What happens when a business suddenly runs short of cash—even while sales look strong on paper? Cash flow disruptions are one of the most silent yet damaging threats to business stability, often triggered by delayed receivables, unplanned expenses, inaccurate inventory valuation, or slow financial visibility. In today’s complex operating environment, traditional spreadsheets and disconnected systems simply cannot keep pace with fast-moving cash cycles. This is why modern enterprises are turning to ERP systems—not just as financial tools, but as strategic engines that bring clarity, accuracy, and predictability to every part of the cash flow equation.

The impact of implementing an ERP solution is now measurable and widely recognized. According to industry studies, 83% of companies that conducted an ROI analysis successfully met their ERP goals, with over 70% reporting significant gains in efficiency, productivity, and cost savings. For manufacturers specifically, ERP adoption has resulted in a 22% reduction in operational costs, while organizations across sectors have experienced 20–30% lower inventory carrying costs and up to 50% faster financial close cycles. In high-velocity environments, where timely decisions determine profitability, ERPs have also been shown to cut decision-making time by 36%—a direct advantage when managing cash flow constraints.

These outcomes reinforce a powerful truth: better visibility creates better cash flow stability. Businesses using integrated ERP systems report over 90% improvement in inventory accuracy, 77% increases in productivity, and nearly 64% reductions in operating and labor costs. With order-to-cash accuracy exceeding 99%, organizations can avoid the costly gaps and delays that often lead to liquidity crunches. When finance, sales, procurement, and operations run on unified data, cash flow shifts from being reactive and unpredictable to controlled, optimized, and forecastable.

Modern cloud ERPs like Deskera ERP take this advantage even further. Deskera provides real-time financial dashboards, automated invoicing and reminders, tight spend controls, and accurate inventory tracking—all essential tools for preventing cash flow disruptions before they occur. Its AI-powered forecasting, mobile accessibility, and seamless integration across sales, accounting, and operations help businesses maintain healthy liquidity while scaling with confidence. For growing enterprises, Deskera ensures cash flow isn’t just monitored—it’s strategically managed.

What Are Cash Flow Disruptions?

Cash flow disruptions occur when the movement of money into and out of a business becomes unbalanced, creating gaps in available cash. Even when a company is profitable on paper, these disruptions limit its ability to pay suppliers, manage payroll, cover operational expenses, or fund growth initiatives. In simple terms, a cash flow disruption happens when expected cash inflows are delayed or when cash outflows exceed what the business has planned for—resulting in immediate liquidity stress.

These disruptions can stem from several sources, including delayed customer payments, unexpected expenses, poor inventory control, inaccurate demand forecasting, seasonal fluctuations, inefficient billing cycles, and a lack of real-time financial visibility. When financial and operational data sit in disconnected systems, businesses often misjudge their true cash position, increasing the risk of sudden shortfalls.

The consequences extend far beyond finances. Cash flow disruptions can trigger missed supplier payments, production delays, strained vendor relationships, higher borrowing costs, and reduced profitability. Over time, recurring disruptions weaken operational stability and make it harder for businesses to invest confidently in new opportunities.

Ultimately, cash flow disruptions are more than temporary hurdles—they are operational risks that can impact every department. Executives increasingly recognize that AI usage by enterprise can help uncover operational blind spots and align technology investments with strategic objectives. This is why modern organizations increasingly rely on integrated systems like ERP platforms to maintain accurate, real-time visibility and prevent these breakdowns before they occur.

Impact of Cash Flow Disruptions on Businesses

Cash flow disruptions can destabilize even the most profitable companies, affecting day-to-day operations, long-term planning, and overall financial health. When cash inflows slow down or outflows rise unexpectedly, businesses are forced into reactive decisions that can hinder growth, damage relationships, and reduce competitiveness.

Below are the key ways cash flow disruptions impact organizations.

1. Delayed Supplier Payments and Damaged Relationships

When a business lacks sufficient cash, it often delays paying suppliers, leading to strained partnerships, loss of credit terms, and higher prices. Over time, vendors may prioritize other clients, disrupting supply continuity.

2. Production and Operational Slowdowns

Cash shortages can halt production due to limited materials, delayed procurement, or the inability to maintain equipment. These slowdowns result in missed orders, reduced output, and declining customer satisfaction.

