Individuals involved in a business or profession are subject to a Professional Tax of Rs.2500 (at the maximum) and Rs.1000 per year under the provisions of the Bihar Professional Tax Act, 2011. (As the minimum). Bihar professional tax is collected by the state government on those who earn a living from salary or professions, or who are involved in commerce or trade.

We'll talk about professional tax in Bihar in this article. Continue reading to learn about the many facets of professional taxation in Bihar. The following themes were covered:

- What Is Bihar's Professional Tax?

- What is the professional tax slab rate in Bihar?

- Benefits of Professional Tax Registration in Bihar

- Documents required, Registration, enrollment and returns for professional tax in Bihar

- Who Is Responsible for Collecting, Paying and exempt from paying Professional Tax in Bihar?

- Compliance and penalty for professional tax

- Newly Revised Rules

- Key takeaways

Professional tax

A professional tax is a levy imposed by a state government on all people who make a living through any means. This is not to be confused with the definition of professional, which refers to persons like doctors. This is a tax that must be paid by everyone who earns money.

What Is Bihar's Professional Tax?

Professional tax is regulated by state governments in India on those engaged in the government and non-government sectors, or making income from commerce or trade, or practicing a profession such as lawyer, company secretary, or chartered accountants.

The Bihar State Tax on Professionals, Trades, Callings, and Employment Act, 2011, was passed to levy a tax on professions, trades, callings, and employments. The act is applicable throughout Bihar.

In Bihar, the professional tax is collected by the commercial taxes department. Professional tax can be collected at a maximum of Rs. 2500 and a minimum of Rs. 1000 every year. The state government does not levy a fee for professional tax registration.

What is the professional tax slab rate in Bihar?

According to the Professions, Trades, Callings, and Employments Act, 2011, the professional tax slab rates in Bihar are:

Benefits of Professional Tax Registration in Bihar

The advantages of professional tax registration. The advantages of professional tax registration include:

• It aids in the compliance with state legislation;

• It protects the rights of both the employer and the employee, or the person involved in business / trade, or practicing any profession.

• The professional tax deducted is based on the state government's slab rates as set forth in the appropriate rules and Act.

Documents required, Registration, enrollment and returns for professional tax in Bihar

Professional tax registration in Bihar necessitates the following documents:

• Applicant's address proof

• Completed application form (that includes copy of telephone, electricity bill or driving license or passport)

• Id proof of the applicant (that includes copy of Voter Id card or Aadhar Card or driving license or passport)

• PAN Card copy or TAN card of the Partners or Proprietor or Karta of HUF or Employer

• Bank account details (copies of passbooks or bank account statements showing the bank name and account number)

• 2 passport-size pictures

Due Date for Paying Professional Tax in Bihar

Every year, the 15th of November is the deadline for paying professional taxes in Bihar. Payment should be made on or before the due date. In the event that payment is not made within the specified time, the Tax Assessee authority imposes a penalty of not more than Rs.100 per month of delay.

Those who violate the Bihar PT Act's rules would be required to pay a fine of not more than 500 rupees. A concerned individual must pay not more than ten rupees every day of violation if the infraction continues.

Registration

(1) Every employer required to be registered under Section 5 must submit an application for registration under the Act in Form PT-I to the In-charge of the circle whose jurisdiction the employer's office is located.

Such an application for registration by an employer who has employed persons before the coming into force of these Rules shall be submitted within seven days of the employer being required to be registered and shall be filed in an electronic manner on the Commercial Taxes Department's official website, and the said application shall be processed in the manner hereinafter specified: Provided, however, that such an application for registration by an employer who has employed persons before the coming into force of these Rules shall be made within thirty days of the coming into force of these Rules.

(2) (a) Every employer must file FORM PT-I on the Commercial Taxes Department's official website to declare his Permanent Account Number, Name as per PAN, mobile number, email address, and any other information required.

(b) The Permanent Account Number must be authenticated electronically through the Commercial Taxes Department's official website using the Central Board of Direct Taxes' database.

(c) The mobile number must be validated using a one-time password provided to that number, and

(d) the email address must be verified using a second one-time password given to that email address.

(e) The applicant must electronically submit an application in FORM PT-I together with the required papers to the Commercial Taxes Department's official websites following successful verification of PAN, mobile number, and email address.

(f) An electronic acknowledgment will be sent to the applicant upon successful submission of the registration application under subsection (e).

(3) (a) The application will be forwarded to the concerned circle's Tax Assessing Authority, who, after verifying that all of the application's columns have been properly filled in, will approve the grant of registration in Form PT-II within one working day of the application's submission, and a certificate of registration will be made available to the applicant on the Commercial Taxes Department's official website.

