If you have been looking for clarity on filing taxes for your small corporation, you must read on as this post addresses all your queries.

It’s a known fact that if you are a part of the corporate field and own a business, you are certainly required to file your income tax return. However, small businesses are usually the ones that have a tough time looking for the right information on which form to file. If you are an owner of a small corporation, then this post is for you.

IRS Form 1120 is used for filing returns for corporate income taxes to the IRS.

In 2018, the corporate tax schedule for a single tax rate of 21% has been removed by The Tax Cuts and Jobs Act. There will be no differentiation in tax rates for corporate income tax returns based on income, and it's permanent.

The post includes the description of the following terms:

- What is the 1120 Form?

- Who Needs to File 1120 Form?

- How to File Form 1120?

- What Information is Included in 1120 Form?

- What is the Deadline for Form 1120?

- What happens if there is a mistake while filling 1120 Form?

What is the 1120 Form?

Taxes are paid by corporations by filing Form 1120. Businesses must abide by the regulations that apply to them while filing returns. Corporate income taxes are paid at the corporate income tax rate, not a personal tax rate.

Estimated taxes for corporations are reported using Form 1120-W, which is a form for Estimated Taxes for Corporations. A corporation with a tax obligation of $500 or more for the tax year should file Form 1120-W along with Form 1120.

Businesses also use Form 1120 to determine their income tax liability. You might need to use the form to file your income taxes if your company is incorporated.

Your corporation's tax bill will be determined after completing Form 1120. These taxes are typically paid in a quarterly format as an estimated tax.

Who Needs to File 1120 Form?

All domestic corporations must file 1120 form. Even if a domestic corporation had no income, it must report its income, gains, losses, deductions, and credits on Form 1120 to determine its income tax liability.

For businesses that are corporations or file as corporations, Form 1120 must be filed. This includes:

- Businesses that choose to be taxed as corporations: Form 8832 must also be filed by these businesses and a copy attached to form 1120.

- Limited liability companies (LLCs): Form 1120 must be filed by LLCs that elect to be taxed as corporations. LLCs with partners usually file Form 1065 instead, and LLCs with just one owner usually file their own tax return

- Farming corporations: The form 1120 must be filed and used by them to report income and losses

- Corporations with ownership interest in a FASIT: It is Financial Asset Securitization Investment Trust

- Foreign-owned domestic disregarded entities: In addition to Form 1120, the foreign person or corporation must attach Form 5472

Your business must file an annual form if you are incorporated. A lot of times, there is a confusion surrounding the S corporations because of the word- corporations. However, S corporations do not need to file Form 1120. Instead, it the Form 1120-S that is required for filing by them.

How to File Form 1120?

Form 1120 can be filed electronically or by mail. Mailing the form to the IRS requires you to complete the form and mail it.

By using the IRS e-File service, you can electronically file your form. Form 1120 must be filed electronically by corporations reporting $10 million or more in assets.

What Information is Included in 1120 Form?

You will need information to complete Form 1120. You will need the following information before you begin your form:

- Employer Identification Number (EIN)

- Gross receipts

- Capital gains

- Total assets and income

- Date you incorporated

- Cost of goods sold (COGS)

- Any dividends, interest, and royalties earned

- Business tax credits, if applicable

- Tax deductions

Sections 1 through 4 must be completed by filling out the information as mentioned:

- Basic corporation information

- Income

- Deductions

- Tax, refundable credits, and payments

Finally, be sure to sign and date the bottom of the first page of Form 1120 before submitting it.

What is the Deadline for Form 1120?

A corporation's year-end date determines when Form 1120 is due. Tax returns for corporations are typically due on the 15th of the fourth month following the end of their financial year.

Form 1120 must be filed by the 15th of the third month, if your business' fiscal year ends on June 30.

What happens if there is a mistake while filling 1120 Form?

You must amend Form 1120 if there’s an error while filing the form. Use Form 1120X, Amended U.S. Corporation Income Tax Return to file the amendment. In general, Form 1120X must be filed within three years of the original return.

The following information is required to fill out Form 1120X:

- Business name

- Explanation of changes

- Business address

- Payments and credits

- Income and deductions

- Tax due or overpayment

- EIN

- Signature

The Form 1120X must be accompanied by the appropriate schedule, statement, or form if the correction includes income, deductions, or credits.

How can Deskera Help You?

