips to ensure a smooth sailing tax season!

In today’s guide, we’ll learn in detail about tax return 2023 and related concepts. Let’s take a look that the table of content:

- What is a Tax Return?

- Understanding Tax Return

- 3 Major Sections of Tax Return

- Special Considerations

- Deadline of Tax Return

- Steps to File a Tax Return

- Protect Yourself from Identity Theft Related to Taxes

- Extension for Filing Tax Returns

- How Deskera Can Assist You?

Let's start!

What is a Tax Return?

A tax return is a form (or forms) that is filed to a taxing body and contains information on incomes, expenses, and other important tax factors.

With the use of tax returns, taxpayers can ascertain their tax liability, schedule their tax payments, or request refunds for any overpaid taxes.

Tax returns must normally be filed yearly for any person or corporation with reportable income, which includes wages, interest, dividends, capital gains, or other revenues.

Understanding Tax Return

In the United States, tax returns that include the data needed to calculate taxes are filed with either the local or state tax collecting agency or the Internal Revenue Service (IRS) (Massachusetts Department of Revenue, for instance).

Typically, tax returns are filled out using forms provided by the IRS or another relevant organization.

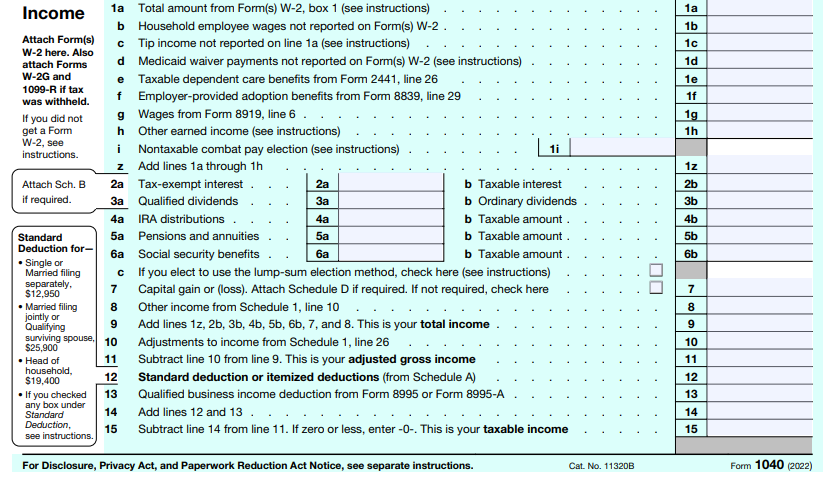

The Internal Revenue System's Form 1040 is used by individuals in the United States to file their federal income taxes.

Corporations and partnerships, respectively, file their annual reports using Forms 1120 and 1065.

Numerous 1099 forms disclose income from sources unrelated to employment.

Use Form 4868 to apply for an automatic extension of time to file a U.S. individual income tax return.

The taxpayer frequently provides personal information, such as their filing status and information about their dependents, at the beginning of a tax return.

3 Major Sections of Tax Return

There are three key places on tax returns where you can record your income and find out the tax credits and deductions you are eligible for:

1. Income

The income section of a tax return includes a list of all sources of income. A W-2 is the most typical reporting document. Wages, dividends, royalties, self-employment income, and, in many countries, capital gains are also subject to reporting obligations.

Click to learn more about W2 and W4 Form.

2. Deductions

Deductions help lower tax liabilities. Alimony payments, donations to retirement savings plans, and interest deductions on specific loans are a few examples of frequent tax deductions, however they greatly vary by jurisdiction.

The majority of expenses incurred by corporations that are directly related to business operations are tax deductible.

Depending on their filing status, taxpayers can either itemise their deductions or use the standard deduction.

The taxpayer can calculate their tax rate based on their adjusted gross income following any deductions (AGI).

3. Tax Credits

Tax credits are monies that are used to lower tax obligations or liabilities. These, like deductions, vary widely between nations.

Nevertheless, credit is commonly granted for things like education, taking care of old and dependent children, pensions, and many other things.

After the disclosure of income, deductions, and credits, the amount of taxes that the taxpayer owes, or the amount of any tax overpayment is stated.

Taxes that have been overpaid may be reimbursed or carried over to a future tax year. A single payment or regular tax payments are also options available to taxpayers.

Similar to this, the majority of self-employed individuals can reduce their tax obligation by making quarterly advance payments.

