There is most likely a tower of tax forms sitting on the desk, or probably just thrown on your kitchen counter. The forms are from banks, lenders, employers, stockbrokers, and many others.

One such form is form 1099 MISC income that you must have questions about and waiting to fill up. Hence, we have this article for you to help with all the details of Form 1099 MISC.

This article will cover the following:

- What is form 1099 MISC income?

- When should you file form 1099 MISC income?

- Who should file for form 1099-MISC income?

- How to file form 1099 MISC income?

- How can Deskera assist you?

What is Form 1099-MISC Income?

Form 1099-MISC, Miscellaneous Income or Miscellaneous Information, is an Internal Revenue Service (IRS) form used to report certain types of miscellaneous compensation, such as rents, prizes and awards, healthcare payments, and payments to an attorney.

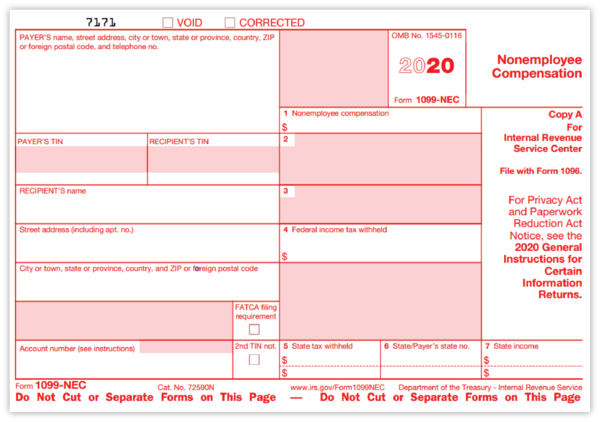

Before the 2020 tax year, Form 1099-MISC was also used to report non-employee compensation for independent contractors, freelancers, sole proprietors, and self-employed individuals.

Starting with 2020, this non-employee pay is reported on Form 1099-NEC: Nonemployee Compensation. These forms generally report business payments and not personal ones.

When Should You File 1099-MISC Income?

The basic rule is that you must file a 1099-MISC whenever you pay an unincorporated independent contractor-that is, an independent contractor who is a sole proprietor or member of a partnership or LLC-$600 or more in a year for work done in the course of your trade or business by direct deposit or cash. You have no duty to report payments you make electronically.

However, remember that a 1099-MISC need is filed only when an independent contractor's services are performed in the course of your trade or business. A trade or business is an activity carried on for gain or profit. You don't have to file a 1099-MISC for payments for non-business-related services. This includes payments you make to independent contractors for personal or household services.

Who Should File for Form 1099-MISC Miscellaneous Income?

Form 1099-MISC income (is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest to another person. It's also sent to each person to whom you paid at least $600 during the calendar year in the following categories:

- Rents (real estate agents and property managers report rent paid to property owners, for instance, or you report the office space rent you paid).

- Cash payments for fish (or other aquatic life) purchased from anyone who makes a living catching fish.

- Cash paid from a notional principal contract to an individual, partnership, or estate.

- Payments to an attorney.

- Any fishing boat proceeds.

- Prizes and awards.

- Other income payments.

- Medical and healthcare payments (made in the course of your trade or business).

- Crop insurance proceeds.

The form 1099 MISC is also used to report direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

The payer must send the form to the recipient by February 1, and file it with the IRS by March 1 (March 31 if filing electronically). The recipient can attach the form to their tax return.

How to File Form 1099 MISC Income?