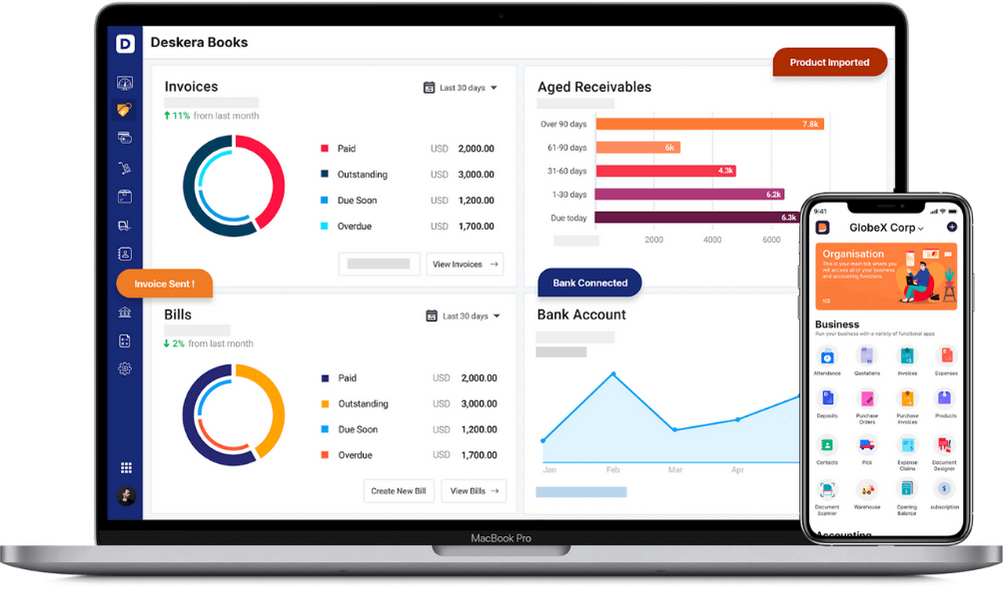

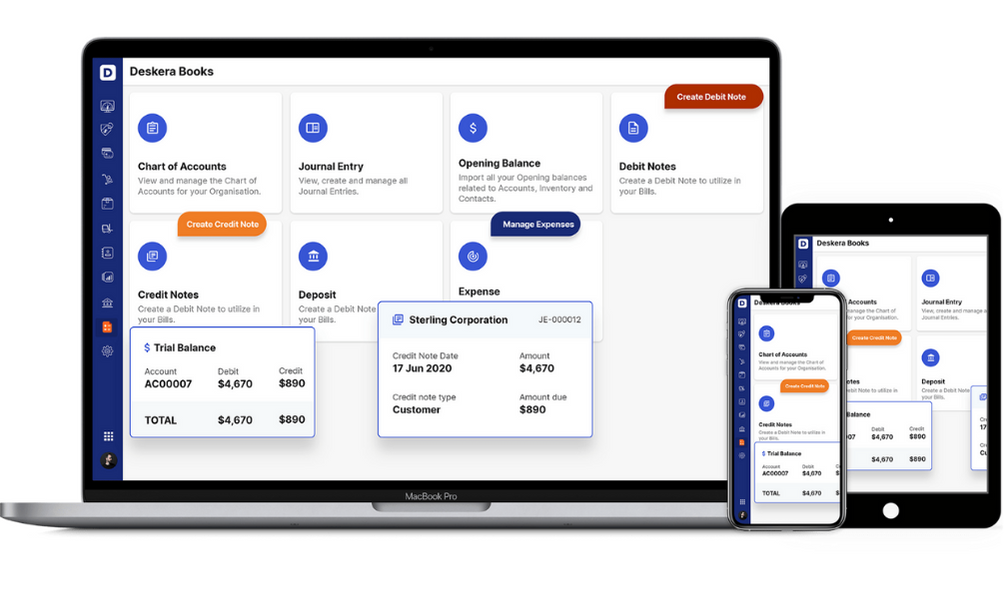

Whatever the scope of your business, whether large or small, Deskera Books is committed to providing accounting solutions. It allows you to handle all your financial documents, such as invoices, expenses, and all your contacts, in one place, in addition to enabling easy handling of online accounting and invoicing applications.

Start-ups will particularly benefit from the enterprise software's user-friendly features. You can easily navigate through the software because of the simplified layout and clear depictions. Simply click to access your journal entries, debit notes, credit notes, payments, and estimates.

There are also templates designed by Deskera to work astonishingly well for your business. You can easily create quotes, purchase orders, back orders, bills, and payment receipts.

You can now relax a bit if you run a drop shipping business since the platform will enable you to create drop ship orders based on customer orders. Check out and learn more about this from the video for more information about Deskera's accounting and sales services.

Software aimed at expediting your regular tasks is also available named Deskera People. By using this tool, you can take care of your core business tasks while leaving other actions, such as hiring, payroll, leaves, and attendance, to the tool.

Key Takeaways

Here are the top observations from the article:

- Taxes are paid by corporations by filing Form 1120 and paying the taxes shown on the return. Businesses must abide by the regulations that apply to them while filing returns

- Corporate income taxes are paid at the corporate income tax rate, not a personal tax rate

- Businesses also use Form 1120 to determine their income tax liability.

- All domestic corporations must file an 1120 form. Even if a domestic corporation had no income, it must report its income, gains, losses, deductions, and credits on Form 1120 to determine its income tax liability

- LLCs, farming corporations, businesses that choose to be taxed as corporations are some of the entities that need to file Form 1120

- Form 1120 can be filed electronically or by mail. Mailing the form to the IRS requires you to complete the form and mail it

- Use Form 1120X, Amended U.S. Corporation Income Tax Return to file the amendment. In general, Form 1120X must be filed within three years of the original return

Related Articles