(b) The application for grant of registration shall be deemed to have been approved and a certificate of registration in Form PT-II shall be made available to the applicant on the Commercial Taxes Department's official website if the Tax Assessing Authority of the circle fails to take any action within one working day from the date of submission of the application.

(c) The registration number allocated to the employer shall be the 'Tax Deduction and Collection Account Number,' allotted to the employer under the Income Tax Act, 1961, prefixed by the digits "10" and suffixed by the letter 'R' on the certificate indicated in clauses (a) and (b) of sub-rule (3).

Provided, however, that if an employer has not been assigned a Tax Deduction and Collection Account Number under the Income Tax Act of 1961, the registration number will be the Permanent Account Number, which will be prefixed by the numbers "10" and suffixed by the letter "R."

(4) The certificate of registration must be digitally signed and made available on the Commercial Taxes Department's official website.

The term 'employer' shall refer to a company, firm, society, association of persons, undivided Hindu family, body corporate, board, Authority, Undertaking, or Corporation that has hired persons liable to pay tax under the Act, as the case may be.

If the employer is a corporation, partnership, sole proprietorship, or other business entity, it must register and acquire a professional tax registration certificate in order to pay professional tax on the business or profession.

In the case of employees, the employer is responsible for deducting and paying professional tax to the State Government in accordance with the applicable law. Individuals who want to start a freelancing business without hiring anyone are also obliged to register under the laws of their individual state.

Enrollment

(1) Every assessee to whom the second proviso to Section 5 and sub-section (2) of Section 6 apply must apply in Form PT-IA to the In-charge of the Circle within whose jurisdiction the assessee resides for enrolment under the Act. Such an application must be made in an electronic format on the Commercial Taxes Department's official website within seven days of the assessee becoming liable to pay tax under the Act, and the application must be handled in the following manner:

Provided, however, that an assessee engaged in any profession, trade, calling, or employment prior to the effective date of these Rules must submit an application for enrollment within thirty days of the effective date of these Rules.

(2) (a) Every person who is obliged to enroll under these Rules must submit FORM PT-IA on the Commercial Taxes Department's official website, which includes his Permanent Account Number, Name as per PAN, mobile number, email address, and any other information required.

(b) The Permanent Account Number must be authenticated electronically through the Commercial Taxes Department's official website using the Central Board of Direct Taxes' database.

(c) The applicant's cell phone number will be validated via a one-time password given to that number, and

(d) the applicant's email address will be verified via a second one-time password provided to that email address.

(e) The applicant must electronically submit an application in FORM PT-IA at the Commercial Taxes Department's official websites after the PAN, mobile number, and email address have been verified.

(f) An electronic acknowledgment will be sent to the applicant upon successful submission of the registration application under subsection (e).

(3) (a) The application shall be forwarded to the Tax Assessing Authority of the concerned circle, who, after verifying that all of the application's columns have been properly filled in, shall approve the grant of registration in Form PT-IIA within one working day of the application's submission, and a certificate of enrollment shall be made available to the applicant on the Commercial Taxes Department's official website.

(b) If the circle's Tax Assessing Authority fails to take action within one working day of the application's submission, the application for grant of enrollment will be deemed approved, and a certificate of enrollment in Form PT-IIA will be made available to the applicant on the Commercial Taxes Department's official website.

(c) The enrollment number allotted to the assessee shall appear on the certificate specified in clauses (a) and (b) of sub-rule (3), and the enrollment number shall be the 'Permanent Account Number,' allotted to the assessee under the Income Tax Act, 1961, prefixed by the digits "10" and suffixed by the letter 'E.']

Returns

(1) On or before the end of November each year, every employer registered under the Act must submit to the designated authorities an annual return in form PT-VIII containing details of the tax deducted by him for the year.

(2) Every individual enrolled under the Act is required to file an annual return in form PT-IX with the prescribed authority by the end of November each year.

(3) The returns referred to in sub-rules (1) and (2) must be filed and disposed of in the manner specified by the Commissioner by notification.

Who Is Responsible for Collecting, Paying and exempt from paying Professional Tax in Bihar?

The Bihar Government's Commercial Taxes Department is in charge of collecting professional tax in the state. Now that people are aware of the authorities in charge of collecting the P tax, let us look into the individuals who are responsible for paying it.