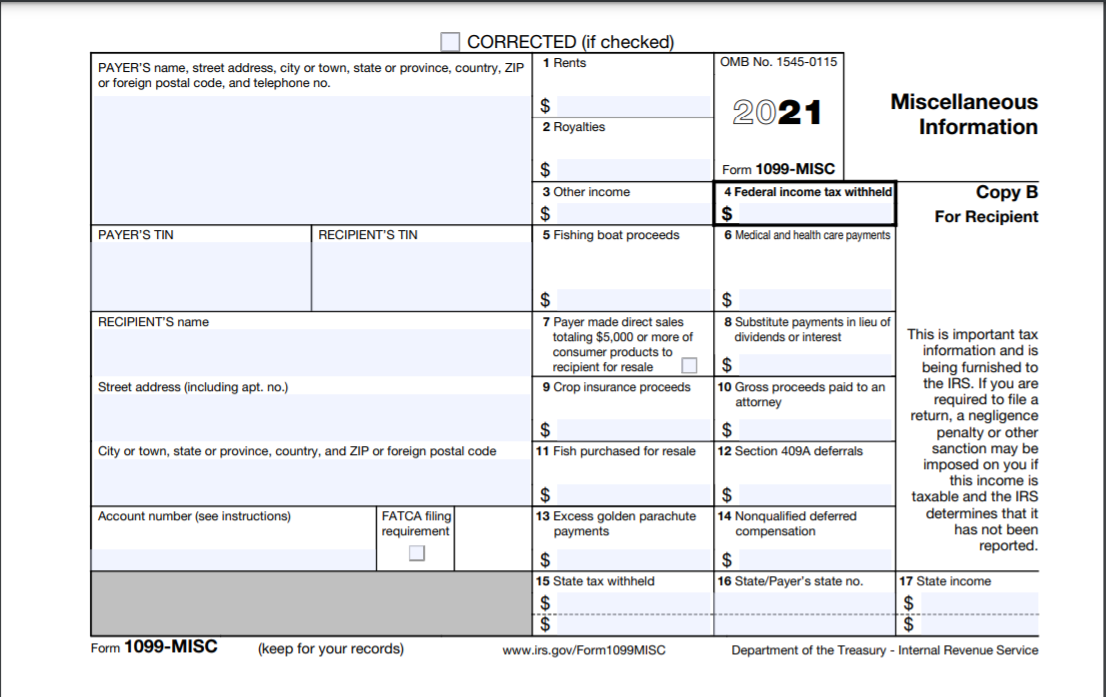

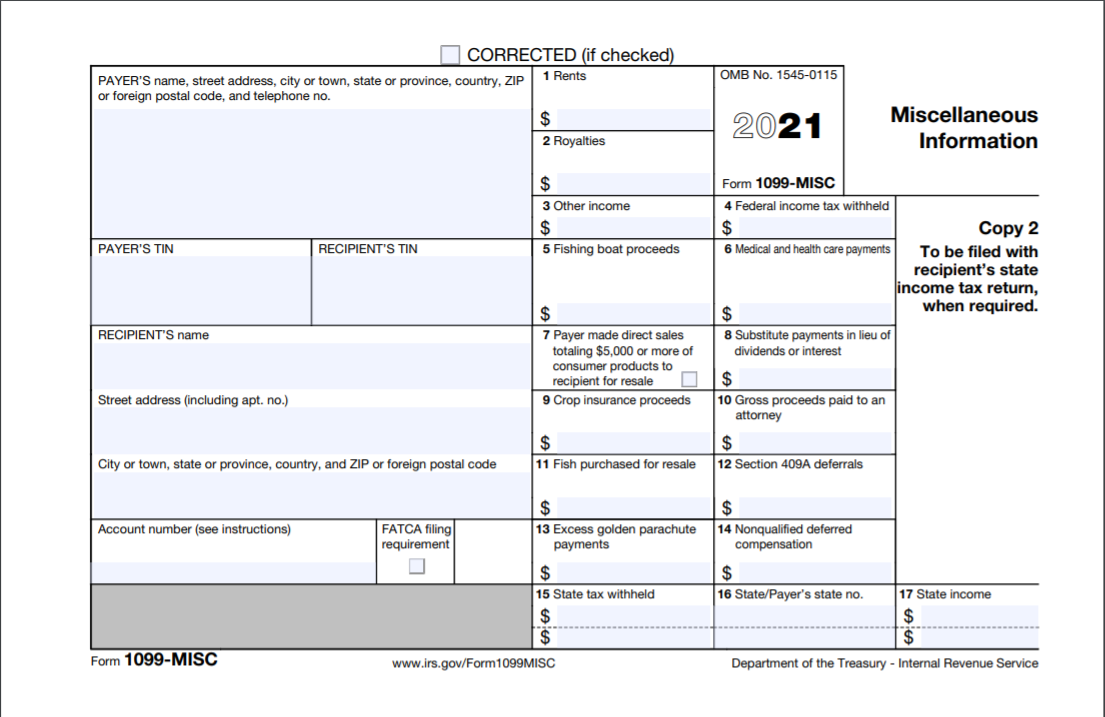

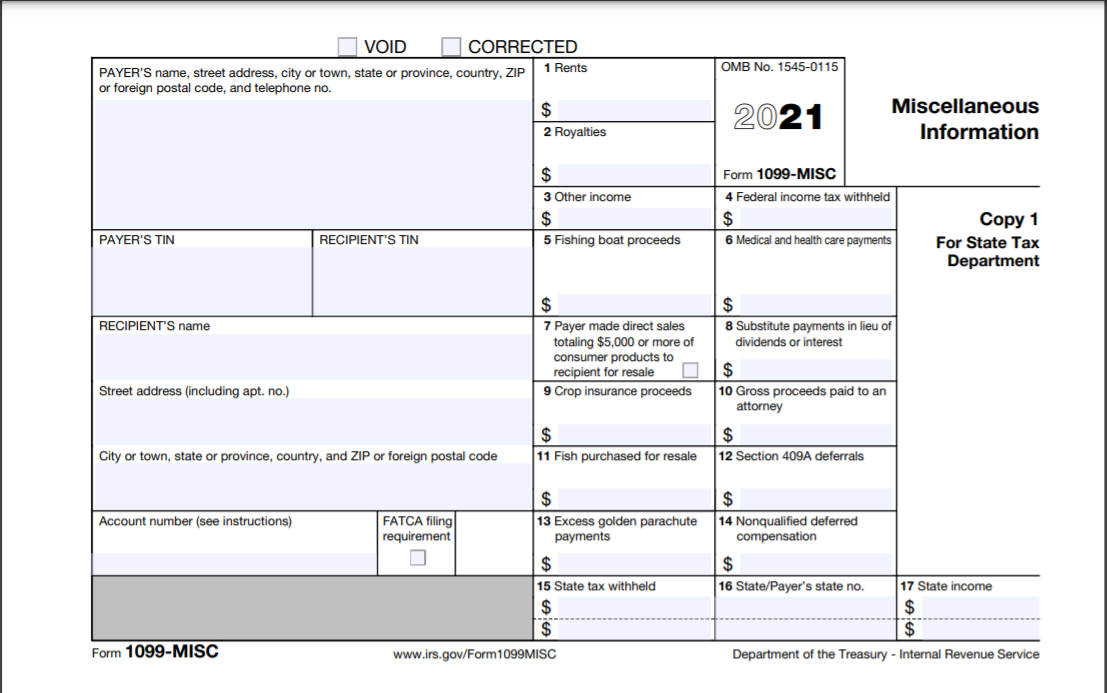

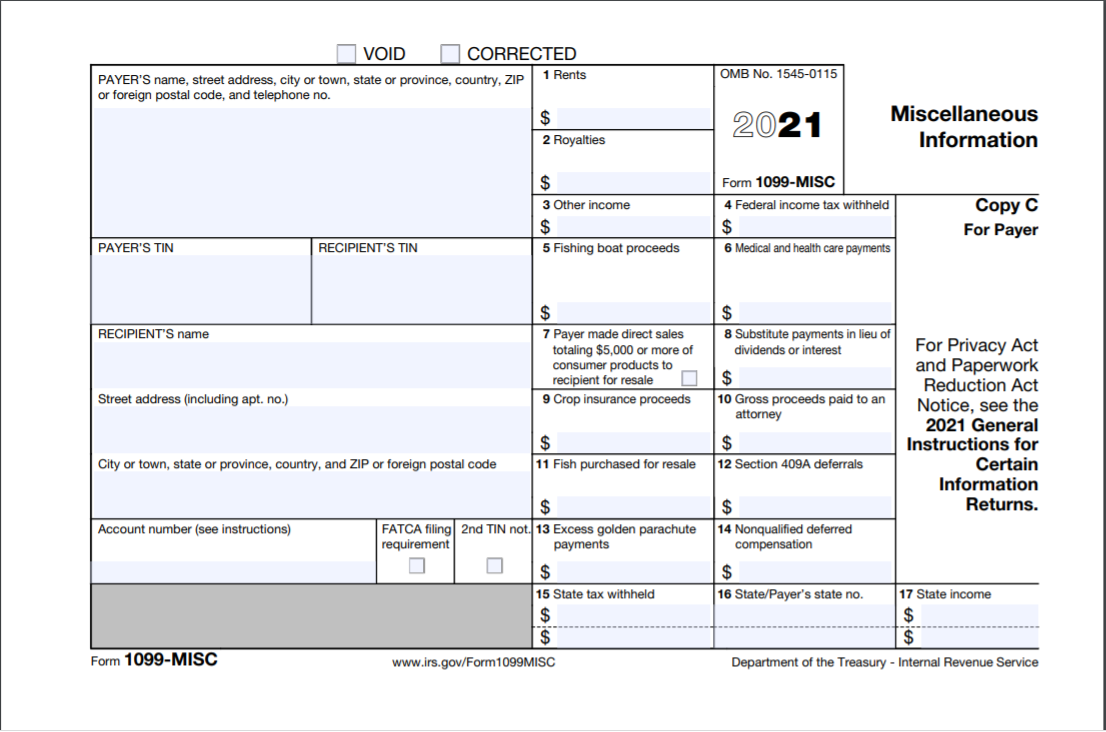

Form 1099-MISC is a multi-part form. Here are the parts of this form and where to send each:

- Copy B and Copy 2 are for the independent contractor and must be provided no later than January 31.

- Copy A must be filed with the IRS no later than January 31.

- Copy 1 is for your state taxing authority if your state has a state income tax; the filing deadline for most states is likely January 31, but check with your state tax department.

- Copy C is for you to retain in your files.

You can obtain an automatic 30-day extension on the time to file 1099s by filing IRS Form 8809, Extension of Time to File Information Returns. The form must be filed with the IRS by January 31. This extension is only for the time to file your 1099 forms with the IRS, it does not extend the deadline to provide copies of the forms to the contactors hired the prior year.

Today, a majority of businesses file their 1099s with the IRS electronically instead of on paper. If you are required to file 250 or more information returns, you must file electronically with the