Andrew Tenza had a problem. He had to pay off expenses but was short of cash. He took advantage of the potentially forgivable loans disbursed by the PPP lenders and submitted 3 loan applications to two PPP lenders totaling $272,284 under the Paycheck Protection Program.

He used the funds intended for providing pandemic relief to small businesses to pay down his credit card debt, pay off loans for a residential pool and minivan, pay a dog breeder and meet other non-business expenses. Did the PPP lenders who disbursed loans to Andrew forgive the loans? No, They didn't. So, it is important to know when the loans are forgiven, and how to apply for forgiveness.

This article covers the following points:

- When Are the Loans Forgiven By the PPP Lenders

- Are PPP Lenders Accepting Forgiveness Applications

- Apply to PPP Lenders for Loan Forgiveness

- How to Compile Your Documentation For PPP Lenders

- How to Submit the Forgiveness Form to Your PPP Lenders

- How to Monitor Your Forgiveness Application Through PPP Lenders

- Conclusion

- Key Takeaways

The courts declared that despite holding a senior executive position at NASA, Andrew applied for fraudulent loans and benefits under the Paycheck Protection Program. He even applied for unemployment benefits from Virginia for his mother-in-law, submitted fabricated IRS tax returns, and fraudulently claimed payroll expenses.

Tenza, who pleaded guilty to bank fraud, was sentenced to prison because the Paycheck Protection Program (PPP) was established by the US Federal Government to help certain businesses, self-employed workers, some non-profit organizations, and tribal businesses pay their workers. The loans were not meant for people to cover their personal expenses.

Thus, it is important to know when your loans are forgiven and how to apply for loan forgiveness.

When Are the Loans Forgiven By the PPP Lenders

Under the loan forgiveness program, eligible expenses, including payroll costs, interest payments on mortgages, and rent and utility payments made during the loan's qualifying period, will be forgiven by the PPP lenders provided the borrower meets all of the loan's employee-retention criteria.

Sole proprietors with no employees and firms that borrowed less than $50,000 found the process of forgiveness simple. Many PPP borrowers who borrowed large amounts over $300,000 did not receive notices from their lenders encouraging them to apply for forgiveness.

Even though the Paycheck Protection Program did not benefit everyone, there were some genuine applicants whose loans were forgiven as a result of the program. Mark Fisher Fitness (MFF), a boutique fitness studio based in New York, was able to rehire 28 of its employees it laid off in March 2020 and retain them for a period of 8 weeks as a result of the Paycheck Protection Program.

For the loan to be forgiven, MFF had to spend the money in two months, mostly on the payroll. The relief did not last long, for it had to once again lay off most of its staff and close one of its two locations, so MFF turned to virtual classes in addition to in-person classes to keep the business going.

Small businesses, independent contractors, eligible self-employed individuals, sole proprietors, non-profit businesses, tribal businesses, housing cooperatives, news organizations, and tax-exempt veteran organizations should meet the following criteria to submit an application of loan forgiveness to the PPP lenders:

- The borrowers can apply for loan forgiveness once the entire amount for which they are requesting forgiveness had been used up

- They can submit an application for loan forgiveness to the PPP lenders anytime up to the maturity of the loan

- Borrowers have to apply for forgiveness within 10 months from the last day covered by the loan; otherwise, PPP lenders cannot request the SBA to defer the loans. The borrowers will then have to start making loan payments to the PPP lenders

- The borrowers should have used at least 60% of the loan for covering payroll costs

- To be eligible for loan forgiveness by the PPP lenders, the borrowers should have maintained employee staffing and compensation levels at the same level as required in the case of the First Draw PPP loan

- They should have spent the loan proceeds on other eligible expenses

Are PPP Lenders Accepting Forgiveness Applications

If you think you are an eligible candidate for PPP loan forgiveness, you can submit an application to your PPP lenders provided your lenders are not participating in the direct loan forgiveness program through the SBA.

Here's what you need to know:

PPP lenders are accepting forgiveness applications

Most PPP lenders are now accepting forgiveness applications from borrowers who have used the loan proceeds as required by the program. The Small Business Administration (SBA) provides an online application portal for borrowers to apply for forgiveness, which can be accessed through the lender or directly on the SBA website.

PPP loan forgiveness application deadline

The deadline to submit a PPP loan forgiveness application depends on the lender's individual requirements. Some lenders have set their own deadlines for submitting forgiveness applications, while others are following the SBA's guidelines. The SBA has established a deadline of 10 months after the end of the borrower's covered period, which is the period of time during which the loan funds must be used.

Types of PPP forgiveness applications

There are two types of forgiveness applications available for PPP loans: the simplified form and the regular form. Borrowers may be eligible to use the simplified form if their loan amount is less than $150,000. The simplified form requires fewer calculations and documentation than the regular form.

