The name– Professional Tax– could be a tad misleading as people tend to assume it applies to professionals exclusively. However, that is not true. On the contrary, the Professional tax is applicable to all professionals, traders, businesses, and all kinds of employment. It is calculated based on the income of the entity.

Additionally, the professional tax is also applicable to businesses including doctors, freelancers, Chartered Accountants, and employees in organizations. The tax comes into effect within the first 30 days of a profession or business commencement. In situations where the business has multiple locations, they must register each of their office sites under the Act.

If your business is based in Tamil Nadu, and you are wondering how to file your professional tax, this article shall guide you. We will be looking at various other components related to the professional tax in the southern Indian state of Tamil Nadu.

- What Is Professional Tax in Tamil Nadu?

- Who must pay the Professional Tax in Tamil Nadu?

- Who Collects the Professional Tax in Tamil Nadu?

- Ways to pay Professional Tax in Tamil Nadu?

- Due date for the payment of Professional Tax in Tamil Nadu?

- Forms

- Exemptions in paying Professional Tax in Tamil Nadu?

- Slab Rates across Corporations in Tamil Nadu

- FAQs

- Key takeaways

- How can Deskera Help You?

What Is Professional Tax in Tamil Nadu?

Professional tax is a state-level tax levied by the Tamil Nadu government and must be paid by the individuals earning an income mandatorily. Individuals who get a salary or generate money under the professional tax structure are subject to this tax. It includes a multitude of professions such as lawyers, doctors, and chartered accountants, and so on.

The Tamil Nadu Town Panchayats, Municipalities, and Municipal Corporations (Collection of Arrears of Tax on Profession, Trades, Calling, and Employment's) Rules, 1998 govern professional taxation in Tamil Nadu. All these entities in the state are subject to the rules.

In Tamil Nadu, the amount of Professional tax is determined by the slab rate, which fluctuates every year.

Rules:

1. Title and Application

The Municipalities, Town Panchayats, and Municipal Corporations Rules, 1998.

- All the Municipalities, Town Panchayats, and Municipal Corporations are subject to the rules mentioned in the Act.

- These rules come into effect on October 1, 1998.