3. Increased Borrowing and Financial Stress

To bridge short-term gaps, businesses may take on emergency loans at unfavorable interest rates. This increases debt burden, raises financial risk, and reduces future working capital availability.

4. Reduced Ability to Invest in Growth

Cash flow disruptions make it difficult to allocate funds to expansion, technology upgrades, marketing, or hiring. As a result, growth initiatives stall, and competitors gain an advantage.

5. Higher Operating and Administrative Costs

Disruptions can trigger overtime, rush orders, penalty fees, or expedited shipping costs—further squeezing margins. The lack of financial predictability drives inefficiencies across departments.

6. Declining Profitability and Liquidity

As disruptions accumulate, profitability decreases due to rising costs, delayed revenue, and operational inefficiencies. Liquidity weakens, making it harder to sustain business continuity.

7. Loss of Customer Trust and Missed Sales Opportunities

Inability to fulfill orders, delayed deliveries, or inconsistent service directly impacts customer loyalty. Lost opportunities compound over time, affecting revenue and market share.

8. Long-Term Business Instability

Persistent cash flow gaps can lead to layoffs, halted projects, compliance failures, and—in severe cases—business closure. Stability erodes when an organization cannot predict or manage its financial position effectively.

Why Traditional Cash Flow Management Fails

Traditional cash flow management—often dependent on spreadsheets, manual entries, and disconnected systems—cannot keep up with the speed, complexity, and volume of today’s business operations.

As transactions scale and supply chains become more dynamic, these outdated methods create blind spots that lead to errors, delays, and inaccurate financial visibility. This ultimately causes businesses to make decisions based on outdated or incomplete information.

1. Reliance on Manual Processes and Spreadsheets

Manual cash flow tracking is slow, error-prone, and difficult to update in real time. A single miscalculation or outdated entry can distort the company’s entire financial picture, leading to reactive rather than strategic decisions.

2. Fragmented Financial and Operational Data

When sales, procurement, inventory, and finance operate in silos, businesses struggle to understand actual cash positions. Disconnected systems cause inconsistent data, duplicate entries, and delays in reconciling financial information.

3. Lack of Real-Time Visibility

Traditional methods cannot provide instant insight into receivables, payables, expenses, or inventory valuations. Without real-time dashboards, businesses fail to spot cash shortages early or forecast future liquidity needs accurately.

4. Slow Billing and Inefficient Collections

Manual invoicing, delayed approvals, and inconsistent follow-up practices extend the order-to-cash cycle. Late payments increase AR aging and directly contribute to cash flow bottlenecks.

5. Inaccurate or Infrequent Forecasting

Traditional forecasting often relies on historical data rather than dynamic inputs. This results in projections that overlook current demand shifts, seasonal trends, supply disruptions, or changing expenses—leading to poor cash planning.

6. Delays in Financial Close and Reporting

When teams compile data manually from different departments, financial close cycles become lengthy and error-ridden. Slow reporting limits management’s ability to respond quickly to cash flow risks.

7. Limited Control Over Spend and Approvals

Without automated approval workflows or budget controls, unauthorized spending or unplanned purchases go unnoticed until the damage is done. This makes it difficult to maintain a disciplined cash outflow structure.

8. Inability to Scale with Business Growth

As transaction volumes grow, manual cash flow management collapses under complexity. What may work for a small business becomes unsustainable for a scaling organization, leading to costly inefficiencies and liquidity gaps.

Why Preventing Cash Flow Disruptions Is Critical for Business Stability

Preventing cash flow disruptions isn’t just a financial best practice—it’s a strategic necessity for maintaining operational continuity, protecting profitability, and enabling long-term growth.

When cash flow is predictable and well-managed, businesses can operate confidently, invest in innovation, and respond swiftly to market changes. On the other hand, even short-term liquidity issues can cascade into operational setbacks, strained relationships, and lost opportunities.

1. Ensures Smooth Day-to-Day Operations

Consistent cash flow allows businesses to pay suppliers, employees, and service providers on time without relying on emergency funding or credit. This stability is essential for keeping production, sales, and customer service running without interruption.

2. Strengthens Vendor and Customer Relationships

Maintaining timely payments builds trust with suppliers, leading to better credit terms, priority service, and stronger partnerships. Likewise, reliable cash flow supports faster order fulfillment and boosts customer satisfaction.