PPP forgiveness eligibility requirements

To be eligible for PPP loan forgiveness, borrowers must meet certain criteria, including spending at least 60% of the loan proceeds on payroll costs and maintaining employee and compensation levels. Borrowers must also provide documentation to support their forgiveness application, including payroll records, tax forms, and other financial statements.

PPP lender responsibilities

PPP lenders are responsible for reviewing and approving forgiveness applications submitted by borrowers. Lenders must confirm that the borrower used the loan proceeds as required by the program and that the information provided on the forgiveness application is accurate.

What happens if forgiveness is denied

If a borrower's forgiveness application is denied, they may be required to repay the loan according to the terms outlined in their loan agreement. However, borrowers do have the option to appeal the decision with the SBA.

Apply to PPP Lenders for Loan Forgiveness

Borrowers whose PPP lenders are not participating in the direct loan forgiveness program through the SBA, have to apply through their creditors. The PPP lenders can provide the borrowers with either the SBA Form 3508, SBA Form 3508EZ, SBA Form 3508S, or a lender equivalent form. The PPP Lenders can provide further guidance on how to submit the application.

Borrowers whose PPP lenders are participating in a direct loan forgiveness program through the Small Business Administration, have to log in to the SBA portal and then complete the correct form. All direct forgiveness borrowers must apply for SBA forgiveness. The questions asked in the SBA portal will correspond to those asked on SBA form 3508S.

How to Compile Your Documentation For PPP Lenders

SBA Form 3508S does not require you to attach additional documents in order to show the calculations used to determine the amount of loan that is forgiven, but the SBA may request information and documents to review the amount of the loan that can be forgiven.

You have to provide documentation for all the payroll periods that have overlapped with the covered period.

- Bank account statements or third-party payroll service provider reports have to be kept ready since they reveal the amount of cash compensation paid to the employees

- Tax forms for the period that coincide with the covered period or third-party service provider reports have to be made available

- Payment receipts, canceled checks, or account statements documenting the amount of employer contribution to the employee health insurance and retirement plans have to be kept handy if you have included those in your forgiveness amount

For nonpayroll expenses that were incurred during the covered period you have to include the following:

- In case of the business mortgage interest payments, you must have a copy of the lender's amortization schedule and receipts

- You must have a copy of the current lease agreement, receipts, or canceled checks in order to verify eligible payments

- In case of business utility payments, you must have copies of invoices, receipts, canceled checks, and/or account statements

- In case of covered operations expenditure, you must have a copy of the invoices, orders or purchase orders paid, receipts canceled checks, or account statements verifying eligible payments

- You must have a copy of invoices, orders or purchase orders paid, receipts, canceled checks, account statements verifying eligible payments that are related to uninsured property due to public disturbance, vandalism, or shooting

- In case of covered supplier costs, you must have a copy of the contracts, orders or purchase orders, a copy of invoices, receipts, canceled checks, or account statements verifying eligible payments

- Finally, in case of covered worker protection expenses, you need to have a copy of the invoices, orders or purchase orders paid, receipts, canceled checks, or account statements verifying that eligible payments and expenditures comply with COVID-19 rules and regulations

How to Submit the Forgiveness Form to Your PPP Lenders

If your PPP lenders are not participating in the direct loan forgiveness program through the SBA, you can submit the form to them with the required supporting documents. Remember your lenders can always ask for additional documentation since the above list is not all-inclusive.

In case your lenders are participating in the direct loan forgiveness program through the SBA, you can submit your form directly through the SBA portal.

Here are the steps you need to follow to submit the forgiveness form to your PPP lenders:

Review the forgiveness application: Before submitting the forgiveness application to your PPP lender, make sure you understand the requirements and the necessary documentation. The SBA has provided different forms for different types of borrowers. You should review the instructions and gather all the necessary information and documents.

Complete the forgiveness application: The forgiveness application has several sections that require information on your PPP loan and how you used the funds. Some of the sections include the PPP loan forgiveness calculation form, payroll and non-payroll costs documentation, and borrower certifications. Complete each section carefully, and make sure you have all the necessary information and supporting documents.

Prepare the necessary documentation: The documentation you need to provide will depend on the expenses you claimed for forgiveness. This may include payroll records, tax forms, rent or lease agreements, utility bills, and other financial documents.

Submit the forgiveness application to your PPP lender: Once you have completed the forgiveness application and gathered all the necessary documentation, submit the application to your PPP lender. Make sure you follow the lender's instructions for submitting the application, which may include uploading the application and documents to an online portal or mailing them in.

Wait for a decision: Your lender will review your forgiveness application and supporting documentation and make a decision on whether to forgive your PPP loan or not. You should expect to receive a response from your lender within a few weeks.