2. Filing the Returns for Tamil Nadu Professional Tax

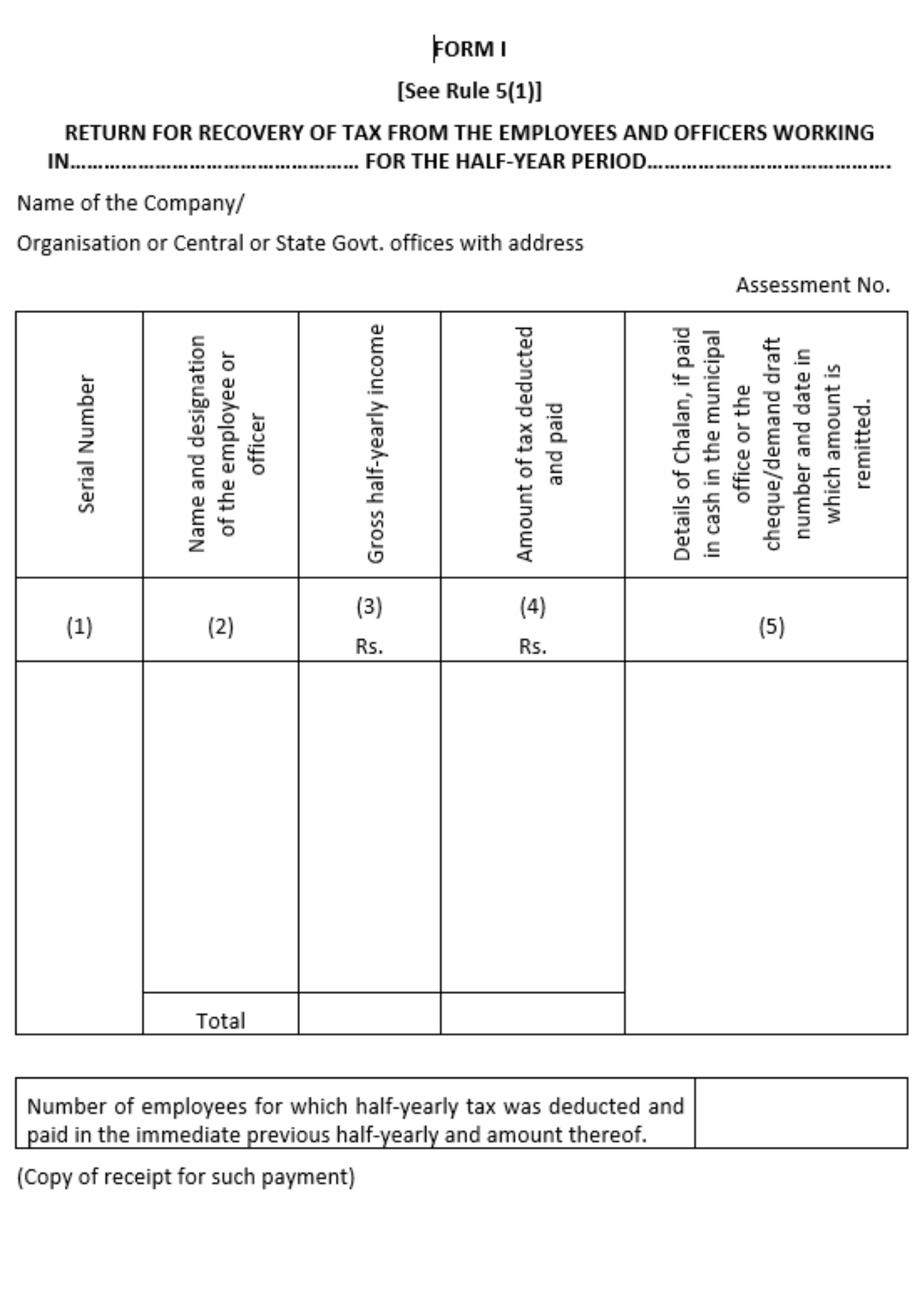

Any professional or dealer who has an overdue or is in arrears of professional tax must make a return through Form 1 with the Commissioner of a Municipality or Corporation or the Executive Officer. They must state the payable amount at the rate decided by the Council under the requirements of the Act of 1992 (Tamil Nadu Act 24 of 1992). The Act was enacted from April 1, 1992, to September 30, 1998.

The Executive Officer or Commissioner, as the case may be, may extend the deadline for filing the return by thirty days beginning December 31, 1998, and ending February 28, 1999.

3. Ways to pay Tamil Nadu Professional Tax

(1) A challan in favor of payment of arrears of profession tax due by a professional for the period commencing on April 1, 1992, must be included in the return. On all working days, however, such payment must be done during regular business hours at the individual local body's office.

(2) During the ongoing half-year, a professional or trader should pay any outstanding professional tax arrears up to September 30, 1998. This also includes any arrears for durations of more than two and a half years.

(3) Usually, the Commissioner or the Executive Officer acknowledges the receipt of the payment.

4. Government Interpretation of Professional Tax Rules

(1) In case of uncertainty concerning the interpretation of these rules, the matter must be brought to the attention of the government.

(2) If someone faces difficulty in following or carrying out the regulations, the government may make an order to remedy the situation.

Summary of the Rules:

Who must pay the Professional Tax in Tamil Nadu?

Individuals engaged in any profession, trade, or any kind of employment inside the municipal limits of Greater Chennai must deposit a half-yearly professional tax. They must follow Tamil Nadu Municipal Laws Second Amendment Act 59 of 1998, Section 138 C. Specifically, this tax is imposed on the individuals mentioned here:

Self-employed Individuals: The self-employed individuals in Tamil Nadu are accountable for their own filing of the Professional tax.

Salaried Individual: The salaried individuals have their salaries deducted by their respective employers which go toward the Professional tax; the deductions are sent to the state government.

Companies: Establishments such as businesses and organizations are also subject to paying the professional tax in Tamil Nadu.

Other Entities: The entities other than the ones mentioned which must pay the professional tax include any society, club, association, HUF–Hindu Undivided Family, corporate bodies, and so on.

Who Collects the Professional Tax in Tamil Nadu?

The Commercial Tax Department of Tamil Nadu is the authority that collects the tax in the state.

Ways to pay Professional Tax in Tamil Nadu?

Employers and individuals in Tamil Nadu can submit the professional tax to all zonal offices of their appropriate municipal administrations. They can pay with a check or a demand draft for the same amount.

Employers and individuals who wish to pay Professional tax to the Greater Chennai Corporation can do so through the Greater Chennai Corporation's website.

Here is the process for paying professional tax online in Chennai:

- After providing their details such as their mobile number and email address on the website, the candidate will receive their unique username and password through SMS and email.

- Using the Citizen portal, the applicant will create a self-assessment application and submit a Tamil Nadu professional tax application.

- The following documents must be uploaded with the application:

i) The certificate was granted by the Registrar of Companies.

ii) Articles Note to self (In case of Limited Company)

iii) Commercial Tax Department Certificate

iv) Employer and employee information (Mandatory)

v) Bank A/c / PAN card data (Mandatory)

- There is no charge at the time of submission.