3. Protects Profit Margins and Reduces Financial Risk

When disruptions occur, companies often incur penalties, rush charges, or higher borrowing costs. Preventing these interruptions helps safeguard margins and reduces exposure to unnecessary financial risks.

4. Enables Better Strategic Planning and Forecasting

Stable cash flow gives leadership accurate insights for budgeting, resource allocation, and investment decisions. It also ensures organizations can seize growth opportunities instead of being held back by liquidity concerns.

5. Supports Innovation and Long-Term Growth

Organizations with strong cash flow can invest confidently in new technologies, talent, product development, and expansion initiatives—key drivers of competitive advantage.

6. Enhances Business Resilience

A business that actively prevents cash flow disruptions is better equipped to handle economic fluctuations, market volatility, and unexpected disruptions without compromising operations or financial health.

How ERP Systems Help Prevent Cash Flow Disruptions

ERP systems play a strategic role in stabilizing cash flow by integrating financial, operational, and inventory data into one unified platform. This eliminates blind spots, accelerates decision-making, and ensures businesses have the real-time visibility needed to manage liquidity proactively.

By streamlining processes across the order-to-cash, procure-to-pay, and inventory management cycles, ERPs reduce delays, eliminate errors, and strengthen financial predictability.

Below are the key ways ERP systems prevent cash flow disruptions.

1. Real-Time Financial Visibility

ERP systems give businesses an always-updated view of receivables, payables, expenses, and cash balances across departments. This centralization eliminates guesswork and ensures leaders can detect potential shortfalls before they escalate.

With instant access to dashboards and drill-down reports, finance teams can identify overdue invoices, predict upcoming obligations, and make timely decisions that protect liquidity and improve financial stability.

2. Faster and Automated Billing Cycles

Manual billing often leads to slow invoice generation and missed follow-ups, resulting in delayed payments. ERP systems automate every part of the invoicing cycle—creating invoices instantly, scheduling recurring bills, sending reminders, and reconciling payments.

This speeds up the order-to-cash process and reduces the time money stays stuck in receivables. Faster billing directly improves cash inflow consistency and reduces administrative burdens on finance teams.

3. Improved Collections and Reduced Payment Delays

ERPs strengthen collections by automatically sending reminders, customer statements, and due alerts, ensuring clients are consistently notified. They highlight overdue accounts, helping teams prioritize follow-ups and take corrective action before cash gaps emerge.

Digital payment integration further simplifies settlements for customers. By minimizing delays and improving collection efficiency, ERPs help businesses maintain predictable cash inflows and avoid disruptions caused by slow-paying clients.

4. Stronger Spend Control Through Approval Workflows

Uncontrolled spending can quickly drain cash reserves. ERP systems introduce structured approval workflows, budget controls, and real-time tracking of all expenses.

Managers are notified instantly when purchase requests exceed limits, preventing unnecessary or unauthorized spending. This proactive oversight ensures that outflows are aligned with financial goals, protects the company from unplanned expenses, and helps maintain a disciplined cash management framework.

5. Accurate Inventory Management and Cost Control

Inventory tied up in excess stock or lost to inefficiencies directly strains cash flow. ERP systems optimize inventory levels by providing real-time tracking, automated reorder points, and accurate valuation.

This prevents overstocking, reduces carrying costs, and minimizes stockouts that disrupt sales. By improving COGS visibility and reducing waste, ERPs enhance cost control and support healthier, more predictable cash cycles.

6. Integrated Sales, Procurement, and Finance Data

Cash flow issues often arise when departments operate in silos. ERP systems unify sales orders, procurement data, financial transactions, and inventory updates in one system.

This alignment eliminates data mismatches, delays, and errors that slow down payment cycles or inflate expenses. With synchronized processes from order to delivery, businesses experience faster revenue realization, smoother operations, and improved cash predictability.

7. Predictive Cash Flow Forecasting

ERP systems leverage historical trends, sales data, supplier patterns, seasonality, and expenses to forecast future cash positions accurately. These predictive insights help businesses anticipate liquidity gaps early and plan funding or cost control measures proactively.

Scenario-based modeling allows leaders to test best- and worst-case projections, ensuring better preparation for fluctuations. Ultimately, forecasting transforms cash flow from reactive to forward-looking and strategically managed.