IRS. Electronic filing can be easily accomplished with accounting software such as Deskera. Payroll tax services can also file these forms for you. You can also electronically file the forms directly with the IRS by using its FIRE Production System at https://fire.irs.gov.

Independent contractors must be provided with a paper copy of the 1099-MISC unless they agree to accept an electronic version.

If you want to file a paper 1099-MISC, you cannot simply photocopy the form from the IRS website. Because it is a multi-part form, you need an original copy, which you can obtain from the IRS or stationery or office supply stores.

If you have questions about filing Form 1099-MISC, you may call the IRS toll-free at 1-866-455-7438.

To help you fill the form 1099 MISC, here is a breakdown of what must be filled in the form.

The left top side of the form has the payer’s information, and your information is on the left lower side of Form 1099-MISC. Either your full Social Security Number (SSN) or perhaps only the last couple digits, is likely to be printed there as well.

Although your full SSN is required for some other forms, such as the W-2, on the 1099-MISC the first few digits may be eliminated to help protect your privacy. Regardless of what is printed on the form, the lender sends your complete Social Security Number with Copy A when it is sent to the IRS.

New regulations require some payers to comply with the requirements of the Foreign Account Tax Compliance Act (FATCA) by checking the related box on Form 1099-MISC.

If there is a check in the box for FATCA, you might have a requirement for FATCA reporting. Ignore the check-in this box at your own peril - the consequences of making mistakes in regards to FATCA can be very serious, including being charged with criminal offenses.

BOX 1 - If you received rent of more than USD 600 within the year, that will be in the BOX 1 amount. Included in this is rent for coin-operated amusements as well as machine rentals.

BOX 2- This reports royalty payments of more than USD 10 gross. This includes gas, oil, or mineral property royalties. It does not include surface royalties (which are reported in the Box 1 amount), working interest gas or oil payments (reported in Form 1099-NEC), or royalties from timber pay-as-cut contracts (which have their own form). Royalty payments from intangibles are also reported in Box 2, such as trademarks, trade names, copyrights, and patents.