- After the application is submitted, the individual receives an acknowledgment receipt for filing a return with the professional tax registration number. This is called PT-NAN or the Professional Tax New Account Number.

- Now, the tax can be paid either online or offline.

- Having paid the tax, the individual can obtain a copy from the website.

- The assessment data will be delivered to the inbox of the Zone's corresponding Assistant Returning Officer (ARO) for authentication of the applicant's professional tax assessment.

- The A.R.O. will either alter the professional tax demand if it is under-assessed or if it is considered correct after verification.

Due date for the payment of Professional Tax in Tamil Nadu?

The professional tax in Tamil Nadu must be paid by the 1st of April and the 1st of October for the corresponding half years.

Forms

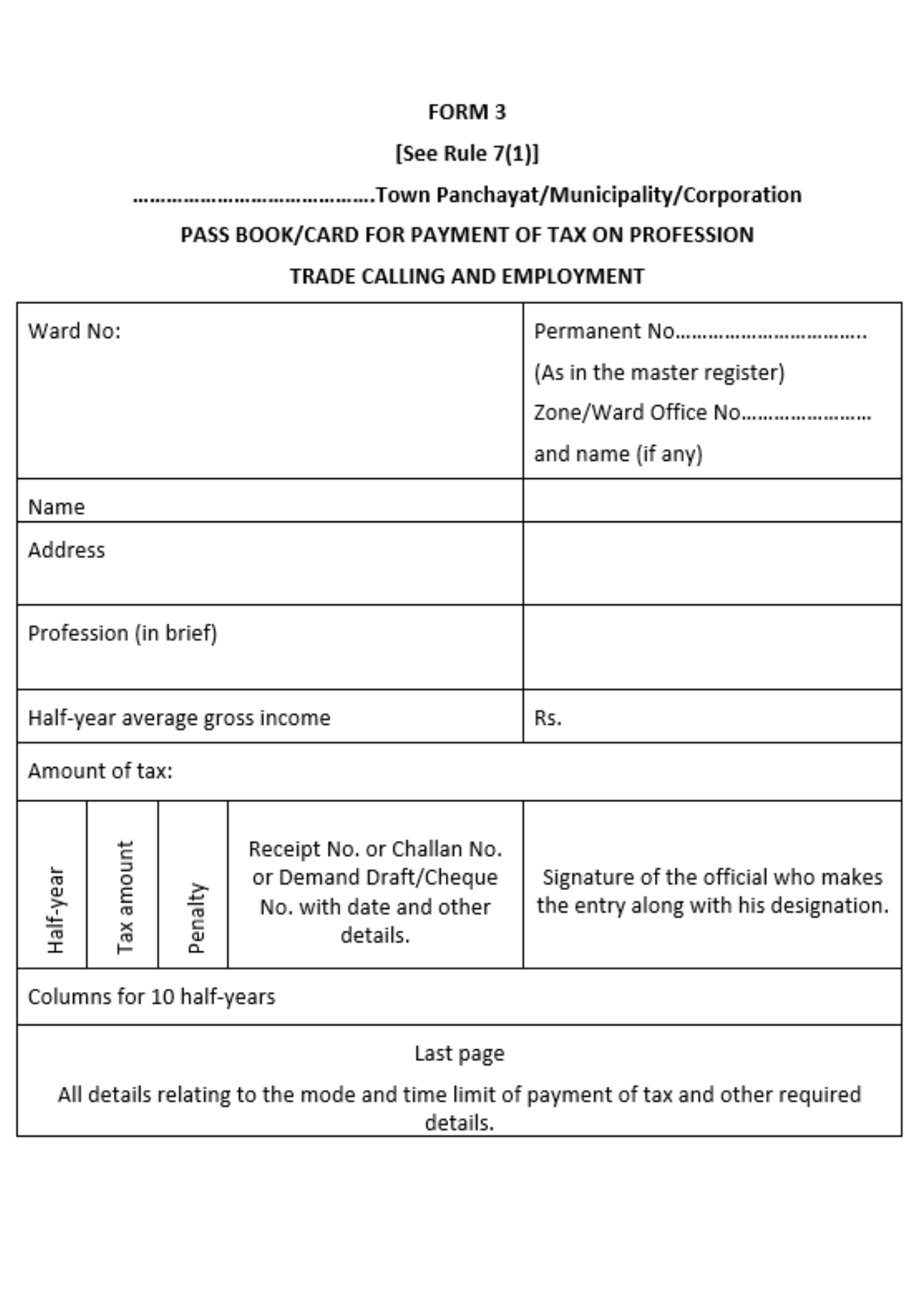

The two forms applicable while filing Tamil Nadu professional tax are Form 1 and From 3.

Exemptions in paying Professional Tax in Tamil Nadu?