8. Faster Financial Close and Reporting

Financial close becomes significantly faster with ERPs because data from all departments flows into a unified system, eliminating the need for manual consolidation.

Automated reconciliation, real-time entries, and error checks reduce delays and inaccuracies. Timely reporting equips leadership with updated financial insights, enabling quicker decisions around spending, collections, and cash preservation. A faster close cycle strengthens financial agility and cash visibility.

9. Better Compliance and Reduced Penalties

Compliance lapses often lead to penalties, interest charges, or audit risks—each of which impacts cash flow. ERP systems help businesses maintain compliance by automating tax calculations, generating audit-ready reports, and ensuring accurate financial entries.

Built-in controls and alerts notify teams of regulatory deadlines or discrepancies. By preventing fines and ensuring timely filings, ERPs safeguard cash reserves and reduce unnecessary financial leakage.

Best Practices to Maximize ERP Success in Cash Flow Management

Maximizing the cash flow benefits of an ERP system requires more than just implementation—it demands disciplined processes, well-designed workflows, and a culture of data-driven decision-making.

When businesses strategically align their ERP capabilities with financial objectives, they gain stronger control over inflows, outflows, and working capital.

Below are the most effective best practices to ensure your ERP drives consistent cash flow stability and long-term financial resilience.

1. Centralize All Financial and Operational Data

Ensure every department—finance, sales, procurement, warehousing, and operations—runs on the same ERP ecosystem. Centralizing data eliminates silos, improves accuracy, and allows your finance team to view real-time cash positions. This integration accelerates decision-making and helps identify liquidity gaps before they escalate into disruptions.

2. Automate Billing, Invoicing, and Follow-Ups

Leverage your ERP’s automation tools to speed up the order-to-cash cycle. Set up automated invoicing, recurring billing, and payment reminders to reduce AR aging. When billing is timely and consistent, cash inflows become predictable. This is one of the simplest and most impactful ways to strengthen cash flow discipline.

3. Implement Strict Spend Controls and Approval Workflows

Use ERP approval rules, budget thresholds, and enforced authorization chains to prevent unnecessary purchases. Real-time spend monitoring helps avoid unplanned cash outflows and keeps expenses aligned with financial goals. Strict controls ensure cash isn’t tied up in non-essential or poorly timed purchases.

4. Use Accurate, Real-Time Inventory Data for Better Planning

Inventory decisions significantly influence cash flow. ERPs with real-time stock visibility help reduce excess inventory, carrying costs, and waste. Automated reordering ensures stock is replenished only when needed, reducing unnecessary cash tied up in inventory and improving overall working capital efficiency.

5. Leverage ERP Forecasting Tools for Cash Flow Predictions

Enable predictive analytics to project future cash inflows and outflows based on historical data, seasonality, customer behavior, and expense trends. Scenario planning—best case, worst case, and expected—helps leadership stay prepared. Accurate forecasting prevents cash shortages and informs smarter budgeting decisions.

6. Maintain Clean and Consistent Master Data

Reliable cash flow management requires clean customer, supplier, product, and financial data. Regularly audit and update master data to avoid billing errors, duplicate entries, and inaccurate reporting. Strong data hygiene ensures your ERP calculations and forecasts remain dependable.

7. Integrate Payment Gateways and Digital Collection Tools

Connecting your ERP to online payment systems accelerates settlements and reduces manual collection efforts. Customers can pay faster through digital channels, improving cash inflows. This also enhances customer experience and reduces friction in the payment process.

8. Train Teams to Use ERP Features Effectively

ERP success depends on user adoption. Invest in continuous training so finance, operations, and sales teams understand how to use dashboards, reports, workflows, and automation tools. Well-trained teams extract deeper value from the ERP and prevent manual workarounds that weaken cash flow accuracy.

9. Conduct Regular Cash Flow Reviews and Adjust Workflows

Review ERP-generated cash flow reports weekly or monthly to identify trends, bottlenecks, or unusual spikes. Continuously refine processes like credit terms, approval limits, and reorder points. This ensures your ERP evolves with business growth and changing financial conditions.

10. Align ERP Configuration with Business Goals

Ensure your ERP workflows reflect your company’s actual cash flow priorities—whether that’s reducing receivables, optimizing inventory, controlling expenses, or improving forecasting. Tailoring modules and dashboards to financial objectives increases ERP effectiveness and strengthens organizational cash discipline.