Follow up with your lender: If you have not heard back from your lender within a reasonable amount of time, follow up with them to check the status of your forgiveness application. You can also contact the SBA for assistance if necessary.

How to Monitor Your Forgiveness Application Through PPP Lenders

Your PPP lenders will notify you if the SBA decides to review your loan. The decision taken by the SBA regarding your loan will be communicated to you by your PPP lenders. You have the right to appeal against certain SBA review decisions. Your PPP lenders have to notify you of the amount paid by the SBA to the lenders in lieu of the loan forgiven and the date on which your first payment is due.

Borrowers whose PPP lenders are participating in the direct forgiveness loan program through the SBA have the option of calling the SBA's call center from Monday-Friday between 8 am and 8 pm.

In case your PPP loans are not forgiven, you should not feel disheartened. At least you were able to avail of loans, for there were many who were denied. Although PPP lenders provided loans to help some small businesses cover payroll expenses and other costs in order to remain viable by accepting forgiveness applications, there were people like Mark Shriner who were turned down when he tried to borrow from his PPP lender.

In the spring of 2020, Mark's coffee shop was at risk since COVID was forcing his business to shut shop. In spite of applying 3 times for a PPP loan, his application was turned down. Loans were provided through SBA-approved PPP lenders only to certain eligible entities, so you should be thankful that you were able to avail of loans.

After the first two rounds of the Paycheck Protection Program winded down, and the PPP lenders accepted forgiveness applications, the third round of paycheck-protected funding started. Round three had funding of $284 billion, but then the funds got depleted, and by May 2021, the Paycheck Protection Program was no longer available. The PPP lenders, however, are still accepting forgiveness applications from borrowers.

Common Mistakes to Avoid in the PPP Loan Forgiveness Application

Failing to Keep Accurate Records: One of the most important things you can do to ensure a successful PPP loan forgiveness application is to keep accurate records. You must maintain documentation that demonstrates how you used the funds and that you used them for eligible expenses.

Some of the required documentation includes payroll records, utility bills, rent or lease agreements, and mortgage statements.

Misinterpreting Eligible Expenses: Another common mistake is misinterpreting what expenses are eligible for loan forgiveness. PPP loans were intended to cover certain expenses, including payroll costs, rent, mortgage interest, and utilities.

However, there are specific guidelines around what constitutes eligible expenses. For example, not all employee benefits are eligible expenses, and not all rent or lease agreements qualify.

Failing to Maintain Adequate Staffing Levels: PPP loan forgiveness is dependent on maintaining staffing levels during the covered period. If you reduce your workforce or reduce employee salaries, it may impact your ability to receive full loan forgiveness.

Failing to maintain adequate staffing levels during the covered period may result in a reduction in your loan forgiveness amount.

Not Spending the Funds in the Correct Time Frame: PPP loans were intended to cover expenses incurred during a specific time frame, typically 8 or 24 weeks after loan disbursement. If you fail to use the funds during this time period, you may not be eligible for full loan forgiveness.

Not Filing Your Forgiveness Application on Time: PPP loan forgiveness applications must be submitted within a certain time frame after the covered period ends. If you fail to submit your application on time, it may impact your ability to receive full loan forgiveness.

Failing to Provide Adequate Supporting Documentation: PPP loan forgiveness applications require extensive documentation to support your eligibility for forgiveness. Failing to provide adequate supporting documentation may result in a denial of forgiveness.

Failing to Account for Wage Reductions: If you reduced employee salaries during the covered period, it may impact your loan forgiveness amount. You must account for any wage reductions when calculating your forgiveness amount.

Not Accounting for Non-Payroll Expenses: Non-payroll expenses, such as rent or utility payments, can account for up to 40% of your total forgiveness amount. Failing to account for these expenses can result in a reduction in your forgiveness amount.