We have seen the individuals who must pay the professional tax. This section takes us through the list of people who are not subject to filing the tax. Let’s see the list here:

- Senior citizens of age 65 years and above

- People who are permanently physically disabled

- Women who work as agents under the Mahila Pradhan Kshetriya Bachat Yojana. It also includes women who hold the post of a Director of small savings

- Badli workers in the textile sector

- Parents or guardians with children suffering from mental disabilities

- Personnel from the forces based on the Army Act 1950, the Navy Act 1957, and the Air Force Act 1950.

- Foreign technicians who have offered services to the government

- People with transport permits to carry goods via taxi or three-wheelers

- Philanthropic or non-profit hospitals

- Educational institutions that offer education up to twelfth grade

Slab Rates across Corporations in Tamil Nadu

The slab rates may differ slightly based on the corporations and the panchayats across the state.

FAQs

Let’s go through some of the most commonly asked questions regarding Tamil Nadu professional tax.

Q: How is the professional tax estimated in Tamil Nadu?

A: The professional tax calculation is based on the tax slabs of the individuals.

Q: When is the return filed under Tamil Nadu Professional Tax Act?

A: Tamil Nadu professional tax must be filed on the first day of the half-year; which means the due date to file the tax is April 1 and October 1 for the respective half year.

Q: Through which website can I file my Tamil Nadu Professional Tax Act?

A: You can register under the act by visiting www.chennaicorporation.gov.in.

Q: What are the essential documents I will need for registering under Tamil Nadu Professional Tax Act?

A: PAN Card, Lease Agreement, the association of articles, memorandum of association, Trade license copy or the registration certificate for the Shops and Establishments are the documents required to enroll under the Act.

Q: Is the professional tax applicable only to professionals?

A: No. The professional tax is applicable to all kinds of trades, professions, and employments. It is based on the income of the individual.

Q: What is the number of the form for registering under the Tamil Nadu Professional Tax Act?

A: It is Form no. 1 that will be used to register under the Act.

How can Deskera Help You?

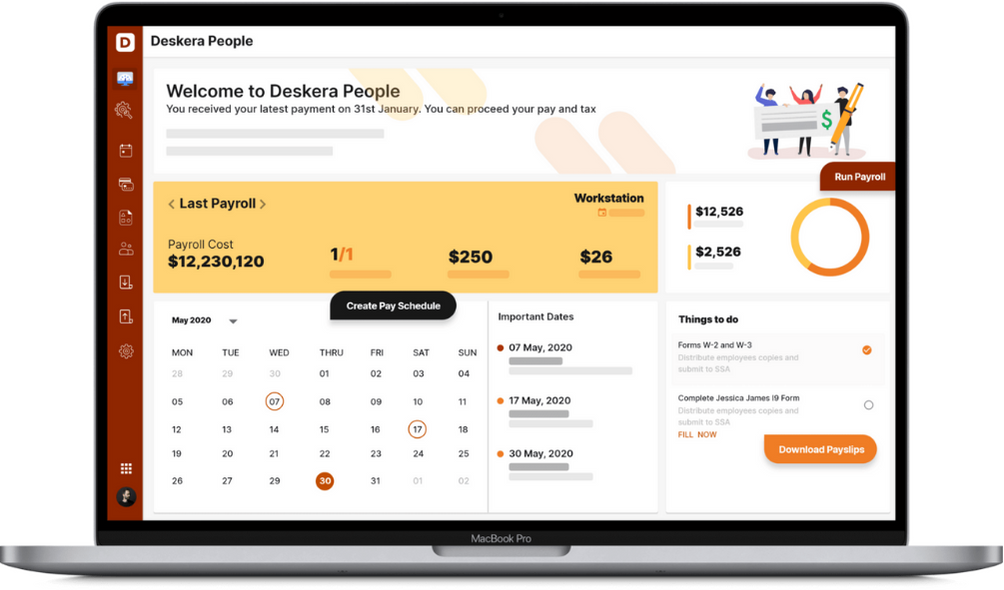

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like flexible pay schedule, custom payroll components, detailed reports, customizable pay slip, scan, and upload expense, creating new leave types, and more, it makes your work simple.

Key takeaways

- Professional Tax is deducted from salaried employees' wages and sent to the government by the employer.

- Professional and salaried individuals in Tamil Nadu pay a professional tax based on their gross income. It is deducted from every employee's salary once a month.

- When it comes to a company, individual partners, self-employed individuals, and businesses, it is deducted from the previous year's gross turnover.

- In some cases, the tax payment is set and must be paid regardless of the amount of revenue received. In Tamil Nadu, the professional tax slab differs across corporations and panchayats.

Related Articles