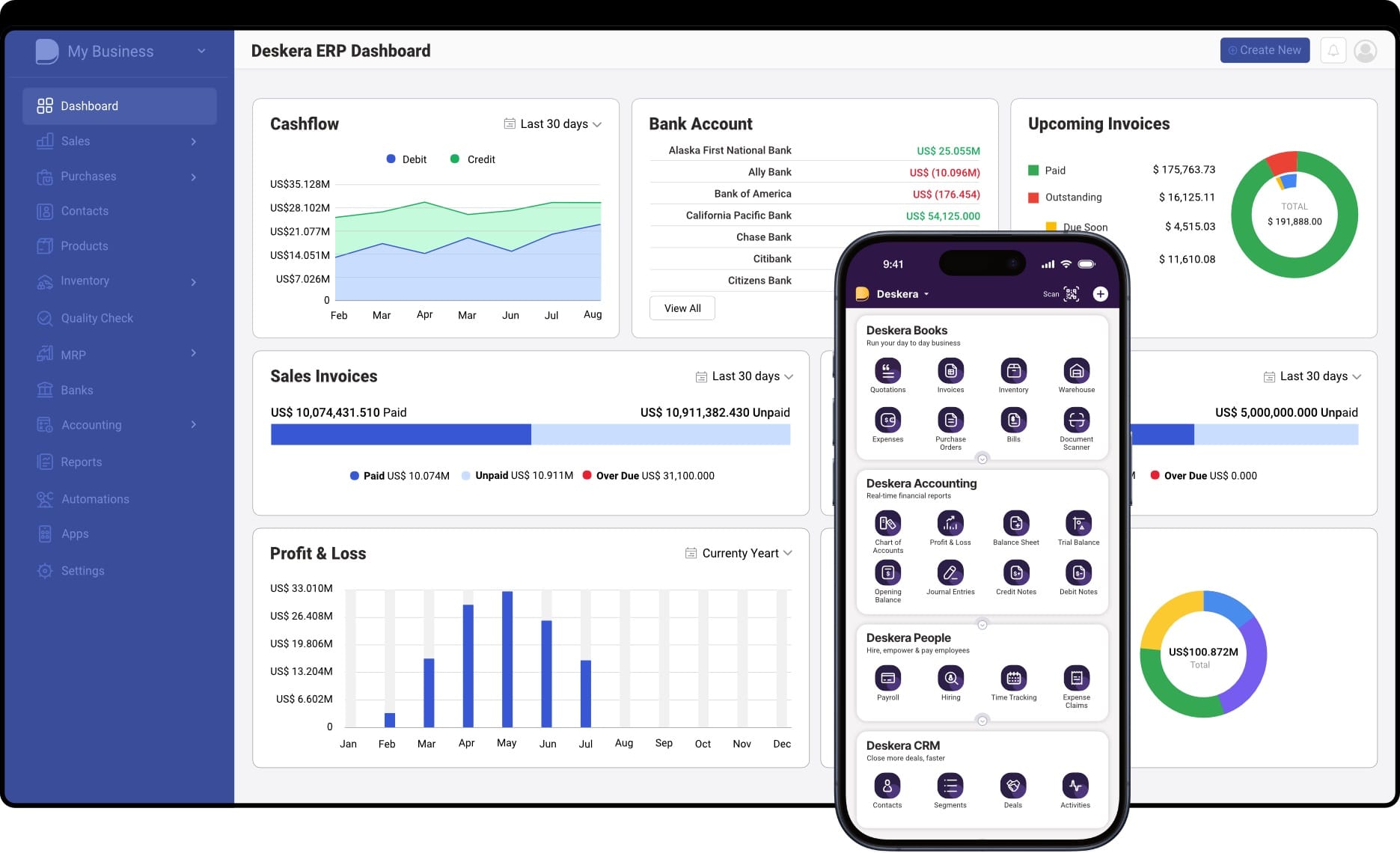

How Deskera ERP Strengthens Cash Flow Control

Deskera ERP offers an integrated, cloud-based platform that gives businesses complete visibility and control over their financial operations, helping them prevent cash flow disruptions and maintain steady liquidity.