Box 3- This includes profits from Indian gaming, awards, prizes (including any winnings from fantasy sports), taxable damages, and other income exceeding USD 600. Box 3 also reports amounts received by beneficiaries of deceased employees.

This may seem a little odd, but remember that Box 3 gets used for reporting income not reportable in other boxes or on other forms. Usually, the number in Box 3 will go on line 8 of your 1040, in the line for “other income”. But, if the amount is from a business or trade, it should be reported on a Schedule C and/or Schedule F.

BOX 4- If any federal tax is withheld, it will be in the BOX 4 amount. Usually, this is from backup withholding for people who didn’t give their tax ID number (TIN), or who had another requirement for backup withholding.

Box 5- While not likely applicable to many, proceeds from fishing boats will be in BOX 5. This box includes any share in proceeds from the sale of the catch, and the fair market value of distributions in kind for boats normally having less than 10 members of the crew.

Also, cash payments less than 100 USD per trip that is contingent on minimum catches, and paid only because of additional duties get reported in Box 5. Wages, though, will be on the W-2, not on the 1099-MISC.

Box 6- Payments you received of at least USD 600 as a doctor or other provider or supplier of healthcare or medical services will be in the BOX 6 amount. This is only for payments made in the conduct of business (not things like personal visits). It also includes payments by insurers under accident, sickness, and health insurance programs.

Payments made from Health Reimbursement Arrangements (HRAs) or Flexible Spending Arrangements (FSAs) might be excluded from the reporting requirements. Exemption from Form 1099-MISC issuance to corporations is not applicable to health care or medical services payments to corporations, which includes professional corporations.

Box 7- Check BOX 7 if you sold $5,000 or more of consumer products to a person on a buy-sell, deposit-commission, or another commission basis for resale anywhere other than in a permanent retail establishment. Do not enter a dollar amount in this box. You do not need to use the official form when giving a report to the recipient for direct sales. A letter showing this information along with commissions, prizes, awards, etc. should suffice.

Box 8- For most people, it is uncommon for these boxes to contain an amount.

Box 14- Box 14 can be left empty since reporting for Section 409A might be done on other forms.

Box 15, 16 & 17- State information for one or two states. The IRS does not require this information, but it is useful to you if you are in one of the states that have an income tax (as most do).

Often, the amounts on Form 1099-MISC are the same from both the federal and state tax perspectives. If any money was withheld for the state tax, it will show up in the Box 15 amount, although this isn’t a very common case.

How Can Deskera Assist You?

