A federal tax benefit known as the standard deduction enables taxpayers to lower their taxable income by a predetermined amount. Regardless of their filing status or taxable income, all taxpayers are eligible for the standard deduction.

This benefit can be valuable if you have heavy tax liabilities. The standard deduction's amount varies based on your filing status, personal income, and family circumstances.

The standard deduction can be a helpful tool for taxpayers who may not itemize deductions on their federal tax return. However, it's important to understand how the standard deduction works and which items qualify.

In today’s guide, we’ll learn in detail about standard deduction, updated taxable income, and related concepts. Let’s take a look that the table of content:

- What is Standard Deduction?

- Working of Standard Deduction

- State Tax Considerations: Standard Deduction vs. Itemized Deductions

- When to Itemize vs. take the Standard Deduction?

- Standard Deduction Restrictions

- Standard Deduction: Taxable Income

- When to Claim the Standard Deduction?

- Special Situation

- How to Claim Your Standard Deductions: Making a Decision

- How Deskera Can Assist You?

Let's get started!

What is Standard Deduction?

Whether you're an employer or an employee, you want to reduce your income tax liability. In this circumstance, deductions are important instruments. Depending on your financial situation, you may be eligible to deduct a variety of expenses from your taxes. You can calculate your prospective tax burden once you have a handle on the items you might be able to claim.

Some of the costs that can be written off are charitable contributions, mortgage interest, student loan interest, some business-related fees, and medical costs. When you subtract each of these particular expenses separately from your taxable income, you itemize deductions on your tax return.

You must present proof that you qualify for a portion of your income to be free from taxation in order to make these deductions.

Not everyone will, however, iterate their deductions. The standard deduction, which is just a fixed amount that taxpayers can automatically deduct from their taxable income, is also present, which explains why.

In general, you just take the standard deduction in place of any allowed itemised deductions if your standard deduction is larger. Age, income, and filing status are just a few of the variables that affect the magnitude of your standard deduction.

Working of Standard Deduction

Even if you do not have any other allowable deductions or tax credits, the IRS automatically grants you the standard deduction. The standard deduction reduces the amount of income that must be taxed.

- You only have two options when filing your taxes: itemize on your tax return or take the basic deduction. Moreover, you cannot do both of them. Itemized deductions are essentially expenses that the IRS allows and that can lower your taxable income.

- You cannot deduct your home mortgage interest or any other commonly utilized tax deductions, such as charity contributions and medical expenses, if you opt for the standard deduction. (If you itemize, keep hold of the documents that prove your deductions in the event that the IRS decides to audit you.)

- If someone may claim you as a dependent on their tax return, your standard deduction is decreased.

- For the 2022 tax year, you can boost your standard deduction by $1,400 if you are over 65 or blind; by $1,750 if you are single and do not have a surviving spouse. These two new standard deduction amounts will rise by $100 to $1,500 and $1,850, respectively, for the 2023 tax year.

State Tax Considerations: Standard Deduction vs. Itemized Deductions

Two ways to lower your taxable income are the standard deduction and itemised deductions. While everyone is allowed to claim the standard deduction, itemized deductions are a list of expenses that you can select to exclude from your income.

States have different standards for itemized deductions and standard deduction amounts. In general, you can only deduct your expenses one way—either the standard deduction or itemized deductions. The basic deduction will typically be greater than the total of your allowable itemized deductions.

When it comes to state taxes, the decision of whether to take the standard deduction or itemize is usually determined by which one will result in the lower tax liability.

For example, some states have higher state income taxes than others, so the standard deduction may be more beneficial in those states. Additionally, some states offer tax credits or deductions for certain types of expenses that you may be able to take advantage of if you itemize.

Even if your total itemized deductions fall short of your standard deduction, there is one circumstance in which you may desire to itemize deductions. You might decide to do this if doing so will cause you to pay less tax overall, including federal and state taxes.

If you decide to itemize on your federal and state tax returns in order to get a bigger tax break than you would if you choose to take the standard deduction, this could happen.

Be aware that some states, like Massachusetts and Michigan, do not permit itemized deductions.

When to Itemize vs. take the Standard Deduction?

On Form 1040, there are times when it makes sense to itemize rather than claim the standard deduction. It makes sense to itemize your tax deductions if you:

- Had significant out-of-pocket costs for medical and dental care.

- Have itemized deductions that are more than your standard deduction

- Have losses from gambling

- Paid your property taxes for your home (See more about deducted mortgage interest and Form 1098)

- Had large, uninsured losses from theft or accidents (fire, flood, wind)

- Made significant donations to recognized causes

- Have additional permissible deductions, such as a disabled person's impairment-related employment expenditures or the repayment of monies subject to a claim of right that are greater than $3,000

Standard Deduction Restrictions

Not all individuals are qualified to take advantage of the standard deduction because of particular tax-related actions or filing conditions.

It's crucial to determine whether you fit into one of these categories before you start so that you can avoid filing a mistake that triggers an audit. If you fall into any of the following categories, you will regrettably likely be required to itemize your deductions:

There are several restrictions on the standard deduction, depending on filing status and other factors.

- Filing Status: Your spouse is itemizing their deductions, and you are married but filing separately.

- Shortened tax return: You file a tax return for a period of fewer than 12 months as a result of a change in your yearly accounting cycle.

- Non-residents: At any time during the tax year, you were an alien non-resident.

- Entity Types: Partnerships, estates, common trust funds, and trusts are also ineligible for the standard deduction, among other entity types.

If you fall under one of these headings, you might wish to speak with a tax-savvy financial counsellor. They ought to be able to point you in the direction of the best tax-related decisions so you can properly prepare and file your taxes and save money.