Special Considerations

The IRS recommends keeping tax returns for at least three years. However, in rare cases a longer retention period may be necessary. In some situations, keeping filed returns on hand indefinitely may be necessary.

If the initial tax return has errors, an amended one should be submitted.

Deadline of Tax Return

The deadline for submitting federal income taxes has been changed for all taxpayers from April 15 to April 18, 2023. This is because today is Emancipation Day in the District of Columbia.

The state and local tax returns are exempt from these deadlines. To ensure that you submit your state taxes on time, find out when they must be filed. You will be penalized with interest and a late payment fee if you owe money yet fail to file and pay your taxes on time. There is no cost for filing a late return if you will be getting a refund.

Steps to File a Tax Return

Following, we’ve discussed steps to file your tax return. Let’s check:

1. Gather all your Financial Documents –

You will need to have all of your income and expense documents to file your taxes. This includes your employer's W-2 form, any 1099 forms you may have from freelance work, any 1098 forms you may have from student loan payments, and any other records that detail your income and outgoings.

2. Choose a Tax Filing Method –

Depending on your income level, you may be able to file your taxes for free online. As an alternative, you can submit your taxes for you using tax preparation services or tax software.

3. Input your Personal Information –

This includes your name, address, Social Security number, and filing status are examples of personal data that should be entered.

4. Enter your Income Information –

Input all of your income information, such as your wages, interest, dividends, and other forms of income.

5. Enter your Deductions and Credits –

Input any deductions and credits you may be eligible for, such as the standard deduction, the Earned Income Credit, and other itemized deductions.

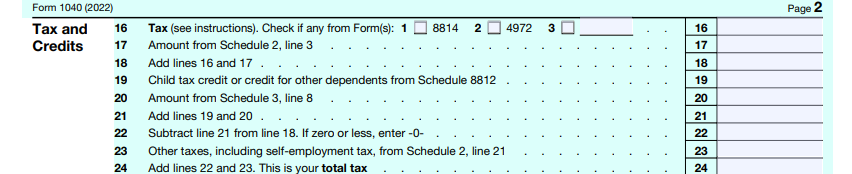

6. Calculate your Taxes –

Use the information you have entered to calculate your taxes. You can easily find numerous resources online where you can calculate taxes return and so on.

7. E-file or Mail your Tax Return –

You can either e-file your tax return online or mail it in. If you choose to mail it in, you will need to print out the forms and send them to the Internal Revenue Service (IRS).

Note: Tax filing deadline is April 18, 2023.

Protect Yourself from Identity Theft Related to Taxes

Tax ID theft is the act of someone stealing your personal data and using it to file a tax return. The fraudulent tax filer typically uses your Social Security Number (SSN) to submit your return and get a refund.

You can get a six-digit Identity Protection PIN (IP PIN) from the IRS to avoid tax ID theft.

IP PINs enable the IRS to verify your identity when you file your return because they are confidential information that only you and the IRS have access to.

Extension for Filing Tax Returns

In the event that you are unable to submit your federal income tax return by the due date, the Internal Revenue Service may give you a six-month extension (IRS).

The deadline for submitting your taxes is not extended by this. To avoid possible penalties, calculate your tax amount and pay it by April 18, 2023.

How Deskera Can Assist You?

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- A tax return is a form (or forms) that is filed to a taxing body and contains information on incomes, expenses, and other important tax factors. With the use of tax returns, taxpayers can ascertain their tax liability, schedule their tax payments, or request refunds for any overpaid taxes.

- In the United States, tax returns that include the data needed to calculate taxes are filed with either the local or state tax collecting agency or the Internal Revenue Service (IRS) (Massachusetts Department of Revenue, for instance).

- The income section of a tax return includes a list of all sources of income. A W-2 is the most typical reporting document. Wages, dividends, royalties, self-employment income, and, in many countries, capital gains are also subject to reporting obligations.

- Tax credits are monies that are used to lower tax obligations or liabilities. These, like deductions, vary widely between nations.

- Nevertheless, credit is commonly granted for things like education, taking care of old and dependent children, pensions, and many other things.

- You will need to have all of your income and expense documents to file your taxes. This includes your employer's W-2 form, any 1099 forms you may have from freelance work, any 1098 forms you may have from student loan payments, and any other records that detail your income and outgoings.

Related Articles