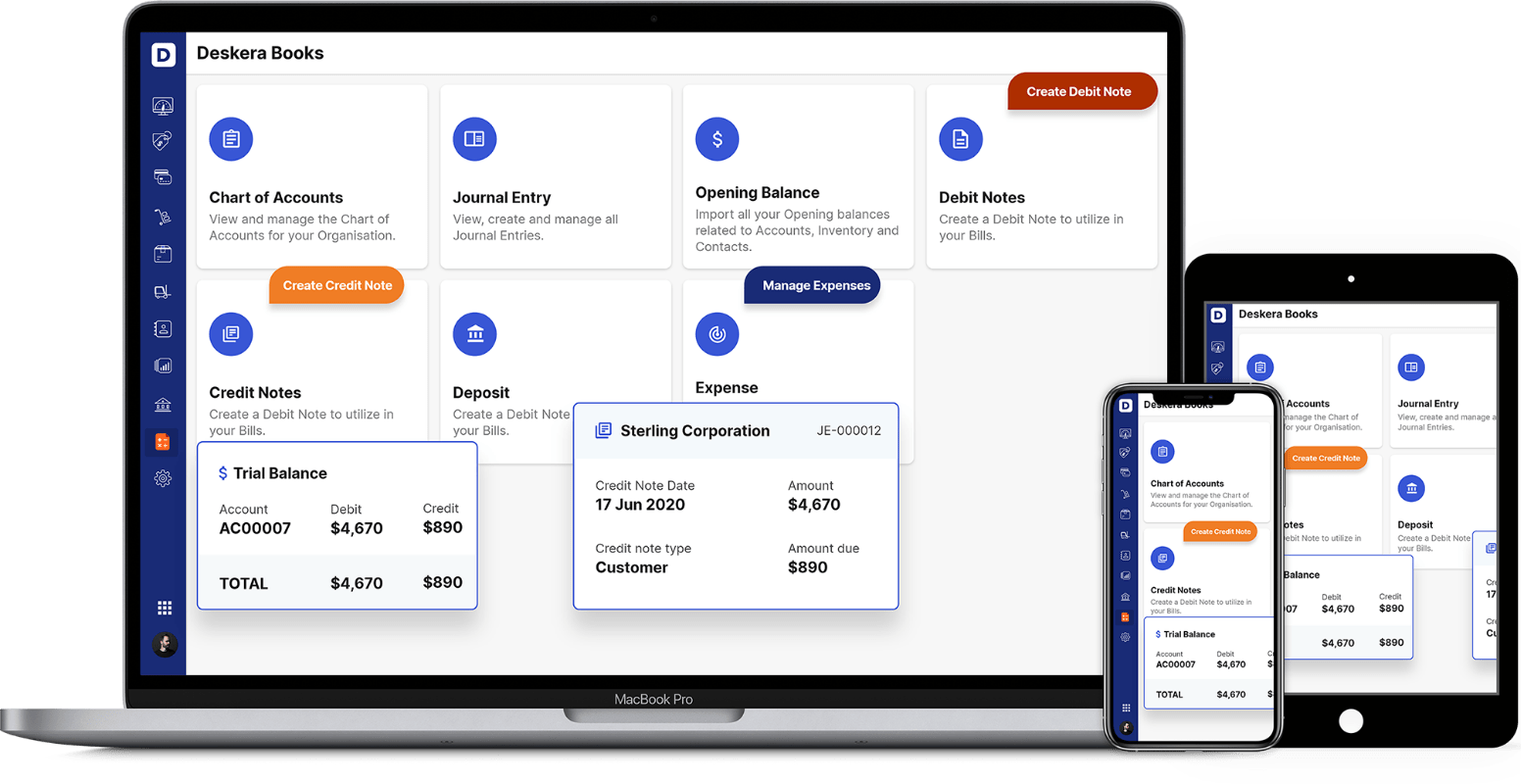

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Through Deskera Books, your accounting would be handled by it, with all that you would need to do is update your invoices, your account receivables and accounts payable, and the operating expenses incurred as well as operating income earned on the software. In fact, you can even delete or edit the existing debit notes and credit notes, as is applicable.

The platform works exceptionally well for small businesses that need to figure out a lot of things when they are setting out. This delightful software allows them to keep up with the client’s expectations by assisting them in overseeing a timely delivery.

The platform works exceptionally well for small businesses that need to figure out a lot of things when they are setting out. This delightful software allows them to keep up with the client’s expectations by assisting them in overseeing a timely delivery.

With the well-thought and well-designed templates, you can now anticipate your work to become simpler. These templates can be used for transactions like invoices, quotations, orders, bills, and payment receipts.

If yours is a drop shipping business, you can easily track your orders and create new dropship orders for your suppliers based on the customer orders.

Watch this video for a quick Deskera demo:

Key Takeaways

- Form 1099-MISC, Miscellaneous Income is an Internal Revenue Service (IRS) form used to report certain types of miscellaneous compensation, such as rents, prizes and awards, healthcare payments, and payments to an attorney.

- You must file a 1099-MISC whenever you pay an unincorporated independent contractor-that is, an independent contractor, a sole proprietor, or member of a partnership.

- LLC-$600 or more in a year for work done in the course of your trade or business by direct deposit or cash.

- Remember, however, that a 1099-MISC need is filed only when an independent contractor's services are performed in the course of your trade or business.

- You don't have to file a 1099-MISC for payments for non-business-related services.

- Form 1099-MISC income (is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest to another person.

- The form 1099 MISC is also used to report direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

- The payer must send the form to the recipient by February 1, and file it with the IRS by March 1.

- You can obtain an automatic 30-day extension on the time to file 1099s by filing IRS Form 8809.

- Often, the amounts on Form 1099-MISC are the same from both the federal and state tax perspectives.

Related Articles