Standard Deduction: Taxable Income

The standard deduction, which is a fixed cash amount, lowers your taxable income. In 2022, the standard deduction is $25,900 for joint filers, $19,400 for heads of household, $12,950 for single taxpayers, and $19,400 for married couples who file separately.

For 2023 (taxes filed in 2024), the standard deduction will increase to $27,700 for married couples filing jointly, $20,800 for heads of household, and $13,850 for single taxpayers.

When to Claim the Standard Deduction?

Check the following points that explains that when you should claim the standard deduction:

- You should absolutely itemize your deductions and save money if your standard deduction is less than your actual deductions. If the standard deduction is greater than your itemized deductions, it may be wise to take it and save some time.

- Even while taking the standard deduction is simpler than itemizing, it may be advantageous if you have a mortgage or home equity loan. Utilize the information from the IRS Mortgage Interest Statement Form 1098. (You typically get this from your mortgage company at the end of the year).

- It's typically advantageous to take the time to respond to all the itemized deductions-related queries that might be relevant to you if you're utilizing tax software. Why? – The software (or a tax professional) can process your return both ways to discover which results in a lower tax bill. Even if you choose to take the standard deduction, you'll at least be aware of your advantage in terms of money.

Special Situation

For some taxpayers, the federal standard deduction is ineligible. You are ineligible to claim the standard deduction if you are married, file your taxes separately, and your spouse itemizes their deductions on their return.

If you (or your spouse, if you're filing jointly) were a non-resident alien at any point during the tax year, you are also ineligible to claim it.

Finally, if you alter your yearly accounting period and file a return for shorter than 12 months, you are not eligible for the standard deduction.

How to Claim Your Standard Deductions: Making a Decision

It's a good idea to do the calculations if you're unsure whether to itemize deductions or accept the standard deduction. Whichever choice gives you the highest deduction is probably the one you should pick.

Undoubtedly, taking the standard deduction is simpler, especially if you didn't keep track of your expenses during the year. The majority of Americans choose that, and you can still claim the standard deduction even if you have no other eligible costs to write off.

When deciding how to claim your standard deductions, you should consider your filing status, age, and income level. You can be eligible for a bigger deduction if you're married and filing separately rather than single or jointly.

In addition, you can be eligible for a larger deduction if you're over 65 or blind than you would be if you were younger. And finally, if your income is higher than average, you might be able to claim a larger deduction.

Depending on your situation, you may be able to claim the highest amount of standard deduction available to you.

How Deskera Can Assist You?

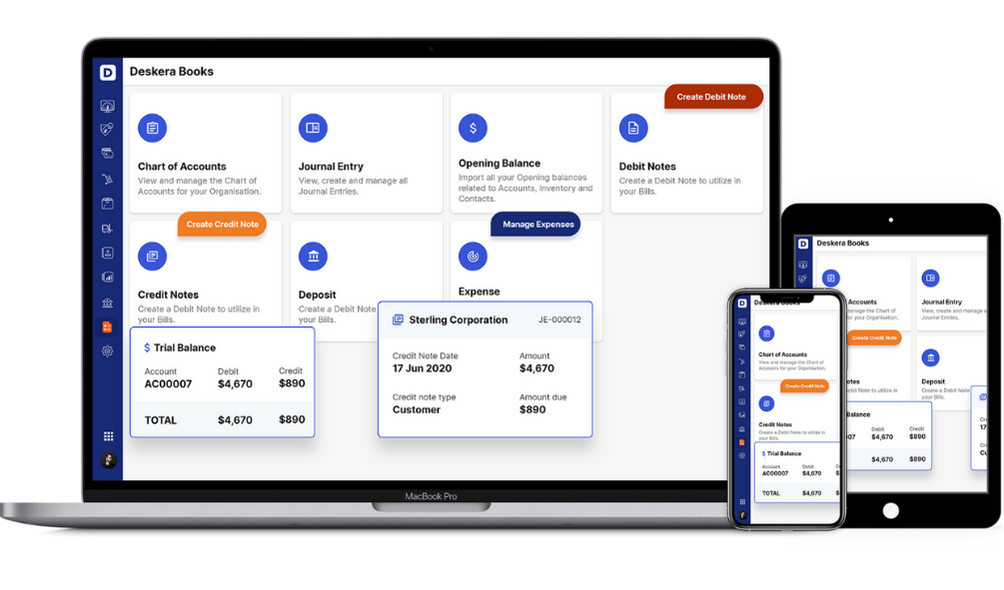

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- Whether you're an employer or an employee, you want to reduce your income tax liability. In this circumstance, deductions are important instruments. Depending on your financial situation, you may be eligible to deduct a variety of expenses from your taxes.

- You only have two options when filing your taxes: itemize on your tax return or take the basic deduction. Moreover, you cannot do both of them. Itemized deductions are essentially expenses that the IRS allows and that can lower your taxable income.

- States have different standards for itemized deductions and standard deduction amounts. In general, you can only deduct your expenses one way—either the standard deduction or itemized deductions. The basic deduction will typically be greater than the total of your allowable itemized deductions.

- For 2023 (taxes filed in 2024), the standard deduction will increase to $27,700 for married couples filing jointly, $20,800 for heads of household, and $13,850 for single taxpayers.

- You should absolutely itemize your deductions and save money if your standard deduction is less than your actual deductions. If the standard deduction is greater than your itemized deductions, it may be wise to take it and save some time.

Related Articles

-5.jpg?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=MnwxMTc3M3wwfDF8c2VhcmNofDN8fGJ1c2luZXNzfGVufDB8fHx8MTY1ODg0MTM5NQ&ixlib=rb-1.2.1&q=80&w=2000)