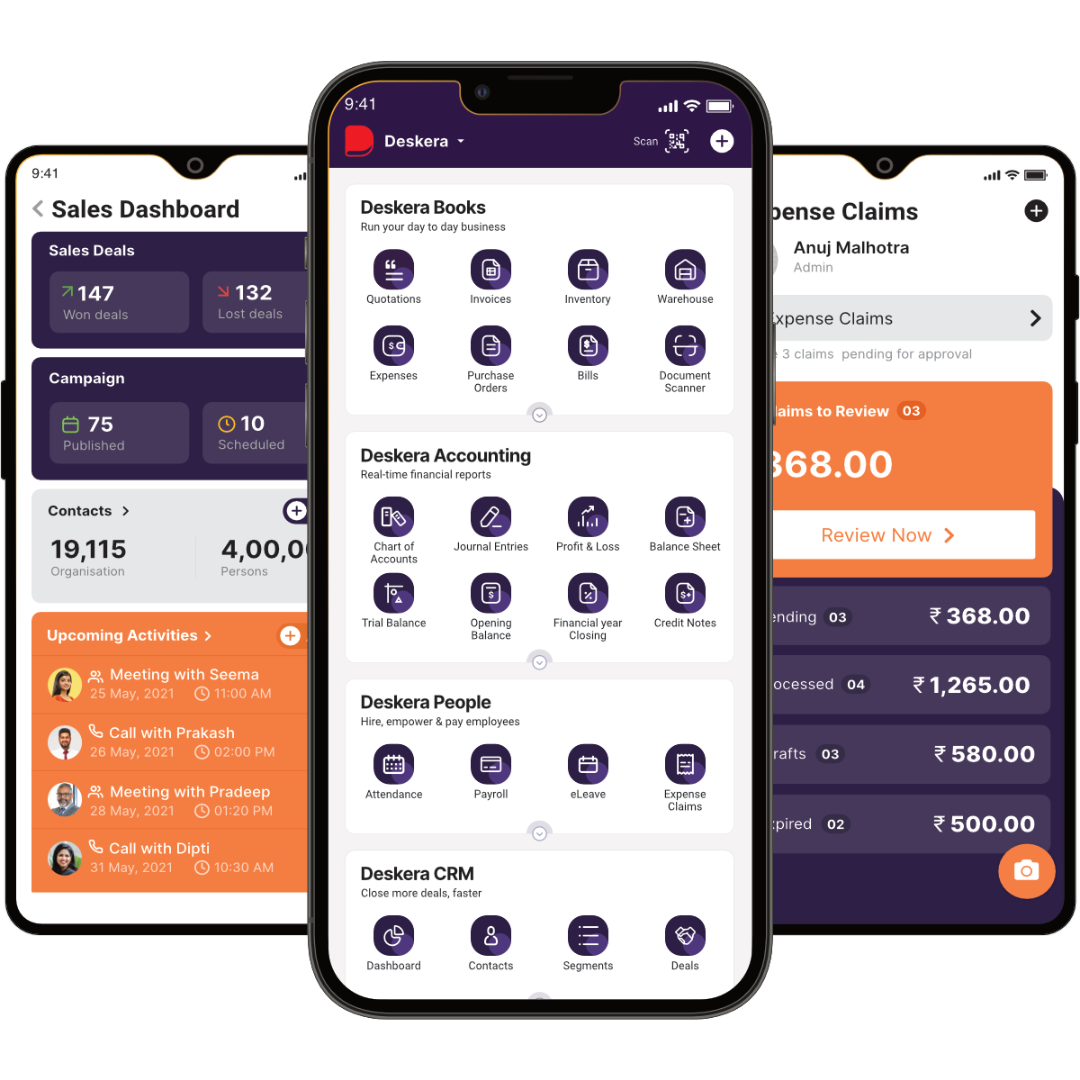

How Deskera Can Assist You?

Deskera MRP allows you to closely monitor the manufacturing process. From the bill of materials to the production planning features, the solution helps you stay on top of your game and keep your company's competitive edge.

Deskera ERP and MRP system can help you:

- Manage production plans

- Maintain Bill of Materials

- Generate detailed reports

- Create a custom dashboard

Deskera ERP is a comprehensive system that allows you to maintain inventory, manage suppliers, and track supply chain activity in real-time, as well as streamline a variety of other corporate operations.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Conclusion

Even though the process of applying for loan forgiveness seems daunting, the steps become easy to understand as you move along. The these tips will ensure that you find the process of applying for loan forgiveness less cumbersome.

Key Takeaways

- Borrowers have to ensure that to be eligible for loan forgiveness by the PPP lenders they should have maintained employee staffing and compensation levels at the same level as required in the case of the First Draw PPP loan

- They should have spent the loan proceeds on payroll costs and other eligible expenses

- The borrowers should have used at least 60% of the loan to cover payroll costs

- Borrowers can apply for loan forgiveness once all amount for which they are requesting forgiveness has been used up

- Borrowers can submit an application for loan forgiveness to the PPP lenders anytime up to the maturity of the loan

- Borrowers have to submit their loan forgiveness application within 10 months from the last day of the covered period; otherwise, the PPP lenders can no longer request the SBA to forgive the loans. Then the borrowers will have to start making loan payments to the PPP lenders

- The borrowers must compile their documentation well and make sure they have all the documents related to payroll and nonpayroll expenses

- Borrowers have to submit forgiveness applications to PPP lenders if their PPP lenders are not participating in the direct loan forgiveness program through the SBA

- They have to monitor their application through their PPP lenders who have to notify them of the forgiveness amount paid by the SBA and the date on which the first payment is due

Related Articles