Individuals engaged in any profession, trade, calling, or employment in Bihar must pay professional tax based on their income threshold, according to the definition of professional tax. Individuals can be classified into two categories based on their employment status using this concept. These are:

• Salaried Individual: For employees earning a salary or wages, the employer will deduct the amount due and pay it to the Bihar State Government on their behalf.

• Self-employed Individual: In Bihar, self-employed individuals must pay P tax. They must pay it to the Bihar government straight here.

Exempt

Members of the Union armed services stationed in any area of Bihar are exempt from paying professional tax in the state. Read the process of paying professional tax in Bihar carefully and complete the task without making any mistakes!

Compliance and penalty for professional tax

Compliance

- Form I - Application for Certificate of Registration / Amendment of Certificate of Registration

- Form IA - Application for Enrolment

- Form II - Certificate of Registration

- Form IIA - Certificate of Enrolment

- Form III - Professional Tax Register

- Form IV - Statement of Deduction

- Form V - Statement of Deduction Deposited in the Treasury

- Form VI - Certificate of Tax Deducted by Employer

- Form VII - Certificate of Tax Paid / Payable by Employee / Professional

- Form VIII - Returns by person making deduction from salary/wages payable to employees

- Form IX - Returns by person enrolled under the Act

- Form X - Challan

In Bihar, what is the penalty for professional tax?

If a taxpayer fails to pay the professional tax within the given time, the assessing authority may levy a penalty of 2% of the tax amount per month until the default is resolved.

Newly Revised Rules

The Bihar Professional Tax (Amendment) Rules, 2021 were published by the Governor of Bihar on January 13, 2022 to update the Bihar Professional Tax Rules, 2011. On January 13, 2022, this will take effect.

The following was amended namely: -

Rule 3 which specify “Registration”, a new sub-rules (5) shall be inserted namely

"If the name of the employer, the deductor, or the date of liability changes, the employer must file an application electronically along with the papers relating to the change on the Commercial Taxes Department's official website within fifteen days of the change." If a change results in:

1. a change in the Permanent Account Number, or the name associated with it, or

2. a change in the Tax Deduction and Collection Account Number, or the name associated with it, or

3. a change in the circle's jurisdiction, or

4. a change in the name and style, or

5. a change in the Goods and Services Tax Identification Number,

the employer must apply for new registration.

Where there is a change in the name of the employer, deductor, or date of liability, the employer must submit an application electronically along with the papers relevant to the change on the Commercial Taxes Department's official website within fifteen days of the change.

Rule 3(5)(b) states that the prescribed authority must authorize the amendment after appropriate verification, and the updated certificate of registration must be made available to the applicant on the Commercial Taxes Department's official website.

Rule 3(5)(c) states that if the application or the documents supplied with it are determined to be weak, the said authority must reject the application and notify the applicant.

Please note that any changes in the employer's mobile number, e-mail address, business address or name, nature of profession or trade must be amended by the employer through his personal login on the Commercial Taxes Department's official website.

Rule 4 which specify “Enrollment” a new sub-rule (4) has been inserted namely

"Where the assessee's name or the date of liability changes, the assessee must file an application electronically along with the papers relevant to the change on the Commercial Taxes Department's official website within fifteen days of the change."

Please note that any change in the tax assessee's mobile number, e-mail address, company address or firm name, nature of profession or trade must be updated through his personal login on the Commercial Taxes Department's official website.

Rule 4(4)(b) states that the prescribed authority must authorize the adjustment after appropriate verification, and the updated Certificate of Enrollment must be made available to the applicant on the Commercial Taxes Department's official website.

Rule 4(4)(c) states that if the application or the documents supplied with it are determined to be weak, the said authority must reject the application and notify the applicant.

Sub – rule (5): Cancellation of Enrollment certificate

According to Rule 4(5)(a), an employer desiring to cancel his membership must submit an electronic application, along with accompanying documents as evidence, on the Commercial Taxes Department's official website within thirty days of the occurrence of the event warranting the cancellation.

Rule 4(5)(b) states that the specified authority must approve or reject the application after appropriate verification and notify the applicant.

Sub – rule (6): Cancellation of Registration certificate

According to Rule 3(6)(a), an employer seeking cancellation of his registration must file an electronic application, along with accompanying documents as evidence, on the Commercial Taxes Department's official website within thirty days of the occurrence of the event warranting cancellation.

Rule 3(6)(b) states that the specified authority must approve or reject the application after appropriate verification and notify the applicant.

How Deskera Can help You?