By automating core financial processes, synchronizing data across departments, and offering powerful forecasting tools, Deskera ensures companies can manage cash inflows and outflows with greater accuracy, speed, and confidence.

Here’s how Deskera strengthens cash flow control end-to-end.

1. Unified Financial Dashboard for Real-Time Visibility

Deskera centralizes receivables, payables, expenses, bank balances, and transaction histories into one live dashboard. This eliminates fragmented spreadsheets and provides leaders with instant clarity on their cash position. With a single source of truth, businesses can quickly spot overdue invoices, upcoming liabilities, and cash shortages—enabling timely action before disruptions occur.

2. Automated Billing, Invoicing, and Collections

Deskera automates the entire order-to-cash process, helping businesses speed up cash inflows. It instantly generates invoices, schedules recurring bills, sends automated reminders, and enables faster collections through integrated payment links. These automation features reduce AR aging, prevent manual errors, and ensure cash enters the business faster and more consistently.

3. Intelligent Spend Controls and Approval Workflows

The platform supports customizable approval flows, budget checks, and spending limits. Every purchase request, bill, or expense claim passes through structured authorization layers, preventing unauthorized or poorly timed expenditures. This keeps cash outflow disciplined and aligned with budgetary goals, minimizing surprise expenses that disrupt liquidity.

4. Accurate Inventory Tracking and Cost Optimization

Deskera’s real-time inventory tracking helps businesses avoid overstocking and unnecessary carrying costs—two major drains on cash flow. Automated reorder points, stock aging insights, and demand-linked replenishment keep inventory lean and efficient. This frees up working capital and ensures businesses don’t lock cash in excess or obsolete stock.

5. Integrated Procurement, Sales, and Accounting Processes

Deskera connects procurement, sales orders, fulfillment, and financial entries in one workflow. This integration ensures that every transaction—from purchase to payment and sale to settlement—is updated instantly. Such synchronization removes delays, reduces errors, and ensures financial reports always reflect the true cash position of the business.

6. Predictive Cash Flow Forecasting and Planning

Deskera’s analytics engine uses sales trends, payment patterns, procurement data, and expense histories to generate accurate cash flow forecasts. These predictive insights help businesses anticipate liquidity gaps, plan spending, adjust payment schedules, and make proactive financial decisions. Scenario modeling further supports budgeting and risk management.

7. Faster Month-End Close and Audit-Ready Reporting

With automated journal entries, real-time syncing, and built-in reconciliation tools, Deskera significantly speeds up financial close cycles. Faster, error-free reporting equips leadership with timely insights and reduces the likelihood of compliance penalties. Audit-ready records also help businesses avoid fines and cash leakage.

8. Mobile Accessibility for On-the-Go Cash Flow Control

Deskera’s mobile applications allow leaders to approve purchases, track payments, view dashboards, and monitor cash flow on the go. This ensures decision-makers can act quickly—even outside the office—preventing bottlenecks and maintaining smooth financial operations.

Key Takeaways

- Cash flow disruptions arise when incoming cash cannot keep pace with outgoing obligations, often caused by delayed receivables, poor forecasting, or sudden expense spikes. Understanding these disruptions is crucial to financial stability and operational continuity.

- Cash flow disruptions can lead to halted operations, delayed vendor payments, strained customer relationships, and limited growth opportunities. They weaken a company’s financial resilience and increase dependency on high-cost borrowing.

- Traditional methods rely heavily on manual tracking, spreadsheets, and fragmented data, making them slow, error-prone, and reactive. This results in poor visibility, delayed decision-making, and inaccurate forecasting.

- Proactively preventing disruptions helps ensure stable liquidity, stronger supplier trust, better creditworthiness, and uninterrupted operations. It empowers businesses to pursue new opportunities without financial constraints.

- ERP systems centralize financial data, automate accounts payable and receivable, enhance forecasting accuracy, optimize inventory costs, and streamline procurement—ensuring businesses maintain cash flow clarity and control.

- Businesses must focus on proper ERP configuration, data hygiene, user training, cross-department integration, and continuous monitoring to unlock maximum value from their ERP system for cash flow stability.

- Deskera ERP enables real-time financial visibility, automated billing, intelligent inventory planning, and predictive insights. With features powered by AI assistant David, it helps businesses maintain healthy cash flow and reduce financial risks.

Related Articles