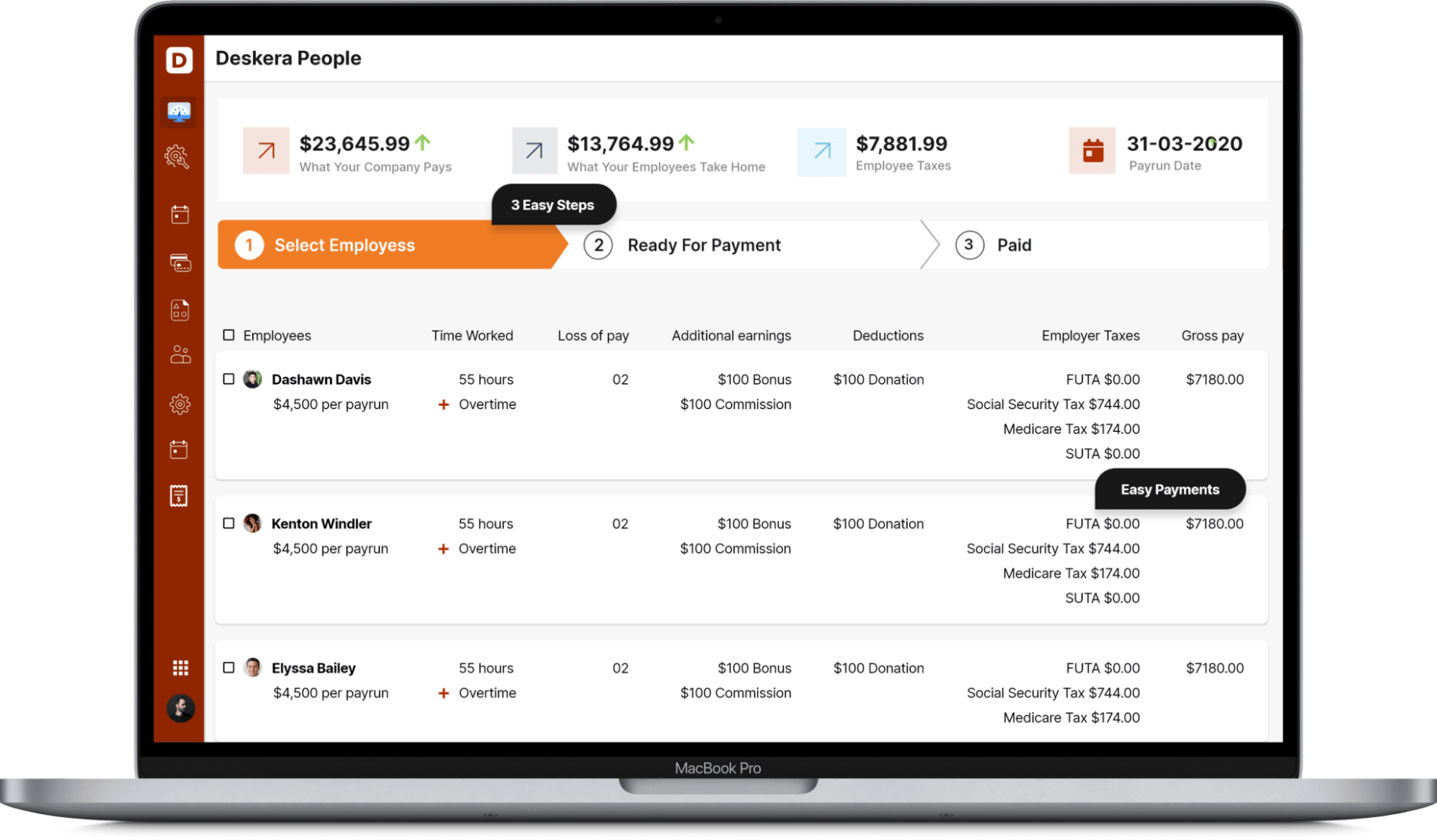

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- The Commercial Taxes Department, which is governed by the Bihar government, is in charge of collecting professional tax debts from the state's professionals. Individuals involved in a business or profession are subject to a Profession Tax of Rs.2500 (at the maximum) and Rs.1000 per year under the provisions of the Bihar Professional Tax Act, 2011. (as the minimum).

- By going to the official website and selecting the registration type, you may check the status of your application. Then, on the acknowledgement receipt, enter the application number.

- The Bihar Professional Tax is imposed on individuals who get income from an employer's wage or who engage in trade, business, or practice any profession. The state governments decide the tax slab rate to charge the professional tax, as stated in the article above.

- Under this amendment, if the name of the employer, the deductor, or the date of liability changes, the employer must file an application electronically along with the papers relating to the change on the Commercial Taxes Department's official website within fifteen days of the change.

Related articles